false0001335112

0001335112

2023-06-08

2023-06-08

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

(State or other jurisdiction of incorporation) |

|

|

|

|

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code:

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Name of each exchange on which registered |

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Entry into a Definitive Agreement. |

As previously disclosed in that Current Report on Form 8-K filed by Logiq, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”) on September 9, 2022 (the “September 2022 8-K”), on September 9, 2022, the Company,

DLQ

, Inc., a Nevada corporation and wholly-owned subsidiary of the Company (“DLQ”), Abri SPAC I, Inc., a Delaware corporation (“Abri”) and Abri Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Abri (“Merger Sub”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), whereby Merger Sub will merge with and into Company (the “Merger”) with Company being the surviving Company (the “Surviving Company”) and wholly-owned subsidiary of Abri.

As previously disclosed, on May 1, 2023, the Company and DLQ into an amendment to the Merger Agreement (the “First Amendment”) with the other parties thereto, to remove the requirement that Abri have at least $5,000,001 of net tangible assets either immediately prior to or upon consummation of the Merger.

On June 8, 2023, the Company and DLQ entered into a second amendment to the Merger Agreement (the “Second Amendment”) with the other parties thereto, to (i) amend the exchange on which its securities can be listed in connection with the Business Combination to include being listed on Nasdaq Global Market, and (ii) waive any default of Section 9.1(i) of the Merger Agreement for having received a notice from Nasdaq for non-compliance.

On July 20, 2023, the Company, DLQ, Abri and Merger Sub entered into the Third Amendment to the Merger Agreement (the “Third Amendment”)

to (i) remove provisions related to the transfer of certain intellectual property assets of Fixel AI, Inc. (“Fixel”) and Rebel AI, Inc. (“Rebel”), (ii) change the name of the Surviving Corporation to “Collective Audience, Inc.” , and (iii) increase the size of the senior financing facility from $25 Million to $30 Million.

The summary above is qualified in its entirety by reference to the complete text of the Merger Agreement

, the First Amendment, the Second Amendment

and the

Third

Amendment, copies of which are attached hereto as Exhibits 2.1

, 2.2, 2.3

and 2.

4

and are incorporated herein. Unless otherwise defined herein, the capitalized terms used above are defined in the Merger Agreement.

Important Cautions Regarding Forward Looking Statements

This Current Report and the documents incorporated by reference herein contain certain forward-looking statements and information, as defined within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the Safe Harbor created by those sections. This Current Report also contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation that relate to Logiq’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result,” “are expected to,” “expects,” “will continue,” “is anticipated,” “anticipates,” “believes,” “estimated,” “intends,” “plans,” “forecast,” “projection,” “strategy,” “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon.

Examples of forward-looking statements include, among others, statements made in this Current Report on Form 8-K regarding the proposed transactions contemplated by the Merger Agreement, including the benefits of the Merger, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, achievement of the Management and Sponsor Earnout Shares, other performance metrics, projections of market opportunity, expected management and governance of the postbusiness combination company and expected timing of the Merger. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, these statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K and on the current expectations of Abri’s and DLQ’s respective management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Abri and DLQ. Some important factors that could cause actual results to differ materially from those in any forward-looking statements could include changes in domestic and foreign business, market, financial, political and legal conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Abri’s and DLQ’s control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, investors and security holders of Abri should not rely on any of these forward-looking statements.

Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, the following: (1) the occurrence of any event, change or other circumstances that could give rise to an amendment or termination of the Merger Agreement and the proposed transaction contemplated thereby; (2) the inability to complete the transactions contemplated by the Merger Agreement due to the failure to obtain approval of the stockholders of Abri or DLQ or other conditions to closing in the Merger Agreement; (3) the inability to project with any certainty the amount of cash proceeds remaining in the Abri trust account at Closing; (4) the uncertainty relative to the cash made available to DLQ at Closing should any material redemption requests be made by the Abri stockholders (since the sources of cash projected in the exhibit to this Current Report on Form 8-K assume that no redemptions will be requested by Abri stockholders); (5) the inability of the post-business combination company to obtain or maintain the listing of its securities on Nasdaq following the Merger; (6) the amount of costs related to the Merger; (7) DLQ’s ability to yield sufficient cash proceeds from the transaction to support its short-term operations and research and development efforts since the Merger Agreement requires no minimum level of funding in the trust fund to close the transaction; (8) the outcome of any legal proceedings that may be instituted against the parties to the Merger Agreement following the announcement of the proposed Merger; (9) changes in applicable laws or regulations; (10) the ability of DLQ to meet its post-Closing financial and strategic goals due to competition, among other things; (11) the ability of the post-business combination company to grow and manage growth profitability and retain its key employees; (12) the possibility that the post-business combination company may be adversely affected by other economic, business and/or competitive factors; (13) risks relating to the successful retention of DLQ’s customers; (14) the potential impact that the COVID-19 pandemic may have on DLQ’s customers, suppliers, vendors, regulatory agencies, employees and the global economy as a whole; (15) the expected duration over which DLQ’s balances will fund its operations; and (16) other risks and uncertainties described herein, as well as those risks and uncertainties indicated in Abri’s final prospectus filed with the SEC on August 11, 2021 in connection with Abri’s initial public offering, the preliminary and definitive proxy statements/prospectuses relating to the proposed Merger to be filed by Abri with the SEC, particularly those under the “Risk Factors” sections therein, and in Abri’s other filings with the SEC. Abri cautions that the foregoing list of factors is not exclusive. If any of these risks materialize or Abri’s or DLQ’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Abri nor DLQ presently know, or that Abri and DLQ currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Abri and DLQ’s current expectations, plans and forecasts of future events and views as of the date hereof. Nothing in this Current Report on Form 8-K and the attachments hereto should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved.

Logiq undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Logiq to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

|

|

Financial Statements and Exhibits |

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Merger. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.

The following documents are herewith filed or furnished as exhibits to this report:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

† Certain of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the Securities and Exchange Commission upon its request.

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer and Executive Chairman |

Exhibit 2.4

THIRD AMENDMENT TO THE

MERGER AGREEMENT

Dated as of July 20, 2023

This Third Amendment to the Merger Agreement (this “Amendment”) is made and entered into as of the date first set forth above (the “Amendment Date”) by and among Logiq, Inc., a Delaware corporation (the “DLQ Parent”), DLQ, Inc., a Nevada corporation (the “Company”), Abri SPAC I, Inc., a Delaware corporation (“Parent”), and Abri Merger Sub, Inc., a Delaware corporation (“Merger Sub”). The DLQ Parent, the Company, Parent, and Merger Sub, are sometimes referred to herein individually as a “Party” and, collectively, as the “Parties.”

WHEREAS the Parties are all of the Parties to that certain Merger Agreement dated as of September 9, 2022 (as amended, modified or supplemented from time to time, the “Merger Agreement”); and

WHEREAS, the Parties now desire to amend the Merger Agreement to (i) remove provisions related to the transfer of certain intellectual property assets of Fixel AI, Inc. (“Fixel AI”) and Rebel AI, Inc. (“Rebel”) (ii) change the name of the Surviving Corporation to “Collective Audience, Inc.”, and (iii) increase the size of the senior financing facility from $25 Million to $30 Million;

NOW THEREFORE, in consideration of the mutual agreements contained herein and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

| 1. | Definitions. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Merger Agreement. |

| 2. | Amendments. Pursuant to the provisions of Section 12.2 of the Merger Agreement, the Merger Agreement is hereby amended as follows: |

| (a) | Recital F is hereby deleted in its entirety and replaced with the following: |

“Merger Sub will merge with and into the Company (the “Merger ”), after which the Company will be the surviving company in the Merger (the “Surviving Corporation”) and a wholly-owned subsidiary of Parent and Parent shall change its name to “Collective Audience, Inc.”;

| (b) | Recital G is hereby deleted in its entirety and replaced with “Reserved”. |

| (c) | Section 2.1 is hereby deleted in its entirety and replaced with the following: |

2.1 Merger. Upon the terms and subject to the conditions set forth in this Agreement, and in accordance with the General Corporation Law of the State of Delaware (the “DGCL ”) and the Nevada Revised Statutes (the “NRS ”), at the Effective Time, (a) Merger Sub shall be merged with and into the Company, (b) the separate corporate existence of Merger Sub shall thereupon cease, and the Company shall be the Surviving Corporation, which shall be a name agreeable to all Parties, and (c) the Surviving Corporation shall become a wholly-owned Subsidiary of Parent, which shall change its name to “Collective Audience, Inc.”

| (d) | Section 2.5(b) is hereby deleted in its entirety and replaced with the following: |

(b) The Bylaws of the Company as in effect immediately prior to the Effective Time shall be amended at the Effective Time to read in its entirety as the Bylaws of Merger Sub as in effect immediately prior to the Effective Time, except that the name of the Surviving Corporation shall be a name agreeable to all Parties, until thereafter amended in accordance with the terms thereof, the articles of incorporation of the Surviving Corporation and applicable Law.

| (e) | Section 6.6(e) is removed in its entirety and replaced with the following: |

(e) In accordance with Parent’s amended and restated certificate of incorporation and applicable securities laws, rules and regulations, including the DGCL and rules and regulations of the NASDAQ, in the Proxy Statement, Parent shall seek from the holders of Parent Common Stock the approval the following proposals: (i) the Parent Stockholder Approval; (ii) adoption and approval of the second amended and restated certificate of incorporation of Parent, in the form attached hereto as Exhibit G, including the change of the name of Parent to “Collective Audience, Inc.” (the “Amended Parent Charter”); (iii) adoption and approval of the amended and restated bylaws of Parent in the form attached hereto as Exhibit H; (iv) approval of the members of the Board of Directors of Parent immediately after the Closing; (v) approval of the issuance of more than 20% of the issued and outstanding shares of Parent Common Stock to DLQ Parent in connection with the Merger under applicable exchange listing rules; (vi) approval to adjourn the Parent Stockholder Meeting, if necessary; and (vii) approval to obtain any and all other approvals necessary or advisable to effect the consummation of the Merger as reasonably determined by the Company, DLQ Parent, and the Parent (the proposals set forth in the forgoing clauses (i) through (vii) collectively, the “Parent Proposals”).

| (f) | Section 7.10 is removed in its entirety and replaced with the following: |

Senior Financing Facility. The Company, Parent and Sponsor shall each use commercially reasonable efforts to enter into a mutually acceptable agreement that provides that Sponsor shall be the exclusive financing source of the Company and Parent after the Business Combination in an amount which shall not exceed $30 Million.

| (g) | Section 9.1(j) is removed in its entirety and replaced with the following: |

The Company shall have entered into an agreement which provides that the Sponsor shall be the exclusive financing source of the Company and Parent after Closing in an amount which shall not exceed $30 Million. Such agreement shall be on terms mutually agreed between the parties.

| (h) | Section 9.1(f), Section 9.2(l), Section 9.2(m), Section 9.2(n), and Section 9.2(o) are each removed in their entirety and each is replaced with the word “Reserved.” |

| (i) | For the avoidance of doubt, the obligations of DLQ Parent in Section 9.2(a) shall no longer include any obligations with respect to the Sister Companies, including, without limitation, any obligations with respect to the Sister Companies under Article VI, Article VII and Article VIII of the Agreement, which such obligations shall be specifically excluded from the Agreement.. |

| (j) | With respect to Section 9.2(b), the representations and warranties made by DLQ Parent as of the Closing Date or any earlier date shall specifically exclude the Sister Companies. |

| (k) | Exhibit D, the Form of Revenue Sharing Agreement, paragraph 1 is removed in its entirety and replaced with the following: |

Reference is made to that certain Merger Agreement dated September 9, 2022 (the “Merger Agreement”) among DLQ, Inc. (“DLQ”), Logiq, Inc. (“DLQ Parent”), Abri SPAC I, Inc. (“Parent”), and Abri Merger Sub, Inc. (“Abri Sub”) pursuant to which, Abri Sub will merge with and into DLQ, after which DLQ will be the surviving company and a wholly-owned subsidiary of Parent (the “Merger”) and Parent shall change its name to “Collective Audience, Inc.”.

| (l) | Exhibit G, the Form of Second Amended and Restated Certificate of Incorporation of Abri SPAC I, Inc., Article I is hereby removed in its entirety and replaced with the following: |

The name of the corporation is Collective Audience, Inc. (the “Corporation”).

| (m) | Exhibit H, the Amended and Restated Bylaws of Datalogiq, Inc. shall be amended to be the “Amended and Restated Bylaws of Collective Audience, Inc.” |

| (n) | Exhibit I, Form of Voting Agreement, Preamble shall be removed in its entirety and replaced as follows: |

This Voting Agreement (this “Agreement”) is made as of [ _ ], by and among Collective Audience, Inc. (f/k/a Abri SPAC I, Inc.), a Delaware corporation (the “Parent”), Abri Ventures I, LLC (the “Sponsor”), and each of the individuals and entities set forth on the signature page hereto (each a “Voting Party” and collectively, the “Voting Parties”). For purposes of this Agreement, capitalized terms used and not defined herein shall have the respective meanings ascribed to them in the Merger Agreement (as defined below). This Agreement shall be effective as of the Closing Date of the Merger.

| 3. | Effect of Amendment; Full Force and Effect. This Amendment shall form a part of the Merger Agreement for all purposes, and each Party shall be bound hereby and this Amendment and the Merger Agreement shall be read and interpreted as one combined instrument. From and after the Amendment Date, each reference in the Merger Agreement to “this Agreement,” “hereof,” “hereunder,” “herein,” “hereby” or words of like import referring to the Merger Agreement shall mean and be a reference to the Merger Agreement as amended by this Amendment. Except as herein expressly amended or otherwise provided herein, each and every term, condition, warranty and provision of the Merger Agreement shall remain in full force and effect, and such are hereby ratified, confirmed and approved by the Parties. |

| 4. | Governing Law. This Amendment shall be governed by, construed and enforced in accordance with the Laws of the State of Delaware without regard to the conflict of laws principles thereof. |

| 5. | Counterparts. This Amendment may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Amendment by electronic means, including DocuSign, Adobe Sign or other similar e-signature services, e-mail or scanned pages shall be effective as delivery of a manually executed counterpart to this Amendment. |

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the Parties has caused this Amendment to be duly executed on its behalf as of the Amendment Date.

ABRI SPAC I, INC. | |

| |

By: | /s/ Jeffrey Tirman | |

Name: | Jeffrey Tirman | |

Title: | Chief Executive Officer | |

| |

ABRI MERGER SUB, INC. | |

| |

By: | /s/ Jeffrey Tirman | |

Name: | Jeffrey Tirman | |

Title: | Chief Executive Officer | |

| |

DLQ, INC. | |

| |

By: | /s/ Brent Suen | |

Name: | Brent Suen | |

Title: | Chief Executive Officer | |

| |

LOGIQ, INC. | |

| |

By: | /s/ Brent Suen | |

Name: | Brent Suen | |

Title: | Chief Executive Officer | |

[Signature Page to Third Amendment to Merger Agreement]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

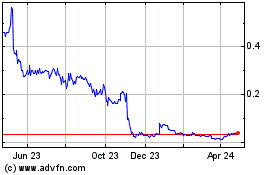

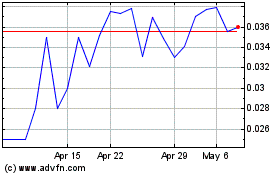

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024