Enservco Corporation (NYSE American: ENSV), a diversified national

provider of specialized well-site services to the domestic onshore

conventional and unconventional oil and gas industries, today

reported financial results for its first quarter ended March 31,

2023.

“We are pleased to report our eighth consecutive quarter of

higher year-over-year revenue,” said Rich Murphy, Executive

Chairman. “In addition to a 4% increase in revenue, our gross

profit improved by 56% year over year and adjusted EBITDA more than

tripled. We anticipate improved profit metrics based on expected

non-recurrence of certain legal and stock-based compensation

expenses combined with Company-wide cost reductions.

“Going forward, we are focused on three primary initiatives –

improving cost efficiencies, further de-levering our balance sheet,

and continuing to grow and diversify our revenue,” Murphy added.

“We are implementing expense reductions across our business, with

an emphasis on lowering corporate overhead, including headcount and

public company costs. Having already reduced our peak long-term

debt of $36 million to $7.2 million, we anticipate further debt

reduction in 2023 and are working on a refinancing plan designed to

lower debt service and enhance cash flows. And, finally, we expect

to continue driving organic growth while exploring opportunities to

add accretive revenue streams through M&A activity and

potentially adding new, internally developed service

offerings.”

First Quarter Results

Revenue increased 4% year over year to $8.9 million from $8.6

million due to increased customer demand coupled with continued

growth in the Company’s East Texas hot oiling operations and price

increases in certain markets.

Gross profit increased 56% to $2.0 million from $1.3 million in

the same quarter last year due to the positive impact of cost

reduction measures.

Adjusted EBITDA in the first quarter was up 255% to $0.7 million

compared to adjusted EBITDA of $0.2 million in the same quarter

last year.

Net loss in the first quarter was $1.0 million, or $0.07 per

basic and diluted share, versus net income of $3.1 million, or

$0.27 per basic and diluted share, in the same quarter last year.

The first quarter 2023 net loss included approximately $0.3 million

in legal costs, a large portion of which are expected to be

non-recurring, as well as $0.1 million for a one-time restricted

stock issuance. The year-ago first quarter included a $4.3 million

gain on extinguishment of debt related to the Company’s first

quarter 2022 debt refinancing.

The Company continued to reduce long-term debt in the first

quarter, which declined to $7.2 million from $8.4 million at 2022

year-end and from a high of $36 million in 2019 when the Company

began its debt reduction program.

Enservco closed the first quarter with stockholders’ equity of

$4.3 million, up from $1.2 million at December 31, 2022. Per the

NYSE American Exchange’s continued listing standards, the Company

is required to have stockholders’ equity in excess of $6.0 million,

a threshold it expects to achieve assuming Enservco shareholders

approve Proxy Proposal 2 at the upcoming June 13, 2023, Annual

Meeting. Management strongly encourages shareholders to approve

Proxy Proposal 2, which clears the way for its largest shareholder

Cross River Partners to convert up to $2.5 million of convertible

debt to equity. Such conversion would not only help Enservco meet

the NYSE American’s stockholders’ equity requirement, but it would

support the Company’s ongoing initiative to reduce long-term debt

to enhance cash flows and increase financial flexibility.

Conference Call InformationManagement will hold

a conference call today to discuss these results. The call will

begin at 3:00 p.m. Mountain Time (5:00 p.m. Eastern) and will be

accessible by dialing 888-506-0062 (973-528-0011 for international

callers). Entry code: 48443. A telephonic replay will be available

through May 29, 2023, by calling 877-481-4010 (919-882-2331 for

international callers) and entering the Replay ID # 48443. To

listen to the webcast, participants should go to the Enservco

website at www.enservco.com and link to the “Investors” page at

least 10 minutes early to register and download any necessary audio

software. A replay of the webcast will be available until June 15,

2023. The webcast also is available here:

https://www.webcaster4.com/Webcast/Page/2228/48443

About EnservcoThrough its various operating

subsidiaries, Enservco provides a range of oilfield services,

including hot oiling, acidizing, frac water heating, and related

services. The Company has a broad geographic footprint covering

seven major domestic oil and gas basins and serves customers in

Colorado, Montana, New Mexico, North Dakota, Oklahoma,

Pennsylvania, Ohio, Texas, Wyoming, West Virginia, Utah, Michigan,

Illinois, Florida, and Louisiana. Additional information is

available at www.enservco.com.

*Note on non-GAAP Financial Measures This press

release and the accompanying tables include a discussion of EBITDA

and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with

generally accepted accounting principles ("GAAP"). The term

"EBITDA" refers to a financial measure that we define as earnings

(net income or loss) plus or minus net interest plus taxes,

depreciation and amortization. Adjusted EBITDA excludes from EBITDA

stock-based compensation and, when appropriate, other items that

management does not utilize in assessing Enservco’s operating

performance (as further described in the attached financial

schedules). None of these non-GAAP financial measures are

recognized terms under GAAP and do not purport to be an alternative

to net income as an indicator of operating performance or any other

GAAP measure. We have reconciled Adjusted EBITDA to GAAP net loss

in the Consolidated Statements of Operations table at the end of

this release. We intend to continue to provide these

non-GAAP financial measures as part of our future earnings

discussions and, therefore, the inclusion of these non-GAAP

financial measures will provide consistency in our financial

reporting.

Cautionary Note Regarding Forward-Looking

StatementsThis news release contains information that is

"forward-looking" in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

contained in this release using the terms "may," "expects to,"

“should,” and other terms denoting future possibilities, are

forward-looking statements. The accuracy of these statements cannot

be guaranteed as they are subject to a variety of risks, which are

beyond Enservco's ability to predict, or control and which may

cause actual results to differ materially from the projections or

estimates contained herein. Among these risks are those set forth

in Enservco’s annual report on Form 10-K for the year ended

December 31, 2022, and subsequently filed documents with the SEC.

Forward looking statements in this news release that are subject to

risk include ability to reduce costs, improve efficiencies and grow

and diversify revenue through M&A and internal service

development; potential for shareholder approval of Cross River

Partners’ debt conversion; ability to meet the NYSE American’s

stockholders’ equity standard and to achieve further debt service

reduction, debt refinancing and improvement in profit metrics and

cash flows; and expectations that certain legal and accounting

expenses will be non-recurring. It is important that each person

reviewing this release understand the significant risks attendant

to the operations of Enservco. The Company disclaims any obligation

to update any forward-looking statement made herein.

Contact:

Mark PattersonChief Financial OfficerEnservco

Corporationmpatterson@enservco.com

| ENSERVCO

CORPORATION AND SUBSIDIARIES |

|

Condensed Consolidated Statements of

Operations |

| (In

thousands, except per share amounts) |

|

(Unaudited) |

|

|

|

|

|

| |

For the Three Months Ended March 31, |

| |

2023 |

|

2022 |

|

|

|

|

|

|

Revenues: |

|

|

|

|

Production services |

$ |

2,863 |

|

|

$ |

2,747 |

|

|

Completion and other services |

|

6,049 |

|

|

|

5,836 |

|

|

Total revenues |

|

8,912 |

|

|

|

8,583 |

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

Production services |

|

2,317 |

|

|

|

2,584 |

|

|

Completion and other services |

|

4,580 |

|

|

|

4,710 |

|

|

Sales, general, and administrative expenses |

|

1,503 |

|

|

|

1,111 |

|

|

Severance and transition costs |

|

1 |

|

|

|

- |

|

|

(Gain) Loss on disposal of equipment |

|

(1 |

) |

|

|

35 |

|

|

Depreciation and amortization |

|

971 |

|

|

|

1,143 |

|

|

Total operating expenses |

|

9,371 |

|

|

|

9,583 |

|

| |

|

|

|

| Loss

from operations |

|

(459 |

) |

|

|

(1,000 |

) |

| |

|

|

|

| Other

(expense) income: |

|

|

|

|

Interest expense |

|

(590 |

) |

|

|

(172 |

) |

|

Gain on debt extinguishment |

|

- |

|

|

|

4,277 |

|

|

Other (expense) income |

|

29 |

|

|

|

35 |

|

|

Total other (expense) income |

|

(561 |

) |

|

|

4,140 |

|

|

|

|

|

|

| (Loss)

income from before taxes |

|

(1,020 |

) |

|

|

3,140 |

|

| Deferred

Income tax benefit |

|

16 |

|

|

|

- |

|

| Net

(loss) income |

$ |

(1,004 |

) |

|

$ |

3,140 |

|

| |

|

|

|

| Net (loss)

income per share - basic and diluted |

$ |

(0.07 |

) |

|

$ |

0.27 |

|

| |

|

|

|

| Weighted

average number of common shares outstanding - basic and

diluted |

|

14,208 |

|

|

|

11,452 |

|

| Add:

Dilutive shares |

|

- |

|

|

|

135 |

|

|

Diluted weighted average number of common shares

outstanding |

|

14,208 |

|

|

|

11,587 |

|

| |

|

|

|

|

NON-GAAP FINANCIAL MEASURES |

|

|

|

|

Adjusted EBITDA |

|

|

|

| |

|

|

|

| |

|

|

|

| |

For the Three Months Ended March 31, |

|

Reconciliation from Net (Loss) Income to Adjusted

EBITDA |

2023 |

|

2022 |

|

Net (loss) income |

$ |

(1,004 |

) |

|

$ |

3,140 |

|

| Add

back: |

|

|

|

|

Interest expense |

|

590 |

|

|

|

172 |

|

|

Deferred Income tax benefit |

|

(16 |

) |

|

|

- |

|

|

Depreciation and amortization |

|

971 |

|

|

|

1,143 |

|

|

EBITDA (non-GAAP) |

|

541 |

|

|

|

4,455 |

|

| Add back

(deduct): |

|

|

|

|

Stock-based compensation |

|

196 |

|

|

|

21 |

|

|

(Gain) Loss on disposal of assets |

|

(1 |

) |

|

|

35 |

|

|

Gain on debt extinguishment |

|

- |

|

|

|

(4,277 |

) |

|

Other (income) expense |

|

(29 |

) |

|

|

(35 |

) |

|

Adjusted EBITDA (non-GAAP) |

$ |

707 |

|

|

$ |

199 |

|

| ENSERVCO

CORPORATION AND SUBSIDIARIES |

|

Condensed Consolidated Balance Sheets |

| (In

thousands, except share and per share amounts) |

|

(Unaudited) |

|

|

|

|

|

| |

March 31, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

1,771 |

|

|

$ |

35 |

|

|

Accounts receivable, net |

|

4,221 |

|

|

|

4,463 |

|

|

Prepaid expenses and other current assets |

|

508 |

|

|

|

989 |

|

|

Inventories |

|

322 |

|

|

|

320 |

|

|

Note receivable, current |

|

75 |

|

|

|

75 |

|

|

Assets held for sale |

|

78 |

|

|

|

78 |

|

|

Total current assets |

|

6,975 |

|

|

|

5,960 |

|

| |

|

|

|

| Property and

equipment, net |

|

10,349 |

|

|

|

11,236 |

|

|

Goodwill |

|

546 |

|

|

|

546 |

|

| Intangible

assets, net |

|

127 |

|

|

|

182 |

|

|

Note receivable, less current |

|

200 |

|

|

|

225 |

|

| Right-of-use

asset - finance, net |

|

19 |

|

|

|

22 |

|

| Right-of-use

asset - operating, net |

|

1,338 |

|

|

|

1,476 |

|

| Other

assets |

|

187 |

|

|

|

191 |

|

| |

|

|

|

|

TOTAL ASSETS |

$ |

19,741 |

|

|

$ |

19,838 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| |

|

|

|

| Current

Liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

3,660 |

|

|

$ |

4,868 |

|

|

Utica facility (Note 5) |

|

1,301 |

|

|

|

1,250 |

|

|

LSQ facility (Note 5) |

|

2,611 |

|

|

|

2,945 |

|

|

March 2022 convertible note, related party (note 2 and Note 5) |

|

120 |

|

|

|

100 |

|

|

July 2022 convertible note, related party (note 2 and Note 5) |

|

90 |

|

|

|

60 |

|

|

Lease liability - finance, current |

|

14 |

|

|

|

13 |

|

|

Lease liability - operating, current |

|

611 |

|

|

|

597 |

|

|

Current portion of long-term debt |

|

39 |

|

|

|

54 |

|

|

Other Current Liabilities |

|

76 |

|

|

|

354 |

|

|

Total current liabilities |

|

8,522 |

|

|

|

10,241 |

|

| |

|

|

|

| Non-Current

Liabilities: |

|

|

|

|

Utica facility, less current portion (Note 5) |

|

3,636 |

|

|

|

3,963 |

|

|

March 2022 convertible note, related party (note 2 and Note 5) |

|

29 |

|

|

|

1,100 |

|

|

July 2022 convertible note, related party (note 2 and Note 5) |

|

1,110 |

|

|

|

1,140 |

|

|

Nov Cross River Revolver note, related party (note 2 and Note

5) |

|

870 |

|

|

|

818 |

|

|

Utica Residual Liability |

|

146 |

|

|

|

110 |

|

|

Lease liability - finance, less current portion |

|

12 |

|

|

|

11 |

|

|

Lease liablity - operating, less current portion |

|

833 |

|

|

|

991 |

|

|

Deferred tax liabilities |

|

257 |

|

|

|

273 |

|

|

Other non-current liabilities |

|

22 |

|

|

|

22 |

|

|

Total non-current liabilities |

|

6,915 |

|

|

|

8,428 |

|

| |

|

|

|

|

TOTAL LIABILITIES |

|

15,437 |

|

|

|

18,669 |

|

| |

|

|

|

| Commitments

and Contingencies |

|

|

|

| |

|

|

|

|

Stockholders' Equity: |

|

|

|

|

Preferred stock, $.005 par value, 10,000,000 shares authorized, no

shares issued or outstanding |

|

- |

|

|

|

- |

|

|

Common stock, $.005 par value, 100,000,000 shares authorized;

11,835,753 and 11,439,191 shares issued as of December 31, 2022 and

December 31, 2021, respectively; 6,907 shares of treasury stock as

of December 31, 2022 and December 31, 2021, respectively; and

11,828,846 and 11,432,284 shares outstanding as of December 31,

2022 and December 31, 2021, respectively |

|

90 |

|

|

|

59 |

|

|

Additional paid-in capital |

|

46,374 |

|

|

|

42,266 |

|

|

Accumulated deficit |

|

(42,160 |

) |

|

|

(41,156 |

) |

| Total

stockholders' equity |

|

4,304 |

|

|

|

1,169 |

|

| |

|

|

|

| TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY |

$ |

19,741 |

|

|

$ |

19,838 |

|

| ENSERVCO

CORPORATION AND SUBSIDIARIES |

|

Condensed Consolidated Statements of Cash

Flows |

| (In

thousands) |

|

(Unaudited) |

|

|

|

|

|

| |

For the 3 Months Ended Mar 31, |

| |

2023 |

|

2022 |

|

|

|

|

|

|

OPERATING ACTIVITIES: |

|

|

|

|

Net (loss) income |

$ |

(1,004 |

) |

|

$ |

3,140 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by

(used in) operating activities |

|

|

|

|

Depreciation and amortization |

|

971 |

|

|

|

1,143 |

|

|

(Gain) Loss on disposal of equipment |

|

(1 |

) |

|

|

35 |

|

|

Board compensation issued in equity |

|

- |

|

|

|

60 |

|

|

Gain on debt extinguishment |

|

- |

|

|

|

(4,277 |

) |

|

Interest paid-in-kind on line of credit |

|

- |

|

|

|

119 |

|

|

Stock-based compensation |

|

196 |

|

|

|

21 |

|

|

Amortization of debt issuance costs and discount |

|

70 |

|

|

|

12 |

|

|

Income tax benefit |

|

(16 |

) |

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

243 |

|

|

|

(2,821 |

) |

|

Inventories |

|

(1 |

) |

|

|

(60 |

) |

|

Prepaid expense and other current assets |

|

481 |

|

|

|

927 |

|

|

Amortization of operating lease assets |

|

139 |

|

|

|

198 |

|

|

Other assets |

|

17 |

|

|

|

5 |

|

|

Accounts payable and accrued liabilities |

|

(1,189 |

) |

|

|

2,194 |

|

|

Operating lease liabilities |

|

(143 |

) |

|

|

(199 |

) |

|

Other liabilities |

|

(242 |

) |

|

|

- |

|

|

Net cash (used in) provided by operating

activities |

|

(479 |

) |

|

|

497 |

|

| |

|

|

|

|

INVESTING ACTIVITIES: |

|

|

|

|

Purchases of property and equipment |

|

(49 |

) |

|

|

(68 |

) |

|

Proceeds from disposals of property and equipment |

|

9 |

|

|

|

- |

|

|

Collections on note receivable from sale of Tioga property in North

Dakota |

|

25 |

|

|

|

- |

|

| Net

cash used in investing activities |

|

(15 |

) |

|

|

(68 |

) |

| |

|

|

|

|

FINANCING ACTIVITIES: |

|

|

|

|

Net proceeds from February 2023 Offering |

|

2,952 |

|

|

|

- |

|

|

Term loan contractual repayments |

|

- |

|

|

|

(350 |

) |

|

Term loan repayment consummated in conjunction with Refinance |

|

- |

|

|

|

(8,400 |

) |

|

Establishment of LSQ Facility consummated in conjunction with

Refinance |

|

- |

|

|

|

2,400 |

|

|

Establishment of Utica Facility consummated in conjunction with

Refinance, net |

|

- |

|

|

|

6,000 |

|

|

Repayments on LSQ Facility, net |

|

(334 |

) |

|

|

- |

|

|

Repayments of Utica Facility |

|

(294 |

) |

|

|

- |

|

|

Troubled debt restructuring accrued future interest payments |

|

- |

|

|

|

(176 |

) |

|

March 2022 Convertible Note proceeds, net, related party |

|

- |

|

|

|

963 |

|

|

Repayment of long-term debt |

|

(15 |

) |

|

|

(14 |

) |

|

Payments of finance leases |

|

(80 |

) |

|

|

- |

|

|

Payments of finance leases |

|

1 |

|

|

|

(11 |

) |

| Net

cash provided by financing activities |

|

2,230 |

|

|

|

412 |

|

|

|

|

|

|

| Net

Increase in Cash and Cash Equivalents |

|

1,736 |

|

|

|

841 |

|

|

|

|

|

|

| Cash

and Cash Equivalents, beginning of period |

|

35 |

|

|

|

149 |

|

|

|

|

|

|

| Cash

and Cash Equivalents, end of period |

$ |

1,771 |

|

|

$ |

990 |

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

Cash Flow Information: |

|

|

|

|

Cash paid for interest |

|

312 |

|

|

$ |

176 |

|

| Supplemental

Disclosure of Non-cash Investing and Financing Activities: |

|

|

|

| Non-cash

establishment of EWB Obligation consummated in conjunction with the

Refinance (Note 5) |

|

- |

|

|

$ |

1,000 |

|

| Non-cash

partial conversion of March 2022 Convertible Note to equity |

|

1,051 |

|

|

|

- |

|

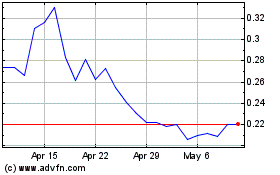

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Apr 2023 to Apr 2024