0001630113

false

--03-31

0001630113

2023-06-29

2023-06-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): June 29, 2023

BIOTRICITY

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-56074 |

|

30-0983531 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

203

Redwood Shores Parkway, Suite 600

Redwood

City, California

94065

(Address

of Principal Executive Offices)

(650)

832-1626

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 |

Results of Operations and Financial Condition. |

On

June 30, 2023, Biotricity Inc. (the “Company”) issued a press release reporting its financial results for the period ended

March 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Current Report, including the exhibits hereto, is being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or

Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying

Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document filed by the Company with the Securities

and Exchange Commission, whether made before or after the date of this report, regardless of any general incorporation language in such

filing (or any reference to this Current Report on Form 8-K generally), except as shall be expressly set forth by specific reference

in such filing.

| Item

3.03 |

Material

Modification to Rights of Security Holders. |

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this report is incorporated herein by reference.

| Item

5.03 |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On

June 29, 2023, the Company filed a Certificate of Amendment to its Amended and Restated Articles of Incorporation to effect a one-for-six

(1-for-6) reverse split (the “Reverse Split”). The Reverse Split became effective on July 3, 2023. As a result of the Reverse

Split, every six shares of the Company’s issued and outstanding common stock shall be automatically converted into one share of

common stock, without any change in the par value per share and began trading on a post-split basis under the Company’s existing

trading symbol, “BTCY,” when the market opened on July 3, 2023.

A

total of approximately 8,508,052 shares of common stock were issued and outstanding immediately after the Reverse Split. No fractional

shares will be outstanding following the Reverse Split. Any holder who would have received a fractional share of common stock will automatically

be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. The new CUSIP number for

the common stock following the Reverse Split is 09074H 203.

The

above description is a summary of the text of the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form

8-K and incorporated herein by reference.

Item

8.01 Other Events

On

June 30, 2023, the Company announced that it was effecting the Reverse Split. A copy of the press release is attached hereto as Exhibit

99.2 and is incorporated herein by reference.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date:

July 5, 2023

| |

BIOTRICITY

INC. |

| |

|

|

| |

By: |

/s/

Waqaas Al-Siddiq |

| |

|

Waqaas

Al-Siddiq |

| |

|

Chief

Financial Officer |

Exhibit 3.1

Exhibit

99.1

Biotricity

Reports Business Update, Financial Results for Q4 and Full Year FY23; Company Posts Robust Revenue Growth, Overall Higher Margins, with

Lower SG&A Driving Clear Path to Positive Cash Flow

| |

● |

Company

advancing toward positive cashflow likely by end of CY 2024 |

| |

|

|

| |

● |

Accelerating

product sales, and customer re-order revenue, |

| |

|

|

| |

● |

FY23

revenue rose 26% YOY to $9.64 million on 5% lower SG&A of $17.6 million |

| |

|

|

| |

● |

Improving

gross margins currently at 57% despite reduced, loss-leader device pricing to boost recurring ‘Technology Fees,’ lower

customers’ cost of entry, and capture market share |

| |

|

|

| |

● |

Recurring

Technology Fee revenue - over 90% of total revenue with a 71% gross margin — rose a robust 49% YOY |

| |

|

|

| |

● |

Net

loss decreased 35.4% to $19.5 million |

| |

|

|

| |

● |

Company

will host its FY23 Financial Results Call Friday, June 30 at 4:30 p.m. ET |

REDWOOD

CITY, CA / ACCESSWIRE / June 30, 2023 / Biotricity Inc. (NASDAQ:BTCY) (“Biotricity” or the “Company”),

a Technology-as-a-Service (TaaS) company operating in the remote cardiac monitor sector of consumer healthcare, today announced its financial

results for its fiscal 2023 year and (unaudited) fourth quarter ended March 31, 2023.

Dr.

Waqaas Al-Siddiq, Biotricity Founder & CEO, commented, “Fiscal 2023 was another year of excellent progress as we are scaling

the business to plan, putting us solidly on our path to positive cash flow which we plan to reach by the end of CY24. To do so, we are

generating strong revenue growth at a healthy gross margin. To gain efficiency and ensure our industry leadership, we have a dedicated

team working with our proprietary AI programs companywide to improve automation and big data analytics, optimize operations and strengthen

our state-of-the-art predictive cardiac diagnostics.

“This

enables us to rapidly build revenue while we reduce or hold our operating expenses stable. As we continue to scale the business, we expect

to raise blended gross margins into the 60% range as the bulk of our revenues are generated from Technology Fees, which had a gross margin

of approximately 70%.

“Given

the small size of our operations and staff relative to our footprint, we hold a robust market share with about 2,500 physicians, mostly

cardiologists, integrated into our cloud-based Biosphere ecosystem.

“In

the past year, we have transitioned from just one cardiac device in the market, to a platform company selling and serving four products

that are integrated into our secure, cloud-based Biosphere portal. We are upselling to a repeat, loyal customer base who have used our

first product to deliver better diagnostics to their patients and can now deliver better long term and holistic care through our latest

products,” Dr. Al-Siddiq added.

“Our

product strategy is focused on upselling and delivering complementary solutions that enhance one another as opposed to replacement products

that can potentially cannibalize existing products. In this way, we are adding a vertical strategy of upselling alongside our horizontal

strategy of new customer acquisition. Our newest solutions are more bought than sold to existing customers, which skips onboarding and

requires less time and resources to solicit the sale. Developing solutions that complement the rest of our product line without overlapping

has the added benefit of expanding our market opportunity. In the last year, our portfolio expansion has expanded our total global addressable

market (TAM) geometrically from approximately $1 billion to approximately $35 billion.

“In

fact, since we first launched Bioflux® four years ago we have achieved sales of $22 million to date and are continuing to grow this

solution. Today, Bioflux is approximately at a $12 million runrate. Now that we’re seeing existing customer sales of our BiotresTM

as a second product, those sales are ramping up far faster and we project they will reach a $2 million run rate just fifteen months

from commercial launch compared to thirty months for Bioflux®.”

Q4-FY23

Financial Highlights

| |

● |

Revenue

increased 27.6% to $2.74 million compared with $2.15 million in Q4 FY22 |

| |

|

|

| |

● |

Blended

gross margin was 56% vs. 67% a year ago, reflecting Company’s strategic reduction in device pricing to lower the customers’

cost of entry into recurring Technology Fees |

| |

|

|

| |

● |

Technology

Fee margins were steady at 71%, and comprised 93% of total revenue |

| |

|

|

| |

● |

Gross

profit totaled $1.5 million, up 7% from $1.4 million in the year-earlier quarter |

| |

|

|

| |

● |

Net

loss decreased 19% YOY to $4.9 million, or $0.09 per share, from a net loss of $6.0 million, or $0.118 per share, in Q4-FY2 |

FY23

Financial Highlights

| |

● |

Revenue

increased 26% to $9.64 million, as compared with $7.65 million in FY22 |

| |

|

|

| |

● |

Gross

profit rose 19% YOY to $5.44 million from $4.57 million |

| |

|

|

| |

● |

Blended

gross margin decreased slightly to 57% from 60% in FY23, reflecting lower pricing on cardiac devices to capture market share and

reduce customers’ cost of entry |

| |

|

|

| |

● |

Net

loss decreased 35.4% YOY to $19.5 million, or $0.38 per share, vs. a net loss of $30.2 million, or $0.665 per share, in FY22 |

Operating

Highlights for FY23

| |

● |

FY23

recurring (TaaS) Technology Fees rose a robust 49% YOY to $8.8 million, representing over 10 times Device Sales revenue |

| |

|

|

| |

● |

Company

continues to report near-perfect 98% customer retention rate boosting recurring Technology Fee revenue |

| |

|

|

| |

● |

Increased

total addressable market from $1 billion to approximately $35 billion through the launch of its full line of cardiac solutions |

| |

|

|

| |

● |

Expanded

its network to over 350 centers across 31 states with over 2,500 cardiologists |

| |

|

|

| |

● |

Growing

repeat second-product sales to installed customer base with lower associated cost of sales |

| |

|

|

| |

● |

Company

is driven to reach positive cash flow, driving revenue higher while reducing or holding SG&A stable |

“We

achieved revenue growth of 26% year over year in FY23, with a healthy blended gross margin of 57% that confirms our capital efficient

business model is highly scalable,” Dr. Al-Siddiq continued. “Gross margin is down slightly, due to our reduced pricing strategy

of device hardware to capture market share and lower customers’ cost of entry which then accelerates our recurring Technology Fee

revenue streams via our near-perfect 98% customer retention rate.

“At

$8.8 million, our recurring Technology Fees totaled more than ten times our Device Sales. Technology Fees are our most reliable leading

indicator of growth, and I am delighted to report they increased by a robust 49% year over year. Technology Fees have consistently delivered

a gross margin of approximately 71% which weighs heavily and blends with our loss-leading device sales that are earned and recognized

up front. However, as our business grows we expect the Technology Fee component to outpace and comprise an ever-growing larger percentage

of our overall sales boosting our blended gross margin higher.”

Dr.

Al-Siddiq concluded, “Our business is high-growth, recession resilient, and highly scalable via our superior offering driven by

proprietary AI-based technology that supports our remote cardiac monitors, diagnostics, Biosphere, and our seamless front and back-office

interface functionality.”

Full

details of the Company’s financial results will be filed with the SEC on Form 10-K and available by visiting www.sec.gov

..

Financial

Results and Business Update Conference Call

Management

will host a conference call on Friday, June 30, 2023 at 4:30 p.m. ET to discuss its financial results for the fiscal 2023 fourth quarter

and full year and provide a business update. Additional details are available under the Investor Relations section of the Company’s

website: https://www.biotricity.com/investors/

Event:

Biotricity FY 2023 Financial Results and Business Update Call

Date:

Friday, June 30th

Time:

4:30 p.m. ET (1:30 p.m. PT)

Toll

Free: 877-405-1216

International:

+1 201-689-8336

Webcast

URL: https://event.choruscall.com/mediaframe/webcast.html?webcastid=HhUoTP8T

Investors

can begin accessing the webcast 15 minutes before the call, where an operator will register your name and organization. The call will

be in listen-only mode.

A

replay of the call will be available approximately 3 hours after the live call via the Investors section of the Biotricity website at

https://www.biotricity.com/investors/.

Toll

Free Replay Number: 877-660-6853

International:

201-612-7415

Replay

Access ID: 13739462

Expiration:

July 14, 2023, 11:59 PM ET

About

Biotricity Inc.

Biotricity

is reforming the healthcare market by bridging the gap in remote monitoring and chronic care management. Doctors and patients trust Biotricity’s

unparalleled standard for preventive & personal care, including diagnostic and post-diagnostic solutions for chronic conditions.

The Company develops comprehensive remote health monitoring solutions for the medical and consumer markets. To learn more, visit www.biotricity.com.

Important

Cautions Regarding Forward-Looking Statements

Any

statements contained in this press release that do not describe historical facts may constitute forward-looking statements. Forward-looking

statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use

of the words “may,” “should,” “would,” “will,” “could,” “scheduled,”

“expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,”

“project,” or “goal” or the negative of these words or other variations on these words or comparable terminology.

Forward-looking statements may include, without limitation, statements regarding (i) the plans, objectives and goals of management for

future operations, including plans, objectives or goals relating to the design, development and commercialization of Bioflux or any of

the Company’s other proposed products or services, (ii) a projection of income (including income/loss), earnings (including earnings/loss)

per share, capital expenditures, dividends, capital structure or other financial items, (iii) the Company’s future financial performance,

(iv) the regulatory regime in which the Company operates or intends to operate and (v) the assumptions underlying or relating to any

statement described in points (i), (ii), (iii) or (iv) above. Such forward-looking statements are not meant to predict or guarantee actual

results, performance, events or circumstances and may not be realized because they are based upon the Company’s current projections,

plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other

influences, many of which the Company has no control over. Actual results and the timing of certain events and circumstances may differ

materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence

or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired

results may include, without limitation, the Company’s inability to obtain additional financing, the significant length of time

and resources associated with the development of its products and related insufficient cash flows and resulting illiquidity, the Company’s

inability to expand the Company’s business, significant government regulation of medical devices and the healthcare industry, lack

of product diversification, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity,

and the Company’s failure to implement the Company’s business plans or strategies. These and other factors are identified

and described in more detail in the Company’s filings with the SEC. There cannot be any assurance that the Company will ever become

profitable. The Company assumes no obligation to update any forward-looking statements in order to reflect any event or circumstance

that may arise after the date of this release.

Contacts

Investor

Relations

Biotricity

Investor Relations

Investors@biotricity.com

SOURCE:

Biotricity, Inc.

Exhibit

99.2

Biotricity

Announces Reverse Stock Split

REDWOOD

CITY, CA / ACCESSWIRE / June 30, 2023 / Biotricity Holdings, Inc. (“Biotricity” or the “Company”) (NASDAQ:BTCY),

a medical diagnostic and consumer healthcare technology company, today it will effect a reverse stock split of its common stock. Biotricity

expects its common stock to begin trading on a split-adjusted basis on the Nasdaq Capital Market as of the commencement of trading on

July 3, 2023.

The

reverse stock split was approved by the Board of Directors of the Company and is intended to increase the per share trading price of

the Company’s common stock to satisfy the $1.00 minimum bid price requirement for continued listing on the Nasdaq Capital Market.

At

the effective time of the reverse stock split, every 6 shares of Biotricity common stock issues and outstanding will be combined into

one share of common stock issued and outstanding. This will reduce the Company’s outstanding common stock from approximately 51

million shares to approximately 8.5 million shares. No fractional shares of common stock will be issued as a result of the reverse stock

split and instead fractional shares will be rounded up.

Waqaas

Al-Siddiq, Chief Executive Officer, commented, “The reverse split is a necessary step in our efforts to maintain our listing on

the Nasdaq market. The visibility and credibility that comes with a Nasdaq listing is an important component in our efforts to enhance

shareholder value.”

About

Biotricity

Biotricity

is reforming the healthcare market by bridging the gap in remote monitoring and chronic care management. Doctors and patients trust Biotricity’s

unparalleled standard for preventive & personal care, including diagnostic and post-diagnostic products for chronic conditions. The

Company develops comprehensive remote health monitoring solutions for the medical and consumer markets. To learn more, visit www.biotricity.com.

Forward

Looking Statements

Any

statements contained in this press release that do not describe historical facts may constitute forward-looking statements. Forward-looking

statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use

of the words “may,” “should,” “would,” “will,” “could,” “scheduled,”

“expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,”

“project,” or “goal” or the negative of these words or other variations on these words or comparable terminology.

Forward-looking statements may include, without limitation, statements regarding (i) the plans, objectives and goals of management for

future operations, including plans, objectives or goals relating to the design, development and commercialization of Bioflux or any of

the Company’s other proposed products or services, (ii) a projection of income (including income/loss), earnings (including earnings/loss)

per share, capital expenditures, dividends, capital structure or other financial items, (iii) the Company’s future financial performance,

(iv) the regulatory regime in which the Company operates or intends to operate and (v) the assumptions underlying or relating to any

statement described in points (i), (ii), (iii) or (iv) above. Such forward-looking statements are not meant to predict or guarantee actual

results, performance, events or circumstances and may not be realized because they are based upon the Company’s current projections,

plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other

influences, many of which the Company has no control over. Actual results and the timing of certain events and circumstances may differ

materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence

or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired

results may include, without limitation, the Company’s inability to obtain additional financing, the significant length of time

and resources associated with the development of its products and related insufficient cash flows and resulting illiquidity, the Company’s

inability to expand the Company’s business, significant government regulation of medical devices and the healthcare industry, lack

of product diversification, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity,

and the Company’s failure to implement the Company’s business plans or strategies. These and other factors are identified

and described in more detail in the Company’s filings with the SEC. The Company assumes no obligation to update any forward-looking

statements in order to reflect any event or circumstance that may arise after the date of this release.

Investor

Relations:

Biotricity

Inc.

1-800-590-4155

investors@biotricity.com

SOURCE:

Biotricity, Inc.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

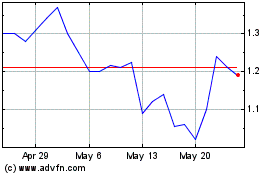

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

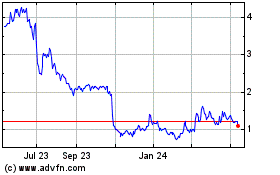

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Apr 2023 to Apr 2024