Table of Contents

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING

TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”). INFORMATION CONTAINED IN THIS PRELIMINARY

OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE

OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR

THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE

WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER

A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL

WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR August 9,

2023

THUNDER ENERGIES CORP.

1100 Peachtree St NE, Suite 200

Atlanta, GA 30309

404-793-1956

OFFERING SUMMARY

Up to 15,000,000 shares of

Class A Common Stock

SEE “SECURITIES BEING OFFERED”

AT PAGE 24

| |

|

Price to Public |

|

Underwriting

discount and

commissions |

|

Proceeds to

issuer |

|

Proceeds to

other persons |

| Per share |

|

$5.00 |

|

$0.25 |

|

$4.75 |

|

0 |

| Total Maximum |

|

$75,000,000 |

|

$3,700,000 |

|

$71,300,000 |

|

0 |

The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”),

to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes

the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. See “Plan of Distribution and Selling Securityholders” for details. To the extent that the Company’s officers and directors make

any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration

contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of

them is required to register as a broker-dealer.

The company expects that, not including state filing fees, the amount of

expenses of the offering that we will pay will be approximately $3,700,000 based on the maximum number of shares sold in this offering.

This offering (the “Offering”) will terminate at the earlier

of (1) the date at which the Maximum Offering amount has been sold, (2) the date which is one year from this offering being qualified

by the United States Securities and Exchange Commission, or (3) the date at which the offering is earlier terminated by the company at

its sole discretion. The Offering is being conducted on a best-efforts basis and there is no minimum number of shares that needs to be

sold in order for funds to be released to the company and for this Offering to close, which may mean that the company does not receive

sufficient funds to cover the cost of this Offering. The company may undertake one or more closings on a rolling basis. After each closing,

funds tendered by investors will be made available to the company. After the initial closing of this offering, we expect to hold closings

on at least a monthly basis.

The holders of Thunder Energies preferred stock (the “Preferred

Stock”) are entitled to an aggregate vote of the following:

Series A – Cumulative Control Voting of 75%

Series B – 1,000 votes per share convertible into 1,000

shares of Common Stock

Series C – 1,000 votes per share, non-convertible

Holders of the Preferred Stock will continue to hold a majority of the

voting power of all of the company’s equity stock at the conclusion of this Offering and therefore control the board.

The Company has granted Piggyback Registration Rights for current

holders of common stock and the underlying conversion rights of both Series B Preferred Shares and the currently outstanding Convertible

Notes.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON

THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS

OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH

THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE

PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS

AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU

TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 3. THERE IS NO ASSURANCE THAT THE NECESSARY FUNDS WILL BE RAISED OR THAT THE ISSUER WILL BE ABLE TO BE SUCCESSFUL

IN THEIR BUSINESS OPERATIONS AS DESCRIBED HEREIN.

Sales of these securities will commence approximately 10 days after

the approval of this Offering.

The company is following the “Offering Circular” format

of disclosure under Regulation A.

TABLE OF CONTENTS

In this Offering Circular, the term “Thunder Energies,”

“we,” “us, “our” or “the company” refers to THUNDER ENERGIES CORP., a Florida corporation.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION

RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED

ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING

MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,”

“EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS.

THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT

COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS

ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE.

THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES

AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

SUMMARY

Thunder Energies Corp. was incorporated April 2011 and underwent new

management as of February 2022. This new team has created a vision that is still in the early stages of redevelopment and growth. The

Company looks to drive outstanding results for our shareholders by deploying capital in well diversified business venture acquisitions

and partnerships (i.e., commercial/residential real estate, mining, water purification technologies, solar energy, entertainment, etc.)

and seeks current sustainable income as a primary objective and capital appreciation as a secondary objective.

The company has already secured impressive partnerships - including

real estate development, mining, marketing and advertising, and is continually expanding investment opportunities in multiple capital

markets to create diverse revenue streams. Its mission is to protect the shareholders through a diversified operating base with various

industry classes that allow it to stay liquid and self-sufficient to aid in heading off any unforeseeable market shifts and political

changes around the globe, which are critically important in current times.

The company will operate under the brand name “Thunder Energies”

with consideration given to future name changes due to a diversification of operations outside of the former business.

Revenue Plan

The company will be identifying and acquiring operating businesses

that provide revenue or cash flowing assets and companies that will provide a return on investment to our shareholders.

The Offering

| Securities offered |

|

Common Stock |

| |

|

|

| Common Stock outstanding before the Offering |

|

25,140,735 shares of Common Stock. |

| |

|

|

| Share Price |

|

$5.00 per share |

|

Maximum Common Shares Offered |

|

15,000,000 |

| |

|

|

| Minimum Investment |

|

$10,000 |

Use of Proceeds

Proceeds from this Offering will be used to acquire companies or interests

in companies. Thunder Energies has current minority interests in a mining venture, development of family resorts in Tennessee and Georgia

and letter of intent for a water purification technologies and solar energy company. Thunder Energies approach is to find and develop

companies who can benefit from its management expertise, synergies and access to capital.

Summary Risk Factors

Thunder Energies is a startup. The company was incorporated on April

2011 and is still in an early stage of development. The company is not close to profitability as projects take approximately 18 months

to develop and construct and may not provide a return on investment for approximately 24 months thereafter. Investing in the company

involves a high degree of risk (see “Risk Factors”). As an investor, you should be able to bear a complete

loss of your investment. Some of the more significant risks include those set forth below:

| |

· |

This is a very young company. |

| |

|

|

| |

· |

The company has minimal operating capital and minimal

revenue from operations. |

| |

|

|

| |

· |

The success of Thunder Energies is dependent on

the acquisition of business venture assets that produce revenue at favorable prices. |

| |

|

|

| |

· |

The company may need to raise more capital and future fundraising rounds could result in dilution. |

| |

|

|

| |

· |

Success in the real estate and other investments is highly unpredictable, and there is no guarantee the company will be successful in the market. |

| |

|

|

| |

· |

Thunder Energies runs the risk of becoming an inadvertent investment company. |

| |

|

|

| |

· |

Market risks could have material negative effects on Thunder Energies’ planned operations. |

| |

|

|

| |

· |

Thunder Energies operates in a highly competitive market. |

| |

|

|

| |

· |

Litigation against our operations, our business,

results of operations or financial condition. |

| |

|

|

| |

· |

The company’s insurance coverage may not be adequate to cover all possible losses that it could suffer and its insurance costs may increase. |

| |

|

|

| |

· |

Some of the company’s operations will be in

real estate, which are subject to numerous risks, including the risk that the values of their investments may decline if there is

a prolonged downturn in real estate values. |

| |

|

|

| |

· |

The illiquidity of real estate may make it difficult for the company to dispose of one or more of our investments or negatively affect our ability to profitably sell such investments and access liquidity. |

| |

|

|

| |

· |

The company’s growth strategy depends on its ability to identify and fund acquisition of income producing assets. |

| |

|

|

| |

· |

The company’s real estate acquisitions may

depend on their ability to obtain favorable mortgage financing. |

| |

|

|

| |

· |

Thunder Energies depends on a small management team and may need to hire more people to be successful. |

| |

|

|

| |

· |

The Offering price has been arbitrarily set by the company. |

| |

|

|

| |

· |

The officers of Thunder Energies control the company and the company does

not currently have any independent directors.

|

| |

· |

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable, which could result in less favorable outcomes to the plaintiff(s) in any such action. |

| |

|

|

| |

· |

There is little to no current market for Thunder Energies’ shares. |

| |

|

|

| |

· |

The interests of Thunder Energies and the company’s other affiliates may conflict with your interests. |

RISK FACTORS

The SEC requires the company to identify risks that are specific to its

business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies

in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments

(such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently riskier than more developed companies.

You should consider general risks as well as specific risks when deciding whether to invest.

Risks relating to our business

This is a very young company.

The company was incorporated in Florida on April 21, 2011 and underwent

new management as of February 2022. This new team has created a vision that is still in the early stages of redevelopment and growth.

Despite the time since incorporation the company is still a startup company that has recently been acquired and changed its operations

to a new business model. The company is initiating the execution of its business plan discussed herein. There is limited history upon

which an evaluation of its past performance and future prospects can be made. Statistically, most startup companies fail.

The company has minimal operating capital, no significant

assets and no revenue from operations.

The company currently has minimal operating capital and for the foreseeable

future will be dependent upon its ability to finance its planned operations from the sale of securities or other financing alternatives.

There can be no assurance that it will be able to successfully raise operating capital in this or other offerings of securities, or to

raise enough funds to become operational. The failure to successfully raise operating capital could result in its inability to execute

its business plan and potentially lead to bankruptcy, which would have a material adverse effect on the company and its investors.

The success of Thunder Energies business

is dependent on acquisition of operating assets that produce revenue at favorable prices.

As of the date of this Offering Circular the company has a minority

interest in a mining operation and a family resort operation. The company is also in negotiations with a water/solar technology company.

The company does not know whether it will be able to obtain additional acquisitions in other companies at acceptable purchase terms that

are favorable. Finally, if this Offering does not raise enough capital to finalize the acquisitions, the company may need to turn to

other sources of funds.

Thunder Energies

runs the risk of becoming an inadvertent investment company.

As Thunder Energies executes its business

plan it must acquire and control properties and businesses. Failure to control the assets could lead to Thunder Energies holding greater

than 40% of its assets in securities which could lead to it being ruled an investment company under Section 3(a)(1)(C) of the Investment

Company Act of 1940.

The company may raise more capital and future fundraising

rounds could result in dilution.

Thunder Energies may need to raise additional funds to finance its operations

or fund its business plan. Even if the company manages to raise subsequent financing or borrowing rounds, the terms of those borrowing

rounds might be more favorable to new investors or creditors than to existing investors such as you. New equity investors or lenders could

have greater rights to our financial resources (such as liens over our assets) compared to existing shareholders. Additional financings

could also dilute your ownership stake, potentially drastically. See “Dilution” and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations– Plan of Operation” for more information.

Success in real estate and other acquisitions

is highly unpredictable, and there is no guarantee the company will be successful in the market.

The company’s success will depend on the performance of the companies

and assets it acquires. Thunder Energies will perform due diligence, appraisals and evaluation of operations but investment trends are

difficult to predict. For example, if the company fails to anticipate future preferences in the real estate markets, its business and

financial performance will likely suffer. The company may also invest in operations that end up losing money. Even if one of its facilities

is successful, the company may lose money in others.

Market risks could have material negative effects

on Thunder Energies’ planned operations.

Market risk includes the risk that geopolitical and other events will disrupt

the economy on a national or global level. For instance, war, terrorism, market manipulation, government defaults, government shutdowns,

political changes or diplomatic developments, public health emergencies (such as the spread of infectious diseases, pandemics, such as

COVID-19, and epidemics) and natural/environmental disasters can all negatively impact markets, which could cause the Company to lose

value. These events could reduce consumer demand or economic output, result in market closures, travel restrictions or quarantines, and

significantly adversely impact the economy. The current contentious domestic political environment, as well as political and diplomatic

events within the United States and abroad, such as presidential elections in the United States or abroad or the U.S. government’s

inability at times to agree on a long-term budget and deficit reduction plan, has in the past resulted, and may in the future result,

in a government shutdown or otherwise adversely affect the U.S. regulatory landscape, the general market environment and/or investor sentiment,

which could have an adverse impact on the Company’s investments and operations. Additional and or prolonged U.S. federal government

shutdowns may affect investor and consumer confidence and may adversely impact financial markets and the broader economy, perhaps suddenly

and to a significant degree.

Thunder Energies operates in a highly competitive market.

Thunder Energies plans to operate in a highly competitive market and faces

intense competition. Many of the company’s current and potential competitors have greater resources, longer histories, more customers,

and greater brand recognition. Competitors may secure better financial terms, adopt more aggressive pricing and devote more resources

to technology, infrastructure, fulfillment, and marketing.

Litigation against our operations, our business,

results of operations or financial condition.

The company’s businesses may be adversely affected by legal or

governmental proceedings. Regardless of whether any claims against the company are valid or whether they are liable, claims may be expensive

to defend and may divert time and money away from operations and hurt the company’s financial performance. A judgment significantly

in excess of their insurance coverage or not covered by insurance could have a material adverse effect on the company’s business,

results of operations or financial condition which will reduce or eliminate Thunder Energies’ ability to recover its investment.

The company’s insurance coverage may not

be adequate to cover all possible losses that it could suffer and its insurance costs may increase.

The company has not yet acquired insurance. It may not be able to acquire

insurance policies that cover all types of losses and liabilities. Additionally, once the company acquires insurance, there can be no

assurance that its insurance will be sufficient to cover the full extent of all of its losses or liabilities for which it is insured.

Further, insurance policies expire annually and the company cannot guarantee that it will be able to renew insurance policies on favorable

terms, or at all. In addition, if it, or other assets sustain significant losses or make significant insurance claims, then its ability

to obtain future insurance coverage at commercially reasonable rates could be materially adversely affected. If the company’s insurance

coverage is not adequate, or it becomes subject to damages that cannot by law be insured against, such as punitive damages or certain

intentional misconduct by their employees, this could adversely affect the company’s financial condition or results of operations.

Some of the company’s assets will be

in real estate, which are subject to numerous risks, including the risk that the values of those assets may decline if there is a prolonged

downturn in real estate values.

Some of the company’s operations will consist of real estate

operations. Accordingly, the company is subject to the risks associated with holding and developing real estate. A prolonged decline

in the popularity of certain real estate could adversely affect the value of its holdings and could make it difficult to sell its interest

or divest from the company or businesses.

The company’s real estate holdings will be subject to risks typically

associated with real estate. The returns available from real estate depend in large part on the amount of income earned, expenses incurred

and capital appreciation generated by the related properties. In addition, a variety of other factors affect income from properties and

real estate values, including governmental regulations, real estate, insurance, zoning, tax and eminent domain laws, interest rate levels

and the availability of financing. For example, new or existing real estate zoning or tax laws can make it more expensive and time-consuming

to expand, modify or renovate older properties. Under eminent domain laws, governments can take real property. Sometimes this taking

is for less compensation than the owner believes the property is worth. Any of these factors could have an adverse impact on our business,

financial condition or results of operations.

The illiquidity of real estate may make it

difficult for the company to dispose of one or more of our assets or negatively affect our ability to profitably sell such assets and

access liquidity.

The company may from time to time decide to dispose of one or more

of its assets which may include real estate. Because real estate holdings generally, are relatively illiquid, the company may not be

able to dispose of one or more investment assets on a timely basis. In some circumstances, sales may result in losses which could adversely

affect the company’s financial condition. The illiquidity of its holdings assets could mean that it continues to operate a facility

that management has identified for disposition. Failure to dispose of a real estate asset in a timely fashion, or at all, could adversely

affect the company’s business, financial condition and results of operations.

The company’s growth strategy depends

on its ability to identify and fund acquisition of income producing companies.

A key element of the company’s growth strategy is to identify,

acquire and fund income producing companies. Positive cash flow is a critical consideration. The company has identified a number of strategic

markets and is still in the process of identifying additional opportunities. The company’s ability to fund, develop and operate

these companies on a cost-effective basis, is dependent on a number of factors, many of which are beyond its control, including but not

limited to our ability to:

| |

· |

Find quality companies to acquire. |

| |

|

|

| |

· |

Reach acceptable agreements regarding the purchase

of assets and comply with our commitments to our shareholders. |

| |

|

|

| |

· |

Raise or have available an adequate amount of cash or currently available financing. |

The company’s real estate investments may

depend on the company’s ability to obtain favorable mortgage financing.

The company intends to acquire real estate operations and those companies

may need to secure both construction and mortgage financing beyond Thunder Energies ability to fund their operations. There is no guarantee

that the companies will be able to obtain financing on favorable terms. In the event that the companies are unable to obtain such financing

it may limit their ability to effectuate its plans and may, thereby negatively impacting Thunder Energies financial prospects.

Thunder Energies depends on a small management team and

may need to hire more people to be successful.

The success of Thunder Energies will greatly depend on the skills,

connections and experiences of its executives. Thunder Energies has entered into employment agreements with most of its executives but

additional skills and expertise may be necessary to effectively integrate the different operations of the acquired companies. Further,

there is no assurance that the company will be able to identify, hire and retain the right people for various key positions.

Risks relating to this Offering and our shares

The Offering price has been arbitrarily set by the company.

Thunder Energies has set the price of its Common Stock at $5.00 per share.

Valuations for companies at Thunder Energies stage are purely speculative. The company’s valuation has not been validated by any

independent third party and may fall precipitously. It is a question of whether you, the investor, are willing to pay this price for a

percentage ownership of a start-up company. You should not invest if you disagree with this valuation.

The officers of Thunder Energies control the

company and the company does not currently have any independent directors.

The Founders are currently the company’s controlling shareholders.

Moreover, they are the company’s executive officers and directors, through their ownership in Thunder Energies. This could lead

to unintentional subjectivity in matters of corporate governance, especially in matters of compensation and related party transactions.

The company does not benefit from the advantages of having independent directors, including bringing an outside perspective on strategy

and control, adding new skills and knowledge that may not be available within Thunder Energies, and having extra checks and balances to

prevent fraud and produce reliable financial reports.

The company does plan on the addition of independent

directors as a requirement of OTCQX or OTCQX uplifts.

Investors in this offering may not be entitled

to a jury trial with respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable,

which could result in less favorable outcomes to the plaintiff(s) in any such action.

Investors in this offering will be bound by the subscription agreement,

which includes a provision under which investors waive the right to a jury trial of any claim they may have against the company arising

out of or relating to the subscription agreement. Section 27 of the Exchange Act does create exclusive federal jurisdiction over all

suits brought to enforce and duty or liability created by the Exchange Act or the rules and regulations thereunder. Section 22 of the

Securities Act creates a concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability

created by the by the Securities Act or the rules and regulations thereunder. Investors may not waive compliance with the federal securities

laws and rules and regulations promulgated thereunder.

If the company opposed a jury trial demand based on the waiver, a court

would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable

state and federal law. To the company’s knowledge, the enforceability of a contractual pre-dispute, jury trial waiver in connection

with claims arising under the state or federal securities laws has not been finally adjudicated by the courts. However, the company believes

that a contractual pre-dispute jury trial waiver provision is generally enforceable. In determining whether to enforce a contractual pre-dispute

jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement

is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. The company believes

that this is the case with respect to the subscription agreement. Investors should consult legal counsel regarding the jury waiver provision

before entering into the subscription agreement.

If an investor brings a claim against the company in connection with matters

arising under the subscription agreement, including claims under federal securities laws, an investor may not be entitled to a jury trial

with respect to those claims, which may have the effect of limiting and discouraging lawsuits against the company. If a lawsuit is brought

against the company under the subscription agreement, it may be heard only by a judge or justice of the applicable trial court, which

would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including

results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable

law, an action could proceed under the terms of the subscription agreement with a jury trial. No condition, stipulation or provision of

the subscription agreement serves as a waiver by any holder of common shares or by Thunder Energies of compliance with any substantive

provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred, the transferee is required

to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor with regard to ownership

of the shares, that were in effect immediately prior to the transfer of the shares, including but not limited to the subscription agreement.

There is little to no current market for Thunder Energies’

shares.

Thunder Energies is listed on the OTC Markets Pink with a pending application

to OTCQX. At the current time the Company’s trading is limited. There is no guarantee there will be demand for the shares. Investors

should assume that they may not be able to liquidate their investment or pledge their shares as collateral for some time.

Risks Related to Certain Conflicts of Interest

The interests of Thunder Energies and the company’s

other affiliates may conflict with your interests.

The company’s Amended and Restated Certificate of Incorporation,

bylaws and Florida law provide company management with broad powers and authority that could result in one or more conflicts of interest

between your interests and those of the officers and directors of Thunder Energies, and the Company’s future investments. This

risk may increase if and investment targets are controlled by Thunder Energies or our officers and directors, through ownership, as an

officer or director contractually or any combination thereof. Potential conflicts of interest include, but are not limited to, the following:

| |

· |

Thunder Energies and the company’s other affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separate from the company, and you will not be entitled to receive or share in any of the profits, return, fees or compensation from any other business owned and operated by the management and their affiliates for their own benefit. |

| |

|

|

| |

· |

The investment target may engage Thunder Energies, or other companies affiliated with Thunder Energies to perform services, and determination for the terms of those services will not be conducted at arms’ length negotiations; and |

| |

|

|

| |

· |

The company’s officers and directors are not required to devote all of their time and efforts to the affairs of the company. |

DILUTION

Dilution means a reduction in value, control or earnings of the shares

the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over

its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity”

into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger

sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the

shares are worth the same amount, and you paid more than earlier investors for your shares. If you invest in our Preferred Stock, your

interest will be diluted immediately to the extent of the difference between the Offering price per share of our Preferred Stock and the

pro forma net tangible book value per share of our Preferred Stock after this Offering.

As of March 31, 2023, the net tangible book

value of the Company was a deficit of $8,365,208. Based on the number of shares of Common Stock issued and outstanding as of the date

of the offering (25,140,735) that equates to a net tangible book value of approximately ($0.333) per share of Common Stock on a pro forma

basis. Based on the total number of shares of Common Stock that would be outstanding assuming full subscription (40,140,735) at total

net proceeds of $71,300,000, that equates to approximately $1.57 of tangible net book value per share.

Thus, if the Offering is fully subscribed,

the net tangible book value per share of Common Stock owned by our current stockholders will have immediately increased by approximately

$1.90 without any additional investment on their behalf and the net tangible book value per share for new investors will be immediately

diluted by $3.18 per share. These calculations do include the costs of the Offering, and such expenses will not cause further dilution.

Future dilution

Another important way of looking at dilution is the dilution that happens

due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares.

In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of

the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from

a stock offering (such as a venture capital round, angel investment), employees exercising stock options, or by conversion of certain

instruments (e.g., convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience

value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less

than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if

the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the

company).

The type of dilution that hurts early-stage investors most often occurs

when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of

how this might occur is as follows (numbers are for illustrative purposes only):

| |

· |

In June 2014 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. |

| |

|

|

| |

· |

In December, the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. |

| |

|

|

| |

· |

In June 2015, the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

This type of dilution might also happen upon conversion of convertible

notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round

of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid

by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may

have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the

convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the

holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares

for their money. Investors should pay careful attention to number of convertible notes that the company has issued and may issue in the

future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of

the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can

decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control,

and earnings per share.

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

Thunder Energies Corp. is offering a maximum of 15,000,000 shares

of Common Stock on a “best efforts” basis.

The cash price per share of Common Stock is $5.

While Shares are expected to be offered and sold directly by the Company

and its respective Officers and employees, the Company has reserved the right to offer and sell Shares through the services of independent

broker-dealers who are member firms of the Financial Industry Regulatory Authority (“FINRA”) and who will be entitled to receive

customary and standard commissions of up to ten percent (10%) of the Proceeds received for the sale of Shares. Notwithstanding the foregoing,

the amount and nature of commissions payable to broker-dealers is expected to vary in specific instances and may be lower than the one

listed herein. The Investor who is admitted to the Company through such broker-dealer (and not the Company) may be responsible for all

such commissions payable to broker-dealers (and such payments may reduce the Investor’s invested capital) or the Company may pay

such commissions.

The company is offering its securities in all states.

Selling Shareholders

No founders will be selling securities into the offering; all net proceeds

in this offering will go to Thunder Energies Corp.

Piggyback Rights

Existing holders of common stock, convertible preferred shares and

convertible notes will be eligible to obtain Piggyback Rights with respect to their ability to remove restrictive legends from their

shares and obtain free trading stock.

Investors’ Tender of Funds

After the Offering Statement has been qualified by the Securities and Exchange

Commission (the “SEC”), the company will accept tenders of funds to purchase the shares. Prospective investors who submitted

non-binding indications of interest during the “test the waters” period will receive an automated message from us indicating

that the Offering is open for investment. (NOTE: AT THIS TIME NO “TEST THE WATER” PRESENTATIONS HAVE BEEN MADE, NO PROSPECTIVE

INVESTIONS HAVE SUBMITTED INDICATIONS OF INTEREST AND NO PRESENTATION MATERIALS ARE AVAILABLE). We will conduct multiple closings on investments

(so not all investors will receive their shares on the same date). Each time the company accepts funds transferred from the Escrow Agent

is defined as a “Closing.".

Process of Subscribing

You will be required to complete a subscription agreement in order to invest.

The subscription agreement includes a representation by the investor to the effect that, if you are not an “accredited investor”

as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your

net worth (excluding your principal residence).

Any potential investor will have ample time to review the Subscription

Agreement, along with their counsel, prior to making any final investment decision.

If a subscription is rejected, all funds will be returned to subscribers

within thirty days of such rejection without deduction or interest. Upon acceptance by us of a subscription, a confirmation of such

acceptance will be sent to the subscriber. Escrow Agent has not investigated the desirability or advisability of investment in the shares

nor approved, endorsed or passed upon the merits of purchasing the securities.

The company intends to engage a registered transfer agent with the SEC,

who will serve as transfer agent to maintain shareholder information on a book-entry basis; there are no set up costs for this service,

fees for this service will be limited to secondary market activity. The company estimates the aggregate fee due to the transfer agent

for the above services to be $35,000 annually.

The Company has engaged Dalmore Group, LLC (“Dalmore”),

a broker-dealer registered with the Commission and a member of FINRA, to act as the broker-dealer of record for this Offering, but not

for underwriting or placement agent services. As compensation, the Company has agreed to pay Dalmore a commission equal to 1% of the

amount raised in the Offering to support the Offering on all newly invested funds after the issuance of a No Objection Letter by FINRA.

In addition, the Company has paid Dalmore a one-time advance set up fee of $5,000 to cover reasonable out-of-pocket accountable expenses

actually anticipated to be incurred by Dalmore, such as, among other things, preparing the FINRA filing. Dalmore will refund any fee

related to the advance to the extent it is not used, incurred or provided to the Company. In addition, the Company will pay a $20,000

consulting fee that will be due after FINRA issues a No Objection Letter and the Commission qualifies the Offering. An assumption of

$755,000 in total fees paid to Dalmore were used in estimating the expenses of this Offering.

USE OF PROCEEDS TO ISSUER

The following discussion addresses the use of proceeds from this Offering.

The company currently estimates that, at a per share price of $5, the net proceeds from the sale of the 15,000,000 shares of Preferred

Stock will likely be $71,300,000 after deducting the estimated offering expenses of approximately $3,700,000.

The following table breaks down the use of proceeds into different categories

under various funding scenarios:

| | |

| 25% | | |

| 50% | | |

| 75% | | |

| 100% | |

| Gross Proceeds | |

$ | 18,750,000 | | |

$ | 37,500,000 | | |

$ | 56,250,000 | | |

$ | 75,000,000 | |

| Estimated Offering Expenses | |

$ | 736,250 | | |

$ | 1,472,500 | | |

$ | 2,208,750 | | |

$ | 2,945,000 | |

| Dalmore | |

$ | 188,750 | | |

$ | 377,500 | | |

$ | 566,250 | | |

$ | 755,000 | |

| Net Proceeds | |

$ | 17,825,000 | | |

$ | 35,650,000 | | |

$ | 53,475,000 | | |

$ | 71,300,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Overhead - 12 months | |

$ | 1,782,500 | | |

$ | 3,565,000 | | |

$ | 5,347,500 | | |

$ | 7,130,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Real Estate Acquisition | |

$ | 8,021,250 | | |

$ | 20,855,250 | | |

$ | 24,063,750 | | |

$ | 32,085,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Mining Acquisitions | |

$ | 4,812,750 | | |

$ | 4,812,750 | | |

$ | 4,812,750 | | |

$ | 4,812,750 | |

| | |

| | | |

| | | |

| | | |

| | |

| Entertainment/Lifestyle Acquisitions | |

$ | 3,208,500 | | |

$ | 3,208,500 | | |

$ | 9,625,500 | | |

$ | 13,636,125 | |

| | |

| | | |

| | | |

| | | |

| | |

| Infrastructure Technologies | |

$ | 0 | | |

$ | 2,406,375 | | |

$ | 7,219,125 | | |

$ | 10,227,094 | |

| | |

| | | |

| | | |

| | | |

| | |

| NASDAQ Uplift1 | |

$ | 0 | | |

$ | 802,125 | | |

$ | 2,406,375 | | |

$ | 3,409,031 | |

| 1 | The Company currently plans to file for an uplift to NASDAQ but

the uplift is not contingent upon final approval of this listing and offering. |

THE COMPANY’S BUSINESS

THUNDER ENERGIES BUSINESS OVERVIEW

Our principal business objective is to generate revenue through strategic

acquisitions, partnerships and joint ventures that focus on income generation. We achieve this vision through prudent management of borrowed

funds together with our capital and shareholders’ equity that is invested primarily in a diversified balance sheet of real estate

investments and other cash flowing companies that earns our shareholders a return on investment and share value appreciation.

The business is financed by an appropriate mix of shareholders’

equity and future sale of corporate debt to achieve its primary business objective of an annual return on equity while maintaining a

sound financial structure. This is achieved by rigorous due diligence to vet companies and assets that have significant upside potential

and cash flow while minimizing risks through a financial strategy that pursues an “absolute return” or positive returns to

preserve investor capital and returns to our shareholders. This strategy enables the company to maximize profitability by taking advantage

of different market cycles across various industries and diversifying risk.

We believe that our business objectives are supported through our

long-term conservative financial vision, the diversity of our acquisition strategy and comprehensive risk management approach to preserve

investor capital for our shareholders.

KEYS TO SUCCESS

Thunder Energies’ key to success is the effective negotiation

of value in the acquisition of certain income producing assets where the return on investment is based on asset appreciation and cash

flow from the asset. The Company’s management team are seasoned real estate developers, business managers and financial strategy

specialists.

THE COMPANY’S CURRENT ACQUISITIONS, JOINT

VENTURES AND PARTNERS

At the current time the Company has acquired

or is in the process of acquiring the rights or ownership in several diversified assets:

| |

1. |

Fourth and One, LLC (Fourth and One) –

Thunder Energies acquired fifty-one point five percent (51.5%) of Fourth and One, LLC’s interest in W.C. Mine Holdings which equates

to 30.9% ownership of the property rights and development of the Kinsley Mountain mine project. Fourth and One will be distributing the

resources to the market. In addition to the mineral rights, Thunder Energies has the surface rights which will be used by Bear Village

as a third resort development site two hours outside of Salt Lake City.

Bear Village (discussed below) will start

analysis of the site and local family activities such as hiking, spelunking and panning for gold along with the traditional resort amenities.

With respect to the mining operation the preliminary rock sampling

is complete which indicates significant commercial minerals and ores available including silver, lead, copper, other critical metals,

gold and marble. The estimated valuation of the property is $33 million based on a November 17, 2022 review of site data (Please refer

to the attached Kinsley Mountain Valuation document). The Kinsley Mountain property is located in the Antelope Mountains in northeastern

Nevada divided by Elko County to the north and White Pine County to the south. It is approximately 93.2 miles (150 km) northeast of Ely,

Nevada and 51.6 miles (83 km) southwest of Wendover, Nevada.

|

The Kinsley Mountain property is attractive as a precious and

base metal (battery metals) prospect for the following reasons:

| · | Favorable jurisdiction for the conduct of exploration and mining activities.

Nevada is considered one of the best localities in the world for finding and developing a mineral resource. |

| | | |

| · | Recent

drilling by other mining companies has demonstrated the existence of significant gold mineralization

in a geologic setting very similar to that which exists in the NW portion of the claim block

and at possibly a shallower depth and other mining companies have expressed interest in leasing

this ground. |

| | | |

| · | The geology, mineralogy and milling details are well known in the general

area. |

| | | |

| · | Permitting, environmental, and infrastructure concerns are minimal. |

| | | |

| · | Water rights have been secured. |

| | | |

| · | Critical base metals have been identified and historically produced from

the property. Copper, tungsten, lead, molybdenum, zinc, antimony and bismuth have been found in ore concentrations and in anomalous amounts. |

As part of the agreement Thunder Energies has the rights

to develop the surface as a family resort with its Bear Village, Inc. affiliate.

| |

2. |

Bear Village Resorts, Inc. (Bear Village) –

Thunder Energies shares common ownership with this company and it is now wholly owned as a subsidiary of Thunder Energies. Bear Village

is focused on development of family resorts. The management team is actively involved in the operation of this company and its real estate

development strategy. Bear Village has properties planned in Snellville, GA and Pidgeon Forge, TN. The subsidiary is also evaluating

the Kinsley Mountain property to determine the best mode of creating a family resort.

Bear Villag has identified the drive to destination resort market

as its primary interest and has focused its efforts on the development of premiere Family Destination Resort featuring Eco-Friendly,

Eco-Tourism in conjunction with education in a heavily themed Resort. The initial developments are primarily focused on Tennessee, Georgia,

and Nevada. The Company has two resorts in development. The first, in Pigeon Forge, TN is the furthest in concept development with zoning

changes completed from R-1 (residential) to C-5 (commercial use for lodging, entertainment and tourism), water/sewer utilities available

to the property and a preliminary master design submitted to Sevier county in TN. A second proposed property located in Jackson County,

Georgia is undergoing initial site layout. The Nevada property is newly acquired and final master plans are being developed. Additional

properties will be acquired as destination resort demographics are evaluated. The goal is to provide family get away resorts from cities

and suburb communities within a four or five-hour driving radius of the resorts.

Strategic partners will own portions of the assets and business

within each Resort. As an example, the daily operations and general management of the hotel portion of the resorts will be performed

by Fairview Hospitality LLC, working in unison with Bear Village, and its team of industry professionals each with over 20 years in the

hospitality industry. Fairview Hospitality will provide a professional, experienced on-site management team.

Quality family entertainment and experiences is the primary focus

of Bear Village. The construction and commercialization of the proposed resorts is factored into the use of funds detailed within.

The first resort to be developed is Pidgeon Forge which is situated

on over 37.8 acres. The company's proposed resort will be designed to provide the type of facilities the current market demands. Situated

on the land will be a 250+ unit Condominium development, 250+ Time Share units, 250 room resort hotel, 80,000 sq. ft. Indoor Water Park,

15,000 Gallon Fresh Water Aquarium, 90,000 sq. ft. Family Entertainment Center and 20,000 sq. ft. banquet and conference center. Within

the resort facilities will be numerous revenue centers including multiple food and beverage outlets, unique retail outlets, chair lift

unique photo opportunities, our unique Family Entertainment Center.

|

| |

3. |

Truvata Holdings Limited/RoRa Holdings, Inc.

(Truvata) – Thunder Energies entered into a contingent convertible promissory note with Truvata on May 12, 2022. The conversion

of the promissory note is contingent upon the listing of the Rora Prime coin on a United States exchange. To date Truvata has not successfully

obtain approved listing status as an asset back coin. Once listed the coins will be on the Thunder Energies balance sheet as an asset

which can be leveraged as collateral to obtain favorable construction financing.

This new crypto currency is backed by real

assets, including copper mines, gold, rhodium, real estate, oil and gas, precious gems and various other high-value assets. As a decentralized

cryptocurrency based on Ethereum, the RoRa™ Prime coins are inherently stable assets and provide a convenient means of value for

regular transactions. RoRa™ Prime coins expand the mobility of crypto assets across the ecosystem as adoption increases within

the Global FI standards. The synergistic management philosophies of providing asset backed business models is an excellent match as both

companies grow in their respective fields.

Rora obtains the benefit of holding shares

backed by real estate while Thunder Energies has a stable asset that may be used as collateral for further acquisition of additional

real estate and development.

At the current time the coins are not listed on Thunder Energies’

Balance Sheet because Rora has not been listed.

|

| |

|

|

| |

4. |

NextMart, Inc. (NextMart)

is a publicly traded company that is acquiring environmentally friendly water purification technologies and solar energy for industrial

applications. Thunder Energies is negotiating the formation of a joint venture where NextMart will expand into commercial and drinking

water applications with eco-friendly power generation and water recovery systems for Thunder Energies’ resorts developed by

Bear Village and other real estate projects. |

| |

|

|

| |

5. |

Las Vegas Aces (Aces) – Thunder Energies announced

on December 20, 2022, that it has negotiated a marketing agreement with the Las Vegas Aces WNBA team that is owned by Mark Davis

who also owns the Las Vegas Raiders NFL team. The agreement provides Thunder Energies the opportunity market its real estate development

projects and assets through the Aces to bring brand recognition to Thunder Energies owned companies, its Nevada owned Kinsley Mountain

asset and to strengthen their ties to champion change in multiple industries. The Aces are the 2022 WNBA Champions after only their

fifth season and they have advanced to the postseason in each of the last four years and these two forward-thinking and like-minded

organizations will help to align both brands into the future. |

The purpose of the aforementioned agreements are as follows:

| 1. | To

realize operational profits through the minority owned WC Mine Holdings while developing

a third family resort through the Bear Village subsidiary. |

| 2. | To

create an infrastructure development company with NextMart to provide an eco-friendly

experience to its visitors then expand into other real estate eco-friendly developments. |

| 3. | The

pending crypto currency equity swap agreement with Truvata will provide operational liquidity

to Thunder Energies for real estate development and acquisition. |

| 4. | To

provide marketing and brand awareness to Thunder Energies joint venture partnerships with

Fourth and Ones’ Kinsley Mountain family resort project in Nevada and the other

resorts in Tennessee and Georgia along with the eco-friendly infrastructure principals supplied

by the potential NextMart joint venture. Other future real estate and development acquisitions

may also be marketed through the Aces sponsorship. |

CONFLICTS OF INTEREST

We are not aware of any conflicts of interest between the founders

of Thunder Energies Corp. and the founders. Potential sources of conflicts are discussed below.

General

At the current time management contracts do not have conflicts in the operation

of the Company.

Bear Village

Bear Village shares common ownership with Thunder Energies and a full

acquisition of Bear Village is planned. To avoid any conflicts of interest the acquisition will be for a de minimis amount.

Allocation of Our Affiliates’ Time

Thunder Energies relies on Thunder Energies executive officers and other

professionals who act on behalf of Thunder Energies, for the day-to-day operation of our business.

As a result of the executives competing responsibilities, their obligations

to other investors and the fact that they will continue to engage in other business activities on behalf of themselves and others, they

will face conflicts of interest in allocating their time to Thunder Energies and other entities and other business activities in which

they are involved. However, the company believes that the executive officers and investment professionals have sufficient depth to fully

discharge their responsibilities to the company and the other entities for which they work. The long-term plan is for the executives to

resign from their other operations and dedicate their time to Thunder Energies.

Receipt of Fees and Other Compensation by Thunder Energies and its Affiliates

Thunder Energies and its affiliates will receive substantial fees from

the company, which fees will not be negotiated at arm’s length. These fees could influence Thunder Energies advice to the company

as well as the judgment of the affiliated executives of Thunder Energies. For additional information see “The Company’s Business

– Support from Thunder Energies” for conflicts relating to the payment structure between Thunder Energies and its’ affiliates.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion includes information

from the audited financial statements for the periods ending December 31, 2022 and March 31, 2023, and should be read in conjunction

with our financial statements and the related notes included in this Offering Circular. Audited financials are be completed in accordance

with the Regulation A requirements and have been filed with the SEC through the EDGAR System.

The following discussion contains forward-looking statements that reflect

our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

Overview

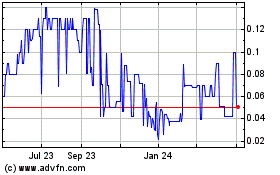

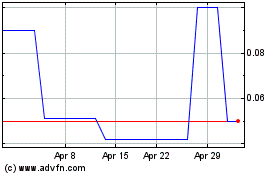

Thunder Energies is an OTC Markets listed company (OTC:TNRG) and is

fully PCAOB audited with a pending OTCQX filing on OTC Markets. The current ownership group purchased controlling interest in the company

on February 23, 2022. Since that time the Company has continued to clean the financials, update the corporate finings and structure.

The Company is up to date on filing will continue to file its Annual and Quarterly reports with PCAOB audit review.

Results of Operations

Over the past 12 months, the prior ownership allowed its business to decline

with $0 revenues. The current ownership has taken over the prior management and reviewed all financials and updated all the filings.

As a result of the foregoing, the company generated a net loss of $5,466,473

which includes loss from operations of $2,386,303 with additional losses due to stock and interest expenses totaling $3,080,170 through

December 31, 2022. For the 3 month period ending March 31, 2023, the company generated a net loss of $2,866,314 which includes loss

from operations of $531,690 with additional losses due to stock and interest expenses totaling $2,334,624.

Plan of Operation

Upon completion of this Offering, the company intends to fund investments

with the proceeds from this Offering and use strategic acquisition of assets.

SHAREHOLDERS, DIRECTORS, EXECUTIVE OFFICERS AND

SIGNIFICANT EMPLOYEES

The table below sets forth the directors of the company.

| Name |

|

Position |

|

Age |

|

Term of Office (If

indefinite give date

of appointment) |

| Eric Collins |

|

Director, Chairman |

|

57 |

|

Indefinite - July 21,

2022 |

| Ricardo Haynes |

|

Director |

|

55 |

|

Indefinite - July 21,

2022 |

| Lance Lehr |

|

Director |

|

56 |

|

Indefinite - July 21,

2022 |

| Tori White |

|

Director |

|

30 |

|

Indefinite - July 21,

2022 |

| Donald R. Keer |

|

Director |

|

61 |

|

Indefinite - July 21,

2022 |

OTCQX requires independent directors

The table below sets forth the officers of THUNDER ENERGIES.

| Name |

|

Position |

|

Age |

|

Term of Office (If

indefinite give date

of appointment) |

| Eric Collins |

|

Director, Chairman |

|

57 |

|

Indefinite - July 21,

2022 |

| Ricardo Haynes |

|

President/CEO |

|

55 |

|

Indefinite - July 21,

2022 |

| Lance Lehr |

|

VP Operations |

|

56 |

|

Indefinite - July 21,

2022 |

| Tori White |

|

Development Consultant |

|

30 |

|

Indefinite - July 21,

2022 |

| Donald R. Keer |

|

Attorney, Secretary, Treasury |

|

61 |

|

Indefinite - July 21,

2022 |

Biographies

Eric Collins - Director, Chairman

Mr. Collins is a well-polished leader with over 39 years in project management

experience specializing in logistics planning for the U.S. Air Force, Special Operation Forces Division where he was responsible for oversight,

coordination and execution of operational cost efficiencies of funds, time, material and facilities to resolve problems and issues in

support and maintenance programs. This included preparing briefings and presentations for senior leadership using methods such as data

mining, data modeling, and or cost or benefit analysis to acquire and secure new government contracts. Over the past 5 years Mr. Collins

has continued working with the US Air Force at Warner Robins Air Base where he manages the defense budget and contracts. He has also worked

for Top Flight Development Group Inc. in Atlanta, GA buying and selling property for residential development.

Ricardo Haynes

President/CEO

Highly accomplished business development executive with more than 20 years

of experience in producing exponential revenue growth, cultivating enduring relationships within the hospitality and financial industry.

Worked for Marriot Corporation for over 15 years in property development, licensing and investment. Also operated in the financial industry

providing corporate bond placement and project financing. Total experience includes commercial real estate sales and loan origination

with regional and nationally based lending institutions, corporate finance consulting. Grass roots development experience in creating

and issuing collateralized bond obligation and related instruments. Over the last 5 years Mr. Haynes has worked assisting clients in construction

financing in both commercial and hospitality markets with Candela Group, Ltd. In Alberta, Canada.

Lance L. Lehr

Operations Manager

Mr. Lehr has 25 years of senior management experience

in the Hospitality Industry. He has worked at the senior most level of projects ranging from Ski Area’s with Hotel, Condo, F&B

and Adventure Parks to Indoor Water Park Resorts development and operations. Mr. Lehr serves as a senior advisor to one POS, a hospitality

technology leader and has developed numerous independent companies and concepts. His entrepreneurial management style of leadership empowers

associates and holds them accountable for high level performance. This has led to the successful development and operation of several

companies in the hospitality industry that focus on franchise like systems and aggressive labor and cost management. Mr. Lehr’s

entrepreneurial focus leads to creative solutions that deliver superior result in today’s dynamic marketplace. Through aggressive

cost control coupled with out of the box sales building efforts and an intense focus on the guest experience, Mr. Lehr has been able to

provide superior long term results for his clients. Over the past 5 years has worked as President of Hybrid Hospitality, LTD in Erie,

PA developing amusement parks, water parks and hospitality properties for clients.

Tori White

Development Consultant

Ms. White has been working for Northpointe Realty since 2015 in commercial

and residential real estate leasing and contracting. Prior to that, she worked at Jlew Enterprises, LLC in Boca Raton, FL in their residential

construction group from 2012-2015. Over the last 5 years Ms. White has marketed and sold commercial and residential real estate.

Donald R. Keer, P.E., ESQ.

Corporate Attorney

Mr. Keer is an attorney and a professional engineer who spent the first

half of his career as a construction project manager working for Fluor Corporation and then local developers in New Jersey and Pennsylvania.

Mr. Keer has also been an expert witness for various construction issues including delay damages, building code standards, construction

technologies and insurance claims.

For the past 25 years Mr. Keer has represented business clients working

on construction projects, real estate development, mergers and acquisitions and publicly traded companies to ensure their businesses and

construction projects move forward in a timely manner. He is a sole practitioner and has had his own law practice for 25 years.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

The company paid Ricardo Haynes $47,708 and

$37,500 through December 31, 2022 and March 31, 2023 respectively and did not pay any of its other officers or directors a salary.

The company intends to pay salaries within 12 months after of the approval

of this Offering. The highest paid officers of the company will have employment agreements and salaries negotiated. Salaries are targeted

to be as follows:

| Name |

|

Position |

|

Annual

Compensation |

|

| Eric Collins |

|

Chairman/COO |

|

$ |

100,000 |

|

| Ricardo Haynes |

|

President/CEO |

|

$ |

250,000 |

|

| Lance Lehr |

|

VP Operations |

|

$ |

100,000 |

|

| Tori White |

|

Director/Development Consultant |

|

$ |

100,000 |

|

| Donald R. Keer |

|

Corporate Counsel |

|

$ |

150,000 |

|

All compensation will be on behalf of the company by Thunder Energies

Corp. and allocated to the subsidiaries.

In the future, the company will have to pay its officers, directors and

other employees, which will impact the company’s financial condition and results of operations, as discussed in “Management’s

Discussion and Analysis of Financial Condition and Results of Operations.” The company may choose to establish an equity compensation

plan for its management and other employees in the future. Further, as the company grows, the company intends to add additional executives,

including but not limited to, a General Manager, a Food and Beverage Manager and Resort Managers.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS

GENERALLY

Thunder Energies Corp. is authorized to issue

900,000,000 shares of common stock, $0.001 par value per share, in the Company and 750,000,000 shares of preferred stock. As of March

31, 2023, 25,140,735 shares of common stock issued and outstanding, 50,000,000 shares of Series A Preferred Stock have been authorized,

issued and outstanding,10,000,000 shares of Series B Preferred Stock have been authorized and 69,000 shares issued and outstanding, and

10,000,000 shares of Series C Preferred Stock have been authorized and 10,000 shares issued and outstanding. See “Description of

Capital” and “Principal Shareholders.”

We have reserved 15,000,000 shares of common stock for this issuance

under the Thunder Energies Corp.’s private placement. The Company has not issued any options.

COMMON STOCK

Holders of outstanding shares of common stock are entitled to one vote

per share on all matters submitted to a vote of the shareholders. Except as may be required by applicable law, holders of outstanding

shares of common stock vote together as a single class. Holders of a majority of the outstanding shares of common stock constitute a quorum

at any meeting of shareholders.

PREFERRED STOCK

Holders of the outstanding shares of Series A Preferred Stock, in accordance

with the Certificate of Designation, have conversion rights of 15:1 with Piggyback Rights and super majority voting rights of 75% of

all voting.

Holders of the outstanding shares of Series B Preferred Stock, in accordance

with the Certificate of Designation, have conversion rights of 1,000:1 with Piggyback Rights and voting rights of 1,000:1.

Holders of the outstanding shares of Series C Preferred Stock, in accordance

with the Certificate of Designation, have no conversion rights and voting rights of 1,000:1.

Principal Shareholders

| Title

of Class |

Name

and Address of beneficial owner |

Amount and

Nature of

beneficial

ownership |

Amount and

Nature of

beneficial

ownership

acquirable |

Percent of

class |

| Series A Preferred |

Ricardo Haynes; 1100 Peachtree Street NE, Suite

200, Atlanta, Georgia 30309 |

7,500,000 |

Restricted |

15% |

| Series A Preferred |

Eric Collins; 1100 Peachtree Street NE, Suite

200, Atlanta, Georgia 30309 |

12,500,000 |

Restricted |

25% |

| Series A Preferred |

Lance Lehr; 1100 Peachtree Street NE, Suite 200,

Atlanta, Georgia 30309 |

2,500,000 |

Restricted |

5% |

| Series A Preferred |

Tori White; 1100 Peachtree Street NE, Suite 200,

Atlanta, Georgia 30309 |

24,000,000 |

Restricted |

48% |

| Series A Preferred |

Donald Keer; 1100 Peachtree Street NE, Suite

200, Atlanta, Georgia 30309 |

3,500,000 |

Restricted |

7% |

| Title of Class |

Name and Address of

beneficial owner |

Amount and

Nature of

beneficial

ownership |

Amount and

Nature of

beneficial

ownership

acquirable |

Percent of

class (1) |

| Series B Preferred |

Ricardo Haynes; 1100 Peachtree Street NE, Suite 200, Atlanta, Georgia 30309 |

750 |

Restricted |

1.18% |

| Series B Preferred |

Eric Collins; 1100 Peachtree Street NE, Suite 200, Atlanta, Georgia 30309 |

1,250 |

Restricted |

1.97% |

| Series B Preferred |

Lance Lehr; 1100 Peachtree Street NE, Suite 200, Atlanta, Georgia 30309 |

250 |

Restricted |

0.39% |

| Series B Preferred |

Tori White; 1100 Peachtree Street NE, Suite 200, Atlanta, Georgia 30309 |

2,400 |

Restricted |

3.78% |

| Series B Preferred |

Donald Keer; 1100 Peachtree Street NE, Suite 200, Atlanta, Georgia 30309 |

350 |

Restricted |

0.55% |

| Series B Preferred |

Top Flight Development Group; 1447 Peachtree St., Suite 230, Atlanta, Georgia 30309 |

58,500 |

Restricted |

92.13% |

| (1) | Series B Preferred is a convertible

stock. 48,600 Shares were converted between the issuance of the 10Q dated March 31, 2023

published May 15, 2023 and the date of this offering. |

| Title

of Class |

Name

and Address of beneficial owner |

Amount and

Nature of

beneficial

ownership |

Amount and

Nature of

beneficial

ownership

acquirable |

Percent of

class |

| Series C Preferred |

Ricardo Haynes; 1100 Peachtree Street NE, Suite

200, Atlanta, Georgia 30309 |

1,500 |

Restricted |

15% |

| Series C Preferred |

Eric Collins; 1100 Peachtree Street NE, Suite

200, Atlanta, Georgia 30309 |

2,500 |

Restricted |

25% |

| Series C Preferred |

Lance Lehr; 1100 Peachtree Street NE, Suite 200,

Atlanta, Georgia 30309 |

500 |

Restricted |

5% |

| Series C Preferred |

Tori White; 1100 Peachtree Street NE, Suite 200,

Atlanta, Georgia 30309 |

4,800 |

Restricted |

48% |

| Series C Preferred |

Donald Keer; 1100 Peachtree Street NE, Suite

200, Atlanta, Georgia 30309 |

700 |

Restricted |

7% |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

Management Services Agreement and Employment Agreements

No Management Services Agreement is in place with any of the management

team.

SECURITIES BEING OFFERED

Thunder Energies Corp. is offering Common Stock in this Offering.

The company is qualifying up to 15,000,000 shares of Common Stock under this Offering Statement, of which this Offering Circular is part.

Thunder Energies authorized capital stock consists of 900,000,000 shares of Common Stock (the “Common Stock”), at $0.001

par value, of which 25,140,735 shares are Common Stock are issued.

The following is a summary of the rights of Thunder Energies’ capital

common stock as provided in its Amended and Restated Certificate of Incorporation, and Bylaws, which have been filed as exhibits to the

Offering Statement of which this Offering Circular is a part.

Common Stock

Shares of our common stock have the following rights,

preferences and privileges:

Voting