Summerway Capital PLC Posting of Circular, Notice of GM and RPT (6779J)

December 23 2020 - 4:58AM

UK Regulatory

TIDMSWC

RNS Number : 6779J

Summerway Capital PLC

23 December 2020

23 December 2020

Summerway Capital Plc

("Summerway" or the "Company")

Posting of Circular and Notice of General Meeting and Related

Party Transaction

Further to the announcement on 15 December 2020 in relation to

the Company's proposal to amend its investing policy in conjunction

with proposed Board changes, a proposed subscription and issue of

warrants and a proposed share purchase by Vinodka (Vin) Murria, the

Board of Directors of Summerway Capital Plc (AIM: SWC) announce

that the Company is today posting a Circular to shareholders.

The Circular contains a notice convening a General Meeting of

the Company, at which certain resolutions in connection with the

new investing policy, authority to allot ordinary shares, and the

dis-application of pre-emption rights will be put to shareholders.

The meeting will be held at 10:00 a.m. on 15 January 2021 at the

offices of Nplus1 Singer Advisory LLP at 1 Bartholomew Lane, London

EC2N 2AX.

In light of the continuing uncertainty regarding the COVID-19

pandemic, and the UK Government's evolving restrictions on public

gatherings of persons from different households as well as social

distancing requirements, shareholders will not be permitted to

attend the General Meeting in person, save for those shareholders

of the Company required to be present in person for the purposes of

establishing a quorum (in person or by telephone conference), and

whose attendance has been pre-agreed with the Directors in

advance.

Shareholders are asked to vote by way of proxy in advance of the

General Meeting and are encouraged to appoint the Chairman of the

General Meeting as their proxy with their voting instructions.

The Company has received irrevocable undertakings from certain

shareholders and Directors to vote in favour of all Resolutions to

be put to shareholders at the forthcoming General Meeting, in

respect of their direct holdings, representing in aggregate 71.8%

of the Company's existing issued share capital.

The Circular and the Notice of General Meeting will also be

available for viewing on the Company's website at

www.summerwaycapital.co.uk.

Related Party Transaction

The Company proposes to take steps to amend its previously

disclosed Subsidiary Incentive Scheme.The amendments recognise the

proposed change in strategic direction of the Company and the

expectation that Ms Murria and others will be instrumental in

leading the execution of this revised strategy, and in turn, the

anticipated creation of Shareholder Value.

A summary of the proposed key amendments compared to the

original Subsidiary Incentive Scheme are set out in the following

table and included in the Circular.

Item Previous Subsidiary Amended Subsidiary

Incentive Scheme Incentive Scheme

--------------------------- ---------------------------- --------------------------

Percentage of Shareholder 10 per cent. Up to 20 per cent.

Value available to

Scheme Participants

(pre acquisition

of, or investment

in operating company)

--------------------------- ---------------------------- --------------------------

Target compound annual 13.5 per cent. 7.5 per cent.

growth rate hurdle

--------------------------- ---------------------------- --------------------------

Commencement date On Admission 15 January 2021

--------------------------- ---------------------------- --------------------------

Initial Value Market capitalisation Unchanged

on Admission

--------------------------- ---------------------------- --------------------------

Vesting period Three- to five-year Unchanged

period or upon a change

of control of the Company

or the Subsidiary

--------------------------- ---------------------------- --------------------------

Scheme Participants Alexander Anton - 333,333 Up to 2,000,000 (or

and respective B Benjamin Shaw - 333,333 such amount as equates

Share holdings Mark Farmiloe - 333,333 to 20 per cent. of

Shareholder Value)

to include Vin Murria

and each of the Founder

Directors and to be

allocated on a basis

to be determined

--------------------------- ---------------------------- --------------------------

It is anticipated that the Subsidiary Incentive Scheme will be

amended so as to take effect immediately and conditionally upon the

passing of the Resolutions at the General Meeting.

Alexander Anton, Benjamin Shaw and Mark Farmiloe (the "Founder

Directors") who are related parties as defined in the AIM Rules for

Companies (the "AIM Rules") will be parties to the amendments to

the Subsidiary Incentive Scheme. The proposed amendments to the

Subsidiary Incentive Scheme, insofar as they relate to the

participation of the Founder Directors, will constitute a related

party transaction under Rule 13 of the AIM Rules. They are expected

to result, inter alia, in a significant reduction in the individual

and collective entitlements of the Founder Directors under the

Subsidiary Incentive Scheme, in addition to which the Founder

Directors have agreed, conditional upon completion of the proposals

referred to above, to the termination, without compensation, of the

Corporate Advisory Agreement entered into between the Company and

AFS Advisors LLP (an entity wholly-owned by the Founder Directors)

as set out in paragraph 16.5 of the Admission Document. David

Firth, the Independent Non-Executive Director considers, having

consulted with the Company's nominated adviser, N+1 Singer, that

the terms of the proposed amendments to the Subsidiary Incentive

Scheme are fair and reasonable insofar as the Company's

Shareholders are concerned.

Terms used in this announcement shall have the same meaning as

those used in the Circular.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

For more information contact:Summerway Capital Plc

Mark Farmiloe, Executive Director +44 (0) 20 7440 7520

N+1 Singer (Nominated Adviser and Broker)

Sandy Fraser, Amanda Gray +44 (0) 207 496 3000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FUREANADASXEFEA

(END) Dow Jones Newswires

December 23, 2020 04:58 ET (09:58 GMT)

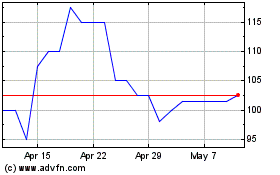

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Sep 2023 to Sep 2024