0001785345false00017853452023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 09, 2023 |

Landos Biopharma, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39971 |

81-5085535 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

P.O. Box 11239 |

|

Blacksburg, Virginia |

|

24062 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 540 218-2232 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

LABP |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 9, 2023, Landos Biopharma, Inc. (the “Company”) issued a press release announcing its financial results for the three months ended June 30, 2023. A copy of this press release is furnished as Exhibit 99.1 hereto.

The information in this Item 2.02 and Exhibit 99.1 hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d). Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Landos Biopharma, Inc. |

|

|

|

|

Date: |

August 9, 2023 |

By: |

/s/ Gregory Oakes |

|

|

|

Gregory Oakes

Chief Executive Officer |

Exhibit 99.1

Landos Biopharma Provides Business Update &

Reports Second Quarter 2023 Results

Initiated NEXUS Phase 2 Clinical Trial of NX-13 for Ulcerative Colitis

NEXUS Remains On Track With Top-line Results Planned for Q4 2024

Sufficient Cash to Fund Planned Operations into First Half of 2025

NEW YORK, August 9, 2023 –– Landos Biopharma, Inc. (NASDAQ: LABP), a clinical-stage biopharmaceutical company developing novel, oral medicines for patients with autoimmune diseases, today provided a business update and announced financial results for the second quarter ended June 30, 2023.

“We continued to advance and execute the NX-13 Phase 2 clinical program (NEXUS) during the second quarter. We have activated sites in the US and are actively recruiting and screening patients,” said Gregory Oakes, President and CEO of Landos. “NEXUS is designed to advance this important program and to build on the promising early signals of clinical improvement from our Phase 1b trial. We firmly believe in the potential of NX-13 to help the millions of patients suffering with moderate-to-severe UC.”

Clinical Development Updates

NX-13 is a novel, gut-selective NLRX1 agonist in development as a once-daily, oral treatment for ulcerative colitis (UC).

•The NEXUS Phase 2 proof-of-concept clinical trial of NX-13 was initiated during the second quarter of 2023 with multiple sites activated in the United States. Site selection in Europe has been completed with site activation underway.

•NEXUS is a randomized, statistically powered, multicenter, double-blind, placebo-controlled, multiple dose, 12-week induction study evaluating 80 patients with moderate-to-severe UC with a long-term extension (LTE) period out to one year. All subjects will be randomized to receive either 250 mg or 750 mg immediate release NX-13, or placebo. The primary objective of the trial will be to evaluate the clinical efficacy, safety and pharmacokinetics of oral NX-13 vs. placebo (NCT05785715 ClinicalTrials.gov).

•Top-line results are expected to be reported by the fourth quarter of 2024.

•NX-13 and its novel, immunometabolic mechanism of action will be highlighted through oral and poster presentations at the United European Gastroenterology Week (UEGW) and the American College of Gastroenterology (ACG) in October 2023.

Corporate Update

•The Company announced the appointment of Alka Batycky, Ph.D. to its Board of Directors and Audit Committee, expanding its Board of Directors from six to seven. Dr. Batycky brings with her over 25 years of global drug development experience in the biopharmaceutical industry, spanning from early discovery through product approval across a broad range of therapeutic areas.

Summary of Second Quarter 2023 Results

As of June 30, 2023, the Company had cash, cash equivalents and marketable securities of $44.7 million, which it believes will be sufficient to fund operating expenses and capital requirements into the first half of 2025.

Research and development expenses were $2.5 million for the second quarter of 2023, compared to $6.6 million for the second quarter of 2022. The decrease was primarily attributed to reduced clinical activities due to the wind down of omilancor, LABP-104 and NX-13 Phase 1b clinical trial costs partially offset by the initiation of the NEXUS trial. Additionally, there were decreases in consulting costs and depreciation expense.

General and administrative expenses were $2.0 million for the second quarter of 2023, compared to $4.7 million for the second quarter of 2022. The decrease was primarily attributable to a decrease in compensation, recruiting and Directors & Officers (D&O) insurance costs.

About Landos Biopharma

Landos Biopharma is a clinical stage biopharmaceutical company focused on the development of first-in-class, oral therapeutics for patients with autoimmune disease. Our mission is to create safer and more effective treatments that address the therapeutic gap in the current treatment paradigm.

We have a portfolio of novel targets anchoring two libraries of immunometabolic modulation pathways, including four potentially first-in-class, once-daily, oral therapies targeting eight indications in the immunology space.

We are currently focused on advancing the clinical development of NX-13 in UC. We initiated the NEXUS Phase 2 proof-of-concept trial in April 2023 and expect to report topline results by the fourth quarter of 2024.

For more information, please visit www.landosbiopharma.com.

Cautionary Note on Forward-Looking Statements

Statements in this press release about future expectations, plans and prospects for Landos Biopharma, Inc. (the “Company”), including statements about the Company’s strategy, clinical development and regulatory plans for its product candidates and other statements containing the words “anticipate”, “plan”, “expect”, “may”, “will”, “could”, “believe”, “look forward”, “potential”, the negatives thereof, variations thereon and similar expressions, or any discussions of strategy constitute forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: the uncertainties inherent in the initiation and enrollment of current and future clinical trials, including the ongoing Phase 2 trial of NX-13, availability and timing of data from ongoing clinical trials, expectations for regulatory approvals, other matters that could affect the availability or commercial potential of the Company’s product candidates, our anticipated cash runway and other similar risks. Risks regarding the Company’s business are described in detail in its Securities and Exchange Commission (“SEC”) filings, including in its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, which are available on the SEC’s website at www.sec.gov. Additional information will be made available in other filings that the Company makes from time to time with the SEC. In addition, the forward-looking statements included in this press release represent the Company’s views only as of the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so, except as may be required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

Contacts

Investors

Patrick Truesdell, Vice President, Controller and Principal Accounting Officer

Landos Biopharma

ir@landosbiopharma.com

John Mullaly

LifeSci Advisors, LLC

jmullaly@lifesciadvisors.com

Landos Biopharma, Inc. Unaudited Condensed Consolidated Statements of Operations (in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

$ 2,463 |

|

$ 6,604 |

|

$ 5,789 |

|

$ 17,404 |

General and administrative |

|

1,976 |

|

4,662 |

|

5,129 |

|

8,815 |

Total operating expenses |

|

4,439 |

|

11,266 |

|

10,918 |

|

26,219 |

Loss from operations |

|

(4,439) |

|

(11,266) |

|

(10,918) |

|

(26,219) |

Other income (loss), net |

|

517 |

|

(18) |

|

962 |

|

71 |

Net loss |

|

$ (3,922) |

|

$ (11,284) |

|

$ (9,956) |

|

$ (26,148) |

Net loss per share, basic and diluted |

|

$ (0.63) |

|

$ (2.80) |

|

$ (1.57) |

|

$ (6.50) |

Weighted-average shares used to compute net loss per share, basic and diluted |

|

6,207,707 |

|

4,025,489 |

|

6,345,206 |

|

4,025,489 |

Landos Biopharma, Inc. Condensed Consolidated Balance Sheets (in thousands)

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

2023 |

|

2022 |

|

|

(Unaudited) |

|

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

$ 44,049 |

|

$ 36,640 |

Marketable securities, available-for-sale |

|

687 |

|

7,762 |

Prepaid expenses and other current assets |

|

1,549 |

|

851 |

Total current assets |

|

46,285 |

|

45,253 |

Total assets |

|

$ 46,285 |

|

$ 45,253 |

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

|

$ 1,029 |

|

$ 3,435 |

Accrued liabilities |

|

1,986 |

|

2,687 |

Total current liabilities |

|

3,015 |

|

6,122 |

Total liabilities |

|

3,015 |

|

6,122 |

Commitments and contingencies |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock |

|

31 |

|

40 |

Additional paid-in capital |

|

186,629 |

|

172,575 |

Accumulated other comprehensive loss |

|

(7) |

|

(57) |

Accumulated deficit |

|

(143,383) |

|

(133,427) |

Total stockholders’ equity |

|

43,270 |

|

39,131 |

Total liabilities and stockholders’ equity |

|

$ 46,285 |

|

$ 45,253 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

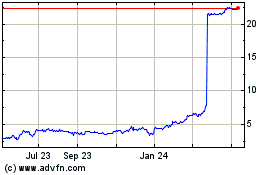

Landos Biopharma (NASDAQ:LABP)

Historical Stock Chart

From Mar 2024 to Apr 2024

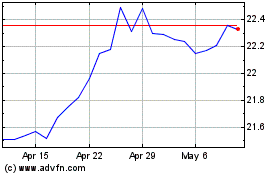

Landos Biopharma (NASDAQ:LABP)

Historical Stock Chart

From Apr 2023 to Apr 2024