0000887247

false

0000887247

2023-07-19

2023-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

___________________________________________

CURRENT REPORT

___________________________________________

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 19, 2023

___________________________________________

ADAMIS PHARMACEUTICALS CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

0-26372 |

|

82-0429727 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

11682 El Camino Real, Suite 300

San Diego, CA |

|

92130 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (858) 997-2400

(Former name or Former Address, if Changed Since Last

Report.)

___________________________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock |

|

ADMP |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreement

On July 19,

2023, Adamis Pharmaceuticals Corporation (the “Company”) entered into a purchase and sale agreement (the “Agreement”)

to sell the building and real property located in Conway, Arkansas, formerly utilized by the Company’s discontinued compounding

pharmacy business, to FarmaKeio Pharmacy Network, LLC, a Texas limited liability company ("Purchaser"). The Company also entered

into a related agreement to sell to the Purchaser certain personal property assets and equipment located at the building and real property

as well as certain related intellectual property assets. The total aggregate consideration for the real property and other assets is $2,000,000,

before estimated commissions, fees and closing costs of approximately $232,700. The closing of the transaction is subject to satisfaction

of a number of customary closing conditions, and is expected to be completed in the near future.

The Agreement includes a number customary provisions

addressing matters such as title and title insurance, closing deliverables, representations and warranties of the Company and the Purchaser,

survival of the Company’s representations and warranties for a period of time after the closing, indemnification by the Company

of the Purchaser for breach of the Company’s representations, warranties and covenants in the Agreement and relating to the property,

liability limitations, and other matters.

The preceding description of the Agreement does

not purport to be complete, and is qualified in its entirety by reference to the Agreement and the personal property and assets sales

agreement, which are filed as Exhibits to this Current Report on Form 8-K. The representations, warranties and covenants contained in

the Agreement have been made solely for the benefit of the parties to the Agreement and: (i) may be intended not as statements of fact

but rather as a way of allocating risk among the parties if those statements prove to be inaccurate; and (ii) were made only as of the

date of the Agreement or such other dates as may be specified in the Agreement and are subject to more recent developments. Accordingly,

any such representations and warranties should not be relied upon as characterizations of the actual state of facts or affairs on the

date they were made or at any other time.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or operations,

including, but not limited to: the Company’s beliefs concerning the anticipated closing and expected timing of closing of the transactions

contemplated by the Agreement; the amount of estimated commissions, fees and closing costs payable by the Company pursuant to the agreements

described above; and estimates of costs and liabilities associated with the transactions described above. These forward-looking statements

are based on the Company’s current expectations and inherently involve significant risks and uncertainties. The Company’s

actual results, the timing of events, and costs, expenses, charges and liabilities associated with the transactions described in this

Current Report may differ materially from those anticipated by such forward-looking statements. There are no assurances that the transactions

described in this Current Report will be consummated or will be completed within the time period anticipated by the Company, or concerning

the commissions, fees, costs, expenses, charges or liabilities that we may incur in in connection with the transactions described in this

Current Report. Certain other risks relating to the Company’s business, financial conditions and prospects, are described in the

Company’s other filings from time to time with the Securities and Exchange Commission, including the risk factors identified under

the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K, as updated by the Company’s

subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which the Company strongly urges you to read and consider

and all of which are available free of charge on the SEC’s web site at http://www.sec.gov. Such forward-looking statements

speak only as of the date of this Current Report, and except to the extent otherwise required by law, the Company undertakes no duty or

obligation, and expressly disclaims any obligation, to update any forward-looking statements contained in this Current Report as

a result of new information, future events or changes in its expectations.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

* Non-material schedules and exhibits have been omitted pursuant

to Item 601(a)(5) of Regulation S-K. The Registrant hereby undertakes to furnish supplementally copies of any of the omitted schedules

and exhibits upon request by the SEC.

+ Certain marked information has been omitted from this exhibit because

it is both not material and would be competitively harmful if publicly disclosed.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

ADAMIS PHARMACEUTICALS CORPORATION |

| |

|

|

| |

|

|

| Dated: July 24, 2023 |

By: |

/s/ David J. Marguglio |

| |

Name: |

David J. Marguglio |

| |

Title: |

President |

Adamis Pharmaceuticals Corporation 8-K

Exhibit 10.1

Certain confidential information

contained in this document, marked by [***], has been omitted because it is not material and would likely cause competitive harm IF PUBLICLY

DISCLOSED

PURCHASE

AND SALE AGREEMENT

(1270 Dons

Lane, Conway, Arkansas)

This

Purchase and Sale Agreement (this "Agreement") is entered into as of the Effective Date (defined below), by and among Adamis

Pharmaceuticals Corporation, a Delaware corporation ("Seller"), and FarmaKeio Pharmacy Network, LLC, a Texas limited liability

company ("Purchaser").

WHEREAS,

Seller desires to sell to Purchaser and Purchaser desires to purchase from Seller certain real property and related improvements and leases

that are more fully described below in accordance with the terms and conditions hereinafter provided.

NOW,

THEREFORE, for good and valuable consideration received, and intending to be legally bound hereby, Seller and Purchaser do hereby covenant

and agree as follows:

| 1. | Definitions.

As used herein, the following capitalized terms shall possess the following meanings: |

| a. | “Earnest Money

Deposit” means $480,000. |

| b. | “Closing”

means the closing of the transaction contemplated by this Agreement, which shall occur within five (5) days after the Effective Date. |

| c. | “Effective

Date” means the date of Escrow Agent’s signature to this fully-executed Agreement. |

| d. | “Escrow Agent”

means [***}, Arkansas, [***]. |

| e. | “Property”

means that real property bearing a street address of 1270 Dons Lane, Conway, Arkansas that is more fully described on Exhibit A

attached hereto, along with all tenant leases, improvements, appurtenances, rights and easements of every nature related thereto. |

| f. | “Purchase

Price” means the sum of $1,525,000 payable in cash or other readily available funds. |

| g. | “Real Estate

Brokers” means [***],as representative of the Seller, it being noted that Purchaser

is not represented by a broker or agent. |

| h. | “Seller’s

Diligence Materials” means a list of documents requested by Purchaser which Seller shall deliver to Purchaser within 5 business

days after the receipt of said request, to the extent that such documents are within Seller’s possession. |

| 2. | Purchase

of Property. Seller agrees to sell and convey the Property to Purchaser, and Purchaser agrees to buy the Property from Seller in

an “as is”, “where is”, and “with all faults”. For the avoidance of doubt, but subject to the express

representations and warranties of Seller set forth in this Agreement, Seller provides no warranties or representations of any kind with

regard to the nature of the Property and its improvements, or any other aspect of the Property except as otherwise expressly provided

herein. Notwithstanding, Seller shall at Closing assign to Purchaser any and all third-party warranties applicable to the Property or

any appurtenances located thereon. |

| 3. | Purchase

Price. Purchaser agrees to pay the Purchase Price to Seller at the Closing. |

| 5. | Earnest Money Deposit.

Before or substantially contemporaneously with the execution of this

Agreement, Purchaser has delivered or will deliver the Earnest Money Deposit to the Escrow Agent,

which shall be immediately nonrefundable to Purchaser. Should this transaction proceed to closing, then the Earnest Money Deposit shall

be credited against the Purchase Price. Should Purchaser not otherwise close this transaction, then, except as otherwise set forth in

this Agreement, the Earnest Money Deposit shall be paid to Seller as liquidated damages. |

| 6. | Seller’s Due Diligence. Buyer acknowledges

that prior to the Effective Date, its Due Diligence has been completed. |

| 7. | Title Insurance

Commitment. Seller has furnished to Purchaser at Seller’s sole cost and expense

a commitment for title insurance (along with legible copies of all exception documents referenced therein and any and all surveys related

thereto) issued by [***] in the full amount of the Purchase Price. Purchaser has had the right to inspect the foregoing and did not provide

Seller with any objections thereto. |

| 8. | No

Further Encumbrances. Seller covenants and agrees that from the date hereof until the date of Closing, it shall not encumber or adversely

affect title to the Property and will continue operating the Property in the same manner as so operated as of the date of this Agreement. |

| 9. | Good

and Merchantable Title. Seller covenants to convey to Purchaser at Closing good and marketable title in and to the Property by general

warranty deed. For the purposes of this Agreement, "good and marketable title" shall mean fee simple ownership, free of all

monetary claims or liens other than routine pre-printed exceptions which are not customarily removed by title companies in the State

of Arkansas and those provisions identified in the Property title insurance commitment that are deemed not to be objectionable by Purchaser

(the "Permitted Exceptions"). Notwithstanding anything to the contrary, Seller shall in all events (notwithstanding

anything to the contrary contained in this Agreement) be obligated to cause to be released

on or before Closing (i) all liens and claims of lien (including any tax, judgment, mechanic's and/or materialman's liens or claims of

lien but excluding any inchoate ad valorem tax liens that relate to taxes that are not yet due and payable) filed against the Property;

(ii) all items Seller agrees to cure in Seller’s response to Purchaser’s title objections; and (iii) any exceptions to title

created by or otherwise permitted by Seller or its affiliates and not reflected in the initial title commitment, and in no event shall

such items be Permitted Exceptions. In addition, and notwithstanding anything to the contrary, Seller covenants and agrees to satisfy

any Schedule B-I requirements shown on the title commitment that require Seller's action to allow for issuance of the title policy or

which are otherwise within Seller's control. |

| 10. | Closing.

The closing of the acquisition and sale of the Property by Purchaser

and Seller shall occur at Closing. |

| 11. | Place of Closing.

The Closing shall take place at the office of the Escrow Agent, or at any other location at the parties hereto might mutually agree upon.

|

| 12. | Seller's Deliveries

and Conditions to Purchaser's Obligations; Closing Conditions. Seller shall execute and deliver at Closing the following documents,

dated the date of Closing, the form of each of which shall be reasonably acceptable to Seller and Purchaser: |

| a. | Warranty Deed.

A general warranty deed duly executed by Seller conveying to Purchaser good and marketable title to the Property, with the legal description

provided in the Escrow Agent’s commitment for the Title Policy, subject only to the Permitted Exceptions; |

| b. | Bill of Sale; Assignment

of Warranties. A bill of sale and assignment of warranties (including to the extent still in existence, all roof, HVAC, and other

warranties applicable to the Property appurtenances) executed by Seller conveying to Purchaser good and merchantable title to all personal

property located upon the Property and all warranties applicable thereto; |

| c. | FIRPTA Certificate.

A certificate duly executed by Seller setting forth Seller's address and Social Security or tax identification number and certifying whether

or not Seller is a foreign person for purposes of the Foreign Investment in Real Property Tax Act; |

| d. | Assignment.

An assignment, duly executed by Seller in recordable form, assigning and transferring to Purchaser all of Seller's right, title and interest

in any and all leases, and operating or maintenance agreements applicable to the Property or its appurtenances, which Purchaser has otherwise

agreed in writing to assume; |

| e. | Evidence of Termination.

Evidence of termination of any service contracts relating to the Property which either (i) Purchaser has not elected in writing to assume

at Closing or (ii) which are not assignable as of Closing,

all in form and substance reasonably acceptable to Purchaser; |

| f. | Closing Statement.

A closing statement duly executed by Seller, setting forth in reasonable detail the financial transaction contemplated by this Agreement,

including without limitation the Purchase Price, all prorations, the allocation of costs specified herein, and the source, application

and disbursement of all funds; and |

| g. | Additional Documents.

Such other documents as Purchaser or its counsel may reasonably require. |

In

addition to the foregoing, the obligations of the Purchaser hereunder are additionally contingent upon (collectively, the “Seller’s

Closing Conditions”):

| a. | Purchaser’s acquisition of certain personal

property located upon the Property, and the payment of the $475,000 purchase price related thereto, pursuant to the provisions that certain

personal property sale and purchase agreement that the parties hereto have separately executed (the “Personal Property Purchase

Agreement”); |

| b. | Seller’s representations and warranties

being true and correct in all material respects on the Closing and Seller being in compliance with all of the covenants under this Agreement

as of the Closing; |

| c. | There being no material change in the condition

of the Property; |

| d. | Seller’s timely and full performance of

all of its material obligations under this Agreement; and |

| e. | Purchaser’s receipt, as of the date of

Closing, of an updated title commitment for the issuance of the Title Policy. |

| 13. | Purchaser’s

Deliveries and Conditions to Seller’s Obligations. Purchaser shall perform the following obligations and shall execute and deliver

the following documents all as of the date of Closing: |

| a. | Delivery of Purchase

Price. Purchaser (and/or any lender of Purchaser) shall have delivered via wire transfer or other readily-available funds the net

Purchase Price to the Escrow Agent along with the purchase price related to the Personal Property Purchase Agreement; |

| b. | Purchaser’s

Certificate. A certificate duly executed by the Purchaser certifying that each and every warranty and representation made by the Purchaser

in this Agreement is true and correct as of the Closing, as if made by Purchaser at such time; |

| c. | Assumption.

An assumption of any and all other contracts which Purchaser has elected in writing to assume at Closing; |

| d. | Closing Statement.

A closing statement duly executed by Purchaser setting forth in reasonable detail the financial transaction contemplated by this Agreement

including without limitation the Purchase Price, all prorations, the allocation of costs specified herein, and the source, application

and disbursement of all funds; and |

| e. | Additional Documents.

Such other documents as Seller or its counsel may reasonably require. |

In

addition to the foregoing, the obligations of the Seller hereunder are additionally contingent upon (collectively, the “Purchaser’s

Closing Conditions”) (Seller’s Closing Conditions and Purchaser’s Closing Conditions, collectively, the “Closing

Conditions”):

| a. | Purchaser’s representations and warranties

being true and correct in all material respects on the Closing and Purchaser being in compliance with all of the covenants under this

Agreement as of the Closing; |

| b. | Purchaser’s payment at Closing of the

purchase price identified in the Personal Property Purchase Agreement; and |

| c. | Purchaser’s timely and full performance

of all of its material obligations set forth within this Agreement. |

| 14. | Closing Costs.

Seller shall pay the premium associated with the issuance of a standard coverage title insurance policy related to this transaction. Purchaser

shall be responsible for the payment any transfer taxes or documentary stamps, and the cost of any extended title insurance coverage or

endorsements otherwise required by the Purchaser or any current or additional lender. Each party shall pay their own legal fees and costs.

All other closing costs shall be split in accordance with local custom. |

| 15. | Prorations.

At the Closing, the following items shall be prorated between Purchaser and Seller: |

| a. | all assessments, taxes

and other similar charges assessed against the applicable Property (provided that if any such charges are not known as of the Closing

then Seller and Purchaser shall use the most-recent tax statement or other reasonable means for prorating such charges and shall thereafter

adjust such proration as soon as reasonably practicable; this provision shall survive Closing); |

| b. | charges, if any, for

utilities servicing the Property, including, without limitation, charges for gas, electricity and water; |

| c. | payments, if any, under

service and similar contracts affecting the Property; |

| d. | any and all amounts

due under leases and operating agreements encumbering the Property, and |

| e. | all other charges and

fees customarily prorated and adjusted in similar transactions. |

For

purposes of making such prorations, Seller shall have the benefits and burdens of ownership on the day of Closing.

| 16. | Real Estate Commission.

Purchaser and Seller represent and warrant that neither party has dealt with any broker or other finder in connection with the sale to

Purchaser of the Property, with the exception of the Real Estate Broker which will be compensated by Seller at Closing. Each party agrees

to indemnify and hold harmless the other from any claim made by brokers or agents who claim to act for the party sought to be charged

for a commission, compensation, brokerage fees, or similar payment in connection with this transaction and against any and all expense

or liability arising out of any such claim. |

| 17. | Possession of Subject

Property. Seller shall deliver possession of the Property to Purchaser at the time of Closing. |

| 18. | Seller Representations and

Warranties. Seller hereby represents and warrants to Purchaser as of the Effective Date and again as of the Closing that: |

| a. | Seller is the owner in fee simple of the Property; |

| b. | there are no unrecorded mortgages, leases, liens

or encumbrances which may affect title to the Property; |

| c. | to Seller’s knowledge, no parties have

delivered to Seller any notices of violation of any land use restrictions, environmental regulations or other rules or regulations affecting

the Property; |

| d. | to Seller’s knowledge, there are no intended

public improvements which will or could result in any charges being assessed against the Property which will result in a lien upon the

Property; |

| e. | to Seller’s knowledge, there is no impending

or contemplated condemnation or taking by inverse condemnation of the Property, or any portion thereof, by any governmental authorities; |

| f. | there are no suits or claims pending or to Seller’s

knowledge, threatened with respect to or in any manner affecting the Property, nor does Seller know of any circumstances which should or could reasonably form the basis

for any such suits or claims which have not been disclosed in writing to Purchaser by Seller; |

| g. | Seller has not entered into and there is not

existing any other agreement, written or oral, under which Seller is or could become obligated to sell the Property, or any portion thereof,

to a third party; |

| h. | to Seller’s knowledge, no changes in the

zoning or land use regulations applicable to the Property are pending or threatened; |

| i. | this transaction will not in any way violate

any other agreements to which Seller is a party; |

| j. | Seller is duly organized, validly existing and

in good standing under the laws of the state of its organization, and Seller is authorized to transact business in the state in which

the Property is located and Seller has full power and authority to execute, deliver and perform under this Agreement as well as under

the closing documents as described above; |

| k. | to Seller’s knowledge, all amounts due

and payable by Seller under any leases or other contracts affecting the Property have been paid in full and no default of Seller exists

under any contracts affecting the Property and, to Seller’s knowledge after due inquiry, no default of any other party exists under

any of any contracts affecting the Property; |

| l. | Seller itself has not caused any generation,

production, location, transportation, storage, treatment, discharge, disposal, release or threatened release upon, under or about the

Property of any matters so deemed to be environmentally hazardous by any local, state or federal rules or regulations; |

| m. | except as set forth in Seller’s Diligence

Materials, to Seller’s knowledge, there is not now, nor has there ever been, on or in the Property or any portion thereof underground

storage tanks, any asbestos-containing materials or any polychlorinated biphenyls, including those used in hydraulic oils, electric transformers,

or other equipment; |

| n. | as of the Closing, after giving effect to the

transactions contemplated by this Agreement, Seller will not (a) be insolvent (either because its financial condition is such that the

sum of its debts is greater than the fair market value of its assets or because the fair salable value of its assets is less than the

amount required to pay its probable liabilities on existing debts as they mature); (b) have unreasonably small capital with which to engage

in its business; or (c) have incurred debts beyond its ability to pay as they become due; |

| o. | Seller has not made any general assignment for

the benefit of creditors, become insolvent or filed a petition for voluntary bankruptcy or filed a petition or answer seeking reorganization

or an arrangement or composition, extension or readjustment of its indebtedness or consented, in any creditors’ proceeding, to the

appointment of a receiver or trustee of Seller or the property or any part thereof of either of them or been named in an involuntary bankruptcy

proceeding and to Seller’s knowledge, no such actions are contemplated or have been threatened; |

| p. | there is no litigation pending or judgments

outstanding or threatened in writing against Seller and Seller has not received written notice of, and is not otherwise aware of, any

pending or threatened claims, actions, suits, arbitrations, proceedings or investigations by or before any court or arbitration body,

any governmental, administrative or regulatory authority, or any other body, which would affect the Property or the ability of Seller

to complete the transactions contemplated in this Agreement; |

| q. | Seller has caused no construction or other work

to be done upon the Property that either has resulted in or could result in the imposition of a mechanics or materialmen’s lien

or encumbrance affecting the Property on and after Closing; |

| r. | Seller has not received any written notice of

violation from any governmental authority as to the use or operation of the Property, and to Seller’s knowledge, Seller has operated

the Property in material compliance with all applicable laws, rules and regulations; |

| s. | Seller is not a “foreign person”

within the meaning of Section 1445(f) of the Internal Revenue Code of 1986, as amended (the “Code”); and |

| t. | neither Seller nor any of its affiliates, nor

any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors,

representatives or agents is, nor will they become, a person or entity with whom United States persons or entities are restricted from

doing business under regulations of the Office of Foreign Asset Control. |

All of the foregoing

warranties or representations of Seller will survive Closing for a period of nine months from and after the date of Closing. Purchaser

shall be deemed to possess knowledge of all matters contained or disclosed within the documents collectively comprising Seller’s

Diligence Materials.

Further, Seller

hereby covenants to Purchaser as of the Effective Date that Seller shall, at its sole cost:

| i. | operate and continue to operate the Property

in the ordinary course of business; |

| ii. | maintain the Property in its then current condition; |

| iii. | pay prior to the Closing, all sums due for work,

materials or services furnished or otherwise incurred in the ownership, use or operation of the Property up to the Closing; |

| iv. | exercise reasonable efforts to comply with all

governmental requirements applicable to the Property; |

| v. | except as required by a governmental agency,

not place or permit to be placed on any portion of the Property any new improvements of any kind or remove or permit any improvements

to be removed from the Property without the prior written consent of Purchaser; and |

| vi. | except as required by a governmental agency,

not restrict, rezone, file or modify any development plan or zoning plan or establish or participate in the establishment of any improvement

district with respect to all or any portion of the Property without Purchaser’s prior written consent; |

| vii. | between the Effective Date and Closing, Seller

may not cause or create any easement, encumbrance, or mechanic’s or materialmen’s liens, and/or similar liens or encumbrances

to arise or to be imposed upon the Property or any portion thereof that affects title thereto, or allow any amendment or modification

to any existing easements or encumbrances without the prior written consent of Purchaser; and |

| viii. | should Seller receive notice or knowledge of

any information regarding any of the matters set forth in this Article after the Effective Date and prior to the Closing, Seller will

immediately notify Purchaser of the same in writing. |

For the purposes of the above referenced

warranties and representation, the term “Seller” shall mean David J. Marguglio, as a principal officer of Seller, and Seller’s

property management firm responsible for managing and administering the Property, and none other. Seller shall and does hereby indemnify

against, defend and hold Purchaser harmless from any loss, damage, liability and expense, together with all court costs and attorneys’

fees (at trial and on appeal) which Purchaser may incur, by reason of any misrepresentation by Seller or any breach of any of Seller’s

warranties or covenants; provided, however, that Purchaser agrees that Seller shall possess no liability with regard to any breach of

Seller’s warranties or representations to the extent that damage or any indemnification liability arising from any such breach does

not equal at least $10,000. Purchaser further agrees that Seller’s maximum indemnification liability arising from a breach by Seller

of any of Seller’s warranties and representations shall not, in the aggregate, exceed $100,000. The representations and warranties

of Seller contained in this Agreement shall survive the Closing or

earlier termination of this Agreement for a period of 12 months.

Notwithstanding any other provision

herein to the contrary, but subject to Seller’s express representations and warranties contained in this Agreement, Purchaser acknowledges

that Purchaser is acquiring the Property in its existing condition, “AS IS, WHERE IS, AND WITH ALL FAULTS” and, that Purchaser

has had an opportunity to perform all Property inspections and investigations that the Purchaser believes are necessary in order to protect

the Purchaser’s interest in and its contemplated use of the property. Other than the express representations and warranties of the

Seller as contained within this Agreement, Purchaser acknowledges and agrees that neither Seller nor any person or entity acting by or

on behalf of the Seller nor any officer, director or agent of the Seller has made any other verbal or written warranties, representations,

inducements, promises, agreements, assurances or statements of any kind upon which the Purchaser is relying in connection with the Purchaser’s

acquisition of the Property including, without limitation, warranties, representations or statements regarding governmental regulations

applicable to the Property and/or hazardous substances violative of federal or state environmental laws that may pertain to the Property.

Excluding any express representation or warranty set forth in this Agreement, Seller hereby disclaims all warranties implied by law; all

implied warranties of merchantability, habitability or fitness for a particular purpose; warranties or representations regarding the water,

soil conditions or geology applicable to the Property; warranties and representations regarding any rights of way, encumbrances or exceptions

applicable to the Property; and/or warranties and representations pertaining to the Property’s compliance with any federal or state

regulations. Purchaser acknowledges and agrees that Seller has made no warranties and representations regarding the completeness of the

documents collectively comprising Seller’s Diligence Materials and Purchaser further acknowledges that certain of said materials

have been prepared by third parties and the veracity and accuracy of the information contained therein has not been verified by Seller.

If Seller or Purchaser obtain knowledge of any facts or circumstances that would render as inaccurate any of the warranties or representations

of Seller, and notice of such event shall be provided to the other party, thereafter, the other party shall have the option of either

waving the breach of warranty or change and proceed to closing, or, terminating this Agreement in which event the Earnest Money Deposit

shall be returned to the Purchaser. If, under such circumstances, Purchaser opts not to terminate this Agreement, then Purchaser shall

be deemed to have waived its rights to terminate this Agreement in connection with the breach of such warranty or representation (but

not any future breaches of Seller’s representations and warranties) and shall have elected to waive all rights and remedies at law

or in equity with respect to the subject warranty or representation (but not any future breaches of Seller’s representations and

warranties).

| 19. | Purchaser

Representations and Warranties. Purchaser hereby represents and warrants to Seller as of the Effective Date and again as of the Closing

that: |

| a. | Purchaser

is duly organized, validly existing and in good standing under the laws of the state of its organization, and Purchaser is authorized

to transact business in the state in which the property is located and Purchaser has full power and authority to execute, deliver and

perform under this Agreement as well as under the closing documents as described herein; |

| b. | there

is no litigation pending or judgments outstanding or threatened in writing against Purchaser and Purchaser has not received written notice

of, and is not otherwise aware of, any pending or threatened claims, actions, suits, arbitrations, proceedings or investigations by or

before any court or arbitration body, any governmental, administrative or regulatory authority, or any other body, which would affect

the ability of Purchaser to complete the transactions contemplated in this Agreement; |

| c. | neither

Purchaser nor its partners, members, officers, directors, investors, or shareholders, nor any of their respective affiliates, is acting,

directly or indirectly, on behalf of terrorists, terrorist organizations, or narcotics traffickers, including those persons or entities

designated as a Specially Designated National pursuant to the Executive Order 13224 of the President of the United States dated as of

September 23, 2001, as amended, or that appear on the Annex to the Executive Order or are included on any relevant lists maintained by

the Office of Foreign Assets Control of the United States Department of Treasury, United States Department of State, or any other United

States governmental agency, as amended from time to time (“Government List”). Neither Purchaser, nor any person controlling

or controlled by Purchaser, is a country, territory, individual or entity named on a Government List, and, to Purchaser’s actual

knowledge, the monies used in connection with this Agreement and the amounts committed with respect to this Agreement were not and are

not derived from any activities that contravene any applicable anti-money laundering or anti-bribery laws or regulations. |

| 20. | Risk

of Loss. The risk of loss with respect to the Property will be upon Seller until Closing. In the event of any loss or damage to the

Property subsequent to the Effective Date, Seller shall at its election either repair the same, or not repair the same. In the event

Seller elects not to repair the same, Purchaser’s option shall be to terminate this Agreement, in which case the Earnest Money

Deposit shall be returned to Purchaser, or to elect to proceed to Closing and receive any proceeds of insurance, if any, otherwise payable

to Seller as a result of such loss or damage. |

| 21. | Eminent

Domain. Should the Property or any portion thereof be taken by condemnation or conveyed under the threat of condemnation prior to

Closing, or if there is any pending or threatened condemnation against the Property as of the date of Closing, Purchaser may, at its

sole election, either: (i) terminate this Agreement by notifying Seller in writing on or before Closing, in which case the Earnest Money

Deposit shall be refunded to Purchaser, and all rights and obligations of the parties under this Agreement shall expire, and this Agreement

shall become null and void, except as expressly provided herein; or (ii) proceed to Closing, in which event the Purchase Price shall

be reduced by the total of any awards or other proceeds received by Seller on or before the date of Closing with respect to any taking,

and, at Closing, Seller shall assign to Purchaser all of its right to any and all awards or other proceeds paid or payable thereafter

by reason of any taking. Seller shall notify Purchaser of the existence or threat of eminent domain proceedings within 5 days after Seller

learns thereof. |

| 22. | Casualty.

Until the purchase of the Property has been consummated on the date of Closing, all risk of, or damage to, or destruction of,

the Property, whether by fire, flood, tornado, hurricane or other casualty, or by the exercise of the power of eminent domain, or otherwise,

shall belong to and be borne by the Seller. If, prior to Closing, the Property or any part thereof shall be damaged or destroyed,

Purchaser, at Purchaser’s option, may declare this Agreement null and void except as expressly provided herein and receive a full

refund of the Earnest Money Deposit. If Purchaser elects to proceed and to consummate the transfer and conveyance under this Agreement

despite such damage or destruction, there shall be no reduction in, abatement of or set-off against the Purchase Price, and Seller shall

(i) assign to Purchaser all of Seller’s right, title and interest in and to all insurance proceeds resulting from such damage or

destruction and (ii) be responsible for the payment of any and all insurance deductibles in connection with such casualty event(s).

Seller agrees to keep the Property and all improvements located thereon insured against fire and all other hazards at the Property’s

full insurable value. |

| 23. | Default;

Liquidated Damages. If Seller breaches this Agreement, including, without limitation, a breach of any representation or warranty

of Seller set forth herein and/or the failure of Seller to satisfy any conditions precedent to the Closing as specified herein, by written

notice to Seller and Escrow Agent, Purchaser may (i) bring an action for specific performance of this Agreement or (ii) terminate this

Agreement whereupon the Earnest Money Deposit shall be paid immediately by Escrow Agent to Purchaser, Seller shall promptly reimburse

Purchaser for all actual, reasonable out-of-pocket expenses incurred by Purchaser in connection with this Agreement (not to exceed $25,000)

and neither of the parties shall have any further liability or obligation hereunder. If Purchaser elects to pursue an action for specific

performance and such action is denied by a competent court of jurisdiction, Purchaser shall then have the right to pursue the remedy

specified in (ii) above. Alternatively, if acceptable to Purchaser, Purchaser may otherwise proceed forward with the closing of this

transaction in which event the terms of this Agreement shall remain in full force and effect. |

If Purchaser breaches this Agreement,

the Earnest Money Deposit shall be paid to the Seller as liquidated damages and all other financial and other liabilities by between the

parties hereto shall terminate in full.

Notwithstanding the foregoing, either

party shall not be in default pursuant to this Agreement unless and until the other party has delivered notice of default and such default has not been cured within 3 business

days following delivery of such notice; provided, however, that either party’s failure to timely close shall be an immediate event

of default.

| 24. | Entire Agreement;

Counterparts; Amendments. This Agreement constitutes the entire agreement between the parties hereto with respect to the transactions

contemplated herein, and it supersedes all prior understandings or agreements between the parties, which shall be of no force or effect

upon the execution of this Agreement. This Agreement may be executed in one (1) or more duplicate original counterparts, each of which

shall be effective as and shall constitute an original document binding upon the party or parties signing the same. It is agreed that

PDF signatures, DocuSign signatures, or other alternative electronic signatures hereon shall be just is enforceable as original signatures

hereto. |

| 25. | Assignment.

Purchaser reserves the right to assign its rights hereunder to a related

third party owned and controlled by Purchaser at any time upon the delivery of written notice of such assignment to Seller. |

| 26. | Binding Effect.

This Agreement shall be binding upon and inure to the benefit of the parties hereto, and their respective heirs, devisees, personal representatives,

successors and assigns. |

| 27. | Time of Essence.

TIME IS OF THE ESSENCE OF THIS AGREEMENT. As used in this Agreement, a “business day” shall mean any day which is not a Saturday,

Sunday or day in which national banking institutions are closed for business. If any time period or period for performance shall expire

on a day which is not a business day, then such period shall automatically be extended until the next business day. |

| 28. | Construction.

Each party hereto hereby acknowledges that all parties hereto participated equally in the drafting of this Agreement and that, accordingly,

no court construing this Agreement shall construe it more stringently against one party than the other. |

| 29. | Governing Law.

This Agreement shall be governed by, and construed under, the laws of the State of Arkansas. |

| 30. | Date Hereof.

For purposes of this Agreement, "the date hereof" or similar references shall mean the Effective Date. |

| 31. | Acceptance.

Purchaser’s offer to acquire the Property shall terminate unless this

Agreement is accepted and executed by Seller within 5 business days after the date that this offer is tendered by Purchaser, which date

is identified below adjacent to Purchaser’s signature block. |

| 32. | Attorneys’ Fees. If either party

commences an action against the other to enforce any of the terms hereof or because of the breach by either party of any of the covenants,

terms or conditions hereof, the prevailing

party shall be entitled to costs, expenses, and reasonable attorneys' fees at both trial and appellate levels, incurred in connection

with the bringing and/or defense of any such action. |

| 33. | WAIVER OF JURY TRIAL. SELLER

AND PURCHASER HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE THE RIGHT EITHER MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION

BASED HEREON OR ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT AND ANY AGREEMENT CONTEMPLATED TO BE EXECUTED IN CONJUNCTION

HEREWITH, OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTION OF EITHER PARTY. THIS PROVISION

IS A MATERIAL INDUCEMENT FOR THE SELLER AND PURCHASER ENTERING INTO THIS AGREEMENT. |

| 34. | Exclusivity; No-Shop. As an inducement

for Purchaser to commit the resources, forego other potential opportunities, and incur the legal, accounting, survey, architectural, inspection

and incidental expenses necessary to properly evaluate the acquisition of the Property, Seller agrees that during the term of this Agreement,

Seller and its officers, directors, employees and agents will not initiate, solicit, encourage, directly or indirectly, or accept an offer

or proposal regarding the possible purchase and sale of the Property by any person or entity other than Purchaser until the termination

of this Agreement. |

| 35. | Notices. All

notices, requests, consents and other communications hereunder shall be in writing and shall be (i) personally delivered, (ii) sent by

Federal Express or other overnight or same day courier service providing a return receipt, (iii) mailed by first-class registered

or certified mail, return receipt requested, postage prepaid (and shall be effective when received, when refused or when the same cannot

be delivered, as evidenced on the return receipt), or (iv) sent by electronic

mail (and shall be effective on the day and at the time transmitted): |

| If to Seller: |

Adamis Pharmaceuticals Corporation |

| |

11682 El Camino Real |

| |

Suite 300 |

| |

San Diego, CA 92130 |

| |

E-mail: [***] |

| |

|

| |

With a copy to: |

| |

|

| |

[***] |

| If to Purchaser: |

FarmaKeio Pharmacy Network, LLC |

| |

Dan

Deneui |

| |

920

South Kimball Ave. |

| |

Suite

100 |

| |

Southlake,

TX 76092 |

| |

E-mail:

[***] |

Any

failure by either party to accept any notice delivered pursuant to the terms of this section shall not invalidate the effectiveness of

such notice. Notices given by either party’s attorney shall be deemed to be given from the party represented by such attorney.

[SIGNATURES

ON THE FOLLOWING PAGE]

(Signature Page

to Purchase and Sale Agreement)

IN

WITNESS WHEREOF, the parties have hereunto set their hands and seals as of the day and year written thereof.

| |

SELLER: |

| |

|

|

| |

Adamis Pharmaceuticals Corporation |

| |

|

|

| |

By: |

/s/ David J. Marguglio |

| |

Name: David J. Marguglio |

| |

Title: President & COO |

| |

|

|

| |

|

|

| |

Date of Execution: July 19, 2023 |

| |

|

|

| |

|

|

| |

PURCHASER: |

| |

|

|

| |

FarmaKeio Pharmacy Network, LLC |

| |

|

|

| |

By: |

/s/ Daniel DeNeui |

| |

Name: Daniel D. DeNeui |

| |

Title: CEO |

| |

|

|

| |

|

|

| |

Date of Execution: July 19, 2023 |

| |

|

|

| |

|

|

| |

ESCROW AGENT: |

| |

|

|

| |

Beach Abstract and Guaranty Company |

| |

|

|

| |

By: |

/s/ Renea Hendershot |

| |

Name: Renea Hendershot |

| |

Title: Escrow Officer |

| |

|

|

| |

|

|

| |

Date of Execution: July 20, 2023 |

| |

(the “Effective Date”) |

EXHIBIT

A

LEGAL

DESCRIPTION

Adamis Pharmaceuticals Corporation 8-K

Exhibit 10.2

SALES AGREEMENT

FOR 1270 DON'S LN CONWAY AR

ASSETS & ADAMIS/US COMPOUNDING IP

1. Definitions:

For the purpose of this Agreement, the SELLER shall mean 'Operating Company'; the BUYER shall mean the company or person that is purchasing

the item from the Seller. SALES REPRESENTATIVE shall mean the authorized asset broker representing the Seiler. ARTICLES is the

property that is for sale, which shall be defined as all assets and equipment located on the premises of 1270 Don's Ln, Conway AR,

72032 plus US Compounding intellectual property, including but not limited to the equipment and supplies listed in Exhibit A, the intellectual

property and gastro guard patent/IP listed in Exhibit A, plus US Compounding customer lists.

2. Buyer

agrees to purchase the following ARTICLES from the SELLER as indicated below. SELLER and BUYER. have agreed to a sales price of $475,000

for the ARTICLES. The price is inclusive of state and/or local Taxes.

3.

It is the Buyers responsibility to perform

any required checks or inspect items. All items are sold as is, where is and with all faults. Buyer agrees to Sales Representative's As-Is

terms and conditions, which are listed herein as

Exhibit B. The Seller does not make any warranty, express or implied, as to the nature,

quality, value, or condition of any asset. The seller expressly disclaims any warranty

of merchantability, fitness for a particular purpose of non-infringement.

4. Indemnification

and Insurance: From the closing date forward, Buyer indemnifies, defends and holds Seller and all its affiliates harmless against any

and all liability and damage, including, but not limited to, reasonable attorney's fees arising out of any claim for personal injury,

sickness, and death to any persons and for any property damage caused by the Articles or by hazardous material associated with the Articles.

5. Payment Terms and Transfer of Title: Title to ARTICLES shall transfer from

the SELLER to the BUYER upon proper payment detailed in the following payment terms. $475,000 shall be due upon satisfactory completion

of Buyer's due diligence on the 1270 Dons Ln Property, or 5 days prior to closing, whichever occurs first. BUYER fully understands and

agrees that closing on the 1270 Dons Ln real property cannot occur if these payment terms for the Articles are not met. The SELLER shall

have the right to postpone the 1270 Don's Ln property closing until proper payment is made for the Articles. All monies paid to SALES

REPRESENTATIVE by the BUYER shall be 100% refundable up to the closing of the 1270 Dons Ln real property should Buyer decide not to proceed

with the purchase of the real property at 1270 Dons Ln.

Title

to the Articles shall pass to BUYER upon 1270 Don's Ln property closing and a Bill or Sale for the Articles shall be furnished by SBLLER

as part of the closing documents, which shall include a clear title warranty. Thereafter, BUYER shall be responsible for the maintenance,

operation, and/or disposal of the ARTICLES in accordance with applicable law.

6. This

Sales Agreement shall be governed by and shall be construed according to the laws of the state of Arkansas if executed and to be performed

wholly within the State of Arkansas. All actions, legal or other, instituted by BUYER under this Agreement must filed in a federal or

state court located in Arkansas.

7. This

Sales Agreement contains the entire agreement and understanding between the SELLER and the BUYER as to the ARTICLES, and supersedes all

prior agreements, commitments, representations, and discussions between the SELLER and the BUYER pertaining to the sale of the ARTICLES.

Sales

Representative : HealthStar, Inc.

| Signature: |

/s/ Carl Cote |

| Name: |

CJ Cote |

| Title: |

COO |

| Address: |

62 Johnson Lane, Braintree, MA 02184 |

| |

|

| Seller: |

Adamis Pharmaceuticals Corporation |

| Signature: |

/s/ David Marguglio |

| Name: |

David Marguglio |

| Title: |

COO |

| Address: |

11682 El Camino Real, Suite #300, San Diego, CA 92130 |

| |

|

| Buyer: |

FarmaKeio AR LLC |

| |

|

| Signature: |

/s/ Daniel D. DeNeui |

| Name: |

Daniel D. DeNeui |

| Title: |

CEO |

| Address: |

920 S. Kimball Ave, Suite 100, Southlake, TX 76092 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

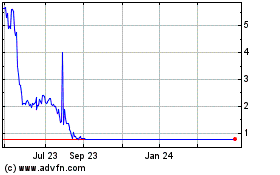

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024