Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 24 2019 - 5:02PM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant ¨

Filed

by a Party other than the Registrant þ

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| þ |

Definitive Additional Materials |

| o |

Soliciting Material Under Rule 14a-12 |

HomeStreet, Inc.

(Name of Registrant as Specified In Its

Charter)

Roaring

Blue Lion Capital Management, L.P.

Blue

Lion Opportunity Master Fund, L.P.

BLOF

II LP

Charles

W. Griege, Jr.

Ronald

K. Tanemura

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

| þ |

No fee required. |

| |

|

| o |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

On May 24, 2019, Roaring Blue Lion

Capital Management, L.P. (“Blue Lion”) issued a letter to shareholders of HomeStreet, Inc.

(“HomeStreet”) to highlight (1) the qualifications of its nominees—Charles W. Griege, Jr. and Ronald K.

Tanemura—to be elected to serve as directors of HomeStreet and (2) HomeStreet’s poor total shareholder return

performance. A copy of Blue Lion’s mailing is filed herewith as Exhibit 1.

Exhibit 1

VOTE THE BLUE PROXY CARD “ FOR " CHARLES GRIEGE AND RON TANEMURA To Refresh HomeStreet’s Board of Directors RONALD K. TANEMURA Charles Griege is the founder and Managing Partner of Blue Lion Capital which he started in 2005. > Investor in HomeStreet since 2012 > Over 25 years of capital markets experience and has been analyzing and investing in banks for over 30 years. > The returns generated from Blue Lion’s bank investments are excellent and speak to Mr. Griege’s ability to understand the intricacies of bank stock investing. > Four different public company bank executives have sent letters of recommendation to HomeStreet’s Board advocating for his addition. > HomeStreet’s decision to embrace several of Mr. Griege’s past recommendations is further evidence that Mr. Griege would be an excellent operational and strategic addition to HomeStreet’s Board of Directors. CHARLES W. GRIEGE, JR B LUE L ION C APITAL Blue Lion encourages its fellow shareholders to review its proxy materials and shareholder letters at www.FixHMST.com Ronald Tanemura has served as a director of post - reorganization Lehman Brothers Holdings Inc., since March 2012. > Has worked over the past seven years to unwind what is likely the most complex bankruptcy in the history of the financial markets. > Former Partner at Goldman Sachs, where he was the Global Co - Head of Credit Derivatives and a member of the Fixed Income, Currency and Commodities Risk Committee and Firmwide Credit Policy Committee. > Director of TPG Specialty Lending, Inc., a NYSE - listed middle - market business lender. Former director of ICE Clear Credit and ICE Clear Europe. > Mr. Tanemura’s broad experience in the financial services industry, his deep understanding of risk and his prior board experience including service at highly regulated financial companies, would make Mr. Tanemura an excellent corporate governance and strategic addition to the Board.

Important Information Blue Lion Capital, Roaring Blue Lion Capital Management, L.P., Blue Lion Opportunity Master Fund, L.P., BLOF II LP, Charles W . Griege, Jr. (collectively, "Blue Lion") and Ronald K. Tanemura (together with Blue Lion, the "Participants") have filed with the Securities and Exchange Commission (the "SEC") a definitive proxy statement and accompany ing form of proxy to be used in connection with the solicitation of proxies from shareholders of HomeStreet , Inc. (the "Company"). All shareholders of the Company are advised to read the definitive proxy statement and other document s r elated to the solicitation of proxies by the Participants, as they contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying pr oxy card is being furnished to some or all of the Company's shareholders and is, along with other relevant documents, available at no charge on the SEC website at http://www.sec.gov/ or from the Participants' proxy solicito r, Morrow Sodali , LLC. Information about the Participants and a description of their direct or indirect interests by security holdings is contained in the definitive proxy statement on Schedule 14A filed by Blue Lion with the SEC on May 16, 2019. This document is available free of charge from the sources indicated above. VOTE THE BLUE PROXY CARD “ FOR " CHARLES GRIEGE AND RON TANEMURA 509 MADISON AVENUE SUITE 1206 NEW YORK, NY 10022 Shareholders Call Toll Free: (800) 662 - 5200 | Banks & Brokers Call Collect: (203) 658 - 9400 | E - mail: BlueLion@morrowsodali.com If you have any questions or need assistance voting your shares, contact our proxy solicitor DON’T BE MISLED BY HOMESTREET’S PERFORMANCE CLAIMS HomeStreet doesn’t want shareholders to see that the Company’s one - , three - and five - year total shareholder return (TSR) is exceptionally poor on an absolute and relative basis . In absolute terms, the TSR over these periods (through December 31 , 2018 ) has been - 26 . 7 % , - 2 . 2 % and + 6 . 8 % , respectively . As the table below shows, HomeStreet has significantly underperformed every relevant peer group and index over these periods as well . The relative under - performance is astonishing . This table updates and replaces the table included in Blue Lion Capital’s letter to HomeStreet shareholders dated May 17, 2019. Source: Bloomberg, as of 12/31/2018; Pacific Northwest Peers: COLB, BANR, GBCI, HFWA; California Peers: PPBI, TCBK, WABC, CVB F; HomeSteet’s chosen peers reported in the Company’s Form 10 - K for fiscal year 2018, filed with the SEC on March 6, 2019. Total Shareholder Return Relative to Peers 1 - Year 3 - Year 5 - Year Pacific Northwest Peers - 26.0% - 48.4% - 51.0% California Peers - 16.1% - 31.4% - 25.8% HomeStreet’s Chosen Peers - 19.0% - 29.5% - 36.1% KBW Bank Index (BKX) - 9.0% - 27.6% - 31.0% KBW Regional Banking Index (KRX) - 9.2% - 19.1% - 20.1% S&P 500 Banks Industry (GICS 4010) - 10.2% - 29.5% - 41.5% Russell 2000 Index (RTY) - 15.6% - 25.9% - 17.2% S&P 500 Index (SPY) - 22.3% - 32.6% - 43.4%

This regulatory filing also includes additional resources:

srz203108-dfan14a.pdf

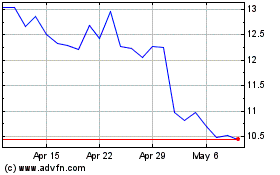

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Aug 2024 to Sep 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Sep 2023 to Sep 2024