UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the

Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for

Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional

Materials

|

|

|

x

|

Soliciting Material Pursuant

to §240.14a-12

|

BIOSCRIP,

INC.

(Name of the Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table

below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

¨

Fee

paid previously with preliminary materials.

¨

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

BioScrip Teammates,

As we begin to plan for our integration with Option Care and

unlock the value potential of combining our two incredible companies, I would like to share a note from Option Care CEO, John Rademacher,

which you can find below. I am very enthusiastic about our future together with Option Care and look forward to creating a combined

organization that drives engagement and fulfilment for our teammates and is beneficial to all the patients and their families we

serve. This is just the beginning of our collective journey together. As we take this next step in our evolution, we are committed

to communicating with you and will share more information as it becomes available in the coming weeks and months.

Take care,

Dan

Daniel E Greenleaf

President and Chief Executive Officer

***

To All BioScrip Employees,

I hope this email finds you well. My name is John Rademacher

and as the CEO of Option Care, I am very excited to introduce Option Care to all of you and to share some of my thoughts on why

I am excited about the pending combination of our two great companies. I would also like to share a little information on my background

as well as some of the guiding principles for how we will operate and communicate through this critical integration process.

First, I would like to personall

y

thank Dan and the entire BioScrip executive team for their collaboration and partnership throughout this process. Without

the commitment and energy of this team, the opportunity to combine our companies would not be possible. And, I would like to thank

each of you. As I have gotten to know some of the leaders at BioScrip, when they speak about all of you, the passion and commitment

you exemplify shines through. We are excited to further our partnership with you as we combine organizations and create an industry-leading

company focused on delivering extraordinary care.

As quick background, I have nearly two decades of experience

in various aspects of the healthcare industry with significant operational and public company expertise. I have been with Option

Care since 2015, and served as CEO since 2017. In my time at Option Care, we have created a culture based on compassionate care,

a commitment to quality and the deep engagement of our teams. Our investments into our people, process, technology and facilities

has been focused on driving the highest standards of quality, superior clinical outcomes and continuous improvement in the delivery

of services to patients, healthcare providers, payors and manufacturers. Our passionate people are at the center of everything

we do, and we fully understand the immense responsibility that we have to deliver hope to our patients.

This integration is exciting because it brings together two

leading organizations with proud histories and thousands of great employees dedicated to creating a best-in-class experience for

our patients and their families. At the center of both organizations is deep clinical expertise and a passion to deliver extraordinary

care. As a combined company, we will be uniquely positioned to provide high-quality, cost-effective patient care, allowing us to

be the partner of choice for payors, hospitals and patients. We will have the reach to serve 96% of the U.S. population and deliver

hope to more families than either organization is able to do on its own.

To ensure that we are developing comprehensive plans for integrating

our two businesses, and in anticipation of gaining regulatory and shareholder approvals, we have created an Integration Management

Office (“IMO”) with the partnership of Boston Consulting Group. The IMO kicked off with meetings with the entire BioScrip

executive team a few weeks ago followed up by an in-person meeting in early May with the Area Vice Presidents and key leaders from

the Sales, Operations and Revenue Cycle Management teams. It is very important to me that both the BioScrip and Option Care voices

are a part of this process and I will ensure we have meaningful and appropriate representation from both of our organizations.

As part of our plan to be “best in class,” we recently

asked you to fill out a brief cultural survey to help us better understand our respective ways of working, and to inform our plans

to effectively integrate our two companies. Preliminary results show that our two cultures are closely aligned and complimentary. Both

have compassionate cultures that connect our clinical expertise and company success to patient outcomes. Moreover, both value accountability,

nimble response and working with a focused drive to achieve our business goals.

Until closing, the two companies are and must remain separate

and independent.

I fully recognize that a pending merger of our two companies’

size can create anxiety in both organizations, and we are taking steps to make this transition as smooth as possible for all of

our colleagues. I also recognize that with our size, scale, and great market position, our combined organization will have unparalleled

opportunities for the future of healthcare. Our goal throughout our integration process is to share, understand, and incorporate

the “best of both organizations” so that our combined organization benefits from the most effective business processes,

quality of care standards, and talents of our outstanding people. Communication will be one of the most critical aspects to the

success of this integration and as such, we will be as open and transparent as possible. Our commitment to you is that we will

communicate openly and honestly to ensure everyone has the timely answers they need.

I look forward to sharing more information with you about this

exciting combination in the near future. Should you have any additional questions or comments throughout this process, please

do not hesitate to send an email to

BioScripTransaction@bioscrip.com.

All the best,

-jcr-

Passionate People, Partnering in Health

to Deliver Extraordinary Care.

ADDITIONAL INFORMATION AND WHERE

TO FIND IT

On April 30, 2019, BioScrip, Inc. (“BioScrip”

or the “Company”) filed with the Securities and Exchange Commission (“SEC”) a preliminary proxy statement

in connection with the proposed transaction. The definitive proxy statement will be sent to the stockholders of BioScrip and will

contain important information about the proposed transaction and related matters. INVESTORS AND SECURITY HOLDERS ARE URGED

AND ADVISED TO READ THE PRELIMINARY PROXY STATEMENT AND THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL

CONTAIN IMPORTANT INFORMATION. The proxy statement and other relevant materials (when they become available) and any other

documents filed by the Company with the SEC may be obtained free of charge at the SEC’s website, at

www.sec.gov

.

In addition, security holders will be able to obtain free copies of the proxy statement and other relevant materials from the

Company by contacting Investor Relations by mail at 1600 Broadway, Suite 700, Denver, CO 80202, Attn: Investor Relations, by telephone

at (720) 697-5200, or by going to the Company’s Investor Relations page on its corporate web site at

https://investors.bioscrip.com

.

PARTICIPANTS IN THE SOLICITATION

The Company and its directors and executive

officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the matters discussed

above. Information about the Company’s directors and executive officers is set forth in the Proxy Statement on Schedule

14A for the Company’s 2019 annual meeting of stockholders, which was filed with the SEC on April 30, 2019. This document

can be obtained free of charge from the sources indicated above. Information regarding the ownership of the Company’s

directors and executive officers in the Company’s securities is included in the Company’s SEC filings on Forms 3,

4, and 5, which can be found through the SEC’s website at

www.sec.gov

.

Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise, is contained in the preliminary proxy statement and will be contained in the definitive proxy

statement and other relevant materials to be filed with the SEC when they become available.

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Aug 2024 to Sep 2024

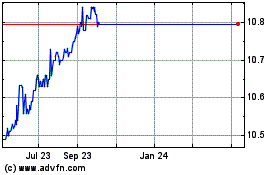

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Sep 2023 to Sep 2024