0001013706

Wilhelmina International, Inc.

false

--12-31

Q2

2023

1,931

1,612

1,292

1,216

0.01

0.01

9,000,000

9,000,000

6,472,038

6,472,038

6,472,038

6,472,038

1,314,694

1,314,694

15

0

00010137062023-01-012023-06-30

xbrli:shares

00010137062023-08-11

iso4217:USD

00010137062023-06-30

00010137062022-12-31

iso4217:USDxbrli:shares

0001013706us-gaap:ServiceMember2023-04-012023-06-30

0001013706us-gaap:ServiceMember2022-04-012022-06-30

0001013706us-gaap:ServiceMember2023-01-012023-06-30

0001013706us-gaap:ServiceMember2022-01-012022-06-30

0001013706whlm:LicenseFeesMember2023-04-012023-06-30

0001013706whlm:LicenseFeesMember2022-04-012022-06-30

0001013706whlm:LicenseFeesMember2023-01-012023-06-30

0001013706whlm:LicenseFeesMember2022-01-012022-06-30

00010137062023-04-012023-06-30

00010137062022-04-012022-06-30

00010137062022-01-012022-06-30

0001013706us-gaap:CommonStockMember2021-12-31

0001013706us-gaap:TreasuryStockCommonMember2021-12-31

0001013706us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001013706us-gaap:RetainedEarningsMember2021-12-31

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

00010137062021-12-31

0001013706us-gaap:CommonStockMember2022-01-012022-03-31

0001013706us-gaap:TreasuryStockCommonMember2022-01-012022-03-31

0001013706us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0001013706us-gaap:RetainedEarningsMember2022-01-012022-03-31

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

00010137062022-01-012022-03-31

0001013706us-gaap:CommonStockMember2022-03-31

0001013706us-gaap:TreasuryStockCommonMember2022-03-31

0001013706us-gaap:AdditionalPaidInCapitalMember2022-03-31

0001013706us-gaap:RetainedEarningsMember2022-03-31

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-31

00010137062022-03-31

0001013706us-gaap:CommonStockMember2022-04-012022-06-30

0001013706us-gaap:TreasuryStockCommonMember2022-04-012022-06-30

0001013706us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

0001013706us-gaap:RetainedEarningsMember2022-04-012022-06-30

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-30

0001013706us-gaap:CommonStockMember2022-06-30

0001013706us-gaap:TreasuryStockCommonMember2022-06-30

0001013706us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001013706us-gaap:RetainedEarningsMember2022-06-30

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

00010137062022-06-30

0001013706us-gaap:CommonStockMember2022-12-31

0001013706us-gaap:TreasuryStockCommonMember2022-12-31

0001013706us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001013706us-gaap:RetainedEarningsMember2022-12-31

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001013706us-gaap:CommonStockMember2023-01-012023-03-31

0001013706us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0001013706us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001013706us-gaap:RetainedEarningsMember2023-01-012023-03-31

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

00010137062023-01-012023-03-31

0001013706us-gaap:CommonStockMember2023-03-31

0001013706us-gaap:TreasuryStockCommonMember2023-03-31

0001013706us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001013706us-gaap:RetainedEarningsMember2023-03-31

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

00010137062023-03-31

0001013706us-gaap:CommonStockMember2023-04-012023-06-30

0001013706us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0001013706us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001013706us-gaap:RetainedEarningsMember2023-04-012023-06-30

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0001013706us-gaap:CommonStockMember2023-06-30

0001013706us-gaap:TreasuryStockCommonMember2023-06-30

0001013706us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001013706us-gaap:RetainedEarningsMember2023-06-30

0001013706us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

00010137062012-12-31

00010137062013-12-31

00010137062016-01-012016-12-31

00010137062016-12-31

00010137062012-01-012023-06-30

0001013706whlm:ServicesAgreementsMember2022-01-012022-12-31

0001013706us-gaap:RelatedPartyMember2023-01-012023-06-30

0001013706us-gaap:RelatedPartyMember2022-01-012022-06-30

0001013706whlm:ServicesAgreementsMember2023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 001-36589

| WILHELMINA INTERNATIONAL, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 74-2781950 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 5420 LBJ Freeway, Lockbox #25, Dallas, Texas | 75240 |

| (Address of principal executive offices) | (Zip Code) |

| (214) 661-7488 |

| (Registrant’s telephone number, including area code) |

| |

| n/a |

| (Former name, former address and former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | WHLM | Nasdaq Capital Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of August 11, 2023, the registrant had 5,157,344 shares of common stock outstanding.

WILHELMINA INTERNATIONAL, INC. AND SUBSIDIARIES

Quarterly Report on Form 10-Q

For the Three and Six Months Ended June 30, 2023

PART I

FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements

WILHELMINA INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

| | | (Unaudited) | | | | | |

| | | June 30, 2023 | | | December 31, 2022 | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 10,943 | | | $ | 11,998 | |

| Accounts receivable, net of allowance for doubtful accounts of $1,931 and $1,612, respectively | | | 9,965 | | | | 9,467 | |

| Prepaid expenses and other current assets | | | 214 | | | | 181 | |

| Total current assets | | | 21,122 | | | | 21,646 | |

| | | | | | | | | |

| Property and equipment, net of accumulated depreciation of $1,292 and $1,216, respectively | | | 340 | | | | 307 | |

| Right of use assets-operating | | | 3,429 | | | | 3,565 | |

| Right of use assets-finance | | | 108 | | | | 138 | |

| Trademarks and trade names with indefinite lives | | | 8,467 | | | | 8,467 | |

| Goodwill | | | 7,547 | | | | 7,547 | |

| Other assets | | | 301 | | | | 322 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 41,314 | | | $ | 41,992 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 3,883 | | | $ | 4,306 | |

| Due to models | | | 7,815 | | | | 8,378 | |

| Contract liabilities | | | - | | | | 270 | |

| Lease liabilities – operating, current | | | 572 | | | | 385 | |

| Lease liabilities – finance, current | | | 64 | | | | 62 | |

| Total current liabilities | | | 12,334 | | | | 13,401 | |

| | | | | | | | | |

| Long term liabilities: | | | | | | | | |

| Deferred income tax, net | | | 1,138 | | | | 985 | |

| Lease liabilities – operating, non-current | | | 3,187 | | | | 3,310 | |

| Lease liabilities – finance, non-current | | | 52 | | | | 85 | |

| Total long term liabilities | | | 4,377 | | | | 4,380 | |

| | | | | | | | | |

| Total liabilities | | | 16,711 | | | | 17,781 | |

| | | | | | | | | |

| Shareholders’ equity: | | | | | | | | |

| Common stock, $0.01 par value, 9,000,000 shares authorized; 6,472,038 shares issued and outstanding at June 30, 2023 and December 31, 2022 | | | 65 | | | | 65 | |

| Treasury stock, 1,314,694 shares at June 30, 2023 and December 31, 2022, at cost | | | (6,371 | ) | | | (6,371 | ) |

| Additional paid-in capital | | | 88,819 | | | | 88,770 | |

| Accumulated deficit | | | (57,564 | ) | | | (57,709 | ) |

| Accumulated other comprehensive loss | | | (346 | ) | | | (544 | ) |

| Total shareholders’ equity | | | 24,603 | | | | 24,211 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 41,314 | | | $ | 41,992 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

WILHELMINA INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the Three and Six Months Ended June 30, 2023 and 2022

(In thousands, except for share and per share data)

(Unaudited)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service revenues |

|

$ |

4,486 |

|

|

$ |

4,691 |

|

|

$ |

8,962 |

|

|

$ |

9,232 |

|

| License fees |

|

|

7 |

|

|

|

8 |

|

|

|

15 |

|

|

|

15 |

|

| Total revenues |

|

|

4,493 |

|

|

|

4,699 |

|

|

|

8,977 |

|

|

|

9,247 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and service costs |

|

|

2,979 |

|

|

|

2,697 |

|

|

|

5,859 |

|

|

|

5,349 |

|

| Office and general expenses |

|

|

1,063 |

|

|

|

693 |

|

|

|

2,143 |

|

|

|

1,402 |

|

| Amortization and depreciation |

|

|

56 |

|

|

|

47 |

|

|

|

107 |

|

|

|

106 |

|

| Corporate overhead |

|

|

246 |

|

|

|

222 |

|

|

|

490 |

|

|

|

476 |

|

| Total operating expenses |

|

|

4,344 |

|

|

|

3,659 |

|

|

|

8,599 |

|

|

|

7,333 |

|

| Operating income |

|

|

149 |

|

|

|

1,040 |

|

|

|

378 |

|

|

|

1,914 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange loss (gain) |

|

|

61 |

|

|

|

(110 |

) |

|

|

79 |

|

|

|

(104 |

) |

| Interest expense |

|

|

- |

|

|

|

2 |

|

|

|

1 |

|

|

|

5 |

|

| Total other expense (income) |

|

|

61 |

|

|

|

(108 |

) |

|

|

80 |

|

|

|

(99 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision for income taxes |

|

|

88 |

|

|

|

1,148 |

|

|

|

298 |

|

|

|

2,013 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current |

|

|

56 |

|

|

|

(54 |

) |

|

|

- |

|

|

|

(84 |

) |

| Deferred |

|

|

(158 |

) |

|

|

(173 |

) |

|

|

(153 |

) |

|

|

(269 |

) |

| Provision for income taxes, net |

|

|

(102 |

) |

|

|

(227 |

) |

|

|

(153 |

) |

|

|

(353 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(14 |

) |

|

$ |

921 |

|

|

$ |

145 |

|

|

$ |

1,660 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

|

|

112 |

|

|

|

(338 |

) |

|

|

198 |

|

|

|

(512 |

) |

| Total comprehensive income |

|

$ |

98 |

|

|

$ |

583 |

|

|

$ |

343 |

|

|

$ |

1,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income per common share |

|

$ |

0.00 |

|

|

$ |

0.18 |

|

|

$ |

0.03 |

|

|

$ |

0.32 |

|

| Diluted net income per common share |

|

$ |

0.00 |

|

|

$ |

0.18 |

|

|

$ |

0.03 |

|

|

$ |

0.32 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding-basic |

|

|

5,157 |

|

|

|

5,157 |

|

|

|

5,157 |

|

|

|

5,157 |

|

| Weighted average common shares outstanding-diluted |

|

|

5,157 |

|

|

|

5,157 |

|

|

|

5,157 |

|

|

|

5,157 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

WILHELMINA INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

For the Three and Six Months Ended June 30, 2023 and 2022

(In thousands)

(Unaudited)

| |

|

Common Shares |

|

|

Stock Amount |

|

|

Treasury Shares |

|

|

Stock Amount |

|

|

Additional Paid-in Capital |

|

|

Accumulated Deficit |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

Total |

|

| Balances at December 31, 2021 |

|

|

6,472 |

|

|

$ |

65 |

|

|

|

(1,315 |

) |

|

$ |

(6,371 |

) |

|

$ |

88,580 |

|

|

$ |

(61,238 |

) |

|

$ |

(23 |

) |

|

$ |

21,013 |

|

| Share based payment expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

55 |

|

|

|

- |

|

|

|

- |

|

|

|

55 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

739 |

|

|

|

- |

|

|

|

739 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(174 |

) |

|

|

(174 |

) |

| Balances at March 31, 2022 |

|

|

6,472 |

|

|

$ |

65 |

|

|

|

(1,315 |

) |

|

$ |

(6,371 |

) |

|

$ |

88,635 |

|

|

$ |

(60,499 |

) |

|

$ |

(197 |

) |

|

$ |

21,633 |

|

| Share based payment expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

55 |

|

|

|

- |

|

|

|

- |

|

|

|

55 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

921 |

|

|

|

- |

|

|

|

921 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(338 |

) |

|

|

(338 |

) |

| Balances at June 30, 2022 |

|

|

6,472 |

|

|

$ |

65 |

|

|

|

(1,315 |

) |

|

$ |

(6,371 |

) |

|

$ |

88,690 |

|

|

$ |

(59,578 |

) |

|

$ |

(535 |

) |

|

$ |

22,271 |

|

| |

|

Common Shares |

|

|

Stock Amount |

|

|

Treasury Shares |

|

|

Stock Amount |

|

|

Additional Paid-in Capital |

|

|

Accumulated Deficit |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

Total |

|

| Balances at December 31, 2022 |

|

|

6,472 |

|

|

$ |

65 |

|

|

|

(1,315 |

) |

|

$ |

(6,371 |

) |

|

$ |

88,770 |

|

|

$ |

(57,709 |

) |

|

$ |

(544 |

) |

|

$ |

24,211 |

|

| Share based payment expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

24 |

|

|

|

- |

|

|

|

- |

|

|

|

24 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

159 |

|

|

|

- |

|

|

|

159 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

86 |

|

|

|

86 |

|

| Balances at March 31, 2023 |

|

|

6,472 |

|

|

$ |

65 |

|

|

|

(1,315 |

) |

|

$ |

(6,371 |

) |

|

$ |

88,794 |

|

|

$ |

(57,550 |

) |

|

$ |

(458 |

) |

|

$ |

24,480 |

|

| Share based payment expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

25 |

|

|

|

- |

|

|

|

- |

|

|

|

25 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(14 |

) |

|

|

- |

|

|

|

(14 |

) |

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

112 |

|

|

|

112 |

|

| Balances at June 30, 2023 |

|

|

6,472 |

|

|

$ |

65 |

|

|

|

(1,315 |

) |

|

$ |

(6,371 |

) |

|

$ |

88,819 |

|

|

$ |

(57,564 |

) |

|

$ |

(346 |

) |

|

$ |

24,603 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

WILHELMINA INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

For the Six Months Ended June 30, 2023 and 2022

(In thousands)

(Unaudited)

| |

|

Six Months Ended June 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income: |

|

$ |

145 |

|

|

$ |

1,660 |

|

| Adjustments to reconcile net income to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Amortization and depreciation |

|

|

107 |

|

|

|

106 |

|

| Share based payment expense |

|

|

49 |

|

|

|

110 |

|

| Loss (gain) on foreign exchange rates |

|

|

79 |

|

|

|

(104 |

) |

| Deferred income taxes |

|

|

153 |

|

|

|

269 |

|

| Bad debt expense |

|

|

82 |

|

|

|

79 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(659 |

) |

|

|

(2,412 |

) |

| Prepaid expenses and other current assets |

|

|

(33 |

) |

|

|

(116 |

) |

| Right of use assets-operating |

|

|

349 |

|

|

|

238 |

|

| Other assets |

|

|

21 |

|

|

|

(227 |

) |

| Due to models |

|

|

(563 |

) |

|

|

681 |

|

| Lease liabilities-operating |

|

|

(149 |

) |

|

|

(240 |

) |

| Contract liabilities |

|

|

(270 |

) |

|

|

(535 |

) |

| Accounts payable and accrued liabilities |

|

|

(423 |

) |

|

|

14 |

|

| Net cash used in operating activities |

|

|

(1,112 |

) |

|

|

(477 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(109 |

) |

|

|

(18 |

) |

| Net cash used in investing activities |

|

|

(109 |

) |

|

|

(18 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Payments on finance leases |

|

|

(32 |

) |

|

|

(33 |

) |

| Net cash used in financing activities |

|

|

(32 |

) |

|

|

(33 |

) |

| |

|

|

|

|

|

|

|

|

| Foreign currency effect on cash flows: |

|

|

198 |

|

|

|

(412 |

) |

| |

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents: |

|

|

(1,055 |

) |

|

|

(940 |

) |

| Cash and cash equivalents, beginning of period |

|

|

11,998 |

|

|

|

10,251 |

|

| Cash and cash equivalents, end of period |

|

$ |

10,943 |

|

|

$ |

9,311 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for income taxes |

|

$ |

49 |

|

|

$ |

5 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

WILHELMINA INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1. Basis of Presentation

The interim consolidated financial statements included herein have been prepared by Wilhelmina International, Inc. (together with its subsidiaries, "Wilhelmina" or the "Company") without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Although certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to those rules and regulations, all adjustments considered necessary in order to make the consolidated financial statements not misleading have been included. In the opinion of the Company’s management, the accompanying interim unaudited consolidated financial statements reflect all adjustments, of a normal recurring nature, that are necessary for a fair presentation of the Company’s consolidated balance sheets, statements of operations and comprehensive income, statements of shareholders’ equity, and cash flows for the periods presented. These interim unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022. Results of operations for the interim periods are not necessarily indicative of results that may be expected for any other interim periods or the full fiscal year.

Note 2. Business Activity

The primary business of Wilhelmina is fashion model management. These business operations are headquartered in New York City. The Company’s predecessor was founded in 1967 by Wilhelmina Cooper, a renowned fashion model, and became one of the oldest, best known and largest fashion model management companies in the world. Since its founding, Wilhelmina has grown to include operations located in Los Angeles, Miami, and London, as well as a network of licensees. Wilhelmina provides traditional, full-service fashion model and talent management services, specializing in the representation and management of models, entertainers, athletes and other talent, to various clients, including retailers, designers, advertising agencies, print and electronic media and catalog companies.

Note 3. Foreign Currency Translation

The functional currency of our subsidiary in the United Kingdom is the British Pound. Assets and liabilities are translated into U.S. dollars at the exchange rates in effect at each balance sheet date. Results of operations are translated using the weighted average exchange rates during reporting periods. Related translation adjustments are accumulated in a separate component of shareholders’ equity and transaction gains and losses are recognized in the consolidated statements of operations and comprehensive income when realized.

Note 4. Commitments and Contingencies

On October 24, 2013, a putative class action lawsuit was brought against the Company by former Wilhelmina model Alex Shanklin and others, including Louisa Raske, Carina Vretman, Grecia Palomares and Michelle Griffin Trotter (the “Shanklin Litigation”), in New York State Supreme Court (New York County) by the same lead counsel who represented plaintiffs in a prior, now-dismissed action brought by Louisa Raske (the “Raske Litigation”). The claims in the Shanklin Litigation initially included breach of contract and unjust enrichment allegations arising out of matters similar to the Raske Litigation, such as the handling and reporting of funds on behalf of models and the use of model images. Other parties named as defendants in the Shanklin Litigation included other model management companies, advertising firms, and certain advertisers. On January 6, 2014, the Company moved to dismiss the Amended Complaint in the Shanklin Litigation for failure to state a claim upon which relief can be granted and other grounds, and other defendants also filed motions to dismiss. On August 11, 2014, the court denied the motion to dismiss as to Wilhelmina and other of the model management defendants. Separately, on March 3, 2014, the judge assigned to the Shanklin Litigation wrote the Office of the New York Attorney General bringing the case to its attention, generally describing the claims asserted therein against the model management defendants, and stating that the case “may involve matters in the public interest.” The judge’s letter also enclosed a copy of his decision in the Raske Litigation, which dismissed that case.

Plaintiffs retained substitute counsel, who filed a Second and then Third Amended Complaint. Plaintiffs’ Third Amended Complaint asserts causes of action for alleged breaches of the plaintiffs' management contracts with the defendants, conversion, breach of the duty of good faith and fair dealing, and unjust enrichment. The Third Amended Complaint also alleges that the plaintiff models were at all relevant times employees, and not independent contractors, of the model management defendants, and that defendants violated the New York Labor Law in several respects, including, among other things, by allegedly failing to pay the models the minimum wages and overtime pay required thereunder, not maintaining accurate payroll records, and not providing plaintiffs with full explanations of how their wages and deductions therefrom were computed. The Third Amended Complaint seeks certification of the action as a class action, damages in an amount to be determined at trial, plus interest, costs, attorneys’ fees, and such other relief as the court deems proper. On October 6, 2015, Wilhelmina filed a motion to dismiss as to most of the plaintiffs’ claims. The Court entered a decision granting in part and denying in part Wilhelmina’s motion to dismiss on May 26, 2017. The Court (i) dismissed three of the five New York Labor Law causes of action, along with the conversion, breach of the duty of good faith and fair dealing and unjust enrichment causes of action, in their entirety, and (ii) permitted only the breach of contract causes of action, and some plaintiffs’ remaining two New York Labor Law causes of action to continue, within a limited time frame. The plaintiffs and Wilhelmina each appealed, and the decision was affirmed on May 24, 2018. On August 16, 2017, Wilhelmina timely filed its Answer to the Third Amended Complaint.

On June 6, 2016, another putative class action lawsuit was brought against the Company by former Wilhelmina model Shawn Pressley and others, including Roberta Little (the “Pressley Litigation”), in New York State Supreme Court (New York County) by the same counsel representing the plaintiffs in the Shanklin Litigation, and asserting identical, although more recent, claims as those in the Shanklin Litigation. The Amended Complaint, asserting essentially the same types of claims as in the Shanklin action, was filed on August 16, 2017. Wilhelmina filed a motion to dismiss the Amended Complaint on September 29, 2017, which was granted in part and denied in part on May 10, 2018. Some New York Labor Law and contract claims remain in the case. Pressley has withdrawn from the case, leaving Roberta Little as the sole remaining named plaintiff in the Pressley Litigation. On July 12, 2019, the Company filed its Answer and Counterclaim against Little.

On May 1, 2019, the Plaintiffs in the Shanklin Litigation (except Raske) and the Pressley Litigation filed motions for class certification on their contract claims and the remaining New York Labor Law Claims. On July 12, 2019, Wilhelmina filed its opposition to the motions for class certification and filed a cross-motion for summary judgment against Shanklin, Vretman, Palomares, Trotter and Little, and a motion for summary judgment against Raske.

By Order dated May 8, 2020 (the “Class Certification Order”), the Court denied class certification in the Pressley case, denied class certification with respect to the breach of contract and alleged unpaid usage claims, granted class certification as to the New York Labor Law causes of action asserted by Vretman, Palomares and Trotter, and declined to rule on Wilhelmina’s motions for summary judgment, denying them without prejudice to be re-filed at a later date. Currently the parties are engaging in merits discovery.

The Company believes the claims asserted in the Shanklin Litigation and Pressley Litigation are without merit and intends to continue to vigorously defend the actions. Nonetheless, an adverse outcome in either case is at least reasonably possible. However, the Company is presently unable to reasonably estimate the amount or range of possible loss in either case. Therefore, no amount has been accrued as of June 30, 2023 related to these matters.

In addition to the legal proceedings disclosed herein, the Company is also engaged in various legal proceedings that are routine in nature and incidental to its business. None of these routine proceedings, either individually or in the aggregate, are believed likely, in the Company's opinion, to have a material adverse effect on its consolidated financial position or its results of operations.

Note 5. Income Taxes

Generally, the Company’s combined effective tax rate is high relative to reported income before taxes as a result of certain amortization expense, stock based compensation, and corporate overhead not being deductible and income being attributable to certain states in which it operates. In recent years, the majority of taxes paid by the Company were state and foreign taxes, not U.S. federal taxes. The Company operates in three states which have relatively high tax rates: California, New York, and Florida. Realization of net operating loss carryforwards, foreign tax credits, and other deferred tax temporary differences are contingent upon future taxable earnings. The Company’s deferred tax assets are reviewed for expected utilization by assessing the available positive and negative factors surrounding recoverability, including projected future taxable income, reversal of existing taxable temporary differences, tax-planning strategies, and results of recent operations. A valuation allowance is recorded when it is more likely than not that a deferred tax asset will not be realized.

At June 30, 2022, due primarily to the effects of the COVID-19 pandemic on its business, the Company maintained a full $1.5 million valuation allowance against its deferred tax assets. As of each reporting date, management considers new evidence, both positive and negative, that could affect its view of the future realization of deferred tax assets. In connection with its assessment for the third quarter of 2022, management determined that there was sufficient evidence to conclude that it was more likely than not that all deferred tax assets were realizable. This evidence included three years of cumulative pretax income, excluding nonrecurring items, and expected reversal of existing taxable temporary differences. Consequently, the full valuation allowance against our deferred tax assets was released in 2022, and there is no valuation allowance at June 30, 2023. The Company will continue to assess the evidence used to determine the need for a valuation allowance and may reinstate the valuation allowance in future periods if warranted by changes in estimated future income and other factors.

As of June 30, 2023, the Company had no federal income tax loss carryforwards.

Note 6. Treasury Shares

During 2012, the Board of Directors authorized a stock repurchase program whereby the Company could repurchase up to 500,000 shares of its outstanding common stock. During 2013, the Board of Directors renewed and extended the Company’s share repurchase authority to enable it to repurchase up to an aggregate of 1,000,000 shares of common stock. In 2016, the Board of Directors increased by an additional 500,000 shares the number of shares of the Company’s common stock that may be repurchased under its stock repurchase program to an aggregate of 1,500,000 shares. The shares may be repurchased from time to time in the open market or through privately negotiated transactions at prices the Company deems appropriate. The program does not obligate the Company to acquire any particular amount of common stock and may be modified or suspended at any time at the Company’s discretion.

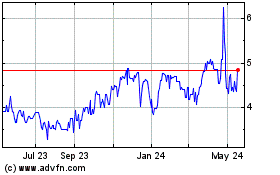

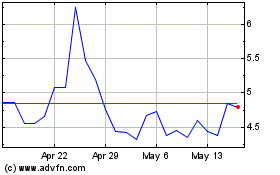

From 2012 through June 30, 2023, the Company had repurchased 1,314,694 shares of common stock at an average price of approximately $4.85 per share, for a total of approximately $6.4 million in repurchases under the stock repurchase program. During the first six months of 2023, no shares were repurchased under the stock repurchase program.

Note 7. Related Parties

The Executive Chairman of the Company, Mark E. Schwarz, is also the chairman, chief executive officer and portfolio manager of Newcastle Capital Management, L.P. (“NCM”). NCM is the general partner of Newcastle Partners L.P. (“Newcastle”), which is the largest shareholder of the Company.

The Company’s corporate headquarters are located at the offices of NCM. The Company utilizes NCM facilities on a month-to-month basis at $2.5 thousand per month, pursuant to a services agreement entered into between the parties. The Company incurred expenses pursuant to the services agreement totaling $15 thousand for the six months ended both June 30, 2023 and 2022. The Company did not owe NCM any amounts under the services agreement as of June 30, 2023.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following is a discussion of the interim unaudited consolidated financial condition and results of operations for the Company and its subsidiaries for the three and six months ended June 30, 2023 and 2022. It should be read in conjunction with the financial statements of the Company, the notes thereto and other financial information included elsewhere in this report, and the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains certain “forward-looking” statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Such forward looking statements relating to the Company and its subsidiaries are based on the beliefs of the Company’s management as well as information currently available to the Company’s management. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases of similar import, as they relate to the Company or Company management, are intended to identify forward-looking statements. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitation, competitive factors, general economic conditions, the interest rate environment, governmental regulation and supervision, seasonality, changes in industry practices, one-time events and other factors described herein and in other filings made by the Company with the SEC. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected or intended. The Company does not undertake any obligation to publicly update these forward-looking statements. As a result, you should not place undue reliance on these forward-looking statements.

OVERVIEW

The primary business of Wilhelmina is fashion model management. These business operations are headquartered in New York City. The Company’s predecessor was founded in 1967 by Wilhelmina Cooper, a renowned fashion model, and became one of the oldest, best known and largest fashion model management companies in the world. Since its founding, Wilhelmina has grown to include operations located in Los Angeles, Miami, and London, as well as a network of licensees. Wilhelmina provides traditional, full-service fashion model and talent management services, specializing in the representation and management of models, entertainers, athletes and other talent, to various clients, including retailers, designers, advertising agencies, print and electronic media and catalog companies.

Trends and Opportunities

The Company expects that the combination of Wilhelmina’s main operating base in New York City, the industry’s capital, with the depth and breadth of its talent pool and client roster and its diversification across various talent management segments, together with its geographical reach, should make Wilhelmina’s operations more resilient to industry changes and economic swings than those of many of the smaller firms operating in the industry.

With total annual advertising expenditures on major media (newspapers, magazines, television, cinema, outdoor and Internet) estimated to have exceeded $280 billion in recent years, North America is the world’s largest advertising market. For the fashion talent management industry, including Wilhelmina, advertising expenditures on television, Internet, magazines, and outdoor are of particular relevance.

In recent periods, traditional retail clients in the fashion and beauty industry have had increased competition from digital, social, and new media, reducing their budgets for advertising and model talent. Wilhelmina reviews the mix of talent and resources available to best operate in this changing environment.

Although Wilhelmina has a large and diverse client base, it is not immune to global economic conditions. The Company closely monitors economic conditions, client spending, and other industry factors and continually evaluates opportunities to increase its market share and further expand its geographic reach. There can be no assurance as to the effects on Wilhelmina of current or future economic circumstances, client spending patterns, client creditworthiness and other developments and whether, or to what extent, Wilhelmina’s efforts to respond to them will be effective.

Strategy

Management’s long-term strategy is to increase value to shareholders through the following initiatives:

• increase Wilhelmina’s brand awareness among advertisers and potential talent;

• expand the women’s high end fashion board;

• expand the Aperture division’s representation in commercials, film, and television;

• expand celebrity and social media influencer representation;

• expand the Wilhelmina network through strategic geographic market development; and

• promote model search contests and events and partner on media projects (television, film, books, etc.).

The Company makes use of digital technology to effectively connect with clients and talent, utilizing video conferencing and other digital tools to best position our team to identify opportunities to grow the careers of the talent we represent and expand our business. The Company has made significant investments in technology, infrastructure, and personnel, to support our clients and talent.

Key Financial Indicators

In addition to net income, the key financial indicators that the Company reviews to monitor its business are revenues, operating expenses, and cash flows.

The Company analyzes revenue by reviewing the mix of revenues generated by the different “boards,” each a specific division of the fashion model management operations which specializes by the type of model it represents, by geographic locations and from significant clients. Within its fashion model management business, Wilhelmina’s primary source of service revenue is from model fees and service charges paid by the client for bookings directly negotiated by the Company. The Company also receives commissions paid on bookings by third-party agencies. See “Critical Accounting Policies - Revenue Recognition.”

Wilhelmina provides professional services. Therefore, salary and service costs represent the largest part of the Company’s operating expenses. Salary and service costs are comprised of payroll and related costs and travel, meals and entertainment (“T&E”) to deliver the Company’s services and to enable new business development activities.

Analysis of Consolidated Statements of Operations and Service Revenues

| (in thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

Six Months Ended |

|

|

|

|

|

| |

|

June 30 |

|

|

June 30 |

|

|

% Change |

|

|

June 30 |

|

|

June 30 |

|

|

% Change |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 vs 2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 vs 2022 |

|

| Service revenues |

|

|

4,486 |

|

|

|

4,691 |

|

|

|

(4.4% |

) |

|

|

8,962 |

|

|

|

9,232 |

|

|

|

(2.9% |

) |

| License fees and other income |

|

|

7 |

|

|

|

8 |

|

|

|

(12.5% |

) |

|

|

15 |

|

|

|

15 |

|

|

|

- |

|

| TOTAL REVENUES |

|

|

4,493 |

|

|

|

4,699 |

|

|

|

(4.4% |

) |

|

|

8,977 |

|

|

|

9,247 |

|

|

|

(2.9% |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and service costs |

|

|

2,979 |

|

|

|

2,697 |

|

|

|

10.5 |

% |

|

|

5,859 |

|

|

|

5,349 |

|

|

|

9.5 |

% |

| Office and general expenses |

|

|

1,063 |

|

|

|

693 |

|

|

|

53.4 |

% |

|

|

2,143 |

|

|

|

1,402 |

|

|

|

52.9 |

% |

| Amortization and depreciation |

|

|

56 |

|

|

|

47 |

|

|

|

19.1 |

% |

|

|

107 |

|

|

|

106 |

|

|

|

0.9 |

% |

| Corporate overhead |

|

|

246 |

|

|

|

222 |

|

|

|

10.8 |

% |

|

|

490 |

|

|

|

476 |

|

|

|

2.9 |

% |

| OPERATING INCOME |

|

|

149 |

|

|

|

1,040 |

|

|

|

(85.7% |

) |

|

|

378 |

|

|

|

1,914 |

|

|

|

(80.3% |

) |

| OPERATING MARGIN |

|

|

0.8 |

% |

|

|

5.9 |

% |

|

|

|

|

|

|

1.1 |

% |

|

|

5.6 |

% |

|

|

|

|

| Foreign exchange loss (gain) |

|

|

61 |

|

|

|

(110 |

) |

|

|

(155.5% |

) |

|

|

79 |

|

|

|

(104 |

) |

|

|

(176.0% |

) |

| Interest expense |

|

|

- |

|

|

|

2 |

|

|

|

(100.0% |

) |

|

|

1 |

|

|

|

5 |

|

|

|

(80.0% |

) |

| INCOME BEFORE INCOME TAXES |

|

|

88 |

|

|

|

1,148 |

|

|

|

(92.3% |

) |

|

|

298 |

|

|

|

2,013 |

|

|

|

(85.2% |

) |

| Current income tax expense |

|

|

56 |

|

|

|

(54 |

) |

|

|

(203.7% |

) |

|

|

- |

|

|

|

(84 |

) |

|

|

(100.0% |

) |

| Deferred tax expense |

|

|

(158 |

) |

|

|

(173 |

) |

|

|

(8.7% |

) |

|

|

(153 |

) |

|

|

(269 |

) |

|

|

(43.1% |

) |

| Effective tax rate |

|

|

115.9 |

% |

|

|

19.8 |

% |

|

|

|

|

|

|

51.3 |

% |

|

|

17.5 |

% |

|

|

|

|

| NET INCOME |

|

|

(14 |

) |

|

|

921 |

|

|

|

(101.5% |

) |

|

|

145 |

|

|

|

1,660 |

|

|

|

(91.3% |

) |

Supplemental Non-GAAP Information

| (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

Six Months Ended |

|

|

|

|

|

| |

|

June 30 |

|

|

June 30 |

|

|

% Change |

|

|

June 30 |

|

|

June 30 |

|

|

% Change |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 vs 2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 vs 2022 |

|

| Gross Billings |

|

|

17,541 |

|

|

|

17,604 |

|

|

|

(0.4% |

) |

|

|

35,128 |

|

|

|

34,249 |

|

|

|

2.6 |

% |

| EBITDA |

|

|

144 |

|

|

|

1,197 |

|

|

|

(88.0% |

) |

|

|

406 |

|

|

|

2,124 |

|

|

|

(80.9% |

) |

| Adjusted EBITDA |

|

|

230 |

|

|

|

1,142 |

|

|

|

(79.9% |

) |

|

|

534 |

|

|

|

2,130 |

|

|

|

(74.9% |

) |

| Pre Corporate EBITDA |

|

|

476 |

|

|

|

1,364 |

|

|

|

(65.1% |

) |

|

|

1,024 |

|

|

|

2,606 |

|

|

|

(60.7% |

) |

See pages 14 to 15 for a reconciliation of these non-GAAP financial measures to the most comparable GAAP financial measures and for other important information.

Service Revenues

The Company’s service revenues fluctuate in response to its clients’ willingness to spend on advertising and the Company’s ability to have the desired talent available. The decreases of 4.4% and 2.9% for the three and six months ended June 30, 2023, when compared to the three and six months ended June 30, 2022, were primarily due to decreased commissions from core model bookings.

License Fees and Other Income

License fees and other income include franchise revenues from independently owned model agencies that use the Wilhelmina trademark and various services provided by the Company. License fees decreased by 12.5% for the three months ended June 30, 2023, when compared to three months ended June 30, 2022, primarily due to the timing of income from licensing agreements. License fees were unchanged for the six months ended June 30, 2023 when compared to the six months ended June 30, 2022.

Salaries and Service Costs

Salaries and service costs consist of payroll related costs and T&E required to deliver the Company’s services to its clients and talents. The 10.5% and 9.5% increases in salaries and service costs during the three and six months ended June 30, 2023, when compared to the three and six months ended June 30, 2022, were primarily due to personnel hires and payroll changes to better align Wilhelmina staffing with the needs of each office and geographical region.

Office and General Expenses

Office and general expenses consist of office and equipment rents, legal expenses, advertising and promotion, insurance expenses, administration and technology cost. The increase in office and general expenses of 53.4% and 52.9% for the three and six months ended June 30, 2023, when compared to the three and six months ended June 30, 2022, were primarily due to increased legal expense, rent expense, utilities, and other office related expenses.

Amortization and Depreciation

Amortization and depreciation expense is incurred with respect to certain assets, including computer hardware, software, office equipment, furniture, and finance leases. Amortization and depreciation expense increased by 19.1% and 0.9% for the three and six months ended June 30, 2023 compared to the three and six months ended June 30, 2022 primarily due to increased depreciation of capitalized furniture and leasehold assets at the Company’s new New York City office. Fixed asset purchases (mostly related to technology and computer equipment) totaled approximately $36 thousand and $109 thousand during the three and six months ended June 30, 2023, compared to $3 thousand and $18 thousand for the three and six months ended June 30, 2022.

Corporate Overhead

Corporate overhead expenses include director and executive officer compensation, legal, audit and professional fees, corporate office rent and travel. Corporate overhead increased by 10.8% and 2.9% for the three and six months ended June 30, 2023, compared to the three and six months ended June 30, 2022, primarily due to increased corporate travel expenses and the timing of audit costs incurred earlier than the prior year.

Operating Income and Loss and Operating Margin

Operating income was $0.1 million and $0.4 million for the three and six months ended June 30, 2023 compared to $1.0 million and $1.9 million in the three and six months ended June 30, 2022. As a result, operating margin decreased to 0.8% and 1.1% for the three and six months ended June 30, 2023, compared to 5.9% and 5.6% for the three and six months ended June 30, 2022. These decreases were primarily the result of the decrease in revenues and the increase in operating expenses.

Foreign Currency Exchange

The Company realized $61 thousand and $79 thousand loss from foreign currency exchange during the three and six months ended June 30, 2023, and $110 thousand and $104 thousand gain from foreign currency exchange during the three and six months ended June 30, 2022. Foreign currency gain and loss is due to fluctuations in currencies from Great Britain, Europe, and Latin America.

Interest Expense

Interest expense is primarily attributable to interest on finance leases. Interest expense was $0 and $1 thousand for the three and six months ended June 30, 2023, compared to $2 thousand and $5 thousand for the three and six months ended June 30, 2022.

Income before Income Taxes

Income before income taxes decreased to $0.1 million and $0.3 million for the three and six months ended June 30, 2023, compared to income of $1.1 million and $2.0 million for the three and six months ended June 30, 2022. The lower pre-tax income in 2023 was primarily due to lower operating income.

Income Taxes

Generally, the Company’s combined effective tax rate is high relative to reported net income (loss) as a result of certain valuation allowances on deferred tax assets, amortization expense, foreign taxes, and corporate overhead not being deductible and income being attributable to certain states in which it operates. The Company operates in three states, which have relatively high tax rates: California, New York, and Florida. In addition, foreign taxes in the United Kingdom related to our London office are not deductible from U.S. federal taxes. The Company had income tax expense of $0.1 million and $0.2 million for the three and six months ended June 30, 2023 compared to $0.2 million and $0.4 million for the three and six months ended June 30, 2022.

Net Income and Loss

The Company had a net loss of $14 thousand and net income of $0.1 million for the three and six months ended June 30, 2023, compared to net income of $0.9 and $1.7 million for the three and six months ended June 30, 2022. The decrease in net income was primarily due to the decrease in operating income.

Liquidity and Capital Resources

The Company’s cash balance decreased to $10.9 million at June 30, 2023 from $12.0 million at December 31, 2022. The cash balances decreased as a result of $1.1 million net cash used in operating activities, $0.1 million net cash used in investing activities, $32 thousand cash used in financing activities, partially offset by $0.2 million positive effect of exchange rate on cash flow during the six months ended June 30, 2023.

Net cash used by operating activities of $1.1 million was primarily the result of increases in accounts receivable, prepaid expenses, decreases in amounts due to models, accounts payable and accrued liabilities, and contract liabilities, partially offset by net income and increases in deferred income taxes. The $0.1 million cash used in investing activities was attributable to purchases of property and equipment, including furniture and fixtures, leasehold improvements, software and computer equipment. The $32 thousand cash used in financing activities was attributable to payments on finance leases.

The Company’s primary liquidity needs are for working capital associated with performing services under its client contracts. Generally, the Company incurs significant operating expenses with payment terms shorter than its average collections on billings. Based on budgeted and year-to-date cash flow information, management believes that the Company has sufficient liquidity to meet its projected operational expenses and capital expenditure requirements for the next twelve months and beyond.

Important Information Regarding Non-GAAP Financial Measures

The Company reports its financial results in accordance with GAAP. However, management believes that certain non-GAAP financial measures provide users of the Company's financial information with additional useful information in evaluating operating performance. The Company considers Gross Billings, EBITDA, Adjusted EBITDA and Pre-Corporate EBITDA to be important measures of performance because they are key operating metrics of the Company's business, are used by management in its planning and budgeting processes and to monitor and evaluate its financial and operating results and provide stockholders and potential investors with a means to evaluate the Company's financial and operating results against other companies within the Company's industry.

Gross Billings represents the gross amount billed to customers on behalf of its models and talent for services performed. The Company calculates Gross Billings as total revenue plus model costs, which includes amounts owed to talent, including taxes required to be withheld and remitted directly to taxing authorities, commissions owed to other agencies, and related costs such as those paid for photography. The Company calculates EBITDA as net income (loss) plus interest expense, income tax expense, and depreciation and amortization expense. The Company calculates “Adjusted EBITDA” as EBITDA plus foreign exchange gain/loss, share-based payment expense and certain significant non-recurring items that the Company may include from time to time. There were no such non-recurring items during the six months ended June 30, 2023 and 2022. The Company calculates “Pre-Corporate EBITDA” as Adjusted EBITDA plus corporate overhead expense, which includes director compensation, securities laws compliance costs, audit and professional fees, and other public company costs.

Non-GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, the Company's financial results prepared in accordance with GAAP. Certain of the items that may be excluded or included in non-GAAP financial measures may be significant items that could impact the Company's financial position, results of operations or cash flows and should therefore be considered in assessing the Company's actual and future financial condition and performance. The methods used by the Company to calculate its non-GAAP financial measures may differ significantly from methods used by other companies to compute similar measures. As a result, any non-GAAP financial measures presented herein may not be comparable to similar measures provided by other companies.

Gross Billings

The following is a tabular reconciliation of the non-GAAP financial measure Gross Billings to GAAP total revenues, which the Company believes to be the most comparable GAAP measure:

| (in thousands) |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30 |

|

|

June 30 |

|

|

June 30 |

|

|

June 30 |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Total Revenues |

|

|

4,493 |

|

|

|

4,699 |

|

|

|

8,977 |

|

|

|

9,247 |

|

| Model Costs |

|

|

13,048 |

|

|

|

12,905 |

|

|

|

26,151 |

|

|

|

25,002 |

|

| Gross Billings |

|

|

17,541 |

|

|

|

17,604 |

|

|

|

35,128 |

|

|

|

34,249 |

|

Model costs include amounts owed to talent, including taxes required to be withheld and remitted directly to taxing authorities, commissions owed to other agencies, and related costs such as those paid for photography.

EBITDA, Adjusted EBITDA, and Pre-Corporate EBITDA

The following is a tabular reconciliation of the non-GAAP financial measures EBITDA, Adjusted EBITDA, and Pre-Corporate EBITDA to GAAP net income, which the Company believes to be the most comparable GAAP measure:

| (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30 |

|

|

June 30 |

|

|

June 30 |

|

|

June 30 |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net (loss) income |

|

|

(14 |

) |

|

|

921 |

|

|

|

145 |

|

|

|

1,660 |

|

| Interest expense |

|

|

- |

|

|

|

2 |

|

|

|

1 |

|

|

|

5 |

|

| Income tax expense |

|

|

102 |

|

|

|

227 |

|

|

|

153 |

|

|

|

353 |

|

| Amortization and depreciation |

|

|

56 |

|

|

|

47 |

|

|

|

107 |

|

|

|

106 |

|

| EBITDA |

|

|

144 |

|

|

|

1,197 |

|

|

|

406 |

|

|

|

2,124 |

|

| Foreign exchange loss (gain) |

|

|

61 |

|

|

|

(110 |

) |

|

|

79 |

|

|

|

(104 |

) |

| Share based payment expense |

|

|

25 |

|

|

|

55 |

|

|

|

49 |

|

|

|

110 |

|

| Adjusted EBITDA |

|

|

230 |

|

|

|

1,142 |

|

|

|

534 |

|

|

|

2,130 |

|

| Corporate overhead |

|

|

246 |

|

|

|

222 |

|

|

|

490 |

|

|

|

476 |

|

| Pre-Corporate EBITDA |

|

|

476 |

|

|

|

1,364 |

|

|

|

1,024 |

|

|

|

2,606 |

|

Critical Accounting Policies

Basis of Presentation

The consolidated financial statements include the accounts of Wilhelmina and its wholly owned subsidiaries. All significant inter-company accounts and transactions have been eliminated in consolidation.

Revenue Recognition

The Company has adopted the requirements of Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASC 606”). ASC 606 establishes a principle for recognizing revenue upon the transfer of promised goods or services to customers, in an amount that reflects the expected consideration received in exchange for those goods or services.

Our revenues are derived primarily from fashion model bookings and representation of social media influencers and actors for commercials, film, and television. Our performance obligations are primarily satisfied at a point in time when the talent has completed the contractual requirements.

A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. The performance obligations for most of the Company’s core modeling bookings are satisfied on the day of the event, and the “day rate” total fee is agreed in advance when the customer books the model for a particular date. For contracts with multiple performance obligations, we allocate the contract’s transaction price to each performance obligation based on the estimated relative standalone selling price.

We report service revenues on a net basis, which represents gross amounts billed net of amounts owed to talent, including taxes required to be withheld and remitted directly to taxing authorities, commissions owed to other agencies, and related costs such as those paid for photography. The Company typically enters into contractual agreements with models under which the Company is obligated to pay talent upon collection of fees from the customer.

Although service revenues are reported on a net basis, accounts receivable are recorded at the amount of gross amounts billed to customers, inclusive of model costs. As a result, both accounts receivable and amounts due to models appear large relative to total revenue.

Amounts billed that have not yet met the applicable revenue recognition criteria are recorded as deferred revenue within accrued expenses and the related talent costs are recorded as contract liability.

Share Based Compensation

Share-based compensation expense is estimated at the grant date based on the award’s fair value as calculated by the Black-Scholes option pricing model and is recognized on a straight line basis as an expense over the requisite service period, which is generally the vesting period. The determination of the fair value of share-based awards on the date of grant using an option pricing model is affected by our stock price as well as assumptions regarding a number of complex and subjective variables. These variables include the estimated volatility over the expected term of the awards, actual and projected employee stock option exercise behaviors, risk-free interest rates, estimated forfeitures and expected dividends.

Income Taxes

We are subject to income taxes in the United States, the United Kingdom, and numerous local jurisdictions.

Deferred tax assets are recognized for unused tax losses, unused tax credits, and deductible temporary differences to the extent that it is probable that future taxable profits will be available against which they can be used. Unused tax loss carry-forwards are reviewed at each reporting date and a valuation allowance is established if it is doubtful we will generate sufficient future taxable income to utilize the loss carry-forwards.

In determining the amount of current and deferred income tax, we take into account whether additional taxes, interest, or penalties may be due. Although we believe that we have adequately reserved for our income taxes, we can provide no assurance that the final tax outcome will not be materially different. To the extent that the final tax outcome is different than the amounts recorded, such differences will affect the provision for income taxes in the period in which such determination is made and could have a material impact on our financial condition and operating results.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are accounted for at net realizable value, do not bear interest and are short-term in nature. The Company maintains an allowance for doubtful accounts for estimated losses resulting from the inability to collect on accounts receivable. Based on management’s assessment, the Company provides for estimated uncollectible amounts through a charge to earnings and a credit to the allowance. Balances that remain outstanding after the Company has used reasonable collection efforts are written off through a charge to the allowance and a credit to accounts receivable. The Company generally does not require collateral.

Although service revenues are reported on a basis net of model costs, accounts receivable are recorded at the amount of gross amounts billed to customers inclusive of model costs. As a result, both accounts receivable and amounts due to models appear large relative to total revenue.

Goodwill and Intangible Asset Impairment Testing

The Company performs impairment testing at least annually and more frequently if events and circumstances indicate that the asset might be impaired. An impairment loss is recognized to the extent that the carrying amount exceeds the reporting unit’s fair value. The Company sometimes utilizes an independent valuation specialist to assist with the determination of fair value. In accordance with ASU 2017-03, effective January 1, 2020, only a one-step quantitative impairment test is performed, whereby a goodwill impairment loss will be measured as the excess of a reporting unit’s carrying amount over its fair value. If the carrying amount of the reporting unit’s goodwill exceeds its fair value, an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill.