Approximately $3.6 Billion in New U.S. Direct

Lending Commitments Closed in the First Quarter

Ares Management Corporation (NYSE:ARES) is providing details on

certain new financing commitments made across its U.S. direct

lending strategies. During the first quarter, the Credit Group

closed approximately $3.6 billion in commitments across 45

transactions.

Below is a description of selected transactions that funds

managed by the Ares Credit Group (collectively “Ares”) closed

during the first quarter.

Alera Group / Genstar Capital

Ares served as administrative agent and lead arranger for a

senior secured credit facility to support the company’s organic and

inorganic growth strategy. Sponsored by Genstar Capital, Alera

Group is an independent national insurance and financial services

firm helping clients achieve exceptional outcomes in employee

benefits, property & casualty, risk management and wealth

management.

athenaHealth, Inc. / Veritas Capital & Evergreen Coast

Capital

Ares served as the first lien joint lead arranger and joint

bookrunner and second lien administrative agent and bookrunner for

a senior secured credit facility to support Veritas Capital and

Evergreen Coast Capital’s acquisition of athenaHealth. athenaHealth

provides electronic health record and revenue cycle management

services to the ambulatory healthcare market in the U.S.

Avetta / Welsh, Carson, Anderson & Stowe

Ares served as the administrative agent for a senior secured

credit facility to support the strategic acquisition of BROWZ by

Avetta, a WCAS portfolio company. The combination of Avetta and

BROWZ forms a market-leading SaaS-based supply chain risk

management software platform, which focuses on driving workplace

safety and compliance by electronically vetting and prequalifying a

network of contractors and suppliers and connecting them to global

enterprise customers who primarily operate within industrial end

markets.

Five Star Food Service / Freeman Spogli & Co.

Ares served as the administrative agent, collateral agent, joint

lead arranger and joint bookrunner for a senior secured credit

facility to support Freeman Spogli & Co.’s acquisition of Five

Star Food Service. Five Star is a leading provider of self-checkout

micro markets, automated retail vending services, office coffee and

water solutions, and cafeteria and catering services to corporate

and institutional customers throughout the Southeastern United

States.

IntraPac / ONCAP

Ares served as the administrative agent and collateral agent for

a senior secured credit facility to support a strategic acquisition

by IntraPac and ONCAP’s business plan for the company. IntraPac is

a leading designer and manufacturer of a diversified set of

specialty rigid packing solutions.

Invoice Cloud / General Atlantic

Ares served as the administrative agent, joint lead arranger and

joint lead bookrunner for a senior secured credit facility to

support General Atlantic’s acquisition of Invoice Cloud. Invoice

Cloud is a collection of SaaS-based customer engagement software

assets, primarily focused on electronic payments and processing

related solutions.

Perforce Software / Clearlake Capital

Ares served as a joint lead arranger and joint lead bookrunner

for a senior secured credit facility to support Clearlake Capital’s

simultaneous acquisition and merger of Rogue Wave Software with

Perforce Software, an existing Clearlake portfolio company. The

combined company, Perforce, is a leading provider of enterprise

scale software solutions to technology developers and development

operations teams requiring productivity, visibility, and scale

during all phases of the software development lifecycle.

Pritchard Industries / Alvarez & Marsal Capital

Partners

Ares served as the administrative agent for a senior secured

credit facility to support a strategic acquisition by Pritchard

Industries. Sponsored by Alvarez & Marsal Capital Partners,

Pritchard Industries is a leading provider of facilities services,

delivering a wide-range of janitorial and specialty services to

commercial office buildings, education and government facilities,

sports/entertainment venues, medical complexes and industrial

facilities.

RTI Surgical / Water Street Healthcare Partners

Ares served as the lead arranger, bookrunner, and administrative

agent for a senior secured term loan to support RTI Surgical’s

acquisition of Paradigm Spine. Sponsored by Water Street Healthcare

Partners, RTI is a leading global surgical implant company

providing surgeons with biologic, metal and synthetic implants.

Ultimus Group / GTCR, LLC

Ares served as the joint lead arranger and joint bookrunner for

a senior secured credit facility to support GTCR’s simultaneous

acquisition and merger of Ultimus Fund Solutions and The Gemini

Companies. Ultimus and Gemini are both leading independent fund

administration platforms that address the entire spectrum of fund

lifecycle requirements for asset managers, public plans and

alternative funds, with capabilities spanning across fund

administration, accounting, transfer agency and shareholder

services.

About Ares Management Corporation

Ares Management Corporation is a publicly traded, leading global

alternative asset manager with approximately $137 billion of assets

under management as of March 31, 2019 and 18 offices in the United

States, Europe, Asia, Australia and the Middle East. Since its

inception in 1997, Ares has adhered to a disciplined investment

philosophy that focuses on delivering strong risk-adjusted

investment returns throughout market cycles. Ares believes each of

its three distinct but complementary investment groups in Credit,

Private Equity and Real Estate is a market leader based on assets

under management and investment performance. Ares was built upon

the fundamental principle that each group benefits from being part

of the greater whole. For more information, visit

www.aresmgmt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190503005077/en/

Ares Management CorporationCarl Drake, (888)

818-5298cdrake@aresmgmt.comorJohn Stilmar, (888)

818-5298jstilmar@aresmgmt.com

Media:Mendel Communications LLCBill Mendel,

212-397-1030bill@mendelcommunications.com

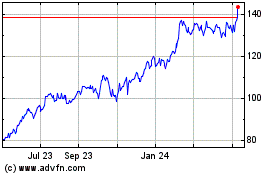

Ares Management (NYSE:ARES)

Historical Stock Chart

From Aug 2024 to Sep 2024

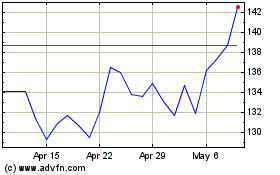

Ares Management (NYSE:ARES)

Historical Stock Chart

From Sep 2023 to Sep 2024