false

0001583648

0001583648

2023-07-17

2023-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 18, 2023 (July 17, 2023)

PIERIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-37471

|

30-0784346

|

|

(State or other jurisdiction of

Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

225 Franklin Street, 26th Floor

|

02110

|

|

Boston, MA

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 857-246-8998

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

|

PIRS

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement

On July 17, 2023, AstraZeneca AB (“AstraZeneca”) provided Pieris Pharmaceuticals, Inc. (the “Company”) with a written notice of termination of the License and Collaboration Agreement, dated as of May 2, 2017, and subsequently amended, by and among AstraZeneca, the Company, Pieris Pharmaceuticals GmbH and Pieris Australia Pty Limited, and the Non-Exclusive Anticalin Platform Technology License Agreement, dated as of May 2, 2017, and subsequently amended, by and among AstraZeneca, the Company, and Pieris Pharmaceuticals GmbH (collectively, the “Agreements”). The termination will be effective October 15, 2023 (the “Termination Date”), or 90 days from the date on which AstraZeneca notified the Company of its intent to terminate the Agreements.

Pursuant to the Agreements, AstraZeneca and the Company agreed to collaborate on the research, development and commercialization of Anticalin-based therapeutics as part of the Company’s respiratory franchise, including the phase 2a study of elarekibep. The termination will include both elarekibep and the remaining active discovery stage program. AstraZeneca’s decision to terminate the Agreements was based on non-clinical safety findings in a 13-week toxicology study of elarekibep in non-human primates previously disclosed by the Company. Following the Termination Date, the Company will be free to choose to further develop its assets that were the subject of the Agreements; the Company will evaluate the programs and its rights under the Agreements and determine its strategic options after its review.

The foregoing is only a summary of the material terms of the Agreements, does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreements, which were filed as Exhibits 10.1 and 10.2 to the Company’s Quarterly Report on Form 10-Q (File No. 001-37471) with the Securities and Exchange Commission (the “SEC”) on April 26, 2018; Amendment No. 2, dated as of March 29, 2021, to the License and Collaboration Agreement, which was filed as Exhibit 10.4 to the Company’s Quarterly Report on Form 10-Q with the SEC on May 17, 2021; Amendments No. 3 and 4, dated as of June 9, 2022 and June 30, 2022, respectively, to the License and Collaboration Agreement, which were, Exhibit 10.2 and 10.3 to the Company’s Quarterly Report on Form 10-Q with the SEC on August 4, 2022; Amendment No. 5, dated as of August 1, 2022, to the License and Collaboration Agreement, which was filed as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q with the SEC on November 4, 2022; and Amendment No. 1, dated as of March 29, 2021, to the Non-Exclusive Anticalin Platform Technology License Agreement, which was filed as Exhibit 10.5 to the Company’s Quarterly Report on Form 10-Q with the SEC on May 17, 2021.

Item 2.02 Results of Operations and Financial Condition

On July 18, 2023, the Company announced that as of June 30, 2023, the Company's cash, cash equivalents, and investments totaled approximately $54.9 million.

The cash, cash equivalents and investments information above is based on preliminary, unaudited information and management estimates for the quarter ended June 30, 2023, is not a comprehensive statement of the Company’s financial results as of and for the quarter ended June 30, 2023 and is subject to completion of the Company’s financial closing procedures and may change. The Company’s independent registered public accounting firm has not conducted an audit or review of, and does not express an opinion or any other form of assurance with respect to, this preliminary estimate.

The information set forth under this “Item 2.02. Results of Operations and Financial Condition,” including the estimate of the Company’s cash, cash equivalents, and investments as of June 30, 2023 set forth in Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On July 18, 2023, the Company announced its intention to explore strategic alternatives, as described further under Item 8.01 of this Current Report on Form 8-K. In connection therewith, on July 17, 2023, the Board of Directors of the Company approved a reduction in force of the Company's workforce by approximately 70% to be substantially completed in the fourth quarter of 2023 (the "Workplace Reduction"). As a result of the Workplace Reduction, the Company expects to incur estimated severance and other employee termination-related costs of approximately $3.4 million in the third quarter 2023.

The Company has not yet completed its analysis of additional charges associated with implementation of the Workforce Reduction, and therefore is not able to make a good faith determination of an estimate of the amount, or range of amounts, of any additional charges such as costs for retention payments. The Company will provide additional disclosure through an amendment to this Current Report on Form 8-K once it makes a determination of an estimate or range of estimates of such charges, if any. In addition, as the Workplace Reduction is implemented, the Company’s management will re-evaluate the estimated costs and expenses set forth above and may revise the estimated reduction-related cost as appropriate, consistent with generally accepted accounting principles. The estimated charges that the Company expects to incur in connection with the Workplace Reduction are subject to a number of assumptions, and actual results may differ materially from these estimates. The Company may also incur additional costs not currently contemplated due to events that may occur as a result of, or that are associated with, the Workplace Reduction.

Item 8.01 Other Events.

On July 18, 2023, the Company issued a press release announcing the decision to explore strategic alternatives for the Company with the goal of maximizing shareholder value and its engagement of Stifel, Nicolaus & Company, Incorporated to serve as strategic advisor in its review of strategic alternatives. The information in the press release attached as Exhibit 99.1 to this report, except for the estimate of the Company’s cash, cash equivalents, and investments as of June 30, 2023 as set forth in the press release, is incorporated by reference into this Item 8.01 of this Current Report on Form 8-K.

Cautionary Note Regarding Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, statements related to the Company’s Workforce Reduction, including the anticipated amount of costs associated with the Workforce Reduction and the expected time periods during which such costs will be incurred and the Workforce Reduction will be completed; the Company’s intention to explore strategic alternatives; and the Company’s ability to consummate one or more strategic transactions. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In addition, any statements that refer to estimates, projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this Current Report on Form 8-K are based on the Company’s current expectations, estimates and projections only as of the date of this Current Report on Form 8-K and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that the Company may incur other costs or costs greater than previously anticipated in connection with the Workforce Reduction; that the Workforce Reduction may not occur in the expected timeframe; and that Company may not be successful in exploring strategic alternatives or consummating any strategic transaction on attractive terms if at all. In addition, the Company’s business is subject to numerous additional risks and uncertainties, which are discussed under the heading “Risk Factors” and in other sections of the Company’s filings with the Securities and Exchange Commission (the “SEC”), and in its current and periodic reports filed or furnished from time to time with the SEC. All forward-looking statements in this Current Report on Form 8-K are made as of the date hereof, based on information available to the Company and the Company assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PIERIS PHARMACEUTICALS, INC.

|

| |

|

|

Dated: July 18, 2023

|

/s/ Tom Bures

|

| |

Tom Bures

|

| |

Chief Financial Officer

|

Exhibit 99.1

July 18, 2023

Pieris Pharmaceuticals Provides Strategic Update and Announces Restructuring

BOSTON, MA, July 18, 2023 – Pieris Pharmaceuticals, Inc. (Nasdaq:PIRS), a clinical-stage biotechnology company advancing novel biotherapeutics through its proprietary Anticalin® technology platform for respiratory diseases and cancer, today provided a strategic update following recent events that have impacted its inhaled respiratory franchise, including AstraZeneca's discontinuation of enrollment of the Phase 2a study for elarekibep. AstraZeneca has now informed the Company of its decision to terminate the parties’ R&D collaboration agreement and hand back elarekibep along with discontinuing the remaining discovery program.

Pieris’ management and board of directors have assessed several strategic options, which will include focusing on execution of new or expanded partnerships to advance its therapeutic programs, including cinrebafusp alfa (PRS-343), PRS-220 and PRS-400. While it explores potential transactions, Pieris will prioritize capital preservation, with cash, cash equivalents and investments totaling approximately $54.9 million as of June 30, 2023. As part of its cash preservation plan, Pieris initiated a corporate restructuring that will result in a reduction of the Company’s workforce by approximately 70%. These and other cost-saving measures are expected to maximize the opportunity to pursue a range of transactions across both its respiratory and immuno-oncology franchises and its discovery platform. Pieris has retained Stifel, Nicolaus & Company, Inc. as its exclusive financial advisor to evaluate a range of strategic options. These strategic options may include an acquisition, merger, reverse merger, other business combination, sale of assets, financing alternatives, licensing, or other strategic transactions involving the Company. There can be no assurance of a transaction, a successful outcome of these efforts, or the form or timing of any such outcome. The Company does not intend to make any further disclosures regarding the strategic review process unless and until a specific course of action is approved by the Company’s board of directors or until the Company determines that further disclosure is appropriate.

"We are pursuing strategic options across three main areas following the recent developments that have impacted our ability to independently advance our respiratory programs," commented President and CEO Stephen Yoder. "One track is accelerating partnering discussions of PRS-220 and PRS-400. A second focal area is diligently selecting the best possible development partner and deal structure to re-initiate clinical development of cinrebafusp alfa, our former lead immuno-oncology asset, which has shown 100% ORR in five patients in a HER2+ gastric cancer trial that was discontinued for strategic reasons. Third, we will explore whether our balance sheet, position as a public company, and other assets are of strategic value to a range of third parties.” Mr. Yoder continued, "While the challenges we recently experienced across our respiratory franchise have forced us to make very difficult personnel decisions, I cannot express enough gratitude to our departing colleagues for their dedication, collaborative spirit and integrity."

About Pieris Pharmaceuticals:

Pieris is a clinical-stage biotechnology company that combines leading protein engineering capabilities and deep understanding into molecular drivers of disease to develop medicines that drive local biology to produce superior clinical outcomes for patients. Our pipeline includes inhalable Anticalin proteins to treat respiratory diseases and locally-activated bispecifics for immuno-oncology. Proprietary to Pieris, Anticalin proteins are a novel class of therapeutics validated in the clinic and by strong partnerships with leading pharmaceutical companies. For more information, visit www.pieris.com.

Forward-Looking Statements:

This press release contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements in this press release that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things, statements relating to our exploration of strategic alternatives; the cost-saving potential of our strategic reprioritization and restructuring; the potential for us to enter into one or more collaborative partnerships, including in connection with the development of PRS-220, PRS-440 and cinrebafusp alfa; our ability to consummate one or more other strategic transactions, that may include, but are not limited to, an acquisition, merger, reverse merger, other business combination, sale of assets, financing alternatives, licensing or other strategic transactions involving the company; and our future performance and the advancement and funding of our developmental programs generally. Actual results could differ from those projected in any forward-looking statement due to numerous factors. Such factors include, among others, our ability to be successful in exploring strategic alternatives and consummating one or more collaborative partnerships or other strategic transactions on attractive terms if at all; our actual reductions in spending as compared to anticipated cost reductions; our ability to raise the additional funding we will need to continue to pursue our business and product development plans; including in collaboration with other parties, the inherent uncertainties associated with developing new products or technologies and operating as a development stage company; our ability to develop, complete clinical trials for, obtain approvals for and commercialize any of our product candidates, including our ability to recruit and enroll patients in our studies; competition in the industry in which we operate; the fact that data and results from clinical studies may not necessarily be indicative of future results; delays or disruptions due to COVID-19 or geopolitical issues, including the conflict in Ukraine; and market conditions. These forward-looking statements are made as of the date of this press release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Investors should consult all of the information set forth herein and should also refer to the risk factor disclosure set forth in the reports and other documents we file with the Securities and Exchange Commission, or the SEC, available at www.sec.gov, including, without limitation, the Company’s most recent Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and subsequent filings with the SEC.

Investor Relations Contact:

Pieris Pharmaceuticals, Inc.

Investors@pieris.com

v3.23.2

Document And Entity Information

|

Jul. 17, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PIERIS PHARMACEUTICALS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 17, 2023

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-37471

|

| Entity, Tax Identification Number |

30-0784346

|

| Entity, Address, Address Line One |

225 Franklin Street

|

| Entity, Address, Address Line Two |

26th Floor

|

| Entity, Address, Postal Zip Code |

02110

|

| Entity, Address, City or Town |

Boston

|

| Entity, Address, State or Province |

MA

|

| City Area Code |

857

|

| Local Phone Number |

246-8998

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PIRS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001583648

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

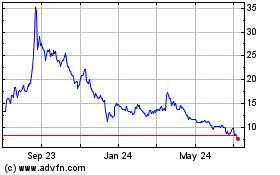

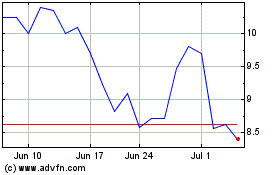

Pieris Pharmaceuticals (NASDAQ:PIRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pieris Pharmaceuticals (NASDAQ:PIRS)

Historical Stock Chart

From Apr 2023 to Apr 2024