0000704172

false

0000704172

2023-06-27

2023-06-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 27, 2023

PHI

GROUP, INC.

(n/k/a

PHILUX GLOBAL GROUP INC.‚

(Exact

name of registrant as specified in its charter)

| Wyoming |

|

001-38255-NY |

|

90-0114535 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2323

Main Street, Irvine, CA |

|

92614 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 714-793-9227

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PHIL |

|

OTC

Markets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provide pursuant to Section 13(a) of the Exchange Act. ☐

/2

Section

1 – Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement

On

June 27, 2023, Premier Enterprises Group Inc., a Wyoming corporation and subsidiary of PHI Group, Inc. (/n/k/a Philux Global Group Inc.),

(the “Registrant”) entered into an Agreement of Purchase and Sale with Jinshan Limited Liability Company, a limited liability

company organized and existing by virtue of the laws of Socialist Republic of Vietnam, with principal business address at 37 Road No.

4, Do Thanh Housing Complex, Ward 4, District 3, Ho Chi Minh City, Vietnam, hereinafter referred to as “JSH,” the Majority

Member(s) of JSH, hereinafter referred to as the “Majority Member(s),” (both JSH and the Majority Member(s) are referred

to as the “Seller”), to acquire fifty-one percent (51%) of equity ownership in JSH for a purchase price to be determined

as follows:

The

value of JSH’s fifty-one percent (51%) equity ownership as at the date of signing this contract shall be (a) provisionally calculated

as Five Million One Hundred Ninety Four Thousand Seven Hundred Fourteen United States Dollars (US$5,194,714), which is equivalent to

fifty-one percent (51%) of twice the equity of JSH according to the audit report of JSH issued by Viet Dragon Auditing and Consulting

Co., Ltd. made for the year ended December 31, 2022, based on the exchange rate of foreign currency transfer by Eximbank Vietnam as at

the end of June 26, 2023, (b) or an amount equivalent to fifty-one percent (51%) of the value of JSH independently valued by a qualified

professional valuation firm mutually acceptable on or before the Closing Date of this transaction, whichever is greater, (c) or a number

of shares of PEG with a market value of twice the greater amount between the two cases above, based on the average ten-day closing price

of PEG shares in the U.S. Stock Market immediately prior to the Closing date after PEG has become a publicly traded company in the U.S.

for at least one month, according to the final agreement between the Parties prior to or on the Closing date.

The

Closing of this transaction is subject to PEG’s being listed and traded on a U.S. stock exchange at least one month prior to the

Closing date.

The

foregoing description of the Agreement of Purchase and Sale dated June 27, 2023 among Premier Enterprises Group Inc. , a subsidiary of

PHI Group, Inc., Jinshan Limited Liability Company and the Majority Member(s) of JSH is qualified in its entirety by reference to the

full text of said Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

SECTION

9 – FINANCIAL STATEMENTS AND EXHBITS

Item

9.01 Financial Statements and Exhibits

The

following is a complete list of exhibit(s) filed as part of this Report.

Exhibit

number(s) correspond to the number(s) in the exhibit table of Item 601 of Regulation S-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

June 28, 2023

| PHI

GROUP, INC. |

|

| (Registrant)

|

|

| |

|

|

| By:

|

/s/

Henry D. Fahman |

|

| |

Henry

D. Fahman |

|

| |

Chairman

and CEO |

|

EXHIBIT

10.1

AGREEMENT

OF PURCHASE AND SALE

THIS

AGREEMENT OF PURCHASE AND SALE (this “Agreement”) is made effective as of June 27, 2023, among Premier Enterprises Group

Inc., a corporation organized and operating according to the laws of the State of Wyoming, U.S.A., Business Registration No. 2023-001290120,

Federal Tax ID No. 93-2062057, with registered address at 30 N. Gould Street, Suite R, Sheridan, WY 82801, U.S.A, hereinafter referred

to as “PEG”, Jinshan Limited Liability Company, a limited liability company organized and existing by virtue of the laws

of Socialist Republic of Vietnam, with principal business address at 37 Road No. 4, Do Thanh Housing Complex, Ward 4, District 3, Ho

Chi Minh City, Vietnam, hereinafter referred to as “JSH,” the Majority Member(s) of JSH, hereinafter referred to as the “Majority

Member(s).” Both JSH and the Majority Member(s) are hereinafter referred to as the “Seller”.

WHEREAS:

A.

JSH is a multi-disciplinary company, which mainly focuses on the production of apparel and footwear accessories.

B.

PEG is a company incorporated and operating under the laws of the state of Wyoming, USA with the aim of becoming a publicly traded company

on the US stock market and acquiring a number of domestic and foreign businesses in the US. to create value for its Member(s)s and stakeholders

who participate in the development of the company.

C.

The Parties hereby wish to enter into this Agreement, in which PEG agrees to acquire fifty-one percent (51%) of the equity ownership

rights of JSH and Seller agrees to sell to PEG fifty-one percent ( 51%) equity ownership rights of JSH under the terms and conditions

of this Agreement.

NOW

THEREFORE THIS AGREEMENT WITNESSES that in consideration of covenants and agreements set forth herein and other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree each with the other as follows:

1.

DEFINITIONS

1.1

Definitions. The following terms have the following meanings, unless the context indicates otherwise:

(a)

“Acquired Assets” means all assets listed in Schedule 1 hereto;

(b)

“Agreement” means this Agreement, and all the exhibits, schedules and other documents attached to or referred to in

this Agreement, and all amendments and supplements, if any, to this Agreement;

(c)

“Closing” shall mean the completion of the Transaction, in accordance with Section 7 hereof, at which time the Closing

Documents shall be exchanged by the parties, except for those documents or other items specifically required to be exchanged at a later

time;

(d)

“Closing Date” shall mean a date mutually agreed upon by the parties hereto in writing and in accordance with Section

8.1(d) of this Agreement;

(e)

“Closing Documents” shall mean the papers, instruments and documents required to be executed and delivered at the

Closing pursuant to this Agreement;

(f)

“Liabilities” includes, any direct or indirect indebtedness, guaranty, endorsement, claim, loss, damage, deficiency,

cost, expense, obligation or responsibility, fixed or unfixed, known or unknown, asserted choate or inchoate, liquidated or unliquidated,

secured or unsecured.

(g)

“Loss” shall mean any and all demands, claims, actions or causes of action, assessments, losses, damages, liabilities,

costs, and expenses, including without limitation, interest, penalties, fines and reasonable attorneys, accountants and other professional

fees and expenses, but excluding any indirect, consequential or punitive damages suffered by JSH or PEG including damages for lost profits

or lost business opportunities.

(h)

“SEC” shall mean the United States Securities and Exchange Commission;

(i)

“Taxes” shall include international, federal, state, provincial and local income taxes, capital gains tax, value-added

taxes, franchise, personal property and real property taxes, levies, assessments, tariffs, duties (including any customs duty), business

license or other fees, sales, use and any other taxes relating to the assets of the designated party or the business of the designated

party for all periods up to and including the Closing Date, together with any related charge or amount, including interest, fines, penalties

and additions to tax, if any, arising out of tax assessments;

(j)

“Transaction” shall mean the exchange of Consideration pursuant to this Agreement as described in Section 2.2;

(k)

“1933 Act” shall mean the United States Securities Act of 1933, as amended;

(l)

“1934 Act” shall mean the United States Securities Exchange Act of 1934, as amended; and,

(m)

Schedules. The following schedules are attached to and form part of this Agreement:

| |

Schedule

1 - The Acquired Assets. |

| |

Schedule

2- Title of Acquired Assets. |

| |

Schedule

3 - Impairments to Title of Acquired Assets, if any. |

| |

Schedule

4 - Licenses and Permits |

| |

Schedule

5 - Exceptions |

| |

Schedule

6 - The Majority Member(s) |

| |

Schedule

7 – Exhibits |

1.2

Currency. All dollar amounts referred to in this Agreement are in United States funds, unless expressly stated otherwise.

2.

AGREEMENT OF PURCHASE AND SALE AND OTHER CONSIDERATION

2.1

Purchase and Sale of Equity Ownership Rights in JSH. Subject to the terms and conditions of this Agreement, as set out in Section

2.2 below:

PEG

hereby undertakes and agrees to purchase fifty-one percent (51%) of the ownership interest in JSH under the terms and conditions of this

Agreement.

2.2.

Consideration for fifty one percent (51%) ownership interest in JSH

(i)

The Purchased Assets will be fifty-one percent (51%) of all JSH equity ownership as of the Closing date (“Purchased Assets”);

(ii)

The Seller shall pay all and any liabilities relating to the Purchased Assets, if any;

(iii)

The value of JSH’s fifty-one percent (51%) equity ownership as at the date of signing this contract shall be (a) provisionally

calculated as Five Million One Hundred Ninety Four Thousand Seven Hundred Fourteen United States Dollars (US$5,194,714), which is equivalent

to fifty-one percent (51%) of twice the equity of JSH according to the audit report of JSH issued by Viet Dragon Auditing and Consulting

Co., Ltd. made for the year ended December 31, 2022, based on the exchange rate of foreign currency transfer by Eximbank Vietnam as at

the end of June 26, 2023, (b) or an amount equivalent to fifty-one percent (51%) of the value of JSH independently valued by a qualified

professional valuation firm mutually acceptable on or before the Closing Date of this transaction, whichever is greater, (c) or a number

of shares of PEG with a market value of twice the greater amount between the two cases above, based on the average ten-day closing price

of PEG shares in the U.S. Stock Market immediately prior to the Closing date, according to the final agreement between the Parties prior

to or on the Closing date.

The

issuance and transfer of equity ownership of JSH from Seller to PEG shall qualify as a securities or business transaction in full compliance

with the laws of the Socialist Republic of Vietnam.

3.

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller

represent and warrant to PEG, and acknowledges that PEG is relying upon such representations and warranties, in connection with the execution,

delivery and performance of this Agreement, notwithstanding any investigation made by or on behalf of PEG, as follows:

3.1

History of Assets. The Acquired Assets have not previously been illegally owned by a corporation or other entity.

3.2

Authority. The Majority Member(s) and JSH have all requisite corporate power and authority to execute and deliver this Agreement

and any other document contemplated by this Agreement (collectively, the “JSH Documents”) to be signed by the pertinent

Member(s)s and/or an authorized officer of JSH and to perform their obligations hereunder and to consummate the transactions contemplated

hereby. The execution and delivery of JSH Documents by Seller and the consummation of the transactions contemplated hereby have been

duly authorized. No other proceedings on the part of Seller is necessary to authorize such documents or to consummate the transactions

contemplated hereby. This Agreement has been, and the other JSH Documents when executed and delivered by Seller will be, duly executed

and delivered by Seller and this Agreement is, and the other JSH Documents when executed and delivered by Seller as contemplated hereby

will be, valid and binding obligations of Seller enforceable in accordance with their respective terms except:

(a)

as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement

of creditors’ rights generally;

(b)

as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

3.3

Title to the Acquired Assets. The Seller possesses or shall have possessed good and marketable title of all of the Acquired Assets

prior to the Closing Date. All Acquired Assets are owned or shall have been owned by the Majority Member(s) by the Closing Date free

and clear of all liens, security interests, charges, encumbrances, and other adverse claims, except as disclosed in Schedule 5 to this

Agreement.

3.4

Non-Contravention. Neither the execution, delivery, performance of this Agreement nor the consummation of the Transaction, will:

(a)

conflict with, result in a violation of, cause a default under (with or without notice, lapse of time or both) or give rise to a right

of termination, amendment, cancellation or acceleration of any obligation contained in or the loss of any material benefit under, or

result in the creation of any lien, security interest, charge or encumbrance upon any of the Acquired Assets under any term, condition

or provision of any loan or credit agreement, note, debenture, bond, mortgage, indenture, lease or other agreement, instrument, permit,

license, judgment, order, decree, statute, law, ordinance, rule or regulation applicable to JSH, or any of its material property or assets;

or,

(b)

violate any order, writ, injunction, decree, statute, rule, or regulation of any court or governmental or regulatory authority applicable

to JSH or any of the Acquired Assets.

3.5

Actions and Proceedings. To the best knowledge of JSH, there is no basis for and there is no action, suit, judgment, claim, demand

or proceeding outstanding or pending, or threatened against or affecting JSH or the Acquired Assets that involves any of the business,

or the properties or assets of JSH that, if adversely resolved or determined, would have a material adverse effect on the Acquired Assets

(a “Material Adverse Effect”). There is no reasonable basis for any claim or action that, based upon the likelihood

of its being asserted and its success if asserted, would have such a JSH Material Adverse Effect.

3.6

Absence of Changes. Except as otherwise stated in this Agreement, from the date of this Agreement to the Closing of this Transaction,

Seller shall not:

(a)

fail to pay or discharge when due any liabilities of which the failure to pay or discharge would cause any material damage or risk of

material loss to any of the Acquired Assets;

(b)

sell, encumber, assign or transfer any of the Acquired Assets;

(c)

create, incur, assume or guarantee any indebtedness for money borrowed, or mortgage, pledge or subject any of the Acquired Assets to

any mortgage, lien, pledge, security interest, conditional sales contract or other encumbrance of any nature whatsoever;

3.7

Completeness of Disclosure. No representation or warranty by Seller in this Agreement nor any certificate, schedule, statement, document

or instrument furnished or to be furnished to PEG pursuant hereto contains or will contain any untrue statement of a material fact or

omits or will omit to state a material fact required to be stated herein or therein or necessary to make any statement herein or therein

not materially misleading.

4.

REPRESENTATIONS AND WARRANTIES OF PEG

PEG

represents and warrants to Seller and acknowledges that Seller is relying upon such representations and warranties in connection with

the execution, delivery and performance of this Agreement, notwithstanding any investigation made by or on behalf of Seller as follows:

4.1

Organization and Good Standing.

a.

PEG is duly incorporated, organized, validly existing and in good standing under the laws of the State of Wyoming, U.S.A. and has all

requisite corporate power and authority to own, lease and to carry on its business as now being conducted.

b.

PGT, the subsidiary of PEG mentioned elsewhere herein, will have been duly incorporated, organized, validly existing and in good standing

under the laws of the State of Wyoming, U.S.A. and will have had all requisite corporate power and authority to own, lease and to carry

on its business prior to the Closing of this Agreement.

4.2

Authority. PEG has all requisite corporate power and authority to execute and deliver this Agreement and any other document contemplated

by this Agreement (collectively, the “PEG Documents”) to be signed by PEG and to perform its obligations hereunder

and to consummate the Transaction contemplated hereby. The execution and delivery of each of the PEG Documents by PEG and the consummation

by PEG of the transaction contemplated hereby have been duly authorized by its board of directors and no other corporate or Member(s)

proceedings on the part of PEG is necessary to authorize such documents or to consummate the Transaction contemplated hereby. This Agreement

has been, and the other PEG Documents when executed and delivered by PEG and this Agreement is, and the other PEG Documents when executed

and delivered by PEG, as contemplated hereby will be, valid and binding obligations of PEG enforceable in accordance with their respective

terms, except:

(a)

as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement

of creditors’ rights generally;

(b)

as limited by laws relating to the availability of specific performance, injunctive relief.

4.3

Corporate Records of PEG. The corporate records of PEG, as required to be maintained by it pursuant to the Wyoming Statues, are accurate,

complete and current in all material respects, and the minute book of PEG is, in all material respects, correct and contains all material

records required by the laws of the State of Wyoming in regard to all proceedings, consents, actions and meetings of the shareholders

and the board of directors of PEG.

4.4

Non-Contravention. Neither the execution, delivery, performance of this Agreement nor the consummation of this Transaction will:

(a)

subject to certain provisions contained elsewhere in this Agreement, conflict with, result in a violation of, cause a default under (with

or without notice, lapse of time or both) or give rise to a right of termination, amendment, cancellation or acceleration of any obligation

contained in or the loss of any material benefit under, or result in the creation of any lien, security interest, charge or encumbrance

upon any of the material properties or assets of PEG under any term, condition or provision of any loan or credit agreement, note, debenture,

bond, mortgage, indenture, lease or other agreement, instrument, permit, license, judgment, order, decree, statute, law, ordinance, rule

or regulation applicable to PEG or any of its material property or assets;

(b)

violate any provision of the applicable incorporation or charter documents of PEG; or

(c)

violate any order, writ, injunction, decree, statute, rule, or regulation of any court or governmental or regulatory authority applicable

to PEG or any of its material property or assets.

4.5

Compliance.

(a)

To the best knowledge of PEG, PEG is in compliance with, is not in default or violation in any material respect under, and has not been

charged with or received any notice at any time of any material violation of any statute, law, ordinance, regulation, rule, decree or

other applicable regulation to the business or operations of PEG;

(b)

To the best knowledge of PEG, PEG is not subject to any judgment, order or decree entered in any lawsuit or proceeding applicable to

its business and operations that would constitute a Material Adverse Effect;

(c)

PEG will have duly filed all reports and returns required to be filed by it with governmental authorities and has obtained all governmental

permits and other governmental consents, except as may be required after the execution of this Agreement. All of such permits and consents

are in full force and effect, and no proceedings for the suspension or cancellation of any of them, and no investigation relating to

any of them, is pending or to the best knowledge of PEG, threatened, and none of them will be affected in a material adverse manner by

the consummation of the Transaction; and

(d)

PEG has operated in material compliance with all laws, rules, statutes, ordinances, orders and regulations applicable to its business.

PEG has not received any notice of any violation thereof, nor is PEG aware of any valid basis therefore.

4.6

Filings, Consents and Approvals. PEG shall conduct or obtain any filing, registration, permit or authorization from any public or

governmental body or authority, Member(s)s or other person that is necessary for the consummation by PEG of the Transaction contemplated

by this Agreement and to continue to conduct its business after the Closing Date in a manner which is consistent with that in which it

is presently conducted.

4.7

Holder of Acquired Assets. PEG will be the holder of the title to the Acquired Assets and any ownership documentation associated

with such assets.

4.8

No Brokers. PEG has not incurred any obligation or liability to any party for any brokerage fees, agent’s commissions, or finder’s

fees in connection with the Transaction contemplated by this Agreement, except for the terms and conditions in connection with the agreement

between PEG and JSH as mentioned above.

4.9

Completeness of Disclosure. No representation or warranty by PEG in this Agreement nor any certificate, schedule, statement, document

or instrument furnished or to be furnished to JSH pursuant hereto contains or will contain any untrue statement of a material fact or

omits or will omit to state a material fact required to be stated herein or therein or necessary to make any statement herein or therein

not materially misleading.

5.

CLOSING CONDITIONS

5.1

Conditions Precedent to Closing by PEG. The obligation of PEG to consummate the Transaction is subject to the satisfaction or waiver

of the conditions set forth below on or before the Closing Date or such earlier date as hereinafter specified. The Closing of the Transaction

contemplated by this Agreement will be deemed to mean the satisfaction or waiver of all conditions to Closing. These conditions of closing

are for the benefit of PEG and may be waived by PEG in its sole discretion.

(a)

PEG shall have obtained the approval of their Board of Directors for the purchase of the equity ownership in JSH.

(b)

Representations and Warranties. The representations and warranties of JSH set forth in this Agreement will be true, correct and complete

in all respects as of the Closing Date, as though made on and as of the Closing Date and JSH will have delivered to PEG a certificate

dated as of the Closing Date, to the effect that the representations and warranties made by JSH respectively in this Agreement are true

and correct.

(c)

Performance. All of the covenants and obligations that JSH are required to perform or to comply with pursuant to this Agreement at or

prior to the Closing shall have been performed and complied with in all material respects.

(d)

Transaction Documents. This Agreement, the JSH Documents and all other documents necessary or reasonably required to consummate the Transaction,

all in form and substance reasonably satisfactory to PEG, will have been executed and delivered to PEG.

(e)

Third Party Consents. PEG will have received duly executed copies of all third-party consents and approvals contemplated by this Agreement,

in form and substance reasonably satisfactory to PEG.

(f)

No Material Adverse Change. No JSH Material Adverse Effect will have occurred since the date of this Agreement.

(g)

No Action. No suit, action, or proceeding will be pending or threatened which would:

| |

(i)

|

prevent

the consummation of any of the transactions contemplated by this Agreement,

or

|

| |

|

|

| |

(ii)

|

cause

the Transaction to be rescinded following consummation. |

(h)

Due Diligence. PEG and its attorneys will be reasonably satisfied with their due diligence investigation of JSH that is reasonable and

customary in a transaction of a similar nature to that contemplated by the Transaction, including:

| |

(i)

|

satisfactory

technical specifications of the properties of the referenced Acquired Assets; |

| |

|

|

| |

(ii)

|

materials,

documents and information in the possession and control of JSH that are reasonably germane to the Transaction; |

| |

|

|

| |

(iii)

|

title

to the Acquired Assets held by the Majority Member(s) and JSH; |

| |

|

|

| |

(iv)

|

completion

of the financial, operational and legal due diligence review of JSH by PEG or a third-party contractor. PEG will be responsible for

the costs in connection with the reviews. |

| |

|

|

| |

(vi)

|

the

time limit for the required Due Diligence is a maximum of 30 days following the signing of this Agreement, unless further extended

in writing by the Majority Member(s), JSH and PEG. |

(i)

Financial audits. Completion of an audit of the financial statements of JSH for the fiscal years ended December 31, 2021 and December

31, 2022 by a PCAOB-registered independent auditing firm in order to consolidate with PEG to become a fully reporting publicly traded

company with the U.S. Securities and Exchange Commission.

(j)

PEG must be listed and traded on a U.S. stock exchange at least one month prior to the Closing date.

5.2

Conditions Precedent to Closing by Seller. The obligation of Seller to consummate the Transaction is subject to the satisfaction

or waiver of the conditions set forth below on or before the Closing Date or such earlier date as hereinafter specified. The Closing

of the Transaction will be deemed to mean the satisfaction or waiver of all conditions to Closing. These conditions precedent are for

the benefit of JSH and the Majority Member(s) and may be waived by JSH and the Majority Member(s) in their discretion.

(a)

On or before the Closing, the Board of Directors and the general meeting of Member(s)s of JSH shall have approved, in accordance with

the laws of Socialist Republic of Vietnam, the execution, delivery and performance of this Agreement and the consummation of the transaction

contemplated herein and authorized all of the necessary and proper action to enable JSH to comply with the terms of the Agreement, including

but not limited to the acquisition plan to be prepared by JSH and PEG.

(b)

Representations and Warranties. The representations and warranties of PEG set forth in this Agreement will be true, correct and complete

in all respects as of the Closing Date, as though made on and as of the Closing Date and PEG will have delivered to JSH a certificate

dated the Closing Date, to the effect that the representations and warranties made by PEG in this Agreement are true and correct.

(c)

Performance. All of the covenants and obligations that PEG is required to perform or to comply with pursuant to this Agreement at or

prior to the Closing shall have been performed and complied with in all material respects. PEG shall have delivered each of the documents

required to be delivered by it pursuant to this Agreement.

(d)

Transaction Documents. This Agreement, the PEG Documents and all other documents necessary or reasonably required to consummate the Transaction,

all in form and substance reasonably satisfactory to JSH, shall have been executed and delivered by PEG.

(e)

Secretary’s Certificate – PEG. JSH shall have received a certificate from the Secretary of PEG attaching:

(i)

a copy of PEG’s articles, bylaws and all other incorporation documents, as amended through the Closing Date, and

(ii)

copies of resolutions duly adopted by the board of directors of PEG approving the execution and delivery of this Agreement and the consummation

of the transactions contemplated herein.

(f)

No Action. No suit, action, or proceeding shall be pending or threatened before any governmental or regulatory authority wherein an unfavorable

judgment, order, decree, stipulation, injunction or charge would:

(i)

prevent the consummation of any of the transactions contemplated by this Agreement, or,

(ii)

cause the Transaction to be rescinded following consummation.

6.

ADDITIONAL COVENANTS OF THE PARTIES

6.1

Access and Investigation. Between the date of this Agreement and the Closing Date, JSH, on the one hand, and PEG, on the other hand,

shall, and shall cause each of their respective representatives to:

(a)

afford the other and its representatives full and free access to its personnel, properties, assets, contracts, books and records, and

other documents and data;

(b)

furnish the other and its representatives with copies of all such contracts, books and records, and other existing documents and data

as required by this Agreement and as the other may otherwise reasonably request; and,

(c)

furnish the other and its representatives with such additional financial, operating, and other data and information as the other may

reasonably request.

All

of such access, investigation and communication by a party and its representatives shall be conducted during normal business hours and

in a manner designed not to interfere unduly with the normal business operations of the other party. Each party shall instruct its auditors

to co-operate with the other party and its representatives in connection with such investigations.

6.2

Notification. Between the date of this Agreement and the Closing Date, each of the parties to this Agreement shall promptly notify

the other parties in writing if it becomes aware of any fact or condition that causes or constitutes a material breach of any of its

representations and warranties as of the date of this Agreement, if it becomes aware of the occurrence after the date of this Agreement

of any fact or condition that would cause or constitute a material breach of any such representation or warranty had such representation

or warranty been made as of the time of occurrence or discovery of such fact or condition. Should any such fact or condition require

any change in the Schedules relating to such party, such party shall promptly deliver to the other parties a supplement to the Schedules

specifying such change. During the same period, each party shall promptly notify the other parties of the occurrence of any material

breach of any of its covenant in this Agreement or of the occurrence of any event that may make the satisfaction of such conditions impossible

or unlikely.

6.3

Exclusivity. The relationship established by both parties herein is exclusive unless the transaction contemplated by this Agreement

is terminated pursuant to Article 8 herein.

6.4

Conduct of JSH and PEG Business Prior to Closing. Except as expressly contemplated by this Agreement or for purposes in furtherance

of this Agreement, from the date of this Agreement to the Closing Date, and except to the extent that JSH otherwise consents in writing,

PEG shall operate its business substantially as presently operated and only in the ordinary course and in compliance with all applicable

laws, and use its best efforts to preserve intact its good reputation and present business organization and to preserve its relationships

with persons having business dealings with it.

6.5

Full Disclosure Requirement. JSH acknowledges that PEG is required to file with the SEC upon Closing a disclosure document which

includes discussion of many aspects of its future business, financial affairs, risks and management. JSH shall cooperate fully in providing

PEG with all information and documentation reasonably requested.

6.6

Licenses and Permits. JSH and the Majority Member(s) acknowledge and warrant that they shall be responsible for obtaining and maintaining

all the valid and effective licenses and permits for JSH’s operations.

6.7

Additional Investments. In conjunction with the purchase of fifty-one percent equity ownership in JSH herein, PEG is committed to

providing or causing to be provided the required capital through PEG’s international financial networks for JSH to implement its

growth and expansion plans as may be needed.

6.8

Taking PEG public on the U.S. Stock Market. PEG is committed to taking its common stock public as a fully-reporting company in the

US Stock Market at least one month before the Closing of this transaction.

7.

CLOSING

7.1

Closing Date. The Closing Date shall be at least thirty (30) days after PEG’s stock is traded on the U.S. Stock Market.

7.2

Closing. The Closing shall take place on the Closing Date at the offices of PEG or JSH, or at such other location as agreed to by

the parties. Notwithstanding the location of the Closing, each party agrees that the Closing may be completed by the exchange of undertakings

between the respective legal counsel for JSH and PEG, provided such undertakings are satisfactory to each party’s respective legal

counsel.

7.3

Closing Deliveries of Seller. At Closing, the Seller shall deliver or cause to be delivered the following, fully executed and in

the form and substance reasonably satisfactory to PEG:

(a).

Proof of the conveyance of Fifty-One percent (51.00%) of equity ownership of JSH by Seller to PEG or PEG’s other designee(s).

(b)

all certificates and other documents required by Section 5.1 of this Agreement;

(c

) a certificate of an officer of JSH, dated as of Closing, certifying that:

(i)

each respective covenant and obligation of JSH has been complied with, and

(ii)

each respective representation, warranty and covenant of JSH is true and correct at the Closing as if made on and as of the Closing;

and

(d)

The JSH Documents and any other necessary documents, each duly executed by JSH, as required to give effect to the Transaction.

7.4

Closing Deliveries of PEG. At Closing, PEG shall deliver or cause to be delivered the following, fully executed and in the form and

substance reasonably satisfactory to JSH:

(a)

copies of all resolutions and/or consent actions adopted by or on behalf of the board of directors of PEG evidencing approval of this

Agreement.

(b.1)

A minimum amount of Five Million One Hundred Ninety Four Thousand Seven Hundred Fourteen United States Dollars ($5,194,714), which is

equivalent to fifty one percent (51%) of twice the equity owned by JSH according to the audit report of JSH by Viet Dragon Auditing and

Consulting Co., Ltd. made for the year ended December 31, 2022, based on the exchange rate of foreign currency transfer by Eximbank Vietnam

as at the end of June 26, 2023, or an amount equivalent to fifty-one percent (51%) of the value of JSH independently assessed by a qualified

professional valuation firm mutually acceptable on or before the Closing Date of this transaction, whichever is greater, or

(b.2)

The number of shares of PEG with a market value of twice the greater amount between the two cases in Article 7.4 (b.1) above, based on

the average ten-day closing price of PEG shares in the U.S. Stock Market immediately prior to the Closing date, according to the final

agreement between the Parties prior to or on the Closing date.

| (c) |

all

certificates and other documents required by Section 5.2 of this Agreement; |

| |

|

| (d) |

a

certificate of an officer of PEG, dated as of Closing, certifying that: |

| |

|

|

| |

(i) |

each

covenant and obligation of PEG has been complied with, and |

| |

|

|

| |

(ii) |

each

representation, warranty and covenant of PEG is true and correct at the

Closing as if made on and as of the Closing; and |

(e)

any other necessary documents, each duly executed by PEG, as required to give effect to the Transaction.

8.

TERMINATION

8.1

Termination. This Agreement may be terminated at any time prior to the Closing Date contemplated hereby by:

(a)

mutual agreement of PEG and JSH;

(b)

PEG, in the event of unsatisfactory legal, technical and other due diligence of JSH and the Acquired Assets, as mentioned elsewhere in

this Agreement.

(c)

PEG, if there has been a material breach by JSH or any of JSH of any material representation, warranty, covenant or agreement set forth

in this Agreement on the part of JSH that is not cured, to the reasonable satisfaction of PEG, within ten business days after notice

of such breach is given by PEG (except that no cure period shall be provided for a breach by JSH that by its nature cannot be cured);

(d)

JSH, if there has been a material breach by PEG of any material representation, warranty, covenant or agreement set forth in this Agreement

on the part of PEG that is not cured, to the reasonable satisfaction of JSH, within ten business days after notice of such breach is

given by JSH (except that no cure period shall be provided for a breach by PEG that by its nature cannot be cured);

(e)

PEG or JSH, if the Transaction contemplated by this Agreement has not been consummated on or prior to December 31, 2023 unless PEG and

JSH agree to extend such date in writing; or,

(g)

PEG or JSH, if any injunction or other order of a governmental entity of competent authority prevents the consummation of the Transaction

contemplated by this Agreement.

8.2

Effect of Termination. In the event of the termination of this Agreement as provided in Section 8.1, this Agreement shall be of no

further force or effect, provided, however, that no termination of this Agreement shall relieve any party of liability for any breaches

of this Agreement that are based on a wrongful refusal or failure to perform any obligations.

9.

INDEMNIFICATION, REMEDIES, SURVIVAL

9.1

Certain Definitions. For the purposes of this Section 9, the terms “Loss” and “Losses” mean

any and all demands, claims, actions or causes of action, assessments, losses, damages, liabilities, costs, and expenses, including without

limitation, interest, penalties, fines and reasonable attorneys, accountants and other professional fees and expenses of an amount not

less than $US 5,000, but excluding any indirect, consequential or punitive damages suffered by PEG or JSH including damages for lost

profits or lost business opportunities.

9.2

JSH Indemnity. JSH shall and does hereby indemnify, defend, and hold harmless PEG and its Member(s)s from, against, and in respect

of any and all Losses asserted against, relating to, imposed upon, or incurred by PEG and its Member(s)s by reason of, resulting from,

based upon or arising out of:

(a)

any breach by JSH of this Agreement; or

(b)

any misstatement, misrepresentation or breach of the representations and warranties made by JSH contained in or made pursuant to this

Agreement , any JSH Document or any certificate or other instrument delivered pursuant to this Agreement.

9.3

PEG Indemnity. PEG shall and does hereby indemnify, defend, and hold harmless JSH from, against, for, and in respect of any and all

Losses asserted against, relating to, imposed upon, or incurred by JSH by reason of, resulting from, based upon or arising out of:

(a)

any breach by PEG of this Agreement; or

(b)

any misrepresentation, misstatement or breach of warranty of PEG contained in or made pursuant to this Agreement, any PEG Document or

any certificate or other instrument delivered pursuant to this Agreement.

10.

GENERAL

10.1

Effectiveness of Representations; Survival. Each party is entitled to rely on the representations, warranties, indemnifications and

agreements of each of the other parties and all such representation, warranties and agreement shall be effective regardless of any investigation

that any party has undertaken or failed to undertake. The representations, warranties and agreements shall survive the Closing Date and

continue in full force and effect until one (1) year after the Closing Date.

10.2

Further Assurances and Provision of Information. Each of the parties hereto shall co-operate with the others and execute and deliver

to the other parties hereto such other instruments and documents and take such other actions as may be reasonably requested from time

to time by any other party hereto as necessary to carry out, evidence, and confirm the intended purposes of this Agreement. JSH agrees

to provide such information as requested by PEG in a timely manner prior to Closing Date.

10.3

Amendment. This Agreement may not be amended except by an instrument in writing signed by each of the parties.

10.4

Expenses. Except as otherwise stated in this Agreement, JSH and PEG shall pay and be responsible for their own expenses that will

or may be incurred in connection with the preparation, execution, and performance of this Agreement and the Transaction contemplated

hereby, including all fees and expenses of their own agents, representatives, counsel, and accountants.

10.5

Entire Agreement. This Agreement, the schedules attached hereto and the other documents in connection with this transaction contain

the entire agreement between the parties with respect to the subject matter hereof and supersede all prior arrangements and understandings,

both written and oral, expressed or implied, with respect thereto. Any preceding correspondence or offers are expressly superseded and

terminated by this Agreement.

10.6

Notices. All notices and other communications required or permitted under to this Agreement shall be sent to the addresses exchanged

by the parties hereto for this purpose, as may from time to time be updated by one party to the other, must be in writing and shall be

deemed given if sent by personal delivery, faxed with electronic confirmation of delivery, internationally-recognized express courier

or registered or certified mail (return receipt requested), postage prepaid, to the parties at the addresses specified by a party to

the others from time to time for notice purposes. All such notices and other communications shall be deemed to have been received:

(a)

in the case of personal delivery, on the date of such delivery;

(b)

in the case of a fax, when the party sending such fax has received electronic confirmation of its delivery;

(c)

in the case of delivery by internationally-recognized express courier, on the sixth business day following dispatch; and,

(d)

in the case of mailing, on the fifteenth business day following mailing.

| |

If

to JSH and the Majority Member(s): |

| |

|

| |

Jinshan

Vietnam Limited Liability Company |

| |

Attn:

Mr. Huynh Minh Phat |

| |

37

Road No. 4, Do Thanh Housing Complex |

| |

Ward

4, District 3, Ho Chi Minh City, Vietnam, |

| |

Email:

|

| |

|

| |

If

to PEG: |

| |

|

| |

Premier

Enterprises Group Inc. |

| |

Attn:

Mr. Jack Hoang Dinh Vo, CEO |

| |

30

N. Gould Street, Suite R |

| |

Sheridan,

WY 82801, U.S.A. |

| |

Email:

jackv@philuxglobal.com |

10.7

Headings. The headings contained in this Agreement are for convenience purposes only and shall not affect in any way the meaning

or interpretation of this Agreement.

10.8

Benefits. This Agreement is and shall only be construed as for the benefit of or enforceable by those persons party to this Agreement.

10.9

Assignment. This Agreement may not be assigned (except by operation of law) by any party without the consent of the other parties.

10.10

Governing Laws. This Agreement shall be governed by and construed in accordance with the laws of the State of Wyoming, U.S.A. and

the laws of Socialist Republic of Vietnam with respect to the acquisition of the Acquired Assets, where appropriate.

10.11

Gender. All references to any party shall be read with such changes in number and gender as the context or reference requires.

10.12

Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement

and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other parties,

it being understood that all parties need not sign the same counterpart.

10.13

Fax Execution and/or Scanned Copy. This Agreement may be executed by delivery of executed signature pages by fax or scanned copy

and such fax execution or scanned copy shall be effective for all purposes.

10.14

Independent Legal Advice. JSH confirms that he has been given an opportunity to seek and obtain independent legal advice prior to

execution of this Agreement and cannot and does not rely on the representations of PEG or its advisors respecting the legal effects of

this Agreement.

10.15

Schedules and Exhibits. The schedules and exhibits that are attached to this Agreement are incorporated herein.

10.16

References. Unless otherwise explicitly stated, all references to a “Section” “Schedule” or Exhibit”

herein refer to a section, schedule or exhibit in and to this Agreement.

IN

WITNESS WHEREOF the parties hereto have executed this Agreement as of the day and year first above written.

| PREMIER

ENTERPRISES GROUP INC |

|

JINSHAN

VIETNAM CO., LTD. |

| a

Wyoming corporation, U.S.A. |

|

a

Vietnamese limited liability company |

| |

|

|

|

|

| By: |

/s/

Jack Hoang Dinh Vo |

|

By: |

/s/

Huynh Minh Phat |

| |

Jack

Hoang Dinh Vo |

|

|

Huynh

Minh Phat |

| |

CEO

|

|

|

Director |

| THE

MAJORITY MEMBER(S)(S) |

|

WITNESS |

| |

|

|

| By: |

/s/

Huynh Ngoc Vu |

|

By: |

/s/

Henry D Fahman |

| |

Huynh

Ngoc Vu (55.00%) |

|

|

Henry

D Fahman, Chairman |

| |

An

individual |

|

|

Philux

Global Group Inc. |

SCHEDULE

1

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

The

Acquired Assets

The

following sets out the Acquired Assets to be exchanged for cash or stock of Premier Enterprises Group Inc. pursuant to the Agreement:

| Description:

|

Fifty-One

percent (51.00%) of all the equity ownership in Jinshan Vietnam Limited

Liability Company

|

| |

|

| Location:

|

37

Road No. 4, Do Thanh Housing Complex, Ward 4, District 3, Ho Chi Minh City, Vietnam. |

| |

|

| Legal

status: |

Clean

and Clear. |

SCHEDULE

2

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

Title

of Acquired Assets

1.

Owned and fully paid.

SCHEDULE

3

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

Impairments

to Title of Acquired Assets

None

SCHEDULE

4

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

Licenses

and Permits of JSH

Please

see attached

SCHEDULE

5

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

Exceptions

None

SCHEDULE

6

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

| I.

|

The

Majority Member(s)(s) |

| |

Name:

|

Percentage

of |

| |

|

Ownership

in JSH: |

| |

|

|

| |

1)

Huynh Ngoc Vu |

55.00% |

| |

|

|

| |

2) |

|

| |

|

|

| |

3)

|

|

SCHEDULE

7

TO

THE AGREEMENT OF PURCHASE AND SALE

DATED

JUNE 27, 2023 BETWEEN PREMIER ENTERPRISES GROUP INC

AND

JINSHAN VIETNAM LIMITED LIABILITY COMPANY

| Exhibits

|

|

Description |

| |

|

|

| 1

|

|

Articles

of Incorporation (Business Registration) |

| 2

|

|

Operating

Agreement |

| 3

|

|

Financials |

| 4 |

|

Liability

disclosure |

| 5 |

|

Assets |

| 6 |

|

Contracts |

| 7 |

|

Litigation |

| 8 |

|

Insurance |

| 9 |

|

Employees |

| 10 |

|

Compliance

with Laws - Exceptions |

| 11 |

|

Leases |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

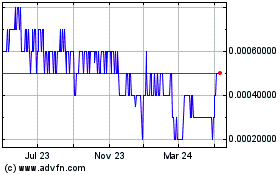

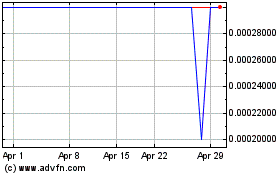

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Apr 2023 to Apr 2024