Workday Shares Rise After 3Q Results Soothe Analysts

November 30 2022 - 12:13PM

Dow Jones News

By Dean Seal

Shares of Workday Inc. rose 12% to $160.44 Wednesday as Wall

Street analysts reacted positively to the company's performance in

the third quarter despite strengthening macroeconomic

headwinds.

The company said after the bell Tuesday that its top line surged

to $1.60 billion from $1.33 billion a year ago, reflecting strong

continued demand for its enterprise cloud applications for finance

and human resources.

JP Morgan analysts said in a note that the results demonstrate

"relative resilience and stability in a tough macro environment,"

noting that finance and HR solutions remain a high priority in the

current labor market.

The results show Workday selling back to its own customers, who

are continuing to consolidate on the platform, according to DA

Davidson analysts Robert Simmons and Lucky Schreiner.

"Overall, the customer base motion and medium enterprise are

driving Workday's ability to maintain healthy growth as the economy

continues to be uneven," the DA Davidson analysts said in a note

Wednesday.

Workday also announced Tuesday that its directors have approved

a share repurchase program with an authorization of up to $500

million, with the hope of reducing the impact of future share

dilution from employee stock issuances.

Analysts at Mizuho Securities view the buyback program

positively, saying in a note that it demonstrates management's

confidence in the business and validates the view that Workday's

shares are currently undervalued.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

November 30, 2022 11:58 ET (16:58 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

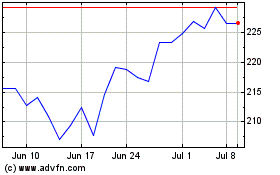

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

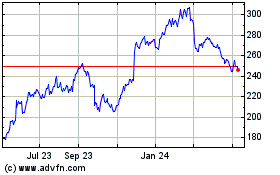

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Apr 2023 to Apr 2024