UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO RULE 13d-1(a) AND AMENDMENTS THERETO

FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

GOODNESS GROWTH HOLDINGS, INC.

(Name of Issuer)

Subordinate Voting Shares

(Title of Class of Securities)

38238W103

(CUSIP Number)

J. Michael Schroeder

General Counsel and Corporate Secretary

Goodness Growth Holdings, Inc.

207 South 9th Street

Minneapolis, Minnesota 55402

(612)

999-1606

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 31, 2023

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions of the Exchange

Act (however, see the Notes).

CUSIP No. 70451X104

| 1 |

NAMES OF REPORTING PERSONS |

|

|

| Kyle E. Kingsley, M.D. |

|

|

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

¨ |

| |

(b) |

¨ |

| |

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

| OO (1) |

|

|

| |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

¨ |

| |

|

|

| |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| United States |

|

|

| |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

| 11,980,485 |

|

|

| |

|

| 8 |

SHARED VOTING POWER |

|

|

| 0 |

|

|

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| 11,980,485 |

|

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| 0 |

|

|

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| 11,980,485 |

|

|

| |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

¨ |

| |

|

|

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| 10.5% (2) |

|

|

| |

|

| |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

| 14 |

|

|

|

|

|

| |

IN |

|

|

(1) Includes (i) 6,541,100 Subordinate Voting

Shares acquired by the Reporting Person as a result of the conversion of 65,411 Super Voting Shares

held by the Reporting Person on July 31, 2023, for no consideration; and (ii) 5,439,385 Subordinate Voting Shares underlying options exercisable

within 60 days.

(2) All calculations of percentage ownership herein

are based on a total of 108,262,130 Subordinate Voting Shares of the Issuer issued and outstanding

as reported in the Issuer’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission on August 4, 2023.

| Item 1. |

Security and Issuer |

This Statement on Schedule

13D (this “Schedule 13D”) relates to the subordinate voting shares (the “Subordinate Voting Shares”) of Goodness

Growth Holdings, Inc., a British Columbia corporation (the “Issuer”). The principal executive office of the Issuer is located

at 207 South 9th Street, Minneapolis, Minnesota 55402.

| Item 2. |

Identity and Background. |

This Schedule 13D is being

filed on behalf of Kyle E. Kingsley, M.D. (the “Reporting Person”).

The principal business address

of the Reporting Person is 207 South 9th Street, Minneapolis, Minnesota 55402.

The Reporting Person is a

director and the Executive Chairman of the Issuer.

As a director and the Executive

Chairman of the Issuer, the Reporting Person may have influence over the corporate activities of the Issuer, including activities which

may relate to transactions described in clauses (a) through (j) of Item 4 of Schedule 13D. The Reporting Person has no present plan or

proposal which would relate to or result in any of the matters set forth in subparagraphs (a) — (j) of Item 4 of Schedule 13D except

as set forth herein or such as would occur upon or in connection with completion of, or following, any of the actions discussed herein;

however, the Reporting Person, at any time and from time to time, may review, reconsider and change their intention with respect to any

and all matters referred to in this Item 4.The Reporting Person is a U.S. citizen.

| Item 3. |

Source and Amount of Funds or Other Consideration |

On July 31, 2023, the Reporting

Person acquired 6,541,100 Subordinate Voting Shares pursuant to the conversion of 65,411 Super Voting

Shares of the Issuer held by the Reporting Person. No consideration was paid for this conversion.

| Item 4. |

Purpose of Transaction. |

The

information set forth in Items 3, 5 and 6 of this Schedule 13D is hereby incorporated by reference.

As

of the date of this Schedule 13D, the Reporting Person does not have any plans or proposals that relate to, or would result in, any actions

or events specified in clauses (a) through (j) of Item 4 to Schedule 13D.

| Item 5. |

Interest in Securities of the Issuer. |

| |

(a)-(b) |

The information contained in the cover page of

this Schedule 13D is incorporated herein by reference. The percentages used in this Schedule 13D are calculated based upon on a total

of 108,262,130 Subordinate Voting Shares of the Issuer issued and outstanding as reported

in the Issuer’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission on August 4, 2023.

The number of Subordinate Voting Shares held by

the Reporting Person consists of 6,541,100 Subordinate Voting Shares and 5,439,385 Subordinate Voting Shares underlying currently exercisable

options. The Reporting Person has sole voting and dispositive power with respect to these securities. |

| |

(c) |

The information set forth in Item 3 of this Schedule 13D is hereby incorporated by reference. Other than as described in Item 3, the Reporting Person has not effected any transaction in the Subordinate Voting Shares during the past sixty (60) days. |

| |

(d) |

To the best knowledge of the Reporting Person, no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds of the sale of, the securities that are the subject of this Schedule 13D. |

| |

|

|

| |

(e) |

Not applicable. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

The conversion by the Reporting Person of 65,411 Super Voting Shares

of the Issuer into 6,541,100 Subordinate Voting Shares of the Issuer on July 31, 2023 was effected pursuant to the Fifth Amendment to

Credit Agreement and First Amendment to Security Agreement, dated March 31, 2023, by and among the Issuer and certain of its subsidiaries,

the persons from time-to-time party thereto as guarantors, the lenders party thereto, and Chicago Atlantic Admin, LLC as administrative

and collateral agent.

| Item 7. |

Material to be Filed as Exhibits. |

| 1 |

Fifth Amendment to Credit Agreement and First Amendment to Security Agreement, dated as of March 31, 2023, by and among Goodness Growth Holdings, Inc. and certain of its subsidiaries, the persons from time-to-time parties thereto as guarantors, the lenders party thereto, and Chicago Atlantic Advisers, LLC, as administrative agent and as collateral agent (incorporated by reference to Exhibit 10.45 to the Issuer’s Quarterly Report on Form 10-Q for the three months ended March 31, 2023). |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: August 10, 2023 |

|

| |

|

| |

Signature: |

/s/ Kyle E. Kingsley, M.D. |

| |

Name: |

Kyle E. Kingsley, M.D. |

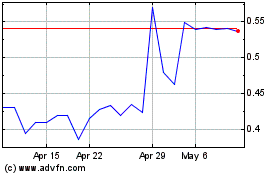

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

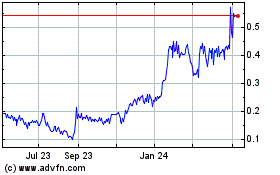

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Apr 2023 to Apr 2024