0001119190

false

0001119190

2023-07-14

2023-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 14, 2023

HUMBL,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-31267 |

|

27-1296318 |

| (State

of other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 600

B Street |

|

|

| Suite

300 |

|

|

| San

Diego, CA |

|

92101 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (786) 738-9012

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HMBL |

|

OTC

Pink |

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

July 14, 2023, HUMBL, Inc. (“HUMBL”) entered into a Settlement Agreement and Mutual Release dated July 14,

2023 (the “Settlement Agreement”) with BizSecure, Inc. (“BizSecure”), Alfonso Arana, Alfonso Rodriguez-Arana

and Clement Danish to resolve matters arising under the Asset Purchase Agreement dated February 12, 2022 between HUMBL and BizSecure

in which HUMBL purchased the assets of BizSecure. Under the terms of the Settlement Agreement, HUMBL agreed as follows: (i) within three

(3) business days of the execution date, HUMBL will issue and deliver 127,000,000 restricted shares of its common stock (the “Shares”)

that HUMBL will register on SEC Form S-1 within 60 calendar days of the execution date of the Settlement Agreement; (ii) if, prior to

and including the effective date of the Form S-1, and through the end of the 12th month following such effective date, the value per

Share falls below $0.0030, then HUMBL shall file an amendment to the initial Form S-1 filing to increase the number of Shares issued

to BizSecure and the aggregate offering price of the Shares being registered (“|the “Registered Shares”), reflecting

the public market value of the Shares within three (3) business days of the execution date, but in no event shall the Shares be valued

less than $0.0030 per share; (iii) if HUMBL fails to register the Shares, then HUMBL agrees to immediately pay BizSecure the cash equivalent

of the public market value of the Shares based on (a) the value of the price of HUMBL’s common stock on the day HUMBL was obligated

to register the Shares, multiplied by 127,000,000 or (b) $0.0030 multiplied by 127,000,000 whichever is higher; (iv) the public

market value of the Shares on the execution date shall be equal to the number of Shares multiplied by $.0032 (the “Share

Value”); (v) on the last day of the first year following the execution date (the “Anniversary Date”), the Share Value

shall be no less than the per share value of the Shares on the Anniversary Date based on the closing price of the Registered Shares on

the Anniversary Date (the “Anniversary Value”) (as may be adjusted pursuant to any reverse split). To the extent the Anniversary

Value is lower than the Share Value, which in no event will be less than $0.0030, HUMBL will register and issue and deliver additional

shares to BizSecure equal to the amount necessary for the public market value of the total number of Shares issued to the Stockholders

in accordance with this Agreement to equal the Anniversary Value; and (vi) HUMBL will transfer ownership of and title to the Vibe Board

Pro 75 to BizSecure. The parties also agreed to a mutual release of claims.

HUMBL

also agreed to make certain changes to the Asset Purchase Agreement and the Confidential Information, Invention Assignment, and Arbitration

Agreements signed by Alfonso Rodriguez-Arana and Clement Danish to allow BizSecure to conduct its former business that it sold

to HUMBL under the terms of the Asset Purchase Agreement.

The

foregoing description of the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the

Settlement Agreement which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, HUMBL has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

July 20, 2023 |

HUMBL,

Inc. |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

|

Brian

Foote |

| |

|

President

and CEO |

Exhibit

10.1

SETTLEMENT

AGREEMENT AND MUTUAL RELEASE

THIS

SETTLEMENT AGREEMENT AND MUTUAL RELEASE (this “Agreement”), effective upon execution and dated as of July 14,

2023 (the “Execution Date”), is entered into by and among HUMBL, INC., a Delaware corporation (“Company”),

BIZSECURE INC., a Delaware corporation(“Seller”), Alfonso Arana, an individual (“A. Arana”), Alfonso Rodriguez-Arana,

an individual (“A.R. Arana”), and Clement Danish (“Danish”). A. Arana, A.R. Arana and Danish are collectively

referred to as the “Stockholders”). Each of Seller, Company, and the Stockholders are sometimes referred to herein

individually as a “Party” and collectively as the “Parties.” This Agreement shall be binding upon

and inure to the benefit of each Party and their respective successors and assigns.

RECITALS

WHEREAS,

Company is a public, “smaller reporting company” and “emerging growth company” as defined in U.S. Securities

and Exchange Commission (“SEC”) Rule 12b-2 under the Securities Exchange Act of 1934 and, as of the Execution Date,

trades on the OTC Markets Group Inc.’s Pink® Open Market (OTCMKTS: HMBL);

WHEREAS,

Company purchased Seller’s assets pursuant to an Asset Purchase Agreement dated February 12, 2022 by and among the Parties (the

“Purchase Agreement”);

WHEREAS,

the Parties seek to secure a full, final, and complete settlement to any and all disputes or actions deriving or that may derive from

the Purchase Agreement and any and all related events or transactions, including but not limited to disputes regarding timely registration

of shares; and

WHEREAS,

the Parties agree that this Agreement is being entered into due to the significant devaluation of Company since the signing of the

Purchase Agreement through no fault of Seller or the Stockholders.

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing recitals and the mutual promises and covenants set forth herein, the Parties agree

as follows:

1.

Incorporation of Recitals. The above Recitals are incorporated herein by reference.

2.

Issuance and Value of Shares; Transfer of Vibe Board Pro 75. Within three (3) business days of the Execution Date, Company will

issue and deliver 127,000,000 shares of its common stock (the “Shares”) to Seller in a private transaction. Company

agrees to register the Shares (the “Registered Shares”) under the U.S. Securities Act of 1933, as amended (the “Securities

Act”), with the SEC on a U.S. Securities and Exchange Commission (“SEC”) Form S-1 registration statement, or any

successor SEC form thereto (the “Registration Statement”). Company shall file such registration statement within sixty

(60) calendar days of the Execution Date and use its reasonable best efforts to cause such Registration Statement to promptly become

effective under the Securities Act and to qualify the Shares under applicable state securities laws. The date that the Registration Statement

is first declared effective by the SEC shall be the “Effective Date.”

2.1.

If, prior to and including the Effective Date, and through the end of the 12th month following the Effective Date, the value

per Share falls below $0.0030, then the Company shall file an amendment to the initial Form S-1 filing in order to increase the number

of Shares issued to Seller and the aggregate offering price of the Shares being registered, reflecting the public market value of the

Shares within three (3) business days of the Execution Date, but in no event shall the Shares be valued less than $0.0030 per share.

2.2

If Company fails to register the Shares as stated in this Section 2, then Company agrees to immediately pay to Seller the cash equivalent

of the public market value of the Shares based on (a) the value of the price of Company’s common stock on the day Company was obligated

to register the Registered Shares, multiplied by 127,000,000 or (b) $0.0030 multiplied by 127,000,000 whichever is higher.

2.3

The public market value of the Shares on the Execution Date shall be equal to the number of Shares multiplied by [INSERT CLOSING PRICE

ON EXECUTION DATE] (the “Share Value”). On the last day of the first year following the Execution Date (the “Anniversary

Date”), the Share Value shall be no less than the per share value of the Shares on the Anniversary Date based on the closing

price of the Registered Shares on the Anniversary Date (the “Anniversary Value”) (as may be adjusted pursuant to any

reverse split). To the extent the Anniversary Value is lower than the Share Value, which in no event will be less than $0.0030, Company

will register and issue and deliver additional shares to Seller equal to the amount necessary for the public market value of the total

number of Shares issued to the Stockholders in accordance with this Agreement to equal the Anniversary Value.

2.4

Upon the Execution Date, Company will transfer ownership of and title to the Vibe Board Pro 75 to Seller.

3.

Beneficial Ownership Reports. Each Shareholder covenants and agrees to file a report with the SEC on Schedule 13D or 13G, as applicable,

if it acquires beneficial ownership of more than five percent of Company’s Registered Shares, within the applicable timeframe required

under federal securities laws and agrees to make all other required filings under federal securities laws related to its beneficial ownership

of Company stock.

4.

Release of Claims. Except as provided herein, upon the Execution Date and for the consideration contemplated in this Agreement, each

Party, for itself, its owners, officers, directors, shareholders, subsidiaries, and affiliates, and for each of their respective successors

and assigns (collectively, the “Releasing Persons”), hereby releases, acquits, waives, satisfies, and forever discharges

each other Party, its owners, officers, directors, shareholders, subsidiaries, and affiliates, and each of their respective past and

present directors, managers, officers, shareholders, partners, agents, principals, employees, attorneys, contractors, insurers, servants,

parent corporations or entities, direct and indirect subsidiaries, predecessors, successors, assigns, heirs, and estates (“Released

Persons”), and each of them, separately and collectively, from any and all existing claims, liens, demands, causes of action,

obligations, damages, attorney’s fees and liabilities that it ever had, now has, or may claim to have, arising out of facts and/or

circumstances relating to the Purchase Agreement and/or Company’s acquisition and operation of Seller’s assets before or

as of the date of this Agreement (“Claim or Claims”). Nothing in this Section is meant to dilute or change Company’s

indemnification obligations as stated in Section 7 (“Indemnification”) herein. By way of further clarification, if there

is any conflict between this Section 3 and Section 7, Section 7 shall control.

6.

No Pending Actions. The Parties represent and agree that as of the Execution Date, none of the Releasing Persons or Released Persons

on their own behalf or done on their behalf have instituted, prosecuted, filed, or processed any litigation or other claims or charges

any nature whatsoever against the others. The Parties further agrees, to the maximum extent permitted by law, not to bring or join in

any claim against the Released Persons concerning any matter which arose on or before the Execution Date and not to encourage or voluntarily

assist others in bringing any claims against the Released Persons. In addition, this Agreement and covenant not to sue does not restrict

a Party’s right to pursue an action concerning his rights and/or benefits as described in this Agreement.

7.

Indemnification

7.1 Indemnification

by Company. Company shall indemnify, defend, and hold harmless Seller, Stockholders and their Released Persons (collectively

“Seller and Stockholder Indemnitees”) from any and all losses arising from, connected with, or based on any of the

following: (a) any claim based on allegations that, if true, would constitute a breach of any of Company’s representations,

warranties, or covenants under this Agreement; (b) any claim based on allegations of negligence, gross negligence or willful

misconduct by a Party, a Party’s personnel, or any subcontractors of a Party or third-Party suppliers before and up through

the date of this Agreement; (c) any claim for death or bodily injury, or the damage, loss or destruction of real or tangible

personal property or assets of any of the Parties (including but not limited to an action by a Party’s shareholders); (d) any

claims by any third party or investors based on allegations of breach of fiduciary duty, negligence, gross negligence, intentional

misconduct, breach of contract or fraud made against a Party, a Party’s personnel or a Party’s subcontractors before and

up though and including the date of this Agreement, e) any claims regarding Sellers and Stockholder Indemnitees operation of and

third Party investments in Seller’s assets before or as of and including the date of this Agreement and (f) the enforcement of

this indemnification obligation.

7.2

Indemnification by Seller and Stockholders. Seller and Stockholders shall indemnify, defend, and hold harmless Company and their

Released Persons from any and all losses arising from, connected with, or based any claim based on allegations that, if true, would constitute

a breach of any of Company’s representations, warranties, or covenants under this Agreement.

7.3.

As soon as is reasonable after Seller or Stockholder either (i) receives notice of any Claim or the commencement of any action by any

third party which Company reasonably believes may give rise to a claim for indemnification from Company (a “Third Party Claim”)

or (ii) sustains any loss not involving a Third Party Claim (“Loss”) or action which Seller or Stockholder reasonably

believes may give rise to a claim for indemnification from Company hereunder, Seller or Stockholder shall, if a claim in respect thereof

is to be made against Seller or Stockholder under this Section 5 notify the Company in writing of such claim, action or Loss, as the

case may be; provided, however, that failure to notify Company shall not relieve Company of its indemnity obligation. Any such notification

must be in writing and must state in reasonable detail the nature and basis of the Claim, action or Loss, to the extent known. Except

as provided in this Section 5 Company shall have the right to contest, defend, litigate or settle any such Third Party Claim which involves

solely monetary damages; provided that the Company shall have notified the Seller or Stockholder in writing of its intention to do so

within 15 days of the Seller or Stockholder having given notice of the Third Party Claim to the Company; provided, that the Company shall

diligently contest the Third Party Claim. The Seller or Stockholder shall have the right to participate in, and to be represented by

counsel (at Company’s expense) in any such contest, defense, litigation or settlement conducted by the Company.

7.4.

The Company, if it shall have assumed the defense of any Third Party Claim as provided in this Agreement, shall not consent to a settlement

of, or the entry of any judgment arising from, any such Third Party Claim without the prior written consent of the Seller or Stockholder

(which consent shall not be unreasonably withheld, conditioned or delayed). The Company shall not, without the prior written consent

of the Seller or Stockholder, enter into any compromise or settlement which commits the Seller or Stockholder to take, or to forbear

to take, any action or which does not provide for a complete release by such third party of the Seller or Stockholder. All expenses (including

attorneys’ fees) incurred by the Company in connection with the foregoing shall be paid by the Company.

7.5.

If Seller or Stockholder Indemnitees are entitled to indemnification against a Third Party Claim, and the Company fails to accept a tender

of, or assume the defense of, a Third Party Claim pursuant to this Section 7 the Company shall not be entitled, and shall lose its right,

to contest, defend, litigate and settle such a Third Party Claim, and the Seller or Stockholder shall have the right, without prejudice

to its right of indemnification hereunder, in its discretion exercised in good faith, to contest, defend and litigate such Third Party

Claim, and may settle such Third Party Claim either before or after the initiation of litigation, at such time and upon such terms as

the Seller or Stockholder deems fair and reasonable, provided that at least ten (10) days prior to any such settlement, written notice

of its intention to settle is given to the Company.

7.6

The terms of this Section 7 shall survive the expiration or termination of this Agreement.

8.

Cancellation and Modification of Certain Purchase Agreement Provisions. In the event Company either files for bankruptcy or ceases

operations, Seller will have the right to purchase back Seller’s assets sold to Company pursuant to the Purchase Agreement for

$1.00. The Parties agree that the Purchase Agreement is hereby amended to reflect the following:

a.

Section 4.1.1 Covenants Not to Compete is hereby deleted; and

b.

Section 4.1.4 Discontinue Use of Business Name and Information is hereby deleted.

c.

Items 1and 8 from Exhibit A List of Assets to be Acquired by Buyer will be deleted from Exhibit A and added to Exhibit B List of Excluded

Assets.

d.

Item 9 from Exhibit A (List of Assets to be Acquired by Buyer) will be deleted and replaced in its entirety as follows: All Contracts

between Seller and any of its customers or clients necessary or related to the operation of the Business excluding the Dexter Airforce

Contract which shall be retained by Seller.

9.

Modification and Termination of Stockholders Alfonso Rodriguez-Arana and Clement Danish Confidential Information, Invention Assignment,

and Arbitration Agreements.

9.1

The Company expressly agrees that upon the Execution Date the Confidential Information, Invention Assignment, and Arbitration Agreements

(CIIAA) signed by Mr. Rodriguez-Arana and Clement Danish will be modified to:

| |

a. |

Delete

the words “developed or” from Section 1. Confidentiality; |

| |

|

|

| |

b. |

Delete

Section 2. A. Assignment of Inventions |

| |

|

|

| |

c. |

Delete

Section B. Pre-Existing Materials and replace in its entirety with the following: A. Assignment of Inventions, Pre-Existing

Materials. I will inform the Company, in writing, before incorporating any inventions, discoveries, ideas, original works of

authorship, developments, improvements, trade secrets and other proprietary information or intellectual property rights owned by

me or in which I have an interest prior to, or separate from, my employment with the Company, including, without limitation, any

such inventions that are subject to California Labor Code Section 2870 (attached hereto as Exhibit A) (“Prior Inventions”)

into any Invention (“Company Invention”) and the Company is hereby granted a nonexclusive, royalty-free, perpetual,

irrevocable, transferable worldwide license (with the right to grant and authorize sublicenses) to make, have made, use, import,

offer for sale, sell, reproduce, distribute, modify, adapt, prepare derivative works of, display, perform, and otherwise exploit

such incorporated Prior Inventions only as part of, or in connection with, such Company Invention, and to practice any method related

thereto. I will not incorporate any inventions, discoveries, ideas, original works of authorship, developments, improvements, trade

secrets and other proprietary information or intellectual property rights owned by any third Party into any Invention without the

Company’s prior written permission. |

| |

|

|

| |

d. |

Add

the word “Company” in front of each mention of the word “Invention” in current subsections 2. D. through

and including 2. F. |

9.2

Both CIIAAs will terminate on the Effective Date.

9.3

With regard to Mr. Danish, his employment and the conditions thereof will otherwise remain unchanged.

10.

Legal Fees. Within ten (10) calendar days of the Execution Date, Seller will provide Company with an invoice reflecting the legal

expenses paid by Seller in regard to the negotiations of this Agreement and legal advice sought due to the devaluation of the Company

since the signing of the Purchase Agreement Company will reimburse Seller for the full amount of the invoice within 30 days of the receipt

of the invoice

11.

Miscellaneous. The provisions set forth in this Section 10 shall apply to this Agreement.

11.1

Governing Law; Venue. This Agreement shall be construed and enforced in accordance with, and all questions concerning the construction,

validity, interpretation and performance of this Agreement shall be governed by, the internal laws of the State of Delaware, without

giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction)

that would cause the application of the laws of any jurisdiction other than the State of Delaware. Each Party hereto hereby (i) consents

to and expressly submits to the exclusive personal jurisdiction of any state or federal court sitting in San Diego County, California,

(ii) expressly submits to the exclusive venue of any such court for the purposes hereof, and (iii) waives any claim of improper venue

and any claim or objection that such courts are an inconvenient forum or any other claim, defense or objection to the bringing of any

such proceeding in such jurisdiction or to any claim that such venue of the suit, action or proceeding is improper.

11.2

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all

of which together shall constitute one instrument. The Parties acknowledge and agree that this Agreement may be executed by electronic

signature, which shall be considered as an original signature for all purposes and shall have the same force and effect as an original

signature. The Parties hereto confirm that any electronic copy of another Party’s executed counterpart to this Agreement (or such

Party’s signature page thereof) will be deemed to be an executed original thereof.

11.3

Headings. The headings of this Agreement are for convenience of reference only and shall not form part of, or affect the interpretation

of, this Agreement.

11.4

All monetary amounts in this Agreement are expressed as currency of the United States of America (U.S. Dollars).

11.5

Severability. In the event that any provision of this Agreement is invalid or unenforceable under any applicable statute or rule

of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith and shall be deemed modified to

conform to such statute or rule of law. Any provision hereof which may prove invalid or unenforceable under any law shall not affect

the validity or enforceability of any other provision hereof.

11.6

Amendments. No provision of this Agreement may be waived or amended other than by an instrument in writing signed by both Parties

hereto.

11.7

Notices. Any notice required or permitted hereunder shall be given in writing (unless otherwise specified herein) and shall be

deemed effectively given on the earliest of: (i) the date delivered, if delivered by personal delivery as against written receipt therefor

or by email to an executive officer, or by facsimile (with successful transmission confirmation), (ii) the earlier of the date delivered

or the third business day after deposit, postage prepaid, in the United States Postal Service by certified mail, or (iii) the earlier

of the date delivered or the third business day after mailing by express courier, with delivery costs and fees prepaid, in each case,

addressed to each of the other Parties thereunto entitled at the addresses previously provided by the Parties (or at such other addresses

as such Party may designate by five (5) calendar days’ advance written notice similarly given to each of the other Parties hereto).

The Parties shall also simultaneously provide notice to each other’s counsel via email, if to Company to Brian Foote at Brian@HUMBL.com

and if to Seller or Stockholders to Jeff Schagren at Gordon Rees Scully Mansukhani, LLP at jschagren@grsm.com

11.8

Successors and Assigns. This Agreement or any of the severable rights and obligations inuring to the benefit of or to be performed

by Seller hereunder may be assigned by Seller to its affiliates, in whole or in part, without the need to obtain Company’s consent

thereto. Except as set forth above, neither Seller nor Company may assign its rights or obligations under this Agreement or delegate

its duties hereunder without the prior written consent of the other Party.

11.9

Further Assurances. Each Party shall do and perform, or cause to be done and performed, all such further acts and things, and

shall execute and deliver all such other agreements, certificates, instruments and documents, as the other Party may reasonably request

in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated

hereby.

11.10

Waiver. No waiver of any provision of this Agreement shall be effective unless it is in the form of a writing signed by the Party

granting the waiver. No waiver of any provision or consent to any prohibited action shall constitute a waiver of any other provision

or consent to any other prohibited action, whether or not similar. No waiver or consent shall constitute a continuing waiver or consent

or commit to provide a waiver or consent in the future except to the extent specifically set forth in writing.

[Remainder

of page intentionally left blank; signature page follows]

IN

WITNESS WHEREOF, the undersigned Seller and Company have caused this Agreement to be duly executed as of the date first above written.

| |

SELLER: |

| |

|

| |

BizSecure

Inc. |

| |

|

|

| |

By: |

/s/

Alfonso Rodriguez-Arana |

| |

|

Alfonso

Rodriguez-Arana, CEO |

| |

|

|

| |

STOCKHOLDERS: |

| |

|

|

| |

|

/s/ Alfonso Arana |

| |

|

Alfonso

Arana |

| |

|

|

| |

|

/s/ Alfonso Rodriguez-Arana |

| |

|

Alfonso

Rodriguez-Arana |

| |

|

|

| |

|

/s/ Clement Danish |

| |

|

Clement

Danish |

| |

|

|

| |

COMPANY:

|

| |

|

|

| |

HUMBL,

Inc. |

| |

|

|

| |

By:

|

/s/

Brian Foote |

| |

|

Brian

Foote, President and CEO |

[Signature

Page to Settlement Agreement]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

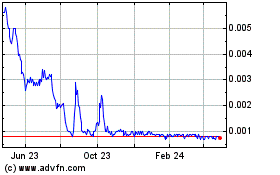

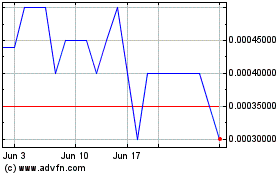

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024