0001585608

false

0001585608

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2023

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36714 |

46-2956775 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

200 Pine Street, Suite 400

San Francisco, California |

94104 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (415) 371-8300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share |

JAGX |

The Nasdaq Capital Market |

Item 2.02 Results of Operations and Financial Conditions.

On August 14, 2023, Jaguar Health, Inc. (the “Company”)

issued a press release announcing second quarter 2023 results. A copy of this press release is furnished as Exhibit 99.1 to this report.

The information in Item 2.02 and the press release furnished as Exhibit

99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference into any of the Company’s

filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| 104 |

|

Cover Page Interactive Data File (embedded with the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

JAGUAR HEALTH, INC. |

| |

|

| |

By: |

/s/ Lisa A. Conte |

| |

|

Name: |

Lisa A. Conte |

| |

|

Title: |

President and Chief Executive Officer |

Date: August 14, 2023

Exhibit

99.1

Jaguar Health

Reports Second Quarter 2023 Financial Results

Net revenue increased

36% in Q2 2023 versus Q1 2023

Top line results

expected late October 2023 for company’s phase 3 OnTarget trial of crofelemer for preventative treatment of cancer therapy-related

diarrhea

Jaguar is supporting

investigator-initiated proof-of-concept studies of crofelemer for the rare disease indications of short bowel syndrome and microvillus

inclusion disease in the EU and Middle East/North Africa regions, with results expected before the end of 2023 and in 2024

REMINDER:

Jaguar to host investor webcast Monday, August 14th at 8:30 a.m. Eastern regarding Q2 2023 financials and company

updates; Click here to register for webcast

SAN FRANCISCO, CA / August 14, 2023

/ Jaguar Health, Inc. (NASDAQ: JAGX) (“Jaguar” or the “Company”) today reported consolidated second-quarter

2023 financial results and provided Company updates.

The combined net revenue for Mytesi® (crofelemer) and

the Company’s crofelemer prescription product for treatment of chemotherapy-induced diarrhea in dogs, Canalevia®-CA1,

which became commercially available in April 2022, was approximately $2.7 million in the second quarter of 2023, representing an increase

of 36% compared to prescription product net revenue in the first quarter of 2023, which totaled approximately $2.0 million, and a decrease

of approximately 8% over prescription product net revenue in the second quarter of 2022, which totaled approximately $2.9 million. The

loss from operations increased by $1.6 million, from $6.4 million in the quarter ended June 30, 2022 to $8.1 million during the same period

in 2023.

Lisa Conte, Jaguar's president and CEO,

said, “Our paramount near-term clinical activity is our Phase 3 pivotal OnTarget trial of Mytesi for the follow-on

indication of the preventative treatment of chemotherapy-induced overactive bowel (CIOB) – which includes symptoms such as chronic

debilitating diarrhea, GI urgency, and GI incontinence. We have completed patient enrollment for OnTarget – a key step on our journey

to making crofelemer available to treat the neglected comorbidity of CIOB – and top line results from this pivotal study are expected

in late October 2023. With success, we expect to expand the indication of Mytesi in 2024.”

Jaguar is supporting investigator-initiated and investigator IND proof-of-concept

studies of crofelemer for microvillus inclusion disease (MVID) and short bowel syndrome (SBS) with intestinal failure in the US, EU and

Middle East/North Africa (MENA) regions, with results expected before the end of 2023 and in 2024. In accordance with the guidelines of

specific EU countries, published data from such clinical investigations could support reimbursed early patient access to crofelemer for

SBS or MVID, potentially in 2024, for these debilitating conditions.

MVID, an ultra-rare pediatric congenital diarrheal disorder (CDD),

and SBS with intestinal failure are Jaguar’s two prioritized rare disease investigative indications for a novel formulation of crofelemer.

MVID is a catastrophic medical situation for pediatric patients, and there are currently no approved drug treatments. The Company’s

Investigational New Drug application for crofelemer for the treatment of MVID was activated by the U.S. Food and Drug Administration (FDA)

August 7, 2023.

Crofelemer has been granted Orphan Drug

Designation (ODD) by the FDA and the European Medicines Agency (EMA) for both MVID and SBS with intestinal failure. The ODD programs

in the U.S. and European Union qualify sponsors to receive potential incentives to develop therapies for the diagnosis, prevention, or

treatment of rare diseases or conditions.

2023 SECOND QUARTER COMPANY FINANCIAL

RESULTS:

| · | Net

Mytesi Revenue: Net revenue for Mytesi was approximately $2.6 million in the second quarter

of 2023, representing an increase of 36% compared to Mytesi net revenue in the first quarter

of 2023, which totaled approximately $2.0 million, and a decrease of approximately 7.0% over

Mytesi net revenue in the second quarter of 2022, which totaled approximately $2.8 million. |

| · | Mytesi

Prescription Volume: Mytesi prescription volume increased approximately 4.0% in the second

quarter of 2023 compared to the first quarter of 2023, and decreased approximately 4.5% in

the second quarter of 2023 compared to the second quarter of 2022. Prescription volume differs

from invoiced sales volume, which reflects, among other factors, varying buying patterns

among specialty pharmacies in the closed network as they manage their inventory levels. |

| · | Net Canalevia-CA1 Revenue: Net revenue for the Company’s crofelemer prescription product for treatment of chemotherapy-induced

diarrhea in dogs, Canalevia-CA1, which became commercially available in April 2022, was approximately $39,100 in the second quarter of

2023, representing an increase of 40% over Canalevia-CA1 net revenue in the first quarter of 2023, which totaled approximately $27,820. |

| · | Neonorm™: Revenues for the non-prescription

Neonorm products for calves and foals and Jaguar’s Animal Health business unit were minimal for the second quarters of 2023 and

2022, in accordance with the Company’s primary focus on human health and prescription products. |

| | |

Three Months Ended | | |

| | |

| |

| Financial Highlights | |

June 30, | | |

| | |

| |

| (in thousands, except per share amounts) | |

2023 | | |

2022 | | |

$ change | | |

% change | |

| | |

| | |

| | |

| | |

| |

| Net product revenue | |

$ | 2,676 | | |

$ | 2,921 | | |

| (245 | ) | |

| -8 | % |

| Loss from operations | |

$ | (8,102 | ) | |

$ | (6,479 | ) | |

| (1,623 | ) | |

| 25 | % |

| Net loss attributable to shareholders | |

$ | (12,150 | ) | |

$ | (9,367 | ) | |

| (2,783 | ) | |

| 30 | % |

| Net loss per share, basic | |

$ | (0.69 | ) | |

$ | (0.12 | ) | |

| (0.57 | ) | |

| 475 | % |

| Net loss per share, diluted | |

$ | (0.42 | ) | |

$ | (0.12 | ) | |

| (0.30 | ) | |

| 250 | % |

| · | Cost of Product Revenue: Total cost of product revenue increased by

approximately $35,000, from $456,000 for the quarter ended June 30, 2022 to $491,000 for the quarter ended June 30, 2023. This was due

to increased direct labor for QA personnel in Q2 2023 compared to Q2 2022. |

| · | Research

and Development: The R&D expense increased by $1.8 million, from $2.5 million for

the quarter ended June 30, 2022 to $4.3 million during the same quarter in 2023 primarily

due to an increase related to the Phase 3 clinical

trial and regulatory initiatives for OnTarget trial and other initiatives. |

| · | Sales and Marketing: The Sales and Marketing expense decreased by

approximately $0.5 million, from $2.1 million for the quarter ended June 30, 2022 to $1.6 million during the same quarter in 2023. Direct

marketing fees and expenses decreased due to savings associated with the utilization of a more cost-effective patient support services

vendor, other Mytesi marketing initiatives, as well as decreased stock-based compensation, and commission expenses. |

| · | General

and Administrative: The G&A expense increased by $0.1 million, from $4.3 million

for the quarter ended June 30, 2022, to $4.4 million during the same quarter in 2023. The

increase of $0.1 million was largely due to increased travel expenses as travel restrictions

from the pandemic have abated. |

| · | Loss

from Operations: Loss from operations increased by $1.6 million, from $6.5 million in the quarter ended June 30, 2022 to $8.1 million

during the same period in 2023. |

| · | Net

Loss: Net loss attributable to common shareholders increased by approximately $2.8 million, from $9.4 million in the quarter ended

June 30, 2022 to $12.2 million in the same period in 2023. In addition to the loss from operations: |

| · | Interest

expense increased by $1.0 million from $2.5 million in the quarter ended June 30, 2022 to

$3.5 million for the same period in 2023 primarily due to interest from the royalty and note

agreements. |

| · | Change

in fair value of financial instrument and hybrid instrument designated at Fair Value Option

(“FVO") decreased $1.5 million from a gain of approximately $0.8 million for the

three months ended June 30, 2022 to a loss of about $0.7 million for the same period in 2023

primarily due to fair value adjustments in liability classified warrants and notes payable

designated at FVO. |

| · | Other

expenses decreased by about $1.1 million from the quarter ended June 30, 2022 to the same

period in 2023 largely due to foreign currency transactions. |

| · | Non-GAAP

Recurring EBITDA: Non-GAAP recurring EBITDA for the second quarter of 2023 and the second

quarter of 2022 were a net loss of $7.8 million and $5.3 million, respectively. |

| | |

Three Months Ending | |

| | |

June 30, | |

| (in thousands) | |

2023 | | |

2022 | |

| | |

| | |

| |

| | |

(unaudited) | |

| Net loss attributable to common shareholders | |

$ | (12,150 | ) | |

$ | (9,367 | ) |

| Adjustments: | |

| | | |

| | |

| Interest expense | |

| 3,453 | | |

| 2,536 | |

| Property and equipment depreciation | |

| 20 | | |

| 10 | |

| Amortization of intangible assets | |

| 484 | | |

| 422 | |

| Share-based compensation expense | |

| 529 | | |

| 1,113 | |

| Income taxes | |

| - | | |

| - | |

| Non-GAAP EBITDA | |

| (7,665 | ) | |

| (5,286 | ) |

| Impairment of indefinite-lived intangible assets | |

| | | |

| | |

| Loss on extinguishment of debt | |

| - | | |

| - | |

| Non-GAAP Recurring EBITDA | |

$ | (7,665 | ) | |

$ | (5,286 | ) |

Note Regarding Use of Non-GAAP Measures

The Company supplements its

condensed consolidated financial statements presented on a GAAP basis by providing non-GAAP EBITDA and non-GAAP recurring EBITDA,

which are considered non-GAAP under applicable SEC rules. Jaguar believes that the disclosure items of these non-GAAP measures

provide investors with additional information that reflects the basis upon which Company management assesses and operates the

business. These non-GAAP financial measures are not in accordance with GAAP and should not be viewed in isolation or as substitutes

for GAAP net sales and GAAP net loss and are not substitutes for, or superior to, measures of financial performance in conformity

with GAAP.

The Company defines non-GAAP EBITDA

as net loss before interest expense and other expense, depreciation of property and equipment, amortization of intangible assets, share-based

compensation expense and provision for or benefit from income taxes. The Company defines non-GAAP Recurring EBITDA as non-GAAP EBITDA

adjusted for certain non-recurring revenues and expenses. Company management believes that non-GAAP EBITDA and non-GAAP Recurring EBITDA

are meaningful indicators of Jaguar’s performance and provide useful information to investors regarding the Company’s results

of operations and financial condition.

Participation

Instructions for Webcast

When: Monday, August

14, 2023, at 8:30 AM Eastern Time

Participant Registration

& Access Link: Click Here

Replay Instructions

for Webcast

Replay of the webcast

on the investor relations section of Jaguar’s website: (click here)

About Crofelemer

Crofelemer

is the only oral FDA approved prescription drug under botanical guidance. It is plant-based, extracted and purified from the red bark

sap of the Croton lechleri tree in the Amazon Rainforest. Jaguar family company Napo Pharmaceuticals has established a sustainable

harvesting program, under fair trade practices, for crofelemer to ensure a high degree of quality, ecological integrity, and support for

Indigenous communities.

About the Jaguar Health Family of

Companies

Jaguar Health, Inc. (Jaguar) is a commercial

stage pharmaceuticals company focused on developing novel proprietary prescription medicines sustainably derived from plants from rainforest

areas for people and animals with GI distress, specifically overactive bowel, which includes symptoms such as chronic debilitating diarrhea,

GI urgency, and GI incontinence. Jaguar family company Napo Pharmaceuticals focuses on developing and commercializing human prescription

pharmaceuticals. Napo Pharmaceuticals’ crofelemer drug product candidate is the subject of the OnTarget study, an ongoing

pivotal Phase 3 clinical trial for preventative treatment of chemotherapy-induced overactive bowel (CIOB) in adults with cancer on targeted

therapy. Jaguar family company Napo Therapeutics is an Italian corporation Jaguar established in Milan, Italy in 2021 focused on expanding

crofelemer access in Europe and specifically for rare diseases. Jaguar Animal Health is a Jaguar tradename. Magdalena Biosciences, a

joint venture formed by Jaguar and Filament Health Corp., is focused on developing novel prescription medicines derived from plants for

mental health indications.

For more information about Jaguar Health,

please visit https://jaguar.health. For more information about Napo Pharmaceuticals, visit www.napopharma.com. For more

information about Napo Therapeutics, visit napotherapeutics.com. For more information about Magdalena Biosciences, visit magdalenabiosciences.com.

About Mytesi®

Mytesi (crofelemer) is an

antidiarrheal indicated for the symptomatic relief of noninfectious diarrhea in adult patients with HIV/AIDS on antiretroviral

therapy (ART). Mytesi is not indicated for the treatment of infectious diarrhea. Rule out infectious etiologies of diarrhea before

starting Mytesi. If infectious etiologies are not considered, there is a risk that patients with infectious etiologies will not

receive the appropriate therapy and their disease may worsen. In clinical studies, the most common adverse reactions occurring at a

rate greater than placebo were upper respiratory tract infection (5.7%), bronchitis (3.9%), cough (3.5%), flatulence (3.1%), and

increased bilirubin (3.1%).

See full Prescribing Information at

Mytesi.com. Crofelemer, the active ingredient in Mytesi, is a botanical (plant-based) drug extracted and purified from the red

bark sap of the medicinal Croton lechleri tree in the Amazon rainforest. Napo has established a sustainable harvesting program

for crofelemer to ensure a high degree of quality and ecological integrity.

Important Safety Information About

Canalevia®-CA1

For oral use in dogs only. Not for use

in humans. Keep Canalevia-CA1 (crofelemer delayed-release tablets) in a secure location out of reach of children and other animals. Consult

a physician in case of accidental ingestion by humans. Do not use in dogs that have a known hypersensitivity to crofelemer. Prior to

using Canalevia-CA1, rule out infectious etiologies of diarrhea. Canalevia-CA1 is a conditionally approved drug indicated for the treatment

of chemotherapy-induced diarrhea in dogs. The most common adverse reactions included decreased appetite, decreased activity, dehydration,

abdominal pain, and vomiting.

Caution: Federal law restricts

this drug to use by or on the order of a licensed veterinarian. Use only as directed. It is a violation of Federal law to use this

product other than as directed in the labeling. Conditionally approved by FDA pending a full demonstration of effectiveness under application

number 141-552.

See full Prescribing Information at

Canalevia.com.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking

statements.” These include statements regarding Jaguar’s expectation that it will host an investor webcast on August 14, 2023,

the Company’s expectation that top line results from the OnTarget study will be available in late October 2023, the Company’s

expectation that, with success, the indication of Mytesi will be expanded in 2024, the Company’s expectation that data from proof-of-concept

studies of crofelemer for MVID and SBS with intestinal failure will be available before the end of 2023 and in 2024, and Company’s

expectation that published data from such clinical investigations could support reimbursed early patient access to crofelemer for SBS

or MVID, potentially in 2024. In some cases, you can identify forward-looking statements by terms such as “may,” “will,”

“should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,” “predict,”

“potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements

in this release are only predictions. Jaguar has based these forward-looking statements largely on its current expectations and projections

about future events. These forward-looking statements speak only as of the date of this release and are subject to several risks, uncertainties,

and assumptions, some of which cannot be predicted or quantified and some of which are beyond Jaguar’s control. Except as required

by applicable law, Jaguar does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result

of any new information, future events, changed circumstances or otherwise.

Source: Jaguar Health, Inc.

Contact:

hello@jaguar.health

Jaguar-JAGX

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-36714

|

| Entity Registrant Name |

JAGUAR HEALTH, INC.

|

| Entity Central Index Key |

0001585608

|

| Entity Tax Identification Number |

46-2956775

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

200 Pine Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94104

|

| City Area Code |

415

|

| Local Phone Number |

371-8300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.0001 Per Share

|

| Trading Symbol |

JAGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

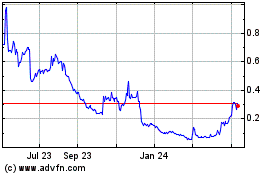

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

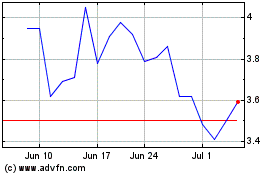

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Apr 2023 to Apr 2024