Current Report Filing (8-k)

June 27 2022 - 4:53PM

Edgar (US Regulatory)

0001661039false00016610392022-06-092022-06-09iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: June 9, 2022

TPT Global Tech, Inc. |

(Exact name of registrant as specified in its charter) |

Florida | | 333-222094 | | 81-3903357 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

501 West Broadway, Suite 800, San Diego, CA 921101

(Address of Principal Executive Offices) (Zip Code)

(619)301-4200

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Title of each Class | | Trading Symbol | | Name of each exchange on which registered |

N/A | | N/A | | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

Crestmark Bank

On June 9, 2022, the Company agreed to an amendment to the Amended and Restated Promissory Note dated May 20, 2021 for $360,000 with Crestmark Bank (Exhibit 10.1). The amendment provides for interest only monthly payments at 6% per annum in excess of Wall Street Journal prime commencing on June 1, 2022 through September 1, 2022, after which payments will include principal of $15,000 per months until paid on May 1, 2024.

1800 Diagonal Lending LLC

Convertible Promissory Note:

TPT Global Tech, Inc. (the “Company”) and 1800 Diagonal Lending, LLC (“Holder”) entered into a Convertible Promissory Note effective June 13, 2022 totaling $200,760 (“1800 Diagonal Note” Exhibit 10.2) and a Securities Purchase Agreement (“SPA,” Exhibit 10.3 (altogether, the “Transaction Documents”). The closing and funding took place on June 16, 2022.

The 1800 Diagonal Note has an original issue discount of 12%, or $21,510.00, and bears interest at 22% and is convertible into shares of the Company’s common stock only under default, as defined. 10 payments of $22,485.10 beginning on July 30, 2022 are to be made each month totaling $224,851,00. At any time following default, as defined, conversion rights exist at a discount rate of 25% of the lowest trading price for the Company’s common stock during the previous 10 trading days prior to conversion. 194,676,363 common shares of the Company have been reserved with the transfer agent for possible conversion under a default.

Securities Purchase Agreement:

The Company and the Holder executed the Securities Purchase Agreement (“SPA”) in accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by Rule 506 under Regulation D as promulgated by the United States Securities and Exchange Commission (the “SEC”) under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act. The SPA outlines the purchase of the 1800 Diagonal Note (the “Securities”), and the Holder understands that the Securities are being offered and sold to it in reliance on specific exemptions from the registration requirements of the 1933 Act and state securities laws and that the Company is relying upon the truth and accuracy of, and the Holder’s compliance with, the representations, warranties, agreements, acknowledgments and understandings of the Holder set forth in the SPA in order to determine the availability of such exemptions and the eligibility of the Holder to acquire the Securities.

Item 2.03 Creation of Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

See the disclosures under Item 1.01 of this Current Report on Form 8-K, incorporated herein by this reference.

Item 3.02 Unregistered Sales of Equity Securities

See the disclosures under Item 1.01 of this Current Report on Form 8-K, incorporated herein by this reference.

Item 9.01 Exhibits

The following exhibits are filed with this report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| TPT Global Tech, Inc. | |

| | | |

| By | /s/ Stephen J. Thomas III | |

| Stephen J. Thomas III, | |

| Title: Chief Operating Officer | |

| | | |

| Date: June 27, 2022 | |

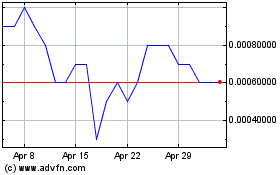

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Aug 2024 to Sep 2024

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Sep 2023 to Sep 2024