Filed Pursuant

to Rule 424(b)(3)

Registration No. 333-272964

PROSPECTUS

Vicinity Motor Corp.

$150,000,000

Common Shares

Warrants

Subscription Receipts

Units

We may offer

and sell up to $150,000,000 in the aggregate of the securities identified from time to time in one or more offerings. This prospectus

provides a general description of the securities we may offer. Each time we offer and sell securities, we will provide a supplement to

this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The prospectus

supplement may also add, update or change information contained in this prospectus. You should read this prospectus and the applicable

prospectus supplement carefully before you invest in any securities.

We may offer and sell these

securities directly to our stockholders or to purchasers, or through one or more underwriters, dealers or agents, or through a combination

of these methods. If any agents, dealers or underwriters are involved in the sale of any of these securities, the applicable prospectus

supplement will provide their names and any applicable fees, commissions or discounts. No securities may be sold without delivery of

this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

Our common shares are traded on the TSX Venture Exchange

under the symbol “VMC”, on the Nasdaq Capital Market under the symbol “VEV” and on the Frankfurt Stock Exchange

under the symbol “6LGA.” Based on the last reported sale price of $0.84 of our common shares on the Nasdaq Capital Market

on July 3, 2023, the aggregate market value of our public float, calculated according to General Instruction I.B.5 of Form F-3, is $34,496,514

based on 45,667,706 common shares outstanding as of July 3, 2023, of which 41,067,278 common shares are held by non-affiliates. We have

not offered any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on, and

includes, the date of this prospectus.

Investing in our securities involves risks. Before

buying any securities you should carefully read the section entitled “Risk Factors” on page 3 of this prospectus along

with the risk factors described in the applicable prospectus supplement and the other information contained in and incorporated by reference

in this prospectus and in the applicable prospectus supplement before purchasing the securities offered hereby.

We are an “emerging growth company” and

“foreign private issuer,” each as defined under the U.S. federal securities laws, and, as such, are subject to reduced public

company reporting requirements.

Our principal executive offices are located at 3168,

262nd Street, Aldergrove, British Columbia, Canada V6B 1R4. Our telephone number is (604) 607-4000.

Neither the Securities and Exchange Commission

nor any state or other securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 5, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This

prospectus is a part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”)

using a “shelf” registration process. Under this shelf registration process, we may, from time to time, offer to sell

any combination of the securities described in this prospectus, either individually or in units, in one or more offerings, up to

an aggregate public offering price of $150,000,000. This prospectus provides you with a general

description of the securities we may offer. Each time we offer and sell securities under this registration statement, we will provide

a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may

also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this

prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. You should read both this prospectus

and any prospectus supplement, together with additional information described under “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference.”

We

have not authorized any other person to provide you with different information. You must not rely upon any information or representation

not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. We will not make an offer

to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained

in this prospectus and the accompanying prospectus supplement is accurate as of the date on its respective cover, and that any

information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. Information

contained on or available through our website does not constitute part of this prospectus.

References in this

prospectus to “Vicinity,” the “Company,” “we,” “our” and “us” refer

to Vicinity Motor Corp. and its consolidated subsidiaries.

In this prospectus

and in any prospectus supplement, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed

in United States dollars, references to “dollars”, “$” or “US$” are to United States dollars

and all references to “C$” are to Canadian dollars.

Unless otherwise indicated, we prepare our annual financial information, which

are incorporated by reference herein, in accordance with International Financial Reporting Standards (the “IFRS”) as

issued by the International Accounting Standards Board, and our interim financial statements, certain of which are incorporated by reference

herein, in accordance with IFRS applicable to the preparation of interim financial statements, including International Accounting Standard

IAS 34, Interim Reporting. Thus, our financial information may not be comparable to financial information of United States companies.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, each prospectus supplement and the documents incorporated herein by reference contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation

Reform Act of 1995, as amended, which such statements are not purely historical and are forward-looking

statements. The use of the words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “would,”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement

is not a forward-looking statement. These statements involve known and unknown risks, uncertainties, and other factors that may

cause actual results or events to differ materially from those anticipated or implied in such forward-looking statements. No assurance

can be given that these expectations will prove to be correct and such forward-looking statements included in this prospectus,

each prospectus supplement and the documents incorporated herein by reference should not be unduly relied upon. Any forward-looking

statements are qualified in their entirety by reference to the risk factors discussed in the section entitled “Risk Factors.”

Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections

contained in the forward-looking statements include but are not limited to:

| ● | the intentions, plans and future actions of the Company; |

| ● | the anticipated developments in the manufacturing operations of the Company; |

| ● | the Company’s dependence on manufacturing facilities and third-party suppliers; |

| ● | the market position of the Company and ability to compete successfully in the bus and electric

vehicle industries; |

| ● | the ability of the Company to establish and maintain a strong brand and attract and retain customers; |

| ● | the costs of raw materials and disruption of supply or shortage of such materials; |

| ● | the availability of labor and the ability of the Company to effectively to hire and retain key

personnel; |

| ● | the future financial or operating performance of the Company; |

| ● | the ability of the Company to finance certain capital expenditures and execute the Company’s

business plans; |

| ● | the adequacy of the Company’s financial resources; |

| ● | the volatility of the market for the Company’s common shares; |

| ● | the effect of dilution on the market price of the Company’s common shares; |

| ● | the costs of being a public company in the U.S. and Canada; |

| ● | the effect on the Company of any changes to existing or new legislation or policy or government

regulations; |

| ● | the reliance on certain intellectual property and other proprietary rights and the ability of the

Company to adequately protect those rights; |

| ● | the effect on the Company of any material failure, weakness, incident or breach of security in

the Company’s information technology and cyber security systems; |

| ● | the impact of global economic conditions and world events on the business and operations of the

Company;

and |

| ● | such other factors discussed in greater detail under “Risk Factors.” |

Although we base the

forward-looking statements contained in this prospectus and the documents incorporated herein

by reference on assumptions that we believe are reasonable, we caution you that actual results and developments (including

our results of operations, financial condition and liquidity, and the development of the industry in which we operate) may differ

materially from those made in or suggested by the forward-looking statements contained in this prospectus

and the documents incorporated herein by reference. Additional impacts may arise that we are not aware of currently. The

potential of such additional impacts intensifies the business and operating risks that we face, and should be considered when reading

the forward-looking statements contained in this prospectus and the documents incorporated

herein by reference. In addition, even if results and developments are consistent with the forward-looking statements contained

in this prospectus and the documents incorporated herein by reference, those results

and developments may not be indicative of results or developments in subsequent periods. As a result, any or all of the forward-looking

statements in this prospectus and the documents incorporated herein by reference may

prove to be inaccurate. No forward-looking statement is a guarantee of future results. Moreover, we operate in a highly competitive

and rapidly changing environment in which new risks often emerge. It is not possible for our management to predict all risks, nor

can they assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any forward-looking statements we may make. You should not place undue

reliance on these forward-looking statements.

You should read this

prospectus and the documents incorporated herein by reference completely and with

the understanding that actual future results may be materially different from what we expect. The forward-looking statements contained

herein are made as of the date of this prospectus, and we do not assume any obligation to update any forward-looking statements

except as required by applicable laws.

RISK

FACTORS

Investing in the securities to be offered pursuant

to this prospectus may involve a high degree of risk. You should carefully consider the important factors set forth under the heading

“Risk Factors” contained in our Annual Report on Form 20-F for the fiscal year ended December

31, 2022, which is incorporated by reference in this prospectus, and under similar headings in our subsequently filed reports on

Form 6-K and annual reports on Form 20-F or Form 40-F, as well as the other risks and uncertainties described in any applicable

prospectus supplement or free writing prospectus and in the other documents incorporated by reference in this prospectus.

Risks relating to a particular offering of securities will be set out in the prospectus supplement relating

to such offering. For further details, see the section entitled “Where You Can Find More Information” in this

prospectus.

The risks and uncertainties

we discuss in the documents incorporated by reference in this prospectus are those we currently believe may materially affect our

business, prospects, financial condition and results of operation. Additional risks and uncertainties not presently known to us

or that we currently believe are immaterial also may materially and adversely affect our business, prospects, financial condition

and results of operations. As a result of these risks and uncertainties, you may lose all or a part of your investment.

OUR COMPANY

We design, build and distribute a full suite

of mid-size transit buses for public and commercial use, including electric, compressed natural gas (“CNG”)

and clean diesel buses and also commercial electric trucks (collectively, the “Vicinity Vehicles”). We have

been successful in supplying Canadian and U.S.-based municipal transportation agencies and private operators with a full suite

of transit buses for public and commercial use, including electric, CNG and clean diesel buses (collectively, “Vicinity

Buses”). With our strong distribution chain in the United States, we are actively pursuing opportunities in public and

private transit fleet operations that would benefit from our vehicles.

We have worldwide strategic partnerships and

supply agreements to manufacture Vicinity products in Europe, Asia, Canada, and the United States. In 2023, we completed construction

of an assembly plant in Ferndale, Washington State (the “Washington State Facility”), a cost-effective location

in proximity to the border between Canada and the United States. The Washington State Facility will produce buses to be compliant

with the “Buy America” Act and is expected to be capable of producing electric, CNG and clean diesel buses across all

sizes and powertrains as well as electric trucks.

In a large and unsaturated market segment,

we are poised to capture sales growth from both the replacement of cut-away buses and the need for transit fleets to find the appropriate

balance of vehicle sizes across Canada and the United States. We are at the forefront of the changeover of industrial combustion

engines to electric vehicles for the bus and truck markets.

Vicinity Vehicles

General

Vicinity Buses were born from a need expressed

by transit systems looking for a durable, reliable, customer oriented mid-size vehicle at a reasonable price point. We design the

Vicinity Buses with affordability, accessibility and global responsibility in mind. The Vicinity Buses cost significantly less

than a 40’ bus and are considerably more durable than cut-away buses which are based on a truck chassis.

The VMC Truck line builds on the in-house expertise

of electric commercial vehicle development we have invested in the transit bus business by expanding product reach into the broad

commercial truck market, specifically Class 3 low cab forward chassis solutions.

Vicinity Classic

Our flagship bus offers significant fuel savings,

lower upfront costs, low operating costs, and provides a smoother ride than competitors providing greatly improved overall value.

The Vicinity Buses are designed to meet North America’s rigorous operating conditions and are durability tested by the federal

government in Altoona, Pennsylvania. Vicinity Buses are ranked “Best in Class” in the Federal Transit Administration’s

Bus Test Program.

Vicinity Buses’ features include:

| ● | Big bus technology in a compact, affordable platform; |

| ● | Worry-free two-year bumper-to-bumper warranty; |

| ● | Galvanized steel monocoque structure; |

| ● | Air ride with independent front suspension; |

| ● | ZF, Allison or Voith transmission; |

| ● | Low floor step-free entry with American Disabilities Act Compliant front entry ramp; and |

| ● | Customizable electronic “smart bus” technical features. |

Vicinity LightningTM

The Vicinity Lightning is our first fully electric

bus and the newest bus model in our product portfolio. The Vicinity Lightning is an environmentally friendly alternative to diesel

buses currently used in a broad product segment. Uniquely positioned to offer the size and maneuverability of small buses with

the durability and capacity of larger buses, the Vicinity Lightning places us in an excellent position to capture market share

as customers and policy drive demand for zero emission transportation solutions.

The Vicinity Lightning is a low-floor transit

bus, scaled down for a diverse range of uses including transit, airports, community shuttles, para-transit, university shuttles,

corporate and other unique applications. The Vicinity Lightning is designed from the ground up and purpose-built to use commercially

available high-volume, reliable components from the automotive industry. It features 19.5” tires and hydraulic disc brakes,

high-power AC direct on-board charging and DC fast charging options. Its design allows it to fit into any standard commercial garage

with no major infrastructural electrical upgrades.

The Vicinity Lightning uses proven zero emission

technology supporting a cleaner and more sustainable planet and drives community prosperity through increased access to mobility.

The size and design of the bus provides maximum versatility supporting multiple transportation applications. The Vicinity Lightning

incorporates high quality, proven, and commercially validated technology along with standardized electric vehicle charging solutions.

The Vicinity Lightning delivers ease of use without high-cost proprietary technology and charging systems. The smart intentional

design allows a diverse range of users to adapt the Vicinity Lightning platform conveniently into operations with very low transition

burden.

VMC 1200 Electric Truck

The VMC 1200 is a fully electric Class 3 commercial

electric vehicle which has the power and potential to transform the freight industry in North America. Powered by cutting edge

Li-Ion battery technology the VMC 1200 is a 11,000 GVWR medium-duty electric truck with a 5,000-pound load capacity and range up

to 150 miles on a single charge. The popular cab-over design provides ease of operation, maneuverability, visibility and simplified

body integration.

Parts Sales

We earn additional recurring revenues by selling

aftermarket parts. Aftermarket parts sales are expected to continue to increase as the existing Vicinity Bus fleet ages and new

vehicles are placed into service. Aging of the installed fleet base in addition to ongoing expansion into the passenger transportation

and freight market naturally increases the reach of aftermarket parts and continued improvements in volume pricing expands our

competitiveness in this high-margin business segment.

Recent Developments

In February 2023, we announced the closing

of a new $30 million credit facility to be used for up to 100% of eligible production costs for the Class 3 VMC 1200 electric trucks.

We also announced the renewal of an asset based lending facility for $10 million for use with bus orders.

In February 2023, we announced the signing

of a dealer network development services agreement with Dealer Solutions Mergers and Acquisitions (“DSMA”) to

enhance North American market penetration for our Class 3 VMC 1200 electric trucks.

In May 2023, we announced the closing of a

new $9 million credit facility with Export Development Canada to be used for operating costs and equipment purchases in the recently

completed Washington State Facility.

During the three months ended March 31, 2023,

we issued 925,667 common shares at prices ranging from $0.87 to $1.01 per share for net proceeds of $824,000 through our “at-the-market”

equity distribution program approved in 2021.

Company Information

The Company was incorporated

under the British Columbia Business Corporations Act (the “BCBCA”)

on December 4, 2012 under the name “Grande West Transport Group Inc.” On August 7, 2013, the Company changed its name

to “Grande West Transportation Group Inc.” On March 29, 2021, the Company changed its name to “Vicinity Motor

Corp.” to reflect the Company’s increasing focus on the commercialization of its next-generation electric buses and

consolidated its share capital on the basis of three pre-consolidation common shares to one post-consolidation common share.

We conduct our active

operations in Canada through our wholly owned operating subsidiary, Vicinity Motor (Bus) Corp. (“VMCBC”), which

was incorporated on September 2, 2008 under the BCBCA under the name “Grande West Transportation International Ltd.”

and changed its name to “Vicinity Motor (Bus) Corp.” on September 15, 2021. We conduct our active operations in the

United States through our wholly owned operating subsidiary, Vicinity Motor (Bus) USA Corp. (“VMUSA”), which

was incorporated on April 8, 2014 under the laws of the State of Delaware under the name “Grande West Transportation USA

Inc.” and changed its name to “Vicinity Motor (Bus) USA Corp.” on June 10, 2021. VMUSA has one wholly-owned subsidiary

“Vicinity Motor Property LLC” (“Vicinity Property”), which was formed on September 16, 2022 under

the laws of the State of Delaware, and is also registered in the State of Washington.

Additional information

about our business is included in the documents incorporated by reference into this prospectus.

USE

OF PROCEEDS

Our management will have broad discretion over

the use of the net proceeds from the sale of our securities pursuant to this prospectus, both in terms of the purposes for which

they will be used and the amounts that will be allocated for each purpose. We intend to use the net proceeds from the sale of any

securities offered under this prospectus for general corporate purposes, including new product development and certifications,

new product demonstration models, expansion of production capacity and general working capital. We had negative cash flow for the

financial year ended December 31, 2022. To the extent that we have negative operating cash flow in future periods, we will need

to allocate a portion of our cash (including proceeds from any offering under this prospectus) to fund such negative cash flow.

The use of proceeds from any offering will be set forth in a prospectus supplement to this prospectus or in a report on Form 6-K

subsequently furnished to the SEC and specifically incorporated herein by reference.

CAPITALIZATION

AND INDEBTEDNESS

Our capitalization

and indebtedness will be set forth in our most recent Annual Report on Form 20-F or a Report on Form 6-K which is incorporated

herein by reference, or in a prospectus supplement to this prospectus.

MARKET FOR COMMON SHARES

Our common shares are traded on the TSX Venture Exchange under the symbol “VMC”,

on the Nasdaq Capital Market under the symbol “VEV” and on the Frankfurt Stock Exchange under the symbol “6LGA.”

On July 3, 2023, the last reported sale price of our common shares on the Nasdaq Capital Market was $0.84, there were 45,667,706 shares

of common stock issued and outstanding, and we had approximately 12 registered shareholders of record.

DESCRIPTION

OF SECURITIES

We may offer common shares, warrants, subscription

receipts or units with a total value of up to $150,000,000 from time to time under this prospectus, together with any applicable

prospectus supplement, at prices and on terms to be determined by market conditions at the time of offering. This prospectus provides

you with a general description of the securities we may offer. Each time we offer securities, we will provide a prospectus supplement

that will describe the specific amounts, prices and other important terms of the securities. A prospectus supplement may also add,

update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus

supplement will offer a security that is not described in this prospectus.

We may offer common shares, which we may issue

independently or together with warrants or subscription receipts, and the common shares may be separate from or attached to such

securities.

All of our common shares rank equally as to

voting rights, participation in a distribution of the assets of the Company on a liquidation, dissolution or winding-up of the

Company and entitlement to any dividends declared by the Company. The holders of our common shares are entitled to receive notice

of, and to attend and vote at, all meetings of shareholders (other than meetings at which only holders of another class or series

of shares are entitled to vote). Each common share carries the right to one vote. In the event of the liquidation, dissolution

or winding-up of the Company, or any other distribution of the assets of the Company among its shareholders for the purpose of

winding-up its affairs, the holders of the common shares will be entitled to receive, on a pro rata basis, all of the assets remaining

after the payment by the Company of all of its liabilities. The holders of our common shares are entitled to receive dividends

as and when declared by our board of directors in respect of the common shares on a pro rata basis.

Since

the Company’s formation, it has not declared or paid any cash dividends on its common shares and does not anticipate paying

any cash dividends in the foreseeable future. Payment of cash dividends, if any, in the future will be at the discretion of our

board of directors and will depend on then-existing conditions, including our financial condition, operating results, contractual

restrictions, capital requirements, business prospects and other factors our board of directors may deem relevant.

Copies of our notice

of articles and articles are included as exhibits to this prospectus.

DESCRIPTION

OF WARRANTS

Warrants may be offered separately or together

with other securities, as the case may be. Each series of warrants will be issued under a separate warrant indenture (the “Warrant

Indenture”) to be entered into between the Company and one or more banks or trust companies acting as warrant agent (“Warrant

Agent”). The applicable prospectus supplement will include details of the terms and conditions of the warrants being

offered. The Warrant Agent will act solely as the Company’s agent and will not assume a relationship of agency with any holders

of warrant certificates or beneficial owners of warrants.

The following description sets forth certain

general terms and provisions of the warrants and is not intended to be complete. The statements made in this prospectus relating

to any Warrant Indenture and warrants to be issued thereunder are summaries of certain anticipated provisions thereof and are subject

to, and are qualified in their entirety by reference to, all provisions of the applicable Warrant Indenture and the prospectus

supplement describing such Warrant Indenture.

The particular terms of each issue of warrants

will be described in the related prospectus supplement and Warrant Indenture. This description will include, where applicable:

| ● | the designation and aggregate number of warrants; |

| ● | the price at which the warrants will be offered; |

| ● | the currency or currencies in which the warrants will be offered; |

| ● | whether the warrants will be listed on a securities exchange; |

| ● | the designation and terms of the common shares purchasable upon exercise of the warrants; |

| ● | the date on which the right to exercise the warrants will commence and the date on which the right

will expire; |

| ● | the number of common shares that may be purchased upon exercise of each warrant and the price at

which and currency or currencies in which the common shares may be purchased upon exercise of each warrant; |

| ● | the designation and terms of any securities with which the warrants will be offered, if any, and

the number of the warrants that will be offered with each security; |

| ● | the date or dates, if any, on or after which the warrants and the related securities will be transferable

separately; |

| ● | whether the warrants will be subject to redemption or call and, if so, the terms of such redemption

or call provisions; |

| ● | material Canadian and U.S. federal income tax consequences of owning the warrants; and |

| ● | any other material terms or conditions of the warrants. |

Prior to the exercise of their warrants, holders

of warrants will not have any of the rights of holders of common shares issuable upon exercise of the warrants.

To the extent that any particular terms of

the warrants described in a prospectus supplement differ from any of the terms described in this prospectus, the description of

such terms set forth in this prospectus shall be deemed to have been superseded by the description of such differing terms as set

forth in such prospectus supplement with respect to such warrants.

DESCRIPTION

OF SUBSCRIPTION RECEIPTS

We may issue subscription receipts, which will

entitle holders to receive upon satisfaction of certain release conditions and for no additional consideration, common shares,

warrants or a combination thereof. Subscription receipts will be issued pursuant to one or more subscription receipt agreements

(each, a “Subscription Receipt Agreement”), each to be entered into between the Company and an escrow agent

(the “Escrow Agent”), which will establish the terms and conditions of the subscription receipts. Each Escrow

Agent will be a financial institution organized under the laws of Canada or a province thereof and authorized to carry on business

as a trustee.

The following description sets forth certain

general terms and provisions of the subscription receipts and is not intended to be complete. The statements made in this prospectus

relating to any Subscription Receipt Agreement and subscription receipts to be issued thereunder are summaries of certain anticipated

provisions thereof and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable Subscription

Receipt Agreement and the prospectus supplement describing such Subscription Receipt Agreement.

The prospectus supplement and the Subscription

Receipt Agreement for any subscription receipts we offer will describe the specific terms of the subscription receipts and may

include, but are not limited to, any of the following:

| ● | the designation and aggregate number of subscription receipts offered; |

| ● | the price at which the subscription receipts will be offered; |

| ● | the currency or currencies in which the subscription receipts will be offered; |

| ● | the designation, number and terms of the common shares, warrants or combination thereof to be received

by holders of subscription receipts upon satisfaction of the release conditions, and the procedures that will result in the adjustment

of those numbers; |

| ● | the conditions (the “Release Conditions”) that must be met in order for holders

of subscription receipts to receive for no additional consideration common shares, warrants or a combination thereof; |

| ● | the procedures for the issuance and delivery of common shares, warrants or a combination thereof

to holders of subscription receipts upon satisfaction of the Release Conditions; |

| ● | whether any payments will be made to holders of subscription receipts upon delivery of the common

shares, warrants or a combination thereof upon satisfaction of the Release Conditions (e.g., an amount equal to dividends declared

on common shares to holders of record during the period from the date of issuance of the subscription receipts to the date of issuance

of any common shares pursuant to the terms of the Subscription Receipt Agreement); |

| ● | the terms and conditions under which the Escrow Agent will hold all or a portion of the gross proceeds

from the sale of subscription receipts, together with interest and income earned thereon (collectively, the “Escrowed

Funds”), pending satisfaction of the Release Conditions; |

| ● | the terms and conditions pursuant to which the Escrow Agent will hold common shares, warrants or

a combination thereof pending satisfaction of the Release Conditions; |

| ● | the terms and conditions under which the Escrow Agent will release all or a portion of the Escrowed

Funds to the Company upon satisfaction of the Release Conditions; |

| ● | if the subscription receipts are sold to or through underwriters or agents, the terms and conditions

under which the Escrow Agent will release a portion of the Escrowed Funds to such underwriters or agents in payment of all or a

portion of their fees or commission in connection with the sale of the subscription receipts; |

| ● | procedures for the refund by the Escrow Agent to holders of subscription receipts of all or a portion

of the subscription price for their subscription receipts, plus any pro rata entitlement to interest earned or income generated

on such amount, if the Release Conditions are not satisfied; |

| ● | any entitlement of the Company to purchase the subscription receipts in the open market by private

agreement or otherwise; |

| ● | whether the Company will issue the subscription receipts as global securities and, if so, the identity

of the depositary for the global securities; |

| ● | provisions as to modification, amendment or variation of the Subscription Receipt Agreement or

any rights or terms attaching to the subscription receipts; |

| ● | the identity of the Escrow Agent; |

| ● | whether the subscription receipts will be listed on any exchange; |

| ● | material Canadian and U.S. federal tax consequences of owning the subscription receipts; and |

| ● | any other material terms of the subscription receipts. |

The holders of subscription receipts will not

be shareholders of the Company. Holders of subscription receipts are entitled only to receive common shares, warrants or a combination

thereof on exchange of their subscription receipts, plus any cash payments provided for under the Subscription Receipt Agreement,

if the Release Conditions are satisfied. If the Release Conditions are not satisfied, the holders of subscription receipts shall

be entitled to a refund of all or a portion of the subscription price therefor and all or a portion of the pro rata share of interest

earned or income generated thereon, as provided in the Subscription Receipt Agreement.

To the extent that any particular terms of

the subscription receipts described in a prospectus supplement differ from any of the terms described in this prospectus, the description

of such terms set forth in this prospectus shall be deemed to have been superseded by the description of such differing terms as

set forth in such prospectus supplement with respect to such subscription receipts.

Description

of Units

We may issue units comprised of one or more

of the other securities described in this prospectus in any combination. Each unit will be issued so that the holder of the unit

is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a

holder of each included security. The unit agreement, if any, under which a unit is issued may provide that the securities comprising

the unit may not be held or transferred separately, at any time or at any time before a specified date.

The particular terms and provisions of each

issue of units will be described in the related prospectus supplement. This description will include, where applicable:

| ● | the designation and aggregate number of units offered; |

| ● | the price at which the units will be offered; |

| ● | the terms of the units and of the securities comprising the units, including whether and under

what circumstances those securities may be held or transferred separately; |

| ● | the number of securities that may be purchased upon exercise of each unit and the price at which

and currency or currency unit in which that amount of securities may be purchased upon exercise of each unit; |

| ● | any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the

securities comprising the units; and |

| ● | any other material terms, conditions and rights (or limitations on such rights) of the units. |

To the extent that any particular terms of

the units described in a prospectus supplement differ from any of the terms described in this prospectus, the description of such

terms set forth in this prospectus shall be deemed to have been superseded by the description of such differing terms as set forth

in such prospectus supplement with respect to such units.

CERTAIN INCOME TAX CONSIDERATIONS

The applicable prospectus supplement will describe

certain U.S. federal income tax consequences of the acquisition, ownership and disposition of any securities offered thereunder

by an initial investor who is a U.S. person (within the meaning of the U.S. Internal Revenue Code).

The applicable prospectus supplement may also

describe certain Canadian federal income tax consequences to an investor of acquiring any securities offered thereunder, including,

for investors who are non-residents of Canada, whether the payment of dividends or distributions, if any, on the securities will

be subject to Canadian non-resident withholding tax.

PLAN

OF DISTRIBUTION

We may offer and sell, from time to time, some

or all of the securities covered by this prospectus up to an aggregate public offering price of $150,000,000. We have registered

the securities covered by this prospectus for offer and sale by us so that those securities may be freely sold to the public by

us. Registration of the securities covered by this prospectus does not mean, however, that those securities necessarily will be

offered or sold.

Securities covered by this prospectus may be

sold from time to time, in one or more transactions, at market prices prevailing at the time of sale, at prices related to market

prices, at a fixed price or prices subject to change, at varying prices determined at the time of sale or at negotiated prices,

by a variety of methods including the following:

| |

● |

on the Nasdaq Capital Market or any other national securities exchange or U.S. inter-dealer system of a registered national securities association on which our common stock may be listed or quoted at the time of sale; |

| |

● |

in the over-the-counter market; |

| |

● |

in privately negotiated transactions; |

| |

● |

in an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

through broker-dealers, who may act as agents or principals; |

| |

● |

through sales “at the market” to or through a market-maker; |

| |

● |

in a block trade, in which a broker-dealer will attempt to sell a block as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

through one or more underwriters on a firm commitment or best-efforts basis; |

| |

● |

directly to one or more purchasers; |

| |

● |

in options transactions; |

| |

● |

any other method permitted pursuant to applicable law; or |

| |

● |

in any combination of the above. |

In effecting sales, brokers or dealers engaged

by us may arrange for other brokers or dealers to participate. Broker-dealer transactions may include:

| |

● |

purchases of the securities by a broker-dealer as principal and resales of the securities by the broker-dealer for its account pursuant to this prospectus; |

| |

● |

ordinary brokerage transactions; or |

| |

● |

transactions in which the broker-dealer solicits purchasers. |

In addition, we may sell any securities that

could have been covered by this prospectus if sold through a registered offering in private transactions or under Rule 144 of the

Securities Act, rather than pursuant to this prospectus.

In connection with the sale of securities covered

by this prospectus, broker-dealers may receive commissions or other compensation from us in the form of commissions, discounts

or concessions. Broker-dealers may also receive compensation from purchasers of the securities for whom they act as agents or to

whom they sell as principals or both. Compensation as to a particular broker-dealer may be in excess of customary commissions or

in amounts to be negotiated. In connection with any underwritten offering, underwriters may receive compensation in the form of

discounts, concessions or commissions from us or from purchasers of the securities for whom they act as agents. Underwriters may

sell the securities to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions

from the underwriters and/or commissions from the purchasers for whom they may act as agents. We and any underwriters, broker-

dealers or agents that participate in the distribution of the securities may be deemed to be “underwriters” within

the meaning of the Securities Act and any profit on the sale of the securities by them and any discounts, commissions or concessions

received by any of those underwriters, broker-dealers or agents may be deemed to be underwriting discounts and commissions under

the Securities Act.

In connection with the distribution of the

securities covered by this prospectus or otherwise, we may enter into hedging transactions with broker-dealers or other financial

institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of

our securities in the course of hedging the positions they assume with us. We may also enter into option or other transactions

with broker-dealers or other financial institutions, which require the delivery to such broker-dealer or other financial institution

of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant

to this prospectus, as supplemented or amended to reflect such transaction.

At any time a particular offer of the securities

covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will be distributed which will

set forth the aggregate amount of securities covered by this prospectus being offered and the terms of the offering, including

the expected issue price or method of determining the price, the time period during which the offer will be open and whether the

purchase period may be extended or shortened, the method and time limits for paying up and delivering securities, name or names

of any underwriters, dealers, brokers or agents, any discounts, commissions, concessions and other items constituting compensation

from us and any discounts, commissions or concessions allowed or paid to dealers. Such prospectus supplement, and, if necessary,

a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the SEC to reflect

the disclosure of additional information with respect to the distribution of the securities covered by this prospectus. In order

to comply with the securities laws of certain states, if applicable, the securities sold under this prospectus may only be sold

through registered or licensed broker-dealers. In addition, in some states the securities may not be sold unless they have been

registered or qualified for sale in the applicable state or an exemption from registration or qualification requirements is available

and is complied with.

In connection with an underwritten offering,

we would execute an underwriting agreement with an underwriter or underwriters. Unless otherwise indicated in the revised prospectus

or applicable prospectus supplement, such underwriting agreement would provide that the obligations of the underwriter or underwriters

are subject to certain conditions precedent and that the underwriter or underwriters with respect to a sale of the covered securities

will be obligated to purchase all of the covered securities if any such securities are purchased. We may grant to the underwriter

or underwriters an option to purchase additional securities at the public offering price, as may be set forth in the revised prospectus

or applicable prospectus supplement. If we grant any such option, the terms of the option will be set forth in the revised prospectus

or applicable prospectus supplement.

Pursuant to a requirement by the Financial

Industry Regulatory Authority, (“FINRA”) the maximum commission or discount to be received by any FINRA

member or independent broker-dealer may not be greater than 8% of the gross proceeds received by us for the sale of any securities

being registered pursuant to Rule 415 under the Securities Act.

Underwriters, agents, brokers or dealers may

be entitled, pursuant to relevant agreements entered into with us, to indemnification by us against certain civil liabilities,

including liabilities under the Securities Act that may arise from any untrue statement or alleged untrue statement of a material

fact, or any omission or alleged omission to state a material fact in this prospectus, any supplement or amendment hereto, or in

the registration statement of which this prospectus forms a part, or to contribution with respect to payments which the underwriters,

agents, brokers or dealers may be required to make.

Any offering of

warrants, subscription receipts or units will be a new

issue of securities with no established trading market. Unless otherwise specified in a prospectus supplement, the warrants, subscription receipts

or units will not be listed on any securities exchange or on any automated dealer quotation system. This may affect the pricing

of the warrants, subscription receipts or units in the

secondary market, the transparency and availability of trading prices, the liquidity of the warrants, subscription receipts

or units and the extent of issuer regulation. Certain broker-dealers may make a market in the warrants,

subscription receipt or units, but will not be obligated

to do so and may discontinue any market making at any time without notice. We cannot assure you that any broker-dealer will make

a market in the warrants, subscription receipts or units

of any series or as to the liquidity of the trading market, if any, for such securities.

We will bear all costs relating to all of the

securities being registered under the registration statement of which this prospectus is a part.

LEGAL

MATTERS

Unless otherwise

indicated in any supplement to this prospectus, certain legal matters with respect to U.S. law will be passed upon for us by Cozen

O’Connor P.C., New York, New York. Unless otherwise indicated in any supplement to this prospectus,

certain legal matters with respect to Canadian law, including in connection with the validity of the offered securities, will be

passed upon for us by Cozen O’Connor LLP, Vancouver, Canada. Additional legal matters may

be passed upon for any underwriters, dealers or agents by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The financial statements incorporated in this

prospectus by reference to our Annual Report on Form 20-F for the year ended December 31, 2022 have been so incorporated in reliance

on the report of PricewaterhouseCoopers LLP, an independent registered

public accounting firm, given on the authority of said firm as experts in accounting and auditing.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation organized under the laws

of the Province of British Columbia. Some of our officers and directors are Canadian residents, and some of our assets or the assets

of our officers and directors are located outside the United States. We have appointed an agent for service of process in the United

States, but it may be difficult for holders of securities who reside in the United States to effect service within the United States

upon those directors, officers who are not residents of the United States. It may also be difficult for holders of securities who

reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil

liability and the civil liability of our officers and directors under the United States federal securities laws. In addition, there

is doubt as to whether an original action could be brought in Canada against us or our directors or officers based solely upon

U.S. federal or state securities laws and as to the enforceability in Canadian courts of judgments of U.S. courts obtained in actions

based upon the civil liability provisions of U.S. federal or state securities laws.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual reports on Form 20-F or Form

40-F, reports on Form 6-K, and other information with the SEC. The SEC maintains an Internet website that contains reports and

other information that we file electronically with the SEC and which are available at http://www.sec.gov. In addition, we

maintain an Internet website at www.vicinitymotorcorp.com. Information contained on or accessible through our website is

not incorporated into or made a part of this prospectus or the registration statement of which this prospectus forms a part.

This prospectus is part of a registration statement

that we filed with the SEC. The registration statement contains more information than this prospectus regarding us and our securities,

including certain exhibits. You can obtain a copy of the registration statement from the SEC’s website listed above.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference

into this prospectus the information we file with the SEC. This means that we can disclose important information to you by referring

you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this

prospectus. Any information that we file later with the SEC and that is deemed incorporated by reference will automatically update

and supersede the information in this prospectus. In all such cases, you should rely on the later information over different information

included in this prospectus.

This prospectus incorporates by reference the

following documents:

| ● | our Annual Report on Form 20-F for the fiscal year ended December 31, 2022, filed with the SEC

on April 28, 2023; and |

| ● | Exhibits 99.1 and 99.2 of our Report on Form 6-K dated May 15, 2023, filed with the SEC on May

15, 2023. |

All annual reports that we file with the SEC

pursuant to the Exchange Act after the date of this prospectus and prior to termination or expiration of the registration statement

of which this prospectus forms a part shall be deemed incorporated by reference into this prospectus and to be part hereof from

the date of filing of such documents. We may incorporate by reference any Form 6-K subsequently submitted to the SEC by identifying

in such Form 6-K that it is being incorporated by reference into this prospectus (including any such Form 6-K that we submit to

the SEC after the date of the filing of the registration statement of which this prospectus forms a part and prior to the date

of effectiveness of such registration statement).

Any statements made in this prospectus or

in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed

document that is also incorporated or deemed to be incorporated by reference in this prospectus modifies or supersedes the statement.

Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will

furnish without charge to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral

request, a copy of any or all of the reports or documents incorporated by reference into this prospectus but not delivered with

the prospectus, including exhibits that are specifically incorporated by reference into such documents. You may direct any requests

for reports or documents to:

Vicinity Motor Corp.

3168 262nd Street

Aldergrove, British Columbia, Canada V6B 1R4

Attention: Corporate Secretary

Telephone: (604) 607-4000

EXPENSES

The following is a statement of the estimated

expenses, other than any underwriting discounts and commissions, that we expect to incur in connection with the issuance and distribution

of the securities registered under this registration statement:

| SEC registration fee | |

$ | 16,530 | |

| FINRA filing fee | |

$ | 23,000 | |

| Printing expenses | |

| * | |

| Legal fees and expenses | |

| * | |

| Accountants’ fees and expenses | |

| * | |

| Miscellaneous | |

| * | |

| Total | |

| $* | |

*

Information regarding the issuance and distribution of the securities is not currently known, and will be provided in an

applicable prospectus supplement.

MATERIAL

CHANGES

Except as otherwise described in our Annual

Report on Form 20-F for the fiscal year ended December 31, 2022 and in our reports on Form 6-K incorporated by reference herein

and as disclosed in this prospectus, no reportable material changes have occurred since December 31, 2022.

Vicinity Motor Corp.

$150,000,000

Common Shares

Warrants

Subscription Receipts

Units

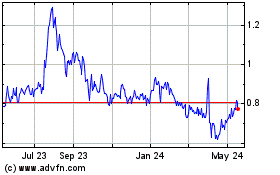

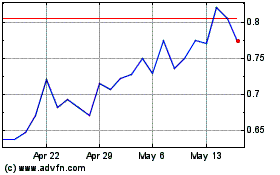

Vicinity Motor (NASDAQ:VEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vicinity Motor (NASDAQ:VEV)

Historical Stock Chart

From Apr 2023 to Apr 2024