Filed pursuant to Rule 253(g)(2)

File No. 024-11617

OFFERING CIRCULAR

Dated: September 10, 2021

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

U.S. STEM CELL, INC.

1560 Sawgrass Corporate Pkwy, 4th FL

Sunrise, Florida 33323

(954) 835-1500

250,000,000 Shares of Common Stock

at a price of $0.01 per Share

Minimum Investment: $25,000

Maximum Offering: $2,500,000

See The Offering - Page 11 and Securities Being Offered - Page 54 For Further Details. None of the Securities Offered Are Being Sold By Present Security Holders. This Offering Will Commence Upon Qualification of this Offering by the Securities and Exchange Commission and Will Terminate 365 days from the date of qualification by the Securities And Exchange Commission, Unless Extended or Terminated Earlier By The Issuer

PLEASE REVIEW ALL RISK FACTORS ON PAGES 12 THROUGH PAGE 17 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best efforts” basis, the following disclosures are hereby made:

|

|

Price to Public

|

Commissions (1)

|

Proceeds to

Company (2)

|

Proceeds to

Other Persons (3)

|

|

Per Share

|

$0.01

|

$0

|

$0.01

|

None

|

|

Minimum Investment

|

$25,000

|

$0

|

$25,000

|

None

|

|

Maximum Offering

|

$2,500,000

|

$0

|

$2,500,000

|

None

|

(1) The Company shall pay no commissions to underwriters for the sale of securities under this Offering.

(2) Does not reflect payment of expenses of this Offering, which are estimated to not exceed $25,000 and which include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, administrative services other costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares. This amount represents the proceeds of the offering to the Company, which will be used as set out in “USE OF PROCEEDS TO ISSUER.”

(3) There are no finder's fees or other fees being paid to third parties from the proceeds. See “PLAN OF DISTRIBUTION.”

This Offering (the “Offering”) consists of Common Stock (the “Shares” or individually, each a “Share”) that is being offered on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold. The Shares are being offered and sold by U.S. Stem Cell, Inc., a Florida Corporation (the “Company”). There are 250,000,000 Shares being offered at a price of $0.01 per Share with a minimum purchase of $25,000 per investor. The Shares are being offered only by the Company on a best efforts basis to an unlimited number of accredited investors and to non-accredited investors based on the limitations of Regulation A. Under Rule 251(d)(2)(i)(C) of Regulation of Regulation A+, non-accredited, non-natural investors are subject to the investment limitation and may only invest funds which do not exceed 10% of the greater of the purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year end). A non-accredited, natural person may only invest funds which do not exceed 10% of the greater of the purchaser’s annual income or net worth (please see below on how to calculate your net worth). The maximum aggregate amount of the Shares offered is 250,000,000 Shares of Common Stock ($2,500,000 at the maximum offering price). There is no minimum number of Shares that needs to be sold in order for funds to be released to the Company and for this Offering to close.

The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier II offerings. The Shares will only be issued to purchasers who satisfy the requirements set forth in Regulation A. The offering is expected to expire on the first of: (i) all of the Shares offered are sold; or (ii) the close of business 365 days from the date of qualification by the Commission, unless sooner terminated or extended by the Company's CEO. Pending each closing, payments for the Shares will be paid directly to the Company. Funds will be immediately transferred to the Company where they will be available for use in the operations of the Company's business in a manner consistent with the “USE OF PROCEEDS TO ISSUER” in this Offering Circular.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov (WHICH IS NOT INCORPORATED BY REFERENCE INTO THIS OFFERING CIRCULAR).

This Offering is inherently risky. See “Risk Factors” beginning on page 12.

Sales of these securities will commence three calendar days of the qualification date and the filing of a Form 253(g)(2) Offering Circular AND it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

The Company is following the “Offering Circular” format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED 'BLUE SKY' LAWS).

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE UNITED STATES, IT IS THE PURCHASER'S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN PURCHASER.

PATRIOT ACT RIDER

The Investor hereby represents and warrants that Investor is not, nor is it acting as an agent, representative, intermediary or nominee for, a person identified on the list of blocked persons maintained by the Office of Foreign Assets Control, U.S. Department of Treasury. In addition, the Investor has complied with all applicable U.S. laws, regulations, directives, and executive orders relating to anti-money laundering , including but not limited to the following laws: (1) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56, and (2) Executive Order 13224 (Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism) of September 23, 2001.

NO DISQUALIFICATION EVENT (“BAD BOY” DECLARATION)

NONE OF THE COMPANY, ANY OF ITS PREDECESSORS, ANY AFFILIATED ISSUER, ANY DIRECTOR, EXECUTIVE OFFICER, OTHER OFFICER OF THE COMPANY PARTICIPATING IN THE OFFERING CONTEMPLATED HEREBY, ANY BENEFICIAL OWNER OF 20% OR MORE OF THE COMPANY'S OUTSTANDING VOTING EQUITY SECURITIES, CALCULATED ON THE BASIS OF VOTING POWER, NOR ANY PROMOTER (AS THAT TERM IS DEFINED IN RULE 405 UNDER THE SECURITIES ACT OF 1933) CONNECTED WITH THE COMPANY IN ANY CAPACITY AT THE TIME OF SALE (EACH, AN “ISSUER COVERED PERSON”) IS SUBJECT TO ANY OF THE “BAD ACTOR” DISQUALIFICATIONS DESCRIBED IN RULE 506(D)(1)(I) TO (VIII) UNDER THE SECURITIES ACT OF 1933 (A “DISQUALIFICATION EVENT”), EXCEPT FOR A DISQUALIFICATION EVENT COVERED BY RULE 506(D)(2) OR (D)(3) UNDER THE SECURITIES ACT. THE COMPANY HAS EXERCISED REASONABLE CARE TO DETERMINE WHETHER ANY ISSUER COVERED PERSON IS SUBJECT TO A DISQUALIFICATION EVENT.

Continuous Offering

Under Rule 251(d)(3) to Regulation A, the following types of continuous or delayed Offerings are permitted, among others: (1) securities offered or sold by or on behalf of a person other than the issuer or its subsidiary or a person of which the issuer is a subsidiary; (2) securities issued upon conversion of other outstanding securities; or (3) securities that are part of an Offering which commences within two calendar days after the qualification date. These may be offered on a continuous basis and may continue to be offered for a period in excess of 30 days from the date of initial qualification. They may be offered in an amount that, at the time the Offering statement is qualified, is reasonably expected to be offered and sold within one year from the initial qualification date. No securities will be offered or sold “at the market.” The supplement will not, in the aggregate, represent any change from the maximum aggregate Offering price calculable using the information in the qualified Offering statement. This information will be filed no later than two business days following the earlier of the date of determination of such pricing information or the date of first use of the Offering circular after qualification.

Sale of these shares will commence within three calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

Subscriptions are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration without notice to subscribers. All proceeds received by the Company from subscribers for this Offering will be available for use by the Company upon acceptance of subscriptions for the Securities by the Company.

Forward Looking Statement Disclosure

This Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein contain forward-looking statements and are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this Form 1-A, Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements give the Company's current reasonable expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as 'anticipate,' 'estimate,' 'expect,' 'project,' 'plan,' 'intend,' 'believe,' 'may,' 'should,' 'can have,' 'likely' and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. The forward-looking statements contained in this Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein are based on reasonable assumptions the Company has made in light of its industry experience, perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. As you read and consider this Form 1-A, Offering Circular, and any documents incorporated by reference, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond the Company's control) and assumptions. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company's actual operating and financial performance may vary in material respects from the performance projected in these forward- looking statements. Any forward-looking statement made by the Company in this Form 1-A, Offering Circular or any documents incorporated by reference herein speaks only as of the date of this Form 1-A, Offering Circular or any documents incorporated by reference herein. Factors or events that could cause our actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

About This Form 1-A and Offering Circular

In making an investment decision, you should rely only on the information contained in this Form 1-A and Offering Circular. The Company has not authorized anyone to provide you with information different from that contained in this Form 1-A and Offering Circular. We are offering to sell, and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents.

TABLE OF CONTENTS

USE OF MARKET AND INDUSTRY DATA

This Offering Circular includes market and industry data that we have obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this Offering Circular are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this Offering Circular or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, internally prepared and third-party market prospective information, in particular, are estimates only and there will usually be differences between the prospective and actual results, because events and circumstances frequently do not occur as expected, and those differences may be material. Also, references in this Offering Circular to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Offering Circular.

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

Unless otherwise indicated or the context otherwise requires, all references in this Offering Circular to “we,” “us,” “our,” “our company,” “U. S. Stem Cell, Inc.” or the “Company” refer to U.S. Stem Cell, Inc. and its subsidiaries.

OFFERING CIRCULAR SUMMARY

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “ Forward-Looking Statement Disclosure.”

Corporate Information

U.S. Stem Cell, Inc. was incorporated in the State of Florida in August 1999 as Bioheart, Inc. In 2015, we changed our name to U.S. Stem Cell, Inc. Our principal executive offices are located at 1560 Sawgrass Corporate Pkwy, 4th Floor, Sunrise, FL 33323 and our telephone number is (954) 835-1500. Information about us is available on our corporate website at www. us-stemcell.com. We include our website address in the Offering Circular on Form 1- only as an interactive textual reference and do not intend it to be an active link to our website. The information on our websites is expressly not incorporated by reference in this Offering Circular.

Mission Statement

We are a biotechnology company focused on the discovery, development and, subject to regulatory approval, commercialization of autologous cell therapies for the treatment of disease and injury. We are also a regenerative medicine company specializing in physician/veterinary training and certification and stem cell products.

Going Concern

As of June 30, 2021, the Company had cash on hand of $137,962 and a working capital deficit (current liabilities in excess of current assets) of $11,086,870. During the six months ended June 30, 2021, the net loss was $1,973,950 and net cash used in operating activities was $635,233. Our independent registered public accounting firm has issued its report in connection with the audit of our annual financial statements as of December 31, 2020, that included an explanatory paragraph describing the existence of conditions that raise substantial doubt about our ability to continue as a going concern and the unaudited financial statements for the period ended June 30, 2021 also describes the existence of conditions that raise substantial doubt about our ability to continue as a going concern. These factors raise substantial doubt about our ability to continue as a going concern within one year after the date the financial statements are issued. The Company’s financial statements do not include any adjustments that might result from the outcome of this uncertainty should we be unable to continue as a going concern.

Management estimates that the current funds on hand will be sufficient to continue operations through the next six months. Our ability to continue as a going concern is dependent upon our ability to continue to implement our business plan. Our management intends to continue the current business strategy, to the extent possible, to finance their clinical development pipeline through revenue (cash in-flows) generated through the marketing and sales of unique educational and training services, animal health products and distribution of products in the industry as well as evaluate and act upon opportunities to increase our top line revenue position and that correspondingly increase cash in-flows. These opportunities include but are not limited to the development and marketing of new products and services, mergers and acquisitions, joint ventures, licensing deals and more.

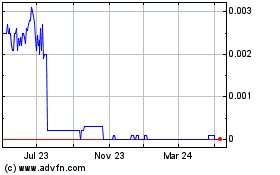

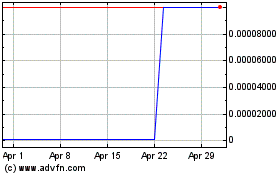

Trading Market

Our Common Stock trades in the OTC Market under the symbol “USRM”.

We are Offering, on a best-efforts, a number of shares of our common stock at a per share price of $0.01 to be sold up to a maximum of 250,000,000 shares. The fixed price per share determined upon qualification shall be fixed for the duration of the Offering unless a post-effective amendment is filed to reset the price per share and approved by the Securities and Exchange Commission. There is a minimum investment of $25,000 per investor. The shares are intended to be sold directly through the efforts of our officers and directors.

We have two billion (2,000,000,000) authorized common stock shares, of which there are 456,217,501 issued and outstanding as of August 27, 2021. We have 20,000,000 authorized Preferred Shares, of which none are outstanding.

We are quoted on the OTC Pink Sheet Market and there is a limited established market for our stock. The Offering price of the Shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the Offering price, we took into consideration our capital structure and the amount of money we would need to implement our business plans. Accordingly, the Offering price should not be considered an indication of the actual value of our securities.

The Offering

This is a public Offering of securities of U.S. Stem Cell, Inc., a Florida corporation. We are offering 250,000,000 shares of our Common Stock at an Offering price of $0.01 per share (the “Offered Shares” or “Shares”). This Offering will terminate on twelve months from the day the Offering is qualified or the date on which the maximum Offering amount is sold (such earlier date, the “Termination Date”). The minimum purchase requirement per investor is $25,000.

These securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” on page 12 to read about factors you should consider before buying shares of Common Stock.

Our Common Stock currently trades on the OTC Market under the symbol “USRM” and the closing price of our Common Stock on August 24, 2021 was $0.012.

We are offering our shares without the use of an exclusive placement agent. We expect to commence the sale of the shares as of the date on which the Offering Statement is Qualified by the SEC.

As there is no minimum Offering, upon the approval of any subscription to this Offering Circular, we shall immediately deposit said proceeds into our bank account and may dispose of the proceeds in accordance with the Use of Proceeds.

This Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best efforts to offer and sell the Shares. Our Officers will not receive any commission or any other remuneration for these sales. Any Officer offering the securities on our behalf will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification under the laws of any such state.

As there is no minimum Offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Completion of this Offering is not subject to us raising a minimum Offering amount. We do not have an arrangement to place the proceeds from this Offering in an escrow, trust or similar account. Any funds raised from the Offering will be immediately available to us for our immediate use. We have provided an estimate below of the gross proceeds to be received by the Company if 25%, 50%, 75%, and 100% of the Shares registered in the Offering are sold.

In order to subscribe to purchase the shares, a prospective investor must complete a subscription agreement and send payment by check, wire transfer or ACH. We have not currently engaged any party for the public relations or promotion of this Offering. As of the date of this filing, there are no additional offers for shares, nor any options, warrants, or other rights for the issuance of additional shares except those described herein.

We are Offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000, excluding their primary residences or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public Offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer compensation, the broker/dealers’ duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers’ rights and remedies in cases of fraud in penny stock transactions; and, FINRA’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

The Offering

This Offering Circular relates to the sale of up to 250,000,000 shares of our Common Stock, through the efforts of our executive officers and directors, at a price of $0.01 per share, for total Offering proceeds of up to $2,500,000, if all Offered Shares are sold. The minimum amount established for investors is $25,000 unless such minimum is waived by the Company, in its sole discretion, on a case-by-case basis. There is no minimum aggregate Offering amount and the Company will not escrow or return investor funds if any minimum number of shares is not sold. All money we receive from the Offering will be immediately available to us for the uses set forth in the “Use of Proceeds” section of this Offering Circular.

|

Type of Stock Offering:

|

Common Stock

|

|

|

|

|

Price Per Share:

|

$0.01

|

|

|

|

|

Minimum Investment:

|

$25,000 per investor (250,000 Shares of Common Stock at the Maximum Offering Price)

|

|

|

|

|

Maximum Offering:

|

$2,500,000. The Company will not accept investments greater than the Maximum Offering amount.

|

|

|

|

|

Maximum Shares Offered:

|

250,000,000 Shares of Common Stock

|

|

|

|

|

Use of Proceeds:

|

See the description in section entitled “USE OF PROCEEDS TO ISSUER” on page 24 herein.

|

|

|

|

|

Voting Rights:

|

The Shares have full voting rights.

|

|

|

|

|

Length of Offering:

|

Shares will be offered on a continuous basis until either (1) the maximum number of Shares or sold; (2) 365 days from the date of qualification by the Commission; or (3) the Company in its sole discretion withdraws this

Offering.

|

|

|

|

|

Risk factors:

|

Investing in our Common Stock involves risks. See “Risk Factors” for a discussion of certain factors that you should carefully consider before making an investment decision.

|

|

|

|

|

Dividend policy:

|

Holders of our Common Stock are only entitled to receive dividends when, as and if declared by our board of directors out of funds legally available for dividends. We do not intend to pay dividends for the foreseeable future. Our ability to pay dividends to our stockholders in the future will depend on regulatory restrictions, liquidity and capital requirements, our earnings and financial condition, the general economic climate, our ability to service any equity or debt obligations senior to our Common Stock and other factors deemed relevant by our board of directors. For additional information, see “Dividend Policy.”

|

|

|

|

|

Use of proceeds:

|

See “Use of Proceeds” beginning on page 25.

|

|

Common Stock Outstanding as of August 27, 2021 (1)

|

456,217,501 Shares

|

|

Common Stock in this Offering

|

250,000,000 Shares

|

|

Stock to be outstanding after the offering (2)

|

706,217,501 Shares

|

|

|

(1)

|

The Company has also authorized 20,000,000 shares of preferred stock, of which 0 are issued and outstanding. No preferred stock is being sold in this Offering.

|

|

|

(2)

|

The total number of Shares of Common Stock assumes that the maximum number of Shares are sold in this Offering. The Company may not be able to sell the Maximum Offering Amount. The Company will conduct one or more closings on a rolling basis as funds are received from investors. The net proceeds of the Offering will be the gross proceeds of the Shares sold minus the expenses of the offering. Investors should not assume that the Offered Shares will be listed. A consistent public trading market for the shares may not develop.

|

Investment Analysis

There is no assurance U.S. Stem Cell, Inc. will be profitable, or that management's opinion of the Company's future prospects will not be outweighed by the unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

ABOUT THIS OFFERING CIRCULAR

We have prepared this Offering Circular to be filed with the Securities and Exchange Commission for our Offering of securities. The Offering Circular includes exhibits that provide more detailed descriptions of the matters discussed in this circular. You should rely only on the information contained in this circular and its exhibits. The Company has not authorized any person to provide you with any information different from that contained in this Offering Circular. The information contained in this Offering Circular is complete and accurate only as of the date of this Offering Circular, regardless of the time of delivery of this circular or sale of our Shares. This Offering Circular contains summaries of certain other documents, but reference is hereby made to the full text of the actual documents for complete information concerning the rights and obligations of the parties thereto. All documents relating to this Offering and related documents and agreements, if readily available to us, will be made available to a prospective investor or its representatives upon request.

TAX CONSIDERATIONS

No information contained herein, nor in any prior, contemporaneous or subsequent communication should be construed by a prospective investor as legal or tax advice. We are not providing any tax advice as to the acquisition, holding or disposition of the securities offered herein. In making an investment decision, investors are strongly encouraged to consult their own tax advisor to determine the U.S. Federal, state and any applicable foreign tax consequences relating to their investment in our securities. This written communication is not intended to be “written advice,” as defined in Circular 230 published by the U.S. Treasury Department.

RISK FACTORS

The purchase of the Company's Common Stock involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Shares offered by the Company constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the Shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company's business and your investment in the Shares. An investment in the Company may not be suitable for all recipients of this Offering Circular. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and the financial resources available to you.

The discussions and information in this Offering Circular may contain both historical and forward- looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company's business, please be advised that the Company's actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company in forward-looking statements. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results may differ from the Company's current expectations.

SHOULD ONE OR MORE OF THE FOREGOING RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD THE UNDERLYING ASSUMPTIONS OF OUR BUSINESS PROVE INCORRECT, ACTUAL RESULTS MAY DIFFER SIGNIFICANTLY FROM THOSE ANTICIPATED, BELIEVED, ESTIMATED, EXPECTED, INTENDED OR PLANNED.

Before investing, you should carefully read and carefully consider the following risk factors:

Risks Relating to the Company and Its Business

The Company is dependent upon its management, key personnel, and consultants to execute its business plan.

The Company's success is heavily dependent upon the continued active participation of the Company's current executive officer, Mike Tomas. Loss of this individual could have a material adverse effect upon the Company's business, financial condition, or results of operations. Further, the Company's success and achievement of the Company's growth plans depend on the Company's ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in the health care, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of the Company's activities, could have a materially adverse effect on its ability to operate. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on the Company's business, financial condition, or results of operations.

The Company's bank accounts will not be fully insured.

The Company's regular bank accounts have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in each account may exceed those limits at times. In the event that any of the Company's banks should fail, the Company may not be able to recover all amounts deposited in these bank accounts.

The Company's business plan is speculative.

The Company's present business and planned business are speculative and subject to numerous risks and uncertainties. There is no assurance that the Company will generate significant revenues or profits.

The Company's expenses could increase without a corresponding increase in revenues.

The Company's operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on the Company's financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations, or government policies which increase the costs of compliance with such laws, regulations, or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

Risks Related to our Intellectual Property

Our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual property. The names and/or logos of Company brands (whether owned by the Company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Current or future patent applications may not result in issued patents which could hinder ability to obtain and maintain other rights to technology required or desirable for the conduct of our business. Such challenges could have a material adverse effect on the Company's financial results as well as your investment.

Changes in the economy could have a detrimental impact on the Company.

Changes in the general economic climate could have a detrimental impact on consumer expenditure and, therefore, on the Company's revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may adversely affect customers' confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on the Company's financial results and on your investment.

Limitation on director liability.

The Company may provide for the indemnification of directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors to the Company and its shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Risks Related to Our Financial Position and Need for Additional Financing

We will need to secure additional financing in 2021 in order to continue to finance our operations. If we are unable to secure additional financing on acceptable terms, or at all, we may be forced to curtail or cease our operations.

As of December 31, 2020, we had cash and cash equivalents of $18,570 and an accumulated capital deficit of $136,514,508. At June 30, 2021, we had cash and cash equivalents totaling $137,962. However, our accumulated capital deficit as of June 30, 2021 was $138,488,458. As such, our existing cash resources are insufficient to finance even our immediate operations. Accordingly, we will need to secure additional sources of capital to develop our business and product candidates as planned. We are seeking substantial additional financing through public and/or private financing, which may include equity and/or debt financings, research grants and through other arrangements, including collaborative arrangements.

As part of such efforts, we may seek loans from certain of our executive officers, directors and/or current shareholders. We may also seek to satisfy some of our obligations to the guarantors of our loan with Seaside National Bank & Trust, or the Guarantors, through the issuance of various forms of securities or debt on negotiated terms. The Company renewed the loan with Seaside National Bank and Trust during the first quarter of 2020 to extend the maturity date to May 18, 2022, all other terms and conditions remain unchanged. However, financing and/or alternative arrangements with the Guarantors may not be available when we need it, or may not be available on acceptable terms.

If we are unable to secure additional financing in the near term, we may be forced to:

|

|

●

|

curtail or abandon our existing business plans;

|

|

|

●

|

reduce our headcount;

|

|

|

●

|

default on our debt obligations;

|

|

|

●

|

file for bankruptcy;

|

|

|

●

|

seek to sell some or all of our assets; and/or

|

|

|

●

|

Cease our operations.

|

If we are forced to take any of these steps, any investment in our common stock may be worthless.

If we raise additional capital and/or secure alternative arrangements, with the Guarantors or otherwise, by issuing equity, equity-related or convertible securities, the economic, voting and other rights of our existing shareholders may be diluted, and those newly issued securities may be issued at prices that are a significant discount to current and/or then prevailing market prices. In addition, any such newly issued securities may have rights superior to those of our common stock. If we obtain additional capital through collaborative arrangements, we may be required to relinquish greater rights to our technologies or product candidates than we might otherwise have or become subject to restrictive covenants that may affect our business.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm issued its report in connection with the audit of our financial statements as of December 31, 2020, which included an explanatory paragraph describing the existence of conditions that raise substantial doubt about our ability to continue as a going concern. In addition, the notes to our financial statements for the quarter ended June 30, 2021 included an explanatory paragraph describing the existence of conditions that raise substantial doubt about our ability to continue as a going concern for a reasonable period of time. If we are not able to continue as a going concern, it is likely that holders of our common stock will lose all of their investment. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are a development stage life sciences company with a limited operating history and a history of net losses and negative cash flows from operations. We may never be profitable, and if we incur operating losses and generate negative cash flows from operations for longer than expected, we may be unable to continue operations.

We are a development stage life sciences company and have a limited operating history, limited capital, limited sources of revenue, and have incurred losses since inception. Our operations to date have been limited to organizing our company, developing and engaging in clinical trials of our MyoCell™ product candidate, expanding our pipeline of complementary product candidates through internal development and third party licenses, expanding and strengthening our intellectual property position through internal programs and third party licenses and recruiting management, research and clinical personnel. Consequently, it may be difficult to predict our future success or viability due to our lack of operating history. As of December 31, 2020, we have accumulated a deficit of $136,514,508 million and as of June 30, 2021, we have an accumulated deficit of $138,488,458. Our MyoCell™ product candidate has not received regulatory approval or generated any material revenues and is not expected to generate any material revenues until commercialization of MyoCell, if ever.

Our ability to continue generating revenues from any of our product candidates will depend on a number of factors, including our ability to successfully complete clinical trials, obtain necessary regulatory approvals and implement our commercialization strategy. In addition, even if we are successful in obtaining necessary regulatory approvals and bringing one or more product candidates to market, we will be subject to the risk that the marketplace will not accept those products. We may, and anticipate that we will need to, transition from a company with a research and development focus to a company capable of supporting commercial activities and we may not succeed in such a transition.

Because of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to predict the extent of our future losses or when or if we will become profitable. Our failure to successfully commercialize our product candidates or to become and remain profitable could impair our ability to raise capital, expand our business, diversify our product offerings and continue our operations.

The amount of capital the Company is attempting to raise in this Offering is not enough to sustain the Company’s current business plan.

In order to achieve the Company's near and long-term goals, the Company will need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms, if at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause you to lose all or a portion of your investment.

Additional financing may be necessary for the implementation of our growth strategy.

The Company may require additional debt and/or equity financing to pursue our growth and business strategies. These include, but are not limited to enhancing our operating infrastructure and otherwise respond to competitive pressures. Given our limited operating history and existing losses, there can be no assurance that additional financing will be available, or, if available, that the terms will be acceptable to us. Lack of additional funding could force us to substantially curtail our growth plans. Furthermore, the issuance by us of any additional securities pursuant to any future fundraising activities undertaken by us would dilute the ownership of existing shareholders and may reduce the price of our Shares.

Risks Relating to This Offering and Investment

The Company may undertake additional equity or debt financing that may dilute the Shares in this Offering.

The Company may undertake further equity or debt financing, which may be dilutive to existing shareholders, including you, or result in an issuance of securities whose rights, preferences and privileges are senior to those of existing shareholders, including you, and also reducing the value of Shares subscribed for under this Offering.

An investment in the Shares is speculative and there can be no assurance of any return on such investment.

An investment in the Company's Shares is speculative, and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The Shares are offered on a “best efforts” basis and the Company may not raise the maximum amount being offered.

Since the Company is offering the Shares on a “best efforts” basis, there is no assurance that the Company will sell enough Shares to meet its capital needs. If you purchase Shares in this Offering, you will do so without any assurance that the Company will raise enough money to satisfy the full Use Of Proceeds To Issuer which the Company has outlined in this Offering Circular or to meet the Company's working capital needs. If the maximum Offering amount is not sold, we may need to incur additional debt or raise additional equity in order to finance our operations. Increasing the amount of debt will increase our debt service obligations and make less cash available for distribution to our shareholders. Increasing the amount of additional equity that we will have to seek in the future will further dilute those investors participating in this Offering.

We have not paid dividends in the past and do not anticipate paying them in the future. You return on investment, if any, will be limited to the market value of the Shares you purchase.

We have never paid cash dividends on our Shares and do not anticipate paying cash dividends in the future. Since we do not pay dividends, our Shares may be less valuable because a return on your investment will only occur if the market value of the Shares appreciates beyond your purchase price. While the Company may choose to pay dividends at some point in the future to its shareholders, there can be no assurance that cash flow and profits will allow such distributions to ever be made.

The Company may not be able to obtain additional financing.

Even if the Company is successful in selling the maximum number of Shares in the Offering, the Company may require additional funds to continue and grow its business. The Company may not be able to obtain additional financing as needed, on acceptable terms, or at all, which would force the Company to delay its plans for growth and implementation of its strategy which could seriously harm its business, financial condition and results of operations. If the Company needs additional funds, the Company may seek to obtain them primarily through additional equity or debt financings. Those additional financings could result in dilution to the Company's current shareholders and to you if you invest in this Offering.

The offering price has been arbitrarily determined.

The offering price of the Shares has been arbitrarily established by the Company based upon its present and anticipated financing needs and bears no relationship to the Company's present financial condition, assets, book value, projected earnings, or any other generally accepted valuation criteria. The offering price of the Shares may not be indicative of the value of the Shares or the Company, now or in the future.

The management of the Company has broad discretion in application and use of Offering proceeds.

The management of the Company has broad discretion to adjust the application and allocation of the net proceeds of this Offering in order to address changed circumstances and opportunities. As such, the success of the Company will be substantially dependent upon the discretion and judgment of the management of the Company with respect to the application and allocation of the net proceeds of the Offering.

An investment in the Company Shares could result in a loss of your entire investment.

An investment in this Offering involves a high degree of risk and you should not purchase the Shares if you cannot afford the loss of your entire investment. You may not be able to liquidate your investment for any reason in the near future.

Sales of a substantial number of shares of our Common Stock may cause the price of our Common Stock to decline.

If our shareholders sell substantial amounts of our Shares in the public market, Shares sold may cause the price to decrease below the current offering price. These sales may also make it more difficult for us to sell equity or equity-related securities at a time and price that we deem reasonable or appropriate.

The Shares in this Offering have no protective provisions.

The Shares in this Offering have no protective provisions. As such, you will not be afforded protection by any provision of the Shares or as a Shareholder in the event of a transaction that may adversely affect you, including a reorganization, restructuring, merger or other similar transaction involving the Company. If there is a 'liquidation event' or 'change of control' the Shares being offered do not provide you with any protection. In addition, there are no provisions attached to the Shares in the Offering that would permit you to require the Company to repurchase the Shares in the event of a takeover, recapitalization or similar transaction.

You will not have significant influence on the management of the Company.

Substantially all decisions with respect to the management of the Company will be made exclusively by the officers, directors, managers or employees of the Company. You will have a very limited ability, if at all, to vote on issues of Company management and will not have the right or power to take part in the management of the Company and will not be represented on the board of directors or by managers of the Company. Accordingly, no person should purchase Shares unless he or she is willing to entrust all aspects of management to the Company.

No guarantee of return on investment.

There is no assurance that you will realize a return on your investment or that you will not lose your entire investment. For this reason, you should read this Form 1-A, Offering Circular, and all exhibits and referenced materials carefully and should consult with your own attorney and business advisor prior to making any investment decision.

Our subscription agreement provides that Florida will be the governing law and forum for substantially all disputes between us and our investors, which could limit an investors’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees but does not preclude the investor for federal or state securities law litigation.

By becoming an investor in this Offering, you are deemed to have notice of and have consented to the provisions of our Subscription Agreement related to governing law and choice of forum. This forum provision may limit an investor’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers, or other employees, which may discourage lawsuits against us and our directors, officers and other employees. This provision does not apply to claims arising under the Securities Act of 1933, the Securities Exchange Act of 1934, or other federal securities laws for which there is exclusive federal or concurrent federal and state jurisdiction. In addition, investors cannot waive compliance with the federal securities laws and the rules and regulations thereunder. In that regard, we note that Section 22 of the Securities Act of 1933 creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Exchange Act 27 creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. If a court were to find the exclusive forum provision in our Subscription Agreement to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving the dispute in other jurisdictions, which could seriously harm our business. In addition, an Investors’ ability to seek relief in the state courts as a more favorable jurisdiction, will likely fail because the Courts will defer to federal jurisdiction.

Risks Related to Product Development

All of our product candidates are in an early stage of development and we may never succeed in developing and/or commercializing them. We depended heavily on the success of our MyoCell™ product candidate. If we are unable to commercialize MyoCell™ or any of our other product candidates or experience significant delays in doing so, our business may fail.

|

|

●

|

We have invested a significant portion of our efforts and financial resources in our MyoCell™ product candidate and depended heavily on its success. MyoCell™ was currently in the clinical testing stage of development, although we have suspended work under our clinical trials.

|

|

|

●

|

We need to devote significant additional research and development, financial resources and personnel to develop commercially viable products, obtain regulatory approvals and establish a sales and marketing infrastructure.

|

|

|

●

|

We are likely to encounter hurdles and unexpected issues as we proceed in the development of our other product candidates. There are many reasons that we may not succeed in our efforts to develop our product candidates, including the possibility that:

|

|

|

●

|

our product candidates will be deemed ineffective, unsafe or will not receive regulatory approvals;

|

|

|

●

|

our product candidates will be too expensive to manufacture or market or will not achieve broad market acceptance

|

|

|

●

|

others will hold proprietary rights that will prevent us from marketing our product candidates; or

|

|

|

●

|

our competitors will market products that are perceived as equivalent or superior.

|

Our approach of using cell-based therapy for the treatment of heart damage is risky and unproven and no products using this approach have received regulatory approval in the United States or Europe.

No company, to our knowledge, has yet been successful in its efforts to obtain regulatory approval in the United States or Europe of a cell-based therapy product for the treatment of heart damage. Cell-based therapy products, in general, may be susceptible to various risks, including undesirable and unintended side effects, unintended immune system responses, inadequate therapeutic efficacy or other characteristics that may prevent or limit their approval by regulators or commercial use. Many companies in the industry have suffered significant setbacks in advanced clinical trials, despite promising results in earlier trials.

One of our competitors exploring the use of skeletal myoblasts ceased enrolling new patients in its European Phase II clinical trial based on the determination of its monitoring committee that there was a low likelihood that the trial would result in the hypothesized improvement in heart function. Although our clinical research to date suggests that MyoCell™ may improve the contractile function of the heart, we have not yet been able to demonstrate a mechanism of action and additional research is needed to precisely identify such mechanism.

U.S. Food and Drug Administration injunction has curtailed our business.

On May 9, 2018, the U.S. Department of Justice filed an injunctive action, specifically United States of America v. U.S. Stem Clinic, LLC, U.S. Stem Cell, Inc., Kristin C. Comella, and Theodore Gradel. The Complaint was filed at the request of the U.S. Food and Drug Administration (FDA) and alleges that the respective defendants manufacture “stromal vascular fraction” (SVF) products from patient adipose (fat) tissue, which the companies then market as stem cell-based treatments without first obtaining what the government alleges are necessary FDA approvals. The Company has retained counsel to defend in this action. . On June 25, 2019, the federal court for the Southern District of Florida ruled in favor of the government, enjoining the Company and the other defendants from certain product sales and processes. The Company filed an appeal on August 23, 2019 and attended oral argument on January 13th, 2021. On June 2nd, 2021, the Eleventh Circuit Court ruled to affirm lower courts’ judgement. The Company did not challenge the district court’s judgment upon any other ground. The Company is not able to predict the duration, scope, results, or consequences of the U.S. Department of Justice actions and final rulings and management is assessing its options on a going forward basis.

Healthcare reform could substantially reduce our revenues, earnings and cash flows.

We cannot predict how employers, private payors or persons buying insurance might react to the changes brought on by broad U.S. healthcare reform legislation or what form many of these regulations will take before implementation. The healthcare reform legislation, enacted in 2010, introduced healthcare insurance exchanges which provide a marketplace for eligible individuals and small employers to purchase healthcare insurance. While patients have begun receiving insurance coverage through these exchanges, the business and regulatory environment for these exchanges continues to evolve as the exchanges mature. Additionally, there is uncertainty about how the applicable state and federal agencies will enforce regulations relating to the exchanges. There is also a considerable amount of uncertainty as to the prospective implementation of the federal healthcare reform legislation and what similar measures might be enacted at the state level. There have been multiple attempts through legislative action and legal challenges to repeal or amend the Patient Protection and Affordable Care Act of 2010, as modified by the Health Reform Acts, including the case that was recently heard by the U.S. Supreme Court, King v. Burwell. Although the Supreme Court upheld the provision by the federal government of subsidies to individuals in federally facilitated healthcare exchanges in Burwell, which ultimately did not disrupt significantly the implementation of the healthcare reform legislation, we cannot predict whether other current or future efforts to repeal or amend these laws will be successful, nor can we predict the impact that such a repeal or amendment would have on our business and operations, or on our revenues and earnings. In addition, in the last year, the executive branch and Congress have taken actions to weaken or modify the Affordable Care Act. The enacted reforms, future legislative changes, as well as current ongoing uncertainty in matters related to the Affordable Care Act, could have a material adverse effect on our results of operations.

Risks Related to Our Common Stock

Our common stock may be considered a “penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell.

Our common stock is considered to be a “penny stock.” It does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Exchange Act. Our common stock is a “penny stock” because it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange or (iii) it is not quoted on the NASDAQ Global Market, or has a price less than $5.00 per share. The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock are subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Securities Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

FINRA sales practice requirements may limit a shareholder’s ability to buy and sell our common shares.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares. In addition, there are a limited number of clearing houses that clear “penny stocks” and those that will clear such stocks may enforce internal time consuming administrative requirements and may arbitrarily determine to refuse to clear any stock.

Rule 144 sales in the future may have a depressive effect on the company’s stock price as an increase in supply of shares for sale, with no corresponding increase in demand will cause prices to fall.

All of the outstanding shares of common stock held by the present officers, directors, and affiliate stockholders are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act of 1933 and as required under applicable state securities laws. Rule 144 provides in essence that a person who is an affiliate or officer or director who has held restricted securities for six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1.0% of a Company’s issued and outstanding common stock. There is no limit on the amount of restricted securities that may be sold by a non-affiliate after the owner has held the restricted securities for a period of six months if the Company is a current reporting company under the Securities Exchange Act of 1934. The Company, as of the date of this report, not current in its filings but is making efforts to bring the filings current. A sale under Rule 144 or under any other exemption from the Securities Act of 1933, if available, or pursuant to subsequent registration of shares of common stock of present stockholders, may have a depressive effect upon the price of the common stock in any market that may develop. In addition, if we are deemed a shell company pursuant to Section 12(b)-2 of the Act, our “restricted securities”, whether held by affiliates or non-affiliates, may not be re-sold for a period of 12 months following the filing of a Form 10 level disclosure or registration pursuant to the Securities Act of 1933. Currently, we are not current in our report and the exemption to registration required pursuant to Rule 144 is unavailable to our shareholders. While we intend to bring our filings current to permit the use of the exemption to registration required pursuant to Rule 144, there can be no assurances as to timing and subsequent continued filings.

Failure to achieve and maintain effective internal controls in accordance with section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results.

It is time consuming, difficult and costly for us to develop and maintain the internal controls, processes and reporting procedures required by the Sarbanes-Oxley Act, and as our business develops, we may need to hire additional financial reporting, internal auditing and other finance staff in order to remain compliant. The cost of compliance will adversely affect our financial results, while, if we are unable to comply, we may not be able to obtain the independent accountant certifications that the Sarbanes-Oxley Act requires of publicly traded companies.

If we fail to comply in a timely manner with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common stock.

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over financial reporting and furnish a report by our management on our internal control over financial reporting. Failure to achieve and maintain an effective internal control environment or complete our Section 404 certifications could have a material adverse effect on our stock price.

In addition, in connection with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover “material weaknesses” in our internal controls as defined in standards established by the Public Company Accounting Oversight Board, or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. The PCAOB defines “significant deficiency” as a deficiency that results in more than a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected.

In the event that a material weakness is identified, upon receiving sufficient financing or generating sufficient revenues, we will employ qualified personnel and adopt and implement policies and procedures to address any such material weaknesses. However, the process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that the measures we will take will remediate any material weaknesses that we may identify or that we will implement and maintain adequate controls over our financial process and reporting in the future.

Any failure to complete our assessment of our internal control over financial reporting, to remediate any material weaknesses that we may identify or to implement new or improved controls, or difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements. Any such failure could also adversely affect the results of the periodic management evaluations of our internal controls and, in the case of a failure to remediate any material weaknesses that we may identify, would adversely affect the annual auditor attestation reports regarding the effectiveness of our internal control over financial reporting that are required under Section 404 of the Sarbanes-Oxley Act. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock.

The systems of internal controls and procedures that we have developed and implemented to date are adequate in a research and development business. The current transaction volume and limited transaction channels mean that operating management, financial management, board members and auditor can, and do, efficiently perform a very extensive and detailed transaction review to ensure compliance with the Company’s established procedures and controls. If our business grows rapidly, we may not be able to keep up with recruiting and training personnel, and enhancing our systems of internal control in line with the growth in transaction volumes and compliance risks which could result in loss of assets, profit, and ability to manage the daily operations of our Company.

Public disclosure requirements and compliance with changing regulation of corporate governance pose challenges for our management team and result in additional expenses and costs which may reduce the focus of management and the profitability of our company.