Current Report Filing (8-k)

May 21 2019 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

May 15, 2019

|

Camber

Energy, Inc.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

(State or other jurisdiction

of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1415

Louisiana, Suite 3500, Houston, Texas 77002

(Address

of principal executive offices)

(210)

998-4035

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which

registered

|

|

Common

Stock, $0.001 Par Value Per Share

|

CEI

|

NYSE

American

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.02 Unregistered Sales of Equity Securities.

On

May 15, 2019, Camber Energy, Inc. (the “

Company

”, “

we

” and “

us

”) entered

into an Agreed Conversion Agreement (the “

Conversion Agreement

”) with Alan Dreeben, the then holder of all

44,000 shares of the Company’s then outstanding Series B Redeemable Convertible Preferred Stock (the “

Series B

Preferred Stock

”). Pursuant to the Conversion Agreement, Mr. Dreeben agreed to convert all of the Series B Preferred

Stock which he held into 503 shares of the Company’s common stock pursuant to the stated terms of such Series B Preferred

Stock, in consideration for $25,000 in cash. Mr. Dreeben also provided us a release in connection with certain of his rights under

the Series B Preferred Stock (including any and all accrued and unpaid dividends) and the prior December 2015 Asset Purchase Agreement

completed by the Company, of which Mr. Dreeben, who was formerly a member of our Board of Directors, was a seller.

As

a result of the Conversion Agreement, and subsequent to the issuance of the common stock shares due to Mr. Dreeben in connection

with the Series B Preferred Stock, which shares the Company plans to issue this week, the Company will have no shares of Series

B Preferred Stock issued or outstanding, and an aggregate of $1,100,000 of the liquidation preference of the Series B Preferred

Stock will be terminated and released.

One

of the reasons for entering into the Conversion Agreement was so that no shares of Series B Preferred Stock would be outstanding

upon the closing of our previously announced planned acquisition of a midstream and downstream pipeline integrity services, specialty

construction and field services company.

The

foregoing description of the Conversion Agreement does not purport to be complete and is qualified in its entirety by reference

to the Conversion Agreement, a copy of which is attached as

Exhibit 10.1

to this Current Report on Form 8-K and incorporated

herein by reference.

We

claim an exemption from the registration requirements of the Securities Act of 1933, as amended (the “

Securities Act

”)

for the offer and sale of the securities under the Conversion Agreement pursuant to (a) Section 4(a)(2) of the Securities Act;

and/or (b) Rule 506(b) of the Securities Act, and the regulations promulgated thereunder. With respect to the transaction described

above, no general solicitation was made either by us or by any person acting on our behalf. The transaction was privately negotiated,

and did not involve any kind of public solicitation. No underwriters or agents were involved in the foregoing and we paid no underwriting

discounts or commissions.

Item 8.01

Other Events.

On

May 21, 2019, we filed a press release disclosing our entry into the Conversion Agreement. A copy of the press release is included

herewith as

Exhibit 99.1

and the information in the press release is incorporated by reference into this

Item

8.01

.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number

|

|

Description

of Exhibit

|

|

10.1

|

|

Agreed Conversion

Agreement dated May 15, 2019, by and between Camber Energy, Inc. and Alan Dreeben

|

|

99.1

|

|

Press release dated

May 21, 2019

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CAMBER ENERGY, INC.

|

|

|

|

|

|

By:

|

/s/

Robert Schleizer

|

|

|

Name:

|

Robert Schleizer

|

|

|

Title:

|

Chief Financial Officer

|

Date:

May 21, 2019

EXHIBIT

INDEX

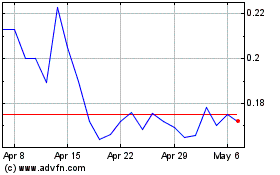

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Sep 2023 to Sep 2024