As filed with the Securities and Exchange Commission on November 26, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KOPIN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

|

04-2833935

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

incorporation or organization)

|

Identification Number)

|

125 North Drive

Westborough, MA 01581

(508) 870-5959

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John J. Concannon III, Esq.

Morgan, Lewis & Bockius LLP

One Federal Street

Boston, Massachusetts 02110

(617) 951-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer

☐

|

Accelerated filer

x

|

Non-accelerated filer

☐

|

Smaller reporting company

☐

Emerging growth company

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

☐

CALCULATION OF REGISTRATION FEE

(1)

|

|

|

|

|

|

|

Title of cash class of securities to be registered

|

Proposed maximum offering price

(1)(2)

|

Amount of registration fee

(2)

|

|

Common Stock

(3)

Preferred Stock

(4)

Warrants

(5)

Debt securities

(6)

|

|

|

|

Total

|

$100,000,000

|

$12,120

|

(1)In no event will the aggregate offering price of all securities issued from time to time by the registrant under this registration statement exceed $100,000,000 or its equivalent in any other currency, currency units, or composite currency or currencies. The securities covered by this registration statement to be sold by the registrant may be sold separately, together, or as units with other securities registered under this registration statement.

|

|

|

|

(2)

|

The proposed maximum aggregate price has been estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act, as amended.

|

|

|

|

|

(3)

|

Subject to note (1), this registration statement covers an indeterminate amount of common stock (with accompanying purchase rights, if any), as may be sold, from time to time, at indeterminate prices, by the registrant.

|

|

|

|

|

(4)

|

Subject to note (1), this registration statement covers an indeterminate number of shares of preferred stock (with accompanying purchase rights, if any), as may be sold, from time to time, at indeterminate prices, by the registrant. Also covered is such an indeterminate amount of common stock (with accompanying purchase rights, if any) (i) as may be issuable or deliverable upon conversion of shares of preferred stock, and (ii) as may be required for delivery upon conversion of shares of preferred stock as a result of anti-dilution provisions.

|

|

|

|

|

(5)

|

Subject to note (1), this registration statement covers an indeterminate amount and number of warrants representing rights to purchase common stock, preferred stock and debt securities registered under this registration statement, as may be sold, from time to time, at indeterminate prices by the registrant. Also covered is an indeterminate amount of common stock and preferred stock (in each case, with accompanying purchase rights, if any) and debt securities (i) as may be issuable or deliverable upon exercise of warrants and (ii) as may be required for delivery upon exercise of any warrants as a result of anti-dilution provisions.

|

|

|

|

|

(6)

|

Subject to note (1), this registration statement covers an indeterminate amount of debt securities, as may be sold, from time to time, at indeterminate prices by the registrant. If any debt securities are issued at an original issue discount, then the offering price shall be in such greater principal amount as shall result in an aggregate initial offering price not to exceed $100,000,000. Also covered is an indeterminate amount of common stock and preferred stock (in each case, with accompanying purchase rights, if any) (i) as may be issuable or deliverable upon exercise or conversion of debt securities and (ii) as may be required for delivery upon exercise or conversion of debt securities as a result of anti-dilution provisions.

|

We hereby amend this registration statement (the “Registration Statement”) on such date or dates as may be necessary to delay its effective date until we shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where such offer or sale is not permitted.

Subject to Completion, Dated November 26, 2018

PROSPECTUS

$100,000,000

KOPIN CORPORATION

Common Stock

Preferred Stock

Warrants

Debt Securities

We may offer or sell to the public from time to time in one or more series or issuances:

|

|

|

|

•

|

shares of our common stock;

|

|

|

|

|

•

|

shares of preferred stock;

|

|

|

|

|

•

|

warrants to purchase shares of our common stock, preferred stock and/or debt securities;

|

|

|

|

|

•

|

debt securities consisting of debentures, notes or other evidences of indebtedness; or

|

|

|

|

|

•

|

any combination of these securities.

|

This prospectus provides a general description of the securities that we may offer. Each time that securities are sold under this prospectus, we will provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. This prospectus may not be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement. You should read both this prospectus and the applicable prospectus supplement together with additional information described under the heading “Where You Can Find More Information” before you make your investment decision.

Securities sold under this prospectus shall be sold directly to purchasers or through agents on our behalf or through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commissions or discounts.

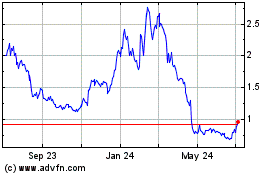

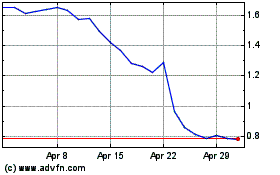

Our common stock is listed on the Nasdaq Global Market under the symbol “KOPN.” On November 23, 2018, the last reported sale price of our common stock was $1.71 per share.

Investing in these securities involves certain risks. See “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K, which is incorporated by reference into this prospectus, and “Risk Factors” in the applicable prospectus supplement, for a discussion of the factors you should carefully consider before purchasing these securities.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We may sell these securities on a continuous or delayed basis directly, through agents, dealers or underwriters as designated from time to time, or through a combination of these methods. We reserve the sole right to accept, and together with any agents, dealers and underwriters, reserve the right to reject, in whole or in part, any proposed purchase of securities. If any agents, dealers or underwriters are involved in the sale of any securities, the applicable prospectus supplement will set forth any applicable commissions or discounts. Our net proceeds from the sale of securities also will be set forth in the applicable prospectus supplement.

The date of this prospectus is , 2018.

ABOUT THIS PROSPECTUS

This prospectus is part of a “shelf” registration statement. Under this process, we may sell, at any time and from time to time, in one or more offerings, any combination of the securities described in this prospectus. The exhibits to our Registration Statement contain the full text of certain contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase the securities we offer, you should review the full text of these documents. The Registration Statement and the exhibits can be obtained from the Securities and Exchange Commission (“SEC”) as indicated under the heading “Where You Can Find More Information.”

This prospectus only provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that contains specific information about the terms of those securities and the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described below under the heading “Where You Can Find More Information.”

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference into this prospectus and any accompanying prospectus supplement. You must not rely upon any information or representation not contained or incorporated by reference into this prospectus or an accompanying prospectus supplement. This prospectus and the accompanying prospectus supplement, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement, if any, constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and any accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities are sold on a later date.

References in this prospectus to the terms “the Company,” “Kopin,” “we,” “our” and “us” or other similar terms mean Kopin Corporation and its subsidiaries, unless the context indicates otherwise.

THE COMPANY

Overview

Kopin Corporation is a leading developer and provider of innovative wearable technologies and critical components for integration into wearable computing systems for military, industrial and consumer products. Kopin’s technology portfolio includes ultra-small displays, optics, speech enhancement technology, voice-interface and hands-free control software, low-power ASICs, and ergonomically designed smart headset reference systems. Kopin’s proprietary components and technology are protected by more than 300 global patents and patents pending.

We were incorporated in Delaware in 1984 and are a leading inventor, developer, manufacturer and seller of technologies, components and systems for the smart headset wearable, military, thermal imager, 3D optical inspection system and training and simulation markets.

The mailing address of our principal executive offices is 125 North Drive Westborough, MA 01581. Our telephone number is (508) 870-5959.

RISK FACTORS

An investment in our securities involves risks. We urge you to consider carefully the risks described below, and in the documents incorporated by reference into this prospectus and, if applicable, in any prospectus supplement used in connection with an offering of our securities, before making an investment decision, including those risks identified under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 30, 2017 (the “2017 Form 10-K”), which is incorporated by reference into this prospectus and which may be amended, supplemented or superseded from time to time by other reports that we subsequently file with the SEC. Additional risks, including those that relate to any particular securities we offer, may be included in a prospectus supplement or free writing prospectus that we authorize from time to time, or that are incorporated by reference into this prospectus or a prospectus supplement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the other documents we have filed with the SEC that are incorporated herein by reference contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. Such forward-looking statements include statements made relating to our expectation that we will have negative cash flow from operating activities in 2018; our intention to continue to pursue U.S. government development contracts for applications that relate to our commercial product applications; our belief that it is important to retain personnel with experience and expertise relevant to our business; our belief that it is important to invest in research and development to achieve profitability even during periods when we are not profitable; our belief that the technical nature of our products and markets demands a commitment to close relationships with our customers; our belief that our wearable technology will be embraced by consumers and commercial users; our belief that our ability to develop and expand our wearable technologies and to market and license our concept systems and components will be critical for our revenue growth, positive cash flow, and profitability; our belief that a strengthening of the U.S. dollar could increase the price of our products in foreign markets; our expectation that the impact of the adoption of the new standard, ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), will be material to the Company’s revenues on an ongoing basis; our expectation is that our revenues for the fiscal year 2018 will be in the range of $24.5 million to $26.5 million; our belief that our future success will depend primarily upon the technical expertise, creative skills and management abilities of our officers and key employees rather than on patent ownership; our belief that our extensive portfolio of patents, trade secrets and non-patented know-how provides us with a competitive advantage in the wearable technologies market; our expectation not to pay cash dividends for the foreseeable future and to retain earnings for the development of our businesses; our expectation that we will expend between $1.0 million and $1.5 million on capital expenditures over the next twelve months; our belief that our available cash resources will support our operations and capital needs for at least the next twelve months; our expectation that we will incur taxes based on our foreign operations in 2018; our expectation that we will have a state tax provision in 2018; our statement that we do not have any immediate plans to repatriate the cash and marketable debt securities held in our foreign subsidiaries, other than Korea; our expectation that we would have foreign withholding at a rate of 16.5% if we were to repatriate foreign earnings from our Korean subsidiary and that no taxes would be paid in the U.S. upon repatriation as we currently expect such foreign earnings to be a return of capital; and our belief that the effect, if any, of reasonably possible near-term changes in interest rates on our financial position, results of operations, and cash flows should not be material.

Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “could,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause or contribute to such differences in outcomes and results include, but are not limited to any of those discussed under “Item 1A. Risk Factors” in our 2017 Form 10-K, and those set forth in our other periodic filings filed with the SEC. Except as required by the federal securities laws, we do not intend to update any forward-looking statements even if new information becomes available or other events occur in the future.

You should read this prospectus, any supplements to this prospectus and the documents that we incorporate by reference into this prospectus completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements, except as otherwise required by law. We advise you, however, to consult any further disclosures we make on related subjects in our future annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K we file with or furnish to the SEC.

USE OF PROCEEDS

Unless otherwise specified in a prospectus supplement accompanying this prospectus, the net proceeds from the sale of the securities to which this prospectus relates will be used for general corporate purposes. General corporate purposes may include repayment of debt, acquisitions, additions to working capital, capital expenditures, research and development, and investments in our subsidiaries. Net proceeds may be temporarily invested prior to use.

PLAN OF DISTRIBUTION

We may sell the offered securities in any of the ways described below or in any combination or any other way set forth in an applicable prospectus supplement from time to time:

|

|

|

|

•

|

to or through underwriters or dealers;

|

|

|

|

|

•

|

through one or more agents; or

|

•

directly to purchasers or to a single purchaser.

The distribution of the securities may be effected from time to time in one or more transactions:

|

|

|

|

•

|

at a fixed price, or prices, which may be changed from time to time;

|

|

|

|

|

•

|

at market prices prevailing at the time of sale;

|

|

|

|

|

•

|

at prices related to such prevailing market prices; or

|

•

at negotiated prices.

Each prospectus supplement will describe the method of distribution of the securities and any applicable restrictions.

The prospectus supplement with respect to the securities of a particular series will describe the terms of the offering of the securities, including the following:

|

|

|

|

•

|

the name or names of any underwriters, dealers or agents and the amounts of securities underwritten or purchased by each of them;

|

|

|

|

|

•

|

the public offering price of the securities and the proceeds to us and any discounts, commissions or concessions allowed or reallowed or paid to dealers; and

|

•

any securities exchanges on which the securities may be listed.

Any offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

Only the agents or underwriters named in each prospectus supplement are agents or underwriters in connection with the securities being offered thereby.

We may authorize underwriters, dealers or other persons acting as our agents to solicit offers by certain institutions to purchase securities from us pursuant to delayed delivery contracts providing for payment and delivery on the date stated in each applicable prospectus supplement. Each contract will be for an amount not less than, and the aggregate amount of securities sold pursuant to such contracts shall not be less nor more than, the respective amounts stated in each applicable prospectus supplement. Institutions with whom the contracts, when authorized, may be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and other institutions, but shall in all cases be subject to our approval. Delayed delivery contracts will be subject only to those conditions set forth in each applicable prospectus supplement, and each prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

Agents, underwriters and other third parties described above may be entitled to indemnification by us against certain civil liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), or to contribution from us with respect to payments which the agents, underwriters or other third parties may be required to make in respect thereof. Agents, underwriters and such other third parties may be customers of, engage in transactions with, or perform services for us in the ordinary course of business.

One or more firms, referred to as “remarketing firms,” may also offer or sell the securities, if a prospectus supplement so indicates, in connection with a remarketing arrangement upon their purchase. Remarketing firms will act as principals for their own accounts or as our agents. These remarketing firms will offer or sell the securities in accordance with the terms of the securities. Each prospectus supplement will identify and describe any remarketing firm and the terms of its agreement, if any, with us and will describe the remarketing firm’s compensation. Remarketing firms may be deemed to be underwriters in connection with the securities they remarket. Remarketing firms may be entitled under agreements that may be entered into with us to indemnification by us against certain civil liabilities, including liabilities under the Securities Act, and may be customers of, engage in transactions with or perform services for us in the ordinary course of business.

Certain underwriters may use this prospectus and any accompanying prospectus supplement for offers and sales related to market-making transactions in the securities. These underwriters may act as principal or agent in these transactions, and the sales will be made at prices related to prevailing market prices at the time of sale.

The securities we offer may be new issues of securities and may have no established trading market. The securities may or may not be listed on a securities exchange. Underwriters may make a market in these securities, but will not be obligated to do so and may discontinue any market making at any time without notice. We can make no assurance as to the liquidity of, or the existence of trading markets for, any of the securities.

Certain persons participating in an offering may engage in overallotment, stabilizing transactions, short covering transactions and penalty bids in accordance with rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Overallotment involves sales in excess of the offering size, which create a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a short covering transaction to cover short positions. Those activities may cause the price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities at any time.

We also may sell any of the securities through agents designated by us from time to time. We will name any agent involved in the offer or sale of these securities and will list commissions payable by us to these agents in the applicable prospectus supplement. These agents will be acting on a best efforts basis to solicit purchases for the period of its appointment, unless stated otherwise in the applicable prospectuses.

We may sell any of the securities directly to purchasers. In this case, we will not engage underwriters or agents in the offer and sale of these securities.

We may engage in sales deemed to be “at the market offerings” as defined in Rule 415 promulgated under the Securities Act, including sales made directly on or through the Nasdaq Global Market, the existing trading market for our common stock, sales made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices, and/or any other method permitted by law. The terms of such “at the market offerings” will be set forth in the applicable prospectus supplement. We may engage an agent to act as a sales agent in such “at the market offerings” on a best efforts basis using commercially reasonable efforts consistent with normal trading and sales practices, on mutually agreed terms between such agent and us. We will name any agent involved in such “at the market offerings” of securities and will list commissions payable by us to these agents in the applicable prospectus supplement.

In addition, we may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be named in the applicable prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus and an applicable prospectus supplement. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

The specific terms of any lock-up provisions in respect of any given offering will be described in the applicable prospectus supplement.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business for which they receive compensation.

GENERAL DESCRIPTION OF SECURITIES THAT WE MAY SELL

We may offer and sell, at any time and from time to time:

|

|

|

|

•

|

Shares of our common stock;

|

|

|

|

|

•

|

Shares of our preferred stock;

|

|

|

|

|

•

|

Warrants to purchase shares of our common stock, preferred stock and/or debt securities;

|

|

|

|

|

•

|

Debt securities consisting of debentures, notes or other evidences of indebtedness; or

|

|

|

|

|

•

|

Any combination of these securities.

|

The terms of any securities we offer will be determined at the time of sale. We may issue debt securities that are exchangeable for or convertible into common stock or any of the other securities that may be sold under this prospectus. When particular securities are offered, a supplement to this prospectus will be filed with the SEC, which will describe the terms of the offering and sale of the offered securities.

DESCRIPTION OF OUR COMMON STOCK

Our authorized capital stock consists of 120,000,000 shares of common stock, par value $.01 per share, and 3,000 shares of preferred stock, par value $.01 per share, which may be issued in one or more series. The following summary of the terms of our common stock is subject to and qualified in its entirety by reference to our charter and by-laws, copies of which are on file with the SEC as exhibits to previous SEC filings. Please refer to “Where You Can Find More Information” below for directions on obtaining these documents.

As of November 23, 2018, we had 76,611,502 shares of common stock outstanding and no shares of preferred stock outstanding.

General

Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights. An election of directors by our stockholders shall be determined by a plurality of the votes cast by the stockholders entitled to vote on the election. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our Board of Directors (the “Board”), subject to any preferential dividend rights of any outstanding preferred stock.

In the event of our liquidation or dissolution, the holders of common stock are entitled to receive proportionately all assets available for distribution to stockholders after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock. Holders of common stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of common stock are subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Our common stockholders will be entitled to receive dividends and distributions declared by the Board, to the extent permitted by any shares of our preferred stock that may then be outstanding and by our restated Certificate of Incorporation. If a dividend is declared, it will be distributed pro rata to our common stockholders on a per share basis.

If we are liquidated or dissolved, our common stockholders will be entitled to receive our assets and funds available for distribution to common stockholders in proportion to the number of shares they hold. Our common stockholders may not receive any assets or funds until our creditors have been paid in full and the preferential or participating rights of our preferred stockholders have been satisfied. If we participate in a corporate merger, consolidation, purchase or acquisition of property or stock, or other reorganization, any payments or shares of stock allocated to our common stockholders will be distributed pro rata to holders of our common stock on a per share basis. If we redeem, repurchase or otherwise acquire for payment any shares of our common stock, we will treat each share of common stock identically.

Holders of our common stock will not have any preemptive, subscription or conversion rights with respect to shares of our common stock. We may issue additional shares of our common stock, if authorized by the Board, without the common stockholders’ approval, unless required by Delaware law or a stock exchange on which our securities are traded. If we receive the appropriate payment, shares of our common stock that we issue will be fully paid and nonassessable.

The Nasdaq Global Market

Our common stock is listed on the Nasdaq Global Market under the symbol “KOPN.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

DESCRIPTION OF OUR PREFERRED STOCK

The Board may, without further action by our stockholders, from time to time, direct the issuance of shares of preferred stock in series and may, at the time of issuance, determine the rights, preferences and limitations of each series, including voting rights, dividend rights and redemption and liquidation preferences. Satisfaction of any dividend preferences of outstanding shares of our preferred stock would reduce the amount of funds available for the payment of dividends on shares of our common stock. Holders of shares of our preferred stock may be entitled to receive a preference payment in the event of any liquidation, dissolution or winding-up of our Company before any payment is made to the holders of shares of our common stock. In some circumstances, the issuance of shares of preferred stock may render more difficult or tend to discourage a merger, tender offer or proxy contest, the assumption of control by a holder of a large block of our securities or the removal of incumbent management. Upon the affirmative vote of the Board, without stockholder approval, we may issue shares of preferred stock with voting and conversion rights which could adversely affect the holders of shares of our common stock.

If we offer a specific class or series of preferred stock under this prospectus, we will describe the terms of the preferred stock in the prospectus supplement for such offering and will file a copy of the certificate establishing the terms of the preferred stock with the SEC. To the extent required, this description will include:

|

|

|

|

•

|

the title and stated value;

|

|

|

|

|

•

|

the number of shares offered, the liquidation preference per share and the purchase price;

|

|

|

|

|

•

|

the dividend rate(s), period(s) and/or payment date(s), or method(s) of calculation for such dividends;

|

|

|

|

|

•

|

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

|

|

|

|

|

•

|

the procedures for any auction and remarketing, if any;

|

|

|

|

|

•

|

the provisions for a sinking fund, if any; the provisions for redemption, if applicable;

|

|

|

|

|

•

|

any listing of the preferred stock on any securities exchange or market;

|

|

|

|

|

•

|

whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price (or how it will be calculated), the conversion period and any other terms of conversion (including any anti-dilution provisions, if any);

|

|

|

|

|

•

|

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price (or how it will be calculated), the exchange period and any other terms of exchange (including any anti-dilution provisions, if any);

|

|

|

|

|

•

|

voting rights, if any, of the preferred stock;

|

|

|

|

|

•

|

a discussion of any material U.S. federal income tax considerations applicable to the preferred stock;

|

|

|

|

|

•

|

the relative ranking and preferences of the preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the affairs of the Company;

|

|

|

|

|

•

|

any material limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the Company; and

|

|

|

|

|

•

|

any other affirmative, negative or other covenants or contractual rights which might be attendant with the specific class or series of preferred stock.

|

The preferred stock offered by this prospectus, when issued, will not have, or be subject to, any preemptive or similar rights.

Transfer Agent and Registrar

The transfer agent and registrar for any series or class of preferred stock will be set forth in each applicable prospectus supplement.

DESCRIPTION OF OUR WARRANTS

This section describes the general terms and provisions of our warrants to acquire our securities that we may issue from time to time. The applicable prospectus supplement will describe the specific terms of the warrants offered through that prospectus supplement.

We may issue warrants for the purchase of our debt securities, common stock or preferred stock or other securities issued by us. We may issue warrants independently or together with other securities, and they may be attached to or separate

from the other securities. We will file a copy of the warrant and warrant agreement with the SEC each time we issue a series of warrants, and these warrants and warrant agreements will be incorporated by reference into the Registration Statement of which this prospectus is a part. A holder of our warrants should refer to the provisions of the applicable warrant agreement and prospectus supplement for more specific information.

The applicable prospectus supplement will contain, where applicable, the following terms of and other information relating to the warrants:

|

|

|

|

•

|

the specific designation and aggregate number of, and the price at which we will issue, the warrants;

|

|

|

|

|

•

|

the currency or currency units in which the offering price, if any, and the exercise price are payable;

|

|

|

|

|

•

|

the designation, amount and terms of the securities purchasable upon exercise of the warrants;

|

|

|

|

|

•

|

if applicable, the exercise price for shares of our common stock and the number of shares of common stock to be received upon exercise of the warrants;

|

|

|

|

|

•

|

if applicable, the exercise price for shares of our preferred stock, the number of shares of preferred stock to be received upon exercise, and a description of that class or series of our preferred stock;

|

|

|

|

|

•

|

if applicable, the exercise price for our debt securities, the amount of our debt securities to be received upon exercise, and a description of that series of debt securities;

|

|

|

|

|

•

|

the date on which the right to exercise the warrants will begin and the date on which that right will expire or, if the warrants may not be continuously exercised throughout that period, the specific date or dates on which the warrants may be exercised;

|

|

|

|

|

•

|

whether the warrants will be issued in fully registered form or bearer form, in definitive or global form or in any combination of these forms, although, in any case, the form of a warrant included in a unit will correspond to the form of the unit and of any security included in that unit;

|

|

|

|

|

•

|

any applicable material U.S. federal income tax consequences;

|

|

|

|

|

•

|

the identity of the warrant agent for the warrants and of any other depositaries, execution or paying agents, transfer agents, registrars or other agents;

|

|

|

|

|

•

|

the proposed listing, if any, of the warrants or any securities purchasable upon exercise of the warrants on any securities exchange;

|

|

|

|

|

•

|

if applicable, the date from and after which the warrants and the common stock, preferred stock or debt securities will be separately transferable;

|

|

|

|

|

•

|

if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time;

|

|

|

|

|

•

|

information with respect to book-entry procedures, if any;

|

|

|

|

|

•

|

any redemption or call provisions;

|

|

|

|

|

•

|

whether the warrants are to be sold separately or with other securities as parts of units; and

|

|

|

|

|

•

|

any additional terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants.

|

After your warrants expire they will become void. All warrants will be issued in registered form. The prospectus supplement may provide for the adjustment of the exercise price of the warrants.

Warrants may be exercised at the appropriate office of the warrant agent or any other office indicated in the applicable prospectus supplement. Before the exercise of warrants, holders will not have any of the rights of holders of the securities purchasable upon exercise and will not be entitled to payments made to holders of those securities.

The warrant agreements may be amended or supplemented without the consent of the holders of the warrants to which it applies to effect changes that are not inconsistent with the provisions of the warrants and that do not materially and adversely affect the interests of the holders of the warrants. However, any amendment that materially and adversely alters the rights of the holders of warrants will not be effective unless the holders of at least a majority of the applicable warrants then outstanding approve the amendment. Every holder of an outstanding warrant at the time any amendment becomes effective, by continuing to hold the warrant, will be bound by the applicable warrant agreement as amended. The prospectus supplement applicable to a particular series of warrants may provide that certain provisions of the warrants, including the securities for which they may be exercisable, the exercise price and the expiration date, may not be altered without the consent of the holder of each warrant.

Transfer Agent and Registrar

The transfer agent and registrar for any warrants will be set forth in the applicable prospectus supplement.

DESCRIPTION OF OUR DEBT SECURITIES

This section describes the general terms and provisions of the debt securities that we may offer under this prospectus, any of which may be issued as convertible or exchangeable debt securities. We will set forth the particular terms of the debt securities we offer in a prospectus supplement. The extent, if any, to which the following general provisions apply to particular debt securities will be described in the applicable prospectus supplement. The following description of general terms relating to the debt securities and the indenture under which the debt securities will be issued are summaries only and therefore are not complete. You should read the indenture and the prospectus supplement regarding any particular issuance of debt securities.

We will issue any debt under an indenture to be entered into between us and the trustee identified in the applicable prospectus supplement. The terms of the debt securities will include those stated in the indenture and those made part of the indenture by reference to the Trust Indenture Act of 1939, as amended (the “Indenture Act”), as in effect on the date of the indenture. We have filed or will file a copy of the form of indenture as an exhibit to the Registration Statement in which this prospectus is included. The indenture will be subject to and governed by the terms of the Indenture Act.

We may offer under this prospectus up to an aggregate principal amount of $100,000,000 in debt securities, or if debt securities are issued at a discount, or in a foreign currency, foreign currency units or composite currency, the principal amount as may be sold for an initial public offering price of up to $100,000,000. Unless otherwise specified in the applicable prospectus supplement, the debt securities will represent direct, unsecured obligations of the Company and will rank equally with all of our other unsecured indebtedness.

The following statements relating to the debt securities and the indenture are summaries, qualified in their entirety by reference to the detailed provisions of the indenture and the final form indenture as may be filed with a future prospectus supplement.

General

We may issue the debt securities in one or more series with the same or various maturities, at par, at a premium, or at a discount. We will describe the particular terms of each series of debt securities in a prospectus supplement relating to that series, which we will file with the SEC.

The prospectus supplement will set forth, to the extent required, the following terms of the debt securities in respect of which the prospectus supplement is delivered:

|

|

|

|

•

|

the title of the series;

|

|

|

|

|

•

|

the aggregate principal amount;

|

|

|

|

|

•

|

the issue price or prices, expressed as a percentage of the aggregate principal amount of the debt securities;

|

|

|

|

|

•

|

any limit on the aggregate principal amount;

|

|

|

|

|

•

|

the date or dates on which principal is payable;

|

|

|

|

|

•

|

the interest rate or rates (which may be fixed or variable) or, if applicable, the method used to determine such rate or rates;

|

|

|

|

|

•

|

the date or dates from which interest, if any, will be payable and any regular record date for the interest payable;

|

|

|

|

|

•

|

the place or places where principal and, if applicable, premium and interest, is payable;

|

|

|

|

|

•

|

the terms and conditions upon which we may, or the holders may require us to, redeem or repurchase the debt securities;

|

|

|

|

|

•

|

the denominations in which such debt securities may be issuable, if other than denominations of $1,000 or any integral multiple of that number;

|

|

|

|

|

•

|

whether the debt securities are to be issuable in the form of certificated securities (as described below) or global securities (as described below);

|

|

|

|

|

•

|

the portion of principal amount that will be payable upon declaration of acceleration of the maturity date if other than the principal amount of the debt securities;

|

|

|

|

|

•

|

the currency of denomination;

|

|

|

|

|

•

|

the designation of the currency, currencies or currency units in which payment of principal and, if applicable, premium and interest, will be made;

|

|

|

|

|

•

|

if payments of principal and, if applicable, premium or interest, on the debt securities are to be made in one or more currencies or currency units other than the currency of denomination, the manner in which the exchange rate with respect to such payments will be determined;

|

|

|

|

|

•

|

if amounts of principal and, if applicable, premium and interest may be determined by reference to an index based on a currency or currencies or by reference to a commodity, commodity index, stock exchange index or financial index, then the manner in which such amounts will be determined;

|

|

|

|

|

•

|

the provisions, if any, relating to any collateral provided for such debt securities;

|

|

|

|

|

•

|

any addition to or change in the covenants and/or the acceleration provisions described in this prospectus or in the indenture;

|

|

|

|

|

•

|

any events of default, if not otherwise described below under “Default and Notice”;

|

|

|

|

|

•

|

the terms and conditions, if any, for conversion into or exchange for shares of our common stock or preferred stock;

|

|

|

|

|

•

|

any depositaries, interest rate calculation agents, exchange rate calculation agents or other agents; and

|

|

|

|

|

•

|

the terms and conditions, if any, upon which the debt securities shall be subordinated in right of payment to other indebtedness of the Company.

|

We may issue discount debt securities that provide for an amount less than the stated principal amount to be due and payable upon acceleration of the maturity of such debt securities in accordance with the terms of the indenture. We may also issue debt securities in bearer form, with or without coupons. If we issue discount debt securities or debt securities in bearer form, we will describe material U.S. federal income tax considerations and other material special considerations which apply to these debt securities in the applicable prospectus supplement.

We may issue debt securities denominated in or payable in a foreign currency or currencies or a foreign currency unit or units. If we do, we will describe the restrictions, elections, and general tax considerations relating to the debt securities and the foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Exchange and/or Conversion Rights

We may issue debt securities which can be exchanged for or converted into shares of our common stock or preferred stock. If we do, we will describe the terms of exchange or conversion in the prospectus supplement relating to these debt securities.

Transfer and Exchange

We may issue debt securities that will be represented by either:

|

|

|

|

•

|

“book-entry securities,” which means that there will be one or more global securities registered in the name of a depositary or a nominee of a depositary; or

|

|

|

|

|

•

|

“certificated securities,” which means that they will be represented by a certificate issued in definitive registered form.

|

We will specify in the prospectus supplement applicable to a particular offering whether the debt securities offered will be book-entry or certificated securities.

Certificated Debt Securities

If you hold certificated debt securities issued under an indenture, you may transfer or exchange such debt securities in accordance with the terms of the indenture. You will not be charged a service charge for any transfer or exchange of certificated debt securities but may be required to pay an amount sufficient to cover any tax or other governmental charge payable in connection with such transfer or exchange.

Global Securities

The debt securities of a series may be issued in the form of one or more global securities that will be deposited with a depositary or its nominees identified in the prospectus supplement relating to the debt securities. In such a case, one or more global securities will be issued in a denomination or aggregate denominations equal to the portion of the aggregate principal amount of outstanding debt securities of the series to be represented by such global security or securities.

Unless and until it is exchanged in whole or in part for debt securities in definitive registered form, a global security may not be registered for transfer or exchange except as a whole by the depositary for such global security to a nominee of the depositary and except in the circumstances described in the prospectus supplement relating to the debt securities. The specific terms of the depositary arrangement with respect to a series of debt securities will be described in the prospectus supplement relating to such series.

No Protection in the Event of Change of Control

Any indenture that governs our debt securities covered by this prospectus may not have any covenant or other provision providing for a put or increased interest or otherwise that would afford holders of our debt securities additional protection in the event of a recapitalization transaction, a change of control of the Company, or a highly leveraged transaction. If we offer any covenants or provisions of this type with respect to any debt securities covered by this prospectus, we will describe them in the applicable prospectus supplement.

Covenants

Unless otherwise indicated in this prospectus or the applicable prospectus supplement, our debt securities may not have the benefit of any covenant that limits or restricts our business or operations, the pledging of our assets or the incurrence by us of indebtedness. We will describe in the applicable prospectus supplement any material covenants in respect of a series of debt securities.

Consolidation, Merger and Sale of Assets

We may agree in any indenture that governs the debt securities of any series covered by this prospectus that we will not consolidate with or merge into any other person or convey, transfer, sell or lease our properties and assets substantially as an entirety to any person, unless such person and such proposed transaction meets various criteria, which we will describe in detail in the applicable prospectus supplement.

Defaults and Notice

The debt securities of any series will contain events of default to be specified in the applicable prospectus supplement, which may include, without limitation:

|

|

|

|

•

|

failure to pay the principal of, or premium or make-whole amount, if any, on any debt security of such series when due and payable (whether at maturity, by call for redemption, through any mandatory sinking fund, by redemption at the option of the holder, by declaration or acceleration or otherwise);

|

|

|

|

|

•

|

failure to make a payment of any interest on any debt security of such series when due;

|

|

|

|

|

•

|

our failure to perform or observe any other covenants or agreements in the indenture with respect to the debt securities of such series;

|

|

|

|

|

•

|

certain events relating to our bankruptcy, insolvency or reorganization; and

|

|

|

|

|

•

|

certain cross defaults, if and as applicable.

|

If an event of default with respect to debt securities of any series shall occur and be continuing, we may agree that the trustee or the holders of at least 25% in aggregate principal amount of the then outstanding debt securities of such series may declare the principal amount (or, if the debt securities of such series are issued at an original issue discount, such portion of the principal amount as may be specified in the terms of the debt securities of such series) of all debt securities of such series or such other amount or amounts as the debt securities or supplemental indenture with respect to such series may provide, to be due and payable immediately. Any provisions pertaining to events of default and any remedies associated therewith will be described in the applicable prospectus supplement.

Any indenture that governs our debt securities covered by this prospectus may require that the trustee under such indenture shall, within 90 days after the occurrence of a default, give to holders of debt securities of any series notice of all uncured defaults with respect to such series known to it. However, in the case of a default that results from the failure to make any payment of the principal of, premium or make-whole amount, if any, or interest on the debt securities of any series, or in the payment of any mandatory sinking fund installment with respect to debt securities of such series, if any, the trustee may withhold such notice if it in good faith determines that the withholding of such notice is in the interest of the holders of debt securities of such series. Any terms and provisions relating to the foregoing types of provisions will be described in further detail in the applicable prospectus supplement.

Any indenture that governs our debt securities covered by this prospectus will contain a provision entitling the trustee to be indemnified by holders of debt securities before proceeding to exercise any trust or power under the indenture at the request of such holders. Any such indenture may provide that the holders of at least a majority in aggregate principal amount of the then outstanding debt securities of any series may direct the time, method and place of conducting any proceedings for any remedy available to the trustee, or of exercising any trust or power conferred upon the trustee with respect to the debt securities of such series. However, the trustee under any such indenture may decline to follow any such direction if, among

other reasons, the trustee determines in good faith that the actions or proceedings as directed may not lawfully be taken, would involve the trustee in personal liability or would be unduly prejudicial to the holders of the debt securities of such series not joining in such direction.

Any indenture that governs our debt securities covered by this prospectus may endow the holders of such debt securities to institute a proceeding with respect to such indenture, subject to certain conditions, which will be specified in the applicable prospectus supplement and which may include, that the holders of at least a majority in aggregate principal amount of the debt securities of such series then outstanding make a written request upon the trustee to exercise its power under the indenture, indemnify the trustee and afford the trustee reasonable opportunity to act. Even so, such holders may have an absolute right to receipt of the principal of, premium or make-whole amount, if any, and interest when due, to require conversion or exchange of debt securities if such indenture provides for convertibility or exchangeability at the option of the holder and to institute suit for the enforcement of such rights. Any terms and provisions relating to the foregoing types of provisions will be described in further detail in the applicable prospectus supplement.

Modification of the Indenture

We and the trustee may modify any indenture that governs our debt securities of any series covered by this prospectus with or without the consent of the holders of such debt securities, under certain circumstances to be described in a prospectus supplement.

Defeasance; Satisfaction and Discharge

The prospectus supplement will outline the conditions under which we may elect to have certain of our obligations under the indenture discharged and under which the indenture obligations will be deemed to be satisfied.

Regarding the Trustee

We will identify the trustee and any relationship that we may have with such trustee, with respect to any series of debt securities, in the prospectus supplement relating to the applicable debt securities. You should note that if the trustee becomes a creditor of the Company, the indenture and the Indenture Act limit the rights of the trustee to obtain payment of claims in certain cases, or to realize on certain property received in respect of any such claim, as security or otherwise. The trustee and its affiliates may engage in, and will be permitted to continue to engage in, other transactions with us and our affiliates. If, however, the trustee acquires any “conflicting interest” within the meaning of the Indenture Act, it must eliminate such conflict or resign.

Governing Law

The law governing the indenture and the debt securities will be identified in the prospectus supplement relating to the applicable indenture and debt securities.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site at http://www.sec.gov that contains reports, statements and other information about issuers, such as us, who file electronically with the SEC. We maintain an Internet site at

www.kopin.com

. However, the information on our Internet site is not incorporated by reference into this prospectus and any prospectus supplement and you should not consider it a part of this prospectus or any accompanying prospectus supplement.

The SEC allows us to “incorporate by reference” into this prospectus the information in other documents that we file with it. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information contained in documents filed earlier with the SEC or contained in this prospectus. We incorporate by reference into this prospectus the documents listed below; provided, however, that we are not incorporating, in each case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules:

|

|

|

|

•

|

Our Annual Report on Form 10-K for the year ended December 30, 2017 (filed on March 23, 2018, including the information in Part III incorporated by reference from our Definitive Proxy Statement on Schedule 14A, filed on March 30, 2018);

|

|

|

|

|

•

|

Our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2018 (filed on May 10, 2018), June 30, 2018 (filed on August 9, 2018) and September 29, 2018 (filed on November 8, 2018);

|

|

|

|

|

•

|

Our Current Reports on Form 8-K filed on January 4, 2018 and May 11, 2018; and

|

|

|

|

|

•

|

The description of our common stock, par value $.01 per share contained in our Current report on Form 8-K filed on March 31, 2017.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of this initial registration statement and prior to the effectiveness of this registration statement, but excluding any information furnished to and not filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may obtain a copy of any or all of the documents referred to above which may have been or may be incorporated by reference into this prospectus, except for exhibits to those documents (unless the exhibits are specifically incorporated by reference into those documents) at no cost to you by writing or telephoning us at the following address: Kopin Corporation, Attn: Investor Relations, 125 North Drive Westborough, MA 01581, telephone: (508) 870-5959.

LEGAL MATTERS

Unless otherwise specified in the prospectus supplement accompanying this prospectus, Morgan, Lewis & Bockius LLP will provide opinions regarding certain legal matters. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements incorporated in this Prospectus by reference from the Company's Annual Report on Form 10-K for the year ended December 30, 2017, and the effectiveness of the Company's internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such financial statements have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

Set forth below is an estimate (except in the case of the registration fee) of the amount of fees and expenses to be incurred in connection with the issuance and distribution of the offered securities registered hereby, other than underwriting discounts and commission, if any, incurred in connection with the sale of the offered securities. All such amounts will be borne by Kopin Corporation.

|

|

|

|

|

|

SEC Registration Fee

|

$12,120.00

|

|

Legal Fees and Expenses

|

$ ***

|

|

Accounting Fees and Expenses

|

$ ***

|

|

Blue Sky Fees and Expenses

|

$ ***

|

|

Printing Expenses

|

$ ***

|

|

Miscellaneous Fees and Expenses

|

$ ***

|

|

Total:

|

$ ***

|

|

|

|

___________________

*** To be provided by amendment. These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

Item 15. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation law empowers a Delaware corporation to indemnify its officers and directors and certain other persons to the extent and under the circumstances set forth therein.

Our Certificate of Incorporation, as amended, and By-laws, as amended, provide for indemnification of our officers and directors and certain other persons against liabilities and expenses incurred by any of them in certain stated proceedings and under certain stated conditions.

The above discussion of our Certificate of Incorporation, as amended, By-laws, as amended, and Section 145 of the Delaware General Corporation Law is not intended to be exhaustive and is qualified in its entirety by such Certificate of Incorporation, By-Laws and statute.

The Company maintains a general liability insurance policy that covers certain liabilities of the Company’s directors and officers arising out of claims based on acts or omissions in their capacities as directors or officers.

In any underwriting agreement that the Company enters into in connection with the sale of common stock being registered hereby, the underwriters will agree to indemnify, under certain conditions, the Company, its directors, its officers and persons who control the Company within the meaning of the Securities Act, against certain liabilities.

Item 16. Exhibits

See Exhibit Index below, which is incorporated herein by reference.

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act.

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however

, that paragraphs (i), (ii) and (iii) do not apply if the registration statement is on Form S-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference into the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement;

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(5) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(6) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) the portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the provisions described under Item 15 above, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

1.1*

|

Form of Underwriting Agreement.

|

|