UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K/A

AMENDMENT NO. 1

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 24, 2023

| |

|

Next Meats Holdings, Inc.

|

| (Exact name of registrant as specified in its charter) |

| |

|

|

|

|

| Nevada |

|

000-56167 |

|

85-4008709 |

| (state or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

| |

|

|

|

3F 1-16-13 Ebisu Minami Shibuya-ku,

Tokyo Japan |

|

150-0022 |

| (address of principal executive offices) |

|

(zip code) |

| |

| 81-90-6002-4978 |

| (registrant’s telephone number, including area code) |

| |

| N/A |

| (former name or former mailing address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Note: “We”,

“Us”, “The Issuer”, and or “The Company” refer to Next Meats Holdings, Inc., a Nevada Company.

Explanatory Statement

The Registrant is amending this Current Report (Amendment No. 1) originally filed with the Commission on July 24,

2023, in order to provide added disclosure, as requested by the Commission in a July 28, 2023 Comment Letter.

Item

4.02 Non-Reliance On Previously Issued Financial Statements Or A Related Audit Report Or Completed Interim Review.

On January 28, 2021, our majority shareholder at the time, Next Meats

Co., Ltd., (“the Company”) along with our Board of Directors, took action to ratify, affirm, and approve the issuance of

452,352,298 shares of the Company's restricted common stock to Next Meats Co., Ltd. The shares were originally accounted for

based on the fair market value closing price per share of common stock based on the open market at the time. However, the

Company has now determined that the subject valuation analysis was not credible resulting in the subject value conclusion to not be

meaningful given the issuance should have been accounted for as a common control transaction. As such, it is the Company’s

belief that the open market value of its common shares did not, at that time, reflect the true value of the shares.

The share valuation has been adjusted and is, in the Company’s belief,

now corrected and accounted for as a common control transaction, with our now wholly owned subsidiary, at a valuation of $0. The

$452,352 increase in the resulting par value of common shares on the Company's balance sheet has been offset by a corresponding decrease

in additional paid in capital in the equity portion of the Company's balance sheet.

The Company currently estimates that the adjustments will have the effect of decreasing the net loss by approximately $5.8 billion as

a result of a non-cash expense, and decreasing additional paid-in capital by the same amount, starting at the three months ended January

31, 2021. The adjustments are expected to impact the Company’s consolidated financial statements for subsequent reporting periods

through year-end April 30, 2023. The adjustments are not expected to impact on the Company’s liquidity or capital resources or compliance

with any material agreements.

Given the above issuance has now been reclassified as a common control

transaction, the Company intends to file amendments to the following reports to rectify the historical error regarding the aforementioned

valuation of shares: the Form 10-Q for the period ended January 31, 2021, the Form 10-K for the year ended April 30, 2021, the Form

10-Q for the period ended July 31, 2021, the Form 10-Q for the period ended October 31, 2021, the Form 10-Q for the period ended January

31, 2022, the Form 10-K for the year ended April 30, 2022, the Form 10-Q for the period ended July 31, 2022, the Form 10-Q for the period

ended October 31, 2022, and the Form 10-Q for the period ended January 31, 2023.

Our forthcoming Form 10-K for the

year ended April 30, 2023, will also include the above share issuance adjusted and reclassified as described above.

The above reclassification of the

share issuance as a common control transaction has been discussed with BF Borgers CPA PC, our current independent registered public accountant,

who has agreed with the reclassification of the share issuance described herein.

Cautionary Statement Regarding

Forward-Looking Information

This current report on Form 8-K/A

contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company

intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,”

“anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements are subject

to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated

by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item

1A in the Company’s Annual Report on Form 10-K, which is expressly incorporated herein by reference, and other factors as may periodically

be described in the Company’s filings with the SEC.

Item 9.01 Financial Statements and Exhibits.

None.

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Next Meats Holdings, Inc.

Dated: August 1, 2023

By: /s/ Koichi Ishizuka

Koichi Ishizuka,

Chief Executive Officer

-3-

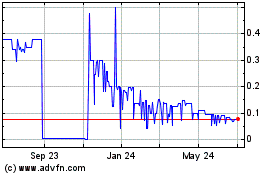

Next Meats (PK) (USOTC:NXMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

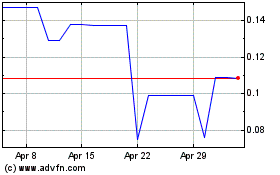

Next Meats (PK) (USOTC:NXMH)

Historical Stock Chart

From Apr 2023 to Apr 2024