Current Report Filing (8-k)

April 06 2023 - 4:44PM

Edgar (US Regulatory)

0001771706

false

A1

0001771706

2023-03-31

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 31, 2023

GOODNESS

GROWTH HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

British Columbia

(State or other jurisdiction of Incorporation)

| 000-56225 |

|

82-3835655 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

207 South 9th Street

Minneapolis, Minnesota |

|

55402 |

| (Address of principal executive offices) |

|

(Zip Code) |

(612) 999-1606

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 1.01. |

Entry into a Material Definitive Agreement |

Fifth Amendment to Credit Agreement and First Amendment to Security

Agreement

On March 31, 2023, Goodness Growth Holdings, Inc. (the “Company”),

entered into a Fifth Amendment to Credit Agreement and First Amendment to Security Agreement by and among the Company and certain of its

subsidiaries (the “Borrowers”), the persons from time-to-time party thereto as guarantors, the lenders party thereto, and

Chicago Atlantic Admin, LLC (the “Agent”) as administrative and collateral agent (the “Fifth Amendment”).

The Fifth Amendment modifies that certain Credit Agreement dated as

of March 25, 2021, as amended by an Omnibus First Amendment to Credit Agreement and Security Agreement dated as of November 1, 2021, a

Second Amendment to Credit Agreement dated as of November 18, 2021, a Third Amendment to Credit Agreement dated as of January 31, 2022,

and a Fourth Amendment to Credit Agreement dated as of March 3, 2022, among the Company and certain subsidiaries of the Company (the “Borrowers”),

the other Credit Parties from time to time party thereto, the Lenders from time to time party thereto, and Agent. Among other matters,

the Fifth Amendment:

| |

- |

Extends the maturity date of all loans under the Credit Agreement to April 30, 2024 |

| |

- |

Permits the Borrowers to extend the maturity date upon satisfaction of certain minimum fixed charge coverage ratio tests applied quarterly, with a potential outside extended maturity date of January 31, 2026 |

| |

- |

Eliminates required amortization of the loans |

| |

- |

Changes the cash interest rate on certain loans to the prime rate quoted in the Wall Street Journal plus 10.375% per year, with a minimum prime rate of 7.75% used in the calculation |

| |

- |

Requires that the Company issue up to 15 million subordinate voting shares (the “Shares”) to parties designated by the Agent |

| |

- |

Reduces the aggregate funds committed by the Lenders to USD$65.2 million |

| |

- |

Requires the sale of the Company’s Minnesota business if adult-use cannabis legislation is passed that is unfavorable to the Company’s interests in certain defined respects |

| |

- |

Requires the Borrowers to enter into a $10 million convertible note facility with one or more Lenders on or before April 30, 2023, with a three-year term, 6.0% per year cash interest rate, 6.0% per year paid-in-kind interest (added to the principal balance), convertible into the Company’s subordinate voting shares at a to-be-agreed ratio, and providing for the issuance of 6,250,000 warrants to purchase the Company’s subordinate voting shares at a to-be-agreed exercise price |

| |

- |

Requires Kyle Kingsley, Executive Chairman of the Company, to convert all of his super voting shares of the Company’s stock into subordinate voting shares no later than July 31, 2023 |

This summary of the Fifth Amendment

is qualified in its entirety by reference to the full text of the Fifth Amendment, a copy of which, subject to any applicable confidential

treatment, will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ending June 30, 2023.

| Item 2.02. |

Results of Operations and Financial Condition |

The information set forth in Item 7.01, to the extent they relate

to results of operations and financial condition of the Company, is incorporated herein by reference to the extent responsive to

Item 2.02.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information under Item 1.01 is incorporated herein by reference

to the extent responsive to Item 2.03.

| Item 3.02 |

Unregistered Sales of Equity Securities |

The information set forth under Item 1.01 is incorporated herein by

reference to the extent responsive to Item 3.02. The Shares have not been registered under the Securities Act of 1933, as amended (the

“Securities Act”), and were issued in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions

not involving a public offering and Rule 506 promulgated under the Securities Act. solely to “accredited investors” as such term is defined in Rule 501(a) of Regulation D under the Securities Act.

| Item 3.03 |

Material Modification to Rights of Security Holders |

The information set forth under Item 1.01 is incorporated herein by

reference to the extent responsive to Item 3.03.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On March 31, 2023, the Company announced that

Chelsea Grayson and Amber Shimpa had resigned their respective positions as members of the Company’s board of directors. Neither

Ms. Grayson nor Ms. Shimpa resigned because of a disagreement with the Company on any matter related to the Company’s operations,

policies or practices. Ms. Shimpa continues to hold the positions of President of the Company and Chief Executive Officer of the Company’s

Minnesota subsidiary.

| Item 7.01. |

Regulation FD Disclosure |

On March 31, 2023, the Company issued a press release announcing financial

results for its fourth quarter and year ended December 31, 2022, a copy of which is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K, including Exhibit

99.1 hereto, is being furnished, but shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, nor shall it be incorporated by reference into any filing with the U.S. Securities and Exchange Commission except

as shall be expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GOODNESS GROWTH HOLDINGS, INC.

(Registrant) |

| |

|

| |

By: |

/s/ J. Michael Schroeder |

| |

|

J. Michael Schroeder |

| |

|

General Counsel and Corporate Secretary |

Date: April 6, 2023

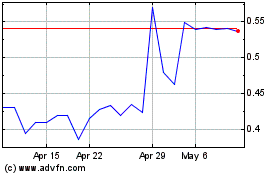

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

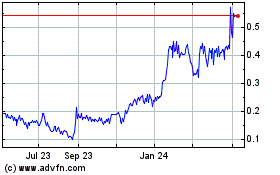

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Apr 2023 to Apr 2024