0000778164

false

0000778164

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): August

1, 2023

ALTO

INGREDIENTS, INC.

(Exact Name of Registrant as Specified

in its Charter)

| Delaware |

|

000-21467 |

|

41-2170618 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

| 1300

South Second Street Pekin, Illinois |

|

61554 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number,

Including Area Code: (916)

403-2123

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

ALTO |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02. | Results of Operations and Financial Condition. |

On August 7, 2023, Alto Ingredients,

Inc. (the “Company”) issued a press release announcing certain results of operations for the three and six months ended June

30, 2023. A copy of the press release is furnished (not filed) as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

The information furnished in

this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section. The information in this Item 2.02 of this Current Report on Form 8-K is not incorporated by reference into any filings

of Alto Ingredients, Inc. made under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date

of this Current Report on Form 8-K, regardless of any general incorporation language in the filing unless specifically stated so therein.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

Appointment of Bryon T. McGregor

as President and Chief Executive Officer

Effective August 1, 2023, the

Board of Directors (the “Board”) of the Company appointed Bryon T. McGregor to serve as the Company’s President and

Chief Executive Officer. Mr. McGregor, age 60, had previously served as the Company’s Chief Financial Officer since 2009.

Currently, Mr. McGregor is compensated

by the Company pursuant to the terms of an employment agreement with Company. In connection with Mr. McGregor’s appointment as President

and Chief Executive Officer, the Company’s Compensation Committee of the Board (the “Compensation Committee”) will work

with Mr. McGregor to amend and restate his current employment agreement on terms to be negotiated between the Company and Mr. McGregor.

Mr. McGregor’s full biographical

background, including a description of his current employment agreement with the Company, is provided in the “Executive Compensation

and Related Information – Executive Officers” section of the Company’s Proxy Statement filed with the Securities and

Exchange Commission on April 28, 2023 (the “2023 Proxy Statement”), and such disclosure regarding Mr. McGregor is incorporated

herein by reference. There are no family relationships between any of the Company’s directors or officers and Mr. McGregor that

are required to be disclosed under Item 401(d) of Regulation S-K. There are no other arrangements or understandings between Mr. McGregor

and any other person pursuant to which Mr. McGregor was appointed as President and Chief Executive Officer. Except as disclosed in the

“Executive Compensation and Related Information” and the “Certain Relationships and Related Transactions” sections

of the 2023 Proxy Statement, and such disclosure regarding Mr. McGregor is incorporated herein by reference, Mr. McGregor has not entered

into any transactions with the Company that are required to be disclosed under Item 404(a) of Regulation S-K.

Retirement of Michael D. Kandris

as President and Chief Executive Officer and Appointment as Interim Chief Operating Officer

Effective August 1, 2023, Michael

D. Kandris retired as President and Chief Executive Officer of the Company. On the same date, the Board appointed Mr. Kandris to serve

as the Company’s Interim Chief Operating Officer for a period of up to one year. Mr. Kandris, age 76, had previously served as the

Company’s President and Chief Executive Officer since 2020 and as the Chief Operating Officer since 2013. Mr. Kandris will remain

a member of the Board.

Currently, Mr. Kandris is compensated

by the Company pursuant to the terms of an employment agreement with the Company. In connection with Mr. Kandris’ retirement as

the Company’s President and Chief Executive Officer and appointment as Interim Chief Operating Officer, the Company’s Compensation

Committee will work with Mr. Kandris to amend and restate his current employment agreement on terms to be negotiated between the Company

and Mr. Kandris.

Mr. Kandris’ full biographical

background, including a description of his current employment agreement, is provided in the “Executive Compensation and Related

Information – Executive Officers” section of the Company’s 2023 Proxy Statement, and such disclosure regarding Mr. Kandris

is incorporated herein by reference. There are no family relationships between any of the Company’s directors or officers and Mr.

Kandris that are required to be disclosed under Item 401(d) of Regulation S-K. There are no other arrangements or understandings between

Mr. Kandris and any other person pursuant to which Mr. Kandris was appointed Interim Chief Operating Officer. Except as disclosed in the

“Executive Compensation and Related Information” and the “Certain Relationships and Related Transactions” sections

of the 2023 Proxy Statement, and such disclosure regarding Mr. Kandris is incorporated herein by reference, Mr. Kandris has not entered

into any transactions with the Company that are required to be disclosed under Item 404(a) of Regulation S-K.

Appointment of Robert R. Olander

as Chief Financial Officer

Effective August 1, 2023, the

Board appointed Robert R. Olander to serve as the Company’s Chief Financial Officer. Mr. Olander, age 45, had previously served

as the Company’s Vice President, Corporate Controller since August 2015 and before that, in other management related roles since

employment with the Company in March 2007. Prior to joining the company, he served as Controller and Business Manager at Hampton Distribution

Companies and supervised audit and consulting at James Marta & Company. He began his career at Deloitte & Touche in audit and

assurance working with ConAgra, Berkshire Hathaway and Union Pacific, among others. Mr. Olander has a B.S. in Business Administration

from Midland University and is a Certified Public Accountant.

Currently, Mr. Olander is compensated

by the Company pursuant to the terms of an employment agreement with Company, the terms of which are described below. In connection with

Mr. Olander’s appointment as the Company’s Chief Financial Officer, the Company’s Compensation Committee will work with

Mr. Olander to enter into an amended and restated employment agreement on terms to be negotiated between the Company and Mr. Olander.

The Company’s current employment

agreement with Mr. Olander provides for at-will employment as the Company’s Vice President, Corporate Controller. Mr. Olander’s

current annual base salary is $274,526. Mr. Olander is eligible to participate in the Company’s short-term incentive plan with a

pay-out target of 30% of his base salary, to be paid based upon performance criteria set by the Company’s Compensation Committee.

Upon termination by the Company

without cause or resignation by Mr. Olander for good reason, Mr. Olander is entitled to receive (i) severance equal to nine months of

his base salary, (ii) 75% of his total target short-term incentive plan award, (iii) continued health insurance coverage for nine months

or until the earlier effective date of coverage under a subsequent employer’s plan, and (iv) accelerated vesting of 25% of all shares

or options subject to any equity awards granted to Mr. Olander prior to Mr. Olander’s termination which are unvested as of the date

of termination.

However, if Mr. Olander is terminated

without cause or resigns for good reason in anticipation of or twenty-four months after a change in control, Mr. Olander is entitled to

(i) severance equal to eighteen months of base salary, (ii) 150% of his total target short-term incentive plan award, (iii) continued

health insurance coverage for eighteen months or until the earlier effective date of coverage under a subsequent employer’s plan,

and (iv) accelerated vesting of 100% of all shares or options subject to any equity awards granted to Mr. Olander prior to Mr. Olander’s

termination that are unvested as of the date of termination.

If the Company terminates Mr.

Olander’s employment upon his disability, Mr. Olander is entitled to severance equal to twelve months of base salary. In addition,

in the event of Mr. Olander’s disability and if he or someone authorized to act on his behalf executes and delivers an agreed release

agreement and allows the release to become effective, the Company has agreed to accelerate the vesting of any equity awards granted to

Mr. Olander prior to the termination of his employment such that 100% of all shares or options subject to such awards which are unvested

as of termination shall be accelerated and deemed fully vested as of the effectiveness of the release.

If Mr. Olander dies, the Company

has agreed to accelerate the vesting of any equity awards granted to Mr. Olander prior to his death such that 100% of all shares or options

subject to such awards which are unvested as of his death will be accelerated and deemed fully vested.

The term “cause”

is defined in Mr. Olander’s employment agreement as (i) Mr. Olander’s indictment or conviction of any felony or of any crime

involving dishonesty, (ii) Mr. Olander’s participation in any fraud or other act of willful misconduct against the Company, (iii)

Mr. Olander’s refusal to comply with any of the Company’s lawful directives, (iv) Mr. Olander’s material breach of his

fiduciary, statutory, contractual, or common law duties to the Company, or (v) conduct by Mr. Olander which, in the good faith and reasonable

determination of the Board, demonstrates gross unfitness to serve; provided, however, that in the event that any of the foregoing events

is reasonably capable of being cured, the Company shall provide written notice to Mr. Olander describing the nature of the event and Mr.

Olander shall thereafter have three business days to cure the event.

The term “for good reason”

is defined in Mr. Olander’s employment agreement as (i) the assignment to Mr. Olander of any duties or responsibilities that result

in the material diminution of Mr. Olander’s authority, duties or responsibility, (ii) a material reduction by the Company in Mr.

Olander’s annual base salary, except to the extent the base salaries of all of the Company’s other executive officers are

accordingly reduced, (iii) a relocation of Mr. Olander’s place of work, or the Company’s principal executive offices if Mr.

Olander’s principal office is at these offices, to a location that increases Mr. Olander’s daily one-way commute by more than

thirty-five miles, or (iv) any material breach by the Company of any material provision of Mr. Olander’s employment agreement.

Mr. Olander’s employment

agreement provides that a “change in control” is deemed to have occurred if, in a single transaction or series of related

transactions (i) any person (as the term is used in Section 13(d) and 14(d) of the Exchange Act), or persons acting as a group, other

than a trustee or fiduciary holding securities under an employee benefit program, is or becomes a “beneficial owner” (as defined

in Rule 13-3 under the Exchange Act), directly or indirectly of the Company’s securities representing a majority of the Company’s

combined voting power, (ii) the Company merges, consolidates or otherwise engages in a business combination with or into another corporation,

entity or person, other than a transaction in which the holders of at least a majority of the Company’s shares of voting capital

stock outstanding immediately prior to the transaction continue to hold (either by the shares remaining outstanding or by their being

converted into shares of voting capital stock of the surviving entity) a majority of the total voting power represented by the Company’s

shares of voting capital stock (or the surviving entity) outstanding immediately after the transaction, or (iii) all or substantially

all of the Company’s assets are sold.

There are no family relationships

between any of the Company’s directors or officers and Mr. Olander that are required to be disclosed under Item 401(d) of Regulation

S-K. There are no other arrangements or understandings between Mr. Olander and any other person pursuant to which Mr. Olander was appointed

as Chief Financial Officer.

| Item 7.01 | Regulation FD Disclosure. |

On August

7, 2023, the Company issued a press release announcing the management changes described in this Current Report on Form 8-K. A copy of

the Company’s press release covering such announcement is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated

herein by reference.

The

information contained in this Item 7.01 (including Exhibit 99.2) shall not be deemed to be “filed” for purposes of Section 18

of the Exchange Act, or otherwise subject to the liabilities of that section,

and shall not be incorporated by reference into any filings made by the Company under the Securities Act of 1933, as amended, or the Exchange

Act, except as may be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 7, 2023 |

ALTO INGREDIENTS, INC. |

| |

|

| |

By: |

/S/ AUSTE M. GRAHAM |

| |

|

Auste M. Graham, |

| |

|

Vice President, General Counsel & Secretary |

Exhibit 99.1

Alto Ingredients, Inc. Reports Second Quarter

2023 Results

- Delivered net income,

positive Adjusted EBITDA and positive operating cash flow, while

making significant capital expenditures to support business transformation -

- Expects Positive Adjusted

EBITDA in Q3 2023 -

Pekin, IL, August

7, 2023 – Alto Ingredients, Inc. (NASDAQ: ALTO), a leading producer and distributor of specialty alcohols and essential ingredients,

reported its financial results for the quarter ended June 30, 2023.

“We continue

to pursue opportunities to maximize value through capital investments and onboarding strategic partners that share our vision. Our strategy

is coming to fruition,” said Bryon McGregor, President and CEO of Alto Ingredients. “In the second quarter of 2023, improved

ethanol crush margins complemented by favorable economics from our high-quality alcohol and essential ingredients delivered strong profitability

and positive operating cash flow. Based on current trends, we expect to post positive Adjusted EBITDA in the third quarter of 2023 as

well.

“We have accelerated

our investments in longer-term capital projects to produce more high-quality products, including grain neutral spirits, corn oil and high

protein, as well as to improve plant efficiency and reliability. Looking ahead, we plan to advance our business transformation with a

natural gas pipeline, biogas conversion, enhanced cogeneration capabilities, primary yeast and carbon capture and sequestration. We have

$137 million in cash and excess borrowing availability to support our business operations and

near-term growth initiatives. For our longer-term projects, we continue to hold productive discussions with strategic partners, and we

will judiciously finance capital needs for those projects, as appropriate. With these investments, we expect to increase annualized EBITDA

incrementally by over $65 million by the end of 2025, with the completion of our near-term projects, and by approximately $125 million

by the end of 2026, when our carbon capture and sequestration, cogeneration, and other long-term initiatives are fully realized.”

Financial

Results for the Three Months Ended June 30, 2023 Compared to 2022

| ● | Net

sales were $317.3 million, compared to $362.2 million. |

| ● | Cost

of goods sold was $300.1 million, compared to $353.3 million. |

| ● | Gross

profit was $17.2 million, compared to $8.8 million. |

| ● | Selling,

general and administrative expenses were $7.9 million, compared to $9.0 million. |

| ● | Operating

income was $9.3 million, compared to an operating loss of $152,000. |

| ● | Net income available to common stockholders was $7.2 million,

or $0.10 per diluted share, compared to $21.5 million, which included a $22.7 million USDA cash grant, or $0.29 per diluted share. |

| ● | Adjusted EBITDA was $15.5 million, compared to $29.9 million,

which included a $22.7 million USDA cash grant. |

Cash and cash equivalents

were $22.7 million at June 30, 2023, compared to $36.5 million at December 31, 2022. At June 30, 2023, the company’s borrowing availability

included $49 million under its operating line of credit and $40 million under its term loan facility with an option to request up to an

additional $25 million under the facility.

Financial Results for the Six Months Ended

June 30, 2023 Compared to 2022

| ● | Net sales were $631.2 million, compared to $670.3 million. |

| ● | Cost of goods sold was $617.2 million, compared to $656.7 million. |

| ● | Gross profit was $14.0 million, compared to $13.6 million. |

| ● | Selling, general and administrative expenses were $15.8 million, compared to $16.6 million. |

| ● | Operating loss was $2.4 million, compared to $3.0 million. |

| ● | Net loss available to common stockholders was $6.2 million, or $0.08 per diluted share, compared to net income

available to common stockholders of $18.6 million, including the $22.7 million USDA cash grant, or $0.26 per diluted share. |

| ● | Adjusted EBITDA was $11.0 million, compared to $34.3 million, including the aforementioned cash grant. |

Second Quarter 2023 Results Conference Call

Management will host

a conference call at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time on Monday, August 7, 2023, and will deliver prepared remarks via

webcast followed by a question-and-answer session.

The webcast for the

conference call can be accessed from Alto Ingredients’ website at www.altoingredients.com. Alternatively, to receive a number and

unique PIN by email, register here. To dial directly twenty minutes prior

to the scheduled call time, dial (833) 630-0017 domestically and (412) 317-1806 internationally. The webcast will be archived for replay

on the Alto Ingredients website for one year. In addition, a telephonic replay will be available at 8:00 p.m. Eastern Time on Monday,

August 7, 2023 through 8:00 p.m. Eastern Time on Monday, August 14, 2023. To access the replay, please dial 877-344-7529. International

callers should dial 00-1 412-317-0088. The pass code will be 6298351.

Use of Non-GAAP Measures

Management believes that certain financial measures

not in accordance with generally accepted accounting principles (“GAAP”) are useful measures of operations. The company defines

Adjusted EBITDA as unaudited consolidated net income (loss) before interest expense, interest income, provision for income taxes, asset

impairments, loss on extinguishment of debt, acquisition-related expense, fair value adjustments, and depreciation and amortization expense.

A table is provided at the end of this release that provides a reconciliation of Adjusted EBITDA to its most directly comparable GAAP

measure, net income (loss). Management provides this non-GAAP measure so that investors will have the same financial information that

management uses, which may assist investors in properly assessing the company’s performance on a period-over-period basis. Adjusted

EBITDA is not a measure of financial performance under GAAP and should not be considered as an alternative to net income (loss) or any

other measure of performance under GAAP, or to cash flows from operating, investing or financing activities as an indicator of cash flows

or as a measure of liquidity. Adjusted EBITDA has limitations as an analytical tool and you should not consider this measure in isolation

or as a substitute for analysis of the company’s results as reported under GAAP.

About Alto Ingredients, Inc.

Alto Ingredients, Inc. (ALTO) is a leading producer

and distributor of specialty alcohols and essential ingredients. The company is focused on products for four key markets: Health, Home

& Beauty; Food & Beverage; Essential Ingredients; and Renewable Fuels. The company’s customers include major food and beverage

companies and consumer products companies. For more information, please visit www.altoingredients.com.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

Statements and information contained in this communication

that refer to or include Alto Ingredients’ estimated or anticipated future results or other non-historical expressions of fact are

forward-looking statements that reflect Alto Ingredients’ current perspective of existing trends and information as of the date

of the communication. Forward looking statements generally will be accompanied by words such as “anticipate,” “believe,”

“plan,” “could,” “should,” “estimate,” “expect,” “forecast,” “outlook,”

“guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,”

“predict,” “project,” or other similar words, phrases or expressions. Such forward-looking statements include,

but are not limited to, statements concerning Alto Ingredients’ plant improvement and other capital projects and other business

initiatives and strategies, and their financing, costs, timing and effects, including, but not limited to, EBITDA and/or Adjusted EBITDA

that Alto Ingredients’ expects to generate as a result of its projects, initiatives and strategies; estimates of EBITDA or Adjusted

EBITDA and Alto Ingredients’ other plans, objectives, expectations and intentions. It is important to note that Alto Ingredients’

plans, objectives, expectations and intentions are not predictions of actual performance. Actual results may differ materially from Alto

Ingredients’ current expectations depending upon a number of factors affecting Alto Ingredients’ business and plans. These

factors include, among others, adverse economic and market conditions, including for fuel-grade ethanol, specialty alcohols and essential

ingredients; export conditions and international demand for the company’s products; fluctuations in the price of and demand for

oil and gasoline; raw material costs, including production input costs, such as corn and natural gas; and the cost, ability to fund, timing

and effects of, including the financial and other results deriving from, Alto Ingredients’ plant improvement and other capital projects

and other business initiatives and strategies. These factors also include, among others, the inherent uncertainty associated with financial

and other projections; the anticipated size of the markets and continued demand for Alto Ingredients’ products; the impact of competitive

products and pricing; the risks and uncertainties normally incident to the specialty alcohol production, marketing and distribution industries;

changes in generally accepted accounting principles; successful compliance with governmental regulations applicable to Alto Ingredients’

facilities, products and/or businesses; changes in laws, regulations and governmental policies; the loss of key senior management or staff;

and other events, factors and risks previously and from time to time disclosed in Alto Ingredients’ filings with the Securities

and Exchange Commission including, specifically, those factors set forth in the “Risk Factors” section contained in Alto Ingredients’

Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 9, 2023.

Company IR and Media Contact:

Michael Kramer, Alto Ingredients, Inc., 916-403-2755,

Investorrelations@altoingredients.com

IR Agency Contact:

Kirsten Chapman, LHA Investor Relations, 415-433-3777,

Investorrelations@altoingredients.com

ALTO INGREDIENTS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands, except per share

data)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

$ | 317,297 | | |

$ | 362,189 | | |

$ | 631,188 | | |

$ | 670,307 | |

| Cost of goods sold | |

| 300,116 | | |

| 353,345 | | |

| 617,171 | | |

| 656,690 | |

| Gross profit | |

| 17,181 | | |

| 8,844 | | |

| 14,017 | | |

| 13,617 | |

| Selling, general and administrative expenses | |

| 7,911 | | |

| 8,996 | | |

| 15,793 | | |

| 16,625 | |

| Asset impairments | |

| — | | |

| — | | |

| 574 | | |

| — | |

| Income (loss) from operations | |

| 9,270 | | |

| (152 | ) | |

| (2,350 | ) | |

| (3,008 | ) |

| Interest expense, net | |

| (1,734 | ) | |

| (319 | ) | |

| (3,299 | ) | |

| (519 | ) |

| Income from cash grant | |

| — | | |

| 22,652 | | |

| — | | |

| 22,652 | |

| Other income (expense), net | |

| 59 | | |

| (66 | ) | |

| 78 | | |

| 388 | |

| Income (loss) before provision for income taxes | |

| 7,595 | | |

| 22,115 | | |

| (5,571 | ) | |

| 19,513 | |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| Net income (loss) | |

$ | 7,595 | | |

$ | 22,115 | | |

$ | (5,571 | ) | |

$ | 19,513 | |

| Preferred stock dividends | |

$ | (315 | ) | |

$ | (315 | ) | |

$ | (627 | ) | |

$ | (627 | ) |

| Net income allocated to participating securities | |

| (96 | ) | |

| (284 | ) | |

| — | | |

| (251 | ) |

| Net income (loss) available to common stockholders | |

$ | 7,184 | | |

$ | 21,516 | | |

$ | (6,198 | ) | |

$ | 18,635 | |

| Net income (loss) per share, basic | |

$ | 0.10 | | |

$ | 0.29 | | |

$ | (0.08 | ) | |

$ | 0.26 | |

| Net income (loss) per share, diluted | |

$ | 0.10 | | |

$ | 0.29 | | |

$ | (0.08 | ) | |

$ | 0.26 | |

| Weighted-average shares outstanding, basic | |

| 73,394 | | |

| 72,936 | | |

| 73,603 | | |

| 71,690 | |

| Weighted-average shares outstanding, diluted | |

| 74,103 | | |

| 73,123 | | |

| 73,603 | | |

| 71,958 | |

ALTO INGREDIENTS, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands, except par value)

| ASSETS | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

| |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 22,739 | | |

$ | 36,456 | |

| Restricted cash | |

| 2,351 | | |

| 13,069 | |

| Accounts receivable, net | |

| 63,367 | | |

| 68,655 | |

| Inventories | |

| 71,115 | | |

| 66,628 | |

| Derivative instruments | |

| 14,038 | | |

| 4,973 | |

| Other current assets | |

| 5,919 | | |

| 9,340 | |

| Total current assets | |

| 179,529 | | |

| 199,121 | |

| Property and equipment, net | |

| 246,693 | | |

| 239,069 | |

| Other Assets: | |

| | | |

| | |

| Right of use operating lease assets, net | |

| 24,433 | | |

| 18,937 | |

| Intangible assets, net | |

| 8,792 | | |

| 9,087 | |

| Goodwill | |

| 5,970 | | |

| 5,970 | |

| Other assets | |

| 5,993 | | |

| 6,137 | |

| Total other assets | |

| 45,188 | | |

| 40,131 | |

| Total Assets | |

$ | 471,410 | | |

$ | 478,321 | |

ALTO INGREDIENTS, INC.

CONSOLIDATED BALANCE SHEETS (CONTINUED)

(unaudited, in thousands, except par value)

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

June 30,

2023 | | |

December 31,

2022 | |

| Current Liabilities: | |

| | |

| |

| Accounts payable | |

$ | 25,933 | | |

$ | 28,115 | |

| Accrued liabilities | |

| 15,328 | | |

| 26,556 | |

| Current portion – operating leases | |

| 3,914 | | |

| 3,849 | |

| Derivative instruments | |

| 8,396 | | |

| 6,732 | |

| Other current liabilities | |

| 5,115 | | |

| 12,765 | |

| Total current liabilities | |

| 58,686 | | |

| 78,017 | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 82,082 | | |

| 68,356 | |

| Operating leases, net of current portion | |

| 21,058 | | |

| 15,062 | |

| Other liabilities | |

| 8,791 | | |

| 8,797 | |

| Total Liabilities | |

| 170,617 | | |

| 170,232 | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value; 10,000 shares

authorized; Series A: no shares issued and outstanding as of June 30, 2023 and December 31, 2022 Series B: 927 shares issued

and outstanding as of June 30, 2023 and December 31, 2022 | |

| 1 | | |

| 1 | |

| Common stock, $0.001 par value; 300,000 shares authorized; 75,923 and 75,154 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 76 | | |

| 75 | |

| Non-voting common stock, $0.001 par value; 3,553 shares authorized; 1 share issued and outstanding as of June 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Additional paid-in capital | |

| 1,039,735 | | |

| 1,040,834 | |

| Accumulated other comprehensive income | |

| 1,822 | | |

| 1,822 | |

| Accumulated deficit | |

| (740,841 | ) | |

| (734,643 | ) |

| Total Stockholders’ Equity | |

| 300,793 | | |

| 308,089 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 471,410 | | |

$ | 478,321 | |

Reconciliation of Adjusted EBITDA to Net Income

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| (in thousands) (unaudited) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net income (loss) | |

$ | 7,595 | | |

$ | 22,115 | | |

$ | (5,571 | ) | |

$ | 19,513 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 1,734 | | |

| 319 | | |

| 3,299 | | |

| 519 | |

| Interest income | |

| (190 | ) | |

| (145 | ) | |

| (411 | ) | |

| (303 | ) |

| Asset impairments | |

| — | | |

| — | | |

| 574 | | |

| — | |

| Acquisition-related expense | |

| 700 | | |

| 875 | | |

| 1,400 | | |

| 1,750 | |

| Depreciation and amortization expense | |

| 5,681 | | |

| 6,728 | | |

| 11,735 | | |

| 12,861 | |

| Total adjustments | |

| 7,925 | | |

| 7,777 | | |

| 16,597 | | |

| 14,827 | |

| Adjusted EBITDA | |

$ | 15,520 | | |

$ | 29,892 | | |

$ | 11,026 | | |

$ | 34,340 | |

Commodity Price Performance

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| (unaudited) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Renewable fuel production gallons sold (in millions) | |

| 51.2 | | |

| 51.3 | | |

| 94.5 | | |

| 100.4 | |

| Specialty alcohol production gallons sold (in millions) | |

| 16.6 | | |

| 25.8 | | |

| 38.0 | | |

| 49.1 | |

| Third party renewable fuel gallons sold (in millions) | |

| 26.6 | | |

| 30.0 | | |

| 60.4 | | |

| 60.8 | |

| Total gallons sold (in millions) | |

| 94.4 | | |

| 107.1 | | |

| 192.9 | | |

| 210.3 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total gallons produced (in millions) | |

| 70.5 | | |

| 77.0 | | |

| 131.1 | | |

| 151.3 | |

| Production capacity utilization | |

| 81 | % | |

| 88 | % | |

| 76 | % | |

| 85 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Average sales price per gallon | |

$ | 2.63 | | |

$ | 2.84 | | |

$ | 2.53 | | |

$ | 2.65 | |

| | |

| | | |

| | | |

| | | |

| | |

| Average CBOT ethanol price per gallon | |

$ | 2.46 | | |

$ | 2.73 | | |

$ | 2.33 | | |

$ | 2.50 | |

| | |

| | | |

| | | |

| | | |

| | |

| Corn cost per bushel – CBOT equivalent | |

$ | 6.52 | | |

$ | 7.46 | | |

$ | 6.56 | | |

$ | 6.84 | |

| Average basis | |

| 0.80 | | |

| 0.69 | | |

| 0.63 | | |

| 0.66 | |

| Delivered corn cost | |

$ | 7.32 | | |

$ | 8.15 | | |

$ | 7.19 | | |

$ | 7.50 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total essential ingredients tons sold (in thousands) | |

| 364.1 | | |

| 414.1 | | |

| 663.4 | | |

| 812.9 | |

| Essential ingredients return % (1) | |

| 37.6 | % | |

| 32.7 | % | |

| 38.6 | % | |

| 34.6 | % |

| (1) | Essential ingredients revenue as a percentage of delivered

cost of corn. |

Segment Financials

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net Sales | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Pekin Campus, recorded as gross: | |

| | |

| | |

| | |

| |

| Alcohol sales | |

$ | 127,694 | | |

$ | 143,768 | | |

$ | 260,075 | | |

$ | 259,818 | |

| Essential ingredient sales | |

| 53,954 | | |

| 59,853 | | |

| 117,585 | | |

| 115,133 | |

| Intersegment sales | |

| 444 | | |

| 269 | | |

| 757 | | |

| 525 | |

| Total Pekin Campus sales | |

| 182,092 | | |

| 203,890 | | |

| 378,417 | | |

| 375,476 | |

| | |

| | | |

| | | |

| | | |

| | |

| Marketing and distribution: | |

| | | |

| | | |

| | | |

| | |

| Alcohol sales, gross | |

$ | 72,589 | | |

$ | 63,558 | | |

$ | 156,936 | | |

$ | 117,484 | |

| Alcohol sales, net | |

| 104 | | |

| 317 | | |

| 218 | | |

| 668 | |

| Intersegment sales | |

| 2,499 | | |

| 3,242 | | |

| 5,342 | | |

| 6,239 | |

| Total marketing and distribution sales | |

| 75,192 | | |

| 67,117 | | |

| 162,496 | | |

| 124,391 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other production, recorded as gross: | |

| | | |

| | | |

| | | |

| | |

| Alcohol sales | |

$ | 44,384 | | |

$ | 67,184 | | |

$ | 65,316 | | |

$ | 126,991 | |

| Essential ingredient sales | |

| 14,421 | | |

| 23,372 | | |

| 22,773 | | |

| 42,309 | |

| Intersegment sales | |

| 62 | | |

| — | | |

| 62 | | |

| 12 | |

| Total Other production sales | |

| 58,867 | | |

| 90,556 | | |

| 88,151 | | |

| 169,312 | |

| | |

| | | |

| | | |

| | | |

| | |

| Corporate and other | |

| 4,151 | | |

| 4,137 | | |

| 8,285 | | |

| 7,904 | |

| Intersegment eliminations | |

| (3,005 | ) | |

| (3,511 | ) | |

| (6,161 | ) | |

| (6,776 | ) |

| Net sales as reported | |

$ | 317,297 | | |

$ | 362,189 | | |

$ | 631,188 | | |

$ | 670,307 | |

| Cost of goods sold: | |

| | | |

| | | |

| | | |

| | |

| Pekin Campus | |

$ | 168,419 | | |

$ | 195,691 | | |

$ | 366,596 | | |

$ | 364,573 | |

| Marketing and distribution | |

| 71,746 | | |

| 63,796 | | |

| 154,871 | | |

| 118,510 | |

| Other production | |

| 57,834 | | |

| 91,606 | | |

| 91,815 | | |

| 169,851 | |

| Corporate and other | |

| 3,414 | | |

| 3,197 | | |

| 5,786 | | |

| 6,070 | |

| Intersegment eliminations | |

| (1,297 | ) | |

| (945 | ) | |

| (1,897 | ) | |

| (2,314 | ) |

| Cost of goods sold as reported | |

$ | 300,116 | | |

$ | 353,345 | | |

$ | 617,171 | | |

$ | 656,690 | |

| Gross profit: | |

| | | |

| | | |

| | | |

| | |

| Pekin Campus | |

$ | 13,673 | | |

$ | 8,199 | | |

$ | 11,821 | | |

$ | 10,903 | |

| Marketing and distribution | |

| 3,446 | | |

| 3,321 | | |

| 7,625 | | |

| 5,881 | |

| Other production | |

| 1,033 | | |

| (1,050 | ) | |

| (3,664 | ) | |

| (539 | ) |

| Corporate and other | |

| 737 | | |

| 940 | | |

| 2,499 | | |

| 1,834 | |

| Intersegment eliminations | |

| (1,708 | ) | |

| (2,566 | ) | |

| (4,264 | ) | |

| (4,462 | ) |

| Gross profit as reported | |

$ | 17,181 | | |

$ | 8,844 | | |

$ | 14,017 | | |

$ | 13,617 | |

####

Exhibit 99.2

Alto Ingredients Announces Executive Leadership

Changes

- Bryon T. McGregor Appointed President

and Chief Executive Officer –

- Michael D. Kandris Retires as President

and Chief Executive Officer and Continues as Director and Interim Chief Operating Officer –

- Robert R. Olander Appointed Chief

Financial Officer -

Pekin, IL, August 7, 2023 – Alto Ingredients, Inc. (NASDAQ:

ALTO), a leading producer and distributor of specialty alcohols and essential ingredients, today announced the following executive

leadership changes as of August 1, 2023: Bryon T. McGregor, the company’s former Chief Financial Officer, has been appointed President

and Chief Executive Officer. He succeeds Michael D. Kandris, who has retired as President and Chief Executive Officer and has been appointed

Interim Chief Operating Officer for a period of up to a year. Kandris will continue to serve as a Director of the company. Robert R. Olander,

the company’s former Vice President, Corporate Controller, has been appointed Chief Financial Officer.

“Mike has been integral to our business transformation into a

leading producer and distributor of specialty alcohols and essential ingredients,” said Chairman of the Board Douglas Kieta. “We

thank Mike for his exemplary leadership and significant contributions over the past 15 years. We are pleased he will continue on as Interim

Chief Operating Officer to offer valuable guidance until we name a successor, and we will continue to benefit from his ongoing services

as an active member of our board of directors.”

Kandris stated, “In planning for my eventual retirement, Bryon

and I have worked closely together for many years, and even more so in the last three years, on our strategy to diversify revenue streams,

optimize operations and expand EBITDA. Recognized for his strong leadership, strategic vision and outstanding management, Bryon has developed

and managed capital financing for over 40 global industrial and infrastructure projects valued in excess of $12 billion. Then, as a critical

player at Alto for over 15 years, he gained a deep understanding of our markets and business needs. The board and I are confident Bryon

will lead the team to deliver sustainable profitability.”

McGregor added “Rob, an expert in public company accounting,

process improvement and contract review, has been a valuable player in developing and implementing our financial strategy. Having worked

together for over 15 years, I know Rob’s financial and accounting acumen as well as his foresight have contributed greatly to where

we are today. These qualities have also prepared him well to assume his new role as Chief Financial Officer.”

McGregor concluded, “I am proud of the company’s progress

in our business transformation to date. More importantly, I am confident our talented and experienced team will execute our initiatives,

including carbon capture and sequestration, to increase additional annualized EBITDA by approximately $125 million by the end of 2026

when we expect our projects will be fully realized.”

Bryon T. McGregor

McGregor, named President and Chief Executive Officer, joined the company

in 2008 as Vice President Finance/Treasurer and was later appointed Chief Financial Officer in 2009. During his tenure as Chief Financial

Officer, McGregor has led multiple financings, raising over $640 million for the company; integrated two acquisitions, increasing the

company’s production capacity by three-fold; strengthened the company’s balance sheet and implemented cost reduction programs.

With over 35 years’ experience, he has developed expertise in business development, project development, corporate planning, M&A,

risk management, corporate and international finance, investor relations, treasury operations and accounting. Prior to joining the company,

McGregor was Brokerage Treasurer for E*TRADE Financial, overseeing Europe and Asian treasury operations. As Manager, Global Head of Project

Finance at BP (formerly ARCO, one of the top 10 fully integrated multi-national oil and gas companies in the world at that time), McGregor

was responsible for the development of and managing investments in global industrial and infrastructure projects, including a multi-billion

dollar LNG project in Indonesia, a $3 billion heavy-oil project in Venezuela, over $1 billion in regasification and natural gas pipeline

projects, and over $1 billion in various other energy and chemical investments located both domestically and internationally. When at

Credit Suisse, he developed limited-recourse financing opportunities globally in excess of $8 billion in energy, mining, petrochemical,

infrastructure and telecommunications, as well as facilitated M&A for clients.

McGregor has a B.S. degree in Business Management from Brigham Young

University.

Michael D. Kandris

Kandris, named Interim Chief Operating Officer, has served the company

for over 15 years. Originally an independent contractor with the company focusing on plant operations, Kandris became a member of the

company’s board of directors in 2008, began serving as Chief Operating Officer in 2013, and served as President and Chief Executive

Officer from 2020 until retiring from those roles in 2023. He has over 40 years of general management experience in the transportation

and logistics including serving as President of Ruan Transportation Management Systems (RTMS) prior to joining Alto. Additionally, Kandris

served on the Executive Committee of the American Trucking Association and as a board member for the National Tank Truck Organization.

Kandris has a B.S. degree in Business from California State University,

Hayward.

Robert R. Olander

Olander, named Chief Financial Officer, has served the company for

over 16 years with increasing responsibility, and, most recently, as Vice President, Corporate Controller. Olander has over 20 years of

accounting, treasury and finance experience. Prior to joining the company, he served as Controller and Business Manager at Hampton Distribution

Companies and supervised audit and consulting at James Marta & Company. He began his career at Deloitte & Touche in audit and

assurance working with ConAgra, Berkshire Hathaway and Union Pacific, among others.

Olander has a B.S. in Business Administration from Midland University

and is a Certified Public Accountant.

About Alto Ingredients, Inc.

Alto Ingredients,

Inc. (NASDAQ: ALTO) is a leading producer and distributor of specialty alcohols and essential ingredients. The company is focused on

products for four key markets: Health, Home & Beauty; Food & Beverage; Essential Ingredients; and Renewable Fuels. The company’s

customers include major food and beverage companies and consumer products companies. For more information, please visit www.altoingredients.com.

Safe Harbor Statement under the Private Securities Litigation Reform

Act of 1995

Statements and information contained in this communication

that refer to or include Alto Ingredients’ estimated or anticipated future results or other non-historical expressions of fact are

forward-looking statements that reflect Alto Ingredients’ current perspective of existing trends and information as of the date

of the communication. Forward looking statements generally will be accompanied by words such as “anticipate,” “believe,”

“plan,” “could,” “should,” “estimate,” “expect,” “forecast,” “outlook,”

“guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,”

“predict,” “project,” or other similar words, phrases or expressions. Such forward-looking statements include,

but are not limited to, the cost, timing and effects of, including the financial results deriving from, Alto Ingredients’ capital

improvement projects and other business initiatives and strategies; the timing and amount of expected increases in annualized EBITDA;

and Alto Ingredients’ other plans, objectives, expectations and intentions. It is important to note that Alto Ingredients’

plans, objectives, expectations and intentions are not predictions of actual performance. Actual results may differ materially from Alto

Ingredients’ current expectations depending upon a number of factors affecting Alto Ingredients’ business. These factors include,

among others, Alto Ingredients’ ability to timely and effectively fund and complete its capital improvement projects and other business

initiatives and strategies, and to operate them as expected and attain the anticipated results; adverse economic and market conditions,

including for alcohols and essential ingredients; export conditions and international demand for the company’s products; fluctuations

in the price of and demand for oil and gasoline; raw material costs, including production input costs, such as corn and natural gas. These

factors also include, among others, the inherent uncertainty associated with financial and other projections; the anticipated size of

the markets and continued demand for Alto Ingredients’ products; the impact of competitive products and pricing; the risks and uncertainties

normally incident to the alcohol production, marketing and distribution industries; changes in generally accepted accounting principles;

successful compliance with governmental regulations applicable to Alto Ingredients’ facilities, products and/or businesses; changes

in laws, regulations and governmental policies; the loss of key senior management or staff; and other events, factors and risks previously

and from time to time disclosed in Alto Ingredients’ filings with the Securities and Exchange Commission including, specifically,

those factors set forth in the “Risk Factors” section contained in Alto Ingredients’ Quarterly Report on Form 10-Q filed

with the Securities and Exchange Commission on May 9, 2023.

Company IR & Media Contact:

Michael Kramer, Alto Ingredients, Inc., 916-403-2755, Investorrelations@altoingredients.com

IR Agency Contact:

Kirsten Chapman, LHA Investor Relations, 415-433-3777, Investorrelations@altoingredients.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

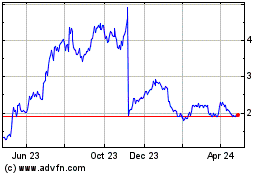

Alto Ingredients (NASDAQ:ALTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alto Ingredients (NASDAQ:ALTO)

Historical Stock Chart

From Apr 2023 to Apr 2024