As

filed with the Securities and Exchange Commission on July 28, 2023

Registration

No. 333-273233

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

| |

|

|

| |

|

|

Pre-Effective

Amendment No. 2 to

FORM S-1 |

| REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| |

|

|

| |

|

|

ADAMIS

PHARMACEUTICALS CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

82-0429727 |

(State or other jurisdiction

of incorporation or organization) |

|

(Primary Standard

Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

11682 El Camino Real, Suite 300

San Diego, CA 92130

(858)-997-2400

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ebrahim

Versi, Chief Executive Officer

Adamis

Pharmaceuticals Corporation

11682

El Camino Real, Suite 300

San

Diego, CA 92130

(858)-997-2400

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

|

C. Kevin Kelso, Esq.

Weintraub Tobin

400 Capitol Mall, 11th Floor

Sacramento, CA 95814

(916) 558-6000 |

|

Ivan Blumenthal, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo P.C.

919 Third Avenue

New York, NY 10022

(212) 935-3000 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY NOTE

Adamis Pharmaceuticals Corporation

is filing this Amendment No. 2 (this “Amendment”) to its Registration Statement on Form S-1 (Registration Statement No. 333-273233)

(the “Registration Statement”) as an exhibit-only filing, solely to file a new Exhibit 5.1 opinion. Accordingly, this Amendment

consists only of the facing page, this explanatory note, Item 16 of Part II of the Registration Statement, the signature page to the Registration

Statement, and the referenced exhibits. The prospectus and the balance of the Registration Statement are unchanged hereby and have been

omitted.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 16: | Exhibits, Financial Statement Schedules |

See the Exhibit Index attached to this Registration

Statement, which is incorporated by reference herein.

Schedules not listed above have been omitted

because the information required to be set forth therein is not applicable or is shown in the financial statements or notes thereto.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of San Diego, State of California, on July 27, 2023.

| |

ADAMIS PHARMACEUTICALS CORPORATION |

| |

|

|

| |

By: |

/s/ EBRAHIM VERSI, M.D., PH.D. |

| |

|

Ebrahim Versi, M.D., Ph.D

|

| |

|

Chief Executive Officer and Director |

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates

indicated.

| Name |

|

Title |

|

Date |

| Principal Executive Officer: |

|

|

|

|

| |

|

|

|

|

| /s/ EBRAHIM VERSI, M.D., PH.D. |

|

Chief Executive Officer and Director

|

|

July 28, 2023 |

| Ebrahim Versi, M.D., Ph.D. |

|

(Principal Executive Officer)

|

|

|

| |

|

|

|

|

| Principal Financial Officer and Principal Accounting Officer: |

|

|

|

|

| |

|

|

|

|

| /s/ DAVID J. MARGUGLIO |

|

Chief Financial Officer

(Principal Financial Officer) |

|

July 28, 2023 |

| David J. Marguglio |

|

|

|

| |

|

|

|

|

| Directors: |

|

|

|

|

| |

|

|

|

|

| /s/ JANNINE VERSI * |

|

Director |

|

July 28, 2023 |

| Jannine Versi |

|

|

|

|

| |

|

|

|

|

| /s/ HOWARD C. BIRNDORF * |

|

Director |

|

July 28, 2023 |

Howard C. Birndorf

|

|

|

|

|

| /s/ MEERA J. DESAI * |

|

Director |

|

July 28, 2023 |

Meera J. Desai

|

|

|

|

|

| /s/ VICKIE S. REED * |

|

Director |

|

July 28, 2023 |

| Vickie S. Reed |

|

|

|

|

| |

|

|

|

|

| * By: /s/ David J. Marguglio, Attorney-in-fact |

|

|

|

EXHIBIT INDEX

| |

|

|

|

|

Incorporated by Reference |

Exhibit

Number |

|

Exhibit Description |

|

Filed

Herewith |

|

Form/

File No. |

|

Date |

| 1.1 |

|

Form of Placement Agent Agreement ***** |

|

|

|

|

|

|

| 2.1 |

|

Agreement and Plan of Share Exchange dated as of October 7, 2004, by and between the Company and Biosyn, Inc. |

|

|

|

8-K |

|

10/26/04 |

| 2.2 |

|

Agreement and Plan of Merger by and among the Company, US Compounding, Inc., Ursula Merger Sub Corp. and Eddie Glover dated as of March 28, 2016 |

|

|

|

8-K |

|

03/29/16 |

| 2.3 |

|

Agreement and Plan of Merger and Reorganization, dated as of February 24, 2023, by and among Adamis Pharmaceuticals, Inc., Adamis Merger Sub, Inc., and DMK Pharmaceuticals Corporation.+ |

|

|

|

8-K |

|

02/27/23 |

| 3.1 |

|

Restated Certificate of Incorporation of the Registrant |

|

|

|

S-8 |

|

03/17/14 |

| 3.2 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock dated August 19, 2014 |

|

|

|

8-K |

|

08/20//14 |

| 3.3 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series A-1 Convertible Preferred Stock |

|

|

|

8-K |

|

01/26/16 |

| 3.4 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series A-2 Convertible Preferred Stock |

|

|

|

8-K |

|

07/12/16 |

| 3.5 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series B Convertible Preferred Stock |

|

|

|

8-K |

|

06/12/20 |

| 3.6 |

|

Certificate of Amendment to Restated Certificate of Incorporation |

|

|

|

8-K |

|

09/08/20 |

| 3.7 |

|

Certificate of Designation of Preferences, Rights, and Limitations of Series C Convertible Preferred Stock |

|

|

|

8-K |

|

07/06/22 |

| 3.8 |

|

Certificate of Designation of Preferences, Rights, and Limitations of Series E Convertible Preferred Stock |

|

|

|

8-K |

|

05/26/23 |

| 4.1 |

|

Amended and Restated Bylaws of the Company |

|

|

|

8-K |

|

06/22/20 |

| 4.2 |

|

Specimen stock certificate for common stock |

|

|

|

8-K |

|

04/03/09 |

| 4.3 |

|

Form of Common Stock Purchase Warrant |

|

|

|

8-K |

|

08/01/19 |

| 4.4 |

|

Description of the Registrant’s Capital Stock |

|

|

|

10-K |

|

04/15/21 |

| 4.5 |

|

Form of Common Stock Purchase Warrant |

|

|

|

8-K |

|

02/21/20 |

| 4.6 |

|

Amended and Restated Bylaws of the Company |

|

|

|

8-K |

|

06/17/22 |

| 4.7 |

|

Form of Common Stock Purchase Warrant |

|

|

|

8-K |

|

07/06/22 |

| 4.8 |

|

Form of Common Stock Purchase Warrant |

|

|

|

8-K |

|

03/14/23 |

| 4.9 |

|

Form of Prefunded Common Stock Purchase Warrant |

|

|

|

8-K |

|

03/14/23 |

| 4.10 |

|

Common Stock Purchase Warrant dated March 16, 2023 |

|

|

|

10-Q |

|

05/15/23 |

| 4.11 |

|

Prefunded Common Stock Purchase Warrant |

|

|

|

10-Q |

|

05/15/23 |

| 4.12 |

|

Form of Common Stock Warrant ***** |

|

|

|

|

|

|

| 4.13 |

|

Form of Pre-Funded Warrant ***** |

|

|

|

|

|

|

| 4.14 |

|

Form of Warrant Agency Agreement

***** |

|

|

|

|

|

|

| 4.15 |

|

Form of Securities Purchase Agreement

***** |

|

|

|

|

|

|

| 5.1 |

|

Opinion of Weintraub Tobin Chediak Coleman Grodin, a Law Corporation |

|

X |

|

|

|

|

| 10.1 |

|

2009 Equity Incentive Plan* |

|

|

|

S-8 |

|

07/18/18 |

| 10.2 |

|

Form of Stock Option Agreement for option awards* |

|

|

|

8-K |

|

09/16/11 |

| 10.3 |

|

Form of Option Agreement for Non-Employee Directors* |

|

|

|

8-K |

|

01/13/11 |

| 10.4 |

|

Form of Stock Appreciation Rights Agreement for Non-employee Directors |

|

|

|

10-Q |

|

11/12/19 |

| 10.5 |

|

Form of Restricted Stock Unit Agreement* |

|

|

|

10-K |

|

03/30/17 |

| 10.6 |

|

Form of Indemnity Agreement with directors and executive officers* |

|

|

|

8-K |

|

01/13/11 |

| 10.7 |

|

Funding Agreement dated October 12, 1992, by and between Ben Franklin Technology Center of Southeastern Pennsylvania and Biosyn, Inc. |

|

|

|

S-4/A 333-155322 |

|

01/12/09 |

| 10.8 |

|

Executive Employment Agreement between the Company and Dennis J. Carlo dated December 31, 2015* |

|

|

|

10-K |

|

03/23/16 |

| 10.9 |

|

Executive Employment Agreement between the Company and David J. Marguglio dated December 31, 2015* |

|

|

|

10-K |

|

03/23/16 |

| |

|

|

|

|

Incorporated by Reference |

Exhibit

Number |

|

Exhibit Description |

|

Filed

Herewith |

|

Form/

File No. |

|

Date |

| 10.10 |

|

Executive Employment Agreement between the Company and Robert O. Hopkins dated December 31, 2015* |

|

|

|

10-K |

|

03/23/16 |

| 10.11 |

|

Exclusive License and Asset Purchase Agreement dated as of August 1, 2013, by and among the Registrant, 3M Corp. and 3M Innovative Properties Company |

|

|

|

8-K |

|

08/06/13 |

| 10.12 |

|

Lease Agreement dated April 1, 2014, between the Registrant and Pacific North Court Holdings, L.P. |

|

|

|

10-KT |

|

03/26/15 |

| 10.13 |

|

First Amendment to Lease between the Registrant and Pacific North Court Holdings, L.P. |

|

|

|

10-K |

|

04/15/21 |

| 10.14 |

|

Registration Rights Agreement dated August 19, 2014, by and between the Company and Sio Partners LP, Sio Partners QP LP and Sio Partners Offshores, Ltd. |

|

|

|

8-K |

|

08/20/14 |

| 10.15 |

|

Purchase Agreement dated January 26, 2016 |

|

|

|

8-K |

|

01/26/16 |

| 10.16 |

|

Amended and Restated Registration Rights Agreement dated January 26, 2016 |

|

|

|

8-K |

|

01/26/16 |

| 10.17 |

|

Purchase Agreement dated July 11, 2016 |

|

|

|

8-K |

|

07/12/16 |

| 10.18 |

|

Registration Rights Agreement dated July 11, 2016 |

|

|

|

8-K |

|

07/12/16 |

| 10.19 |

|

Compensation Committee Authorization Regarding Discretionary Payments Ex |

|

|

|

8-K |

|

02/27/18 |

| 10.20 |

|

Offer Letter between the Company and David C. Benedicto */*** |

|

|

|

10-K |

|

03/31/22 |

| 10.21 |

|

Executive Employment Agreement between the Company and Ronald B. Moss, M.D., dated as of February 28, 2017.* |

|

|

|

10-K |

|

03/30/17 |

| 10.22 |

|

Underwriting Agreement dated August 2, 2018 |

|

|

|

8-K |

|

08/02/18 |

| 10.23 |

|

Distribution and Commercialization Agreement between the company and Sandoz, Inc.** |

|

|

|

10-Q |

|

11/09/18 |

| 10.24 |

|

Placement Agency Agreement between Maxim Group LLC and the Company dated February 20, 2020 |

|

|

|

8-K |

|

02/21/20 |

| 10.25 |

|

Form of Securities Purchase Agreement dated February 21, 2020 |

|

|

|

8-K |

|

02/21/20 |

| 10.26 |

|

Underwriting Agreement dated January 29, 2021 |

|

|

|

8-K |

|

01/29/21 |

| 10.27 |

|

Underwriting Agreement dated September 18, 2020 |

|

|

|

8-K |

|

09/18/20 |

| 10.28 |

|

August 2020 Amendment to Loan Amendment and Assumption Agreement |

|

|

|

8-K |

|

09/15/20 |

| 10.29 |

|

Amended Promissory Note |

|

|

|

8-K |

|

09/15/20 |

| 10.30 |

|

2020 Equity Incentive Plan* |

|

|

|

8-K |

|

08/24/20 |

| 10.31 |

|

Adamis Pharmaceuticals Corporation Bonus Plan* |

|

|

|

8-K |

|

06/22/20 |

| 10.32 |

|

Termination and Transfer Agreement between Sandoz Inc. and the Company ***+ |

|

|

|

10-Q |

|

08/17/20 |

| 10.33 |

|

Transition Service Agreement***+ |

|

|

|

10-Q |

|

08/17/20 |

| 10.34 |

|

License Agreement between the Company and Matrix Biomed, Inc.***+ |

|

|

|

10-Q |

|

08/17/20 |

| 10.35 |

|

Distribution and Commercialization Agreement between the Company and USWM, LLC*** |

|

|

|

10-Q |

|

08/17/20 |

| 10.36 |

|

Lease Agreement between the Company and Oil States Energy Services, LLC, as amended+ |

|

|

|

10-K |

|

04/15/21 |

| 10.37 |

|

Promissory Note dated March 15, 2021 |

|

|

|

10-K |

|

04/15/21 |

| 10.38 |

|

Underwriting Agreement |

|

|

|

8-K |

|

01/29/21 |

| 10.39 |

|

Asset Purchase Agreement effective as of July 30, 2021, by and among the Registrant, US Compounding, Inc. and Fagron Compounding Services, LLC.+*** |

|

|

|

8-K |

|

08/05/21 |

| 10.40 |

|

Supply Agreement Addendum by and among the Registrant, US Compounding Inc. and Fagron Compounding, LLC*** |

|

|

|

8-K |

|

08/05/21 |

| 10.41 |

|

Settlement Agreement between the Company, US Compounding Inc., Nephron Pharmaceuticals Corporation, Nephron S.C., Inc., Nephron Sterile Compounding Center, LLC and certain other parties.+*** |

|

|

|

10-Q |

|

11/22/21 |

| 10.42 |

|

First Amendment to Exclusive License Agreement dated November 9, 2021 between the Company and Matrix Biomed, Inc.*** |

|

|

|

10-K |

|

03/31/22 |

| |

|

|

|

|

Incorporated by Reference |

Exhibit

Number |

|

Exhibit Description |

|

Filed

Herewith |

|

Form/

File No. |

|

Date |

| 10.43 |

|

Executive Employment Agreement between the Company and David J. Marguglio dated as of May 18, 2022 |

|

|

|

8-K |

|

05/19/22 |

| 10.44 |

|

Executive Employment Agreement between the Company and David C. Benedicto dated as of June 22, 2022 |

|

|

|

8-K |

|

06/24/22 |

| 10.45 |

|

Securities Purchase Agreement dated July 5, 2022, between the Company and the parties thereto. |

|

|

|

8-K |

|

07/06/22 |

| 10.46 |

|

Registration Rights Agreement dated July 5, 2022, between the Company and the parties thereto. |

|

|

|

8-K |

|

07/06/22 |

| 10.47 |

|

Forms of Securities Purchase Agreement |

|

|

|

8-K |

|

03/14/23 |

| 10.48 |

|

Form of Support Agreement, dated February 24, 2023, by and among Adamis Pharmaceuticals, Inc., Aardvark Merger Sub, Inc., DMK Pharmaceuticals Corporation, and certain stockholders of DMK Pharmaceuticals Corporation |

|

|

|

8-K |

|

02/27/23 |

| 10.49 |

|

DMK 2016 Stock Plan |

|

|

|

8-K |

|

05/26/2023 |

| 10.50 |

|

Securities Purchase Agreement |

|

|

|

10-Q |

|

05/15/23 |

| 10.51 |

|

Support Agreement |

|

|

|

10-Q |

|

05/15/23 |

| 10.52 |

|

Form of Indemnity Agreement* |

|

|

|

10-Q |

|

05/15/23 |

| 10.53 |

|

Offer Letter dated May 24, 2023 |

|

|

|

8-K |

|

05/26/23 |

| 10.54 |

|

Purchase and Sale Agreement +/**** |

|

|

|

8-K |

|

07/24/23 |

| 10.55 |

|

Sales Agreement. + |

|

|

|

8-K |

|

07/24/23 |

| 21.1 |

|

Subsidiaries of the Registrant ***** |

|

|

|

|

|

|

| 23.1 |

|

Consent of BDO USA, P.A. Independent Registered Public Accounting Firm ***** |

|

|

|

|

|

|

| 23.2 |

|

Consent of BF Borger CPA PC, Independent Registered Public Accounting Firm ***** |

|

|

|

|

|

|

| 23.3 |

|

Consent of Weintraub Tobin Chediak Coleman Grodin, A Law Corporation (included in Exhibit 5.1) (1) |

|

|

|

|

|

|

| 24.1 |

|

Power of Attorney (See signature page) ***** |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| 107 |

|

Filing Fee Table ***** |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| + |

Non-material schedules and exhibits have been

omitted pursuant to Item 601(a)(5) of Regulation S-K. The Registrant hereby undertakes to furnish supplemental copies of any

of the omitted schedules and exhibits upon request by SEC. |

| * |

Represents a compensatory plan or arrangement. |

| ** |

We have received confidential treatment for certain portions of this exhibit. |

| *** |

Certain marked information (indicated by “[***]”)

has been omitted from this exhibit as the registrant has determined it is both not material and is the type that the registrant

customarily and actually treats as private or confidential. |

| **** |

Certain marked information has been omitted

from this exhibit because it is both not material and would be competitively harmful if publicly disclosed.

|

| ***** |

Previously

filed.

|

Adamis Pharmaceuticals Corporation S-1/A

Exhibit 5.1

Weintraub Tobin Chediak Coleman Grodin

400 Capitol Mall, Suite 1100

Sacramento, CA 95814

July 28, 2023

Adamis Pharmaceuticals Corporation

11682 El Camino Real, Suite 300

San Diego, CA 92103

Ladies and Gentlemen:

We have acted as counsel

to Adamis Pharmaceuticals Corporation, a Delaware corporation (the “Company”), in connection with the registration statement

on Form S-1 (as amended, the “Registration Statement”) filed with the Securities and Exchange Commission (the “SEC”

or the “Commission”), relating to the registration under the Securities Act of 1933, as amended (the “Act”), by

the Company with respect to the offer and sale of: (i) up to 5,263,158 units, each unit consisting of one share (the “Shares”)

of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) and one warrant to purchase one share

of Common Stock (the “Common Warrants” and such shares of Common Stock as are issuable upon the exercise of the Warrants,

the “Common Warrant Shares”), and (ii) up to 5,263,158 pre-funded units, each pre-funded unit consisting of one pre-funded

warrant (the “Pre-Funded Warrants” and together with the Common Warrants, the “Warrants”) to purchase one share

of Common Stock (the “Pre-Funded Warrant Shares”) and one Common Warrant (the Common Warrant Shares and Pre-Funded Warrant

Shares referred to as the “Warrant Shares,” and together with the Shares, Pre-Funded Warrants and Common Warrants, the “Securities”).

The Securities are to be sold by the Company pursuant to a Securities Purchase Agreement (the “Securities Purchase Agreement”)

to be entered into by and among the Company and the purchaser parties thereto. As described in the prospectus forming a part of the Registration

Statement (the “Prospectus”), for each pre-funded unit the Company sells, the number of Shares offered will be decreased on

a one-for-one basis.

This opinion is being furnished in connection with

the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act, and no opinion is expressed herein as to any matter pertaining

to the contents of the Registration Statement or related Prospectus, other than as expressly stated herein with respect to the issue of

the Securities. All capitalized terms used herein and not otherwise defined shall have the respective meanings given to them in the Registration

Statement.

For purposes of the opinions we express below, we

have examined the originals or copies, certified or otherwise identified, of (i) the Registration Statement and Prospectus, (ii) the Company’s

Restated Certificate of Incorporation as currently in effect, (iii) the Company’s Bylaws as currently in effect, (iv) the form of

Securities Purchase Agreement filed as an exhibit to the Registration Statement, (v) the form of Warrant Agency Agreement filed as an

exhibit to the Registration Statement, (vi) the form of Common Warrant filed as an exhibit to the Registration Statement, (vii) the form

of Pre-Funded Warrant filed as an exhibit to the Registration Statement, (vii) the form of Placement Agency Agreement filed as an exhibit

to the Registration Statement, and (viii) such other instruments and documents as we considered appropriate for purposes of the opinions

hereafter expressed.

In connection with rendering the opinions set forth

below, we have assumed without verification (i) the authenticity of all documents submitted to us as originals, (ii) the conformity to

the originals of all documents submitted as certified, photostatic or electronic copies and the authenticity of the originals thereof,

(iii) the legal capacity of natural persons, (iv) the genuineness of signatures not witnessed by us, including electronic signatures,

(v) the due authorization, execution and delivery of all documents by all parties, other than the Company, and the validity, binding

effect and enforceability thereof, (vi) the truth, accuracy and completeness of the information, representations and warranties contained

in the records, documents, instruments and certificates we have reviewed, and (vii) the accuracy, completeness and authenticity of certificates

of public officials.

With respect to the Warrant Shares, we express no

opinion to the extent that, notwithstanding the Company’s current reservation of shares of Common Stock, future issuances of securities

of the Company and/or anti-dilution adjustments to outstanding securities of the Company may cause the Warrants to be exercisable for

more shares of Common Stock than the number that then remain authorized but unissued. Further, we have assumed the exercise prices of

the Warrants will not be or adjusted to be an amount below the par value per share of the shares of Common Stock.

As to factual matters, we have relied upon the documents

furnished to us by the Company, the certificates and other comparable documents of officers and representatives of the Company, statements

made to us in discussions with the Company’s management and certificates of public officials, without independent verification of

their accuracy.

We are opining herein as to the General Corporation

Law of the State of Delaware and we express no opinion with respect to any other laws. We are not opining as to the applicability thereto,

or the effect thereon, of the laws of any other jurisdiction or, in the case of Delaware, any other laws, or as to matters of municipal

law or the laws of any local agencies within any states (including “blue sky” or other state securities laws).

With regard to our opinion concerning the Warrants

constituting valid and binding obligations of the Company:

(i) Our opinion is subject to, and may be limited

by, (a) applicable bankruptcy, reorganization, insolvency, moratorium, fraudulent conveyance, debtor and creditor, and similar laws which

relate to or affect creditors’ rights generally, (b) general principles of equity (including, without limitation, concepts of materiality,

reasonableness, good faith and fair dealing) regardless of whether considered in a proceeding in equity or at law, and (c) the invalidity

under certain circumstances under law or court decisions of provisions providing for the indemnification of or contribution to a party

with respect to a liability where such indemnification or contribution is contrary to public policy.

(ii) Our opinion is subject to the qualification

that the availability of specific performance, an injunction or other equitable remedies is subject to the discretion of the court before

which the request is brought.

(iii) We express no opinion as to any provision

of the Warrants that: (a) provides for liquidated damages, buy-in damages, monetary penalties, prepayment or make-whole payments or other

economic remedies to the extent such provisions may constitute unlawful penalties, (b) waivers by the Company of any statutory or constitutional

rights or remedies, (c) restricts non-written modifications and waivers, (d) relates to exclusivity, election or accumulation of rights

or remedies, or (e) provides that provisions of the Securities Purchase Agreement and the Warrants are severable to the extent an essential

part of the agreed exchange is determined to be invalid and unenforceable. In addition, we draw your attention to the fact that, under

certain circumstances, the enforceability of terms to the effect that provisions may not be waived or modified except in writing may be

limited.

(iv) We express no opinion as to compliance with

any federal securities laws.

Based on the foregoing and in reliance thereon,

and subject to the limitations, qualifications, assumptions, exceptions and other matters set forth herein, we are of the opinion that:

(1) The Shares to be issued and sold

by the Company have been duly authorized for issuance and, following the execution and delivery of the Securities Purchase Agreement and

when the Shares are issued and paid for in accordance with the terms and conditions of the Registration Statement and Securities Purchase

Agreement, the Shares will be validly issued, fully paid and non-assessable shares of Common Stock.

(2) The Warrants to be issued and sold

by the Company have been duly authorized for issuance, and, when issued and paid for in accordance with the terms and conditions of the

Registration Statement and Securities Purchase Agreement, will constitute valid and binding obligations of the Company, enforceable against

the Company in accordance with their terms.

(3) The Warrant Shares to be issued

by the Company upon exercise of the Warrants have been duly validly authorized and reserved for issuance and, when issued in accordance

with the terms of the Registration Statement, Warrants and the Securities Purchase Agreement, will be validly issued, fully paid and non-assessable.

Our opinion is as of the date hereof and we have

no responsibility to update this opinion for events and circumstances occurring after the date hereof or as to facts relating to prior

events that are subsequently brought to our attention, and we disavow any undertaking to advise you of any changes in law.

This opinion has been prepared solely for your benefit

in connection with the Registration Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable

provisions of the Securities Act. We hereby consent to the filing of this opinion letter as Exhibit 5 to the Registration Statement and

to the use of our name under the caption “Legal Matters” in the Registration Statement and in the Prospectus forming a part

thereof and any supplement thereto. In giving this consent, we do not thereby admit that we are within the category of persons whose consent

is required under Section 7 of the Act or the rules and regulations of the SEC promulgated thereunder.

Very truly yours,

/s/ Weintraub Tobin Chediak Coleman Grodin Law Corporation

WEINTRAUB TOBIN CHEDIAK COLEMAN

GRODIN LAW CORPORATION

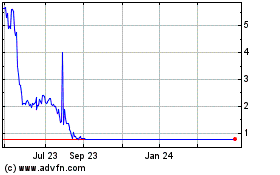

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024