As filed with the Securities and Exchange Commission on July 18, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SCYNEXIS, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

|

56-2181648 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1 Evertrust Plaza, 13th Floor

Jersey City, New Jersey 07302-6548

(Address of principal executive offices) (Zip code)

SCYNEXIS, Inc. Amended and Restated 2014 Employee Stock Purchase Plan

(Full title of the plan)

David Angulo, M.D.

Chief Executive Officer

SCYNEXIS, Inc.

1 Evertrust Plaza, 13th Floor

Jersey City, NJ 07302-6548

(201) 884-5485

(Name and address of agent for service) (Telephone number, including area code, of agent for service)

Copies to:

Matthew B. Hemington

Brett D. White

Cooley LLP

3175 Hanover Street

Palo Alto, California 94304

(650) 843-5000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

SCYNEXIS, Inc. (the “Registrant ”) is filing this Registration Statement on Form S-8 for the purpose of registering 1,500,000 shares of its Common Stock issuable to eligible persons under the SCYNEXIS, Inc. Amended and Restated 2014 Employee Stock Purchase Plan.

PART II

|

|

Item 3. |

Incorporation of Documents by Reference. |

The following documents filed by the Registrant with the Securities and Exchange Commission (“SEC”) are incorporated by reference into this Registration Statement:

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 31, 2023;

(b) The Registrant’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023, filed with the SEC on May 10, 2023;

(c) The Registrant’s Current Reports on Form 8-K filed with the SEC on March 30, 2023, June 16, 2023, and June 23, 2023;

(d) The description of the Registrant’s Common Stock that is contained in a registration statement on Form 8-A filed with the SEC on March 19, 2014 (File No. 001-36365), including any amendment or report filed for the purpose of updating such description, including Exhibit 4.2 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC on March 29, 2022; and

(e) All other reports and documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the filing of such reports and documents. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such earlier statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

|

|

Item 4. |

Description of Securities. |

Not applicable.

|

|

Item 5. |

Interests of Named Experts and Counsel. |

Not applicable.

|

|

Item 6. |

Indemnification of Directors and Officers. |

Section 145 of the Delaware General Corporation Law (the “DGCL”) authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act. The Registrant’s amended and restated certificate of incorporation permits indemnification

of our directors, officers and other agents of the Registrant (and any other persons to which applicable law permits the Registrant to provide indemnification)to the maximum extent permitted by the DGCL, and the Registrant’s amended and restated bylaws provide that the Registrant will indemnify its directors and executive officers and permit the Registrant to indemnify its other officers, employees and other agents, in each case to the maximum extent permitted by the DGCL.

The Registrant has entered into indemnification agreements with its directors and officers, whereby it has agreed to indemnify its directors and officers to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the fact that such director or officer is or was a director, officer, employee or agent of the Registrant, provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in, or not opposed to, the best interest of the Registrant.

The Registrant maintains insurance policies that indemnify its directors and officers against various liabilities arising under the Securities Act and the Exchange Act that might be incurred by any director or officer in his or her capacity as such.

|

|

Item 7. |

Exemption from Registration Claimed. |

Not applicable.

Item 8. Exhibits.

Item 9. Undertakings.

A. The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

Provided, however, that paragraphs (A)(1)(i) and (A)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

B. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new

registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Jersey City, State of New Jersey, on July 17, 2023.

|

|

|

|

|

|

SCYNEXIS, INC. |

|

|

By: |

|

/s/ David Angulo, M.D. |

|

|

David Angulo, M.D. |

|

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints David Angulo, M.D. and Scott Sukenick, and each of them, as his or her true and lawful attorneys-in-fact and agents, each with the full power of substitution, for him or her and in their name, place or stead, in any and all capacities, to sign any and all amendments to this Registration Statement (including post-effective amendments), and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his, her or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form S-8 has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

Name and Signature |

|

Title |

|

Date |

|

|

|

|

|

/s/ David Angulo, M.D. David Angulo, M.D. |

|

President, Chief Executive Officer and Director (Principal Executive Officer) |

|

July 17, 2023 |

|

|

|

/s/ Ivor Macleod Ivor Macleod |

Chief Financial Officer

(Principal Financial and Accounting Officer) |

July 18, 2023 |

|

|

|

/s/ Guy Macdonald Guy Macdonald |

|

Chairman of the Board of Directors |

|

July 17, 2023 |

|

|

|

/s/ Armando Anido Armando Anido |

|

Director |

|

July 17, 2023 |

|

|

|

/s/ Steven C. Gilman Steven C. Gilman, Ph.D. |

|

Director |

|

July 17, 2023 |

|

|

|

/s/ Ann F. Hanham Ann F. Hanham, Ph.D. |

|

Director |

|

July 17, 2023 |

|

|

|

/s/ David Hastings David Hastings |

|

Director |

|

July 18, 2023 |

|

|

|

|

|

Name and Signature |

|

Title |

|

Date |

|

|

|

/s/ Brian Philippe Tinmouth Brian Philippe Tinmouth |

|

Director |

|

July 18, 2023 |

Exhibit 5.1

Matthew B. Hemington

T: +1 650 843 5062

hemingtonmb@cooley.com

July 18, 2023

SCYNEXIS, Inc.

1 Evertrust Plaza, 13th Floor

Jersey City, New Jersey 07302-6548

Ladies and Gentlemen:

We have acted as counsel to SCYNEXIS, Inc., a Delaware corporation (the “Company”), in connection with the filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) covering the offering of up to 1,500,000 shares (the “Shares”) of the Company’s Common Stock, par value $0.001 per share issuable pursuant to the Company’s Amended and Restated 2014 Employee Stock Purchase Plan (the “Plan”).

In connection with this opinion, we have examined and relied upon (a) the Registration Statement and related prospectus, (b) the Plan, (c) the Company’s certificate of incorporation and bylaws, each as currently in effect and (d) originals or copies certified to our satisfaction of such records, documents, certificates, memoranda and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed below. We have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted to us as copies thereof, the accuracy, completeness and authenticity of certificates of public officials and the due authorization, execution and delivery of all documents by all persons other than the Company where authorization, execution and delivery are prerequisites to the effectiveness of such documents. As to certain factual matters, we have relied upon a certificate of officers of the Company and have not independently verified such matters.

Our opinion is expressed only with respect to the General Corporation Law of the State of Delaware. We express no opinion to the extent that any other laws are applicable to the subject matter hereof and express no opinion and provide no assurance as to compliance with any federal or state securities law, rule or regulation.

On the basis of the foregoing, and in reliance thereon, we are of the opinion that the Shares, when sold and issued in accordance with the Plan, the Registration Statement and related prospectus, will be validly issued, fully paid, and nonassessable (except as to shares issued pursuant to deferred payment arrangements, which will be fully paid and nonassessable when such deferred payments are made in full).

We consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the Commission thereunder.

Sincerely,

Cooley LLP

|

|

|

|

|

|

By: |

|

/s/ Matthew B. Hemington |

|

|

Matthew B. Hemington |

Cooley LLP 3175 Hanover Street Palo Alto, CA 94304-1130

t: (650) 843-5000 f: (650) 849-7400 cooley.com

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated March 31, 2023 relating to the financial statements of SCYNEXIS, Inc., appearing in the Annual Report on Form 10-K of SCYNEXIS, Inc. for the year ended December 31, 2022.

/s/ DELOITTE & TOUCHE LLP

Morristown, New Jersey

July 18, 2023

Exhibit 99.1

SCYNEXIS, Inc.

2014 Employee Stock Purchase Plan

Adopted by the Board of Directors: February 11, 2014

Approved by the Stockholders: February 25, 2014

Adjusted for Reverse Stock Split: July 17, 2020

Amended by the Board of Directors: April 14, 2023

Approved by the Stockholders: June 14, 2023

(a)The Plan provides a means by which Eligible Employees of the Company and certain designated Related Corporations may be given an opportunity to purchase shares of Common Stock. The Plan permits the Company to grant a series of Purchase Rights to Eligible Employees under an Employee Stock Purchase Plan.

(b)The Company, by means of the Plan, seeks to retain the services of such Employees, to secure and retain the services of new Employees and to provide incentives for such persons to exert maximum efforts for the success of the Company and its Related Corporations.

(a)The Board will administer the Plan unless and until the Board delegates administration of the Plan to a Committee or Committees, as provided in Section 2(c).

(b)The Board will have the power, subject to, and within the limitations of, the express provisions of the Plan:

(i)To determine how and when Purchase Rights will be granted and the provisions of each Offering (which need not be identical).

(ii)To designate from time to time which Related Corporations of the Company will be eligible to participate in the Plan.

(iii)To construe and interpret the Plan and Purchase Rights, and to establish, amend and revoke rules and regulations for its administration. The Board, in the exercise of this power, may correct any defect, omission or inconsistency in the Plan, in a manner and to the extent it deems necessary or expedient to make the Plan fully effective.

(iv)To settle all controversies regarding the Plan and Purchase Rights granted under the Plan.

(v)To suspend or terminate the Plan at any time as provided in Section 12.

(vi)To amend the Plan at any time as provided in Section 12.

(vii)Generally, to exercise such powers and to perform such acts as it deems necessary or expedient to promote the best interests of the Company and its Related Corporations and to carry out the intent that the Plan be treated as an Employee Stock Purchase Plan.

(viii)To adopt such procedures and sub-plans as are necessary or appropriate to permit participation in the Plan by Employees who are foreign nationals or employed outside the United States.

(c)The Board may delegate some or all of the administration of the Plan to a Committee or Committees. If administration is delegated to a Committee, the Committee will have, in connection with the administration of the Plan, the powers theretofore possessed by the Board that have been delegated to the Committee, including the power to delegate to a subcommittee any of the administrative powers the Committee is authorized to exercise (and references in this Plan to the Board will thereafter be to the Committee or subcommittee), subject, however, to such resolutions, not inconsistent with the provisions of the Plan, as may be adopted from time to time by the Board. The Board may retain the authority to concurrently administer the Plan with the Committee and may, at any time, revest in the Board some or all of the powers previously delegated. Whether or not the Board has delegated administration of the Plan to a Committee, the Board will have the final power to determine all questions of policy and expediency that may arise in the administration of the Plan.

(d)All determinations, interpretations and constructions made by the Board in good faith will not be subject to review by any person and will be final, binding and conclusive on all persons.

3.Shares of Common Stock Subject to the Plan.

(a)Subject to the provisions of Section 11(a) relating to Capitalization Adjustments, the maximum number of shares of Common Stock that may be issued under the Plan will not exceed 1,531,248 shares of Common Stock, which is the sum of: (i) 4,779 shares of Common Stock originally approved; (ii) 26,469 shares of Common Stock that were added pursuant to the annual increase provision of the Plan between 2015 and 2023, and (ii) an additional 1,500,000 shares of Common Stock that were approved by our stockholders at the 2023 Annual Meeting of Stockholders.

(b)If any Purchase Right granted under the Plan terminates without having been exercised in full, the shares of Common Stock not purchased under such Purchase Right will again become available for issuance under the Plan.

(c)The stock purchasable under the Plan will be shares of authorized but unissued or reacquired Common Stock, including shares repurchased by the Company on the open market.

4.Grant of Purchase Rights; Offering.

(a)The Board may from time to time grant or provide for the grant of Purchase Rights to Eligible Employees under an Offering (consisting of one or more Purchase Periods) on an Offering Date or Offering Dates selected by the Board. Each Offering will be in such form and will contain such terms and conditions as the Board will deem appropriate, and will comply with the requirement of Section 423(b)(5) of the Code that all Employees granted Purchase Rights will have the same

2

rights and privileges. The terms and conditions of an Offering shall be incorporated by reference into the Plan and treated as part of the Plan. The provisions of separate Offerings need not be identical, but each Offering will include (through incorporation of the provisions of this Plan by reference in the document comprising the Offering or otherwise) the period during which the Offering will be effective, which period will not exceed 27 months beginning with the Offering Date, and the substance of the provisions contained in Sections 5 through 8, inclusive.

(b)If a Participant has more than one Purchase Right outstanding under the Plan, unless he or she otherwise indicates in forms delivered to the Company: (i) each form will apply to all of his or her Purchase Rights under the Plan, and (ii) a Purchase Right with a lower exercise price (or an earlier-granted Purchase Right, if different Purchase Rights have identical exercise prices) will be exercised to the fullest possible extent before a Purchase Right with a higher exercise price (or a later-granted Purchase Right if different Purchase Rights have identical exercise prices) will be exercised.

(c)The Board will have the discretion to structure an Offering so that if the Fair Market Value of a share of Common Stock on the first Trading Day of a new Purchase Period within that Offering is less than or equal to the Fair Market Value of a share of Common Stock on the Offering Date for that Offering, then (i) that Offering will terminate immediately as of that first Trading Day, and (ii) the Participants in such terminated Offering will be automatically enrolled in a new Offering beginning on the first Trading Day of such new Purchase Period.

(a)Purchase Rights may be granted only to Employees of the Company or, as the Board may designate in accordance with Section 2(b), to Employees of a Related Corporation. Except as provided in Section 5(b), an Employee will not be eligible to be granted Purchase Rights unless, on the Offering Date, the Employee has been in the employ of the Company or the Related Corporation, as the case may be, for such continuous period preceding such Offering Date as the Board may require, but in no event will the required period of continuous employment be equal to or greater than two years. In addition, the Board may provide that no Employee will be eligible to be granted Purchase Rights under the Plan unless, on the Offering Date, such Employee’s customary employment with the Company or the Related Corporation is more than 20 hours per week and more than five months per calendar year or such other criteria as the Board may determine consistent with Section 423 of the Code.

(b)The Board may provide that each person who, during the course of an Offering, first becomes an Eligible Employee will, on a date or dates specified in the Offering which coincides with the day on which such person becomes an Eligible Employee or which occurs thereafter, receive a Purchase Right under that Offering, which Purchase Right will thereafter be deemed to be a part of that Offering. Such Purchase Right will have the same characteristics as any Purchase Rights originally granted under that Offering, as described herein, except that:

(i)the date on which such Purchase Right is granted will be the “Offering Date” of such Purchase Right for all purposes, including determination of the exercise price of such Purchase Right;

3

(ii)the period of the Offering with respect to such Purchase Right will begin on its Offering Date and end coincident with the end of such Offering; and

(iii)the Board may provide that if such person first becomes an Eligible Employee within a specified period of time before the end of the Offering, he or she will not receive any Purchase Right under that Offering.

(c)No Employee will be eligible for the grant of any Purchase Rights if, immediately after any such Purchase Rights are granted, such Employee owns stock possessing five percent or more of the total combined voting power or value of all classes of stock of the Company or of any Related Corporation. For purposes of this Section 5(c), the rules of Section 424(d) of the Code will apply in determining the stock ownership of any Employee, and stock which such Employee may purchase under all outstanding Purchase Rights and options will be treated as stock owned by such Employee.

(d)As specified by Section 423(b)(8) of the Code, an Eligible Employee may be granted Purchase Rights only if such Purchase Rights, together with any other rights granted under all Employee Stock Purchase Plans of the Company and any Related Corporations, do not permit such Eligible Employee’s rights to purchase stock of the Company or any Related Corporation to accrue at a rate which exceeds $25,000 of Fair Market Value of such stock (determined at the time such rights are granted, and which, with respect to the Plan, will be determined as of their respective Offering Dates) for each calendar year in which such rights are outstanding at any time.

(e)Officers of the Company and any designated Related Corporation, if they are otherwise Eligible Employees, will be eligible to participate in Offerings under the Plan. Notwithstanding the foregoing, the Board may provide in an Offering that Employees who are highly compensated Employees within the meaning of Section 423(b)(4)(D) of the Code will not be eligible to participate.

6.Purchase Rights; Purchase Price.

(a)On each Offering Date, each Eligible Employee, pursuant to an Offering made under the Plan, will be granted a Purchase Right to purchase up to that number of shares of Common Stock purchasable either with a percentage or with a maximum dollar amount, as designated by the Board, but in either case not exceeding 15% of such Employee’s earnings (as defined by the Board in each Offering) during the period that begins on the Offering Date (or such later date as the Board determines for a particular Offering) and ends on the date stated in the Offering, which date will be no later than the end of the Offering.

(b)The Board will establish one or more Purchase Dates during an Offering on which Purchase Rights granted for that Offering will be exercised and shares of Common Stock will be purchased in accordance with such Offering.

(c)In connection with each Offering made under the Plan, the Board may specify (i) a maximum number of shares of Common Stock that may be purchased by any Participant on any Purchase Date during such Offering, (ii) a maximum aggregate number of shares of Common Stock that may be purchased by all Participants pursuant to such Offering and/or (iii) a maximum aggregate number of shares of Common Stock that may be purchased by all Participants on any Purchase

4

Date under the Offering. If the aggregate purchase of shares of Common Stock issuable upon exercise of Purchase Rights granted under the Offering would exceed any such maximum aggregate number, then, in the absence of any Board action otherwise, a pro rata (based on each Participant’s accumulated Contributions) allocation of the shares of Common Stock available will be made in as nearly a uniform manner as will be practicable and equitable.

(d)The purchase price of shares of Common Stock acquired pursuant to Purchase Rights will be not less than the lesser of:

(i)an amount equal to 85% of the Fair Market Value of the shares of Common Stock on the Offering Date; or

(ii)an amount equal to 85% of the Fair Market Value of the shares of Common Stock on the applicable Purchase Date.

7.Participation; Withdrawal; Termination.

(a)An Eligible Employee may elect to authorize payroll deductions as the means of making Contributions by completing and delivering to the Company, within the time specified in the Offering, an enrollment form provided by the Company. The enrollment form will specify the amount of Contributions not to exceed the maximum amount specified by the Board. Each Participant’s Contributions will be credited to a bookkeeping account for such Participant under the Plan and will be deposited with the general funds of the Company except where applicable law requires that Contributions be deposited with a third party. If permitted in the Offering, a Participant may begin such Contributions with the first payroll occurring on or after the Offering Date (or, in the case of a payroll date that occurs after the end of the prior Offering but before the Offering Date of the next new Offering, Contributions from such payroll will be included in the new Offering). If permitted in the Offering, a Participant may thereafter reduce (including to zero) or increase his or her Contributions. If specifically provided in the Offering, in addition to making Contributions by payroll deductions, a Participant may make Contributions through the payment by cash or check prior to a Purchase Date.

(b)During an Offering, a Participant may cease making Contributions and withdraw from the Offering by delivering to the Company a withdrawal form provided by the Company. The Company may impose a deadline before a Purchase Date for withdrawing. Upon such withdrawal, such Participant’s Purchase Right in that Offering will immediately terminate and the Company will distribute to such Participant all of his or her accumulated but unused Contributions and such Participant’s Purchase Right in that Offering shall thereupon terminate. A Participant’s withdrawal from that Offering will have no effect upon his or her eligibility to participate in any other Offerings under the Plan, but such Participant will be required to deliver a new enrollment form to participate in subsequent Offerings.

(c)Purchase Rights granted pursuant to any Offering under the Plan will terminate immediately if the Participant either (i) is no longer an Employee for any reason or for no reason (subject to any post-employment participation period required by law) or (ii) is otherwise no longer eligible to participate. The Company will distribute to such individual all of his or her accumulated but unused Contributions.

5

(d)During a Participant’s lifetime, Purchase Rights will be exercisable only by such Participant. Purchase Rights are not transferable by a Participant, except by will, by the laws of descent and distribution, or, if permitted by the Company, by a beneficiary designation as described in Section 10.

(e)Unless otherwise specified in the Offering, the Company will have no obligation to pay interest on Contributions.

8.Exercise of Purchase Rights.

(a)On each Purchase Date, each Participant’s accumulated Contributions will be applied to the purchase of shares of Common Stock, up to the maximum number of shares of Common Stock permitted by the Plan and the applicable Offering, at the purchase price specified in the Offering. No fractional shares will be issued unless specifically provided for in the Offering.

(b)If any amount of accumulated Contributions remains in a Participant’s account after the purchase of shares of Common Stock and such remaining amount is less than the amount required to purchase one share of Common Stock on the final Purchase Date of an Offering, then such remaining amount will be held in such Participant’s account for the purchase of shares of Common Stock under the next Offering under the Plan, unless such Participant withdraws from or is not eligible to participate in such Offering, in which case such amount will be distributed to such Participant after the final Purchase Date, without interest. If the amount of Contributions remaining in a Participant’s account after the purchase of shares of Common Stock is at least equal to the amount required to purchase one whole share of Common Stock on the final Purchase Date of an Offering, then such remaining amount will not roll over to the next Offering and will instead be distributed in full to such Participant after the final Purchase Date of such Offering without interest.

(c)No Purchase Rights may be exercised to any extent unless the shares of Common Stock to be issued upon such exercise under the Plan are covered by an effective registration statement pursuant to the Securities Act and the Plan is in material compliance with all applicable federal, state, foreign and other securities and other laws applicable to the Plan. If on a Purchase Date the shares of Common Stock are not so registered or the Plan is not in such compliance, no Purchase Rights will be exercised on such Purchase Date, and the Purchase Date will be delayed until the shares of Common Stock are subject to such an effective registration statement and the Plan is in material compliance, except that the Purchase Date will in no event be more than 6 months from the Offering Date. If, on the Purchase Date, as delayed to the maximum extent permissible, the shares of Common Stock are not registered and the Plan is not in material compliance with all applicable laws, no Purchase Rights will be exercised and all accumulated but unused Contributions will be distributed to the Participants without interest.

9.Covenants of the Company.

The Company will seek to obtain from each federal, state, foreign or other regulatory commission or agency having jurisdiction over the Plan such authority as may be required to grant Purchase Rights and issue and sell shares of Common Stock thereunder. If, after commercially reasonable efforts, the Company is unable to obtain the authority that counsel for the Company

6

deems necessary for the grant of Purchase Rights or the lawful issuance and sale of Common Stock under the Plan, and at a commercially reasonable cost, the Company will be relieved from any liability for failure to grant Purchase Rights and/or to issue and sell Common Stock upon exercise of such Purchase Rights.

10.Designation of Beneficiary.

(a)The Company may, but is not obligated to, permit a Participant to submit a form designating a beneficiary who will receive any shares of Common Stock and/or Contributions from the Participant’s account under the Plan if the Participant dies before such shares and/or Contributions are delivered to the Participant. The Company may, but is not obligated to, permit the Participant to change such designation of beneficiary. Any such designation and/or change must be on a form approved by the Company.

(b)If a Participant dies, in the absence of a valid beneficiary designation, the Company will deliver any shares of Common Stock and/or Contributions to the executor or administrator of the estate of the Participant. If, to the knowledge of the Company, no executor or administrator has been appointed, the Company, in its sole discretion, may deliver such shares of Common Stock and/or Contributions to the Participant’s spouse, dependents or relatives, or if no spouse, dependent or relative is known to the Company, then to such other person as the Company may designate.

11.Adjustments upon Changes in Common Stock; Corporate Transactions.

(a)In the event of a Capitalization Adjustment, the Board will appropriately and proportionately adjust: (i) the class(es) and maximum number of securities subject to the Plan pursuant to Section 3(a), (ii) the class(es) and number of securities subject to, and the purchase price applicable to outstanding Offerings and Purchase Rights, and (iii) the class(es) and number of securities that are the subject of the purchase limits under each ongoing Offering. The Board will make these adjustments, and its determination will be final, binding and conclusive.

(b)In the event of a Corporate Transaction, then: (i) any surviving corporation or acquiring corporation (or the surviving or acquiring corporation’s parent company) may assume or continue outstanding Purchase Rights or may substitute similar rights (including a right to acquire the same consideration paid to the stockholders in the Corporate Transaction) for outstanding Purchase Rights, or (ii) if any surviving or acquiring corporation (or its parent company) does not assume or continue such Purchase Rights or does not substitute similar rights for such Purchase Rights, then the Participants’ accumulated Contributions will be used to purchase shares of Common Stock within ten business days prior to the Corporate Transaction under the outstanding Purchase Rights, and the Purchase Rights will terminate immediately after such purchase.

12.Amendment, Termination or Suspension of the Plan.

(a)The Board may amend the Plan at any time in any respect the Board deems necessary or advisable. However, except as provided in Section 11(a) relating to Capitalization Adjustments, stockholder approval will be required for any amendment of the Plan for which stockholder approval is required by applicable law or listing requirements, including any amendment that either (i) materially increases the number of shares of Common Stock available for issuance under the

7

Plan, (ii) materially expands the class of individuals eligible to become Participants and receive Purchase Rights, (iii) materially increases the benefits accruing to Participants under the Plan or materially reduces the price at which shares of Common Stock may be purchased under the Plan, (iv) materially extends the term of the Plan, or (v) expands the types of awards available for issuance under the Plan, but in each of (i) through (v) above only to the extent stockholder approval is required by applicable law or listing requirements.

(b)The Board may suspend or terminate the Plan at any time. No Purchase Rights may be granted under the Plan while the Plan is suspended or after it is terminated.

(c)Any benefits, privileges, entitlements and obligations under any outstanding Purchase Rights granted before an amendment, suspension or termination of the Plan will not be materially impaired by any such amendment, suspension or termination except (i) with the consent of the person to whom such Purchase Rights were granted, (ii) as necessary to comply with any laws, listing requirements, or governmental regulations (including, without limitation, the provisions of Section 423 of the Code and the regulations and other interpretive guidance issued thereunder relating to Employee Stock Purchase Plans) including without limitation any such regulations or other guidance that may be issued or amended after the date the Plan is adopted by the Board, or (iii) as necessary to obtain or maintain favorable tax, listing, or regulatory treatment. To be clear, the Board may amend outstanding Purchase Rights without a Participant’s consent if such amendment is necessary to ensure that the Purchase Right and/or the Plan complies with the requirements of Section 423 of the Code.

13.Effective Date of Plan.

The Plan will become effective immediately prior to and contingent upon the IPO Date. No Purchase Rights will be exercised unless and until the Plan has been approved by the stockholders of the Company, which approval must be within 12 months before or after the date the Plan is adopted (or if required under Section 12(a) above, materially amended) by the Board.

14.Miscellaneous Provisions.

(a)Proceeds from the sale of shares of Common Stock pursuant to Purchase Rights will constitute general funds of the Company.

(b)A Participant will not be deemed to be the holder of, or to have any of the rights of a holder with respect to, shares of Common Stock subject to Purchase Rights unless and until the Participant’s shares of Common Stock acquired upon exercise of Purchase Rights are recorded in the books of the Company (or its transfer agent).

(c)The Plan and Offering do not constitute an employment contract. Nothing in the Plan or in the Offering will in any way alter the at will nature of a Participant’s employment or be deemed to create in any way whatsoever any obligation on the part of any Participant to continue in the employ of the Company or a Related Corporation, or on the part of the Company or a Related Corporation to continue the employment of a Participant.

(d)The provisions of the Plan will be governed by the laws of the State of California without resort to that state’s conflicts of laws rules.

8

As used in the Plan, the following definitions will apply to the capitalized terms indicated below:

(a)“Board” means the Board of Directors of the Company.

(b)“Capital Stock” means each and every class of common stock of the Company, regardless of the number of votes per share.

(c)“Capitalization Adjustment” means any change that is made in, or other events that occur with respect to, the Common Stock subject to the Plan or subject to any Purchase Right after the date the Plan is adopted by the Board without the receipt of consideration by the Company through merger, consolidation, reorganization, recapitalization, reincorporation, stock dividend, dividend in property other than cash, large nonrecurring cash dividend, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or other similar equity restructuring transaction, as that term is used in Financial Accounting Standards Board Accounting Standards Codification Topic 718 (or any successor thereto). Notwithstanding the foregoing, the conversion of any convertible securities of the Company will not be treated as a Capitalization Adjustment.

(d)“Code” means the Internal Revenue Code of 1986, as amended, including any applicable regulations and guidance thereunder.

(e)“Committee” means a committee of one or more members of the Board to whom authority has been delegated by the Board in accordance with Section 2(c).

(f)“Common Stock” means the common stock of the Company, having 1 vote per share.

(g)“Company” means SCYNEXIS, Inc., a Delaware corporation.

(h)“Contributions” means the payroll deductions and other additional payments specifically provided for in the Offering that a Participant contributes to fund the exercise of a Purchase Right. A Participant may make additional payments into his or her account if specifically provided for in the Offering, and then only if the Participant has not already had the maximum permitted amount withheld during the Offering through payroll deductions.

(i)“Corporate Transaction” means the consummation, in a single transaction or in a series of related transactions, of any one or more of the following events:

(i)a sale or other disposition of all or substantially all, as determined by the Board in its sole discretion, of the consolidated assets of the Company and its Subsidiaries;

(ii)a sale or other disposition of at least 50% of the outstanding securities of the Company;

(iii)a merger, consolidation or similar transaction following which the Company is not the surviving corporation; or

9

(iv)a merger, consolidation or similar transaction following which the Company is the surviving corporation but the shares of Common Stock outstanding immediately preceding the merger, consolidation or similar transaction are converted or exchanged by virtue of the merger, consolidation or similar transaction into other property, whether in the form of securities, cash or otherwise.

(j)“Director” means a member of the Board.

(k)“Eligible Employee” means an Employee who meets the requirements set forth in the document(s) governing the Offering for eligibility to participate in the Offering, provided that such Employee also meets the requirements for eligibility to participate set forth in the Plan.

(l)“Employee” means any person, including an Officer or Director, who is “employed” for purposes of Section 423(b)(4) of the Code by the Company or a Related Corporation. However, service solely as a Director, or payment of a fee for such services, will not cause a Director to be considered an “Employee” for purposes of the Plan.

(m)“Employee Stock Purchase Plan” means a plan that grants Purchase Rights intended to be options issued under an “employee stock purchase plan,” as that term is defined in Section 423(b) of the Code.

(n)“Exchange Act” means the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder.

(o)“Fair Market Value” means, as of any date, the value of the Common Stock determined as follows:

(i)If the Common Stock is listed on any established stock exchange or traded on any established market, the Fair Market Value of a share of Common Stock will be the closing sales price for such stock as quoted on such exchange or market (or the exchange or market with the greatest volume of trading in the Common Stock) on the date of determination, as reported in such source as the Board deems reliable. Unless otherwise provided by the Board, if there is no closing sales price for the Common Stock on the date of determination, then the Fair Market Value will be the closing sales price on the last preceding date for which such quotation exists.

(ii)In the absence of such markets for the Common Stock, the Fair Market Value will be determined by the Board in good faith in compliance with applicable laws and in a manner that complies with Sections 409A of the Code.

(p)“IPO Date” means the date of the underwriting agreement between the Company and the underwriter(s) managing the initial public offering of the Common Stock, pursuant to which the Common Stock is priced for the initial public offering.

(q)“Offering” means the grant to Eligible Employees of Purchase Rights, with the exercise of those Purchase Rights automatically occurring at the end of one or more Purchase Periods. The terms and conditions of an Offering will generally be set forth in the “Offering Document” approved by the Board for that Offering.

10

(r)“Offering Date” means a date selected by the Board for an Offering to commence.

(s)“Officer” means a person who is an officer of the Company or a Related Corporation within the meaning of Section 16 of the Exchange Act.

(t)“Participant” means an Eligible Employee who holds an outstanding Purchase Right.

(u)“Plan” means this SCYNEXIS, Inc. 2014 Employee Stock Purchase Plan.

(v)“Purchase Date” means one or more dates during an Offering selected by the Board on which Purchase Rights will be exercised and on which purchases of shares of Common Stock will be carried out in accordance with such Offering.

(w)“Purchase Period” means a period of time specified within an Offering, generally beginning on the Offering Date or on the first Trading Day following a Purchase Date, and ending on a Purchase Date. An Offering may consist of one or more Purchase Periods.

(x)“Purchase Right” means an option to purchase shares of Common Stock granted pursuant to the Plan.

(y)“Related Corporation” means any “parent corporation” or “subsidiary corporation” of the Company whether now or subsequently established, as those terms are defined in Sections 424(e) and (f), respectively, of the Code.

(z)“Securities Act” means the Securities Act of 1933, as amended.

(aa)“Trading Day” means any day on which the exchange(s) or market(s) on which shares of Common Stock are listed, including but not limited to the NYSE, Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market or any successors thereto, is open for trading.

11

Exhibit 107

Calculation of Filing Fee Table

Form S-8

SCYNEXIS, Inc.

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Filing Fee Table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form S-8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCYNEXIS, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1: Newly Registered Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Type |

|

Security Class Title |

|

Fee Calculation Rule |

|

Amount Registered (1) |

|

|

Proposed Maximum Offering Price Per Share (2) |

|

|

Maximum Aggregate Offering Price |

|

|

Fee Rate |

|

|

Amount of Registration Fee |

|

Equity |

|

Common Stock, par value $0.001 |

|

457(c) & 457(h) |

|

|

1,500,000 |

|

|

$ |

2.79 |

|

|

$ |

4,185,000 |

|

|

|

0.0001102 |

|

|

$ |

461.19 |

|

Total Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

$ |

4,185,000 |

|

|

|

|

|

$ |

461.19 |

|

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

461.19 |

|

(1) Represents additional shares issuable under the Registrant’s 2014 Amended and Restated Employee Stock Purchase Plan (the “Plan”). Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of Registrant’s common stock that become issuable under the Plan set forth herein by reason of any stock dividend, stock split, recapitalization, or other similar transaction effected that results in an increase to the number of outstanding shares of Registrant’s common stock, as applicable.

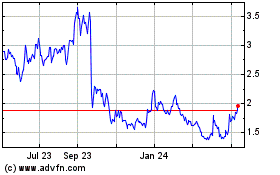

(2) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) and Rule 457(c) promulgated under the Securities Act. The offering price per share and the aggregate offering price is based upon $2.79, which is the average of the high and low selling prices of the Registrant’s Common Stock as reported on The Nasdaq Global Market on July 11, 2023.

Scynexis (NASDAQ:SCYX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Scynexis (NASDAQ:SCYX)

Historical Stock Chart

From Apr 2023 to Apr 2024