Uber Sets Its Sights on Trucking -- WSJ

October 18 2018 - 3:02AM

Dow Jones News

The ride-sharing giant is chasing profitability in the freight

sector ahead of planned IPO

By Greg Bensinger

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 18, 2018).

Uber Technologies Inc., in its ongoing quest to move beyond its

unprofitable business of connecting drivers with passengers, is

adding a new tractor-trailer rental business to help big-rig

truckers haul freight around the country.

The San Francisco company is set to announce a new division

called Powerloop that will connect small- and medium-sized carriers

with fully filled trailers from businesses such as brewer

Anheuser-Busch InBev SA. Uber has leased hundreds of trailers from

an undisclosed company and is renting them to carriers for $25 a

day, planning to profit from the difference.

It may sound like a departure from Uber's business of connecting

urbanites with rides around town, but Uber says the technology

behind its core app translates well to the shipping industry. Its

related Freight division, which alerts truckers with their own

empty trailers to waiting cargo loads through smartphones, has been

growing, expanding from Texas last year to nationwide.

For Uber, the success of Powerloop and Freight is important to

demonstrating the company is more than a one-trick product,

particularly as it eyes an IPO that banks are proposing could value

the company at as much as $120 billion next year, The Wall Street

Journal reported Tuesday.

Uber has found some success with prepared food delivery unit

UberEats, which is expected to be profitable before the core

ride-hailing business and potentially underwrite losses, according

to people familiar with the company's finances.

The Freight business is unprofitable, according to people

familiar with the matter. Chief Executive Dara Khosrowshahi has

said as recently as August it is on a pace to achieve $500 million

in revenue within the next year.

Regarded by the tech industry as cumbersome and labor-intensive,

the trucking business has attracted a number of startups aiming to

shake up the industry.

Venture capital and other investors have, according to market

research firm Armstrong & Associates, bet $662 million since

2011 on digital-friendly, load-matching startups such as Cargomatic

Inc., Flexport Inc. and Jeff Bezos-backed Convoy, which last month

gained a $1 billion valuation in a round led by Alphabet Inc.

Uber may be seizing on an opportunity as trucking capacity has

been strained amid a fast-growing U.S. economy. Rates for

last-minute truck transportation were up nearly one-third over the

summer from a year earlier, during what is typically a slow time of

year.

Uber said its matchmaking system will spare carriers from

waiting around as trailers get loaded with goods and allow shippers

to load them at their convenience, rather than waiting for trailers

to arrive. For now, Uber will be testing Powerloop in Texas, though

the company expects to expand it to other U.S. regions.

Among Uber's first customers is Anheuser-Busch, the brewer

behind Budweiser and Bud Light. On-demand rentable trailers could

cut the time carriers spend at a shipping site by 25%, said Ties

Soeters, Anheuser-Busch's vice president of logistics procurement

in North America. The brewer has already arranged for about 250

trailers of beverages to be hauled off using Powerloop as part of a

trial, he said. About 30% of Anheuser-Busch's U.S. volume is

live-loaded, or done while a big rig truck is waiting, said Mr.

Soeters.

Of course, trucking is far from a sure thing as manufacturing

could take a turn if the economy's growth slows. And Uber faces

stiff competition from a handful of big, tech savvy players, such

as C.H. Robinson Worldwide Inc. and Echo Global Logistics.

Armstrong & Associates President Evan Armstrong said the

Powerloop project potentially faces an uphill climb against the

biggest players. "Shippers could just as easily contract with the

larger trucking companies and negotiate prices" better than Uber

can offer, he said.

Write to Greg Bensinger at greg.bensinger@wsj.com

(END) Dow Jones Newswires

October 18, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

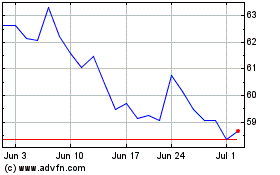

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

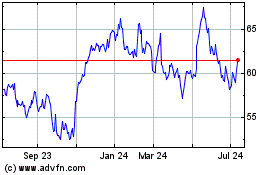

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024