Equinor Raises Buyback as Earnings Boosted by High Oil and Gas Prices

October 27 2021 - 2:07AM

Dow Jones News

By Dominic Chopping

Equinor ASA on Wednesday posted higher-than-expected

third-quarter adjusted earnings and raised the size of its share

buyback as it benefited from the higher oil and gas prices during

the quarter.

The company, which is 67%-owned by the Norwegian state, said

adjusted earnings--its preferred measure--rose to $9.77 billion

from $780 million, against $8.36 billion expected in a

company-compiled consensus.

It reported a net profit of $1.41 billion from a loss of $2.13

million a year earlier, as revenue more than doubled to $23.11

billion.

Analysts polled by FactSet had expected a net profit of $2.47

billion on revenue of $22.28 billion.

"The current unprecedented level and volatility in European gas

prices underlines the uncertainty in the market...we have taken

steps to increase our gas exports to respond to the high demand,"

Chief Executive Anders Opedal said.

Equinor announced a third-quarter dividend of $0.18 and said it

has decided to increase the size of the second tranche of the share

buyback program, to $1 billion from an indicative level of $300

million.

The company delivered total equity production of 1.996 million

barrels of oil equivalent a day in the quarter from 1.994 million

barrels last year.

Organic capital expenditure and production guidance was

maintained.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 27, 2021 01:52 ET (05:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

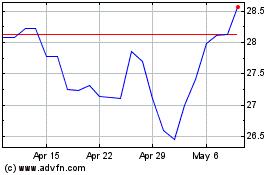

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

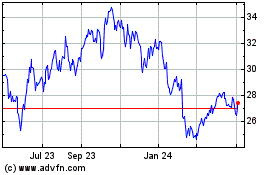

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024