false000160616300016061632023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 9, 2023

LIMBACH HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36541 | 46-5399422 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

797 Commonwealth Drive, Warrendale, Pennsylvania 15086

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (412) 359-2100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value | LMB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 9, 2023, Limbach Holdings, Inc. (the “Company”) issued a press release dated the same date announcing its financial results for its quarter ended June 30, 2023. We have furnished a copy of this release as Exhibit 99.1 to this Current Report on Form 8-K.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

Exhibit 99.1 hereto is incorporated into this Item 7.01 by reference.

The information in this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | LIMBACH HOLDINGS, INC. | |

| | | | |

| | | | |

| | By: | /s/ Jayme L. Brooks | |

| | | Name: Jayme L. Brooks | |

| | | Title: Executive Vice President and Chief Financial Officer | |

Dated: August 9, 2023

FOR IMMEDIATE RELEASE

Limbach Holdings, Inc. Announces Second Quarter 2023 Results

Revenue from Owner Direct Relationships (“ODR”) Segment up 18.1% Year-over-Year

ODR Segment Accounted for Approximately 47.1% of Revenue and 60.5% of Consolidated Gross Profit

Consolidated Gross Margin Increased to 22.8%

Increase in FY 2023 Adjusted EBITDA Guidance

WARRENDALE, PA – August 9, 2023 – Limbach Holdings, Inc. (Nasdaq: LMB) (“Limbach” or the “Company”) today announced its financial results for the quarter ended June 30, 2023.

2023 Second Quarter Financial Overview Compared to 2022 Second Quarter

•Consolidated revenue was $124.9 million, an increase of 7.5% from $116.1 million.

•Gross profit was $28.5 million, an increase of 33.7% from $21.3 million.

•Net income of $5.3 million, or $0.46 per diluted share, compared to a net income of $0.9 million, or $0.08 per diluted share.

•Adjusted EBITDA of $11.9 million, up 81.1% from $6.6 million.

•Net cash provided by operating activities of $16.9 million, compared to $15.6 million.

Management Comments

Michael McCann, Limbach’s President and Chief Executive Officer, said, “We continued to execute on a number of fronts during the second quarter, with solid revenue growth in our ODR segment and improvement in gross margin in both segments. The net result was a sharp improvement in net income and Adjusted EBITDA from year-ago levels. We continue to experience strong demand for our services in the ODR segment across a number of our target end markets as tight supply chain conditions persist. With tight supply chain conditions for new equipment, we see increased demand for T&M work to keep aging equipment working and an increased interest in operating efficiencies on the part of building owners which is largely attributable to the increase in Adjusted EBITDA guidance.”

Mr. McCann continued, “We remain intensely focused on positioning Limbach as the preferred building solutions partner for enterprises with mission critical assets, driving demand for our services throughout the cycle. By providing value-added solutions that enable our customers to improve their operating efficiency and return on assets, we are able to create durable relationships that allow us to realize continued improvement in margins and profitability.”

Mr. McCann concluded, “Our value creation strategy centers on three primary levers – increasing the proportion of our revenues that come from our higher-margin ODR segment; delivering higher-margin evolved offerings for our customers; and pursuit of strategic acquisitions. Following the end of the second quarter, we announced the acquisition of ACME Industrial Products based in Chattanooga, Tennessee. We are very excited to welcome everyone at ACME to the Limbach family. ACME enjoys an outstanding reputation in the Chattanooga area and is a market leader in servicing hydroelectric facilities. This acquisition is very much ‘on strategy’ and we continue to work diligently on additional acquisition opportunities for this year and beyond.”

Second Quarter 2023 Results Detail

The following are results for the three months ended June 30, 2023 compared to the three months ended June 30, 2022:

•Consolidated revenue was $124.9 million, an increase of 7.5% from $116.1 million. ODR segment revenue of $58.8 million increased by $9.0 million, or 18.1%, while GCR segment revenue was relatively flat. The Company continued its strategic focus on expanding the ODR segment’s contribution to the business.

•Gross margin increased to 22.8%, up from 18.4%. On a dollar basis, total gross profit was $28.5 million, compared to $21.3 million. ODR gross profit increased $4.6 million, or 36.6%, due to the combination of an increase in revenue and higher segment margins of 29.3% versus 25.4% driven by contract mix. GCR gross profit increased $2.6 million, or 29.7%, due to higher segment margins of 17.1%, compared with 13.1%. The Company continues to expect annual GCR gross margins to trend to a range of 12% to 15%, while ODR margins are expected to be in a range from 25% to 28%.

•Selling, general and administrative expenses increased by approximately $1.7 million, to $20.4 million, compared to $18.7 million. The increase in SG&A was primarily due to a $1.3 million increase associated with payroll-related expenses and a $0.5 million increase in stock compensation expense, partially offset by a $0.4 million decrease in rent related expenses. As a percent of revenue, selling, general and administrative expenses were 16.3%, up from 16.1%.

•Interest expense was $0.5 million during the current and prior year quarter, which was the result of higher interest rates on outstanding debt despite a lower overall outstanding debt balance period-over-period.

•Interest income was $0.2 million compared to marginal interest income in the prior year. This increase was due to the Company's overnight repurchase agreement, investments in U.S. Treasury Bills, and money market funds.

•Net income was $5.3 million as compared to $0.9 million. Diluted income per share was $0.46 as compared to $0.08. Adjusted EBITDA was $11.9 million as compared to $6.6 million, an increase of 81.1%.

•Net cash provided by operating activities increased to $16.9 million as compared to $15.6 million.

Balance Sheet

At June 30, 2023, we had cash and cash equivalents of $45.9 million. We had current assets of $199.2 million and current liabilities of $127.3 million at June 30, 2023, representing a current ratio of 1.57x compared to 1.42x at December 31, 2022. Working capital was $71.9 million at June 30, 2023, an increase of $5.0 million from December 31, 2022. At June 30, 2023, we had $10.0 million in borrowings against our revolving credit facility and $4.2 million for standby letters of credit. During the six months ended June 30, 2023, the Company made cash payments of $11.5 million on the principal portion of the A&R Wintrust Term Loan prior to its extinguishment.

Through June 30, 2023, all 600,000 of our $15 Exercise Price Sponsor Warrants and 163,444 of our Merger Warrants were exercised on a cashless basis by the holders of the warrants, which resulted in the warrants being exercised for 167,564 and 45,797 shares of our common stock, respectively. For the period from July 1, 2023 through July 20, 2023, the holders to the Merger Warrants exercised on a cashless basis 443,032 warrants, which resulted in the Merger Warrants being converted into 228,945 shares of our common stock. The remaining 23,167 unexercised Merger Warrants expired by their terms on July 20, 2023.

Subsequent Events

On July 3, 2023, the Company completed the acquisition of ACME Industrial Piping, LLC (“ACME”), a specialty industrial contractor based in Chattanooga, Tennessee, for a purchase price at closing of $5 million in cash. The transaction also provides for an earnout of up to $2.5 million potentially being paid out over the next two years. ACME specializes in performing industrial maintenance, capital project work, and emergency services for specialty chemical and manufacturing clients, and is a leading mechanical solutions provider for hydroelectric producers.

2023 Guidance

We are updating our guidance for FY 2023 as follows:

| | | | | | | | | | | |

| Current | | Previous |

| Revenue | $490 million - $520 million | | $490 million - $520 million |

| Adjusted EBITDA | $38 million - $41 million | | $33 million - $37 million |

Conference Call Details

| | | | | |

| Date: | Thursday, August 10, 2023 |

| Time: | 9:00 a.m. Eastern Time |

| Participant Dial-In Numbers: |

| Domestic callers: | (877) 407-6176 |

| International callers: | (201) 689-8451 |

Access by Webcast

The call will also be simultaneously webcast over the Internet via the “Investor Relations” section of Limbach’s website at www.limbachinc.com or by clicking on the conference call link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=c1l6wBEc. An audio replay of the call will be archived on Limbach’s website for 365 days.

About Limbach

Limbach is a building systems solutions firm with expertise in the design, prefabrication, installation, management and maintenance of heating, ventilation, air-conditioning ("HVAC"), mechanical, electrical, plumbing and controls systems. With over 1,500 team members and 17 offices located throughout the United States, we partner with institutions with mission-critical infrastructures, such as data centers and healthcare, industrial & light manufacturing, cultural & entertainment, higher education, and life science facilities. With Limbach's full life-cycle capabilities, from concept design and engineering through system commissioning and recurring 24/7 service and maintenance, Limbach is positioned as a value-added and indispensable partner for building owners, construction managers, general contractors, and energy service companies.

Forward-Looking Statements

We make forward-looking statements in this press release within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations or forecasts for future events, including, without limitation, our earnings, Adjusted EBITDA, revenues, expenses, backlog, capital expenditures or other future financial or business performance or strategies, results of operations or financial condition, and in particular statements regarding the impact of the COVID-19 pandemic on the construction industry in future periods, timing of the recognition of backlog as revenue, the potential for recovery of cost overruns, and the ability of Limbach to successfully remedy the issues that have led to write-downs in various business units. These statements may be preceded by, followed by or include the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,” “target” or similar expressions. These forward-looking statements are based on information available to us as of the date they were made and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak and there may be additional risks that we consider immaterial or which are unknown. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Please refer to our most recent annual report on Form 10-K, as well as our subsequent filings on Form 10-Q and Form 8-K, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements in this press release.

Investor Relations

The Equity Group, Inc.

Jeremy Hellman, CFA

Vice President

(212) 836-9626 / jhellman@equityny.com

LIMBACH HOLDINGS, INC.

Condensed Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (in thousands, except share and per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 124,882 | | | $ | 116,120 | | | $ | 245,891 | | | $ | 230,942 | |

| Cost of revenue | | 96,369 | | | 94,800 | | | 191,151 | | | 191,282 | |

| Gross profit | | 28,513 | | | 21,320 | | | 54,740 | | | 39,660 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 20,416 | | | 18,690 | | | 41,466 | | | 37,424 | |

| Change in fair value of contingent consideration | | 162 | | | 765 | | | 303 | | | 765 | |

| Amortization of intangibles | | 383 | | | 399 | | 766 | | | 798 |

| Total operating expenses | | 20,961 | | | 19,854 | | | 42,535 | | | 38,987 | |

| Operating income | | 7,552 | | | 1,466 | | | 12,205 | | | 673 | |

| Other (expenses) income: | | | | | | | | |

| Interest expense | | (511) | | | (478) | | | (1,178) | | | (964) | |

| Interest income | | 247 | | | — | | | 247 | | | — | |

| Gain (loss) on disposition of property and equipment | | 175 | | | 147 | | | (40) | | | 111 | |

| Loss on early termination of operating lease | | — | | | (32) | | | — | | | (849) | |

| Loss on early debt extinguishment | | (311) | | | — | | | (311) | | | — | |

| Gain on change in fair value of interest rate swap | | 193 | | | — | | | 37 | | | — | |

| | | | | | | | |

| Total other expenses | | (207) | | | (363) | | | (1,245) | | | (1,702) | |

| Income (loss) before income taxes | | 7,345 | | | 1,103 | | | 10,960 | | | (1,029) | |

| Income tax provision (benefit) | | 2,025 | | | 237 | | | 2,647 | | | (379) | |

| Net income (loss) | | $ | 5,320 | | | $ | 866 | | | $ | 8,313 | | | $ | (650) | |

| | | | | | | | |

| Earnings (loss) Per Share (“EPS”) | | | | | | | | |

| Earnings (loss) per common share: | | | | | | | | |

| Basic | | $ | 0.50 | | | $ | 0.08 | | | $ | 0.79 | | | $ | (0.06) | |

| Diluted | | $ | 0.46 | | | $ | 0.08 | | | $ | 0.73 | | | $ | (0.06) | |

| Weighted average number of shares outstanding: | | | | | | | | |

| Basic | | 10,644,423 | | | 10,423,068 | | | 10,560,381 | | | 10,421,886 | |

| Diluted | | 11,507,311 | | | 10,567,304 | | | 11,336,474 | | | 10,421,886 | |

LIMBACH HOLDINGS, INC.

Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| (in thousands, except share and per share data) | June 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 45,929 | | | $ | 36,001 | |

| Restricted cash | 65 | | | 113 | |

| Accounts receivable (net of allowance for credit losses of $295 and net of allowance for doubtful accounts of $234 as of June 30, 2023 and December 31, 2022, respectively) | 87,230 | | | 124,442 | |

| Contract assets | 59,424 | | | 61,453 | |

| Income tax receivable | 814 | | | 95 | |

| Other current assets | 5,747 | | | 3,886 | |

| Total current assets | 199,209 | | | 225,990 | |

| | | |

| Property and equipment, net | 19,623 | | | 18,224 | |

| Intangible assets, net | 14,575 | | | 15,340 | |

| Goodwill | 11,370 | | | 11,370 | |

| Operating lease right-of-use assets | 17,149 | | | 18,288 | |

| Deferred tax asset | 4,999 | | | 4,829 | |

| Other assets | 502 | | | 515 | |

| Total assets | $ | 267,427 | | | $ | 294,556 | |

| | | |

| LIABILITIES | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 2,431 | | | $ | 9,564 | |

| Current operating lease liabilities | 3,598 | | | 3,562 | |

| Accounts payable, including retainage | 53,376 | | | 75,122 | |

| Contract liabilities | 43,682 | | | 44,007 | |

| Accrued income taxes | 1,505 | | | 1,888 | |

| Accrued expenses and other current liabilities | 22,677 | | | 24,942 | |

| Total current liabilities | 127,269 | | | 159,085 | |

| Long-term debt | 19,485 | | | 21,528 | |

| Long-term operating lease liabilities | 14,513 | | | 15,643 | |

| Other long-term liabilities | 502 | | | 2,858 | |

| Total liabilities | 161,769 | | | 199,114 | |

| | | |

| STOCKHOLDERS’ EQUITY | | | |

| Common stock, $0.0001 par value; 100,000,000 shares authorized, issued 10,946,316 and 10,471,410, respectively, and 10,766,664 and 10,291,758 outstanding, respectively | 1 | | | 1 | |

| Additional paid-in capital | 89,712 | | | 87,809 | |

| Treasury stock, at cost (179,652 shares at both period ends) | (2,000) | | | (2,000) | |

| Retained earnings | 17,945 | | | 9,632 | |

| Total stockholders’ equity | 105,658 | | | 95,442 | |

| Total liabilities and stockholders’ equity | $ | 267,427 | | | $ | 294,556 | |

LIMBACH HOLDINGS, INC.

Condensed Consolidated Statements of Cash Flows (Unaudited) | | | | | | | | | | | |

| Six Months Ended

June 30, |

| (in thousands) | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 8,313 | | | $ | (650) | |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: | | | |

| Depreciation and amortization | 3,859 | | | 4,148 | |

| Provision for credit losses / doubtful accounts | 116 | | | 104 | |

| Stock-based compensation expense | 2,234 | | | 1,174 | |

| Noncash operating lease expense | 1,882 | | | 2,232 | |

| Amortization of debt issuance costs | 58 | | | 65 | |

| Deferred income tax provision | (170) | | | (12) | |

| Loss (gain) on sale of property and equipment | 40 | | | (111) | |

| Loss on early termination of operating lease | — | | | 849 | |

| Loss on change in fair value of contingent consideration | 303 | | | 765 | |

| Loss on early debt extinguishment | 311 | | | — | |

| Gain on change in fair value of interest rate swap | (37) | | | — | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 37,096 | | | (11,796) | |

| Contract assets | 2,029 | | | 8,904 | |

| Other current assets | (1,861) | | | (520) | |

| Accounts payable, including retainage | (21,747) | | | (635) | |

| Prepaid income taxes | (719) | | | (562) | |

| Accrued taxes payable | (383) | | | (501) | |

| Contract liabilities | (325) | | | 13,123 | |

| Operating lease liabilities | (1,836) | | | (2,165) | |

| Accrued expenses and other current liabilities | (1,806) | | | (1,861) | |

| Payment of contingent consideration liability in excess of acquisition-date fair value | (1,224) | | | — | |

| Other long-term liabilities | 159 | | | 69 | |

| Net cash provided by operating activities | 26,292 | | | 12,620 | |

| Cash flows from investing activities: | | | |

| Proceeds from sale of property and equipment | 275 | | | 189 | |

| | | |

| Purchase of property and equipment | (1,499) | | | (473) | |

| Net cash used in investing activities | (1,224) | | | (284) | |

| Cash flows from financing activities: | | | |

| | | |

| Payments on Wintrust and A&R Wintrust Term Loans | (21,452) | | | (9,149) | |

| Proceeds from Wintrust Revolving Loan | 10,000 | | | 15,194 | |

| Payments on Wintrust Revolving Loan | — | | | (11,694) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Payment of contingent consideration liability up to acquisition-date fair value | (1,776) | | | — | |

| Payments on finance leases | (1,302) | | | (1,358) | |

| Payments of debt issuance costs | (50) | | | (25) | |

| Taxes paid related to net-share settlement of equity awards | (847) | | | (363) | |

| Proceeds from contributions to Employee Stock Purchase Plan | 239 | | | 213 | |

| Net cash used in financing activities | (15,188) | | | (7,182) | |

| Increase in cash, cash equivalents and restricted cash | 9,880 | | | 5,154 | |

| Cash, cash equivalents and restricted cash, beginning of period | 36,114 | | | 14,589 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 45,994 | | | $ | 19,743 | |

| Supplemental disclosures of cash flow information | | | |

| Noncash investing and financing transactions: | | | |

| Right of use assets obtained in exchange for new operating lease liabilities | $ | 742 | | | $ | — | |

| Right of use assets obtained in exchange for new finance lease liabilities | 3,392 | | | 1,968 | |

| Right of use assets disposed or adjusted modifying operating lease liabilities | — | | | (1,276) | |

| Right of use assets disposed or adjusted modifying finance lease liabilities | (30) | | | (77) | |

| Interest paid | 1,181 | | | 911 | |

| Cash paid for income taxes | $ | 3,919 | | | $ | 696 | |

LIMBACH HOLDINGS, INC.

Condensed Consolidated Segment Operating Results (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Increase/(Decrease) |

| (in thousands, except for percentages) | 2023 | | 2022 | | $ | | % |

| Statement of Operations Data: | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | |

| GCR | $ | 66,102 | | | 52.9 | % | | $ | 66,336 | | | 57.1 | % | | $ | (234) | | | (0.4) | % |

| ODR | 58,780 | | | 47.1 | % | | 49,784 | | | 42.9 | % | | 8,996 | | | 18.1 | % |

| Total revenue | 124,882 | | | 100.0 | % | | 116,120 | | | 100.0 | % | | 8,762 | | | 7.5 | % |

| | | | | | | | | | | |

| Gross profit: | | | | | | | | | | | |

GCR(1) | 11,272 | | | 17.1 | % | | 8,694 | | | 13.1 | % | | 2,578 | | | 29.7 | % |

ODR(2) | 17,241 | | | 29.3 | % | | 12,626 | | | 25.4 | % | | 4,615 | | | 36.6 | % |

| Total gross profit | 28,513 | | | 22.8 | % | | 21,320 | | | 18.4 | % | | 7,193 | | | 33.7 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Selling, general and administrative(3) | 20,416 | | | 16.3 | % | | 18,690 | | | 16.1 | % | | 1,726 | | | 9.2 | % |

| | | | | | | | | | | |

| Change in fair value of contingent consideration | 162 | | | 0.1 | % | | 765 | | | 0.7 | % | | (603) | | | (78.8) | % |

| Amortization of intangibles | 383 | | | 0.3 | % | | 399 | | | 0.3 | % | | (16) | | | (4.0) | % |

| Total operating income | $ | 7,552 | | | 6.0 | % | | $ | 1,466 | | | 1.3 | % | | $ | 6,086 | | | 415.1 | % |

| | | | | | | | | | | |

(1)As a percentage of GCR revenue.

(2)As a percentage of ODR revenue.

(3)Included within selling, general and administrative expenses was $1.1 million and $0.6 million of stock based compensation expense for the three months ended June 30, 2023 and 2022, respectively.

LIMBACH HOLDINGS, INC.

Condensed Consolidated Segment Operating Results (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, | | Increase/(Decrease) |

| (in thousands, except for percentages) | 2023 | | 2022 | | $ | | % |

| Statement of Operations Data: | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | |

| GCR | $ | 128,393 | | | 52.2 | % | | $ | 138,268 | | | 59.9 | % | | $ | (9,875) | | | (7.1) | % |

| ODR | 117,498 | | | 47.8 | % | | 92,674 | | | 40.1 | % | | 24,824 | | | 26.8 | % |

| Total revenue | 245,891 | | | 100.0 | % | | 230,942 | | | 100.0 | % | | 14,949 | | | 6.5 | % |

| | | | | | | | | | | |

| Gross profit: | | | | | | | | | | | |

GCR(1) | 21,590 | | | 16.8 | % | | 17,052 | | | 12.3 | % | | 4,538 | | | 26.6 | % |

ODR(2) | 33,150 | | | 28.2 | % | | 22,608 | | | 24.4 | % | | 10,542 | | | 46.6 | % |

| Total gross profit | 54,740 | | | 22.3 | % | | 39,660 | | | 17.2 | % | | 15,080 | | | 38.0 | % |

| | | | | | | | | | | |

Selling, general and administrative(3) | 41,466 | | | 16.9 | % | | 37,424 | | | 16.2 | % | | 4,042 | | | 10.8 | % |

| Change in fair value of contingent consideration | 303 | | | 0.1 | % | | 765 | | | 0.3 | % | | (462) | | | (60.4) | % |

| Amortization of intangibles | 766 | | | 0.3 | % | | 798 | | | 0.3 | % | | (32) | | | (4.0) | % |

| Total operating income | $ | 12,205 | | | 5.0 | % | | $ | 673 | | | 0.3 | % | | $ | 11,532 | | | 1,713.5 | % |

| | | | | | | | | | | |

(1)As a percentage of GCR revenue.

(2)As a percentage of ODR revenue.

(3)Included within selling, general and administrative expenses was $2.2 million and $1.2 million of stock based compensation expense for the six months ended June 30, 2023 and 2022, respectively.

Non-GAAP Financial Measures

In assessing the performance of our business, management utilizes a variety of financial and performance measures. The key measure is Adjusted EBITDA, a non-GAAP financial measure. We define Adjusted EBITDA as net income plus depreciation and amortization expense, interest expense, and taxes, as further adjusted to eliminate the impact of, when applicable, other non-cash items or expenses that are unusual or non-recurring that we believe do not reflect our core operating results. We believe that Adjusted EBITDA is meaningful to our investors to enhance their understanding of our financial performance for the current period and our ability to generate cash flows from operations that are available for taxes, capital expenditures and debt service. We understand that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties as a measure of financial performance and to compare our performance with the performance of other companies that report Adjusted EBITDA. Our calculation of Adjusted EBITDA, however, may not be comparable to similarly titled measures reported by other companies. When assessing our operating performance, investors and others should not consider this data in isolation or as a substitute for net income calculated in accordance with GAAP. Further, the results presented by Adjusted EBITDA cannot be achieved without incurring the costs that the measure excludes. A reconciliation of net income to Adjusted EBITDA, the most comparable GAAP measure, is provided below.

We refer to our estimated revenue on uncompleted contracts, including the amount of revenue on contracts for which work has not begun, less the revenue we have recognized under such contracts, as “backlog.” Backlog includes unexercised contract options.

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income (Loss) to Adjusted EBITDA | | | | | | |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 5,320 | | | $ | 866 | | | $ | 8,313 | | | $ | (650) | |

| | | | | | | |

| Adjustments: | | | | | | | |

| Depreciation and amortization | 1,937 | | | 2,086 | | | 3,859 | | | 4,148 | |

| Interest expense | 511 | | | 478 | | | 1,178 | | | 964 | |

| Interest income | (247) | | | — | | | (247) | | | — | |

| Non-cash stock-based compensation expense | 1,101 | | | 575 | | | 2,234 | | | 1,174 | |

| Loss on early debt extinguishment | 311 | | | — | | | 311 | | | — | |

| Change in fair value of interest rate swap | (193) | | | — | | | (37) | | | — | |

| CEO transition costs | 147 | | | — | | | 958 | | | — | |

| Loss on early termination of operating lease | — | | | 32 | | | — | | | 849 | |

| Income tax provision (benefit) | 2,025 | | | 237 | | | 2,647 | | | (379) | |

| Acquisition and other transaction costs | 299 | | | 45 | | | 299 | | | 198 | |

| Change in fair value of contingent consideration | 162 | | | 765 | | | 303 | | | 765 | |

Restructuring costs(1) | 532 | | | 1,491 | | | 772 | | | 2,926 | |

| Adjusted EBITDA | $ | 11,905 | | | $ | 6,575 | | | $ | 20,590 | | | $ | 9,995 | |

| | | | | | | |

(1)For the three and six months ended June 30, 2023, the majority of the restructuring costs related to our Southern California and Eastern Pennsylvania branches. For the three and six months ended June 30, 2022, the majority of the restructuring costs related to our Southern California and Eastern Pennsylvania branches and nominal restructuring costs related to cost initiatives throughout the company.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

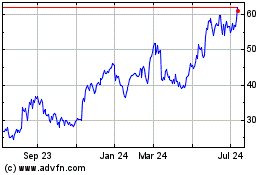

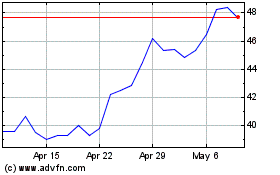

Limbach (NASDAQ:LMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Limbach (NASDAQ:LMB)

Historical Stock Chart

From Apr 2023 to Apr 2024