Rocket's Shares Fall Almost 11% After Posting 1Q Results

May 05 2021 - 5:04PM

Dow Jones News

By Allison Prang

Shares of Rocket Cos., the parent of Rocket Mortgage, fell

almost 11% in after-hours trading with the company logging its

first-quarter results.

The company reported earnings attributable to Rocket of $123.7

million, while a year earlier, the company broke even. Earnings

this quarter were $1.07 a share.

Adjusted earnings were 89 cents a share. According to FactSet,

analysts were expecting 90 cents a share.

The company reported $4.58 billion of net revenue, up from $1.37

billion a year ago. Adjusted revenue was $4.04 billion, higher than

$2.11 billion a year ago.

Closed loan origination volume was $103.53 billion.

The company saw its highest ever purchase application volume in

March for its mortgage business, Chief Executive Jay Farner said in

prepared remarks.

Rocket said it expects between $82.5 billion and $87.5 billion

in closed loan volume for the second quarter. It expects net rate

lock volume for this quarter to be between $81.5 billion and $88.5

billion. The company also expects its gain on sale margins to be

between 2.65% and 2.95%.

Shares were down 10.7% at $20.36 a share in after-hours

trading.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

May 05, 2021 16:49 ET (20:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

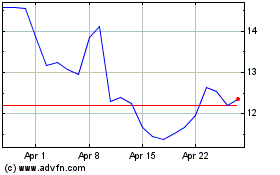

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

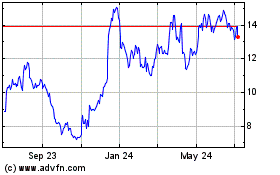

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Apr 2023 to Apr 2024