UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission

File Number: 001-37353

BIONDVAX PHARMACEUTICALS LTD.

(Translation

of registrant’s name into English)

Jerusalem

BioPark, 2nd Floor

Hadassah

Ein Kerem Campus

Jerusalem,

Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

EXPLANATORY

NOTE

BiondVax

Pharmaceuticals Ltd. (the “Company”) hereby furnishes

the following documents in connection with its Annual General Meeting of Shareholders scheduled for August 24, 2023, at

4:00 p.m. Israel time at the offices of Goldfarb Gross Seligman & Co., One Azrieli Center, Tel Aviv 6701101, Israel:

| (1) | Notice

and Proxy Statement with respect to the Company’s Annual General Meeting of Shareholders to

be held on August 24, 2023, describing the proposals to be voted upon at the meeting, the

procedure for voting in person or by proxy at the meeting and various other details related

to the meeting; and |

| (2) | Proxy

Card whereby holders of Company shares may vote at the meeting without attending in person. |

The

Notice and Proxy Statement is furnished with this Form 6-K as Exhibit 99.1 and the Proxy Card is furnished with this Form 6-K as Exhibit

99.2.

Exhibit

Index

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

BiondVax Pharmaceuticals Ltd. |

| |

|

|

| |

By: |

/s/

Amir Reichman |

| |

|

Amir

Reichman |

| |

|

Chief

Executive Officer |

July

12, 2023

Exhibit 99.1

BIONDVAX PHARMACEUTICALS LTD.

Jerusalem BioPark, 2nd Floor

Hadassah Ein Kerem Campus

Jerusalem, Israel

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on August 24, 2023

The Annual General Meeting of Shareholders of

BiondVax Pharmaceuticals Ltd. (the “Company”) will be held at the offices of Goldfarb Gross Seligman & Co., One

Azrieli Center, Tel Aviv, Israel on August 24, 2023, at 4:00 p.m. Israel time, or at any adjournments thereof (the “Meeting”)

for the following purposes:

| 1. | To

approve the re-election of Professor Avner Rotman to the board of directors, to serve until the third annual meeting after the Meeting. |

| 2. | To

approve the re-election of Samuel Moed to the board of directors, to serve until the third annual meeting after the Meeting. |

| 3. | To

approve a change of the Company’s name to “Scinai Immunotherapeutics Ltd.” or such other name that contains the word

“Scinai” as the management of the Company shall determine and as shall be approved by the Israel Registrar of Companies and

to amend the Company’s Articles of Association accordingly. |

| 4. | To approve an amendment to the Company’s Articles of Association

to provide that the Company is required to appoint external directors under the Israel Companies Law, 5759-1999 (“Companies Law”)

only to the extent required by the Companies Law and the regulations thereunder. |

| 5. | To approve amendments to the annual cash compensation paid to

our independent directors. |

| 6. | To approve the cancellation of options to purchase ADSs previously

granted to our non-executive directors and the grant to our non-executive directors of replacement options to purchase ADSs. |

| 7. | To approve a new grant of options to purchase ADSs to our non-executive

directors. |

| 8. | To approve a grant of 78,125 restricted share units to Amir

Reichman, Chief Executive Officer of the Company, as Mr. Reichman’s long-term incentive grant award for 2022. |

| 9. | To approve a cash bonus for 2022 for Mark Germain, Chairman

of the Board of Directors. |

| 10. | To

approve amendments to the Company’s Compensation Policy for Executive Officers and Directors. |

| 11. | To

approve and ratify the appointment of Kesselman & Kesselman, certified public accountants in Israel and a member of PricewaterhouseCoopers

International Limited, as the Company’s auditors for the year 2023 and for an additional period until the next annual meeting. |

In addition, shareholders at the Meeting will

have an opportunity to review and ask questions regarding the financial statements of the Company for the fiscal year ended December 31,

2022.

The Company is currently unaware of any other

matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated as proxies

shall vote according to their own judgment on those matters.

Only holders of record of ordinary shares, no

par value (the “Ordinary Shares”), and holders of record of ADSs, evidenced by American Depositary Receipts issued

by The Bank of New York Mellon, at the close of business on July 10, 2023 (the “Record Date”), shall be entitled to

receive notice of and to vote at the Meeting.

The Board of Directors recommends that you vote

“FOR” each of the proposals, as specified in the attached proxy materials.

Whether or not you plan to attend the Meeting,

it is important that your Ordinary Shares or ADSs be represented. Accordingly, you are kindly requested to (i) vote online or (ii) complete,

date, sign and mail your proxy at your earliest convenience. Execution of a proxy will not in any way affect a shareholder’s

right to attend the Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised.

ADS holders should return their proxies by the

date set forth on their form of proxy.

This Notice and the documents mentioned therein,

as well as the proposed resolutions on the agenda, can be viewed at the Company’s registered office on Jerusalem BioPark, 2nd

Floor, Hadassah Ein Kerem Campus, Jerusalem, Israel, Tel: +972-(8)-930-2529, Sunday through Thursday between 10:00-15:00, and also will

be made available to the public on the Company’s website http://www.biondvax.com, and the SEC’s website at http://www.sec.gov.

| |

By Order of the Board of Directors, |

| |

|

| |

Mark Germain |

| |

Chairman of the Board of Directors |

Jerusalem, Israel

July 12, 2023

BIONDVAX PHARMACEUTICALS LTD.

Jerusalem BioPark, 2nd Floor

Hadassah Ein Kerem Campus

Jerusalem, Israel

PROXY STATEMENT

FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 24, 2023

This Proxy Statement is furnished

to the holders of ordinary shares, no par value (the “Ordinary Shares”), and to holders of American Depositary Shares

(“ADSs”), evidenced by American Depositary Receipts issued by The Bank of New York Mellon (“BNY Mellon”),

of BiondVax Pharmaceuticals Ltd. (the “Company” or “BiondVax”) in connection with the solicitation

by the board of directors of the Company (the “Board of Directors” or the “Board”) of proxies for

use at the Annual General Meeting of Shareholders (the “Meeting”), to be held on August 24, 2023, at 4:00 p.m. Israel

time at the offices of Goldfarb Gross Seligman & Co., One Azrieli Center, Tel Aviv, Israel, or at any adjournments thereof.

It is proposed at the Meeting

to adopt the following proposals or to consider the following items:

| 1. | To

approve the re-election of Professor Avner Rotman to the board of directors, to serve until the third annual meeting after the Meeting. |

| |

2. |

To approve the re-election of Samuel Moed to the board of directors, to serve until the third annual meeting after the Meeting. |

| 3. | To approve a change of the Company’s name to “Scinai

Immunotherapeutics Ltd.” or such other name that contains the word “Scinai” as the management of the Company shall

determine and as shall be approved by the Israel Registrar of Companies and to amend the Company’s Articles of Association (the

“Articles”) accordingly. |

| 4. | To approve an amendment to the Articles to reflect that the

Company is required to appoint external directors under the Israel Companies Law, 5759-1999 (the “Companies Law”)

only to the extent required by the Companies Law and the regulations thereunder. |

| 5. | To approve amendments to the annual cash compensation paid to

our independent directors. |

| 6. | To approve the cancellation of options to purchase ADSs previously

granted to our non-executive directors and the grant to our non-executive directors of replacement options to purchase ADSs. |

| 7. | To approve a new grant of options to purchase ADSs to our non-executive

directors. |

| 8. | To approve a grant of 78,125 restricted share units to Amir

Reichman, Chief Executive Officer of the Company, as Mr. Reichman’s long-term incentive grant award for 2022. |

| 9. | To approve a cash bonus for 2022 for Mark Germain, Chairman

of the Board of Directors. |

| |

10. |

To approve amendments to the Company’s Compensation Policy for Executive Officers and Directors. |

| |

11. |

To approve and ratify the appointment of Kesselman & Kesselman, certified public accountants in Israel and a member of PricewaterhouseCoopers International Limited, as the Company’s auditors for the year 2023 and for an additional period until the next annual meeting. |

In addition, shareholders

at the Meeting will have an opportunity to review and ask questions regarding the financial statements of the Company for the fiscal year

ended December 31, 2022.

The Company is currently

unaware of any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons

designated as proxies shall vote according to their own judgment on those matters.

Shareholders Entitled to Vote

Only shareholders and ADS

holders of record at the close of business on July 10, 2023 (the “Record Date”), shall be entitled to receive notice

of and to vote at the Meeting. At the close of business on July 10, 2023, the Company had outstanding 1,453,970,784 Ordinary Shares and

3,634,927 ADSs (each representing four hundred (400) Ordinary Shares) entitled to vote on each of the matters to be presented at the Meeting.

Proxies

A form of proxy card for use

at the Meeting is attached to this Proxy Statement and has been sent to the ADS holders together with a prepaid return envelope for the

proxy. By appointing “proxies”, shareholders and ADS holders may vote at the Meeting, whether or not they attend. Subject

to applicable law and the rules of The Nasdaq Stock Market, in the absence of instructions, the Ordinary Shares and ADSs represented by

properly executed and received proxies will be voted “FOR” all of the proposed resolutions to be presented at the Meeting

for which the Board of Directors recommends a “FOR” vote. Shareholders and ADS holders may revoke their proxies at any time

before the deadline for receipt of proxies by filing with the Company (in the case of holders of Ordinary Shares) or with BNY Mellon (in

the case of holders of ADSs) a written notice of revocation or duly executed proxy bearing a later date.

ADS holders should return

their proxies to BNY Mellon by the date set forth on their form of proxy.

Shareholders registered

in the Company’s shareholders’ register in Israel may vote through the attached proxy by completing, dating, signing

and mailing the proxy to the Company’s offices, c/o Mr. Uri Ben-Or at BiondVax Pharmaceuticals Ltd., Jerusalem BioPark, 2nd Floor,

Hadassah Ein Kerem Campus, Jerusalem 9112001, Israel, so that it is received by the Company no later than August 22, 2023, at 4:00 p.m.

Israel time. Shareholders registered in the Company’s shareholders’ register in Israel

and who intend to vote their Ordinary Shares either in person or by proxy must deliver to the Company’s offices, c/o Mr. Uri Ben-Or,

Chief Financial Officer, at BiondVax Pharmaceuticals Ltd., Jerusalem BioPark, 2nd Floor, Hadassah Ein Kerem Campus, Jerusalem 9112001,

Israel, no later than August 24, 2023, at 10:00 a.m. Israel time, an ownership certificate confirming their ownership of the Company’s

Ordinary Shares on the Record Date, which certificate must be issued or approved by a recognized financial institution, as required by

the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended.

Expenses and Solicitation

The Board of Directors is

soliciting proxies for use at the Meeting. The Company expects to mail this Proxy Statement and the accompanying proxy cards to ADS holders

on or about July 12, 2023. In addition to solicitation of proxies to ADS holders by mail, certain officers, directors, employees and agents

of the Company, may solicit proxies by telephone, mail or other personal contact. The Company shall bear the cost of the solicitation

of the proxies, including postage, printing and handling and shall reimburse the reasonable expenses of brokerage firms and others for

forwarding materials to beneficial owners of Ordinary Shares or ADSs.

This Proxy Statement and proxy

card shall also serve as a voting deed (ktav hatzba’a), as such term is defined under the Companies Law.

Quorum and Voting

The quorum required for the

Meeting consists of at least one or more shareholders who are present at the Meeting, in person or by proxy, and who hold in the aggregate

ten percent (10%) or more of the voting rights of the Company, and such presence at the Meeting will constitute a legal quorum. Abstentions

and “broker non-votes” are counted as present and entitled to vote for purposes of determining a legal quorum.

Should no legal quorum be

present one-half hour after the scheduled time, the Meeting will be adjourned to one week from that day, at the same time and place, i.e.,

on August 31, 2022, at 4:00 p.m. (Israel Time) at the offices of Goldfarb Gross Seligman & Co., One Azrieli Center, Tel Aviv 6701101,

Israel. Should such legal quorum not be present half an hour after the time set for the adjourned meeting, any number of shareholders

present, in person or by proxy, will constitute a legal quorum.

The approval of Proposals

1, 2, 5, 6, 7 and 11 each require the affirmative vote of at least a majority of the voting power represented at the Meeting, in person

or by proxy, and voting on the matter presented, without taking into account abstaining votes.

The approval of each of Proposals

3 and 4 requires the affirmative vote of seventy-five percent (75%) of the voting power represented at the Meeting, in person or by proxy,

and voting on the matter presented, without taking into account abstaining votes.

The approval of Proposals

8 through 10 each require the affirmative vote of at least a majority of the voting power represented at the Meeting, in person or by

proxy, and voting on the matter presented, without taking into account abstaining votes, provided that one of the following two alternatives

must apply: (i) such majority vote at the Meeting shall include at least a majority of the total votes of shareholders who are not controlling

shareholders of the Company (as defined in the Companies Law) and do not have a personal interest in the approval of the proposal, participating

in the voting at the Meeting in person or by proxy, without taking abstentions into account; or (ii) the total number of votes of the

non-controlling shareholders mentioned in clause (i) above that are voted against such proposal does not exceed two percent (2%) of the

total voting rights in the Company.

For this purpose, “personal

interest” is defined under the Companies Law as: (1) a shareholder’s personal interest in the approval of an act or a transaction

of the Company, including (i) the personal interest of any of his or her relatives (which includes for these purposes the foregoing shareholder’s

spouse, siblings, parents, grandparents, descendants, and spouse’s descendants, siblings, and parents, and the spouse of any of

the foregoing); (ii) a personal interest of a corporation in which a shareholder or any of his/her aforementioned relatives serve as a

director or the chief executive officer, owns at least 5% of its issued share capital or its voting rights or has the right to appoint

a director or chief executive officer; and (iii) a personal interest of an individual voting via a power of attorney given by a third

party (even if the empowering shareholder has no personal interest), and the vote of an attorney-in-fact shall be considered a personal

interest vote if the empowering shareholder has a personal interest, and all with no regard as to whether the attorney-in-fact has voting

discretion or not, but (2) excluding a personal interest arising solely from the fact of holding shares in the Company.

The foregoing threshold for

approval of Proposals 8 through 10 is referred to herein as a “Special Majority.”

Please note that you

are required to indicate on the proxy card with respect to Proposals 8 through 10 whether or not you are a controlling shareholder of

the Company or acting on its behalf, and whether or not you have a personal interest in the approval of the proposals as provided above.

If you fail to so indicate on the proxy card, your vote may not be counted with respect to the proposal(s) for which you failed to provide

such indication.

Shareholders wishing to

express their position on an agenda item for this Meeting may do so by submitting a written statement (“Position Statement”)

to the Company’s offices, c/o Mr. Uri Ben-Or, at BiondVax Pharmaceuticals Ltd., Jerusalem BioPark, 2nd Floor, Hadassah Ein Kerem

Campus, Jerusalem 9112001, Israel, by no later than August 14, 2023. Any Position Statement received that is in accordance with the guidelines

set by the Companies Law will be furnished to the U.S. Securities and Exchange Commission (the “Commission”) on Form

6-K, and will be made available to the public on the Commission’s website at http://www.sec.gov.

THE BOARD OF DIRECTORS

RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS.

Except as specifically provided

herein, the lack of a required majority for the adoption of any resolution presented shall not affect the adoption of any other resolutions

for which the required majority was obtained.

Other

Conversions of amounts in

NIS into US dollars are based on the exchange rate published by the Bank of Israel at the close of business on June 30, 2023.

PROPOSAL NO. 1

RE-ELECTION OF PROFESSOR AVNER ROTMAN AS DIRECTOR

According to the Articles,

the Company’s directors are divided into three groups with staggered three-year terms. The three-year term of service of each group

of directors expires at successive annual general meetings, at which time the directors of such group may be re-nominated to serve until

the third annual meeting held after the date of his appointment. The Company is proposing that Professor Avner Rotman be reelected, to

serve until the third annual meeting held after the date of his appointment.

Professor Rotman has attested

to the Board of Directors and to the Company that he meets all the requirements in connection with the election of directors under the

Companies Law, per the statement substantially in the form attached hereto as Appendix A. The Company is not aware of any reason

why Professor Rotman, if re-elected, should not be able to serve as a director.

The following is based upon

the information furnished by Professor Rotman:

Professor Avner Rotman,

79, has been a member of our board of directors since 2005 and served as the Chairman until 2019. Professor Rotman founded Rodar

Technologies Ltd. in 2000 and served as its Chief Executive Officer and Chairman of the Board until 2019. Professor Rotman also founded

Bio-Dar Ltd. in 1984 and served as its President and CEO from 1985 until 2000. Professor Rotman was also the chairman of the I-Tech incubator

at Kyriat Weizmann. Professor Rotman is the Founder and Chairman of the Foundation of Cardiovascular Research in Israel. Professor Rotman

holds a PhD in chemistry from the Weizmann Institute of Science, Israel, and an M.Sc and B.Sc in chemistry from the Hebrew University

of Jerusalem, Israel. We believe that Professor Rotman is qualified to serve on our board of directors based on his extensive experience

and knowledge in the field of biotechnology and as an executive officer and director of multiple biotechnology companies.

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, that

Professor Avner Rotman be re-elected to hold office as a director of the Company until the third annual meeting held after the date of

his appointment.”

The affirmative vote of at

least a majority of the voting power represented at the Meeting, in person or by proxy and voting thereon, without taking into account

abstaining votes, is required to adopt this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 2

RE-ELECTION OF

SAMUEL MOED AS A DIRECTOR

According to the Articles,

the Company’s directors are divided into three groups with staggered three-year terms. The three-year term of service of each group

of directors expires at successive annual general meetings, at which time the directors of such group may be re-nominated to serve until

the third annual meeting held after the date of his appointment. The Company is proposing Mr. Samuel Moed be reelected, to serve until

the third annual meeting held after the date of his appointment.

Mr. Moed has attested to the

Board of Directors and to the Company that he meets all the requirements in connection with the election of directors under the Companies

Law, per the statement substantially in the form attached hereto as Appendix A. The Company is not aware of any reason why Mr. Moed,

if re-elected, should not be able to serve as a director.

The following is based upon

the information furnished by Mr. Moed:

Mr. Samuel Moed, 61,

has been a member of our board of directors since 2020. He is a healthcare executive with over 35 years of experience. Mr. Moed was for

seven years Head of Corporate Strategy at Bristol Myers Squibb (“BMS”), a global biopharma company, until his retirement in

2020. Prior to that role, Mr. Moed was Head of Strategy Worldwide Pharma, President of US Pharma and President of the WW Consumer Healthcare

Business at BMS. In addition to BiondVax, Mr. Moed serves on the board of Mediwound Ltd., a company that develops, manufactures and commercializes

bio-therapeutic solutions for tissue repair and regeneration, is a Venture Partner at aMoon, a HealthTech and Life Sciences investment

fund with BiondVax’s former controlling shareholder Mr. Marius Nacht as the anchor investor, and advises companies in the healthcare

arena. Mr. Moed received his BA in history from Columbia University in New York City in 1985.

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, that

Mr. Samuel Moed be re-elected to hold office as a director of the Company until the third annual meeting held after the date of his appointment.”

The affirmative vote of at

least a majority of the voting power represented at the Meeting, in person or by proxy and voting thereon, without taking into account

abstaining votes, is required to adopt this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 3

CHANGING

THE COMPANY’S NAME AND AMENDING THE COMPANY’S ARTICLES OF

ASSOCIATION ACCORDINGLY

As set forth in our Articles,

our company name is “BiondVax Pharmaceuticals Ltd.” Our Board of Directors approved, subject to shareholder approval, changing

the name of our company to “Scinai Immunotherapeutics Ltd.” or to such other name that contains the word “Scinai”

as the management of the Company shall determine and as shall be approved by the Israel Registrar of Companies and amending our Articles

accordingly. We believe that such new name would better reflect our current business focus on the

development, manufacturing and commercialization of immunotherapeutic products primarily for the treatment of infectious and

autoimmune diseases. The name change will not have any effect on the rights of our existing shareholders.

In the event that the proposed

change of name is not approved by the Israel Registrar of Companies, our management will be authorized to select a different name approved

by the Israel Registrar of Companies that contains the name “Scinai” in combination with another word or expression or to

leave the name unchanged. The change of the Company’s name will become effective only following the approval and authorization of

the Israel Registrar of Companies.

Upon effectiveness of the

name change and the amendment to the Articles, it is anticipated that the Company’s ADSs will trade under the symbol “SCNI”

on the Nasdaq Capital Market. In addition, we expect that a new CUSIP number will be assigned to our ADSs following the name change.

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, to

change the Company name to “Scinai Immunotherapeutics Ltd.” or to such other name that contains the word “Scinai”

as the management of the Company shall determine and as shall be approved by the Israel Registrar of Companies and to amend the Company’s

Articles of Association accordingly.”

Pursuant to our Articles,

the affirmative vote of the holders of seventy-five percent (75%) of the voting power represented at the Meeting, in person or by proxy,

and voting on the matter presented, without taking into account abstaining votes, is required to approve Proposal 3.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 4

AMENDING

THE COMPANY’S ARTICLES OFASSOCIATION to

reflect

that the Company is required to appoint external directors only to

the extent required by the Companies Law and the regulations thereunder

Companies

incorporated under the laws of the State of Israel whose shares are publicly traded, including companies with shares listed on the Nasdaq

Capital Market, are considered public companies under Israeli law and are required to comply with various corporate governance requirements

under Israeli law relating to such matters as the appointment of external directors and the composition of the audit committee and the

compensation committee. These requirements are in addition to the corporate governance requirements imposed by the listing rules of the

Nasdaq Capital Market and other applicable provisions of U.S. securities laws.

Pursuant

to regulations enacted under the Companies Law, the board of directors of a public company whose shares are listed on certain non-Israeli

stock exchanges, including Nasdaq, that do not have a controlling shareholder (as such term is defined in the Companies Law), may, subject

to certain conditions, elect to “opt-out” of the requirements of the Companies Law regarding the election of external directors

and to the composition of the audit committee and compensation committee, provided that the company complies with the requirements as

to director independence and audit committee and compensation committee composition applicable to companies that are incorporated in the

jurisdiction in which its stock exchange is located. In March 2023, our board of directors determined that our company no longer had a

controlling shareholder and accordingly elected to opt-out of the Companies Law requirements to appoint external directors and related

Companies Law rules concerning the composition of the audit committee and compensation committee designed to prevent undue influence by

a controlling shareholder. The foregoing exemptions will continue to be available to us so long as (i) we do not have a “controlling

shareholder” (as such term is defined under the Companies Law), (ii) our shares are traded on a U.S. stock exchange, including Nasdaq,

and (iii) we comply with the Nasdaq rules applicable to domestic U.S. companies. If in the future we were to have a controlling shareholder,

we would again be required to comply with the requirements relating to external directors and composition of the audit committee and compensation

committee.

Because our company is no

longer required to appoint external directors and we have opted out of the requirement to do so, we are proposing to amend our Articles

to provide that we are required to appoint external directors only to the extent required by the Companies Law and the regulations thereunder.

Specifically, we are proposing to amend Article 90 of our Articles as follows (additions are underlined, deletions are struck through):

“90. To

the extent required by the Companies Law and the regulations thereunder, Tthe Company will have at least

two external directors, and the provisions of the Companies Law in this matter shall apply.”

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, to

approve an amendment to the Company’s Articles of Association to reflect that the Company is required to appoint external directors

only to the extent required by the Companies Law and the regulations thereunder.”

Pursuant to our Articles,

the affirmative vote of the holders of seventy-five percent (75%) of the voting power represented at the Meeting, in person or by proxy,

and voting on the matter presented, without taking into account abstaining votes, is required to approve Proposal 4.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 5

AMENDING

THE ANNUAL CASH COMPENSATION PAyable TO OUR INDEPENDENT DIRECTORS

The Company shareholders have

previously approved the following compensation terms for each of the directors other than our CEO and our Chairman (all such other directors,

the “Independent Directors”): (i) an annual base payment of $35,000 for serving as a director; (ii) an annual fee of

$5,000 for serving as a chairman of a committee (as applicable); (iii) $1,000 for attendance at each meeting of the Board or, as applicable,

meetings of committees of the Board, as the case may be; and (iv) ($500 for each written consent of the Board (or applicable committee)

executed by such director.

The Compensation Committee

and the Board believe that the Company should amend the terms of director compensation and move towards a set payment model for service

on the Board and committees thereof (including in capacity as chairperson of committees) and pay directors and members of committees additional

amounts for attendance at each Board and committee meeting only to the extent there are more than eight Board or committee meetings per

year, as the case may be. We believe this will make more consistent and predictable the annual cash compensation we pay our Independent

Directors and expect it will reduce the annual cash compensation we pay our Independent Directors and members of our Board committees.

In lieu of the anticipated reduction in cash compensation, it was determined that it would be more appropriate that such compensation

be paid in the form of equity grants which would align the interests of the directors more closely with that of the shareholders. As such,

it is proposed in Proposal 6 below to grant RSUs to the independent directors (see description of Proposal 6 below).

Accordingly, the Compensation

Committee and the Board have approved, and are recommending that shareholders approve, amendments to the annual cash compensation payable

to our current and future Independent Directors in exchange for their services, such that following such approval the following cash amounts

shall be payable:

| ● | $35,000 for each Independent Director, which would cover such director’s attendance

at up to eight Board meetings per year; |

| ● | $5,000 for each member of the Company’s Compensation Committee and Strategy

Committee (other than the applicable committee chairperson), which would cover such member’s attendance at up to eight committee

meetings per year; |

| ● | $7,500 for each member of the Company’s Audit Committee (other than the committee

chairperson), which would cover such member’s attendance at up to eight committee meetings per year; |

| ● | $7,500 for the chairperson of each of the Company’s Compensation Committee

and Strategy Committee, which would cover the chairperson’s attendance at up to eight committee meetings per year; |

| ● | $10,000 for the chairperson of the Company’s audit committee, which would

cover the chairperson’s attendance at up to eight committee meetings per year; |

| ● | $500 for attendance (in person or by video or other electronic means) by each director

or committee member at any meeting of the Board or relevant committee in excess of eight meetings for the Board or the applicable committee;

and |

| ● | $300 for each written consent of the Board or any of its committees. |

The Compensation Committee

and Board expect that amending the annual cash compensation terms by utilizing the model described above will reduce the total cash compensation

payable to our Independent Directors. The Compensation Committee and the Board reviewed compensation data of other Israeli and non-Israeli

biopharmaceutical companies of similar size to the Company and believe that the suggested amounts set forth above are reasonable and in

line with industry standards.

The Companies Law generally

requires that the compensation of a company’s directors be approved by the company’s compensation committee, board, and shareholders,

in that order. The Compensation Committee recommended, and the Board approved, the proposed amendments to the annual cash compensation

payable to our Independent Directors and determined that such compensation is consistent with our Compensation Policy for Executive Officers

and Directors.

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, to

approve the amended annual cash compensation payable to our Independent Directors as described in

the proxy statement.”

The affirmative vote of at

least a majority of the voting power represented at the Meeting, in person or by proxy and voting thereon, without taking into account

abstaining votes, is required to adopt this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 6

CANCELLATION OF OPTIONS

PREVIOUSLY GRANTED TO OUR NON-EXECUTIVE DIRECTORS AND THE GRANT TO OUR NON-EXECUTIVE DIRECTORS OF REPLACEMENT OPTIONS

As part of our overall compensation

program, we seek to provide our directors with long-term incentive awards. Over the years the Company has issued options to purchase in

the aggregate 58,771 ADSs (the “Current Options”) to our current directors other than our CEO (all such directors,

the “Non-Executive Directors”). However, the exercise prices of the Current Options are below the current market price

of our ADSs, in most cases significantly so. The current weighted average exercise price of the outstanding options held by the Non-Executive

Directors is $72.38 per ADS, with expiration dates ranging from 2029 to 2030, while the closing price of our ADSs as of July 10, 2023

was $1.41 per ADS. The Compensation Committee and the Board have determined that the Current Options are not fulfilling their intended

function of incentivizing our Non-Executive Directors to continue contributing to the success of the Company and of aligning their long-term

interests with those of our shareholders.

Accordingly, our Compensation

Committee and Board have approved, and are recommending that our shareholders approve, that all the Current Options held by the Non-Executive

Directors be cancelled and in exchange therefor the Company would grant each Non-Executive Director a replacement option to purchase such

number of ADSs (each, a “Replacement Option”) that is equal to the aggregate number of ADSs subject to the Current

Options held by each Non-Executive Directors (the “Exchange”). The number of ADSs underlying the Replacement Option

to be issued to each Non-Executive Director in exchange for such Non-Executive Director’s Current Options is as follows: (i) for

Mr. Mark Germain, 29,071 ADSs; (ii) for Mr. Morris Laster; Mr. Adi Raviv, Professor Avner Rotman and Ms. Yael Margolin, 4,300 ADSs; (iii)

Mr. Samuel Moed, 10,000 ADSs; and (iv) Mr. Jay Green, 2,500 ADSs.

The proposed terms of the

Replacement Options are as follows:

| ● | The exercise price per ADS for the Replacement Options will be the higher of (i) 130% of the closing price

of the Company’s ADSs on June 15, 2023 (the date the Board approved this proposal) or (ii) 100% of the closing price of the Company’s

ADS on the date of the Meeting; and |

| ● | The Replacement Options will (i) vest in equal annual installments during a period of three years, commencing

one year following the date of shareholder approval, (ii), to the extent the options are vested, continue to be exercisable during such

term unless such director is terminated for cause, (iii) be subject to accelerated vesting and immediately exercisable in the event of

a “change of control” (as defined below), and (iv) have a term of ten (10) years following the date of shareholder approval,

and which, as further discussed below, for Israeli grantees will be granted in accordance with the capital gains track of Section 102

of the Israel Tax Ordinance (the “ITO” and “102 Capital Gains Track Options”, respectively), with

all other terms as otherwise described in the Company’s 2018 Israeli Share Option Plan (the “Plan”). For these

purposes, a “change of control” means the first to occur of (i) a sale of all or substantially all of the assets of the Company;

(ii) a merger, consolidation, or like transaction of the Company with or into another company; provided, that in the case of either clauses

(i) or (ii) the Company’s shareholders of record immediately prior to such transaction will, immediately after such transaction,

hold less than fifty percent (50%) of the voting power of the surviving or acquiring entity, and provided further that a change of control

shall not include (x) any consolidation, merger or reorganization effected to change the domicile of the Company or (y) any transaction

or series of transactions effected principally for bona fide equity financing purposes in which cash is received by the Company or any

successor or indebtedness of the Company is cancelled or converted or a combination thereof; (iii) the acquisition by any person, entity

or group of more than 50% of the voting power of the Company, in a single or series of related transactions; and (iv) when a person, entity

or group becomes a shareholder that has “control,” as defined in the Companies Law. |

With respect to any Non-Executive

Director who was granted 102 Capital Gains Track Options, the Company will apply for a ruling (the “Ruling”) from the

Israel Tax Authority (the “ITA”) to determine the terms under which the Company will effect the Exchange with respect

to the options held by such Non-Executive Director, including but not limited to clarifying that the effective date of grant with respect

to the 102 Capital Gains Options subject to the Exchange will be the later of (i) the date of approval of the Exchange by the shareholders

at the Meeting and (ii) the date of the submission of the Ruling application to the ITA.

The Companies Law generally

requires that the compensation of a company’s directors be approved by the company’s compensation committee, board and shareholders,

in that order. The Compensation Committee recommended, and the Board approved, the proposed Exchange of the Cancelled Options of the Non-Executive

Directors for the Replacement Options on the terms described above.

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, to

approve the cancellation of the Current Options of the Non-Executive Directors and the exchange thereof with the Replacement Options on

the terms described above and which for Israeli grantees will be granted in accordance with the capital gains track of Section 102 of

ITO subject to receipt of the Ruling.”

The affirmative vote of at

least a majority of the voting power represented at the Meeting, in person or by proxy and voting thereon, without taking into account

abstaining votes, is required to adopt this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 7

GRANT

OF NEW OPTIONS TO OUR NON-EXECUTIVE DIRECTORS

We are proposing to grant

to each of our Non-Executive Directors new options to purchase ADSs. The Compensation Committee and the Board reviewed director compensation

data of other Israeli and non-Israeli biopharmaceutical companies of similar size to the Company and believe that the current equity holdings

of our Non-Executive Directors is below industry standards for companies of similar size in our industry. Accordingly, we are proposing

to grant to each of our Non-Executive Directors (other than our Chairman) options to purchase 20,000 ADSs, and to grant to our Chairman

options to purchase 40,000 ADSs. Providing such grants will incentivize our Non-Executive Directors to continue to contribute to the success

of the Company and aligning their long-term interests with those of our shareholders.

The terms of the new options

are as follows:

| ● | The exercise price per ADS for the options shall be the higher of (i) 130% of the closing price of the

Company’s ADSs on June 15, 2023 (the date the Board approved this proposal) or (ii) 100% of the closing price of the Company’s

ADS on the date of the Meeting; and |

| ● | The options will (i) vest in equal annual installments during a period of three years, commencing one

year following the date of shareholder approval, (ii), to the extent the options are vested, continue to be exercisable during such term

unless such director is terminated for cause, (iii) be subject to accelerated vesting and immediately exercisable in the event of a “change

of control” (as defined in Proposal No. 6 above), and (iv) have a term of ten (10) years following the date of shareholder approval,

and which for Israeli grantees will be granted in accordance with the capital gains track of Section 102 of the ITO, with all other terms

as otherwise described in the Plan |

The Companies Law generally

requires that the compensation of a company’s directors be approved by the company’s compensation committee, board, and shareholders,

in that order. The Compensation Committee recommended, and the Board approved, the proposed grant of new options to our Non-Executive

Directors on the terms described above.

It is proposed that

at the Meeting, the following resolution be adopted:

“RESOLVED, to

approve the grant of new options to the Non-Executive Directors on the terms described in the Proxy Statement.”

The affirmative vote of at

least a majority of the voting power represented at the Meeting, in person or by proxy and voting thereon, without taking into account

abstaining votes, is required to adopt this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 8

GRANT

OF 78,125 RESTRICTED SHARE UNITS TO MR. AMIR REICHMAN AS MR. REICHMAN’S

LONG-TERM INCENTIVE GRANT AWARD FOR 2022

At the Meeting you will be

asked to approve a one-time grant of 78,125 RSUs to Mr. Amir Reichman, our Chief Executive Officer, as Mr. Reichman’s long-term

incentive grant award for 2022. If approved, the RSUs will vest in three equal annual installments commencing as of the date of the

Meeting, be subject to accelerated vesting and immediately exercisable in the event of a “change of control” (as defined in

Proposal No. 6 above) and be granted in accordance with the Capital Gains Tax Route of Section 102 of the ITO and otherwise in accordance

with our Plan.

The Compensation Committee

and the Board believe that in order to align the interests of our CEO with the interests of our shareholders it is important that part

of our CEO’s compensation includes long-term equity compensation. These awards link a significant portion of our CEO’s compensation

to delivering value to our shareholders and encouraging his retention through long-term vesting periods. The proposed grant of 78,125

RSUs to Mr. Reichman in equity compensation for his service to the Company in 2022 will directly link Mr. Reichman’s performance

to delivering value to our shareholders.

The Companies Law generally

requires that the compensation of a company’s chief executive officer be approved by the company’s compensation committee,

board and shareholders, in that order. In addition, the Companies Law requires such approvals for transactions between a company

and its directors regarding their terms of employment in other positions in the company. The Compensation Committee recommended, and the

Board approved, the proposed grant of RSUs to Mr. Reichman as Mr. Reichman’s long-term incentive grant award for 2022, and determined

that such compensation is consistent with our Compensation Policy for Executive Officers and Directors.

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, to

approve the grant of 78,125 RSUs to Mr. Amir Reichman as Mr. Reichman’s long-term incentive grant award for 2022 on such terms as

described in the Proxy Statement.”

A Special Majority is required

for shareholders to approve this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 9

GRANT

OF A CASH BONUS FOR 2022 FOR MR. MARK GERMAIN

The Compensation Committee

and the Board believe that during 2022, Mr. Germain, our Chairman of the Board, provided significant contributions to our company and

devoted substantial time to the company beyond the scope that are expected of a chairman of the board, working closely with our chief

executive officer, Mr. Amir Reichman, on the initiation and execution of strategic plans, material contracts, financings and business

development, among other things. Accordingly, the Compensation Committee and the Board have each determined it to be fair and appropriate

to compensate Mr. Germain for such contributions and his considerable time and efforts during 2022 by paying Mr. Germain a cash bonus

of $37,500.

Because the Company’s

Compensation Policy for Executive Officers and Directors (the “Compensation Policy”) does not expressly provide for

bonuses to the Chairman of the Board, the proposed grant is not consistent with our Compensation Policy. However, due to Mr. Germain’s

important contributions and significant time and effort expended, the Compensation Committee and Board deem the bonus to be appropriate.

It is proposed that

at the Meeting, the following resolution be adopted:

“RESOLVED, to

approve a cash bonus of $37,500 for 2022 to Mr. Mark Germain.”

A Special Majority is required

for shareholders to approve this resolution.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THIS PROPOSAL.

PROPOSAL NO. 10

AMENDMENTS

TO THE COMPANY’S COMPENSATION POLICY

Under

the Companies Law, the terms of employment and service of officers and directors of public companies, such as the Company, must be determined

in accordance with a directors and officers compensation policy. The compensation policy must be approved by the Board, upon recommendation

of the Compensation Committee, and the shareholders of the Company (except in limited circumstances set forth in the Companies Law). On

December 27, 2021, our shareholders approved our current Compensation Policy.

Following

a review of the Compensation Policy, our Compensation Committee and Board have approved amendments to our Compensation Policy, subject

to the approval of our shareholders. First, we are proposing amendments to the Compensation Policy in order that in the event in the future

we wish to grant an annual cash bonus to our Chairman/Chairwoman for his/her significant contributions to our company (as provided in

Proposal No. 9 above), such grant shall be deemed to be in accordance with the Compensation Policy. We are also proposing to make some

additional technical changes to reflect the above change.

In

addition, we are proposing to amend the Compensation Policy to permit us to adopt a “clawback policy” that complies with the

requirements of the Nasdaq Stock Market and would require the return of incentive compensation paid to executive officers in the case

of certain restatements of the Company’s financial statements under the terms required by Nasdaq. On February 22, 2023, Nasdaq proposed

listing rules mandating that companies with listed securities adopt clawback policies in response to Rule 10D-1 under the U.S. Securities

and Exchange Act of 1934, as amended. The Compensation Policy currently addresses clawback of incentive compensation paid to Executive

Officers in the event of an accounting restatement in accordance with Israeli law. The proposed amendments to the Compensation Policy

would, among other things, revise the current language to make it more consistent with the proposed requirements of the Nasdaq clawback

policy and clarify that in the future we will adopt a Nasdaq clawback policy and that in the event of any inconsistency between the terms

of the Compensation Policy and the Nasdaq clawback policy, the Nasdaq policy will prevail to the extent it creates or expands the obligation

of the Company to conduct a “clawback” from officers.

Accordingly,

we are proposing to amend the Compensation Policy with such changes set forth on Appendix B attached hereto.

As

discussed in Proposal No. 9 above, at the Meeting the Company is proposing to pay a cash bonus for 2022 of $37,500 to Mark Germain, our

Chairman of the Board. As discussed in that proposal 9, the proposed grant is not in accordance with the Compensation Policy, which currently

does not provide for grants of bonuses to our Chairman of the Board. In the event this Proposal 10 is approved, the proposed amendment

to the Compensation Policy described above which provides that we may grant an annual cash bonus to our Chairman in accordance with the

Compensation Policy shall only be effective for any future grants of bonuses to our Chairman of the Board and will not be effective for

the proposed grant that is the subject of Proposal 9.

The

Compensation Committee and the Board have approved the above proposed amendments to the Compensation Policy.

If the proposed amendments

to the Compensation Policy is not approved by the shareholders by the required majority, our Board may nonetheless approve the proposed

amendments, provided that our Compensation Committee and thereafter our Board have concluded, following further discussion of the matter

and for specified reasons, that such approval is in the Company’s best interests.

It is proposed that at the

General Meeting the following resolution be adopted:

“RESOLVED, that

the adoption of the amendments to the Compensation Policy, as described in the Proxy Statement, be, and hereby is, approved.”

A Special Majority is required

for shareholders to approve this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROPOSAL NO. 11

APPOINTMENT OF AUDITORS

Under the Companies Law and

the Articles, the shareholders of the Company are authorized to appoint the Company’s independent auditors.

At the Meeting, shareholders

will be asked to approve and ratify the appointment of Kesselman & Kesselman, certified public accountants in Israel and a member

of PriceWaterhouseCooper International Limited, as the Company’s auditors for the year ending December 31, 2023 and for an additional

period until the next annual meeting of our shareholders. Kesselman & Kesselman has no relationship with the Company or with any affiliate

of the Company except to provide audit services and tax consulting services.

The Audit Committee recently

conducted a process to select a firm to serve as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2023 and for an additional period until the next annual meeting of our shareholders. The Audit Committee invited a number

of firms to participate in this process and following such process the Audit Committee recommended to the Board of Directors that, subject

to the approval of the shareholders, the Company appoint Kesselman & Kesselman. In conjunction with the selection of Kesselman &

Kesselman to serve as the Company’s independent registered public accounting firm, and subject to the approval of the Company’s

shareholders at the Meeting, the engagement of the Company’s current independent registered public accounting year, Kost Forer Gabbay

& Kasierer, a member of Ernst & Young Global, will conclude at the end of the Meeting.

Kost Forer Gabbay & Kasierer,

a member of Ernst & Young Global, served as our independent registered public accountants for the years ended December 31, 2022 and

2021. During such period, there were (i) no disagreements between the Company and Kost Forer Gabbay & Kasierer on any matter of accounting

principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements were not resolved to the satisfaction

of Kost Forer Gabbay & Kasierer and which disagreements, if not resolved to the satisfaction of Kost Forer Gabbay & Kasierer,

would have caused Kost Forer Gabbay & Kasierer to make reference to the subject matter of the disagreement in their reports on the

Company’s consolidated financial statements for such years, and (ii) no “reportable events” as that term is defined in Item

304(a)(1)(v) of Regulation S-K.

Information on fees paid to

the Company’s independent auditors may be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December

31, 2022, filed with the Securities and Exchange Commission on April 17, 2023.

It is proposed that at the

Meeting, the following resolution be adopted:

“RESOLVED, that

Kesselman & Kesselman, certified public accountants in Israel and a member of PriceWaterhouseCooper International Limited be, and

hereby is, appointed as the auditors of the Company for the year 2023 and for an additional period until the next Annual Meeting.”

The affirmative vote of

at least a majority of the voting power represented at the Meeting, in person or by proxy and voting thereon, without taking into account

abstaining votes, is required to adopt this resolution.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

Other than as set forth above,

as of the mailing of this Proxy Statement, management knows of no other business to be transacted at the Meeting, but, if any additional

matters are properly presented at the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance

with their best judgment.

By Order of the Board of Directors

Mark Germain, Chairman of the Board

Dated: July 12, 2023

Appendix A - Form of Statement of a Candidate

to Serve as a Director

The undersigned, ____________________,

hereby declares to BiondVax Pharmaceuticals Ltd. (the “Company”), effective as of ____________________________, as follows:

I am making this statement

as required under Section 224B of the Israeli Companies Law, 5759-1999 (the “Israeli Companies Law”). Such provision requires

that I make the statements set forth below prior to, and as a condition to, the submission of my election as a director of the Company

to the approval of the Company’s shareholders.

I possess the necessary qualifications

and skills and have the ability to dedicate the appropriate time for the purpose of performing my service as a director in the Company,

taking into account, among other things, the Company’s special needs and its size.

My qualifications were presented

to the Company. In addition, attached hereto is a biographical summary as contained in the Company’s most recent Form 20-F, which

includes a description of my academic degrees, as well as previous experience relevant for the evaluation of my suitability to serve as

a director.

I am not restricted from serving

as a director of the Company under any items set forth in Sections 2261, 226A2 or 2273 of the Israeli

Companies Law, which include, among other things, restrictions relating to the appointment of a minor, a person who is legally incompetent,

a person who was declared bankrupt, a person who has prior convictions or anyone whom the administrative enforcement committee of the

Israel Securities Law 5728-1968 (the “Israel Securities Law”) prohibits from serving as a director.

I am aware that this statement

shall be presented at the Annual General Meeting of Shareholders of the Company in which my election shall be considered, and that pursuant

to Section 241 of the Israeli Companies Law it shall be kept in the Company’s registered office and shall be available for review

by any person.

Should a concern arise of

which I will be aware and/or that will be brought to my attention, pursuant to which I will no longer fulfill one or more of the requirements

and/or the declarations set forth above, I shall notify the Company immediately, in accordance with Section 227A of the Israeli Companies

Law.

IN WITNESS WHEREOF, the undersigned

has signed this statement as of the date set forth above.

| 1 | As of the date hereof, Section 226 of the Israeli Companies

Law generally provides that a candidate shall not be appointed as a director of a public company (i) if the person was convicted of an

offense not listed below but the court determined that due to its nature, severity or circumstances, he/she is not fit to serve

as a director of a public company for a period that the court determined which shall not exceed five years from judgment or (ii) if he/she

has been convicted of one or more offences specified below, unless five years have elapsed from the date the convicting judgment was

granted or if the court has ruled, at the time of the conviction or thereafter, that he/she is not prevented from serving as a director

of a public company: |

(1) offenses under

Sections 290-297 (bribery), 392 (theft by an officer), 415 (obtaining a benefit by fraud), 418-420 (forgery), 422-428 (fraudulent solicitation,

false registration in the records of a legal entity, manager and employee offences in respect of a legal entity, concealment of information

and misleading publication by a senior officer of a legal entity, fraud and breach of trust in a legal entity, fraudulent concealment,

blackmail using force, blackmail using threats) of the Israel Penal Law 5737-1997; and offences under sections 52C, 52D (use of inside

information), 53(a) (offering shares to the public other than by way of a prospectus, publication of a misleading detail in the prospectus

or in the legal opinion attached thereto, failure to comply with the duty to submit immediate and period reports) and 54 (fraud in securities)

of the Israel Securities Law;

(2) conviction

by a court outside of the State of Israel of an offense of bribery, fraud, offenses of directors/managers in a corporate body or exploiting

inside information.

| 2 | As of the date hereof, Section 226A of the Israeli Companies

Law provides that if the administrative enforcement committee of the Israel Securities Authority has imposed on a person enforcement

measures that prohibited him/her from holding office as director of a public company, that person shall not be appointed as a director

of a public company in which he/she is prohibited to serve as a director according to this measure. |

| 3 | As of the date hereof, Section 227 of the Israeli Companies

Law provides that a candidate shall not be appointed as a director of a company if he/she is a minor, legally incompetent, was declared

bankrupt and not discharged, and with respect to a corporate body – in case of its voluntary dissolution or if a court order for

its dissolution was granted. |

Appendix B – Amendments to Compensation

Policy

(additions

are underlined, deletions are struck through)

C.

Cash Bonuses

8.

Annual Cash Bonuses -The Objective

| 8.1. | Compensation in the form of an annual cash bonus is an important

element in aligning the Executive Officers’ compensation with BiondVax’s objectives and business goals. Therefore, a pay-for-performance

element is provided for, as payout eligibility and levels are determined based on actual financial and operational results, as well as

individual performance. |

| 8.2. | An annual cash bonus may be awarded to Executive Officers

upon the attainment of pre-set periodical objectives and individual targets determined by the Compensation Committee (and, if required

by law, by the Board) at the beginning of each calendar year, or upon engagement, in case of newly hired Executive Officers, taking into

account BiondVax’s short and long-term goals, as well as its compliance and risk management policies. The Compensation Committee

and the Board shall also determine applicable minimum thresholds that must be met for entitlement to the annual cash bonus (all or any

portion thereof) and the formula for calculating any annual cash bonus payout, with respect to each calendar year, for each Executive

Officer. In special circumstances, as determined by the Compensation Committee and the Board (e.g., regulatory changes, significant changes

in BiondVax’s business environment, a significant organizational change, a significant merger and acquisition events etc.), the

Compensation Committee and the Board may modify the objectives and/or their relative weights during the calendar year. |

| 8.3. | In the event the service of an Executive Officer is terminated

prior to the end of a fiscal year, BiondVax may (but shall not be obligated to) pay such Executive Officer a full annual cash bonus or

a prorated one. |

| 8.4. | The actual annual cash bonus to be awarded to Executive Officers

shall be approved by the Compensation Committee and the Board. |

| 8.5 | For purposes of this Section 8 and Section 9 below, the term “Executive

Officer” shall be deemed to include the Chairman of the Board. |

9.

Annual Cash Bonuses -The Formula

| 9.1 | The annual cash bonus of BiondVax’s Executive Officers,

other than the chief executive officer (the “CEO”), will be based on performance objectives and a discretionary evaluation

of the Executive Officer’s overall performance by the CEO and subject to minimum thresholds. The performance objectives will be

approved by BiondVax’s CEO at the commencement of each calendar year (or upon engagement, in case of newly hired Executive Officers

or in special circumstances as indicated in Section 8.2 above) on the basis of, but not limited to, company, division and individual

objectives. The performance measurable objectives, which include the objectives and the weight to be assigned to each achievement in

the overall evaluation, will be based on overall company performance measures, which are based on actual financial and operational results,

such as revenues, operating income and cash flow (at least 25% of the annual cash bonus will be based on overall company performance

measures) and may further include, divisional or personal objectives which may include operational objectives, such as market share,

initiation of new markets and operational efficiency, customer focused objectives, project milestones objectives and investment in human

capital objectives, such as employee satisfaction, employee retention and employee training and leadership programs |

| 9.2 | The target annual cash bonus that an Executive Officer, other than the CEO, will

be entitled to receive for any given calendar year, will not exceed 100% of such Executive Officer’s annual base salary or annual

payment, as the case may be. |

| 9.3 | The maximum annual cash bonus including for overachievement performance that an

Executive Officer, other than the CEO, will be entitled to receive for any given calendar year, will not exceed 150% of such Executive

Officer’s annual base salary or annual payment, as the case may be. |

* * *

10.

Other Bonuses

| 10.1 | Special Bonus. BiondVax may grant its Executive Officers and (on

a one time basis) directors a special bonus as an award for special efforts or achievements (such as in connection with mergers

and acquisitions, offerings, achieving target budget or business plan under exceptional circumstances or special recognition in case of

retirement) or as a retention award at the CEO’s discretion (and in the CEO’s case, at the Board’s discretion), subject

to any additional approval as may be required by the Companies Law (the “Special Bonus”). The Special Bonus will not

exceed 100% of the Executive Officer’s or director’s annual base salary or annual cash retainer, as the case may be (and in

the case of Executive Officers, together with any annual bonus paid under Section 9 above, not to exceed 150% of the Executive Officer’s

annual base salary). |

* * *

11.

Compensation Recovery

* * *

| 11.3 | Nothing in this Section 11 derogates from any other “Clawback”

or similar provisions regarding disgorging of profits imposed on Executive Officers by virtue of applicable securities laws (including

applicable stock exchange rules) and with respect to which the Board of Directors, following approval of the Compensation Committee, may

adopt additional policies (which, for the sake of clarity, shall not require additional shareholder approval). |

Without

derogating from the generality of the foregoing, the Company intends to adopt a clawback policy (“Nasdaq Clawback Policy”)

that complies with the listing standards (the “Nasdaq Standards”) to be adopted by The Nasdaq Stock Market LLC (“Nasdaq”)

in accordance with the provisions of Rule 10D-1 under the Securities and Exchange Act of 1934, as amended (as amended from time to time,

the “SEC Clawback Rule”), which directs national securities exchanges, including Nasdaq, to establish listing standards

for purposes of complying with such rule. Any provision of the Nasdaq Clawback Policy as required by the Nasdaq Standards

shall be deemed to comply with this Compensation Policy. In the event of any inconsistency between this Policy and the Nasdaq Clawback

Policy, the Nasdaq Clawback Policy shall prevail to the extent the Nasdaq Clawback Policy creates or expands the obligation of the Company

to conduct a “Clawback” from Office Holders. For the avoidance of any doubt, no amendments to, or further corporate approvals

in connection with, this Policy will be required in connection with the adoption of the Nasdaq Clawback Policy as long as it is approved

by the Compensation Committee and the Board of Directors.

18

Exhibit 99.2

BiondVax Pharmaceuticals (NASDAQ:BVXV)

Historical Stock Chart

From Mar 2024 to Apr 2024

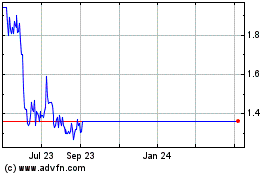

BiondVax Pharmaceuticals (NASDAQ:BVXV)

Historical Stock Chart

From Apr 2023 to Apr 2024