UPS to Sell Freight Trucking Business to TFI for $800 Million

January 25 2021 - 12:09PM

Dow Jones News

By Jennifer Smith and Paul Ziobro

United Parcel Service Inc. agreed to sell its freight business

to rival TFI International Inc. for $800 million, saying it is

pulling out of the domestic trucking market to focus on the soaring

small package-delivery business.

The sale is one of the biggest strategic shifts by new Chief

Executive Carol Tomé since she took the position last June. She has

adopted a mantra of "better, not bigger" in assessing UPS's

operations, and jettisoning the freight business eliminates future

capital investments needed to keep the division competitive.

The agreement announced Monday would allow the business to

continue using UPS's domestic package network for five years to

fulfill shipments. TFI, which is based in Canada, provides similar

freight trucking services, as well as logistics services and parcel

shipping in Canada.

UPS Freight offers less-than-truckload services, in which cargo

from multiple shippers is combined in a single trailer, in all 50

states, Canada and Mexico. The business has about 14,500 employees,

80% of whom are full-time, UPS said.

The unit is the sixth-largest carrier by revenue in the U.S. LTL

market, behind carriers including FedEx Corp.'s FedEx Freight unit

and Old Dominion Freight Line Inc., according to SJ Consulting. UPS

Freight generated an estimated $3.15 billion in 2020 revenue, down

slightly from 2019, according to UPS. TFI, which has truckload,

less-than-truckload and logistics operations, reported revenue of

about $4.1 billion in 2019.

UPS on Monday said it expects to book a noncash impairment

charge of roughly $500 million before taxes for 2020. The deal is

expected to close in the second quarter.

UPS moved into the trucking market with its acquisition in 2005

of Overnite Corp. for $1.25 billion, then its largest-ever

acquisition. It said it decided to sell the business after

assessing its portfolio, enabling it to pay down long-term debt.

The delivery giant said it would retain historical pension assets

and liabilities, while pension benefits earned after closing will

be TFI's responsibility.

UPS and rival FedEx have faced huge increases in shipping volume

during the pandemic, as consumers have ordered everything from

their essential goods like toothpaste and toilet paper to bulky

items to outfit home offices and outdoor play sets. The carriers

have raised shipping rates and added new surcharges to offset the

higher costs, but it has had little effect in slowing demand for

online buying.

"As more and more parcel goes B2C [business-to-consumer], the

bundling with freight and parcel is less relevant," said Satish

Jindel, president of research firm SJ Consulting Group Inc. UPS's

freight "is mostly industrial and manufacturing."

The acquisition leaves UPS rival FedEx, whose FedEx Freight unit

has better operating margins than UPS Freight, as the biggest major

parcel shipper with a less-than-truckload operation, Mr. Jindel

said.

The Teamsters union represents some 11,000 UPS Freight workers

who ratified a five-year contract with the company in late

2018.

Write to Jennifer Smith at jennifer.smith@wsj.com and Paul

Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 25, 2021 11:54 ET (16:54 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

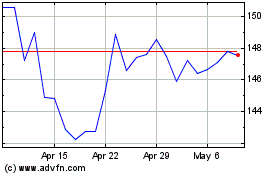

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

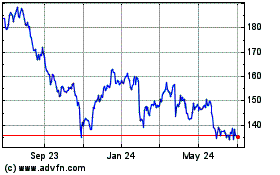

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024