UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

NexTier Oilfield Solutions Inc.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

2023 Annual Meeting of Shareholders June 2023 NYSE: NEX 1 1

voodoo

The Proxy Statement, Notice of 2023 Annual Meeting of Shareholders and 2022

Annual Report are available at https://investors.nextierofs.com/ M E E T I N G I N F O R M AT I O N Meeting Type: Annual Meeting Date: June 13, 2023 Time: 9:30am (CDT) Location: NexTier Company Headquarters 3990 Rogerdale Rd., Houston, TX 77042 Vote

by Internet Vote by Phone Vote by Mail Vote in Person www.proxypush.com/NEX Call 1-866-475-3790 Follow the instructions on Attend our Annual your proxy card Meeting and vote by ballot 2

Proxy Voting Roadmap Voting Matter Board Vote Recommendation FOR Item 1

Election of eleven directors each nominee Ratification of selection of KPMG LLP as our independent registered Item 2 FOR public accounting firm for 2023 Item 3 Approval of advisory resolution on 2022 executive compensation FOR Approval of the

amendment and restatement of the NexTier Oilfield Item 4 FOR Solutions Inc. Equity and Incentive Award Plan 3

Executive Summary Upcoming Proxy Vote Considerations Industry-Leading

Returns: NexTier delivered industry-leading financial results in 2022 and is committed to returning capital to shareholders. The Board is requesting Performance Driven Compensation: Our performance-driven executive your vote FOR each compensation

program is built on best practices and aligns management to work towards goals that drive return on stockholder investment. proposal including the amended equity plan and On the Path to Diversity: We are committed to thoughtful board refreshment

election of all 11 directors that includes a mix of diverse directors who complement each other, and we believe that this diversity will help us to achieve our long-term goals. 4

1. NexTier delivered industry-leading financial results in 2022 and is

committed to returning capital to shareholders.

NexTier Delivered Strong Financial Results in 2022 2022 vs. 2021-Strong

rebound from COVID pandemic market downturn 1 1 Revenue Adj. EBITDA Diluted EPS FCF $3.24B $657M $1.26 $295M Up 5.8x Negative Negative +128% in 2021 in 2021 1 Source: Adjusted EBITDA and FCF (or Free Cash Flow) are non-GAAP financial measures. For a

reconciliation of Adjusted EBITDA and FCF, please see the tables in the appendix. 6

2022 Shareholder Returns Outpaced Sector 1 2022 Total Shareholder Returns

NexTier vs. OFS Peers NexTier significantly outperformed 180.0% the OFS market in delivering total 160% 160.0% shareholder returns in 2022. ▪ Delivered 160% total shareholder 140.0% return 120.0% th ▪ 15 best performing stock in both the

102% 97% Russell 2000 and Russell 3000 in 2022 100.0% ▪ Added to the S&P Small Cap 600 (March 80.0% 2023) 66% .OSX Index = 59% 60.0% ▪ Significantly outperformed the PHLX Oil Service Sector Index (.OSX) 39% 40.0% 28% ▪

Significantly outperformed similar-sized peers Liberty Energy (LBRT) and ProFrac 20.0% (ACDC) 0.0% 2 NEX PTEN RES LBRT ACDC PUMP (1) Includes share price appreciation and dividends from market close on December 31, 2021 to December 31, 2022. 7 (2)

ACDC only includes returns from IPO on May 13, 2022 to December 31, 2022.

Substantial Portion of 2023 Free Cash Flow Allocated to Shareholder Returns

BALANCE SHAREHOLDER RETURNS 2023 ESTIMATED FREE CASH FLOW: $500M AND INORGANIC GROWTH ~$500M FCF PATH TO NET DEBT ZERO IN 2023 Non-CapEx Allocation ▪ Net Debt of $139 million as of 3/31/2023 Share Repurchase ▪ No term loan maturities

until 2025; low cost of debt Path to Net Debt Zero SHAREHOLDER RETURNS ▪ Buyback authorization of $250 million to shareholders through year-end 2023 $250M ▪ Initial focus is on repurchasing shares ALLOCATED TO SHAREHOLDER RETURNS

NON-CAPEX ALLOCATION ▪ Flexibility for opportunistic M&A and/or to increase shareholder return program 2023E Uses of Free Cash Flow ▪ Increase balance sheet strength 8

Capital Allocation Framework includes significant allocation to Repeatable

Shareholder Return Program MAXIMIZE SHAREHOLDER VALUE AND FINANCIAL RETURNS Repeatable Shareholder Non-CapEx Allocation Return Program Option to participate in strategic M&A Allocation and/or increase shareholder return Target return of at least

50% of Free program; target maximum return on Cash Flow annually to shareholders Strategy capital Target Sustained Free Cash Flow Strong Balance Sheet Annual CapEx 8-9% of Revenue Prioritize a Path to Net Debt Zero and Winning Maintain Strong

Liquidity Maintain the fleet, transition to Foundation natural gas over time, and grow the integration machine 9

2. Our performance-driven executive compensation program is built on best

practices and aligns management to work towards goals that drive return on stockholder investment.

Amended Equity Plan Proposal In the 2023 Annual Stockholders Meeting, NEX

has submitted a proposal to: ▪ Share Increase: Increase shares available under the plan by an additional 10 million shares. ▪ Memorialize Current Governance Practices: ▪ Include express language providing for a minimum 1-year

vesting for equity awards. ▪ Include express language clarifying double trigger vesting on change in control (CIC + termination). The Board is Requesting Your Vote FOR this Proposal 11 11

Our Executive Compensation Program is built on best practices consistently

supported by Shareholders Advisory votes on Executive Compensation have The Key Merits of NexTier’s Executive Compensation consistently received support from >90% of shareholders Program Consistently Supported by Shareholders: ▪ Peer

group reflective of industry & comparable in size ▪ Emphasis on variable compensation tied to annual financial Shareholders Voting “Yes” on Executive Compensation performance 105.00% ▪ More than 50% of CEO’s target

total compensation are 99.3% conditioned upon performance 100.00% 97.0% ▪ Incentive programs emphasize financial performance and 93.1% 95.00% shareholder value using EBITDA, Free Cash Flow, ESG and Total 5-yr Average = 93.3% Shareholder Return

90.00% 92.1% ▪ Relative TSR LTI awards are capped at target when TSR performance is negative 85.00% ▪ Stock ownership requirements for senior executive officers 85.1% and non-employee directors 80.00% ▪ Clawback policy 75.00%

▪ NO single trigger change in control equity vesting 2018 2019 2020 2021 2022 12

NexTier stock dilution has decreased, moving toward a normalized level

since 2021 History of NexTier Stock Dilution Burn Rate percentage provided by ISS = Average Share Price at Time of Grant 10% $10 9% Higher Burn Rate during Pandemic Era: $9 $8.48 ▪ Depressed NEX stock price in 2020 and 2021 during Covid, 8% $8

Last Share Increase: 2021 in which equity was used to retain employees ▪ The eligible employee base for awards increased post Keane & C&J Energy merger 7% $7 ▪ Equity was issued in connection with strategic acquisition (Alamo)

Lower Burn Rate in Post- 6% $6 Based on current NEX stock Pandemic Era: price and current equity 5% $5 ▪ Higher NEX stock price results compensation mix we in fewer shares issued for $3.68 equity compensation 4% $4 believe the share increase

▪ Executive performance during $3.21 pandemic lead directly to the would provide sufficient 3% increased share price and the $3 resulting lower dilution 3.01% shares for 3+ years 2% $2 2.35% 1.53% 1% $1 0% $0 2020 2021 2022 13

3. We are committed to thoughtful board refreshment that includes a mix of

diverse directors who complement each other, and we believe that this diversity will help us to achieve our long-term goals.

Approve Election of Directors In the 2023 Annual Stockholders Meeting, NEX

has submitted a proposal for: ▪ Election of Directors: To elect each of the eleven individuals named in the Proxy Statement until the 2024 Annual Meeting of Stockholders The Board is Requesting Your Vote FOR this Proposal 15 15

Our Board has been consistently evolving to include well- qualified,

independent, and diverse Directors 2023 2019 2020 2021 2022 Reduction in Board Size Updated Corporate Appointed Ethnically Appointed Gender Additional Reduction in as C&J/Keane merger Governance Guidelines Diverse Director with Diverse Director

with Board Size following formed combined board of to include – “Any director digital and artificial experience in leadership C&J/Keane Merger, 12 directors reducing from search for the purpose of intelligence and and advocacy in

reduced board size from 12 19 total directors to 9 total directors identifying new candidates cybersecurity expertise, responsible operations in for appointment to the increasing board size to 10 the energy sector, increasing board size to 11 Board

must include diverse candidates generally and 19 must include ethnically 12 12 diverse candidates and 9 gender diverse candidates in particular.” Keane + C&J Merged Co. Merged Co. NexTier NexTier welcomes NexTier welcomes Bernardo J.

Rodriguez Leslie A. Beyer 16

Our Board has been continuously optimizing its size and composition to

achieve high performance Leslie Beyer 47 Chief Executive Officer of Energy NexTier's board can nominate 9 of 11 Workforce & Technology Council Independent Age total board nominees Stuart Brightman 66 Retired CEO and President of TETRA

Technologies, Inc. Independent Age 72.7% (8) of total board nominees are Robert Drummond 62 Schlumberger Limited in various executive Independent positions President, Chief Executive Officer Age Gary M. Halverson 64 Retired Group President Drilling

& Nominated Production Systems at Cameron Independent Age Pursuant to Patrick Murray 80 Shareholders Retired President & CEO Dresser, Inc. 1 Agreement Chairman; Independent Age Amy H. Nelson 54 President and Founder of Greenridge Nominated

by Advisors, LLC Independent Age NexTier, Not Mel Riggs 68 Independent Retired Chief Operating Officer of Clayton Williams Energy, Inc. Independent Age Bernardo Rodriquez 58 Chief Digital & Technology Officer at J.D. Power Independent Age

Michael Roemer 64 NexTier Founder Roemer Financial Consulting Independent Independent Age Nominees James C. Stewart 60 Retired Chief Executive Officer of Keane Group, Inc. KIH/Cerberus Nominee Age (1) Shareholder agreement provides Keane Investor

Holdings/Cerberus Scott Wille 42 Senior Managing Director at Cerberus (“KIH”) designates 2 directors with ownership ≥ 12.5% and 1 director with Capital Management, L.P. ownership ≤ 12.5% but ≥ 7.5%. KIH current

ownership approximately 14%. KIH/Cerberus Nominee Age 17

NexTier recommends you vote FOR each proposal including the amended equity

plan and election of all 11 directors… …So we can continue working our plan to generate industry-leading shareholder returns.

Forward Looking Statements & Disclosures All statements other than

statements of historical facts contained in this presentation and any oral statements made in connection with this presentation, including guidance for 2023 and beyond, outlook information (including with respect to the industry in which NexTier

conducts its business), statements regarding our future operating results, financial position and business strategy, plans and objectives of management for future operations, and management expectation regarding the capabilities and impact of our

products and services on our operating results and financial position, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are only predictions and involve known

and unknown risks and uncertainties, many of which are beyond the Company’s control. Statements of assumptions underlying or relating to our forward-looking statements are also forward-looking statements. Where a forward-looking statement

expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. The words “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “goal,” “intend,” “may,” “outlook,”

“plan,” “potential,” “predict,” “project,” “reflect,” “see,” “should,” “target,” “will,” and “would,” or the negative or plural

thereof, and similar expressions, are intended to identify such forward-looking statements. Any forward- looking statements contained in this presentation or in oral statements made in connection with this presentation speak only as of the date on

which we make them and are based upon our historical performance and on current plans, estimates and expectations. These factors and risks include, but are not limited to, (i) NexTier’s business strategy, plans, objectives, expectations and

intentions; (ii) NexTier’s future operating results; (iii) dependence on capital spending and well completion by the onshore oil and natural gas industry and demand for services in the industry in which NexTier conducts its business; (iv) the

variability of crude oil and natural gas commodity prices; (v) changing regional, national or global economic conditions, including oil and gas supply and demand and the impact of geopolitical conditions on those prices; (vi) the competitive nature

of the industry in which NexTier conducts its business, including pricing pressures; (vii) the impact of pipeline capacity constraints and adverse weather conditions in oil or gas producing regions; (viii) the effect of government regulation,

including regulations of hydraulic fracturing, and the operating hazards of NexTier’s business; (ix) the effect of a loss of, or the financial distress of, or interruption in operations of one or more NexTier suppliers, materials or customers;

(x) the ability to maintain the right level of commitments under NexTier’s supply agreements; (xi) impact of new technology on NexTier’s business; (xii) impact of any legal proceedings, liability claims and external investigations;

(xiii) the ability to obtain permits, approvals and authorizations from governmental and third parties; (xiv) the ability to identify, effect and integrate acquisitions, divestitures and future capital expenditures and the impact of such

transactions; (xv) environmental, social, and governance matters, including investor focus and industry perception; (xvi) the ability to employ a sufficient number of skilled and qualified workers; (xvii) the ability to service debt obligations and

access capital; (xviii) the market volatility of our stock; (xix) the impact of our stock buyback program, (xx) our ability to maintain effective information technology systems and the impact of cybersecurity incidents on our business, (xxi) the

impact of inflation on our business, and (xxii) other risks detailed in Nex Tier’s latest Annual Report on Form 10-K, including, but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and our other filings with the Securities and Exchange Commission (the “SEC”), which are available on the SEC website or www.NexTierOFS.com. “Forward-

looking statements” also include, among other things, (a) statements about NexTier’s ability to participate in any shareholder return program and (b) statements regarding NexTier’s business strategy, its business and operation plan

(including its ability to execute on its well site integration strategy), its future performance (including expected financial results), and its capital allocation strategy. There may be other factors of which NexTier is currently unaware or deem

immaterial that may cause its actual results to differ materially from the forward-looking statements. NexTier assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates, to reflect events

or circumstances after the date hereof, or to reflect the occurrence of unanticipated events, except as may be required under applicable laws. Investors should not assume that any lack of update to a previously issued “forward-looking

statement” constitutes a reaffirmation of that statement. The contents of any website referenced in this presentation are not incorporated herein by reference. 19

Non-GAAP Financial Measures We have included in this presentation and in

oral comments made in connection with this presentation certain non-GAAP financial measures. These measurements provide supplemental information which management believes are useful to analysts and investors to evaluate our ongoing results of

operations. You should not consider them in isolation from, or as a substitute for, analysis of our results under GAAP. Non-GAAP financial measures in this presentation include EBITDA, Adjusted EBITDA, Free Cash Flow, Annualized Adjusted EBITDA per

Deployed Fleet, ROIC, Annualized ROIC, Return on Total Capital, and FCF conversion. Management believes the presentation of these measures gives useful information to investors and stockholders as they provide increased transparency and insight into

the performance of NexTier. EBITDA is defined as net income (loss) adjusted to eliminate the impact of interest, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA, as further adjusted with certain items management

does not consider in assessing ongoing performance. Management uses adjusted EBITDA to set targets and to assess the performance of NexTier. Free Cash Flow or “FCF” is defined as the net increase (decrease) in cash and cash equivalents

before financing activities, excluding acquisitions. NexTier believes free cash flow is important to investors in that it provides a useful measure to assess management's effectiveness in the areas of profitability and capital management. For a

reconciliation of these non-GAAP measures presented on a historical basis, please see the tables at the end of this presentation. Reconciliations of forward-looking non-GAAP financial measures to comparable GAAP measures are not available due to the

challenges and impracticability with estimating some of the items, particularly with estimates for certain contingent liabilities, and estimating non-cash unrealized fair value losses and gains which are subject to market variability and therefore a

reconciliation is not available without unreasonable effort. 20

Appendix 21

Reconciliation and Calculation of Non-GAAP Financial Measurements Adjusted

EBITDA ($ thousands) Three Months Ended Mar. 31, 2021 Jun. 30, 2021 Sept. 30, 2021 Dec. 31, 2021 Mar. 31, 2022 Jun. 30, 2022 Sept. 30, 2022 Dec. 31, 2022 Net Income (Loss) $ (54,502) $ (31,781) $ (43,994) $ 10,854 $ 8,792 $ 68,458 $ 104,734 $

132,985 Interest expense, net 4,206 5,726 6,701 7,976 7,374 7,344 7,150 6,514 Income tax expense 857 621 472 (264) 160 1,240 1,560 1,600 Depreciation and amortization 45,868 40,671 44,861 52,764 55,163 58,794 56,542 58,760 EBITDA $ (3,571) $ 15,237

$ 8,040 $ 71,330 $ 71,489 $ 135,836 $ 169,986 $ 199,859 Plus management adjustments (1) Acquisition, intergation and expansion - 178 4,752 3,779 9,232 23,682 27,521 3,000 (2) Non-cash stock compensation 5,203 4,889 7,350 7,235 7,815 7,547 7,119

7,114 (3) Market driven costs 7,295 378 578 504 - - - - (4) Diverstiture of business (785) 2,428 5,927 279 541 905 1,090 (27) (5) Gain on equity security investment 3,693 (1,331) 522 (3,041) (5,606) (2,111) 132 196 (6) Litigation 2,137 1,638 4,000

100 - 416 (179) - (7) Tax audit (13,328) (8,778) (2,771) - - - - - (8) Insurance recovery - (9,686) (723) - - - (11,044) 2,480 Other 25 347 88 44 22 (390) 138 67 Adjusted EBITDA $ 669 $ 5,300 $ 27,763 $ 80,230 $ 83,493 $ 165,885 $ 194,763 $ 212,689

(1) (5) Represents transaction and integration costs related to acquisitions, including earn out payments. Represents the realized and unrealized (gain) loss on an equity security investment composed (2) primarily of common equity shares in a public

company. Represents non-cash amortization of equity awards issued under the NexTier's Incentive Award (6) Plan. Represents increases in accruals related to contingencies acquired in business acquisitions or (3) exceptional material events.

Represents market-driven severance, leased facility closures, and restructuring costs incurred as a (7) result of significant declines in crude oil prices resulting from demand destruction from the Represents a reduction of NexTier’s accrual

related to tax audits acquired in business acquisitions. COVID-19 pandemic and global oversupply. (4) (8) Represents bad debt expense on the sale of the Well Support Services segment to, and related to Represents a gain on insurance recovery in

excess of book value due to fire incidents. the bankruptcy filing of Basic Energy Services. 22

Reconciliation and Calculation of Non-GAAP Financial Measurements Free Cash

Flow ($ thousands) Twelve Months Ended Dec. 31, 2021 Dec.31, 2022 Net cash used in operating activities 454,390 $ (50,787) $ (1) Net cash used in investing activities : Capital expenditures (225,118) (188,478) Proceeds from disposal of assets 50,227

70,432 Proceeds from insurance recoveries 15,351 22,947 Net cash used in investing activities (95,099) (159,540) $ Free Cash Flow (145,886) 294,850 $ $ (1) Twelve months ended December 31, 2022 excludes $27.2 million from the acquisition from

Continental Intermodal Group LP and $0.5 million due to net working capital adjustments in connection with the acquisition of Alamo Pressure Pumping (“Alamo”). Twelve months ended December 31, 2021 excludes $100.0 million from the

Acquisition of Alamo Pressure Pumping and $2.5 million from a Q2 2021 Completions acquisition 23

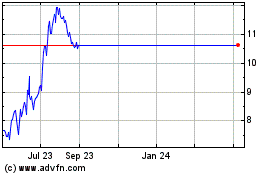

NexTier Oilfield Solutions (NYSE:NEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

NexTier Oilfield Solutions (NYSE:NEX)

Historical Stock Chart

From Apr 2023 to Apr 2024