American Express Says Travel, Entertainment Spending Improving -- Update

April 23 2021 - 12:02PM

Dow Jones News

By Allison Prang

American Express Co. is seeing consumer spending start to

normalize as Covid-19 vaccinations pick up in the U.S. a year into

the pandemic.

Spending in travel and entertainment categories last month rose

40% from February and bookings through American Express Travel

jumped by 50% in the first quarter compared with the fourth

quarter, Chief Financial Officer Jeff Campbell said in an interview

Friday. He also said the number of people signing up for the

company's co-branded cards with Delta Air Lines rose 90% in the

quarter compared with the fourth quarter.

Card companies took a hit over the past year as lockdowns to

stop the spread of the coronavirus led to consumers spending less

on travel and entertainment.

Mr. Campbell said there is an inflection point around the

improving economy and increase in vaccinations.

"People are finally able to exercise the pent-up demand for

travel that we believed in the whole time," he said.

Billed business in the first quarter for goods and services rose

6% from a year earlier adjusted for currency fluctuations. That

business fell by half from a year earlier for the travel and

entertainment category for the entire quarter, but it rose in March

compared with declines in January and February.

While travel and entertainment spending is showing signs of

improving, Mr. Campbell said the company doesn't think cross-border

travel will have fully returned to its 2019 level by 2022.

"In 2022, we're really assuming...that consumer travel and

entertainment spending is mostly back to where it was

pre-pandemic," Mr. Campbell said on the company's earnings call

Friday, adding that "domestic travel in the U.S. and around the

globe will be the fuel that gets us to that level."

Even as the economy and consumer behavior have started to

normalize, the company saw e-commerce spending still rise 23% year

over year.

"As that physical retail has come back it has not cannibalized

the growth we had seen in online and ecommerce," Mr. Campbell said

in the interview.

For the quarter, American Express had a provision expense

benefit of $675 million. The company's provision a year earlier to

cover potential credit losses was $2.62 billion.

Profit for the first quarter rose to $2.24 billion, up from $367

million a year earlier, and the company's earnings were $2.74 a

share, topping Wall Street's consensus according to FactSet of

$1.61 a share. A year ago, earnings were 41 cents a share.

Revenue at the company, net of interest expense, fell 12% to

$9.06 billion, while Wall Street was expecting $9.21 billion.

American Express shares were down 2.4% at $143.65.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

April 23, 2021 11:47 ET (15:47 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

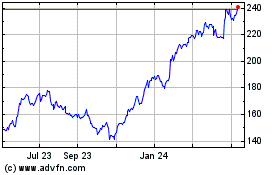

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

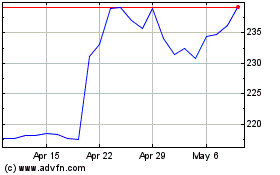

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024