0000921114

false

0000921114

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 14, 2023

ARMATA PHARMACEUTICALS, INC.

(Exact name of Registrant as specified in

its charter)

| Washington |

|

001-37544 |

|

91-1549568 |

(State or other jurisdiction

of incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

4503 Glencoe Avenue

Marina del Rey, California |

|

90292 |

| (Address of principal executive offices) |

|

(Zip Code) |

(310) 655-2928

(Registrant’s Telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

ARMP |

|

NYSE American |

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 14, 2023, Armata Pharmaceuticals, Inc. (the “Company”)

announced its financial results for the quarter ended June 30, 2023, in the press release furnished hereto as Exhibit 99.1.

The information in this Item 2.02 and the attached Exhibit 99.1 is

being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934,

as amended, or otherwise subject to the liabilities of that Section. The information in this Item 2.02 and the attached Exhibit 99.1 shall

not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 14, 2023 |

Armata Pharmaceuticals, Inc. |

| |

|

| |

By: |

/s/ Julianne Averill |

| |

Name: |

Julianne Averill |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Armata Pharmaceuticals Announces Second Quarter

2023 Results and Provides Corporate Update

LOS ANGELES, Calif., August 14, 2023 -- Armata

Pharmaceuticals, Inc. (NYSE American: ARMP) (“Armata” or the “Company”), a biotechnology company focused

on pathogen-specific bacteriophage therapeutics for antibiotic-resistant and difficult-to-treat bacterial infections, today announced

financial results for its second quarter ended June 30, 2023, and provided a corporate update.

Second Quarter 2023 and Recent Developments:

| · | Announced leadership transition whereby world-renowned healthcare leader and former Innoviva Board member Dr. Deborah L. Birx

has been appointed Armata’s new Chief Executive Officer. Dr. Birx has also been appointed to Armata’s Board of Directors; |

| · | Entered into new credit agreement with Innoviva, the Company’s largest shareholder, for gross proceeds of $25 million, and executed

an amendment to its existing senior convertible credit and security agreement with Innoviva, extending the maturity date to January 10,

2025; |

| · | Continued enrollment in the Phase 2 study (“Tailwind”) of inhaled AP-PA02 in patients with non-cystic fibrosis

bronchiectasis (NCFB) and chronic Pseudomonas aeruginosa respiratory infection; |

| · | Further analyzed clinical data from the SWARM-P.a. study with the goal of advancing AP-PA02 into a Phase 2b/3 registrational

study in cystic fibrosis (CF) patients in 2024; |

| · | Completed enrollment as planned of the Phase 1b part of the Phase 1b/2a study of AP-SA02 in Staphylococcus aureus bacteremia

(“diSArm”); Company anticipates initiating the Phase 2a part of the study in 3Q23; |

| · | Commenced feasibility analysis of enrolling AP-SA02 prosthetic joint infection (PJI) study subjects at current “diSArm”

sites for potential dual use enrollment in Q3-Q4 2023; |

| · | Progressed the build-out of its new advanced biologics cGMP facility that will provide the company with the manufacturing capacity

to pursue partnership opportunities while also executing late-stage trials; and, |

| · | Delivered an oral presentation on the Company's recently completed Phase 1b/2a SWARM-P.a. clinical trial at the 6th World Conference

on Targeting Phage Therapy, which was held June 1-2, 2023, in Paris. |

“I am pleased to report significant progress

during the second quarter, as we continued to advance two critical pathway clinical studies while preparing to initiate a third,”

stated Dr. Deborah Birx, Chief Executive Officer. “For AP-PA02, our five-phage cocktail targeting Pseudomonas aeruginosa,

we continue to analyze results from our SWARM-P.a. study with the goal of progressing to a Phase 2b/3 registrational study in adult

cystic fibrosis patients in 2024. At the same time, we have incorporated important learnings from this study into our ongoing Phase 2

trial of AP-PA02 in patients with non-cystic fibrosis bronchiectasis.”

“Regarding our second clinical candidate,

AP-SA02, we are concluding the Phase 1b part of our Staphylococcus aureus complicated bacteremia study in partnership with the

U.S. Department of Defense, with plans to initiate the Phase 2a part this quarter. We are excited to observe that the phage cocktail is

well tolerated every six hours intravenously, opening the door to direct clinical evidence from the Phase 2a part and the potential for

an accelerated 2b/3 registrational study. Based on AP-SA02’s favorable tolerability profile, we are in parallel advancing start-up

activities for a second trial that will evaluate this cocktail as a potential treatment for S. aureus prosthetic joint infections.”

“I am pleased with our progress to date,

and, with our strengthened balance sheet, laser focus, and clearly defined strategy, we look forward to a productive back half of the

year as we work towards introducing phage therapy as a much-needed novel treatment for a broad range of dangerous, drug-resistant pathogens,”

Dr. Birx concluded.

Second Quarter 2023 Financial Results

Grant Revenue. The Company recognized grant

revenue of approximately $1.0 million for the three months ended June 30, 2023, which represents Medical Technology Enterprise Consortium

(“MTEC”)’s share of the costs incurred for the Company’s AP-SA02 program for the treatment of Staphylococcus

aureus bacteremia. The Company expects to receive $16.3 million in grant funding from MTEC administered by the U.S. Department

of Defense and the Defense Health Agency and Joint Warfighter Medical Research Program. The Company recognized approximately $1.9 million

of revenue in the comparable period in 2022.

Research and Development. Research and

development expenses for the three months ended June 30, 2023 were approximately $8.3 million as compared to approximately $9.0 million

for the comparable period in 2022. The Company continues to invest in clinical trial and personnel related expenses associated with its

primary development programs.

General and Administrative. General and

administrative expenses for the three months ended June 30, 2023 were approximately $2.4 million as compared to approximately $2.1

million for the comparable period in 2022. The increase was primarily related to expenses related to the increased legal and professional

expenses.

Loss from Operations. Loss from operations

for the three months ended June 30, 2023 was $(9.6) million as compared to a loss from operations of approximately $(9.2) million

for the comparable period in 2022.

Cash and Equivalents. As of June 30,

2023, Armata held approximately $12.5 million of unrestricted cash and cash equivalents, as compared to $14.9 million as of December 31,

2022. Subsequent to the end of the second quarter, Armata announced a new credit agreement with Innoviva for gross proceeds totaling $25

million.

As of August 8, 2023, there were approximately

36.1 million common shares outstanding.

About Armata Pharmaceuticals, Inc.

Armata is a clinical-stage biotechnology company

focused on the development of pathogen-specific bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat

bacterial infections using its proprietary bacteriophage-based technology. Armata is developing and advancing a broad pipeline of natural

and synthetic phage candidates, including clinical candidates for Pseudomonas aeruginosa, Staphylococcus aureus, and other

pathogens. Armata is committed to advancing phage with drug development expertise that spans bench to clinic including in-house phage

specific GMP manufacturing.

Forward Looking Statements

This communication contains "forward-looking"

statements as defined by the Private Securities Litigation Reform Act of 1995, including, without limitation, statements related to Armata's

bacteriophage development programs, Armata's ability to set up or operate R&D and manufacturing facilities, Armata's ability to meet

expected milestones, Armata's future success or failure, Armata's ability to be a leader in the development of phage-based therapeutics,

and statements related to the timing and results of clinical trials, including the anticipated results of clinical trials of AP-PA02 and

AP-SA02, Armata’s ability to develop new products based on natural bacteriophages and synthetic bacteriophages and Armata’s

ability to obtain additional funding and capacity to repay, refinance, or restructure its existing debt and obligations. Any statements

contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements. These forward-looking

statements are based upon Armata's current expectations. Forward-looking statements involve risks and uncertainties. Armata's actual results

and the timing of events could differ materially from those anticipated in such forward- looking statements as a result of these risks

and uncertainties, which include, without limitation, risks related to the ability of Armata's lead clinical candidates, AP-PA02 and AP-SA02,

to be more effective than previous candidates; that the top line results are indicative of the final data; Armata's ability to expedite

development of AP-PA02 and AP-SA02; Armata's ability to advance its preclinical and clinical programs and the uncertain and time-consuming

regulatory approval process; Armata's ability to develop products based on bacteriophages and synthetic phages to kill bacterial pathogens;

the Company's expected market opportunity for its products; Armata's ability to sufficiently fund its operations as expected, including

obtaining additional funding as needed; and any delays or adverse events within, or outside of, Armata's control, caused by the ongoing

COVID-19 pandemic. Additional risks and uncertainties relating to Armata and its business can be found under the caption "Risk Factors"

and elsewhere in Armata's filings and reports with the SEC, including in Armata's Annual Report on Form 10-K, filed with the SEC

on March 16, 2023, and in its subsequent filings with the SEC.

Armata expressly disclaims any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Armata's expectations

with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

Media Contacts:

At Armata:

Pierre Kyme

Armata Pharmaceuticals, Inc.

ir@armatapharma.com

310-665-2928

Investor Relations:

Joyce Allaire

LifeSci Advisors, LLC

jallaire@lifesciadvisors.com

212-915-2569

Armata Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 12,456,000 | | |

$ | 14,852,000 | |

| Prepaid expenses | |

| 5,745,000 | | |

| 3,664,000 | |

| Other receivable | |

| 8,633,000 | | |

| 8,531,000 | |

| Total current assets | |

| 26,834,000 | | |

| 27,047,000 | |

| Property and equipment, net | |

| 8,807,000 | | |

| 3,617,000 | |

| Operating lease right-of-use assets | |

| 43,652,000 | | |

| 43,035,000 | |

| Other long term assets | |

| 8,173,000 | | |

| 8,389,000 | |

| Intangible assets, net | |

| 13,746,000 | | |

| 13,746,000 | |

| Total assets | |

$ | 101,212,000 | | |

$ | 95,834,000 | |

| | |

| | | |

| | |

| Liabilities and shareholders’ equity | |

| | | |

| | |

| Convertible debt | |

$ | 26,352,000 | | |

$ | - | |

| Other current liabilities | |

| 25,210,000 | | |

| 24,873,000 | |

| Total current liabilities | |

| 51,562,000 | | |

| 24,873,000 | |

| Long term liabilities | |

| 27,430,000 | | |

| 31,804,000 | |

| Deferred tax liability | |

| 3,077,000 | | |

| 3,077,000 | |

| Total liabilities | |

| 82,069,000 | | |

| 59,754,000 | |

| Shareholders’ equity | |

| 19,143,000 | | |

| 36,080,000 | |

| Total liabilities and shareholders’ equity | |

$ | 101,212,000 | | |

$ | 95,834,000 | |

Armata Pharmaceuticals, Inc.

Condensed

Consolidated Statements of Operations

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Grant Revenue | |

$ | 980,000 | | |

$ | 1,883,000 | | |

$ | 1,776,000 | | |

$ | 3,119,000 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 8,259,000 | | |

| 9,020,000 | | |

| 17,863,000 | | |

| 17,048,000 | |

| General and administrative | |

| 2,350,000 | | |

| 2,083,000 | | |

| 4,888,000 | | |

| 4,066,000 | |

| Total operating expenses | |

| 10,609,000 | | |

| 11,103,000 | | |

| 22,751,000 | | |

| 21,114,000 | |

| Loss from operations | |

| (9,629,000 | ) | |

| (9,220,000 | ) | |

| (20,975,000 | ) | |

| (17,995,000 | ) |

| Other income (expense), net | |

| 46,000 | | |

| 5,000 | | |

| 64,000 | | |

| 6,000 | |

| Change in fair value of convertible debt | |

| 6,036,000 | | |

| - | | |

| 2,874,000 | | |

| - | |

| Loss before income taxes and Net Loss | |

$ | (3,547,000 | ) | |

$ | (9,215,000 | ) | |

$ | (18,037,000 | ) | |

$ | (17,989,000 | ) |

| Net loss per share, basic | |

$ | (0.10 | ) | |

$ | (0.26 | ) | |

$ | (0.50 | ) | |

$ | (0.55 | ) |

| Weighted average shares outstanding, basic | |

| 36,068,130 | | |

| 35,999,642 | | |

| 36,056,649 | | |

| 32,517,416 | |

| Net loss per share, diluted | |

$ | (0.17 | ) | |

$ | (0.26 | ) | |

$ | (0.50 | ) | |

$ | (0.55 | ) |

| Weighted average shares outstanding, diluted | |

| 56,544,698 | | |

| 35,999,642 | | |

| 36,056,649 | | |

| 32,517,416 | |

Armata Pharmaceuticals, Inc.

Condensed

Consolidated Statements of Cash Flows

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Operating activities: | |

| | | |

| | |

| Net loss | |

$ | (18,037,000 | ) | |

$ | (17,989,000 | ) |

| Adjustments required to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Share-based compensation | |

| 1,118,000 | | |

| 1,442,000 | |

| Depreciation | |

| 458,000 | | |

| 421,000 | |

| Change in fair value of convertible debt | |

| (2,874,000 | ) | |

| - | |

| Changes in operating assets and liabilities, net | |

| (10,295,000 | ) | |

| 4,463,000 | |

| Net cash used in operating activities | |

| (29,630,000 | ) | |

| (11,663,000 | ) |

| Investing activities: | |

| | | |

| | |

| Purchases of property and equipment, net | |

| (2,232,000 | ) | |

| (1,372,000 | ) |

| Net cash used in investing activities | |

| (2,232,000 | ) | |

| (1,372,000 | ) |

| Financing activities: | |

| | | |

| | |

| Proceeds from issuance of convertible debt, net | |

| 29,226,000 | | |

| - | |

| Proceeds from sale of common shares, net of offering costs | |

| - | | |

| 44,414,000 | |

| Proceeds from exercise of warrants and share-based options | |

| - | | |

| 71,000 | |

| Net cash provided by (used in) financing activities | |

| 29,226,000 | | |

| 44,485,000 | |

| Net increase (decrease) in cash and cash equivalents | |

| (2,636,000 | ) | |

| 31,450,000 | |

| Cash, cash equivalents and restricted cash, beginning of period | |

| 20,812,000 | | |

| 11,488,000 | |

| Cash, cash equivalents and restricted cash, end of period | |

$ | 18,176,000 | | |

$ | 42,938,000 | |

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Reconciliation of Cash and cash equivalents: | |

| | |

| |

| Cash and cash equivalents | |

$ | 12,456,000 | | |

$ | 36,978,000 | |

| Restricted cash | |

| 5,720,000 | | |

| 5,960,000 | |

| Cash, cash equivalents and restricted cash | |

$ | 18,176,000 | | |

$ | 42,938,000 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

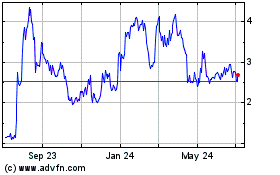

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

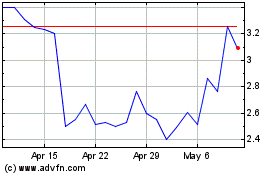

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Apr 2023 to Apr 2024