- Second-quarter reported net sales

totaled $1.4 billion, up 1.4 percent.

- Second-quarter GAAP earnings of

$0.31 per diluted share.

- Second-quarter adjusted

earnings1 of $0.39 per diluted share.

- Company generates $200.2 million of

cash flow from operating activities in first six months of fiscal

2019.

- Company reaffirms fiscal 2019 GAAP

earnings range of $0.84 to $0.94 per diluted share and adjusted

earnings1 range of $1.40 to $1.50 per diluted

share.

Patterson Companies, Inc. (Nasdaq: PDCO) today reported

consolidated net sales of approximately $1.4 billion (see attached

Sales Summary for further details) in its fiscal second quarter

ended October 27, 2018, an increase of 1.4 percent compared to the

same period last year. Internal sales, which are adjusted for the

effects of currency translation and changes in product selling

relationships, increased 1.8 percent.

Reported net income attributable to Patterson Companies, Inc.

for the second quarter of fiscal year 2019 was $28.9 million, or

$0.31 per diluted share, compared to net income attributable to

Patterson Companies, Inc. of $40.2 million, or $0.43 per diluted

share, in last year’s fiscal second quarter. Adjusted net income1

attributable to Patterson Companies, Inc., which excludes deal

amortization costs and integration and business restructuring

costs, totaled $36.3 million for the second quarter of fiscal 2019,

or $0.39 per diluted share, compared to $47.6 million in the same

quarter last year, or $0.51 per diluted share. The reported net

income and the adjusted net income attributable to Patterson

Companies, Inc. were both impacted by the decrease in operating

margins within the Dental segment.

“Our second quarter results met our expectations and we continue

to make progress on our focused initiatives to improve performance

and build a stronger Patterson,” said Mark Walchirk, president and

CEO of Patterson Companies. “While we still have much work ahead,

our team has delivered two consecutive quarters of year-over-year

revenue growth, operating margin improvement from the fiscal first

quarter and continued strong cash flow generation. As a result, we

are reaffirming our fiscal 2019 guidance.”

Patterson Animal Health

Reported net sales in our Animal Health segment for the second

quarter of fiscal 2019, which comprised approximately 61 percent of

the company’s total sales, were $855.4 million compared to $823.6

million in the same quarter last year. Internal sales for the

segment increased 4.5 percent from the fiscal 2018 second

quarter.

Patterson Dental

Reported net sales in our Dental segment for the second quarter

of fiscal 2019, which represented approximately 39 percent of total

company sales, were $542.5 million compared to $553.6 million in

the same quarter last year. Internal sales declined 1.8 percent

compared to the fiscal 2018 second quarter.

Balance Sheet and Capital Allocation

For the first six months of fiscal 2019, Patterson Companies

generated $200.2 million of cash from operating activities and

collected deferred purchase price receivables of $165.6 million for

a total of $365.8 million, compared to a total of $101.7 million in

the same period last year. During the first six months of fiscal

2019, debt has been reduced by $196.3 million and cash has grown by

$102.5 million.

In the second quarter of fiscal 2019, Patterson Companies paid

$24.7 million in cash dividends to shareholders. On a year-to-date

basis, Patterson has returned $50.0 million in cash dividends to

shareholders.

Year-to-Date Results

Consolidated net sales for the first six months of fiscal 2019

totaled $2.7 billion, a 1.9 percent year-over-year increase.

Reported net income attributable to Patterson Companies, Inc. was

$24.4 million, or $0.26 per diluted share, compared to $71.1

million, or $0.76 per diluted share in last year's period. In July

2018, Patterson Companies booked a pre-tax reserve of $28.3 million

for the anticipated settlement of purported class action antitrust

litigation.

Adjusted net income1 attributable to Patterson Companies, Inc.,

which excludes deal amortization costs, integration and business

restructuring costs and legal reserve costs, totaled $60.3 million,

or $0.65 per diluted share, compared to adjusted net income of

$89.0 million, or $0.95 per diluted share, in the year-ago

period.

FY2019 Guidance

Patterson Companies today reaffirmed fiscal 2019 earnings

guidance, which is provided on both a GAAP and non-GAAP adjusted1

basis:

- GAAP earnings are expected to be in the

range of $0.84 to $0.94 per diluted share.

- Non-GAAP adjusted earnings1 are

expected to be in the range of $1.40 to $1.50 per diluted

share.

- Our non-GAAP adjusted earnings1

guidance excludes the after-tax impact of:- Deal amortization

expenses of approximately $31.1 million ($0.33 per diluted share).-

Legal reserve costs of approximately $20.7 million ($0.22 per

diluted share).

Our guidance is for current operations as well as completed or

previously announced acquisitions and does not include the impact

of potential future acquisitions or similar transactions, if any,

or impairments and material restructurings beyond those previously

publicly disclosed. Our guidance assumes North American and

international market conditions similar to those experienced in

fiscal 2018.

1Non-GAAP Financial Measures

The Reconciliation of GAAP to non-GAAP Measures table appearing

behind the accompanying financial information is provided to adjust

reported GAAP measures, namely operating income, income before

taxes, income tax expense, net income, net income attributable to

Patterson Companies, Inc. and diluted earnings per share

attributable to Patterson Companies, Inc., for the impact of deal

amortization, integration and business restructuring expenses and

legal reserve costs along with the related tax effects of these

items.

Management believes that these non-GAAP measures may provide a

helpful representation of the company's second-quarter performance

and earnings guidance, and enable comparison of financial results

between periods where certain items may vary independent of

business performance. These non-GAAP financial measures are

presented solely for informational and comparative purposes and

should not be regarded as a replacement for corresponding,

similarly captioned, GAAP measures.

In addition, the term “internal sales” used in this release

represents net sales adjusted to exclude foreign currency impact

and changes in product selling relationships. Foreign currency

impact represents the difference in results that is attributable to

fluctuations in currency exchange rates the company uses to convert

results for all foreign entities where the functional currency is

not the U.S. dollar. The company calculates the impact as the

difference between the current period results translated using the

current period currency exchange rates and using the comparable

prior period's currency exchange rates. The company believes the

disclosure of net sales changes in constant currency provides

useful supplementary information to investors in light of

significant fluctuations in currency rates.

Second-Quarter Conference Call and Replay

Patterson Companies’ fiscal 2019 second-quarter earnings

conference call will start at 10 a.m. Eastern today. Investors can

listen to a live webcast of the conference call at

www.pattersoncompanies.com. The conference call will be archived on

the Patterson Companies website. A replay of the fiscal 2019

second-quarter conference call can be heard for one week at

800-585-8367 and by providing the Conference ID 5359197 when

prompted.

About Patterson Companies Inc.

Patterson Companies Inc. (Nasdaq: PDCO) is a

value-added distributor serving the dental and animal health

markets.

Dental Market

Patterson’s Dental segment provides a virtually complete range

of consumable dental products, equipment and software, turnkey

digital solutions and value-added services to dentists and dental

laboratories throughout North America.

Animal Health Market

Patterson’s Animal Health segment is a leading

distributor of products, services and technologies to both the

production and companion animal health markets in North

America and the U.K.

This press release contains certain forward-looking statements,

as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

Patterson's ability to control. Forward-looking statements

generally can be identified by words such as "believes," "expects,"

"anticipates," "foresees," "forecasts," "estimates" or other words

or phrases of similar import. It is uncertain whether any of the

events anticipated by the forward-looking statements will transpire

or occur, or if any of them do, what impact they will have on the

results of operations and financial condition of Patterson or the

price of Patterson stock. These forward-looking statements involve

certain risks and uncertainties that could cause actual results to

differ materially from those indicated in such forward-looking

statements. Such risks and uncertainties include, without

limitation, operations disruptions attributable to our enterprise

resource planning system implementation; our ability to attract or

retain qualified sales representatives and service technicians who

relate directly with our customers; the reduction, modification,

cancellation or delay of purchases of innovative, high-margin

equipment; material changes in our purchasing relationships with

suppliers; changes in general market and economic conditions; and

the other risks and important factors contained and identified in

Patterson's filings with the Securities and Exchange Commission,

such as its Quarterly Reports on Form 10-Q and Annual Reports on

Form 10-K, any of which could cause actual results to differ

materially from the forward-looking statements. Any forward-looking

statement in this press release speaks only as of the date on which

it is made. Except to the extent required under the federal

securities laws, Patterson does not intend to update or revise the

forward-looking statements.

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended Six Months Ended October

27, 2018 October 28, 2017

October 27, 2018 October 28,

2017 Net sales $ 1,404,752 $ 1,385,737 $ 2,741,072 $

2,689,852 Gross profit 295,076 315,743 578,739 614,791

Operating expenses 253,860 243,984 533,009

486,199 Operating income 41,216 71,759 45,730

128,592 Other income (expense): Other income, net 5,941

1,160 7,194 2,672 Interest expense (9,456 ) (11,468 ) (20,677 )

(22,671 ) Income before taxes 37,701 61,451 32,247 108,593

Income tax expense 9,055 21,207 8,110

37,502 Net income 28,646 40,244 24,137 71,091 Net

loss attributable to noncontrolling interests (223 ) — (276

) — Net income attributable to Patterson Companies, Inc. $

28,869 $ 40,244 $ 24,413 $ 71,091

Earnings per share attributable to Patterson Companies,

Inc.: Basic $ 0.31 $ 0.43 $ 0.26 $ 0.76

Diluted $ 0.31 $ 0.43 $ 0.26 $ 0.76

Weighted average shares: Basic 92,683 92,722 92,606

93,037 Diluted 93,289 93,351 93,144 93,683 Dividends

declared per common share $ 0.26 $ 0.26 $ 0.52 $ 0.52

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

October 27, 2018 April 28, 2018

ASSETS Current assets: Cash and cash equivalents $

165,515 $ 62,984 Receivables 571,232 826,877 Inventory 792,533

779,834 Prepaid expenses and other current assets 176,019

103,029 Total current assets 1,705,299 1,772,724 Property and

equipment, net 289,602 290,590 Goodwill and other intangible assets

1,182,533 1,205,401 Long-term receivables, net and other 166,820

202,949 Total assets $ 3,344,254 $ 3,471,664

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable $ 662,731 $ 610,368 Other accrued liabilities

225,903 205,415 Current maturities of long-term debt 80,286 76,598

Borrowings on revolving credit — 16,000 Total current

liabilities 968,920 908,381 Long-term debt 738,341 922,030 Other

non-current liabilities 181,305 179,463 Total liabilities

1,888,566 2,009,874 Stockholders' equity 1,455,688 1,461,790

Total liabilities and stockholders' equity $ 3,344,254 $

3,471,664

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended October 27, 2018

October 28, 2017 Operating

activities: Net income $ 24,137 $ 71,091 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 41,926 41,833 Non-cash employee

compensation 13,926 16,635 Deferred consideration in securitized

receivables (165,567 ) (24,581 )

Change in assets and liabilities, net of

acquired

285,792 (27,870 ) Net cash provided by operating activities

200,214 77,108

Investing activities: Additions to property

and equipment (22,094 ) (16,431 ) Collection of deferred purchase

price receivables 165,567 24,581 Other investing activities 2,875

11,626 Net cash provided by investing activities

146,348 19,776

Financing activities: Dividends paid (49,980

) (49,969 ) Repurchases of common stock — (71,254 ) Retirement of

long-term debt (180,321 ) (7,377 ) Draw on (payment on) revolving

credit (16,000 ) 33,000 Other financing activities 3,592

3,561 Net cash used in financing activities (242,709 )

(92,039 ) Effect of exchange rate changes on cash (1,322 ) 1,652

Net change in cash and cash equivalents $ 102,531 $

6,497

PATTERSON COMPANIES, INC.

SALES SUMMARY

(Dollars in thousands)

(Unaudited)

October 27, 2018 October 28,

2017 TotalSales Growth

ForeignExchange Impact Other (a)

Internal SalesGrowth

Three Months

Ended

Consolidated net sales Consumable $ 1,138,251 $ 1,116,091

2.0 % (0.4 )% (0.1 )% 2.5 % Equipment and software 182,120 181,337

0.4 (0.2 ) — 0.6 Other 84,381 88,309 (4.4 ) (0.2 ) —

(4.2 ) Total $ 1,404,752 $ 1,385,737 1.4 %

(0.3 )% (0.1 )% 1.8 % Dental Consumable $ 303,806 $ 311,217

(2.4 )% (0.2 )% — % (2.2 )% Equipment and software 167,686 169,513

(1.1 ) (0.2 ) — (0.9 ) Other 71,024 72,900 (2.6 )

(0.2 ) — (2.4 ) Total $ 542,516 $ 553,630 (2.0

)% (0.2 )% — % (1.8 )% Animal Health Consumable $ 834,445 $

804,874 3.7 % (0.4 )% (0.2 )% 4.3 % Equipment and software 14,434

11,824 22.1 — — 22.1 Other 6,529 6,885 (5.2 ) (0.3 )

— (4.9 ) Total $ 855,408 $ 823,583 3.9 % (0.4

)% (0.2 )% 4.5 % Corporate Other $ 6,828 $ 8,524

(19.9 )% — % — % (19.9 )% Total $ 6,828 $ 8,524

(19.9 )% — % — % (19.9 )%

(a) Sales of certain products previously recognized on a gross

basis were recognized on a net basis during the three and six

months ended October 27, 2018.

PATTERSON COMPANIES, INC.

SALES SUMMARY

(Dollars in thousands)

(Unaudited)

October 27, 2018 October 28,

2017 TotalSales Growth

ForeignExchange Impact Other (a)

Internal SalesGrowth

Six Months

Ended

Consolidated net sales Consumable $ 2,247,648 $ 2,196,196

2.3 % 0.1 % (0.2 )% 2.4 % Equipment and software 329,018 318,286

3.4 (0.1 ) — 3.5 Other 164,406 175,370 (6.3 ) —

— (6.3 ) Total $ 2,741,072 $ 2,689,852

1.9 % 0.1 % (0.2 )% 2.0 % Dental Consumable $ 608,045 $

631,395 (3.7 )% — % — % (3.7 )% Equipment and software 302,643

297,376 1.8 (0.1 ) — 1.9 Other 137,892 143,666 (4.0 )

— — (4.0 ) Total $ 1,048,580 $ 1,072,437

(2.2 )% — % — % (2.2 )% Animal Health Consumable $

1,639,603 $ 1,564,801 4.8 % 0.1 % (0.3 )% 5.0 % Equipment and

software 26,375 20,910 26.1 — — 26.1 Other 14,644 14,008

4.5 0.7 — 3.8 Total $ 1,680,622

$ 1,599,719 5.1 % 0.1 % (0.3 )% 5.3 %

Corporate Other $ 11,870 $ 17,696 (32.9 )% — % — %

(32.9 )% Total $ 11,870 $ 17,696 (32.9 )% — % — %

(32.9 )%

(a) Sales of certain products previously recognized on a gross

basis were recognized on a net basis during the three and six

months ended October 27, 2018.

PATTERSON COMPANIES, INC.

OPERATING INCOME BY SEGMENT

(In thousands)

(Unaudited)

Three Months Ended Six Months Ended October

27, 2018 October 28, 2017

October 27, 2018 October 28,

2017 Operating income (loss) Dental $ 41,594 $ 65,207

$ 77,467 $ 124,726 Animal Health 22,031 23,217 41,063 39,893

Corporate (22,409 ) (16,665 ) (72,800 ) (36,027 ) Total $ 41,216

$ 71,759 $ 45,730 $ 128,592

PATTERSON COMPANIES, INC.

RECONCILIATION OF GAAP TO NON-GAAP

MEASURES

(Dollars in thousands, except per share

amounts)

(Unaudited)

For the three months ended October 27, 2018

GAAP

Dealamortization

Integration

andbusinessrestructuringexpenses

Legal reserve Non-GAAP Operating income $ 41,216 $

9,715 $ — $ — $ 50,931 Other expense, net (3,515 ) — —

— (3,515 ) Income before taxes 37,701 9,715 — —

47,416 Income tax expense 9,055 2,289 — —

11,344 Net income 28,646 7,426 — — 36,072 Net loss

attributable to noncontrolling interests (223 ) — — —

(223 ) Net income attributable to Patterson Companies, Inc.

$ 28,869 $ 7,426 $ — $ — $ 36,295

Diluted earnings per share attributable to Patterson

Companies, Inc.* $ 0.31 $ 0.08 $ — $ —

$ 0.39 Operating income as a % of sales 2.9 % 3.6 %

Effective tax rate 24.0 % 23.9 %

For the three months

ended October 28, 2017 GAAP

Dealamortization

Integration

andbusinessrestructuringexpenses

Legal reserve Non-GAAP Operating income $ 71,759 $

9,660 $ 1,688 $ — $ 83,107 Other expense, net (10,308 ) — —

— (10,308 ) Income before taxes 61,451 9,660 1,688 —

72,799 Income tax expense 21,207 3,346 638 —

25,191 Net income 40,244 6,314 1,050 — 47,608 Net

loss attributable to noncontrolling interests — — —

— — Net income attributable to Patterson

Companies, Inc. $ 40,244 $ 6,314 $ 1,050 $ —

$ 47,608 Diluted earnings per share

attributable to Patterson Companies, Inc.* $ 0.43 $ 0.07

$ 0.01 $ — $ 0.51 Operating

income as a % of sales 5.2 % 6.0 % Effective tax rate 34.5 % 34.6 %

* May not sum due to rounding

PATTERSON COMPANIES, INC.

RECONCILIATION OF GAAP TO NON-GAAP

MEASURES

(Dollars in thousands, except per share

amounts)

(Unaudited)

For the six months ended October 27, 2018 GAAP

Dealamortization

Integration

andbusinessrestructuringexpenses

Legal reserve Non-GAAP Operating income $ 45,730 $

19,681 $ — $ 28,263 $ 93,674 Other expense, net (13,483 ) —

— — (13,483 ) Income before taxes 32,247 19,681 —

28,263 80,191 Income tax expense 8,110 4,575 —

7,523 20,208 Net income 24,137 15,106 — 20,740 59,983

Net loss attributable to noncontrolling interests (276 ) — —

— (276 ) Net income attributable to Patterson

Companies, Inc. $ 24,413 $ 15,106 $ — $ 20,740

$ 60,259 Diluted earnings per share

attributable to Patterson Companies, Inc.* $ 0.26 $ 0.16

$ — $ 0.22 $ 0.65 Operating

income as a % of sales 1.7 % 3.4 % Effective tax rate 25.1 % 25.2 %

For the six months ended October 28, 2017 GAAP

Dealamortization

Integration

andbusinessrestructuringexpenses

Legal reserve Non-GAAP Operating income $ 128,592 $

19,290 $ 8,594 $ — $ 156,476 Other expense, net (19,999 ) —

— — (19,999 ) Income before taxes 108,593 19,290

8,594 — 136,477 Income tax expense 37,502 6,691 3,249

— 47,442 Net income 71,091 12,599 5,345 —

89,035 Net loss attributable to noncontrolling interests — —

— — — Net income attributable to

Patterson Companies, Inc. $ 71,091 $ 12,599 $ 5,345

$ — $ 89,035 Diluted earnings per share

attributable to Patterson Companies, Inc.* $ 0.76 $ 0.13

$ 0.06 $ — $ 0.95 Operating

income as a % of sales 4.8 % 5.8 % Effective tax rate 34.5 % 34.8 %

* May not sum due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181206005168/en/

John M. Wright, Investor RelationsPatterson Companies

Inc.john.wright@pattersoncompanies.compattersoncompanies.com

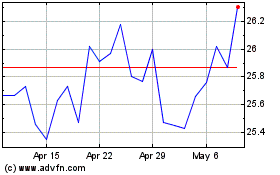

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

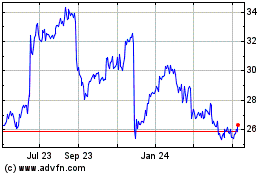

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Sep 2023 to Sep 2024