As

filed with the Securities and Exchange Commission on July 26, 2023

Registration

No. 333-2732333

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

| |

|

|

| |

|

|

Pre-Effective

Amendment No. 1 to

FORM S-1 |

| REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| |

|

|

| |

|

|

ADAMIS

PHARMACEUTICALS CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

82-0429727 |

(State or other jurisdiction

of incorporation or organization) |

|

(Primary Standard

Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

11682 El Camino Real, Suite 300

San Diego, CA 92130

(858)-997-2400

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ebrahim

Versi, Chief Executive Officer

Adamis

Pharmaceuticals Corporation

11682

El Camino Real, Suite 300

San

Diego, CA 92130

(858)-997-2400

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

|

C. Kevin Kelso, Esq.

Weintraub Tobin

400 Capitol Mall, 11th Floor

Sacramento, CA 95814

(916) 558-6000 |

|

Ivan Blumenthal, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo P.C.

919 Third Avenue

New York, NY 10022

(212) 935-3000 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED July 26, 2023

PRELIMINARY

PROSPECTUS

Up to 5,263,158 Units consisting

of

5,263,158 Shares of Common

Stock or 5,263,158 Pre-Funded Warrants to purchase 5,263,158 Shares of Common Stock and

5,263,158 Warrants to purchase

up to 5,263,158 Shares of Common Stock

Up to 5,263,158 Shares of Common Stock Underlying

the Pre-Funded Warrants

Up to 5,263,158 Shares of Common Stock Underlying

the Common Warrants

We are offering on a reasonable best efforts basis up to 5,263,158 units,

each unit consisting of one share of common stock and one common warrant to purchase one share of common stock, at an assumed offering

price of $1.90 per unit, which is equal to the closing price of our common stock on the Nasdaq Capital Market on July 21, 2023. The common

warrants included in the units will have an exercise price of $ per share, will be exercisable immediately and will expire five (5) years

from the date of issuance. We are also offering the shares of our common stock that are issuable from time to time upon the exercise of

the common warrants included in the units.

We are also offering to certain

purchasers whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and certain

related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately

following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded units, each pre-funded

unit consisting of one pre-funded warrant to purchase one share of common stock and one common warrant to purchase one share of common

stock, in lieu of units that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election

of the purchaser, 9.99%) of our outstanding common stock. The purchase price of each pre-funded unit will be equal to the price per unit

being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant included in the pre-funded

units will be $0.0001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of

the pre-funded warrants are exercised in full. Each common warrant included in the pre-funded units has an exercise price of $_________

per share, will be exercisable immediately and will expire five (5) years from the date of issuance. For each pre-funded unit we sell,

the number of units (and shares of common stock) we are offering will be decreased on a one-for-one basis. This offering also relates

to the shares of common stock issuable upon the exercise of the pre-funded warrants and the common warrants included in the pre-funded

units.

The shares of common stock or

pre-funded warrants, as the case may be, and the common warrants included in the units or the pre-funded units, can only be purchased

together in this offering, but the securities contained in the units or pre-funded units will be issued separately and will be immediately

separable upon issuance.

The securities will be

offered at a fixed price and are expected to be issued in a single closing. The offering will terminate on August 31, 2023, unless completed

sooner or unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date; however, notwithstanding

the foregoing, the shares of our common stock underlying the pre-funded warrants and the common warrants will be offered on a continuous

basis pursuant to Rule 415 under the Securities Act of 1933, as amended. We expect this offering to be completed not later than two business

days following the commencement of sales in this offering (after the effective date of the registration statement of which this prospectus

forms a part) and we will deliver all securities to be issued in connection with this offering delivery versus payment/receipt versus

payment upon receipt of investor funds received by us. Accordingly, neither we nor the placement agent have made any arrangements to

place investor funds in an escrow account or trust account since the placement agent will not receive investor funds in connection with

the sale of the securities offered hereunder.

Effective May 22, 2023, we

effected a 1-for-70 reverse stock split, or the Reverse Stock Split, of our outstanding shares of common stock. Unless specifically provided

otherwise herein, the share and per share information that follows in this prospectus, other than in the historical financial statements

and related notes included elsewhere or incorporated by reference in this prospectus and other information and documents incorporated

by reference into this prospectus, which have not been revised or restated to reflect the Reverse Stock Split, assumes the effect of

the Reverse Stock Split.

We have engaged Maxim Group

LLC, or the placement agent or Maxim, to act as our exclusive placement agent in connection with this offering. The placement agent has

agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is

not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale

of any specific number of securities or dollar amount. We have agreed to pay to the placement agent the placement agent fees set forth

in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to

be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering.

We may sell fewer than all of the units and pre-funded units offered hereby, which may significantly reduce the amount of proceeds received

by us. Because there is no escrow account and no minimum number of securities or amount of proceeds, investors could be in a position

where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the

proceeds as described in this prospectus. See “Risk Factors” on page 14 of this prospectus. We will bear all costs associated

with the offering. See “Plan of Distribution” on page 42 of this prospectus for more information regarding these arrangements.

Our common stock is presently listed on The

Nasdaq Capital Market under the symbol “ADMP.” On July 21, 2023, the closing price of our common stock as reported on The

Nasdaq Capital Market was $1.90 per share. The public offering price per unit or pre-funded unit, as the case may be, will be determined

through negotiation among us, the placement agent and the investors in the offering based on market conditions at the time of pricing,

and may be at a discount to the current market price of our common stock. Therefore, the assumed public offering price used throughout

this prospectus may not be indicative of the final offering price. There is no established trading market for the pre-funded warrants

or the common warrants, and we do not expect a market to develop. We do not intend to apply for a listing of the units, the pre-funded

units, the pre-funded warrants or the common warrants on any securities exchange or other nationally recognized trading system. Without

an active trading market, the liquidity of the pre-funded warrants and the common warrants will be limited.

We

are a “smaller reporting company” under applicable federal securities laws and are subject to reduced public company reporting

requirements. Investing in our securities involves risks. See “Risk Factors” beginning on page 14 of this prospectus and elsewhere

in this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

| |

|

Per

Unit(1) |

|

|

Total |

|

| Public offering

price |

|

$ |

|

|

|

$ |

|

|

| Placement agent

fees(2) |

|

$ |

|

|

|

$ |

|

|

| Proceeds

to us (before expenses) |

|

$ |

|

|

|

$ |

|

|

| |

(1) |

Assumes

that all units consist of one share of common stock and one common warrant. |

| |

(2) |

We have agreed to

pay the placement agent a cash fee equal to 7.0% of the aggregate gross proceeds raised in this offering, and to reimburse

the placement agent for certain of its offering-related expenses. See “Plan of Distribution” for a description

of the compensation to be received by the placement agent. |

Delivery

of the securities offered hereby is expected to be made on or about ,

2023, subject to satisfaction of customary closing conditions.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

MAXIM

GROUP LLC

The

date of this prospectus is __________, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference

without charge by following the instructions under “Where You Can Find More Information.” You should carefully read

this prospectus as well as additional information described under “Incorporation of Certain Information by Reference,”

before deciding to invest in our securities.

We

have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than

those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred

you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may

give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current

only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results

of operations and prospects may have changed since that date. To the extent there is a conflict between the information contained

in this prospectus, on the one hand, and the information contained in any document filed with the Securities and Exchange Commission

before the date of this prospectus and incorporated by reference herein, on the other hand, you should rely on the information

in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document

incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the

earlier statement.

Unless

otherwise indicated, all information contained or incorporated by reference in this prospectus concerning our industry in general

or any portion thereof, including information regarding our general expectations and market opportunity, is based on management’s

estimates using internal data, data from industry related publications, consumer research and marketing studies or other externally

obtained data.

For

investors outside the United States: We have not, and the placement agent has not, done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about,

and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United

States.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the

registration statement of which this prospectus is a part and in any document that is incorporated by reference herein were made

solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the

parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants

should not be relied on as accurately representing the current state of our affairs.

This

prospectus and the information incorporated by reference into this prospectus contain references to our trademarks and to trademarks

belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus and the information

incorporated by reference into this prospectus, including logos, artwork, and other visual displays, may appear without the ®

or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under

applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our

use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship

of us by, any other company.

The

Adamis Pharmaceuticals logo and other trademarks or service marks of Adamis Pharmaceuticals Corporation appearing in this prospectus

are the property of Adamis Pharmaceuticals Corporation. All other brand names or trademarks appearing in this prospectus are the

property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus may be referred

to without the ® or TM symbols, but such references should not be construed as any indicator that their respective owners

will not assert their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks

to imply a relationship with, or endorsement or sponsorship of us by, any other company.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

The

statements contained in this prospectus, and the documents incorporated by reference in this prospectus, include forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that relate to future events

or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual

results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “believe,”

“expect,” “anticipate,” “estimate,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “targets,” “likely,” “will,”

“would,” “could,” “should,” “continue,” and similar expressions or phrases, or

the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. Although we believe that we have a reasonable basis for each forward-looking statement

contained in this prospectus and incorporated by reference in this prospectus, we caution you that these statements are based

on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause

our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to

differ. The sections in our periodic reports, including our most recent Annual Report on Form 10-K, our Quarterly Reports on Form

10-Q or our Current Reports on Form 8-K, entitled “Business,” “Risk Factors,” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” sections in our Definitive Proxy Statement on

Schedule 14A, filed with the SEC on April 13, 2023, entitled “Risk Factors,” “Adamis Business,” “DMK

Business,” “Adamis Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and “DMK Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as

other sections in this prospectus and the other documents or reports incorporated by reference in this prospectus, discuss some

of the factors that could contribute to these differences. These forward-looking statements include, among other things, statements

about:

| |

● |

our expectations regarding future revenues and

profitability; |

| |

● |

our expectations regarding future growth; |

| |

● |

our expectations concerning future product research,

development, clinical trial and commercialization activities and related costs; |

| |

● |

our expectations regarding product development

timelines; |

| |

● |

our ability to successfully commercialize and

market our product candidates in development, if approved; |

| |

● |

matters relating to the manufacture of our commercial

products; |

| |

● |

our strategies and opportunities; |

| |

● |

the potential market size, opportunity and growth

potential for our product candidates, if approved; |

| |

● |

anticipated trends in our markets; |

| |

● |

anticipated dates for commencement or completion

of clinical trials; |

| |

● |

our expectations concerning regulatory matters

concerning our product candidates, including the timing of anticipated regulatory filings; |

| |

● |

our liquidity needs and need for future funding

and working capital; |

| |

● |

our need to raise additional capital and our

ability to obtain sufficient funding to support our planned activities; |

| |

● |

our expectations regarding future expense, profit,

cash flow, or balance sheet items or any other guidance regarding future periods; |

| |

● |

the accuracy of our estimates regarding expenses,

capital requirements and needs for additional financing; |

| |

● |

our ability to continue as a going concern; |

| |

● |

the impact of the health emergencies or global

geopolitical events on our business; |

| |

● |

the success, safety and efficacy of our drug

products; |

| |

● |

the potential outcome of any litigation or legal

proceedings; |

| |

● |

the scope of protection we are able to establish

and maintain for intellectual property rights covering our product candidates and technology; |

| |

● |

the volatility of the price of our common stock; |

| |

● |

our financial performance; and |

| |

● |

other factors described from time to time in

documents that we file with the SEC. |

Such

statements are not historical facts, but are based on our current expectations and projections about future events. They are subject

to risks and uncertainties, known and unknown, that could cause actual results and developments to differ materially from those

expressed or implied in such statements.

In

addition, many forward-looking statements concerning our anticipated future business activities assume that we are able to obtain

sufficient funding to support such activities and continue our operations and planned activities. As discussed elsewhere in this

prospectus, we require additional funding to continue operations, and there are no assurances that such funding will be available.

Failure to timely obtain required funding would adversely affect and could delay or prevent our ability to realize the results

contemplated by such forward looking statements. New factors emerge from time to time, and it is not possible for us to predict

which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions

and expectations disclosed in the forward-looking statements we make. We have included important cautionary statements in this

prospectus and in the documents incorporated by reference in this prospectus, particularly in the “Risk Factors” section,

that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. For

a summary of such factors, please refer to the section entitled “Risk Factors” in this prospectus, as supplemented

by the discussion of risks and uncertainties under “Risk Factors” contained in our most recent Annual Report on Form

10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, or our Definitive Proxy Statement on Schedule 14A filed

with the SEC on April 13, 2023, as well as any amendments thereto, as filed with the SEC and which are incorporated herein by

reference.

In

light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained

in this prospectus or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue

reliance on the forward-looking statements, which speak only as of the date of this prospectus or the date of the document incorporated

by reference. Further, any forward-looking statement speaks only as of the date on which it is made, and except as may be required

by applicable law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the occurrence of unanticipated events. All subsequent forward-looking statements

attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section.

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this prospectus. The following summary is qualified in its entirety by, and should be read together with, the more

detailed information and financial statements and related notes thereto included in this prospectus or incorporated by reference

herein. Before you decide to purchase securities in this offering, you should read the entire prospectus carefully, including the

risk factors and the financial statements and related notes included in this prospectus or incorporated by reference herein. Unless

otherwise stated or the context requires otherwise, references in this prospectus to “Adamis,” the “company,”

or the “Company,” “we,” “us,” or “our” refer to Adamis Pharmaceuticals Corporation

and our subsidiaries, taken together.

Company Overview

With the worsening of the opioid crisis due to fentanyl poisoning and our

recent merger transaction with DMK Pharmaceuticals Corporation, our focus on developing and commercializing products in the substance

use disorder space including treatment of opioid use disorder has intensified and expanded, including with a more robust product pipeline.

Our two commercial products are designed to treat opioid overdose and anaphylactic shock. The first is ZIMHI® (naloxone

HCL Injection, USP) 5 mg/0.5 mL, which was approved by the U.S. Food and Drug Administration, or FDA, for the treatment of opioid overdose,

and the second is SYMJEPI® (epinephrine) Injection 0.3mg, which was approved by the FDA for use in the emergency treatment

of acute allergic reactions, including anaphylaxis, for patients weighing 66 pounds or more, and SYMJEPI (epinephrine) Injection 0.15mg,

which was approved by the FDA for use in the treatment of anaphylaxis for patients weighing 33-65 pounds. The foundation of our development

pipeline is a proprietary portfolio of approximately 750 proprietary small molecule neuropeptide analogues. Our lead clinical-stage product

candidate is for the treatment opioid use disorder and acute and chronic pain. The library also has the potential to generate other compounds

for treatment of various substance use disorders and compounds for life cycle management and backup molecules.

Recent Developments

Merger with DMK Pharmaceuticals Corporation

On May 25, 2023, we completed a merger transaction,

or the Merger, with DMK Pharmaceuticals Corporation, or DMK, pursuant to an Agreement and Plan of Merger and Reorganization dated

as of February 24, 2023, or the Merger Agreement, by and among DMK, Aardvark Merger Sub, Inc., a wholly-owned subsidiary of Adamis,

and Adamis. Prior to the Merger, DMK was a privately-held, clinical stage biotechnology company focused on the development and

commercialization of potential products for a variety of central nervous disorders. Pursuant to the Merger, each share of common

stock of DMK was converted into the right to receive a number of shares of Adamis common stock and, in the case of certain DMK

stockholders, shares of our Series E Convertible Preferred Stock, or Series E Preferred. Upon the closing of the Merger,

Ebrahim (Eboo) Versi, M.D., Ph.D., the co-founder and chief executive officer of DMK, became the chairman and chief executive officer

of Adamis, and David J. Marguglio, formerly the President, Chief Executive Officer and a director, continued as President and was

also appointed Chief Operating Officer.

Reverse Stock Split of Common Stock

Following approval by our stockholders at

a special meeting of stockholders of the Company held on May 15, 2023, or the Special Meeting, on May 22, 2023, we effected

a 1-for-70 reverse stock split of our outstanding common stock, or the Reverse Stock Split, pursuant to which each 70 outstanding

shares of our common stock were combined into one post-reverse split share of common stock. All outstanding options, restricted

stock unit awards, and warrants were proportionately adjusted as a result of the Reverse Stock Split, pursuant to their respective

terms. Unless otherwise indicated herein, share and per share numbers and amounts in this prospectus reflect and give effect to

the Reverse Stock Split. However, the historical financial statements of the Company incorporated by reference into this prospectus,

and other information and documents incorporated by reference into this prospectus, have not been revised or restated to reflect

the Reverse Stock Split.

Financial Condition; Other

We have incurred substantial recurring losses

from continuing operations, have used, rather than provided, cash in our continuing operations, and are dependent on additional

financing to fund operations. We incurred a net loss of approximately $8.9 million and $26.5 million for the three months ended

March 31, 2023 and for the year ended December 31, 2022, respectively. As of March 31, 2023, we had cash and cash equivalents

of approximately $3.1 million, an accumulated deficit of approximately $313.5 million and total liabilities of approximately $18.6

million. These conditions raise doubt about our ability to continue as a going concern. To achieve our goals and support our overall

strategy, we will need to raise additional funding in the future and make significant investments in, among other things, product

development and working capital. Prior to the Merger, DMK obtained non-dilutive capital from government and non-government sources

to enable a significant portion of its product development efforts to date, and we intend to seek such additional funding to help

offset some of the costs of future product development. Although we anticipate that we will require additional equity or debt capital

over the next 12 months to sustain operations, satisfy our obligations and liabilities, and fund our ongoing operations, in the

longer term, if revenues from the sale of our commercial products increase sufficiently, we expect that such revenues will help

reduce the need to raise additional funding through the sale of equity securities.

On July 18, 2023, David C. Benedicto, our then-chief financial officer,

notified us that he was resigning from the Company effective July 21, 2023. His resignation was not a result of any disagreement with

the Company or its independent auditors on any matter relating to the Company’s financial statements or accounting policies or practices.

We will commence a search for a new chief financial officer. In the interim, David J. Marguglio, the Company’s President and Chief Operating

Officer, has been appointed and will assume the duties of chief financial officer of the Company on an interim basis until the Company

appoints a successor.

On July 25, 2023, we completed the sale of the building and real property

located in Conway, Arkansas, formerly utilized by our discontinued compounding pharmacy business, as well as the personal property and

equipment located at the real property and certain related assets, to an unaffiliated third party purchaser. The total aggregate consideration

for the real property and other assets was approximately $2,000,000, before estimated commissions, fees and closing costs of approximately

$232,700.

Products and Product Candidates

Opioid Overdose; ZIMHI (naloxone) Injection

Naloxone is an opioid antagonist used to treat narcotic overdoses. Naloxone,

which is generally considered the drug of choice for immediate administration for opioid overdose, blocks or reverses the effects of the

opioid, including extreme drowsiness, slowed breathing, or loss of consciousness and eventually, death. Common opioids include morphine,

heroin, tramadol, oxycodone, hydrocodone and fentanyl. Since the COVID-19 pandemic, the opioid crisis has become significantly worse,

and this increase has disproportionately affected adolescents. According to Bloomberg industry data, the U.S. naloxone market grew by

about 15% in 2022 and according to the December 31, 2022 10-K of Emergent BioSolutions, Inc. filed in March 2023, sales of Narcan®,

the leading naloxone product for treatment of opioid overdoses, were approximately $374 million for 2022.

The Centers for Disease Control and Prevention, or CDC, estimates that

between 1999 and 2020 more than 932,000 people have died of drug overdoses, with annual deaths increasing during the pandemic. More recent

statistics published by the CDC reported that drug overdoses resulted in approximately 107,081 deaths in the United States during the

12-month period ending December 2022, which was an approximately 51% increase over the approximately 71,030 deaths for the 12-month period

ending December 2019. Overdose deaths involving opioids (including both prescription and synthetic) accounted for 81,045 of the overdose

deaths in 2022 and are now the leading cause of death for Americans under age 50. More powerful synthetic opioids, like fentanyl and its

analogues, are responsible for approximately 90% of those opioid deaths. These statistics are even more stark for adolescents according

to the CDC. Comparing July-December 2019 to July-December 2021, overdose deaths among youngsters aged 10 to 19 years increased by 109%

and in that same time period, deaths involving illicitly manufactured fentanyl increased by 182% in the same age group. In June 2021,

the National Institute on Drug Abuse; National Institutes of Health; U.S. Department of Health and Human Services, published the policy

brief, “Naloxone for Opioid Overdose: Life-Saving Science,” which reported that statistical modeling suggests that high rates

of naloxone distribution among laypersons and emergency personnel could avert approximately 21% of opioid deaths. The brief also stated

that overdoses involving highly potent synthetic opioids such as fentanyl or large quantities of opioids may require multiple doses of

naloxone, and if respiratory function does not improve, naloxone doses may be repeated every two to three minutes. This need for availability

of naloxone was emphasized in a CDC Morbidity and Mortality Weekly Report article in 2022 discussing drug overdose deaths among persons

aged 10-19 years, which noted that potential bystanders were present in approximately two-thirds of the overdose deaths in young people

aged 10 to 19, which suggests that at least some of the deaths could have been prevented and the number of deaths reduced if bystanders

had been equipped naloxone, knew how to use it and provided a timely overdose response.

On October 18, 2021, we announced that the FDA had approved ZIMHI (naloxone

hydrocholoride 5mg) for the treatment of opioid overdose, and it was commercially launched in the U.S. on March 31, 2022. Based on

published pharmacokinetic data from FDA approved product package insert material, we believe that ZIMHI’s intramuscular route of

administration could result in faster absorption compared to any other currently marketed naloxone products making it an ideal treatment

for overdoses caused by more potent opioids such as fentanyl.

On June 20, 2023, Dr. Versi, our Chief Executive Officer,

participated in the White House Roundtable with opioid reversal product manufacturers, hosted by White House Office of National Drug Control

Policy, or ONDCP, Director Dr. Rahul Gupta, White House Domestic Policy Council Advisor Neera Tanden, U.S. Assistant Secretary for Health

Admiral Rachel Levine, and U.S. Assistant Secretary for Mental Health and Substance Use Dr. Miriam E. Delphin-Rittmon. During the roundtable

discussion, various members of the current White House administration discussed the opioid crisis, emphasizing the extent and importance

of the opioid crisis and indicting that the administration has a directive and is seeking private-public cooperation to increase access

and affordability of naloxone, including the creation of federal guidelines to remove barriers to access of all naloxone products at state

and local levels. During this same visit to Washington, D.C., Dr. Versi met with 12 congressional offices, in both the Senate and

the House of Representatives, and Republicans and Democrats, and discussed our support of HR 4007 that is currently being drafted that

would be intended to ensure that there would be no barriers to the government purchase of any opioid reversal product. We believe these

congressional meetings were very positive and that there appeared to be bipartisan support for improving access to opioid reversal products.

This is particularly important for Adamis, as we believe some current regional guidelines should be revised and have prevented government

agencies from being able to purchase ZIMHI.

With the increasing prevalence of illicit fentanyl

on the streets, we believe the need for ZIMHI as a product that results in rapid increase in higher blood levels of naloxone is becoming

ever more important and urgent. Dr. Gupta, Director of the ONDCP, stated at the White House meeting in June that about 60% of illicit

pills imported into the U.S. contain deadly doses of fentanyl. In our opinion, this means that more naloxone is needed to counteract

this circumstance.

The results of a study sponsored by the FDA was

recently presented by Dr. David Strauss, M.D., Ph.D. Dr. Straus at a virtual public meeting of the Reagan–Udall Foundation

addressing fatal overdoses. Dr. Straus is the Director of the Division of Applied Regulatory Science at the Center for Drug

Evaluation and Research. The current standard of care is a single intranasal 4mg dose of naloxone, as contained in Narcan. Given the

fentanyl crisis, the investigators tested this single dose against two and four doses to reverse a simulated fentanyl overdose. They

showed that the most effective reversal was achieved by four administrations of 4mg intranasal naloxone given within 2.5 minutes.

However, uses of these multiple doses in such a short time, while necessary, are in fact an “off-label” use of the drug

and therefore pose a challenge for first responders and other caregivers. We believe that this data from the FDA sponsored study

suggests that rapid delivery of naloxone is the answer to a fentanyl overdose and that a single administration of ZIMHI, based on

its pharmacokinetic profile, could be the ideal agent to counter a fentanyl overdose.

Various persons with experience addressing matters relating to the opioid

crisis, including certain law enforcement officials, federal government administration officials, and parent organizations, dealing with

the opioid crisis also have voiced their concerns about the nation’s current capability of dealing with this opioid crisis, noting

the need in many instances of opioid, and particularly fentanyl, overdoses for repeat dosing and to use multiple doses of Narcan in efforts

to revive someone or achieve a recovery. Based on these experiences and other observations in the field, we believe that ZIMHI, if it

was more widely available, could aid in the nation’s efforts to treat fentanyl poisoning and inadvertent overdose, although there

can be no assurance that this will be the case.

Anaphylaxis; SYMJEPI; Epinephrine Injection Pre-Filled Single Dose

Syringe

The American Academy of Allergy Asthma and Immunology,

or AAAAI, defines anaphylaxis as a serious life-threatening allergic reaction. The most common anaphylactic reactions are to foods, insect

stings, medications and latex. According to information published by AAAAI reporting on findings from a 2009-2010 study, up to 8% of U.S.

children under the age of 18 had a food allergy, and approximately 38% of those with a food allergy had a history of severe reactions.

Anaphylaxis requires immediate medical treatment, with epinephrine as the first course of treatment to open airways and maintain blood

pressure.

We estimate that sales of prescription epinephrine

products were more than approximately $1.75 billion in 2022, based on assumptions and estimates using industry data. While we cannot provide

any assurances concerning whether annual prescription sales will decline or grow, we believe that the epinephrine market has the potential

to grow in the future, based in part on the prevalence of medical conditions, such as anaphylaxis, cardiovascular diseases, respiratory

diseases (asthma), and the increased awareness about the treatment options for the management of these diseases. The market for prescription

epinephrine products is competitive, and a number of factors have resulted in, and could continue to result in, downward pressure on the

pricing of, and revenues from sales of, our SYMJEPI (epinephrine) Injection 0.3mg and 0.15mg prescription epinephrine products. Our SYMJEPI

(epinephrine) Injection 0.15mg and 0.3mg products allow users to administer a pre-measured epinephrine dose quickly with a device that

we believe, based on human factors studies, to be intuitive to use.

On June 15, 2017, the FDA approved our SYMJEPI

(epinephrine) Injection 0.3mg product for the emergency treatment of allergic reactions (Type I) including anaphylaxis. SYMJEPI

(epinephrine) Injection 0.3mg is intended to deliver a dose of epinephrine, which is used for emergency, immediate administration

in acute anaphylactic reactions to insect stings or bites, allergic reaction to certain foods, drugs and other allergens, as well

as idiopathic or exercise-induced anaphylaxis for patients weighing 66 pounds or more. On September 27, 2018, the FDA approved

our lower dose SYMJEPI (epinephrine) Injection 0.15mg product, for the emergency treatment of allergic reactions (Type I) including

anaphylaxis in patients weighing 33 to 66 pounds. Our SYMJEPI injection products were fully launched in July 2019 by our then-commercialization

partner Sandoz Inc. Our SYMJEPI products are currently marketed and sold by USWM, LLC, or USWM or US WorldMeds, with which we entered

into an exclusive distribution and commercialization agreement, or the USWM Agreement, in May 2020 for the United States commercial

rights for the SYMJEPI products, as well as for our ZIMHI product.

SYMJEPI is manufactured and tested for us

by Catalent Belgium S.A. During Catalent’s routine testing, a small number of syringes with clogged needles were identified.

On March 21, 2022, we announced a voluntary recall of four lots of SYMJEPI (epinephrine) Injection 0.15 mg (0.15 mg/0.3 mL) and

0.3 mg (0.3 mg/0.3 mL) due to the potential clogging of the needle preventing the dispensing of epinephrine. The recall was conducted

with the knowledge of the FDA, and USWM handled the recall process for the Company, with Company oversight. As of the date of this

prospectus, neither USWM nor we have received, nor are aware of, any adverse events related to this recall and in February 2023,

the Company received notice from the FDA that the agency considers the voluntary recall of our SYMJEPI products to be terminated.

Such notice does not preclude the FDA from taking action in the future related to the recall, and we remain responsible for compliance

with applicable laws relating to the product and the recall. Catalent’s investigation determined the steel used in a specific

stainless steel needle batch as the root cause for the clogged syringes observed. The Company worked with Catalent to develop corrective

and preventive actions. However, despite the corrective actions and sourcing syringes which used a different batch of steel for

the needles, Catalent’s attempt to resume manufacturing of SYMJEPI at its Belgium facility has resulted in similar product

defects. Therefore, as of the date of this prospectus, the Company remains unable to manufacture product. While we are committed

to returning SYMJEPI to the market, we will not do so until we are satisfied that sufficient corrective actions have been implemented

to avoid a repeat of the circumstances which led to the voluntary recall. We are evaluating a range of options to restore SYMJEPI

production, including a critical assessment of Catalent.

Product Candidates

As a result of our Merger with DMK, we acquired

a library of approximately 750 novel small molecule neuropeptide analogues and a number of product candidates and technologies

in development for opioid use disorder and other neuro-based disorders. We intend to focus on developing therapies with novel mechanisms

of action to treat these important conditions where patients are currently underserved, including substance abuse disorders. We

are developing mono, bi- and tri-functional small molecules that simultaneously modulate critical networks in the nervous system

with the goal of creating treatments that are efficacious, safe, and tolerable and could address several unmet or underserved medical

needs by taking the novel approach to integrate with the body’s own efforts to regain balance of disrupted physiology. By

designing small molecule analogs of neuropeptides, one or multiple receptors can be targeted by a single molecule to support a

transition back to a balanced neurophysiological state.

Our lead clinical stage product candidate,

DPI-125, is being developed as a potential novel treatment for opioid use disorder, or OUD. We also plan to study this compound

for the treatment of moderate to severe pain, where it could potentially offer a product with competitive advantages compared to

currently marketed opioids (pain killers) and hence help prevent opioid addiction. Other product candidates include DPI-221, being

developed for treating bladder control problems, and DPI-289 being developed for treating severe end stage Parkinson’s disease.

We currently intend to focus on the development programs that target substance use disorder described above and to seek to out-license

product candidates targeting indications outside of this focus.

DPI-125

DPI-125 is a small molecule that is currently

being developed for two potential uses. The first is for the rapid stabilization of OUD patients actively using prescription or

street opioids, including deadly fentanyl and its analogues. The second potential use is as a potent, acute analgesic, with a potentially

reduced risk of respiratory depression and addiction compared to currently marketed opioids.

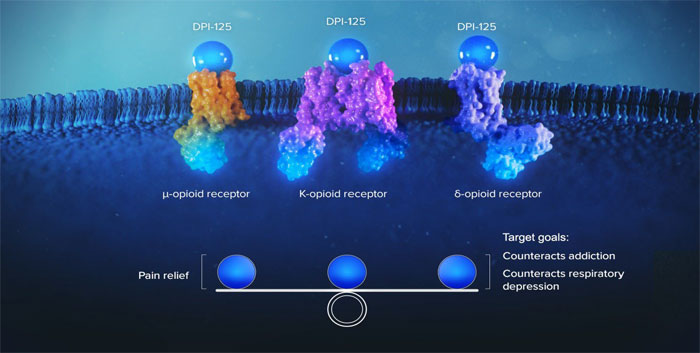

Most marketed opioids are pure mu agonists,

which means they bind and have their effect only through the mu receptor (Fig.1). While they do provide the desired pain relief,

they also carry the risk of respiratory depression, which can lead to death, and euphoria, which can cause addiction. In contrast,

DPI-125 binds with all three receptors, mu, kappa and delta (Fig. 2), which is intended to result in a more balanced approach that

tries to mimic the body’s own endorphins and hence reduced risk of respiratory depression, abuse liability and death.

We have completed a human Phase 1 dose escalation

study with DPI-125, and the pharmacokinetic data showed that the drug was well tolerated in the human study, with no serious adverse

events, deaths or dropouts. The next anticipated development step will be human proof of concept studies, which will attempt to

confirm what has been demonstrated in preclinical studies in terms of reduced or absent respiratory depression and abuse liability.

Following these proof-of-concept studies, assuming adequate funding and no unexpected developments, we believe that the next development

step will be to proceed into Phase 2 trials for the treatment of OUD and acute pain, where the focus of the trials will not only

be on efficacy, but also safety and tolerability. We believe that the same characteristics and mechanism

of action that may make DPI-125 a useful product in the fight against addiction could also make it a significant alternative to

all currently marketed opioids used for treating pain.

Fig. 1: Schema showing a cell surface with the transmembrane

mu, kappa and delta receptors. Opiates bind to just the mu receptors conferring analgesia, but there is the risk of death and addiction.

Fig. 2: DPI-125 is a ‘triple agonist’; meaning

that it readily binds and interacts positively with all three opioid receptors (Mu, Kappa & Delta). This balanced approach

more closely mimics the body’s natural endorphins and is intended to counteract respiratory depression while not providing

the euphoria that can cause addiction.

DPI-221

DPI-221 is a small molecule currently in

development as what we believe is a unique alternative to surgery for benign prostatic hyperplasia, or BPH, by reestablishing bladder

control. BPH is a common problem with approximately six million men seeking treatment annually, with an estimated market size of

approximately $5.4 billion annually in the United States. BPH is a common, chronic disease caused by an enlarged prostate. DPI-221

may offer a novel approach to the treatment of BPH by acting on the central nervous system to suppress abnormal activity without

interfering with normal bladder function. In preclinical studies, DPI-221 was effective at reestablishing neural control of the

bladder, which returns the bladder to more normal function, allowing coordinated bladder contractions and efficient voiding.

A first-in-human Phase 1 oral dose escalation

study, showed that the drug was safe and tolerable in the study. There were no serious adverse events, deaths or study dropouts.

The pharmacokinetic, or PK, characteristics have allowed planning of a proof-of-concept study, which is anticipated to be a human

urodynamic study to determine the efficacious dose that will inform dosing in a subsequent Phase 2 study. We believe that if successfully

developed, this medication could prevent or reduce the need for BPH surgery.

DPI-289

DPI-289, also a small molecule, has been

developed to treat patients suffering from severe Parkinson’s disease, or PD. Many of these patients will have been treated

with a current leading treatment product called levodopa, or L-DOPA. Unfortunately, after a few years of treatment, the duration

of effect is markedly curtailed (reduced “on-time”) and patients can exhibit severe abnormal movements called levodopa

induced dyskinesia, or LID, which make it difficult or impossible to lead a normal life. Preclinical studies have demonstrated

DPI-289’s ability to treat parkinsonian disability in rodent and non-human primate models to dramatically increase on-time

without causing dyskinesia. Our initial goal with respect to this product candidate is to target patients late in their disease

who require deep brain stimulation (DBS-brain surgery) to prevent such surgeries and also treat those patients who are not eligible

for DBS. Given this target population, we plan to seek orphan drug status from the FDA and international regulatory agencies. Initially,

we intend to develop the compound as monotherapy, but we anticipate that future studies will examine its utility in PD patients

as combination therapy with L-DOPA to increase “on-time” without increasing the debilitating side effect of dyskinesia.

We anticipate that the next step for this

program, assuming adequate funding and no unexpected developments, will be to carry out IND-enabling toxicology studies to allow

the filing of an Investigational New Drug Application, or IND, for the first in-person studies. If orphan drug status is conferred

by the FDA or other international regulatory bodies, the cost and duration of the clinical development program may be significantly

reduced, allowing for approval in an accelerated time frame.

Grant Funding

To date and prior to the Merger, development

programs for these product candidates have been largely financed by funding from government and non-governmental organization,

or NGO, awards or grants, including without limitation from the National Institute on Drug Abuse, or NIDA, a division of the National

Institutes of Health, or NIH, the New Jersey Commission on Science, Innovation and Technology, or CSIT, and the Michael J. Fox

Foundation, which has previously provided approximately $1.5 million in grant funding to support much of the preclinical work for

DPI-289. DMK was also the recipient of a grant from the National Institute on Alcohol Abuse and Alcoholism, or NIAAA, of the NIH

to support the development of a novel bifunctional small molecule for the treatment of Alcohol Use Disorder, or AUD. The grant

funding will help fund this preclinical, early-stage project to use gold-standard preclinical assays to vet our library of molecules

that possess the bi-functional attributes hypothesized to reduce excessive alcohol use. In the future, we plan to continue to seek

non-dilutive government funding from the NIH and NGOs as well as funding from other sources. Each of the NIH grants relates to

agreed-upon direct and indirect costs for specific studies or clinical trials, which may include costs such as personnel and consulting

costs, and costs paid to contract research organizations, or CROs, research institutions or other third parties involved in the

grant. We are reimbursed for our eligible direct and indirect costs over time, up to the maximum amount of each specific grant

award. Only costs that are allowable under the grant award, certain government regulations and the NIH’s supplemental policy

and procedure manual may be claimed for reimbursement, and the reimbursements are subject to routine audits from governmental agencies

from time to time. The NIH or other government agency may review our performance, cost structures and compliance with applicable

laws, regulations, policies and standards and the terms and conditions of the applicable NIH grant. If any of our expenditures

are found to be unallowable or allocated improperly or if we have otherwise violated terms of such NIH grant, the expenditures

may not be reimbursed and/or we may be required to repay funds already disbursed.

Future Development Plans

Our development

plans concerning our product candidates, including DPI-125 and the other product candidates described above, and anticipated dates

for future preclinical or clinical trials regarding our product candidates, are affected by a number of factors, including the

availability of adequate funding to support product development efforts and studies, the results of preclinical or clinical studies

that we may conduct, developments in the marketplace including the introduction of potentially competing new products by competitors,

regulatory developments including the outcome of any future discussions with the FDA concerning the regulatory approval pathway

of the applicable product candidate including the number and kind of clinical trials that the FDA will require before the FDA will

consider regulatory approval of the applicable product, and any unexpected difficulties in licensing or sublicensing intellectual

property rights that may be required for other components of the product. As a result, the timing and progress of our product development

plans could be affected by such considerations and, should we choose to seek development, out-licensing or commercialization partners

for one or more of our products or product candidates, our success in negotiating and entering into development, out-licensing

or commercialization agreements relating to our product candidates. In considering development and commercialization alternatives

for our products and product candidates and technologies, we may seek to enter into out-licensing or development agreements for

product candidates or technologies that are not within our core areas of focus.

DMK Intellectual Property

DMK has (i) four issued patents in

the United States, two divisional and one provisional United States patent applications; (ii) two pending Canadian patent applications;

and (iii) one pending European patent application. The patent portfolio comprises of utility patents and one provisional patent

for composition of matter of a transdermal drug delivery system. The patent portfolio covers inventions for the treatment of drug

addiction and Parkinson’s disease. The issued patents are expected to expire between 2026 and 2038, not taking into account

any potential patent-term extensions that may be available in the future. The pending or provisional patent applications, if granted,

are expected to expire between 2037 and 2043, not taking into account any potential patent-term extensions that may be available

in the future.

Corporate Information

We are incorporated under the laws of the

State of Delaware. Our principal executive offices are located at 11682 El Camino Real, Suite 300, San Diego, CA 92130, and our

telephone number is (858) 997-2400. Our website address is: www.adamispharmaceuticals.com. We have included our website address

as a factual reference and do not intend it to be an active link to our website. The information that can be accessed through our

website is not part of this prospectus, and investors should not rely on any such information in deciding whether to purchase our

securities.

Smaller Reporting Company

We are also currently a “smaller reporting

company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent

company that is not a smaller reporting company, and have a public float of less than $250 million or annual revenues of less than

$100 million during the most recently completed fiscal year. As a result, the disclosure that we are required to provide in our

SEC filings is less in certain respects than it would be if we were not considered a “smaller reporting company.” Specifically,

“smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are

exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting

firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased

disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited

financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as a “smaller reporting

company” may make it harder for investors to analyze our results of operations and financial prospects.

| The Offering |

| |

|

| Units to be Offered |

Up to 5,263,158 units, each unit consisting of one share of common stock

and one common warrant to purchase one share of common stock. |

| |

|

| Pre-funded Units to be Offered |

We are also offering to certain purchasers whose purchase of

units in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99%

of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers

so choose, pre-funded units, each pre-funded unit consisting of one pre-funded warrant to purchase one share of common stock and

one common warrant to purchase one share of common stock, in lieu of units that would otherwise result in any such purchaser’s

beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. The purchase

price of each pre-funded unit will equal the price per unit being sold to the public in this offering, minus $0.0001, and the exercise

price of each pre-funded warrant will be $0.0001 per share of common stock. For each pre-funded unit we sell, the number of units

we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of common stock issuable upon

the exercise of any pre-funded warrants or common warrants comprising the pre-funded unit sold in this offering.

|

Description of

Common Warrants |

Each common warrant will have an exercise price of $______ per share, will be immediately exercisable and will expire on the five (5) year anniversary of the original issuance date. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the common warrants. |

| |

|

Description of

Pre-Funded Warrants |

Each pre-funded warrant will have an exercise price of $0.0001 per share, will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants. |

| |

|

Common Stock

Outstanding before

this Offering |

2,378,295 shares |

| |

|

Common Stock

Outstanding after

this Offering |

7,641,453 shares (assuming the sale of the maximum number of units covered

by this prospectus, no sale of pre-funded units and no exercise of the common warrants issued in this offering). |

| |

|

| Use of Proceeds |

Assuming the maximum number of units are sold in this offering at an assumed

public offering price of $1.90 per unit, which represents the closing price of our common stock on the Nasdaq Capital Market on July 21,

2023, and assuming no issuance of pre-funded warrants in connection with this offering, we estimate that the net proceeds from our sale

of shares of our common stock in this offering will be approximately $8,850,000, after deducting the placement agent fees and estimated

offering expenses payable by us and assuming no sale of any pre-funded units offered in this offering. However, this is a reasonable best

efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any

of these securities offered pursuant to this prospectus; as a result, we may receive significantly less in net proceeds. We currently

intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include, without limitation,

expenditures relating to research, development and clinical trials relating to our products and product candidates, manufacturing, capital

expenditures, hiring additional personnel, the payment, repayment, refinancing, redemption or repurchase of existing or future indebtedness,

obligations or capital stock, and payment of obligations and liabilities. We may also use the proceeds to acquire or invest in complementary

products, services, technologies or other assets, although we have no agreements or understandings with respect to any acquisitions or

investments at this time. For additional information please refer to the section entitled “Use of Proceeds” on page 24

of this prospectus.

|

| Risk Factors |

An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus and the other information included in and incorporated by reference into this prospectus for a discussion of the risk factors you should carefully consider before deciding to invest in our securities. |

| |

|

| Nasdaq Capital Market Symbol |

“ADMP.” There is no established trading market for the common warrants or the pre-funded warrants, and we do not expect a trading market to develop. We do not intend to list the common warrants or the pre-funded warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the common warrants and the pre-funded warrants will be extremely limited. |

| |

|

| Reasonable Best Efforts Offering |

We have agreed to offer and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 42 of this prospectus. |

Unless we indicate otherwise, all information

in this prospectus, except for our consolidated financial statements and notes thereto included or incorporated by reference herein,

gives effect to and reflects a 1-for-70 reverse stock split of our issued and outstanding shares of common stock (and proportional

adjustment of options, warrants and restricted stock units) effected May 22, 2023, and the corresponding adjustment of all common

stock price per share and stock option and warrant exercise price data.

The number of shares of our common stock to be outstanding upon completion

of this offering is based on 2,378,295 shares of common stock outstanding as March 31, 2023, and excludes, as of such date, the following:

(i) 59,277 shares of common stock issuable upon exercise of outstanding stock options, with exercise prices ranging from $43.40 to $592.20

and having a weighted average exercise price of $287.16 per share, and 9,286 shares issuable upon the vesting of restricted stock units

outstanding, awarded under our equity incentive plans, 2,143 shares of which were issued after March 31, 2023 following such vesting;

(ii) outstanding warrants and the shares issuable upon exercise of such warrants, to purchase the following numbers of shares of

common stock: 840 shares at an exercise price of $595.00 per share; 197,055 shares at an exercise price of $80.50 per share; 5,000 shares

at an exercise price of $49.00 per share; 10,714 shares at an exercise price of $32.90 per share; and 685,714 shares at an exercise price

of $9.66 per share; (iii) 202,455 shares of common stock reserved for future issuance under our 2020 Equity Incentive Plan; (iv) 1,941.2

shares of Series E Preferred convertible into approximately 1,941,200 shares of common stock subject to various beneficial ownership

and other limitations and restrictions on conversion, and 302,815 shares of common stock, issued after March 31, 2023, in connection with

the closing of the Merger transaction with DMK; (v) outstanding options to purchase 231,490 shares of common stock at an exercise

price of $2.90 per share that we assumed in connection with the Merger, and 18,005 remaining unallocated shares reserved for issuance

pursuant to the 2016 DMK Stock Plan that we assumed in connection with the Merger; (vi) approximately 9,967 shares of common stock issuable

upon conversion of 3,000 outstanding shares of Series C Convertible Preferred Stock, or Series C Preferred; (vii) options to purchase

24,962 shares of common stock that expired unexercised after March 31, 2023; and (viii) 107,142 shares of common stock (post Reverse Stock

Split) issued pursuant to the exercise of prefunded warrants after March 31, 2023.

Unless otherwise indicated, this prospectus

assumes no exercise of the pre-funded warrants and the warrants offered hereby.

RISK FACTORS

Investing in our securities involves

a high degree of risk. Before deciding to invest in our securities, you should consider carefully the risks and uncertainties described

below and under Item 1A.“Risk Factors” in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission,

or SEC, on March 16, 2023, and our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 13, 2023, which are each

incorporated by reference in this prospectus, together with all of the other information contained in this prospectus and documents

incorporated by reference herein, and in any free writing prospectus that we have authorized for use in connection with this offering.

If any of the matters discussed in the following risk factors were to occur, our business, financial condition, results of operations,

cash flows or prospects could be materially adversely affected, the market price of our common stock could decline and you could

lose all or part of your investment in our securities. Additional risks and uncertainties not presently known or which we consider

immaterial as of the date hereof may also have an adverse effect on our business.

Risks Related to This Offering and Ownership of Our Securities

This is a reasonable best efforts offering, with no minimum

amount of securities required to be sold, and we may sell fewer than all of the securities offered hereby.

The placement agent has agreed to use

its reasonable best efforts to solicit offers to purchase the units and pre-funded units in this offering. The placement agent

has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar

amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this

offering. As there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount,

placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set

forth above. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds

received by us, and investors in this offering will not receive a refund in the event that we do not sell all of the units or pre-funded

units offered in this offering. The success of this offering will impact our ability to use the proceeds to execute our business

plans. We may have insufficient capital to implement our business plans, potentially resulting in greater operating losses unless

we are able to raise the required capital from alternative sources. There is no assurance that alternative capital, if needed,

would be available on terms acceptable to us, or at all.

You will experience immediate and substantial dilution

in the net tangible book value per share of the common stock you purchase, and may experience additional dilution in the future.

Because the effective price per share of common stock included in the units

or issuable upon exercise of the warrants or pre-funded warrants being offered may be substantially higher than the net tangible book

value per share of our common stock, you may experience substantial dilution to the extent of the difference between the effective offering

price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after

this offering. Assuming the sale of 5,263,158 units at a public offering price of $1.90 per unit and our net tangible book value

as of March 31, 2023, and assuming no sale of any pre-funded units in this offering, no exercise of any of the common warrants being offered

in this offering, and after deducting the placement agent fees and estimated offering expenses payable by us, you will incur immediate

dilution in as adjusted net tangible book value of approximately $2.01 per share. As a result of the dilution to investors purchasing

securities in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the

event of the liquidation of our company. See the section entitled “Dilution” below for a more detailed discussion of the dilution

you will incur if you participate in this offering. To the extent shares are issued under outstanding options, warrants and convertible

securities at exercise prices or conversion prices lower than the public offering price of the units offered in this offering, you will

incur further dilution.

If we sell additional shares of common stock in future

financings, shareholders may experience immediate dilution and, as a result, our share price may decline.

Our charter allows us to issue up to 200,000,000

shares of our common stock and up to 10,000,000 shares of preferred stock. To raise additional capital, we may in the future sell

additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that

are lower than the prices paid by existing stockholders, and investors purchasing shares or other securities in the future could

have rights superior to existing stockholders. If we issue shares of common stock or securities convertible or exercisable into

shares of common stock, our shareholders would experience additional dilution and, as a result, our share price may decline.

Certain of our securities issued in prior offerings

include a right to receive the Black-Scholes value of the unexercised portion of those securities in the event of a fundamental transaction,

which payment could be significant.

Most of our outstanding warrants

to purchase shares of common stock issued by us in prior offerings provide that, in the event of a “fundamental transaction”

that is approved by our board of directors, including, among other things, a merger or consolidation of our company, sale of all or substantially

all of our assets or a sale of a certain percentage of our common stock, the holders of such warrants have the option to require us to

pay to such holders an amount of cash equal to the Black-Scholes value of the warrants. Such amount could be significantly more than the