REPEAT: GM Reinstates Quarterly Dividend, Suspended in April 2020 -- WSJ

August 19 2022 - 9:27AM

Dow Jones News

By Nora Eckert

ß

General Motors Co. said Friday it plans to reinstate its

quarterly dividend, after suspending it in April 2020 to preserve

cash during the early days of the Covid-19 pandemic.

The Detroit auto maker also said it plans to resume

opportunistic share repurchases, saying progress on key initiatives

has instilled confidence it can fund growth in electric vehicles

and other advancements while returning capital to shareholders.

GM said it expects to pay the first dividend on Sept. 15 and

plans to increase its existing repurchase program of common stock

to $5 billion, up from the $3.3 billion remaining in the

program.

The move marks a shift from GM's position early this year. In

February, Chief Executive Mary Barra said the company wouldn't

resume paying out a dividend, to give priority to spending on EVs

and other growth plans.

In the spring of 2020, GM and other car makers suspended their

quarterly dividend payments, citing uncertainty around the health

crisis and looking to preserve cash as they shut down factories to

comply with lockdown orders and other Covid-19-related

restrictions.

Since then, GM's profits have rebounded, and it has set aside

billions of dollars to expand its lineup of EVs, including hefty

investments in battery factories. In all, the company plans to

spend $35 billion on electric and autonomous vehicles by 2025.

GM's share price has fallen about 34% since the start of the

year, more than those of rivals Ford Motor Co. and Stellantis

NV.

Ford reinstated its quarterly dividend late last year, after

suspending payments early in the pandemic. The Dearborn, Mich.,

auto maker then said in July that it would raise the dividend

payment to 15 cents a share.

When asked by an analyst this month about the dividend, GM

finance chief Paul Jacobson said the company would analyze how much

money it had in its funds after making costly EV investments.

"We've obviously been through a lot of turmoil over the last few

years," Mr. Jacobson said. "But as we start to emerge from that and

maybe we start to get through into better, more stable economic

times, we can have that consistent return."

GM's profits have remained healthy in recent quarters, lifted by

constrained inventory levels at dealerships and buyers' paying

higher prices for its vehicles. Still, its net income fell 40% in

the second quarter of 2022, mostly due to a loss in China and

supply-chain troubles that left the company with tens of thousands

of unfinished vehicles it couldn't sell.

Company executives in July said they expect factory output to

improve in the second half of the year, and GM maintained its

full-year guidance.

GM said it is still taking precautions to guard against

weakening economic conditions, including cutting discretionary

spending and curtailing hiring. Ms. Barra said in July that a

restructuring in 2019 and 2020 cut about $4.5 billion in annual

costs, helping prepare GM for any downturn.

Write to Nora Eckert at nora.eckert@wsj.com

ß

(END) Dow Jones Newswires

August 19, 2022 09:12 ET (13:12 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

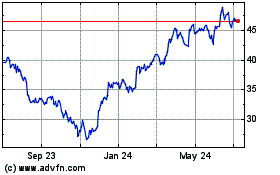

General Motors (NYSE:GM)

Historical Stock Chart

From Aug 2024 to Sep 2024

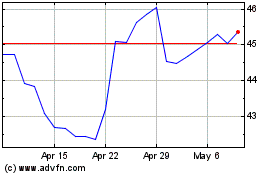

General Motors (NYSE:GM)

Historical Stock Chart

From Sep 2023 to Sep 2024