0000925528

false

HUDSON TECHNOLOGIES INC /NY

0000925528

2023-08-02

2023-08-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported) |

August 2, 2023 |

|

Hudson

Technologies, Inc. |

| (Exact Name of Registrant as Specified in Charter) |

|

New York |

| (State or Other Jurisdiction of Incorporation) |

| 1-13412 |

|

13-3641539 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 300 Tice Boulevard, Suite 290, Woodcliff Lake, New Jersey |

|

07677 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

|

(845) 735-6000 |

| (Registrant's Telephone Number, Including Area Code) |

| |

|

Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbols(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

HDSN |

Nasdaq Capital Market |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition |

On August 2, 2023, Hudson Technologies, Inc. (the “Company”)

issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of the press release is furnished

herewith as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: August 2, 2023

| |

HUDSON TECHNOLOGIES, INC. |

| |

|

| |

|

|

| |

By: |

/s/ Nat Krishnamurti |

| |

Name: Nat Krishnamurti |

| |

Title: Chief Financial Officer & Secretary |

Exhibit 99.1

HUDSON

TECHNOLOGIES REPORTS Second QUARTER 2023 Results

WOODCLIFF

LAKE, NJ – August 2, 2023 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the second quarter ended

June 30, 2023.

For the quarter ended June 30, 2023, Hudson reported

revenues of $90.5 million, a decrease of 13% compared to revenues of $103.9 million in the second quarter of 2022. The decrease is primarily

related to decreased selling prices for certain refrigerants during the period as compared to the second quarter of 2022. Gross margin

in the second quarter of 2023 was 40%, compared to 55% in the second quarter of 2022. Hudson reported operating income of $27.7 million

in the second quarter of 2023, compared to operating income of $49.8 million in the prior year period. The Company recorded net income

of $19.2 million or $0.42 per basic and $0.41 per diluted share in the second quarter of 2023, compared to net income of $39.8 million

or $0.89 per basic and $0.84 diluted share in the same period of 2022. 2023 and future periods will reflect a statutory tax rate of approximately

26%, excluding certain temporary and permanent tax adjustments, while the 2022 period reflects an effective tax rate of 16% due to the

release of the Company’s remaining valuation allowance.

For the six months ended June 30, 2023, Hudson

reported revenues of $167.7 million, a decrease of 11% compared to revenues of $188.3 million in the first six months of 2022. Revenue

in the first half of 2023 declined primarily related to a decrease in selling prices for certain refrigerants during the period as well

as a slightly lower sales volume. Gross margin in the first six months of 2023 was 40%, compared to 55% in the first six months of 2022.

Hudson reported operating income of $50.3 million in the first six months of 2023, compared to operating income of $88.1 million in the

prior year period. The Company recorded net income of $34.7 million or $0.77 per basic and $0.73 per diluted share in the first six months

of 2023, compared to net income of $69.4 million or $1.55 per basic and $1.48 per diluted share in the same period of 2022.

Hudson reduced total outstanding debt from $46.8

million at December 31, 2022 to $32.5 million at June 30, 2023. Stockholders’ equity improved to $211.5 million at June 30, 2023

as compared to $174.9 million at December 31, 2022.

Brian F. Coleman, President and Chief

Executive Officer of Hudson Technologies commented, “As we move through the 2023 selling season,

our results, while solid, continue to face a difficult comparison to the extraordinarily strong revenue and margin performance of

the 2022 season. As many of you know, during the second quarter of last year we saw significant sales price increases without a

corresponding increase in inventory price, a trend that continued for most of 2022. As a result, certain refrigerants we purchased

for the current selling season were obtained at higher price points, and the gap between sales price and inventory price has

narrowed to more historical levels. Our first half profitability and strong cash flow have

enabled us to continue to strengthen our balance sheet by further reducing our total debt by $14.3 million.

“We view the cooling season as a nine-month

season given the varying weather and temperature patterns from year to year. While the warmer weather arrived a little later than normal

this year, the recent surge in temperature has provided opportunities for increased service calls and refrigerant sales. As we move through

the balance of the selling season we believe we are well positioned to meet the needs of our customer base and continue driving solid

profitability.

“Looking at the regulatory landscape, in

July, the EPA issued its final rule confirming the mandated 40% baseline reduction in HFCs beginning in 2024. We believe the current phasedown

schedule represents a tremendous opportunity for our business as the supply of virgin HFCs becomes limited and our reclaimed refrigerants

will be needed to meet demand from the large installed base of HFC equipment. Moving forward, we are seeing increased focus around proposed

regulations promoting the use of more environmentally friendly cooling technology and refrigerants. We believe Hudson is ideally positioned,

with our reclamation technology, conversion and servicing capabilities and our Emerald line of reclaimed refrigerants, to capitalize on

this shift to a more sustainable circular economy for refrigerants and the systems they support,” Mr. Coleman concluded.

Conference Call Information

The Company will host a conference call and webcast

to discuss the second quarter results today, August 2, 2023 at 5:00 P.M. Eastern Time.

To access the live

webcast, log onto the Hudson Technologies website at www.hudsontech.com, and click on “Investor Relations”.

To participate in the call by phone, dial (888)

506-0062 approximately five minutes prior to the scheduled start time. International callers please dial (973) 528-0011. Callers should

use entry code: 830286

A replay of the teleconference

will be available until September 1, 2023 and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331.

Callers should use conference ID: 48711.

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider

of innovative and sustainable refrigerant products and services to the Heating Ventilation Air Conditioning and Refrigeration industry.

For nearly three decades, we have demonstrated our commitment to our customers and the environment by becoming one of the first in the

United States and largest refrigerant reclaimers through multimillion dollar investments in the plants and advanced separation technology

required to recover a wide variety of refrigerants and restoring them to Air-Conditioning, Heating, and Refrigeration Institute standard

for reuse as certified EMERALD Refrigerants™. The Company's products and services are primarily used in commercial air conditioning,

industrial processing and refrigeration systems, and include refrigerant and industrial gas sales, refrigerant management services consisting

primarily of reclamation of refrigerants and RefrigerantSide® Services performed at a customer's site, consisting of system decontamination

to remove moisture, oils and other contaminants. The Company’s SmartEnergy OPS® service is a web-based real time continuous

monitoring service applicable to a facility’s refrigeration systems and other energy systems. The Company’s Chiller Chemistry®

and Chill Smart® services are also predictive and diagnostic service offerings. As a component of the Company’s products and

services, the Company also generates carbon offset projects.

Safe Harbor Statement under the Private Securities Litigation Reform

Act of 1995

Statements contained

herein which are not historical facts constitute forward-looking statements. Such forward-looking statements involve a number of known

and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be

materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, but are not limited to, changes in the laws and regulations affecting the industry, changes in the demand and price

for refrigerants (including unfavorable market conditions adversely affecting the demand for, and the price of, refrigerants), the Company's

ability to source refrigerants, regulatory and economic factors, seasonality, competition, litigation, the nature of supplier or customer

arrangements that become available to the Company in the future, adverse weather conditions, possible technological obsolescence of existing

products and services, possible reduction in the carrying value of long-lived assets, estimates of the useful life of its assets, potential

environmental liability, customer concentration, the ability to obtain financing, the ability to meet financial covenants under existing

credit facilities, any delays or interruptions in bringing products and services to market, the timely availability of any requisite permits

and authorizations from governmental entities and third parties as well as factors relating to doing business outside the United States,

including changes in the laws, regulations, policies, and political, financial and economic conditions, including inflation, interest

and currency exchange rates, of countries in which the Company may seek to conduct business, the Company’s ability to successfully

integrate any assets it acquires from third parties into its operations, the impact of the current COVID-19 pandemic, and other risks

detailed in the Company's 10-K for the year ended December 31, 2022 and other subsequent filings with the Securities and Exchange Commission. The

words "believe", "expect", "anticipate", "may", "plan", "should" and similar

expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date the statement was made.

Investor Relations Contact:

John Nesbett/Jennifer Belodeau

IMS Investor Relations

(203) 972-9200

jnesbett@institutionalms.com |

Company Contact:

Brian F. Coleman, President & CEO

Hudson Technologies,

Inc.

(845) 735-6000

bcoleman@hudsontech.com |

Hudson Technologies, Inc. and Subsidiaries

Consolidated Balance Sheets

(Amounts in thousands, except for share and per

share amounts)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 11,415 | | |

$ | 5,295 | |

| Trade accounts receivable – net | |

| 49,057 | | |

| 20,872 | |

| Inventories | |

| 134,444 | | |

| 145,377 | |

| Prepaid expenses and other current assets | |

| 10,377 | | |

| 5,289 | |

| Total current assets | |

| 205,293 | | |

| 176,833 | |

| | |

| | | |

| | |

| Property, plant and equipment, less accumulated depreciation | |

| 19,909 | | |

| 20,568 | |

| Goodwill | |

| 47,803 | | |

| 47,803 | |

| Intangible assets, less accumulated amortization | |

| 16,167 | | |

| 17,564 | |

| Right of use asset | |

| 7,497 | | |

| 7,339 | |

| Other assets | |

| 2,386 | | |

| 2,386 | |

| Total Assets | |

$ | 299,055 | | |

$ | 272,493 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Trade accounts payable | |

$ | 17,579 | | |

$ | 14,165 | |

| Accrued expenses and other current liabilities | |

| 28,334 | | |

| 27,908 | |

| Accrued payroll | |

| 3,423 | | |

| 6,303 | |

| Current maturities of long-term debt | |

| 4,250 | | |

| 4,250 | |

| Total current liabilities | |

| 53,586 | | |

| 52,626 | |

| Deferred tax liability | |

| 3,161 | | |

| 244 | |

| Long-term lease liabilities | |

| 5,773 | | |

| 5,763 | |

| Long-term debt, less current maturities, net of deferred financing costs | |

| 25,085 | | |

| 38,985 | |

| Total Liabilities | |

| 87,605 | | |

| 97,618 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, shares authorized 5,000,000: Series A Convertible preferred stock, $0.01 par value ($100 liquidation preference value); shares authorized 150,000; none issued or outstanding | |

| — | | |

| — | |

| Common stock, $0.01 par value; shares authorized 100,000,000; issued and outstanding 45,375,598 and 45,287,619, respectively | |

| 454 | | |

| 453 | |

| Additional paid-in capital | |

| 118,296 | | |

| 116,442 | |

| Retained earnings | |

| 92,700 | | |

| 57,980 | |

| Total Stockholders’ Equity | |

| 211,450 | | |

| 174,875 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 299,055 | | |

$ | 272,493 | |

Hudson Technologies, Inc. and Subsidiaries

Consolidated Statements of Income

(unaudited)

(Amounts in thousands, except for share and per

share amounts)

| | |

Three months | | |

Six months | |

| | |

ended June 30, | | |

ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 90,474 | | |

$ | 103,941 | | |

$ | 167,673 | | |

$ | 188,279 | |

| Cost of sales | |

| 53,847 | | |

| 46,444 | | |

| 100,716 | | |

| 84,962 | |

| Gross profit | |

| 36,627 | | |

| 57,497 | | |

| 66,957 | | |

| 103,317 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 8,273 | | |

| 7,014 | | |

| 15,250 | | |

| 13,838 | |

| Amortization | |

| 699 | | |

| 699 | | |

| 1,397 | | |

| 1,397 | |

| Total operating expenses | |

| 8,972 | | |

| 7,713 | | |

| 16,647 | | |

| 15,235 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 27,655 | | |

| 49,784 | | |

| 50,310 | | |

| 88,082 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense: | |

| | | |

| | | |

| | | |

| | |

| Net interest expense | |

| 1,899 | | |

| 2,623 | | |

| 3,748 | | |

| 9,928 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 25,756 | | |

| 47,161 | | |

| 46,562 | | |

| 78,154 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 6,567 | | |

| 7,351 | | |

| 11,842 | | |

| 8,789 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 19,189 | | |

$ | 39,810 | | |

$ | 34,720 | | |

$ | 69,365 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per common share – Basic | |

$ | 0.42 | | |

$ | 0.89 | | |

$ | 0.77 | | |

$ | 1.55 | |

| Net income per common share – Diluted | |

$ | 0.41 | | |

$ | 0.84 | | |

$ | 0.73 | | |

$ | 1.48 | |

| Weighted average number of shares outstanding – Basic | |

| 45,339,570 | | |

| 44,960,464 | | |

| 45,319,155 | | |

| 44,870,642 | |

| Weighted average number of shares outstanding – Diluted | |

| 47,297,419 | | |

| 47,152,257 | | |

| 47,305,196 | | |

| 46,974,441 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

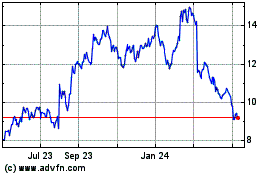

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024