NatWest to Receive Minority Stake in Permanent TSB in Exchange for Irish Assets

July 23 2021 - 2:50AM

Dow Jones News

By Joe Hoppe

NatWest Group PLC said Friday that it has agreed a non-binding

memorandum of understanding with Permanent TSB Group Holdings PLC,

as part of its phased withdrawal from Ireland.

The U.K. bank said that together with its subsidiary Ulster Bank

Ltd., it has entered the memorandum with the Dublin-listed lender

for the proposed sale of performing non-tracker mortgages,

performing micro-SME loans, the subsidiary's asset-finance business

and a subset of its branch locations.

This includes around 7.6 billion euros ($8.95 billion) of gross

performing loans as of March 31 and 25 locations. Ulster Bank had

total retail, micro-SME and asset finance gross lending of EUR16.1

billion in Ireland as of March 2021. Around 400-500 employees will

also be transferred.

In return, the memorandum proposes that NatWest receives a

minority non-consolidating equity stake in PTSB as part of the

consideration for the deal.

NatWest first said it would leave the Irish market on Feb. 19.

It said then that its Northern Irish banking business would be

unaffected.

The potential sale is subject to due diligence, further

negotiation and agreement, regulatory and other approvals and other

terms, and NatWest said there is no guarantee of a sale.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

July 23, 2021 02:39 ET (06:39 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

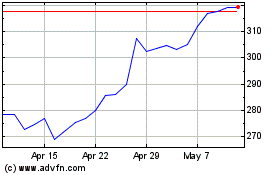

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2024 to May 2024

Natwest (LSE:NWG)

Historical Stock Chart

From May 2023 to May 2024