Current Report Filing (8-k)

September 18 2020 - 4:31PM

Edgar (US Regulatory)

FALSE000152962800015296282020-09-182020-09-1800015296282020-09-092020-09-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2020

SMART SAND, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-37936

|

|

45-2809926

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

1725 Hughes Landing Blvd, Suite 800

The Woodlands, Texas 77380

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 231-2660

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

SND

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement.

Equity Purchase and Sale Agreement

On September 18, 2020, Smart Sand, Inc. (the “Company”) entered into an Equity Purchase and Sale Agreement (the “Purchase Agreement”) with Eagle Materials Inc., a Delaware corporation (“Eagle”), pursuant to which the Company acquired all of the issued and outstanding limited liability company interests in Eagle Oil and Gas Proppants Holdings LLC, a Delaware limited liability company and wholly-owned subsidiary of Eagle (“Eagle Proppants Holdings”), from Eagle for aggregate consideration of $2.0 million, subject to customary purchase price adjustments as set forth in the Purchase Agreement (the “Transaction”). In satisfaction of the purchase price, the Company issued to Eagle 1,503,759 shares of the Company’s common stock, $0.001 par value per share (“Common Stock”). The number of shares of Common Stock isued in the Transaction was determined by the weighted average trading price of the Company's common stock over the twenty days preceding the date of the Purchase Agreement.

Prior to completion of the Transaction, Eagle Proppants Holdings and its subsidiaries (the “Eagle Proppants Group”) constituted the entirety of the assets and operations of Eagle’s oil and gas proppants segment. The primary assets of Eagle Proppants Holdings and its subsidiaries include frac sand mines and related processing facilities in Utica, Illinois and New Auburn, Wisconsin, with approximately 3.5 million tons of total annual processing capacity, 1.6 million tons of which has access to the BNSF rail line.

The Purchase Agreement includes customary representations, warranties, covenants and indemnities by the parties.

Loan and Security Agreement

In connection with the Company’s entry into the Purchase Agreement, the Company, as borrower, also entered into a Loan and Security Agreement (the “Loan Agreement”) with Eagle, as lender, and the Eagle Proppants Group, as guarantors, whereby Eagle will make loans in an aggregate amount up to $5.0 million (the “Loans”) during the twelve month period ending September 18, 2021 (the “Availability Period”). The Company may repay amounts outstanding under the Loans, including accrued interest, in cash, shares of Common Stock or a combination of cash and shares of Common Stock, provided that the aggregate amount of borrowings under the Loans repaid with shares of Common Stock may not at any time exceed 50% of the aggregate principal amount of total borrowings under the Loans repaid as of such date. Beginning with the calendar quarter ending December 31, 2021, the Company will be required to repay the aggregate outstanding principal amount of the Loans in quarterly installments in an amount equal to the outstanding principal amount of the Loans as of the last day of the Availability Period (after giving effect to any prepayments of the Loans occurring on such date) divided by twelve. To secure its obligations under the Loan Agreement, the Company granted Eagle a first priority perfected security interest in certain properties, rights and assets of the Eagle Proppants Group.

The foregoing descriptions of the Purchase Agreement and the Loan Agreement are not complete and are qualified in their entirety by reference to the full text of the Purchase Agreement and the Loan Agreement, which are filed as Exhibits 2.1 and 10.1, respectively, to this Current Report on Form 8-K and incorporated into this Item 1.01 by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The description contained in Item 1.01 in this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The description contained in Item 1.01 in this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The description contained in Item 1.01 in this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

Item 7.01 Regulation FD Disclosure.

The Company released presentation materials (the “Presentation Materials”) regarding the Transaction that management intends to use from time to time. The presentation materials are furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information furnished under Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

2.1

|

|

|

|

10.1

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SMART SAND, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

September 18, 2020

|

|

|

|

By:

|

|

/s/ Lee E. Beckelman

|

|

|

|

|

|

|

|

|

Lee E. Beckelman

|

|

|

|

|

|

|

|

|

Chief Financial Officer

|

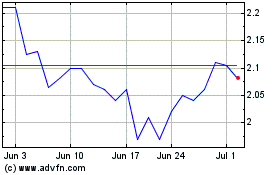

Smart Sand (NASDAQ:SND)

Historical Stock Chart

From Aug 2024 to Sep 2024

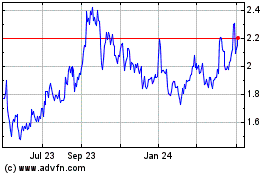

Smart Sand (NASDAQ:SND)

Historical Stock Chart

From Sep 2023 to Sep 2024