UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2023

Commission File Number: 001-40712

Cardiol Therapeutics

Inc.

(Translation of registrant's name into English)

602-2265 Upper Middle Road East, Oakville,

Ontario, Canada L6H 0G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

x Form 20-F ¨

Form 40-F

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CARDIOL THERAPEUTICS INC. |

| |

(Registrant) |

| |

|

|

|

| Date: August 10, 2023 |

By: |

/s/ Chris Waddick |

| |

|

Name: |

Chris Waddick |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

CARDIOL THERAPEUTICS INC.

CONDENSED INTERIM CONSOLIDATED

FINANCIAL STATEMENTS

THREE AND SIX MONTHS ENDED

JUNE 30, 2023

(EXPRESSED

IN CANADIAN DOLLARS)

(UNAUDITED)

Cardiol Therapeutics Inc.

Condensed Interim Consolidated Statements of Financial Position

(Expressed in Canadian Dollars)

Unaudited |

| | |

As at

June 30,

2023 | | |

As at

December 31,

2022 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents (note 3) | |

$ | 44,942,286 | | |

$ | 59,469,868 | |

| Accounts receivable | |

| 188,344 | | |

| 209,923 | |

| Other receivables | |

| 116,725 | | |

| 270,274 | |

| Prepaid expenses (note 14) | |

| 1,400,049 | | |

| 1,487,913 | |

| Total current assets | |

| 46,647,404 | | |

| 61,437,978 | |

| | |

| | | |

| | |

| Non-current

assets | |

| | | |

| | |

|

Property and equipment (note 4) | |

| 269,288 | | |

| 295,738 | |

| Intangible assets (note 5) | |

| 252,580 | | |

| 294,802 | |

| Total assets | |

$ | 47,169,272 | | |

$ | 62,028,518 | |

| | |

| | | |

| | |

EQUITY

AND LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

|

Accounts payable and accrued liabilities (note 14) | |

$ | 7,168,195 | | |

$ | 9,334,158 | |

| Current portion of lease liability (note 6) | |

| 48,194 | | |

| 50,447 | |

| Derivative liability (note 7) | |

| 1,202,713 | | |

| 419,901 | |

| Total current liabilities | |

| 8,419,102 | | |

| 9,804,506 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Lease liability (note 6) | |

| - | | |

| 22,424 | |

| Total liabilities | |

| 8,419,102 | | |

| 9,826,930 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Share capital (note 8) | |

| 147,674,648 | | |

| 147,545,399 | |

| Warrants (note 10) | |

| 3,517,867 | | |

| 3,517,867 | |

| Contributed surplus | |

| 16,567,255 | | |

| 15,586,832 | |

| Deficit | |

| (129,009,600 | ) | |

| (114,448,510 | ) |

| Total equity | |

| 38,750,170 | | |

| 52,201,588 | |

| Total equity and liabilities | |

$ | 47,169,272 | | |

$ | 62,028,518 | |

The accompanying notes to the unaudited condensed interim consolidated

financial statements are an integral part of these consolidated financial statements.

Commitments (notes 5 and 12)

Subsequent event (note 9(c))

Approved on behalf of the Board:

| "David Elsley", Director | |

"Guillermo Torre-Amione", Director |

Cardiol Therapeutics Inc.

Condensed Interim Consolidated Statements of Loss and Comprehensive Loss

(Expressed in Canadian Dollars)

Unaudited |

| | |

Three Months

Ended | | |

Three Months

Ended | | |

Six Months

Ended | | |

Six Months

Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expenses (notes 9, 13, 14) | |

| | | |

| | | |

| | | |

| | |

| General and administration | |

$ | 2,835,264 | | |

$ | 4,825,039 | | |

$ | 6,493,704 | | |

$ | 10,765,990 | |

| Research and development | |

| 3,479,385 | | |

| 4,407,182 | | |

| 7,607,081 | | |

| 8,254,709 | |

| Loss before other income | |

| (6,314,649 | ) | |

| (9,232,221 | ) | |

| (14,100,785 | ) | |

| (19,020,699 | ) |

| Interest income | |

| 528,697 | | |

| 191,336 | | |

| 1,074,624 | | |

| 263,647 | |

| Gain (loss) on foreign exchange | |

| (828,909 | ) | |

| 1,689,797 | | |

| (752,117 | ) | |

| 319,353 | |

| Change in derivative liability (note 7) | |

| (856,893 | ) | |

| 861,600 | | |

| (782,812 | ) | |

| 2,994,117 | |

| Net loss and comprehensive loss for the period | |

$ | (7,471,754 | ) | |

$ | (6,489,488 | ) | |

$ | (14,561,090 | ) | |

$ | (15,443,582 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Basic

and diluted net loss per share (note 11) | |

$ | (0.12 | ) | |

$ | (0.10 | ) | |

$ | (0.23 | ) | |

$ | (0.25 | ) |

| Weighted average number of common shares outstanding | |

| 64,105,448 | | |

| 61,932,362 | | |

| 64,098,586 | | |

| 61,928,811 | |

The accompanying notes to the unaudited condensed interim consolidated

financial statements are an integral part of these consolidated financial statements.

Cardiol Therapeutics Inc.

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in Canadian Dollars)

Unaudited |

| | |

Six Months | | |

Six Months | |

| | |

Ended | | |

Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | |

| Operating activities | |

| | | |

| | |

| Net loss and comprehensive loss for the period | |

$ | (14,561,090 | ) | |

$ | (15,443,582 | ) |

| Adjustments for: | |

| | | |

| | |

| Depreciation of property and equipment | |

| 74,479 | | |

| 65,177 | |

| Amortization of intangible assets | |

| 42,222 | | |

| 42,222 | |

| Share-based compensation | |

| 1,093,223 | | |

| 484,157 | |

| Change in derivative liability | |

| 782,812 | | |

| (2,994,117 | ) |

| Unrealized foreign exchange gain on cash | |

| (849,290 | ) | |

| 419,969 | |

| Accretion on lease liability | |

| 3,011 | | |

| 5,071 | |

| Shares for services | |

| 16,449 | | |

| 217,268 | |

| Research and development expenses settled through warrant exercise | |

| - | | |

| 1,355,775 | |

| Changes in non-cash working capital items: | |

| | | |

| | |

| Accounts receivable | |

| 21,579 | | |

| (59,641 | ) |

| Other receivables | |

| 153,549 | | |

| 63,145 | |

| Prepaid expenses | |

| 87,864 | | |

| 72,671 | |

| Accounts payable and accrued liabilities | |

| (2,165,963 | ) | |

| 2,790,514 | |

| Net cash used in operating activities | |

| (15,301,155 | ) | |

| (12,981,371 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (48,029 | ) | |

| (17,591 | ) |

| Net cash used in investing activities | |

| (48,029 | ) | |

| (17,591 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Payment of lease liability | |

| (27,688 | ) | |

| (26,246 | ) |

| Net cash used in financing activities | |

| (27,688 | ) | |

| (26,246 | ) |

| Net change in cash and cash equivalents | |

| (15,376,872 | ) | |

| (13,025,208 | ) |

| Cash and cash equivalents, beginning of period | |

| 59,469,868 | | |

| 83,899,070 | |

| Impact of foreign exchange on cash and cash equivalents | |

| 849,290 | | |

| (419,969 | ) |

| Cash and cash equivalents, end of period | |

$ | 44,942,286 | | |

$ | 70,453,893 | |

The accompanying notes to the unaudited condensed interim consolidated

financial statements are an integral part of these consolidated financial statements.

|

Cardiol Therapeutics Inc.

Condensed Interim Consolidated Statements of Changes in Equity

(Expressed in Canadian Dollars)

Unaudited |

| | |

Share capital | | |

| | |

Contributed | | |

| | |

| |

| | |

Number | | |

Amount | | |

Warrants | | |

surplus | | |

Deficit | | |

Total | |

| Balance, December 31, 2021 | |

61,922,999 | | |

$ | 142,918,829 | | |

$ | 4,176,780 | | |

$ | 12,660,329 | | |

$ | (83,517,863 | ) | |

$ | 76,238,075 | |

| Shares for services | |

17,000 | | |

| 217,268 | | |

| - | | |

| - | | |

| - | | |

| 217,268 | |

| Share-based compensation (note 9) | |

- | | |

| - | | |

| - | | |

| 484,157 | | |

| - | | |

| 484,157 | |

| Fair value of warrants earned | |

- | | |

| - | | |

| 1,355,775 | | |

| - | | |

| - | | |

| 1,355,775 | |

| Net loss and comprehensive loss for the period | |

- | | |

| - | | |

| - | | |

| - | | |

| (15,443,582 | ) | |

| (15,443,582 | ) |

| Balance, June 30, 2022 | |

61,939,999 | | |

$ | 143,136,097 | | |

$ | 5,532,555 | | |

$ | 13,144,486 | | |

$ | (98,961,445 | ) | |

$ | 62,851,693 | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

64,042,536 | | |

$ | 147,545,399 | | |

$ | 3,517,867 | | |

$ | 15,586,832 | | |

$ | (114,448,510 | ) | |

$ | 52,201,588 | |

| Restricted share units exercised | |

80,000 | | |

| 112,800 | | |

| - | | |

| (112,800 | ) | |

| - | | |

| - | |

| Shares for services | |

5,000 | | |

| 16,449 | | |

| - | | |

| - | | |

| - | | |

| 16,449 | |

| Share-based compensation (note 9) | |

- | | |

| - | | |

| - | | |

| 1,093,223 | | |

| - | | |

| 1,093,223 | |

| Net loss and comprehensive loss for the period | |

- | | |

| - | | |

| - | | |

| - | | |

| (14,561,090 | ) | |

| (14,561,090 | ) |

| Balance, June 30, 2023 | |

64,127,536 | | |

$ | 147,674,648 | | |

$ | 3,517,867 | | |

$ | 16,567,255 | | |

$ | (129,009,600 | ) | |

$ | 38,750,170 | |

The accompanying notes to the unaudited condensed interim consolidated

financial statements are an integral part of these consolidated financial statements.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

Cardiol Therapeutics Inc. (the "Corporation")

was incorporated under the laws of the Province of Ontario on January 19, 2017. The Corporation's registered and legal office is

located at 2265 Upper Middle Rd. E., Suite 602, Oakville, Ontario, L6H 0G5, Canada.

The Corporation is a clinical-stage life sciences

company focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment of heart

disease. The Corporation's lead drug candidate, CardiolRx™ (cannabidiol) oral solution, is pharmaceutically manufactured and in

clinical development for use in the treatment of heart disease.

On December 20, 2018, the Corporation completed

its initial public offering on the Toronto Stock Exchange (the "TSX"). As a result, the Corporation's common shares commenced

trading on that date on the TSX under the symbol "CRDL", and on May 12, 2021, warrants commenced trading under the symbol

"CRDL.WT.A". On August 10, 2021, the Corporation's common shares commenced trading on The Nasdaq Capital Market ("Nasdaq")

under the symbol "CRDL".

| 2. | Significant accounting policies |

Statement of compliance

The Corporation applies International Financial

Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and interpretations

issued by the International Financial Reporting Interpretations Committee (“IFRIC”). These unaudited condensed interim financial

statements have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting. Accordingly,

they do not include all of the information required for full annual financial statements required by IFRS as issued by IASB and interpretations

issued by IFRIC.

The policies applied in these unaudited condensed

interim consolidated financial statements are based on IFRSs issued and outstanding as of August 9, 2023, the date the Board of Directors

approved the statements. The same accounting policies and methods of computation are followed in these unaudited condensed interim consolidated

financial statements as compared with the most recent annual consolidated financial statements as at and for the year ended December 31,

2022.

Any subsequent changes to IFRS that are given

effect in the Corporation’s annual consolidated financial statements for the year ending December 31, 2023, could result in

restatement of these unaudited condensed interim consolidated financial statements.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 3. | Cash and cash equivalents |

Interest earned on cash and cash equivalents for

the three and six months ended June 30, 2023 amounted to $528,697 and $1,074,624 (three and six months ended June 30, 2022 -

$191,336 and $263,647). As at December 31, 2022, Cash and cash equivalents included a cashable Guaranteed Investment Certificate

totaling $61,875 earning interest of 0.5% per annum and maturing on December 4, 2023. The Guaranteed Investment Certificate was redeemed

prior to maturity without penalty during the six months ended June 30, 2023.

| 4. |

Property and equipment |

Cost | |

Right-of-

use asset | | |

Equipment | | |

Leasehold

improvements | | |

Office

equipment | | |

Computer

equipment | | |

Total | |

| Balance, December 31, 2021 | |

$ | 200,319 | | |

$ | 130,770 | | |

$ | 237,248 | | |

$ | 65,716 | | |

$ | 79,823 | | |

$ | 713,876 | |

| Additions | |

| - | | |

| 41,094 | | |

| - | | |

| 1,148 | | |

| 32,467 | | |

| 74,709 | |

| Balance, December 31, 2022 | |

| 200,319 | | |

| 171,864 | | |

| 237,248 | | |

$ | 66,864 | | |

$ | 112,290 | | |

$ | 788,585 | |

| Additions | |

| - | | |

| 48,029 | | |

| - | | |

| - | | |

| - | | |

| 48,029 | |

| Balance, June 30, 2023 | |

$ | 200,319 | | |

$ | 219,893 | | |

$ | 237,248 | | |

$ | 66,864 | | |

$ | 112,290 | | |

$ | 836,614 | |

| Accumulated Depreciation | |

Right-of-

use asset | | |

Equipment | | |

Leasehold

improvements | | |

Office

equipment | | |

Computer

equipment | | |

Total | |

| Balance, December 31, 2021 | |

$ | 103,509 | | |

$ | 75,211 | | |

$ | 105,872 | | |

$ | 25,659 | | |

$ | 47,132 | | |

$ | 357,383 | |

| Depreciation for the year | |

| 40,068 | | |

| 19,750 | | |

| 50,840 | | |

| 8,069 | | |

| 16,737 | | |

| 135,464 | |

| Balance, December 31, 2022 | |

$ | 143,577 | | |

$ | 94,961 | | |

$ | 156,712 | | |

$ | 33,728 | | |

$ | 63,869 | | |

$ | 492,847 | |

| Depreciation for the period | |

| 20,034 | | |

| 18,238 | | |

| 25,420 | | |

| 3,314 | | |

| 7,473 | | |

| 74,479 | |

| Balance, June 30, 2023 | |

$ | 163,611 | | |

$ | 113,199 | | |

$ | 182,132 | | |

$ | 37,042 | | |

$ | 71,342 | | |

$ | 567,326 | |

| Carrying value | |

Right-of-

use asset | | |

Equipment | | |

Leasehold

improvements | | |

Office

equipment | | |

Computer

equipment | | |

Total | |

| Balance, December 31, 2022 | |

$ | 56,742 | | |

$ | 76,903 | | |

$ | 80,536 | | |

$ | 33,136 | | |

$ | 48,421 | | |

$ | 295,738 | |

| Balance, June 30, 2023 | |

$ | 36,708 | | |

$ | 106,694 | | |

$ | 55,116 | | |

$ | 29,822 | | |

$ | 40,948 | | |

$ | 269,288 | |

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| Cost | |

Exclusive global

license agreement | |

| Balance, December 31, 2021, December 31, 2022, and June 30, 2023 | |

$ | 767,228 | |

| | |

| | |

| Accumulated Amortization | |

Exclusive global

license agreement | |

| Balance, December 31, 2021 | |

$ | 387,982 | |

| Amortization for the year | |

| 84,444 | |

| Balance, December 31, 2022 | |

$ | 472,426 | |

| Amortization for the period | |

| 42,222 | |

| Balance, June 30, 2023 | |

$ | 514,648 | |

| | |

| | |

| Carrying Value | |

Exclusive global

license agreement | |

| Balance, December 31, 2022 | |

$ | 294,802 | |

| Balance, June 30, 2023 | |

$ | 252,580 | |

Exclusive global agreement ("Meros License Agreement")

In 2017, the Corporation was granted by Meros

Polymers Inc. (“Meros”) the sole, exclusive, irrevocable license to patented nanotechnologies for use with any drugs to diagnose,

or treat, cardiovascular disease, cardiopulmonary disease, and cardiac arrhythmias. Meros is focused on the advancement of nanotechnologies

developed at the University of Alberta.

Under the Meros License Agreement, Cardiol agreed

to certain milestones and milestone payments, including the following: (i) payment of $100,000 upon enrolling the first patient in

a Phase IIB clinical trial designed to investigate the safety and indications of efficacy of one of the licensed technologies; (ii) payment

of $500,000 upon enrolling the first patient in a Pivotal Phase III clinical trial designed to investigate the safety and efficacy of

one of the licensed technologies; (iii) $1,000,000 upon receiving regulatory approval from the FDA for any therapeutic and/or prophylactic

treatment incorporating the licensed technologies. Cardiol also agreed to pay Meros the following royalties:

(a) 5%

of worldwide proceeds of net sales of the licensed technologies containing cannabinoids, excluding non-royalty sub-license income in (b) below,

that Cardiol receives from human and animal disease indications and derivatives as outlined in the Meros License Agreement;

(b) 7%

of any non-royalty sub-license income that Cardiol receives from human and animal disease indications and derivatives for licensed technologies

containing cannabinoids as outlined in the Meros License Agreement;

(c) 3.7%

of worldwide proceeds of net sales that Cardiol receives from the licensed technology in relation to human and animal cardiovascular and/or

cardiopulmonary disease, heart failure, and/or cardiac arrhythmia diagnosis and/or treatments using the drugs, excluding cannabinoids

included in (a) above, outlined in the Meros License Agreement; and

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 5 | Intangible assets (continued) |

(d) 5%

of any non-royalty sub-license income that Cardiol receives in relation to any human and animal heart disease, heart failure and/or arrhythmias

indications, excluding cannabinoids included in (b) above, as outlined in the Meros License Agreement.

In addition, as part of the consideration under

the Meros License Agreement, Cardiol (i) issued to Meros 1,020,000 common shares; and (ii) issued to Meros 1,020,000 special

warrants convertible automatically into common shares for no additional consideration upon the first patient being enrolled in a Phase

1 clinical trial using the licensed technologies as described in the Meros License Agreement.

| | |

Carrying

Value | |

| Balance, December 31, 2021 | |

$ | 117,579 | |

| Repayments | |

| (53,934 | ) |

| Accretion | |

| 9,226 | |

| Balance, December 31, 2022 | |

$ | 72,871 | |

| Repayments | |

| (27,688 | ) |

| Accretion | |

| 3,011 | |

| Balance, June 30, 2023 | |

$ | 48,194 | |

| Current portion | |

| 48,194 | |

| Long-term portion | |

$ | - | |

(i) When measuring the lease liability for

the property lease that was classified as an operating lease, the Corporation discounted the lease payments using its incremental borrowing

rate. The property lease expires on May 31, 2024, and the lease payments were discounted with a 9% interest rate.

On November 5, 2021, the Corporation

issued 8,175,000 warrants as part of a unit financing. Each warrant is exercisable into one common share at the price of USD$3.75

per share for a period of three years from closing. The original estimated fair value of $11,577,426 was assigned to the 8,175,000

warrants issued by using a fair value market technique incorporating the Black-Scholes option pricing model, with the following

assumptions: a risk-free interest rate of 1.01%; an expected volatility factor of 81%; an expected dividend yield of 0%; and an

expected life of 3 years. The only significant unobservable input is the volatility, which could cause an increase or decrease in

fair value. The warrants have been classified as a derivative liability on the statement of financial position and are re-valued at

each reporting date, as the warrants were issued in a currency other than the Corporation's functional currency. As at June 30,

2023, the fair value of the derivative liability was $1,202,713 (December 31, 2022 - $419,901), resulting in an increase in the

value of the derivative liability for the three and six months ended June 30, 2023 of $856,893 and $782,812 (three and six

months ended June 30, 2022 - decrease in fair value of $861,600 and $2,994,117).

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 7. | Derivative liability (continued) |

Significant assumptions used in determining the fair value of the derivative

warrant liabilities are as follows:

| | |

Six Months

Ended | | |

Six Months

Ended | |

| | |

June 30,

2023 | | |

June 30,

2022 | |

| Share price | |

USD$ |

0.89 | | |

USD$ |

1.32 | |

| Exercise price | |

USD$ |

3.75 | | |

USD$ |

3.75 | |

| Risk-free interest rate | |

| 4.54 | % | |

| 3.14 | % |

| Expected volatility | |

| 101 | % | |

| 88 | % |

| Expected life in years | |

| 1.35 | | |

| 2.35 | |

| Expected dividend yield | |

| Nil | | |

| Nil | |

| a) Authorized share capital |

The authorized share capital consists of an unlimited number of common

shares. The common shares do not have a par value. All issued shares are fully paid.

b) Common shares issued

| | |

Number of | | |

| |

| | |

common

shares | | |

Amount | |

| Balance, December 31, 2021 | |

61,922,999 | | |

$ | 142,918,829 | |

| Shares for services (i) | |

17,000 | | |

| 217,268 | |

| Balance, June 30, 2022 | |

61,939,999 | | |

$ | 143,136,097 | |

| | |

| | |

| | |

| Balance, December 31, 2022 | |

64,042,536 | | |

$ | 147,545,399 | |

| Shares for services (ii) | |

5,000 | | |

| 16,449 | |

| Restricted share units exercised (note 9) | |

80,000 | | |

| 112,800 | |

| Balance, June 30, 2023 | |

64,127,536 | | |

$ | 147,674,648 | |

(i) During the six months ended

June 30, 2022, the Corporation issued 17,000 common shares with a fair value of$ 28,348. The fair value of the shares was

determined to be equal to the value of the services rendered. Included in shares for services is $188,920 related to vesting of

previously issued shares.

(ii) During the six months ended

June 30, 2023, the Corporation issued 5,000 common shares with a fair value of$ 3,550. The fair value of the shares was

determined to be equal to the value of the services rendered. Included in shares for services is $12,899 related to vesting of

previously issued shares.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 8. | Share capital (continued) |

c) 2022 At-The-Market ("ATM") Program

In June 2022, the Corporation announced it

entered into an equity distribution agreement with Canaccord Genuity LLC and Cantor Fitzgerald & Co. (the "Sales Agents")

acting as co-agents in connection with the 2022 at-the-market offering program (the "2022 ATM Program"). Under the terms of

the 2022 ATM Program, the Corporation may, from time to time, sell common shares having an aggregate value of USD$50,000,000 through the

Sales Agents on the Nasdaq Capital Market. As at June 30, 2023 and the date of these consolidated financial statements, the Corporation

has not issued any shares under the 2022 ATM Program.

The timing and extent of the use of the 2022 ATM

Program will be at the discretion of the Corporation and the Corporation has no obligation to sell any shares pursuant to the 2022 ATM

Program. Accordingly, total gross proceeds from offerings under the 2022 ATM Program could be less than US$50 million. The 2022 ATM Program

will be effective until the earlier of the issuance and sale of all of the Offered Shares issuable pursuant to the 2022 ATM Program and

March 8, 2024, unless terminated prior to such date by the Corporation or the Sales Agents.

The Corporation has adopted an Omnibus Equity

Incentive Plan in accordance with the policies of the TSX, which permits the grant or issuance of options, Restricted Share Units ("RSUs"),

Performance Share Units ("PSUs") and Deferred Share Units ("DSUs"), as well as other share-based payment arrangements.

The maximum number of shares that may be issued upon the exercise or settlement of awards granted under the plan may not exceed 15% of

the Corporation's issued and outstanding shares from time to time. The Board of Directors determines the price per common share and the

number of common shares which may be allotted to directors, officers, employees, and consultants, and all other terms and conditions of

the option, subject to the rules of the TSX.

During the three and six months ended June 30,

2023, the total expenses related to share-based compensation amounted to $666,400 and $1,093,223 (three and six months ended June 30,

2022 - $(528,237) and $484,157).

(a)

Stock Options

| | |

Number of | | |

Weighted average | |

| | |

stock options | | |

exercise price ($) | |

| Balance, December 31, 2021 | |

4,301,800 | | |

$ | 4.16 | |

| Issued | |

395,000 | | |

| 1.95 | |

| Expired | |

(403,334 | ) | |

| 4.34 | |

| Balance, June 30, 2022 | |

4,293,466 | | |

$ | 3.94 | |

| | |

| | |

| | |

| Balance, December 31, 2022 | |

1,968,476 | | |

$ | 3.52 | |

| Issued | |

500,000 | | |

| 1.20 | |

| Expired | |

(780,976 | ) | |

| 4.65 | |

| Balance, June 30, 2023 | |

1,687,500 | | |

$ | 2.32 | |

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 9. | Share-based payments (continued) |

At the grant date, the fair value stock options issued was estimated

using the Black-Scholes option pricing model based on the following weighted average assumptions:

| | |

Six

Months

Ended | | |

Six

Months

Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | |

| Fair value of stock options at grant date | |

$ | 0.65 | | |

$ | 1.39 | |

| Share price | |

$ | 1.00 | | |

$ | 1.86 | |

| Exercise price | |

$ | 1.20 | | |

$ | 1.95 | |

| Risk-free interest rate | |

| 3.74 | % | |

| 1.95 | % |

| Expected volatility | |

| 89 | % | |

| 100 | % |

| Expected life in years | |

| 4.40 | | |

| 5.00 | |

| Expected dividend yield | |

| Nil | | |

| Nil | |

The following table reflects the actual stock options issued and outstanding

as of June 30, 2023:

| Expiry date | |

Exercise

price ($) | | |

Weighted

average

remaining

contractual

life (years) | | |

Number of

options

outstanding | | |

Number

of

options

vested

(exercisable) | |

| February 23, 2025 | |

3.54 | | |

1.65 | | |

20,000 | | |

20,000 | |

| April 10, 2025 | |

0.75 | | |

1.78 | | |

100,000 | | |

- | |

| August 19, 2025 | |

2.12 | | |

2.14 | | |

100,000 | | |

66,667 | |

| August 30, 2025 | |

5.00 | | |

2.17 | | |

80,000 | | |

80,000 | |

| April 1, 2026 | |

5.77 | | |

2.76 | | |

60,000 | | |

60,000 | |

| December 8, 2026 | |

3.59 | | |

3.44 | | |

325,000 | | |

108,333 | |

| January 11, 2027 | |

2.18 | | |

3.54 | | |

220,000 | | |

73,333 | |

| March 14, 2027 | |

2.07 | | |

3.71 | | |

60,000 | | |

20,000 | |

| May 12, 2027 | |

1.46 | | |

3.87 | | |

115,000 | | |

38,334 | |

| September 12, 2027 | |

1.61 | | |

4.21 | | |

207,500 | | |

- | |

| June 25, 2028 | |

1.33 | | |

4.99 | | |

400,000 | | |

- | |

| |

2.32 | | |

3.67 | | |

1,687,500 | | |

466,667 | |

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 9. | Share-based payments (continued) |

| (b) | Performance Share Units |

The Corporation has 600,000 outstanding PSUs as

at June 30, 2023 (December 31, 2022 - 600,000). Grants of PSUs require completion of certain performance criteria specific to

each grant. These PSUs have an expiry date of December 31, 2023.

During the six months ended June 30, 2022,

1,200,000 PSUs granted to certain consultants of the Corporation expired. Upon expiry, $1,121,400 of previously recognized share-based

compensation was reversed through general and administration.

| (c) | Restricted Share Units |

The total outstanding RSUs at June 30,

2023 is 3,357,963 (December 31, 2022 - 2,312,963). Of the outstanding RSUs, 1,305,984 have fully vested as of June 30,

2023 (December 31, 2022 - 1,355,984).

During the three and six months ended

June 30, 2023, the Corporation granted 1,125,000 RSUs carrying a value of $1,083,000 (June 30, 2022 - nil carrying a value

of nil, and nil carrying a value of nil). These RSUs will vest one-fifth on each of September 30, 2023, October 31, 2023,

November 30, 2023, December 31, 2023, and January 31, 2024.

Subsequent to June 30, 2023, the Corporation

granted 875,000 RSUs to certain consultants of the Corporation, vesting 20% on each of September 30, 2023, October 31, 2023,

November 30, 2023, December 31, 2023 and January 31, 2024. The Corporation granted an additional 100,000 RSUs to certain

consultants that vest on September 2, 2023.

| | |

Number of

warrants | | |

Amount | |

| Balance, December 31, 2021 | |

12,452,178 | | |

$ | 4,176,780 | |

| Earned (i) | |

- | | |

| 1,355,775 | |

| Balance, June 30, 2022 | |

12,452,178 | | |

$ | 5,532,555 | |

| | |

| | |

| | |

| Balance, December 31, 2022 and June 30, 2023 | |

11,628,178 | | |

$ | 3,517,867 | |

(i) During the six months ended June 30, 2022, 338,943 warrants

with a fair value of $1,355,775 were earned pursuant to the Caro Development Agreement (see note 12 (iii)).

The following table reflects the actual warrants

issued and outstanding as of June 30, 2023, excluding 1,020,000 special warrants convertible automatically into common shares for

no additional consideration in accordance with the original escrow release terms as described in the Meros License Agreement (see note

5):

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

Expiry date | |

Exercise price ($) | | |

Remaining

contractual

life (years) | | |

Warrants

exercisable | |

| May 12, 2024 | |

4.60 | | |

0.87 | | |

3,453,178 | |

| November 5, 2024(1) | |

4.97 | | |

1.35 | | |

8,175,000 | |

| | |

4.86 | | |

1.21 | | |

11,628,178 | |

(1) Warrants carry an exercise price of USD$3.75.

This amount was translated to CAD for presentation purposes at the June 30, 2023 rate of 1.33. These warrants are classified as a

derivative liability on the statement of financial position (see note 7).

For the three and six months ended June 30,

2023, basic and diluted loss per share has been calculated based on the loss attributable to common shareholders of $7,471,754 and $14,561,090,

respectively (three and six months ended June 30, 2022 - $6,489,488 and $15,443,582, respectively) and the weighted average number

of common shares outstanding of 64,105,448 and 64,098,586, respectively (three and six months ended June 30, 2022 - 61,932,362 and

61,928,811, respectively). Diluted loss per share did not include the effect of stock options, PSUs, RSUs, and warrants as they are anti-dilutive.

(i) The

Corporation has leased premises with third parties. The minimum committed lease payments, which include the lease liability payments shown

as base rent, are approximately as follows:

| | |

Base rent | | |

Variable rent | | |

Total | |

| 2023 | |

$ | 27,688 | | |

$ | 25,923 | | |

$ | 53,611 | |

| 2024 | |

| 23,074 | | |

| 21,602 | | |

| 44,676 | |

| | |

$ | 50,762 | | |

$ | 47,525 | | |

$ | 98,287 | |

(ii) The

Corporation has signed various agreements with consultants to provide services. Under the agreements, the Corporation has the following

remaining commitments.

(iii) Cardiol

entered into a development agreement (the “Caro Development Agreement”) with the Clinical Academic Research Organization,

S.A. DE C.V. (“Caro”) dated August 28, 2018, for the further research and development of proprietary drug formulations

for the treatment of heart failure. Caro is a Mexican corporation dedicated to providing clinical and scientific experimentation and consulting,

as well as performing development activities by itself or through third-party providers.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 12. | Commitments (continued) |

(iii) (continued)

Pursuant to the terms of the Caro Development Agreement, Caro will provide scientific experimentation, research activities, medical drug

development activities, and medical drug formulation and discovery to Cardiol (the “Development Activities”), as set out in

a development plan (the “Development Plan”). Under the Caro Development Agreement, Caro may also engage third-party providers

of development activities in support of the Development Plan, which is anticipated to be limited to third-party vendors of materials.

Pursuant to the terms of the Caro Development

Agreement, Cardiol upon execution of the Caro Development Agreement allotted and set aside 824,000 Common Shares of Cardiol, and issued

to Caro 824,000 warrants (the “Caro Compensation Warrants”), each warrant having the following qualifications: (i) an

expiry date of August 31, 2022, or such earlier date as may be specified by a relevant stock exchange; (ii) an exercise price

of $4 per share (to be settled through the issuance of invoices by Caro); and (iii) each of the Caro Compensation Warrants entitles

Caro to purchase one Common Share of Cardiol for the exercise price. The Compensation Warrants were earned and became exercisable as the

Development Activities were completed. Cardiol also further agreed to pay Caro US$400,000 in cash (paid). The unexercised warrants expired

on August 31, 2022. Prior to that, 503,672 warrants that were earned were exercised into common shares, carrying a value of $2,014,688.

Pursuant to the terms of the Caro Development

Agreement, both Cardiol and Caro may terminate the Caro Development Agreement if either party believes in good faith that the continued

performance of the Development Activities may be commercially unwise, jeopardize safety, or otherwise be unethical or illegal. However,

if Caro terminates the Caro Development Agreement for any reason except breach of contract by Cardiol, or terminates the development activities

under the contract prior to achievement of all milestones in the Development Plan, then any unexercised Caro Compensation Warrants that

are not related to Development Activities and milestones in the Development Plan that have been attained up to the time of termination

of the Caro Development Agreement shall be deemed terminated as of the time of termination of the Caro Development Agreement.

Further, if Cardiol terminates the Caro Development

Agreement for any reason (including breach of contract by Caro), or requires Caro to terminate the Development Activities prior to achievement

of all milestones in the Development Plan, then the Caro Compensation Warrants issued to Caro that can be invoiced for the CARO Development

Activities completed up to the time of termination shall be considered to have been earned notwithstanding such termination.

(iv) Cardiol

entered into an exclusive supply agreement (the "Exclusive Supply Agreement”) with Noramco, Inc. (“Noramco”)

dated September 28, 2018, as amended on December 7, 2018, December 11, 2018, July 2, 2019, September 11, 2019,

and November 12, 2019, pursuant to which Noramco will be the exclusive supplier of pharmaceutical cannabidiol for Cardiol, provided

Noramco is able to meet Cardiol’s supply requirements.

During 2020, the Exclusive Supply Agreement was

assigned to Purisys, LLC ("Purisys"), an affiliate of Noramco headquartered in Athens, Georgia. This assignment had no impact

on Cardiol’s rights under the Exclusive Supply Agreement.

Purisys shall not sell pharmaceutical cannabidiol

to any third party for use in the production of products sold to retail pharmacies in Canada and Mexico, such as Shoppers Drug Mart Inc.

Notwithstanding this restriction, Purisys shall have the right to sell pharmaceutical cannabidiol to third parties outside Canada for

use in products that are approved as prescription medicines by the Therapeutic Products Directorate of Health Canada for delivery into

Canada.

The Exclusive Supply Agreement expires on December 31,

2038, subject to certain renewal provisions.

(v) Pursuant

to the terms of agreements with various other contract research organizations, the Corporation is committed for contract research services

for 2023 at a cost of approximately $576,053.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2023

(Expressed in Canadian Dollars)

Unaudited |

| 13. | Other expenses and adjustments |

The following details highlight certain components

of the research and development and general and administration expenses classified by nature. Remaining research and development and operating

expenses include personnel costs and expenses paid to third parties:

| | |

Three Months

Ended | | |

Three Months

Ended | | |

Six Months

Ended | | |

Six Months

Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2023

($) | | |

2022

($) | | |

2023

($) | | |

2022

($) | |

| Research and development expenses | |

| | | |

| | | |

| | | |

| | |

| Non-cash share-based compensation | |

| 98,487 | | |

| 91,347 | | |

| 195,892 | | |

| 263,184 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administration expenses | |

| | | |

| | | |

| | | |

| | |

| Depreciation of property and equipment | |

| 37,385 | | |

| 33,510 | | |

| 74,479 | | |

| 65,177 | |

| Amortization of intangible assets | |

| 21,111 | | |

| 21,111 | | |

| 42,222 | | |

| 42,222 | |

| Non-cash share-based compensation | |

| 567,913 | | |

| (673,584 | ) | |

| 897,331 | | |

| 220,973 | |

| 14. | Related

party transactions |

| (a) | The Corporation entered into the following transactions with related parties: |

(i) Included in research and development

expense is $109,129 and $737,809 for the three and six months ended June 30, 2023 (three and six months ended June 30, 2022

- $362,053 and $702,532) paid to a company related to a director. As at June 30, 2023, $490,261 (December 31, 2022 - $985,022)

was owed to this company and this amount was included in accounts payable and accrued liabilities, and $nil (December 31, 2022 -

$9,413) was paid to this company and was included in prepaid expenses.

(b) Key

management personnel are those persons having authority and responsibility for planning, directing, and controlling the activities of

the Corporation directly or indirectly, including any directors (executive and non-executive) of the Corporation. Remuneration of directors

and key management personnel of the Corporation, except as noted in (a) above, was as follows:

| | |

Three

Months

Ended | | |

Three

Months

Ended | | |

Six

Months

Ended | | |

Six

Months

Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Salaries and benefits | |

$ | 534,446 | | |

$ | 507,290 | | |

$ | 1,704,476 | | |

$ | 1,369,618 | |

| Share-based payments | |

| 262,128 | | |

| 366,498 | | |

| 531,010 | | |

| 847,779 | |

| | |

$ | 796,574 | | |

$ | 873,788 | | |

$ | 2,235,486 | | |

$ | 2,217,397 | |

As at June 30, 2023, $nil (December 31,

2022 - $nil) was owed to key management personnel and this amount was included in accounts payable and accrued liabilities.

Exhibit 99.2

CARDIOL THERAPEUTICS INC.

MANAGEMENT'S DISCUSSION

AND ANALYSIS

THREE AND SIX MONTHS ENDED

JUNE 30, 2023

MANAGEMENT'S DISCUSSION AND ANALYSIS

Introduction

The following management’s discussion and

analysis (“MD&A”) of the financial condition and results of the operations of Cardiol Therapeutics Inc. (the “Corporation”

or “Cardiol”) constitutes management of the Corporation's ("Management") review of the factors that affected the

Corporation’s financial and operating performance for the three and six months ended June 30, 2023 (the “2023 Fiscal

Period”). This discussion should be read in conjunction with the consolidated financial statements for the years ended December 31,

2022, 2021, and 2020 and the unaudited condensed interim consolidated financial statements for the three and six months ended June 30,

2023 (“Financial Statements”), together with the respective notes thereto. Results are reported in Canadian dollars, unless

otherwise noted. The Financial Statements and the financial information contained in this MD&A are derived from the Financial Statements prepared in accordance with International Accounting Standard 34, Interim Financial Reporting. Accordingly,

they do not include all of the information required for full annual financial statements required by International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and interpretations issued

by the International Financial Reporting Interpretations Committee (“IFRIC”). In the opinion of Management, all adjustments (which consist only of normal recurring adjustments) considered

necessary for a fair presentation have been included.

This MD&A is dated August 9, 2023. All

dollar amounts in this MD&A are reported in Canadian dollars, unless otherwise stated. Unless otherwise noted or the context indicates

otherwise, the terms “we”, “us”, “our”, “Cardiol”, the "Company" or the “Corporation”

refer to Cardiol Therapeutics Inc.

This MD&A is presented current to August 9,

2023 unless otherwise stated. The financial information presented in this MD&A is derived from the Financial Statements. This MD&A

contains forward-looking statements that involve risks, uncertainties, and assumptions, including statements regarding anticipated developments

in future financial periods and our plans and objectives. There can be no assurance that such information will prove to be accurate, and

readers are cautioned not to place undue reliance on such forward-looking statements. See “Forward-Looking Statements” and

“Risk Factors”.

Forward-Looking Information

This MD&A contains forward-looking information

that relates to the Corporation’s current expectations and views of future events. In some cases, this forward-looking information

can be identified by words or phrases such as “may”, “might”, "could", “will”, “expect”,

“anticipate”, “estimate”, “intend”, “plan”, “indicate”, “seek”,

“believe”, “predict”, or “likely”, or the negative of these terms, or other similar expressions intended

to identify forward-looking information. Statements containing forward-looking information are not historical facts. The Corporation has

based this forward-looking information on its current expectations and projections about future events and financial trends that it believes

might affect its financial condition, results of operations, business strategy, and financial needs. The forward-looking information includes,

among other things, statements relating to:

| • | our anticipated cash needs, and the need for

additional financing; |

| • | our development of our product candidates for

use in basic research, clinical studies and commercialization; |

| • | our ability to develop new routes of administration

of our product candidates, including parenteral, for use in basic research, clinical studies, and commercialization; |

| • | our ability to develop new formulations of our

product candidates for commercialization; |

| • | the successful development and commercialization

of our current product candidates and the addition of future products and product candidates; |

| • | the ability for our product delivery technologies

to deliver our product candidates to inflamed and/or fibrotic tissue; |

| • | our intention to build a pharmaceutical brand

and our products focused on addressing inflammation and fibrosis in heart disease, including acute myocarditis, recurrent pericarditis,

and heart failure; |

| • | the expected medical benefits, viability, safety,

efficacy, effectiveness, and dosing of our product candidates; |

| • | patents and intellectual property, including,

but not limited to, our (a) ability to procure, defend, and/or enforce our intellectual property relating to our products, product

formulations, routes of administration, product candidates, and associated uses, methods, and/or processes, and (b) freedom to operate; |

| • | our competitive position and the regulatory environment

in which we operate; |

| • | the molecular targets and mechanism of action of our product candidates; |

| • | our financial position; our business strategy; our growth strategies; our

operations; our financial results; our dividend policy; our plans and objectives; and |

| • | expectations of future results, performance, achievements, prospects, opportunities,

or the market in which we operate. |

In addition, any statements that refer to expectations,

intentions, projections, or other characterizations of future events or circumstances contain forward-looking information. Forward-looking

information is based on certain assumptions and analyses made by the Corporation in light of the experience and perception of historical

trends, current conditions, and expected future developments and other factors we believe are appropriate and are subject to risks and

uncertainties. The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking

statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently

available to us. These statements are only predictions based upon our current expectations and projections about future events. Although

we believe that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and we cannot assure that

actual results will be consistent with this forward-looking information. Given these risks, uncertainties, and assumptions, prospective

investors should not place undue reliance on this forward-looking information. Whether actual results, performance, or achievements will

conform to the Corporation’s expectations and predictions is subject to a number of known and unknown risks, uncertainties, assumptions,

and other factors, including those listed under “Risk Factors”, which include:

| • | the inherent uncertainty of product development including basic research

and clinical trials; |

| • | our requirement for additional financing; |

| • | our negative cash flow from operations; |

| • | our history of losses; |

| • | dependence on the success of our early-stage product candidates which may

not generate revenue; |

| • | reliance on Management, loss of members of Management or other key personnel,

or an inability to attract new Management team members; |

| • | our ability to successfully design, initiate, execute, and complete clinical

trials, including the high cost, uncertainty, and delay of clinical trials and additional costs associated with any failed clinical trials; |

| • | the uncertainty our investigational products will have a therapeutic benefit

in the clinical indications we are pursuing; |

| • | potential equivocal or negative results from clinical trials and their adverse

impacts on our future commercialization efforts; |

| • | our ability to receive and maintain regulatory exclusivities, including Orphan

Drug Designations/Approvals, for our products and product candidates; |

| • | delays in achievement of projected development goals; |

| • | management of additional regulatory burdens; |

| • | volatility in the market price for our securities; |

| • | failure to protect and maintain and the consequential loss of intellectual

property rights; |

| • | third-party claims relating to misappropriation by the Corporation of their

intellectual property; |

| • | reliance on third parties to conduct and monitor our pre-clinical studies

and clinical trials; |

| • | our product candidates being subject to controlled substance laws which may

vary from jurisdiction to jurisdiction; |

| • | changes in laws, regulations, and guidelines relating to our business, including

tax and accounting requirements; |

| • | our reliance on early-stage research regarding the medical benefits, viability,

safety, efficacy, and dosing of our product candidates; |

| • | claims for personal injury or death arising from the use of our products

and product candidates; |

| • | uncertainty relating to market acceptance of our product candidates; |

| • | our lack of experience in commercializing any products, including selling,

marketing, or distributing our products; |

| • | securing third-party payor reimbursement for our products and product candidates; |

| • | the level of pricing and reimbursement for our products and product candidates,

if approved; |

| • | our dependence on contract manufacturers; |

| • | unsuccessful collaborations with third parties; |

| • | business disruptions affecting third-party suppliers and manufacturers; |

| • | lack of control in future production and selling prices of our product candidates; |

| • | competition in our industry; |

| • | our inability to develop new technologies and products and the obsolescence

of existing technologies and products; |

| • | unfavorable publicity or consumer perception towards our products; |

| • | product liability claims and product recalls; |

| • | expansion of our business to other jurisdictions; |

| • | fraudulent activities of employees, contractors, and consultants; |

| • | our reliance on key inputs and their related costs; |

| • | difficulty associated with forecasting demand for our products; |

| • | operating risk and insurance coverage; |

| • | our inability to manage growth; |

| • | conflicts of interest among the officers and directors ("Director")

of the Corporation; |

| • | managing damage to our reputation and third-party reputational risks; |

| • | relationships with customers and third-party payors and consequential exposure

to applicable anti-kickback, fraud, and abuse and other healthcare laws; |

| • | exposure to information systems security threats; |

| • | no dividends for the foreseeable future; |

| • | future sales of common shares and warrants by existing shareholders causing

the market price for the common shares and warrants to fluctuate; |

| • | the issuance of common shares in the future causing dilution; |

| • | our operations could be adversely affected by events outside of our control; |

| • | global geo-political events, including the Russian invasion of Ukraine and

the responses of governments having a significant effect on the world economy; and |

| • | failure to meet regulatory or ethical expectations on environmental impact,

including climate change. |

If any of these risks or uncertainties materialize, or if assumptions

underlying the forward-looking information prove incorrect, actual results may vary materially from those anticipated in the forward-looking

information.

Information contained in forward-looking information

in this MD&A is provided as of August 9, 2023, and we disclaim any obligation to update any forward-looking information, whether

as a result of new information or future events or results, except to the extent required by applicable securities laws. Accordingly,

potential investors should not place undue reliance on forward-looking information.

Overview

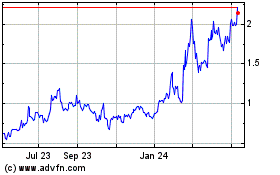

On December 20, 2018, the Corporation completed

its initial public offering on the Toronto Stock Exchange (the "TSX"). As a result, the common shares commenced trading on the

TSX under the symbol "CRDL". On May 12, 2021, warrants arising from a "bought deal" short form prospectus offering

that closed on the same date, commenced trading on the TSX. These warrants trade under the symbol "CRDL.WT.A". On August 10,

2021, the Corporation's common shares commenced trading on The Nasdaq Capital Market ("Nasdaq") under the symbol "CRDL".

The Corporation is a clinical-stage life sciences

company focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment of heart

diseases. The Corporation's lead drug candidate, CardiolRx™ (cannabidiol) oral solution, is pharmaceutically manufactured and is

currently in clinical development for use in the treatment of two heart diseases. It is recognized that cannabidiol inhibits activation

of the inflammasome pathway, an intracellular process known to play an important role in the development and progression of inflammation

and fibrosis associated with myocarditis, pericarditis, and heart failure.

The Corporation has received Investigational New

Drug Application ("IND") application authorization from the United States ("U.S.") Food and Drug Administration ("FDA")

to conduct a Phase II open-label pilot study designed to evaluate the tolerance, safety, and efficacy of CardiolRx in patients with recurrent

pericarditis. The study will also assess the improvement in objective measures of disease, and during an extension period, assess the

feasibility of weaning concomitant background therapy including corticosteroids, while taking CardiolRx. Pericarditis refers to inflammation

of the pericardium (the membrane or sac that surrounds the heart) that follows an initial episode (frequently resulting from a viral infection).

Patients may have multiple recurrences. Symptoms include debilitating chest pain, shortness of breath, and fatigue, resulting in physical

limitations, reduced quality of life, emergency department visits, and hospitalizations. The only FDA-approved therapy for recurrent pericarditis,

launched in 2021, is extraordinarily costly and is primarily used as a third-line intervention. The number of cases of patients seeking

and receiving treatment for recurrent pericarditis annually in the U.S. is estimated at 38,000. Hospitalization due to recurrent pericarditis

is often associated with a 6-8-day length of stay and cost per stay is estimated to range between US$20,000 and US$30,000 in the U.S.

The Corporation has also received IND authorization

from the FDA to conduct a Phase II multi-national, randomized, double-blind, placebo-controlled trial designed to evaluate the efficacy

and safety of CardiolRx in acute myocarditis (the "ARCHER" trial). Myocarditis is an acute inflammatory condition of

the heart muscle (myocardium) characterized by chest pain, impaired cardiac function, atrial and ventricular arrhythmias, and conduction

disturbances. Although the symptoms are often mild, myocarditis remains an important cause of acute and fulminant heart failure and is

a leading cause of sudden cardiac death in people under 35 years of age. Although viral infection is the most common cause of myocarditis,

the condition can also result from administration of therapies used to treat several common cancers, including chemo-therapeutic agents

and immune checkpoint inhibitors. There are no FDA-approved therapies for acute myocarditis which affects an estimated 46,000 people in

the U.S. per year. Patients hospitalized with acute myocarditis experience an average seven day length of stay and a 4-6% risk of in-hospital

mortality, with average hospital charge per stay estimated at US$110,000 in the U.S. Severe cases frequently require ventricular assist

devices or extracorporeal oxygenation and may necessitate heart transplantation.

The Corporation is planning to pursue the development

of CardiolRx as an Orphan Drug for the treatment of recurrent pericarditis and acute myocarditis. The U.S. Orphan Drug Designation program

was created to provide the sponsor of a drug or biologic significant incentives, including seven-year marketing exclusivity and exemptions

from certain FDA fees, to develop treatments for diseases that affect fewer than 200,000 people in the U.S. Products with Orphan Drug

Designation also frequently qualify for accelerated regulatory review. The program was successfully utilized to support the first FDA

approval of an oral cannabidiol solution for the treatment of seizures associated with rare pediatric epilepsy syndromes. The European

Commission's European Medicines Agency ("EMA") has a similar orphan medicine product program for rare diseases.

In addition, the Corporation is developing a novel

subcutaneously administered drug formulation of cannabidiol intended for use in heart failure – a leading cause of death and hospitalization

in the developed world, with associated healthcare costs in the United States exceeding $30 billion annually.

Operations Highlights

During the 2023 Fiscal Period

(i) In

January 2023, the Corporation announced the first patient has been enrolled in the Company-sponsored Phase II open-label pilot study

(NCT05494788) investigating the tolerance, safety, and efficacy of CardiolRx™ in patients with recurrent pericarditis. In addition

to standard safety assessments, the study is designed to evaluate improvement in objective measures of disease, and during an extension

period, assess the feasibility of weaning concomitant background therapy including corticosteroids, while taking CardiolRx.

(ii) In

March 2023, the Corporation announced study results from one of its international collaborating research centers demonstrating that

its pharmaceutically manufactured cannabidiol significantly prevents cardiac dysfunction and the development of fibrosis and cardiomyocyte

hypertrophy in a pre-clinical model of heart failure and reduces expression of key inflammatory and fibrotic markers. Cannabidiol is the

active pharmaceutical ingredient in CardiolRx, the Corporation’s lead investigational oral drug candidate currently in Phase II

clinical trials for recurrent pericarditis and acute myocarditis, and in its novel subcutaneously administered drug formulation intended

for use in heart failure and currently in pre-clinical development.

The studies were presented by researchers from

Instituto Tecnológico y de Estudios Superiores de Monterrey, Mexico (“TecSalud”) at the American College of Cardiology's

72nd Annual Scientific Session together with World Congress of Cardiology (“ACC.23/WCC”). TecSalud is one of the Corporation’s

international collaborating research centers working towards the common goal of developing therapies to advance the treatment of heart

diseases.

The poster entitled

“Cannabidiol Therapy for Chronic Heart Failure Prevents Cardiac Pathological Remodeling in a Non- ischemic Cardiomyopathy Murine

Model” was presented on March 4th within the “Heart Failure and Cardiomyopathies:

Basic and Translational Science 1” session

of ACC.2023/WCC. This work builds upon existing knowledge by confirming cannabidiol’s cardioprotective properties and, in this model,

its ability to reduce inflammation and prevent hypertrophy and fibrosis in heart tissue. This work also furthers the understanding of

cannabidiol’s ability to improve cardiac function and, in isolated cardiomyocytes, improve calcium handling and mitochondrial health.

A second poster

entitled “Abnormal Mitochondrial Calcium Content in Angiotensin-Induced Hypertrophy is Ameliorated by Cannabidiol Mimicking PPAR-y

Activation” was presented on March 5th within the “Heart Failure and Cardiomyopathies: Basic and Translational

Science 8” session of ACC.2023/WCC. This poster presented data related to the role of cannabidiol in mitochondrial calcium dynamics

in hypertrophic cells. Cannabidiol was able to prevent hypertrophy-induced mitochondrial calcium overload and prevent hypertrophy-induced

increase of several mitochondrial function markers such as reactive oxygen species and calcium uptake. In addition, this work suggests

that cannabidiol’s effects may rely on PPAR-y activation, which in turn can inhibit NF-kB, a transcription factor that regulates

pro- inflammatory and pro-hypertrophic genes. Together, these findings further clarify cannabidiol’s mode of action in combatting

cardiac hypertrophy.

(iii) During the 2023 Fiscal Period, the

Corporation granted 500,000 stock options to certain consultants of the Corporation. Each option allows the holder to acquire one

common share of the Corporation at exercise prices between $0.75 and US$1.00 with expiry dates between April 10, 2025 and

June 25, 2028. Of the options granted 100,000 vest one-fourth every three months from the grant date, while the remaining

400,000 vest one-fifth on each of September 30, 2023, October 31, 2023, November 30, 2023, December 31, 2023 and

January 31, 2024. During the 2023 Fiscal Period, the Corporation granted 1,125,000 restricted share units ("RSUs") to

certain consultants of the Corporation. These RSUs vest one-fifth on each of September 30, 2023, October 31, 2023,

November 30, 2023, December 31, 2023 and January 31, 2024.

Subsequent to June 30, 2023

(i) Subsequent

to June 30, 2023, the Corporation granted 875,000 RSUs to certain consultants of the Corporation, vesting 20% on each of September 30,

2023, October 31, 2023, November 30, 2023, December 31, 2023 and January 31, 2024. The Corporation granted an additional

100,000 RSUs to certain consultants that vest on September 2, 2023.

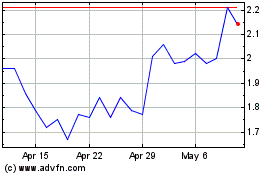

(ii) Subsequent to June 30, 2023, the Corporation announced that it received notice on August 7, 2023 from The Nasdaq Stock Market LLC

stating the Corporation has regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2) for continued

listing on The Nasdaq Capital Market. Accordingly, the Corporation is now in compliance with all applicable listing standards.

Phase II Open Label Pilot Study –

Recurrent Pericarditis

Pericarditis refers to inflammation of the pericardium

(the membrane or sac that surrounds the heart) that follows an initial episode (frequently resulting from a viral infection). Patients

may have multiple recurrences. Symptoms include debilitating chest pain, shortness of breath, and fatigue, resulting in physical limitations,

reduced quality of life, emergency department visits, and hospitalizations. Causes of pericarditis can include infection (e.g., tuberculosis),

systemic disorders such as autoimmune and inflammatory diseases, cancer, and post-cardiac injury syndromes. Based on time of presentation,

acute pericarditis is a symptomatic event lasting less than four to six weeks, the diagnosis of which is based on meeting two of four

criteria: chest pain; pericardial friction rub; electrocardiogram changes; and new or worsening pericardial swelling. Elevation of inflammatory

markers such as C-reactive protein ("CRP"), and evidence of pericardial inflammation by an imaging technique (computed tomography

scan or cardiac magnetic resonance) may help the diagnosis and the monitoring of disease activity. Although generally self-limited and

not life threatening, acute pericarditis is diagnosed in 0.2% of all cardiovascular in-hospital admissions and is responsible for 5% of

emergency room admissions for chest pain in North America and Western Europe.

Recurrent pericarditis is the reappearance of

symptoms after a symptom-free period of at least 4 – 6 weeks following an episode of acute pericarditis. These recurrences appear

in 15% to 30% of acute cases and usually within 18 months. Furthermore, up to 50% of patients with a recurrent episode of pericarditis

experience more recurrences. Standard first-line medical therapy consists of non-steroidal anti-inflammatory drugs or aspirin with or

without colchicine. Corticosteroids such as prednisone are second-line therapy in patients with continued recurrence and inadequate response

to conventional therapy. The only FDA-approved therapy for recurrent pericarditis, launched in 2021, is a costly and potent subcutaneously

injected interleukin-1 inhibitor with immunosuppressive effects. It is generally used as a third-line intervention in patients with a

third or fourth recurrence.

The number of cases of patients seeking and receiving

treatment for recurrent pericarditis annually in the U.S. is estimated at 38,000. Hospitalization due to recurrent pericarditis is often

associated with a 6-8-day length of stay and cost per stay is estimated to range between US$20,000 and US$30,000 in the U.S.

In May 2022, the Corporation announced the

FDA has authorized the Corporation's IND to commence a Phase II open-label pilot study designed to evaluate the tolerance, safety, and

efficacy of CardiolRx in patients with recurrent pericarditis. The study will also assess the improvement in objective measures of disease,

and during an extension period, assess the feasibility of weaning concomitant background therapy including corticosteroids, while taking

CardiolRx. Recurrent pericarditis is a rare disease in the U.S., thereby making CardiolRx eligible for orphan drug status under the FDA's

Orphan Drug Designation program.

Cardiol's study is expected to enroll 25 patients

at major clinical centers in the U.S. specializing in pericarditis. The study protocol has been designed in collaboration with thought

leaders in pericardial disease. The trial's primary efficacy endpoint is the change, from baseline to eight weeks, in patient-reported

pericarditis pain using an 11-point numeric rating scale ("NRS"). The NRS is a validated clinical tool used across multiple

conditions with acute and chronic pain, including previous studies of recurrent pericarditis. Secondary endpoints include the pain score

after 26 weeks of treatment, and changes in high sensitivity CRP.

The Phase II open-label recurrent pericarditis

study was designed with the support of an independent Advisory Committee and key trial investigators, consisting of international thought

leaders in cardiovascular disease, including:

| • | Study Chair: Allan Klein, MD, CM – Director, Center for the

Diagnosis and Treatment of Pericardial Diseases, and Professor of Medicine, Heart, Vascular and Thoracic Institute, Cleveland Clinic; |

| • | Antonio Abbate, MD – Ruth C. Heede Professor of Cardiology,

School of Medicine, and Department of Medicine, Division of Cardiovascular Medicine - Heart and Vascular Center, University of Virginia; |

| • | Allen Luis, MBBS, PhD – Co-Director of the Pericardial Diseases

Clinic, Associate Professor of Medicine, Department of Cardiovascular Medicine, at Mayo Clinic Rochester Minnesota; |

| • | Paul Cremer, MD – Department of Cardiovascular Imaging, Center

for the Diagnosis and Treatment of Pericardial Diseases, Heart, Vascular and Thoracic Institute, Cleveland Clinic; |

| • | Stephen Nicholls – Program Director, Victorian Heart Hospital,

Director, Monash Victorian Heart Institute, and Professor of Cardiology, Monash University, Melbourne; and |

| • | Stefano Toldo, PhD – Associate Professor of Medicine, Department

of Medicine, Cardiovascular Medicine at University of Virginia. |

It is estimated that patient recruitment will

be completed approximately one year following the initiation of all clinical research centers. Cardiol has budgeted additional costs to

complete this study to be approximately $3 million. If Cardiol determines that the Phase II study meets its objectives, it currently expects

to undertake the next steps of its clinical development program, which would consist of a larger clinical study, the details of which

will be determined in conjunction with regulatory agencies. The total cost and timeline to complete this clinical development program

cannot be determined at this stage as this will depend on a variety of factors. The Corporation may involve a commercial partner from

the pharmaceutical industry, to fund the late-stage clinical development and commercialization of CardiolRx for the treatment of recurrent

pericarditis.

Phase II study – Acute myocarditis

(ARCHER)

Myocarditis is an acute inflammatory condition

of the heart muscle (myocardium) characterized by chest pain, impaired cardiac function, atrial and ventricular arrhythmias, and conduction

disturbances. Although the symptoms are often mild, myocarditis remains an important cause of acute and fulminant heart failure and is

a leading cause of sudden cardiac death in people under 35 years of age. Although viral infection is the most common cause of myocarditis,

the condition can also result from administration of therapies used to treat several common cancers, including chemo-therapeutic agents

and immune checkpoint inhibitors.

In a proportion of patients, the inflammation

in the heart persists and causes decreased heart function with symptoms and signs of heart failure, and as such treatment is based on

standard-of-care recommendations for heart failure. This includes diuretics, ACE inhibitors, angiotensin receptors blockers, beta blockers,

and aldosterone inhibitors. For those with a fulminant presentation, intensive care is often required, with the use of inotropic medications

(to increase the force of the heart muscle contraction). Severe cases frequently require ventricular assist devices or extracorporeal

oxygenation and may necessitate heart transplantation. There are no FDA-approved therapies for acute myocarditis. Patients hospitalized

with acute myocarditis experience an average 7-day length of stay and a 4-6% risk of in-hospital mortality, with average hospital charge

per stay estimated at US$110,000 in the U.S.

Data from multiple sources, including the ‘Global

Burden of Disease Study’, reports that the number of cases per year of myocarditis range from approximately 10 to 22/100,000 persons