Current Report Filing (8-k)

August 21 2020 - 8:47AM

Edgar (US Regulatory)

false000076418000007641802020-08-202020-08-200000764180mo:CommonStock0.3313ParValueMember2020-08-202020-08-200000764180mo:CommonStock1.000NotesDue2023Member2020-08-202020-08-200000764180mo:CommonStock1.700NotesDue2025Member2020-08-202020-08-200000764180mo:CommonStock2.200NotesDue2027Member2020-08-202020-08-200000764180mo:CommonStock3.125NotesDue2031Member2020-08-202020-08-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________________________

FORM 8-K

________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 20, 2020

________________________________________________________________________________________________________________

ALTRIA GROUP, INC.

(Exact name of registrant as specified in its charter)

______________________________________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia

|

|

1-08940

|

|

13-3260245

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6601 West Broad Street,

|

Richmond,

|

Virginia

|

23230

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (804) 274-2200

_______________________________________________________________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbols

|

Name of each exchange on which registered

|

|

Common Stock, $0.33 1/3 par value

|

MO

|

New York Stock Exchange

|

|

1.000% Notes due 2023

|

MO23A

|

New York Stock Exchange

|

|

1.700% Notes due 2025

|

MO25

|

New York Stock Exchange

|

|

2.200% Notes due 2027

|

MO27

|

New York Stock Exchange

|

|

3.125% Notes due 2031

|

MO31

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 20, 2020, the Board of Directors (the “Board”) of Altria Group, Inc. (the “Company”) elected Jody L. Begley to become the Company’s Executive Vice President and Chief Operating Officer effective September 1, 2020.

Mr. Begley, age 49, currently serves as the Company’s Senior Vice President, Tobacco Products and has been continuously employed by the Company or its subsidiaries in various positions since 1995.

As a result of Mr. Begley’s election as Executive Vice President and Chief Operating Officer, his new salary band will be band B. The Compensation and Talent Development Committee of the Board set his annual base salary at $650,000. Mr. Begley’s annual incentive award plan, long-term incentive plan (“LTIP”) and annual equity award targets are consistent with current salary band B targets as follows: Mr. Begley’s annual incentive award plan target is 95% of base salary and his annual equity award target is $1.75 million. Once the transition to the overlapping three-year LTIP plans is complete, the target for Mr. Begley’s LTIP award will be 140% of his base salary. Prior to that time, his targets will be 183% of the 140% for the 2020-2022 performance period and 117% of the 140% for the 2021-2023 performance period.

The Company’s annual incentive award program, LTIP and other executive compensation programs are more fully described in the “Compensation Discussion and Analysis” section of the Company’s proxy statement for its 2020 Annual Meeting of Shareholders (filed with the Securities and Exchange Commission on April 2, 2020, as amended by the Company’s Supplement to Proxy Statement on Schedule 14A, filed with the Securities and Exchange Commission on April 17, 2020), which discussion is incorporated into this Item 5.02 by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

ALTRIA GROUP, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ W. HILDEBRANDT SURGNER, JR.

|

|

|

Name:

|

W. Hildebrandt Surgner, Jr.

|

|

|

Title:

|

Vice President, Corporate Secretary and

|

|

|

|

Associate General Counsel

|

DATE: August 21, 2020

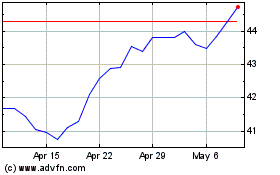

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

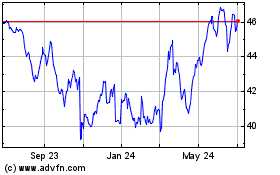

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024