Current Report Filing (8-k)

April 26 2023 - 5:26PM

Edgar (US Regulatory)

false0001335112NY

0001335112

2023-04-21

2023-04-21

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

| | | | |

(State or other jurisdiction | | | | |

| | |

| (Address of Principal Executive Offices) | |

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | Name of each exchange on which |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

This Current Report on Form 8-K (this “Current Report”) is being filed, in part, in connection with the completion of the business combination between Logiq, Inc., a Delaware corporation (the “Company”) and Park Place Payments, Inc., a Delaware corporation (“Park Place”) pursuant to a certain Share Exchange Agreement (the “Share Exchange Agreement”), dated April 21, 2023, with Park Place,

the shareholders of Park Place (the “Shareholders”), and the holders of the Simple Agreements for Future Equity (“SAFEs”) of Park Place (along with the Shareholders shall be described herein collectively as the “Stakeholders”).

Item 1.01 Entry into a Material Definitive Agreement.

The information set forth in Item 2.01 of this Current Report regarding the Share Exchange (as defined in Item 2.01, below) is incorporated by reference into this Item 1.01.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On April 25, 2023, the Company, Park Place, and the Stakeholders consummated the transactions contemplated by the Share Exchange Agreement. Pursuant to the Share Exchange Agreement, at the Closing (as defined therein), the Company shall acquire all of the issued and outstanding shares of common stock of Park Place, and in exchange has committed to issue and sell an aggregate of fourteen million six hundred fifty-two thousand seven hundred ninety-eight (14,652,798) shares of common stock of the Company to Park Place, which are to be held in escrow and distributed to the Stakeholders pursuant to the terms of the Share Exchange Agreement (the “Exchange Shares”)(such transactions, collectively the “Share Exchange”). A certain number of the Exchange Shares, being nine million seven hundred sixty-eight thousand five hundred thirty-two (9,768,532) shares, are subject to the achievement by Park Place of earnout provisions pursuant to the terms of the Share Exchange Agreement.

The Exchange Shares issued pursuant to the Share Exchange have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or under the securities laws of any state, and therefore, cannot be resold, pledged, assigned or otherwise disposed of by the holders thereof, absent such registration or an applicable exemption from such registration requirements, and will be subject to further contractual restrictions on transfer as described in the Share Exchange Agreement.

All descriptions of the Share Exchange Agreement herein are qualified in their entirety by reference to the text thereof filed as Exhibit 2.1 hereto, which is incorporated herein by reference. The Share Exchange Agreement governs the contractual rights between the parties in relation to the transactions contemplated thereby and contains customary representations and warranties and pre- and post-closing covenants of each party. The Share Exchange Agreement is not intended to be, and should not be relied upon as, making disclosures regarding any facts and circumstances relating to the Company or Park Place. The Share Exchange Agreement is described in this Current Report and attached as Exhibit 2.1 hereto only to provide investors with information regarding the terms and conditions of the Share Exchange Agreement, and, except for its status as a contractual document that establishes and governs the legal relationship among the parties thereto with respect to the transactions contemplated thereby, is not intended to provide any other factual information regarding the Company or Park Place or the actual conduct of their respective businesses during the pendency of the Share Exchange Agreement, or to modify or supplement any factual disclosures about the Company contained in any of the Company’s public reports filed with the Securities Exchange Commission (the “SEC”).

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth above in Item 3.02 of this Current Report related to the Share Exchange Agreement and the issuance of the Exchange Shares is incorporated by reference to this Item 3.02. The Exchange Shares have not been registered under the Securities Act, and are instead being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act.

Item 7.01 Regulation FD Disclosure.

On April 2

6

, 2023, the Company issued a press release regarding an operational and corporate update pertaining to the acquisition of Park Place and the consummation of the Share Exchange. A copy of the press release is furnished as Exhibit 99.1 to this Current Report.

Exhibit 99.1 contains forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed in these forward-looking statements.

The information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

| | The copies of the Agreement filed herewith have been redacted to remove certain confidential information. We intend to file a confidential treatment request with the Commission regarding this information and/or include such information by amendment to this Form 8-K. |

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

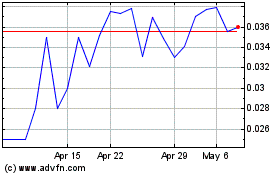

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024