Oracle Advances In Cloud Business -- WSJ

December 18 2018 - 3:02AM

Dow Jones News

By Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 18, 2018).

Oracle Corp. reported flat revenue for its latest quarter, a

result better than what Wall Street had been expecting, as the

software giant made progress in a piece of its struggling cloud

business.

Analysts have been looking for signs of whether Oracle could

energize its cloud-computing business after revenue growth stalled

in the first quarter and Thomas Kurian, the top cloud-computing

executive, left for rival Alphabet Inc.'s Google.

Revenue in Oracle's largest segment -- its cloud services and

license support -- rose to a stronger-than-projected $6.64 billion

in the quarter ended Nov. 30. Overall, Oracle generated $9.56

billion revenue, compared with $9.59 billion a year earlier.

Oracle changed how it reports its quarterly financial results

this year, mixing its cloud-computing business, which had been

growing more slowly than that of competitors, with its

licensing-support business. The change makes it harder to track

performance of the cloud business.

Shares, which closed Monday down 2% at $45.73, rose 6% to $48.55

in post-market trading, though company officials gave a tepid

financial forecast for the current quarter.

The software giant expects revenue in the third quarter to

increase 2% to 4%, excluding currency fluctuations. That would

translate to another quarter of, at best, flat revenue when

factoring in Oracle's projected 4% impact from currency

conversion.

Oracle officials sought to reassure investors about the cloud

business during a Monday conference call with analysts,

highlighting strong software-as-a-service bookings in the latest

period and Oracle's competitive edge from its autonomous

database.

"We need more than just a great database," said Larry Ellison,

the company's co-founder, chairman and chief technology officer.

"We also need first-class infrastructure to run the database on,

and we know finally have that."

Overall, Oracle reported second-quarter profit rose 5% to $2.33

billion, or 61 cents a share. Excluding stock-based compensation

and other items, profit rose to 80 cents a share from 69 cents a

share.

Analysts surveyed by FactSet expected an adjusted profit of 78

cents a share on $9.52 billion in revenue.

Oracle made its business selling software that companies run in

their own databases, but has spent years trying to find its footing

in the fast-growing cloud, where companies are increasingly renting

computing power and storage.

To catch up with the likes of Amazon.com Inc., Microsoft Corp.

and Google, Oracle pledged to quadruple the number of its giant

data-center complexes over a two-year period.

The Redwood City, Calif., company has used its cash pile to

raise stock buybacks, which has helped offset the pressure of

disappointing financial results. Oracle has spent $19.92 billion to

buy back stock for the first half of the year, including about $10

billion on 203 million shares in the quarter that ended in

November.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

December 18, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

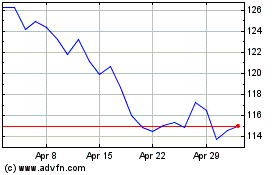

Oracle (NYSE:ORCL)

Historical Stock Chart

From Aug 2024 to Sep 2024

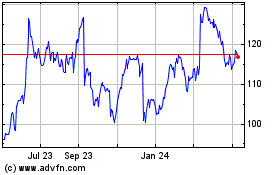

Oracle (NYSE:ORCL)

Historical Stock Chart

From Sep 2023 to Sep 2024