Mortgage Rates Move Lower in Latest Week, Freddie Mac Says

August 05 2021 - 10:15AM

Dow Jones News

By Matt Grossman

Mortgage rates declined in the latest week, extending a stretch

of ultra-low residential borrowing costs during the Covid-19

pandemic, according to mortgage giant Freddie Mac.

"With global market uncertainty surrounding the Delta variant of

Covid-19, we saw 10-year Treasury yields drift lower and

consequently mortgage rates followed suit," said Sam Khater,

Freddie Mac's chief economist. "The 30-year fixed-rate mortgage

dipped back to where it stood at the beginning of 2021, and the

15-year fixed remained at its historic low."

For the week ended Thursday, 30-year fixed-rate mortgages came

with an average rate of 2.77%, down from 2.8% a week ago and 2.88%

this time last year.

The 15-year fixed-rate mortgage was at 2.1%, unchanged from last

week and down from 2.44% 12 months ago.

Five-year Treasury-indexed hybrid adjustable-rate mortgages, or

ARMs, on average, were at 2.4%, compared with 2.45% the previous

week and 2.9% a year earlier.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

August 05, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

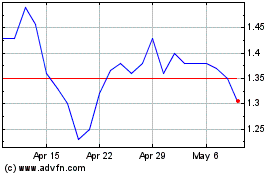

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024