0001620533

false

0001620533

2023-08-02

2023-08-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 2, 2023

Date

of Report (Date of earliest event reported)

SHAKE

SHACK INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

001-36823 |

47-1941186 |

(State

or other jurisdiction of

incorporation

or organization)

|

(Commission

File

Number) |

(IRS

Employer

Identification

No.) |

| |

225

Varick Street, Suite 301

New

York, New York |

10014 |

| |

(Address

of principal executive offices) |

(Zip

Code) |

(646)

747-7200

(Registrant's

telephone number, including area code)

Not applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act

Title

of each class

|

Trading

symbol(s)

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 |

SHAK |

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 3, 2023, Shake Shack Inc. (the “Company”)

announced that Zachary Koff, its Chief Operating Officer, will be leaving the Company, effective September 7, 2023 (the “Separation

Date”). Through the Separation Date, Mr. Koff will work to transition his duties.

Mr. Koff is eligible, pursuant to the terms of

his Amended and Restated Employment Agreement, dated January 5, 2017, to receive certain separation payments. Pursuant to a Separation

Agreement and General Release entered into by and between Mr. Koff and the Company on August 2, 2023, the Company will pay Mr. Koff (i)

an amount equal to Mr. Koff’s full annual base salary in one lump sum; (ii) an amount equal to two-thirds of the amount of the performance-based

cash bonus for the third quarter of fiscal 2023 that would have been payable to Mr. Koff if he was still employed as of the applicable

bonus payment date, which shall be paid only if the Company attains the performance-based goals for the third quarter of fiscal 2023;

(iii) an amount equal to the accelerated vesting of certain outstanding Restricted Stock Units that would have been issuable to Mr. Koff

if he was still employed at the Company as of their applicable vesting dates, less any Federal, state, local, or foreign taxes required

by law to be withheld by reducing the number of shares of common stock otherwise deliverable to Mr. Koff; and (iv) Company reimbursement,

for a period of 12 months following the Separation Date, of the portion of Mr. Koff’s COBRA continuation costs that would have been

payable by the Company had he remained employed, provided, however, that Mr. Koff shall no longer receive reimbursement to the extent

he obtains future employment. Mr. Koff shall have the right to compete with the Company, provided, however, that in such event, he shall

not be entitled to any of the amounts stated above on or after the date he first so competes. Mr. Koff will also be subject to confidentiality,

non-solicitation, non-disparagement and post-termination cooperation covenants.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Shake Shack Inc. |

|

| |

(Registrant) |

|

| |

|

|

| |

|

|

| Dated: August 3, 2023 |

By: |

/s/ Ronald Palmese, Jr. |

|

| |

|

Ronald Palmese, Jr. |

|

| |

|

Chief Legal Officer |

|

Exhibit 10.1

EXECUTION VERSION

SEPARATION AGREEMENT AND GENERAL RELEASE

THIS SEPARATION AGREEMENT

AND GENERAL RELEASE (this “Agreement & Release”) is made and entered into as of August 2, 2023 by and

between Zachary Koff, on his own behalf and on behalf of his descendants, dependents, heirs, executors, administrators, agents, assigns,

and successors (collectively “Executive”), and Shake Shack Enterprises, LLC, on its own behalf, on behalf of

its present and former directors, officers, partners, members, owners, shareholders, employees, representatives, agents, attorneys, and

insurers, and on behalf of all of their parents, subsidiaries, affiliates, predecessors, successors, related entities, and assigns (collectively,

the “Company”, and, with Executive, the “Parties”).

WHEREAS, Executive is currently

serving as the Chief Operating Officer of the Company;

WHEREAS, Executive’s

employment relationship with the Company shall cease as of the end of the day on September 7, 2023 (the “Separation Date”);

and

WHEREAS, Executive and the

Company have negotiated and reached an agreement with respect to all rights, duties and obligations arising between them, including, but

in no way limited to, any rights, duties and obligations that have arisen or might arise out of or are in any way related to Executive’s

continued employment with Company and the conclusion of that employment (other than as specifically provided in this Agreement & Release).

NOW, THEREFORE, in consideration

of the mutual covenants and commitments set forth herein, Executive and Company agree as follows:

1.

Employment; Duties. Executive shall continue

to serve as the Company’s Chief Operating Officer through the Separation Date. Executive acknowledges the importance to Company

of an orderly transition of Executive’s job duties and responsibilities to the Company’s designees. As such, through the Separation

Date, Executive agrees to provide all services necessary and/or as may be asked of him by the Company from time to time to transition

his job duties and responsibilities to the Company’s designees as set forth in Section 11 of this Agreement & Release

and to provide communication regarding his leaving the organization on the Separation Date. Executive’s obligations under this Section

1 shall continue through the Separation Date.

2.

Payments and Benefits. Executive acknowledges

and agrees that he will not be entitled to any compensation or benefits from the Company, except as expressly provided for in this Agreement

& Release, and Executive specifically waives and foregoes all rights to any compensation or benefits of any kind that are not expressly

provided to him in this Agreement & Release. As compensation for Executive’s continuing employment and services hereunder, in

recognition of Executive’s contributions to Company, and as consideration for Executive’s signing this Agreement & Release

and agreeing to be bound by the promises and covenants set forth herein:

(a)

Through the Separation Date, the Company agrees to continue (i) to pay Executive’s base salary

of Three Hundred Eighty-Six Thousand Two Hundred Fifty United States Dollars (US $386,250.00) (the “Annual Base Salary”)

at a rate of Seven Thousand Four Hundred Twenty-Seven United States Dollars and Eighty-Eight Cents (US $7,427.88) per week (less applicable

taxes, withholdings, and deductions) and (ii) to provide Executive with all benefits in which Executive is currently enrolled (including

without limitation health and dental benefits, disability benefits and 401k benefits), in accordance with the terms of the Company’s

benefit plans/programs, except that Executive will not accrue any additional paid time off (“PTO”) as of the

date of this Agreement & Release, other than as required under the New York City Earned Sick and Safe Time Act. Executive shall not

have the ability to take PTO through the Separation Date, other than as agreed to with the Company.

(b)

Provided that Executive (i) does not revoke this Agreement & Release, (ii) signs the Certificate

attached hereto as Exhibit A after the Separation Date, and (iii) does not revoke the Certificate, the Company agrees to the following:

(1)

To pay Executive an amount equal to Executive’s full Annual Base Salary in one lump sum payment

on the Company’s first regularly scheduled payroll date on or following the Certificate Date (as defined below) (the “Base

Salary Separation Payment”);

(2)

To pay Executive an amount equal to two-thirds (2/3) of the amount of the performance-based cash

bonus for the third quarter of fiscal 2023 (the “Quarterly Bonus”) that would have been payable to the Executive

if the Executive was still employed as of the applicable bonus payment date (the “Quarterly Bonus Separation Payment”)

no earlier than November 15, 2023. For the avoidance of doubt, the Quarterly Bonus Separation Payment shall only be paid if the Company

attains the performance-based goals for the third quarter of fiscal 2023; and

(3)

To accelerate the vesting of the Restricted Stock Units awarded annually to Executive pursuant to

the Company’s Incentive Award Plan, as amended, that would have been issuable to the Executive if the Executive was still employed

at the Company as of the applicable vesting dates set forth below, less any Federal, state, local, or foreign taxes required by law to

be withheld by reducing the number of shares of common stock otherwise deliverable to Executive (collectively, the “Accelerated

Restricted Stock Units”), as follows:

| Award |

Vesting Date |

| 2020 RSU Award |

March 2, 2024 |

| 2021 RSU Award |

March 15, 2024 |

| 2022 RSU Award |

March 1, 2024 |

| 2021 PSU Award |

March 15, 2024 |

| 2021 PSU Award (Additional) |

March 15, 2024 |

All such Accelerated Restricted Stock Units shall vest in full as of the Certificate Date. Executive acknowledges that he shall forfeit

any other unvested Restricted Stock Units awarded pursuant to the Company’s Incentive Award Plan, including later vesting tranches

of Restricted Stock Units included in the above annual equity awards. Executive agrees not to trade any common stock on the basis of material

non-public information.

Notwithstanding anything set

forth in Sections 2(b)(1), (2) and (3) to the contrary, in no event shall Executive receive any portion of the Base

Salary Separation Payment or the Quarterly Bonus Separation Payment nor shall the Executive be issued the Accelerated Restricted Stock

Units until the date that is eight (8) days after the date that Executive signs the Certificate (the “Certificate Date”);

it being understood and agreed that the Base Salary Separation Payment, which is deferred by reason of application of this clause (b)

proviso, shall be paid on the Company’s first regularly scheduled payroll date on or following the Certificate Date; it being further

understood and agreed that the Quarterly Bonus Separation Payment shall be paid on or after November 15, 2023 consistent with the Company’s

payment of bonuses earned by all employees for the third quarter.

(c)

Executive acknowledges that all employee benefits provided to him by the Company will end on the

Separation Date. After the Separation Date, Executive may be eligible to continue his Company-sponsored medical insurance benefits through

COBRA and/or the New York Insurance Law (“Continuation Coverage”). In the event Executive is eligible for and

timely elects to continue with such Continuation Coverage, to the fullest extent permitted by applicable law, through the Severance Period,

provided that the Executive timely submits to the Company’s Chief People Officer, Diane Neville, 225 Varick Street, Suite

301, NY, NY 10014, dneville@shakehsack.com, evidence of Executive’s payments (e.g., cancelled check, email confirmation from the

COBRA administrator, etc.) made to the COBRA administrator, the Company will (1) reimburse Executive for the Company’s share of

the premiums associated therewith in an amount equal to what the Company pays for the health insurance premiums of other executives at

the Company and (2) withhold the Executive’s shares of such insurance premiums from the payments made under paragraph 2(b)(1).

Notwithstanding the foregoing, in the event the Executive obtains other employment that offers group health benefits, such Continuation

Coverage and the reimbursement by the Company of any associated premiums shall immediately cease.

(d)

The Base Salary Separation Payment, the Quarterly Bonus Separation Payment, and all other payments

referenced herein shall be paid out to Executive as W-2 wages and thus be subject to all applicable taxes, withholdings and deductions.

3.

No Other Compensation or Benefits Owed. Executive

agrees that he has no entitlement to any salary, bonus, commission, payout, severance pay, vacation pay or other benefits (including 401(k)

and long term disability insurance), damages, attorneys’ fees or costs from the Company except as specifically provided in this

Agreement & Release, and that he will not bring any action contrary to this understanding. Executive represents and warrants that

he has been properly paid by the Company for all time worked while employed by the Company. Executive also agrees that he will submit

for reimbursement all receipts for work related expenses incurred prior to the Separation Date to the Company no later than the Separation

Date. Executive also acknowledges that, as of the Separation Date, he is no longer authorized to incur any expenses, liabilities, and/or

obligations on behalf of the Company, and Executive agrees that, after the Separation Date, he will not hold himself out to be an agent

of the Company.

4.

Executive Release. Executive, on his own behalf

and on behalf of his descendants, dependents, heirs, executors, administrators, agents, assigns, and successors, release and discharge

the Company, on its own behalf, on behalf of its present and former directors, officers, partners, members, trustees, shareholders, owners,

employees, representatives, agents, attorneys, and insurers, and on behalf of all of their parents, subsidiaries, affiliates, predecessors,

successors, related entities, and assigns, from, and with respect to, any and all actions, causes of action, suits, liabilities, claims,

charges and demands whatsoever, to the maximum extent permitted by law, which have accrued at any time from the beginning of time through

the date of his acknowledgement of this Agreement & Release, including but not limited to: (i) any and all claims, demands, causes

of action, complaints or charges, known or unknown, of any kind or character, in tort, or under any other law or statue whatsoever, which

you have or might have as a result of, or in any way connected with, your employment or separation of employment with the Company; (ii)

any claims for breach of contract, quantum meruit, promissory estoppel, fraud, fraudulent misrepresentation or concealment, unjust enrichment,

interference with prospective business advantage, wrongful or bad faith termination, defamation, negligent or intentional infliction of

emotional distress, outrageous conduct, breach of the covenant of good faith and fair dealing, invasion of privacy, business or personal

injury, and any other common law contract and tort claims; (iii) any claims for unpaid or lost benefits, salary, bonus, commissions, gratuities,

service charges, payouts, vacation pay, severance pay, overtime, or other compensation; (iv) any claims for attorneys’ fees, costs,

disbursements, or other expenses; (v) any claims for damages or personal injury; (vi) any claims of employment discrimination, whether

based on federal, state, or local law or judicial or administrative decision; (vii) any claims under Title VII of the Civil Rights Act

of 1964; the Civil Rights Act of 1866 and 1871; the Federal Worker Adjustment and Retraining Notification Act; the Age Discrimination

in Employment Act of 1967, as amended (“ADEA”); the Older Worker Benefits Protection Act (“OWBPA”);

the Americans With Disabilities Act; the Occupational Safety and Health Act; the Employee Retirement Income Security Act of 1974; the

Immigration Reform and Control Act; the Family and Medical Leave Act; the Employee Retirement Income Security Act of 1974; the Families

First Coronavirus Response Act; the Pregnancy Discrimination Act; the Equal Pay Act of 1973; the Rehabilitation Act of 1973; the Genetic

Information Nondiscrimination Act; the Civil Rights Act of 1991, 42 U.S.C. § 1981; Sarbanes-Oxley Act of 2002, Public Law 107-204,

including whistleblowing claims under 18 U.S.C. §§ 1514A and 1513(e); and the New York State Human Rights Law; the New York

Civil Rights Law; the New York City Human Rights Law; the New York Worker Adjustment and Retraining Notification Act; the New York Labor

Law; the New York Wage Theft Prevention Act; the New York Hospitality Industry Wage Order; the New York Minimum Wage Order for Miscellaneous

Industries and Occupations; the New York Corrections Law; the New York City Earned Safe and Sick Time Act; the New York Whistleblower

Law; the New York State Paid Sick Leave Law; New York COVID Leave Law; the New York City Stop Credit Discrimination in Employment Act;

the New York City Fair Work Week Law; the New York City Vaccination Leave and Child Vaccination Leave Law; New York Paid Family Leave

Law; and the New York City Commuter Benefits Law, each as amended; and/or (viii) any other federal, state, or municipal law ordinance,

regulation or order, or the common law, or any self-regulatory organization rule or regulation. This Agreement & Release includes

any claims for or rights to damages, whether contractual, liquidated, compensatory, exemplary, or punitive, or rights to or claims for

injunctive or equitable relief, or rights to or claims for expenses, costs, fees, attorneys' fees, and all losses of any kind whatsoever,

which he has or might have by virtue of any fact(s), act(s) or event(s) occurring prior to the effective date of this Agreement &

Release. Nothing contained in this Agreement & Release, however, precludes Executive from pursuing any claims for a breach of this

Agreement & Release, any claims that you may have that arise after the date that you execute this Release, and any claims for unemployment

insurance benefits or workers’ compensation benefits. Further, you do not release any rights that you may have to any vested benefits

under any applicable employee benefit plan.

5.

Confidentiality.

(a)

Executive agrees that he has kept, and shall keep, the existence and terms of this Agreement &

Release confidential, and has not disclosed, and shall not disclose, them to anyone except his attorney, tax advisor, financial advisor,

and/or spouse (collectively, “Executive Confidants”), provided, that such individuals first agree that

they will treat such information as strictly confidential and that Executive agrees to be responsible for any disclosure by any Executive

Confidant exactly as if Executive had made the disclosure himself. In the event that any Executive Confidant violates the terms of this

Section 5(a), such violation shall be deemed a violation by Executive of the terms of this Section 5(a).

(b)

Executive acknowledges that, during his employment with the Company, he has had unique access to

or became aware of confidential, proprietary, and personal information about the Company, its partners and owners, and its customers and

patrons. Such confidential, proprietary, and personal information includes but is not limited to information concerning the personal and

financial affairs of the Company’s executives, partners and owners as well as the Company’s business, financial condition,

operations, assets and liabilities, research and development, marketing and public relations strategies, formulas, programs, systems of

operations, recipes, ingredient lists, identification of suppliers and resources for goods and services, information regarding the needs,

preferences, electronic mail addresses, names and telephone numbers of Company customers and guests, customer and guest lists, employee

information, training manuals and videos, written procedures integral to the Company’s day-to-day operations, trade secrets, sales,

products, services, accounts, purchasers of Company products, marketing, packaging, merchandising, distribution, manufacturing, finance,

financial data, technology, intellectual property, including patents, design patents, trademarks, trade dress, copyrights, strategies,

business structures, operations or ventures or other business affairs or plans, or information relating to existing or contemplated businesses,

products and/or services of the Company, and any other information which the Company does not disclose to third parties not in a relationship

of confidence with the Company. Such confidential, proprietary, and personal information does not include information (i) that at the

time of disclosure is generally known in the Company’s trade; (ii) that the

recipient thereof can show by written records was already in its possession at the time of disclosure and is not subject to an

existing agreement of confidentiality; or (iii) that is received from a third party without restriction and without breach of this Agreement

& Release or any other agreement. Executive acknowledges that (x) such confidential, proprietary, and personal information is the

exclusive, unique and valuable property of the Company and/or its partners and owners; (y) the business of each entity and their partners

and owners depends on such confidential, proprietary, or personal information; and (z) the Company and its owners and partners wish to

protect such confidential or proprietary information by keeping it confidential for the use and benefit of the Company and/or its partners

and owners. Accordingly, Executive shall not disclose, directly or indirectly, to any person or entity any confidential, proprietary,

or personal information concerning any aspect of the business or affairs of the Company, or its subsidiaries or affiliates, or its partners

or owners, or its or their customers or patrons. Executive also agrees that, on the Separation Date, all confidential, proprietary, or

personal information in his possession or under his control, directly or indirectly, that is in writing, computer generated or other tangible

form (together with all duplicates thereof) will forthwith be returned to the Company and will not be retained by the Executive or furnished

to any person, either by sample, facsimile, film, audio or video cassette, electronic data, verbal communication or any other means of

communication. Executive agrees that the provisions of this Section 5 are reasonable and necessary to protect the proprietary rights

of the Company and its affiliates in the confidential, proprietary, or personal information and trade secrets, goodwill and reputation.

(c)

Nothing in this Section 5 shall be construed to prevent Executive from disclosing information

to any governmental taxing authority or to any court or judicial officer or pursuant to a valid court order, subpoena or other lawful

process; provided, however, that, prior to disclosing any such information, Executive shall, to the extent feasible, provide

at least five (5) business days’ notice in writing to the Company in order to provide the Company with an opportunity to protect

against such disclosure.

(d)

Nothing in this Agreement & Release shall prohibit Executive from disclosing any trade secret:

(i) in confidence to a Federal, state, or local government official, either directly or indirectly, or to an attorney solely for the purpose

of reporting or investigating a suspected violation of law; or (ii) in a complaint or other document filed in a lawsuit or other proceeding,

if such filing is made under seal. Further, Executive will not be deemed to be in violation of this Agreement & Release if Executive

files a lawsuit for retaliation for reporting a suspected violation of law, discloses the trade secret to his attorney, and uses the trade

secret information in the court proceeding, provided, that Executive: (x) files any document containing the trade secret under

seal; and (y) does not publicly disclose the trade secret, except pursuant to a valid court order.

(e)

Nothing in this Agreement & Release infringes on Executive’s ability to testify, assist

or participate in an investigation, hearing or proceeding conducted by or to file a charge or complaint with the National Labor Relations

Board, the Securities and Exchange Commission, U.S. Equal Employment Opportunity Commission, or comparable state or local agencies.

These agencies have the authority to carry out their statutory duties by investigating the charge or complaint, issuing a determination,

filing a lawsuit in federal or state court in their own name, or taking any other action authorized by law. However, Executive is

precluded from receiving compensation as a result any such action.

(f)

Nothing in this Agreement & Release shall prohibit Executive from using without restriction the

Residuals (as defined below) resulting from Executive’s employment and experience with the Company. “Residuals”

means information retained in the unaided memory of Executive resulting from Executive’s work experience. However, for clarity,

this Section 5(f) does not grant Executive any rights under patents, trademarks, or copyrights of the Company, or allow Executive

to disclosing any trade secret, other than as set forth in Section 5(d).

6.

Non-Competition. Further to the terms of Executive’s

Amended & Restated Employment Agreement, dated January 5, 2017 (“Employment Agreement”), Executive shall

have the right to compete against the Company with a fast casual Business; provided, however, that, in such event, Executive

shall not be entitled to any amounts set forth in Section 2 on or after the date Executive first competes in the fast casual Business.

“Business” shall mean the business of developing, managing, and/or operating of (i) “better burger”

restaurants, (ii) “quick service” or “fast food” restaurants with an emphasis on hamburgers, and (iii) fast casual

restaurants (i.e., restaurants that do not offer table service but promise a higher quality of food with fewer frozen or processed ingredients

than a fast food restaurant).

7.

Non-Solicitation. Executive agrees that, through

the first anniversary of the Separation Date, Executive shall not, either directly or indirectly, and whether for himself or on behalf

of any other person; (i) seek to persuade any employee or consultant of the Company or any of its affiliates to discontinue or diminish

his status or employment therewith or seek to persuade any employee or exclusive consultant of the Company or any of its affiliates to

become employed or to provide consulting or contract services to a business competitive with the Company or its affiliates; (ii) solicit,

employ or engage, or cause to be solicited, employed, or engaged, any person who is employed by the Company or any of its affiliates;

or (iii) solicit, encourage, or induce any contractor, agent, client, customer, supplier, or the like of the Company or any of its affiliates

to terminate or diminish its/his relationship with, the Company or any of its affiliates, or to refrain from entering into a relationship

with the Company or any of its affiliates, including, without limitation, any prospective contact, contractor, agent, client, customer,

or the like of the Company or any of its affiliates; provided, however, that the foregoing shall not prohibit Executive

from placing any general advertisements for employees so long as such general advertisements are not directed to any employees of the

Company or any of its affiliates. For the avoidance of doubt, this Section 7 shall not prohibit Executive from soliciting any former

employees of the Company or any of its affiliates at the time of any such soliciting activity.

8.

Non-Disparagement. Executive agrees

that neither he nor anyone under his control or at his direction (including but not limited to any Executive Confidant) will take,

support, encourage, induce or voluntarily participate in any action or attempted action, either orally or in writing, that would negatively

comment on, disparage, or call into question the business operations, policies, or conduct of the Company, or any of its directors, officers,

agents, representatives, partners, members, equity holders or affiliates, or to act in any way with respect to such business operations,

policies or conduct that would likely damage the Company’s reputation, business relationships, or present or future business, or

the reputation, business relationships or present or future business of any of its directors, officers, agents, representatives, partners,

members, equity holders or affiliates. Nothing in this Section 8 shall prohibit any individual from making truthful statements

pursuant to legal process (e.g. in a deposition, under subpoena) or to any government entity or agent.

9.

Return of Company Property. No later than

the Separation Date, Executive will return to the Company all property of the Company, which is or has been in his possession, custody,

or control, including but not limited to written materials, records, computer files, databases, lap-top computers, and documents (whether

maintained in hard copy format, digitally, electronically, or in any other medium), and any copies thereof, including, but not limited

to, all property of the Company taken or received by Executive during his employment or upon his separation from the Company; provided,

however, that Executive may retain his Outlook contacts and similar, provided that such items only include contact information,

and Executive may purchase his iPhone at the rates set by the Company’s IT policy. No later than the Separation Date, Executive

shall cooperate and work with the necessary Company personnel to transfer all non-personal computer files on Executive’s (srv-file1home)

(H:) drive to the Company’s (SRV-FILE1) (Z:) drive.

10.

No Reemployment. Effective as of the Separation

Date, Executive agrees to relinquish and hereby does relinquish any and all rights he may have to either directly or indirectly: (i) be

employed by, (ii) be assigned to, (iii) work for, (iv) seek employment with or apply to, (v) accept employment with, or (vi) provide services

in exchange for compensation in any capacity (including but not limited to as an employee, independent contractor, consultant or temporary

employee) to the Company or any of its current or future parents, subsidiaries, and affiliated entities. Executive agrees that he will

not seek, apply for, or accept any employment or assignment to which he has relinquished any rights. Executive agrees and understands

that this provision is intended to protect the Company from allegations of retaliation.

11.

Remedies

(a) Executive

agrees that money damages may not be a sufficient remedy for his breach of Sections 5, 6, 7 and/or 8 of this Agreement

& Release and that, in addition to all other remedies, the Company shall be entitled to seek specific performance and injunctive or

other equitable relief, without having to post a bond or other security, as a remedy for any such breach from a court of competent jurisdiction.

(b) In

the event that a judicial determination is made that Executive or Executive Confidants have breached the confidentiality, non-solicitation

and non-disparagement provisions of Sections 5, 6, 7 and/or 8 of this Agreement & Release, because damages would

be difficult to quantify, Executive agrees to pay, and a court of competent jurisdiction shall award, liquidated damages in the amount

of one-half of the value of Base Salary Separation Payment, Quarterly Bonus Separation Payment, and Accelerated Restricted Stock Units,

and the Company’s attorneys’ fees, in addition to any other fees, costs, and other damages awarded by such court because damages

for each such breach of Sections 5, 6, 7 and/or 8 would be difficult to quantify. The parties expressly agree that

the liquidated damages provision of this Section 11 is not a penalty but is the reasonable value of Executive’s or Executive’s

Confidants’ breach of Sections 5, 6, 7 and/or 8.

(c) In

the event of any litigation to enforce or regarding a breach of the terms of this Agreement & Release, the prevailing party shall

be entitled to receive from the other reasonable attorneys’ fees and costs up through and including the appellate process.

12.

Cooperation. Executive acknowledges the importance

to the Company of an orderly transition of Executive’s duties and responsibilities to the Company’s designee. Executive also

acknowledges that, but for the promises set forth in the Agreement & Release, including but not limited to his cooperation in the

orderly transition of his duties and responsibilities, the Company would not have offered the Base Salary Separation Payment, the Quarterly

Bonus Separation Payment, and the Accelerated Restricted Stock Units. As such, through the Separation Date, Executive agrees to use commercially

reasonable efforts to provide the services necessary and/or as may be asked of him by the Company from time to time to transition his

job duties and responsibilities to the Company’s designees. In addition, Executive agrees to use commercially reasonable efforts

to meet with the Company representatives as requested by the Company, provide all information requested by the Company and/or its designees,

volunteer to the Company all pertinent information, turn over all relevant documents, and answer all Company inquiries in a timely,

truthful, and complete manner. Executive’s obligations under this Section 12 shall continue through the Separation Date.

Executive understands that, in the event the Company asks for his cooperation in accordance with the terms of this Section 12,

the Company will not compensate him beyond the payments and benefits set forth in Section 2 above, but the Company may reimburse

Executive for his reasonable and necessary travel expenses, if any.

13.

Termination. Notwithstanding anything in Section

12 to the contrary, if, prior to the Separation Date, Executive is terminated by the Company for “Cause”, then Executive

shall forfeit the Base Salary Separation Payment, Quarterly Bonus Separation Payment, and the Accelerated Restricted Stock Units and all

other payments, benefits or equity set forth in Section 2 above. For purposes of this Agreement & Release, “Cause”

means: (i) Executive’s breach of a fiduciary duty owed to the Company or any affiliate; (ii) the willful and continued

failure of Executive to attempt to perform his duties with the Company or any of its affiliates; (iii) any act of dishonesty or fraud

with respect to the Company or any affiliate; (iv) Executive’s commission of an act constituting fraud, embezzlement or a felony

or any tortious or unlawful act causing material harm to the Company’s or any of its affiliates’ standing or reputation; or

(vi) breach of the covenants set forth in Sections 5, 6, 7, 8, and/or 12 hereof.

14.

No Admissions. Neither this Agreement &

Release, nor anything contained in it, shall constitute, or shall be used, as an admission by the Company of any liability or wrongdoing

whatsoever, including but not limited to any violation of federal, state, local, or common laws, ordinances, or regulations. Neither this

Agreement & Release, nor anything contained in it, shall be introduced in any proceeding except to enforce the terms of this Agreement

& Release or to defend against any claim relating to the subject matter of the releases contained herein.

15.

Governing Law. The rights and obligations

of the Parties hereunder shall be construed and enforced in accordance with, and shall be governed by, the laws of the State of New York,

without regard to principles of conflict of laws. Any dispute under this Agreement & Release shall be adjudicated by a court of competent

jurisdiction in the County of New York, State of New York and the parties consent to such jurisdiction and agree that venue only in the

County of New York, State of New York would be proper and hereby waive any challenge thereto based on lack of personal jurisdiction or

inconvenient forum.

16.

No Other Agreements. Executive acknowledges

that by signing this Agreement & Release, he has not relied upon any representations, promises or agreements by the Company, its employees,

its officers, its directors, or its representatives (including any Company attorneys) which are not contained in this Agreement &

Release. Executive acknowledges that he is entering into this Agreement & Release voluntarily and that he fully understands all of

its provisions. This Agreement & Release constitutes the entire understanding of the Parties and supersedes all prior oral and written

agreements, including Executive’s Employment Agreement, except for the Company’s Incentive Award Plan and any equity award

agreements entered into by Executive, all of which shall remain in full force and effect as they have been modified herein. This is an

integrated document. This Agreement & Release cannot be modified except by a writing signed by all parties hereto.

17.

Titles/Captions. The titles/captions to the

sections contained in this Agreement & Release are for convenience of reference only and are not to be considered in construing this

Agreement & Release.

18.

Severability. With the exception of Section

4 above, if any provision of this Agreement & Release or the application thereof is declared or determined by any court to be

illegal or invalid, that part shall be modified or excluded from the Agreement & Release only to the extent required by law, but the

validity of the remaining parts, terms, or provisions shall not be affected and shall continue in full force and effect. In the event

Section 4 is held unenforceable by a court of competent jurisdiction, the Company’s obligations under Section 2 shall

be null and void, and Executive shall be liable for the return of the Base Salary Separation Payment, the Quarterly Bonus Separation Agreement,

and the value of Accelerated Restricted Stock Units as set forth in Section 2 above.

19.

Copies. This Agreement & Release may be

executed in counterparts, and each counterpart, when executed, shall have the efficacy of a signed original. Photographic, facsimiled,

and PDF copies of such signed counterparts may be used in lieu of the originals for any purpose.

20.

Modification. This Agreement & Release

cannot be modified except in a written document signed by both parties to this Agreement & Release.

21.

Successors and Assigns. This Agreement &

Release will apply to, be binding in all respects upon and inure to the benefit of the respective successors and assigns of the Parties,

including their personal representatives, administrators, executors, heirs and others taking from them; provided, however, that no party

may delegate or avoid any of its liabilities, obligations or responsibilities under this Agreement & Release.

22.

Knowing and Voluntary Release of Age Discrimination Claims. Executive

agrees that this Agreement & Release constitutes a knowing and voluntary waiver of rights or claims he may have against the Company,

as set forth in this Agreement & Release, including, but not limited to, all rights or claims arising under the ADEA, including, but

not limited to, all claims of age discrimination in employment and all claims of retaliation in violation of the ADEA.

23.

Consideration Period and Revocation.

(a)

Executive shall have, and Executive represents and warrants that the Company gave him at least

twenty-one (21) days in which to consider this Agreement & Release before signing it, and that such period was sufficient for

him to fully and completely consider all of its terms. The Company advised Executive to take this Agreement & Release home, read it,

and carefully consider all of its terms before signing it. Executive hereby waives any right he might have to additional time within which

to consider this Agreement & Release. Executive also acknowledges that the Company advised him to discuss this Agreement & Release

with his own attorney (at his own expense) during this period if he wished to do so. Executive has carefully read this Agreement &

Release, fully understands what it means, and is entering into it voluntarily.

(b)

Executive may revoke this Agreement & Release, including his release of claims under the ADEA

contained in Section 4 of this Agreement & Release within seven (7) calendar days after he signs it. Revocation may

be accomplished only by delivery to Ronald Palmese, Jr., Chief Legal Officer, Shake Shack Enterprises, LLC, 225 Varick Street, Suite 301,

New York, NY 10014, of a signed written statement (or a facsimile thereof) unequivocally revoking this Agreement & Release. To constitute

an effective revocation, the Company must receive the written revocation within the seven (7)-day period after Executive executes this

Agreement & Release. Upon the expiration of the seventh (7th) day without receipt of such a statement, this Agreement &

Release will become effective and irrevocable.

24.

Separation from Service under Section 409A.

(i) No amount shall be payable pursuant to Section 2 unless the termination of Executive’s employment constitutes a “separation

from service” within the meaning of Section 1.409A-1(h) of the Department of Treasury Regulations; (ii) for purposes of Section

409A, Executive’s right to receive installment payments pursuant to Section 2 shall be treated as a right to receive a series

of separate and distinct payments; and (iii) to the extent that any reimbursement of expenses or in-kind benefits constitutes “deferred

compensation” under Section 409A, such reimbursement or benefit shall be provided no later than December 31 of the year following

the year in which the expense was incurred. The amount of expenses reimbursed in one year shall not affect the amount eligible for reimbursement

in any subsequent year. The amount of any in-kind benefits provided in one year shall not affect the amount of in-kind benefits provided

in any other year. Notwithstanding any provision to the contrary in this Agreement & Release, if Executive’s is deemed at the

time of his separation from service to be a “specified employee” for purposes of Section 409A(a)(2)(B)(i) of the Code, to

the extent delayed commencement of any portion of the termination benefits to which the Executive is entitled under this Agreement &

Release is required in order to avoid a prohibited distribution under Section 409A(a)(2)(B)(i) of the Code, such portion of Executive’s

termination benefits shall not be provided to Executive prior to the earlier of (A) the expiration of the six-month period measured from

the date of Executive’s “separation from service” (as such term is defined in the Treasury Regulations issued under

Section 409A of the Code) with the Company or (B) the date of the with Executive’s death; upon the earlier of such dates, all payments

deferred pursuant to this sentence shall be paid in a lump sum to Executive, and any remaining payments due under the Agreement shall

be paid as otherwise provided herein. “Section 409A” shall mean Section 409A of the Internal Revenue Code of

1986, as amended, and the Department of Treasury regulations and other interpretive guidance issued thereunder.

[SIGNATURE PAGE TO FOLLOW]

IN WITNESS WHEREOF, the parties hereto have

executed, or caused their duly authorized officer to execute, this Separation Agreement and General Release as of the day and year first

above written:

By: /s/ Zachary Koff

Zachary Koff

Date: August 2, 2023

SHAKE SHACK ENTERPRISES, LLC

By: /s/ Ronald Palmese Jr.

Name: Ronald Palmese Jr.

Title: Chief Legal Officer

Date: August 2, 2023

EXHIBIT A

CERTIFICATE

| THIS CERTIFICATE MUST BE SIGNED AFTER AUGUST 14, 2023 |

Zachary Koff (“Executive”)

entered into a Separation Agreement and General Release (“Agreement & Release”) with Shake Shack Enterprises,

LLC (“Company”) dated as of August 2, 2023. Executive hereby acknowledges that:

1) A copy of this Certificate

was attached as an Exhibit to the Agreement & Release when it was given to Executive for his review. Executive has had at least twenty-one

(21) days to consider signing this Certificate, which was sufficient time for him to fully and completely consider its terms.

2) Executive may revoke this

Certificate within seven (7) days after he signs it by delivering written notice of such revocation to the Company, attention of Ron Palmese

as set forth in Section 22(b) of the Agreement & Release.

3) Executive was advised in

writing to discuss the Agreement & Release, including this Certificate, with an attorney before executing either document. Executive

has carefully read this Agreement & Release, fully understands what it means, and he is entering into it voluntarily

4) Provided Executive executes

and does not revoke this Certificate, the Company shall provide Executive the Base Salary Separation Payment, Quarterly Bonus Separation

Payment, and Accelerated Restricted Stock Units set forth in Section 2 of the Agreement & Release.

5) Executive is not entitled

to any other benefits or payments from the Company after signing this Certificate other than those contained in the Agreement & Release.

6) In exchange for receiving

the benefit described in Section 2 of the Agreement & Release, Executive hereby agrees that this Certificate will be a part of the

Agreement & Release and that the Agreement & Release is to be construed and applied as if he signed it on the day he signed this

Certificate; provided that the Company will not be required to duplicate any payment it has already made to Executive as it is required

to make under the terms of the Agreement & Release. This Certificate, among other things, extends Executive’s release of claims

in Section 4 of the Agreement & Release and related promises and representations to any claims that arose at any time during the period

that Executive provided services to the Company through the date Executive signs this Certificate.

________________________________________

Zachary Koff

Date September ___, 2023

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

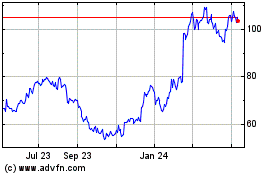

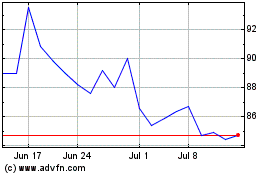

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From Apr 2024 to May 2024

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From May 2023 to May 2024