UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to

Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the Month of August 2018

001-36345

(Commission File Number)

GALMED PHARMACEUTICALS

LTD.

(Exact name of Registrant as specified in its

charter)

16 Tiomkin St.

Tel Aviv 6578317, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover

Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ____

This Form 6-K contains the quarterly report of Galmed

Pharmaceuticals Ltd. (the “Company”), which includes the Company’s unaudited consolidated financial statements

for the three and six months ended June 30, 2018, together with related information and certain other information. The Company

is not subject to the requirements to file quarterly or certain other reports under Section 13 or 15(d) of the Securities Exchange

Act of 1934, as amended. The Company does not undertake to file or cause to be filed any such reports in the future, except to

the extent required by law.

On August 2, 2018, the

Company issued a press release announcing the filing of its financial results for the three and six months ended June 30, 2018

with the Securities and Exchange Commission. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

This Form 6-K and the

text under the heading “Financial Summary - Second Quarter 2018 vs. Second Quarter 2017” in Exhibit 99.1 is incorporated

by reference into the Company’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on August

11, 2015 (Registration No. 333-206292) and its Registration Statement on Form F-3 filed with the Securities and Exchange Commission

on March 26, 2018 (Registration No. 333-223923).

FINANCIAL INFORMATION

Financial Statements

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Balance Sheets

|

|

U.S. Dollars in thousands, except share data and per share data

|

|

|

|

As of

June 30,

2018

|

|

|

As of

December 31,

2017

|

|

|

|

|

Unaudited

|

|

|

Audited

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

6,151

|

|

|

$

|

13,021

|

|

|

Marketable securities

|

|

|

87,954

|

|

|

|

5,976

|

|

|

Other accounts receivable

|

|

|

368

|

|

|

|

155

|

|

|

Total current assets

|

|

|

94,473

|

|

|

|

19,152

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

374

|

|

|

|

491

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

94,847

|

|

|

$

|

19,643

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Trade payables

|

|

$

|

2,346

|

|

|

$

|

2,276

|

|

|

Other accounts payable

|

|

|

1,458

|

|

|

|

1,034

|

|

|

Short-term portion of deferred revenue

|

|

|

-

|

|

|

|

538

|

|

|

Total current liabilities

|

|

|

3,804

|

|

|

|

3,848

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Ordinary shares par value NIS 0.01 per share; Authorized 50,000,000; Issued and outstanding: 20,912,754 shares as of June 30, 2018; 14,435,161 shares as of December 31, 2017

|

|

|

58

|

|

|

|

40

|

|

|

Additional paid-in capital

|

|

|

172,824

|

|

|

|

92,381

|

|

|

Accumulated other comprehensive loss

|

|

|

(29

|

)

|

|

|

(7

|

)

|

|

Accumulated deficit

|

|

|

(81,810

|

)

|

|

|

(76,619

|

)

|

|

Total stockholders' equity

|

|

|

91,043

|

|

|

|

15,795

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

94,847

|

|

|

$

|

19,643

|

|

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Operations (Unaudited)

|

|

U.S. Dollars in thousands, except share data and per share data

|

|

|

|

Three months ended

June 30,

|

|

|

Six months ended

June 30,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2018

|

|

|

2017

|

|

|

Revenue

|

|

$

|

270

|

|

|

$

|

270

|

|

|

$

|

538

|

|

|

$

|

538

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

1,940

|

|

|

|

2,347

|

|

|

|

3,884

|

|

|

|

5,090

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

1,105

|

|

|

|

624

|

|

|

|

1,988

|

|

|

|

1,413

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

2,775

|

|

|

|

2,701

|

|

|

|

5,334

|

|

|

|

5,965

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses (income), net

|

|

|

(90

|

)

|

|

|

(9

|

)

|

|

|

(143

|

)

|

|

|

(111

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

2,685

|

|

|

|

2,692

|

|

|

|

5,191

|

|

|

|

5,854

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on Income

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

2,685

|

|

|

$

|

2,692

|

|

|

$

|

5,191

|

|

|

$

|

5,854

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$

|

0.17

|

|

|

$

|

0.22

|

|

|

$

|

0.34

|

|

|

$

|

0.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of shares outstanding used in computing basic and diluted net loss per share

|

|

|

15,711,736

|

|

|

|

12,175,147

|

|

|

|

15,243,785

|

|

|

|

12,171,668

|

|

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Comprehensive Loss (Unaudited)

|

|

U.S. Dollars in thousands

|

|

|

|

Three months ended

June 30,

|

|

|

Six months ended

June 30,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2018

|

|

|

2017

|

|

|

Net loss

|

|

$

|

2,685

|

|

|

$

|

2,692

|

|

|

$

|

5,191

|

|

|

$

|

5,854

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss (income):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized loss (gain) on available for sale securities

|

|

|

(7

|

)

|

|

|

(41

|

)

|

|

|

22

|

|

|

|

(65

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

$

|

2,678

|

|

|

$

|

2,651

|

|

|

$

|

5,213

|

|

|

$

|

5,789

|

|

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Changes in Stockholders’ Equity (Unaudited)

|

|

U.S. Dollars in thousands, except share data and per share data

|

|

|

|

Ordinary shares

|

|

|

Additional

paid-in

|

|

|

Accumulated

other

Comprehensive

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

capital

|

|

|

loss

|

|

|

Deficit

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - December 31, 2017

|

|

|

14,435,161

|

|

|

$

|

40

|

|

|

$

|

92,381

|

|

|

$

|

(7

|

)

|

|

$

|

(76,619

|

)

|

|

$

|

15,795

|

|

|

Stock based compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

417

|

|

|

|

-

|

|

|

|

-

|

|

|

|

417

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options and Restricted stock units Exercise

|

|

|

328,333

|

|

|

|

1

|

|

|

|

879

|

|

|

|

-

|

|

|

|

-

|

|

|

|

879

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of Ordinary Shares and warrants *)

|

|

|

1,000,000

|

|

|

|

3

|

|

|

|

5,962

|

|

|

|

|

|

|

|

|

|

|

|

5,965

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of Ordinary Shares (Underwriter agreement) **)

|

|

|

5,000,000

|

|

|

|

14

|

|

|

|

70,290

|

|

|

|

|

|

|

|

|

|

|

|

70,304

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of Ordinary Shares (ATM offering) ***)

|

|

|

149,260

|

|

|

|

-

|

|

|

|

2,895

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,895

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss from marketable securities

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(22

|

)

|

|

|

-

|

|

|

|

(22

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(5,191

|

)

|

|

|

(5,191

|

)

|

|

Balance - June 30, 2018

|

|

|

20,912,754

|

|

|

$

|

58

|

|

|

$

|

172,824

|

|

|

$

|

(29

|

)

|

|

$

|

(81,810

|

)

|

|

$

|

91,043

|

|

*) See notes 3.3.

**) See notes 3.4.

***) See note 3.5.

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Cash Flows (Unaudited)

|

|

U.S. Dollars in thousands

|

|

|

|

Six months ended

June 30,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Cash flow from operating activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(5,191

|

)

|

|

$

|

(5,854

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments required to reconcile net loss to net cash used in operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

118

|

|

|

|

120

|

|

|

Stock-based compensation expense

|

|

|

417

|

|

|

|

709

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of discount/premium on marketable securities

|

|

|

(4

|

)

|

|

|

(207

|

)

|

|

Loss from Realization of marketable securities

|

|

|

5

|

|

|

|

115

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Decrease (increase) in other accounts receivable

|

|

|

(213

|

)

|

|

|

18

|

|

|

Increase (decrease) in trade payables

|

|

|

70

|

|

|

|

(757

|

)

|

|

Increase (decrease) in other accounts payable

|

|

|

424

|

|

|

|

(178

|

)

|

|

Decrease in related party

|

|

|

-

|

|

|

|

(117

|

)

|

|

Decrease in deferred revenue

|

|

|

(538

|

)

|

|

|

(538

|

)

|

|

Net cash used in operating activities

|

|

|

(4,912

|

)

|

|

|

(6,689

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from investing activities

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(1

|

)

|

|

|

(8

|

)

|

|

Investment in available for sale securities

|

|

|

(85,174

|

)

|

|

|

-

|

|

|

Consideration from sale of available for sale securities

|

|

|

3,173

|

|

|

|

5,100

|

|

|

Net cash provided in (used in) investing activities

|

|

|

(82,002

|

)

|

|

|

5,092

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from financing activities

|

|

|

|

|

|

|

|

|

|

Issuance of Ordinary Shares *)

|

|

|

79,164

|

|

|

|

-

|

|

|

Proceeds from exercise of options

|

|

|

880

|

|

|

|

247

|

|

|

Net cash provided in financing activities

|

|

|

80,044

|

|

|

|

247

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents

|

|

|

(6,870

|

)

|

|

|

(1,350

|

)

|

|

Cash and cash equivalents at the beginning of the period

|

|

|

13,021

|

|

|

|

3,097

|

|

|

Cash and cash equivalents at the end of the period

|

|

$

|

6,151

|

|

|

$

|

1,747

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash received from interest

|

|

$

|

171

|

|

|

|

136

|

|

*) See notes 3.3, 3.4 and 3.5

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Notes to Consolidated Financial Statements

|

Note 1 - Basis of presentation

Galmed Pharmaceuticals Ltd. (the

“Company”) is a clinical-stage biopharmaceutical company primarily focused on the development of therapeutics for the

treatment of liver diseases. The Company was incorporated in Israel on July 31, 2013 and commenced operations on February 2, 2014.

The Company holds a wholly owned subsidiary, Galmed International Ltd., which was incorporated in Malta. Galmed International Ltd.

holds a wholly owned subsidiary, Galmed Medical Research Ltd., which was incorporated in Israel and has been an inactive company

since 2015. The Company also holds a wholly owned subsidiary, Galmed Research and Development Ltd., which was incorporated in Israel.

These unaudited interim consolidated

financial statements have been prepared as of June 30, 2018 and for the three and six months period then ended. Accordingly, certain

information and footnote disclosures normally included in annual financial statements prepared in accordance with U.S. GAAP have

been omitted. These unaudited interim consolidated financial statements should be read in conjunction with the audited financial

statements and the accompanying notes of the Company for the year ended December 31, 2017 that are included in the Company's Annual

Report on Form 20-F, filed with the Securities and Exchange Commission on March 13, 2018 (the "Annual Report"). The results

of operations presented are not necessarily indicative of the results to be expected for the year ending December 31, 2018.

Note 2 - Summary of significant accounting policies

The significant accounting policies

that have been applied in the preparation of the unaudited consolidated interim financial statements are identical to those that

were applied in preparation of the Company’s most recent annual financial statements in connection with its Annual Report

on Form 20-F.

Note 3 - Stockholders' Equity

|

|

1.

|

During the six months ended June 30, 2018, certain officers, employees and former employees

exercised options into an aggregate of 321,146 ordinary shares of the Company, NIS 0.01 par value per share, for total

consideration of $0.9 million.

|

|

|

2.

|

During the six months ended June 30, 2018, restricted stock units held by certain officers and employees vested resulting in the issuance of 7,187 ordinary shares of the Company, NIS 0.01 par value per share.

|

|

|

3.

|

On April 5, 2018, the Company sold to Biotechnology Value Fund, L.P. and certain of its affiliates in a registered direct offering 1,000,000 ordinary shares and warrants to purchase 1,000,000 ordinary shares, for a purchase price of $6.00 per share and related warrant. Each warrant may be exercised at any time and from time to time through and including the one-year anniversary of the initial exercise date at an exercise price of $15.00 per share, subject to certain adjustments. The net proceeds to the Company, after deducting offering expenses, were $5.96 million.

|

|

|

4.

|

On June 22, 2018, the Company completed an underwritten public offering of 5,000,000 ordinary shares, at a public offering price of $15.00 per share. The net proceeds to the Company, after deducting the underwriting discounts and commissions and offering expenses, were $70.3 million.

|

|

|

5.

|

On December 22, 2017, the Company entered into an At-the-Market Equity Offering Sales Agreement (the "Stifel

Sales Agreement") with Stifel, Nicolaus & Company, Incorporated, as the Company’s sales agent (“Stifel”),.

Pursuant to the prospectus relating to the Company’s shelf registration statement on Form F-3 filed with the SEC on March

26, 2018 (File No. 333-223923) the Company may offer and sell, from time to time through Stifel, its ordinary shares having an

aggregate offering price of up to $35 million. During the six months ended June 30, 2018, the Company sold 149,260 ordinary

shares under the Stifel Sales Agreement for total net proceeds of approximately $2.9 million.

|

|

|

6.

|

In May 2018, the Company granted options to purchase an aggregate of 21,500 ordinary shares of the Company to one of its employees and one of its consultants. The options are exercisable at $6.05 per share, have a 10 year term and vest over a period that varies between two to four years. The aggregate grant date fair value of such options is approximately $0.09 million.

|

|

|

7.

|

In July 2018, subsequent

to the balance sheet date, the Company granted options to purchase 16,000 ordinary shares of the Company to one of its consultants.

The options are exercisable at $11.56 per share, have a 10 year term and vest over a period of two years. The grant date fair

value of such options is approximately $0.14 million.

|

|

|

8.

|

In July 2018, subsequent to the balance sheet date, the Company approved the grant of options to purchase an aggregate of 630,000 ordinary shares of the Company to its directors and officers, subject to the approval by the Company’s shareholders at the Company’s annual general meeting of the increase of the number of shares available for issuance under the Company’s 2013 Incentive Share Option Plan and approval of the grant of options to purchase an aggregate of 430,000 ordinary shares to the Company’s president and chief executive officer and non-management directors. The options are expected to be granted at an exercise price of $11.56 per share, have a 10 year term and vest over a period of four years.

|

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

All references to “we,”

“us,” “our,” “the Company” and “our Company”, in this Form 6-K are to Galmed Pharmaceuticals

Ltd. and its subsidiaries, unless the context otherwise requires. All references to “shares” or “ordinary shares”

are to our ordinary shares, NIS 0.01 nominal par value per share. All references to “Israel” are to the State of Israel.

“U.S. GAAP” means the generally accepted accounting principles of the United States. Unless otherwise stated, all of

our financial information presented in this Form 6-K has been prepared in accordance with U.S. GAAP. Any discrepancies in any table

between totals and sums of the amounts and percentages listed are due to rounding. Unless otherwise indicated, or the context otherwise

requires, references in this Form 6-K to financial and operational data for a particular year refer to the fiscal year of our company

ended December 31 of that year.

Our reporting currency

and financial currency is the U.S. dollar. In this Form 6-K, “NIS” means New Israeli Shekel, and “$,” “US$”

and “U.S. dollars” mean United States dollars.

Cautionary Note Regarding Forward-Looking

Statements

This Form 6-K contains

forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product development

efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our

representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified

by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,”

“may,” “should,” “anticipate,” “could,” “might,” “seek,”

“target,” “will,” “project,” “forecast,” “continue” or their negatives

or variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical

matters. These forward-looking statements may be included in, among other things, various filings made by us with the SEC, press

releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements

relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking

statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that

could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements.

Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking

statements, including, but not limited to, the factors summarized below:

|

|

·

|

the timing and cost of our planned Phase III trial, for our product candidate, Aramchol

TM

(“Aramchol”) for the treatment of patients with Non-Alcoholic Steato-Hepatitis (“NASH”), or whether a Phase

III trial will be conducted at all;

|

|

|

·

|

completion and receiving favorable results of our planned Phase III trial for Aramchol or any other pre-clinical

or clinical trial;

|

|

|

·

|

regulatory action with respect to Aramchol by the U.S. Food and Drug Administration (the “FDA”)

or the European Medicines Authority including but not limited to acceptance of an application for marketing authorization, review

and approval of such application, and, if approved, the scope of the approved indication and labeling;

|

|

|

·

|

the commercial launch and future sales of Aramchol or any other future product candidates;

|

|

|

·

|

our ability to comply with all applicable post-market regulatory requirements for Aramchol in the countries in which we seek

to market the product;

|

|

|

·

|

our ability to achieve favorable pricing for Aramchol;

|

|

|

·

|

our expectations regarding the commercial market for NASH;

|

|

|

·

|

third-party payor reimbursement for Aramchol;

|

|

|

·

|

our estimates regarding anticipated capital requirements and our needs for additional financing;

|

|

|

·

|

market adoption of Aramchol by physicians and patients;

|

|

|

·

|

the timing, cost or other aspects of the commercial launch of Aramchol;

|

|

|

·

|

the development and approval of the use of Aramchol for additional indications or in combination therapy; and

|

|

|

·

|

our expectations regarding licensing, acquisitions and strategic operations.

|

We believe these forward-looking

statements are reasonable; however, these statements are only current predictions and are subject to known and unknown risks, uncertainties

and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to

be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in our Annual

Report on Form 20-F for the year ended December 31, 2017 filed with the SEC on March 13, 2018 in greater detail under the heading

“Risk Factors” and elsewhere in the Annual Report and this Form 6-K. Given these uncertainties, you should not rely

upon forward-looking statements as predictions of future events.

All forward-looking statements

attributable to us or persons acting on our behalf speak only as of the date hereof and are expressly qualified in their entirety

by the cautionary statements included in this report. We undertake no obligations to update or revise forward-looking statements

to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating

forward-looking statements, you should consider these risks and uncertainties.

Overview

We are a clinical-stage

biopharmaceutical company focused on the development of Aramchol, a liver targeted SCD1 modulator, first in class, novel, once-daily,

oral therapy for the treatment of NASH for variable populations. In June 2018, we announced top line data from our ARREST Phase

IIb clinical study, a multicenter, randomized, double blind, placebo-controlled study, designed to evaluate the efficacy and safety

of Aramchol in 247 subjects with NASH, who are overweight or obese, and who are pre-diabetic or type-II-diabetic. We are currently

focused on preparing for an end of Phase IIb meeting with the FDA to discuss the results of the ARREST Study and a Phase III study

protocol, with a view to initiating a Phase III clinical study of Aramchol in 2019.

Financial Overview

To date, we have funded

our operations primarily through proceeds from private placements and public offerings. At June 30, 2018, we had current assets

of $94.5 million, which includes cash and cash equivalents of $6.2 million and short-term investment securities of $88.0 million.

This compares with current assets of $19.2 million at December 31, 2017, which consisted of cash and cash equivalents of $13.0

million and short-term investment securities of $6.0 million. Although we provide no assurance, we believe that such existing funds

will be sufficient to continue our business and operations as currently conducted for more than 12 months from the date of issuance

of this Form 6-K. However, we will continue to incur operating losses, which may be substantial over the next several years, and

we may need to obtain additional funds to further develop our research and development programs.

Recent Developments

During the second quarter

of 2018, we announced the following developments:

|

|

·

|

On April 3, 2018, we announced that we entered into a securities

purchase agreement with Biotechnology Value Fund, L.P. and certain of its affiliates for the purchase and sale in a registered

direct offering of 1,000,000 ordinary shares and warrants to purchase 1,000,000 ordinary shares, for a purchase price of $6.00 per

share and related warrant. Each warrant may be exercised at any time and from time to time through and including the one-year

anniversary of the initial exercise date at an exercise price of $15.00 per share, subject to certain adjustments. The offering

closed on April 5, 2018. The net proceeds to us, after deducting offering expenses, were $5.9 million.

|

|

|

·

|

On June 12, 2018, we announced top

line data from our ARREST Study, a multicenter, randomized, double blind, placebo-controlled Phase IIb clinical study designed

to evaluate the efficacy and safety of Aramchol in 247 subjects with NASH, who are overweight or obese, and who are pre-diabetic

or type-II-diabetic.

|

|

|

·

|

On June 19, 2018, we announced the pricing of an underwritten public offering of 5,000,000 ordinary shares, at a public offering price of $15.00 per share. The offering closed on June 22, 2018. The net proceeds to the Company, after deducting the underwriting discounts and commissions and offering expenses were $70.3 million.

|

Revenues

On July 28, 2016, we entered

into a license agreement with Samil Pharma. Co., Ltd. (the “Samil Agreement”) for the commercialization of Aramchol

(with the option to manufacture) in the Republic of Korea. Under the terms of the Samil Agreement, we have received upfront payments

of $2.1 million, and may be eligible to receive up to $6.0 million in additional payments for development and regulatory milestones

for Aramchol in the licensed territories. For accounting purposes, the upfront payment has been recorded as deferred revenue. The

deferred revenue is then amortized on a straight-line basis over the contractual period and milestone payments are recognized once

earned.

Costs and Operating Expenses

Our current costs and

operating expenses consist of two components: (i) research and development expenses; and (ii) general and administrative expenses.

Research and Development Expenses

Our research and development

expenses consist primarily of outsourced development expenses, salaries and related personnel expenses and fees paid to external

service providers, patent-related legal fees, costs of pre-clinical studies and clinical trials and drug and laboratory supplies.

We account for all research and development expenses as they are incurred. We expect our research and development expense to remain

our primary expense in the near future as we continue to develop Aramchol. Increases or decreases in research and development expenditures

are primarily attributable to the number and/or duration of the pre-clinical and clinical studies that we conduct.

We expect that a substantial

amount of our research and development expense in the future will be incurred in support of our current and anticipated pre-clinical

and clinical development projects. Due to the inherently unpredictable nature of pre-clinical and clinical development studies,

we are unable to estimate with any certainty the costs we will incur in the continued development of Aramchol for NASH and other

indications in our pipeline for potential partnering and/or commercialization. Clinical development timelines, the probability

of success and development costs can differ materially from expectations. We currently expect to continue testing Aramchol in pre-clinical

studies for toxicology, safety and efficacy, and to conduct additional clinical trials for Aramchol.

While we are currently

focused on advancing Aramchol's development, our future research and development expenses will depend on the clinical success of

Aramchol, as well as ongoing assessments of the Aramchol’s commercial potential. As we obtain results from clinical trials,

we may elect to discontinue or delay clinical trials for our product candidate in certain indications in order to focus our resources

on more promising indications for such product candidate. Completion of clinical trials may take several years or more, but the

length of time generally varies according to the type, complexity, novelty and intended use of a product candidate.

We expect our research

and development expenses to increase in the future from current levels as we continue to advance of our clinical product development

and, potentially, the in-licensing of additional product candidates.

The lengthy process of completing clinical

trials and seeking regulatory approval for Aramchol requires the expenditure of substantial resources. Any failure or delay in

completing clinical trials, or in obtaining regulatory approvals, could cause a delay in generating product revenue and cause our

research and development expenses to increase and, in turn, have a material adverse effect on our operations. Because of the factors

set forth above, we are not able to estimate with any certainty when we would recognize any net cash inflows from our projects.

General and Administrative Expenses

General and administrative expenses consist

primarily of compensation for employees in executive and operational roles, including finance/accounting, legal and other operating

positions in connection with our activities. Our other significant general and administrative expenses include non-cash stock-based

compensation costs and facilities costs (including the rental expense for our offices in Tel Aviv, Israel), professional fees for

outside accounting and legal services, travel costs, investors relations, insurance premiums and depreciation.

Financial Income, Net

Our financial income consists

of interest income from marketable securities and our financial expense consists of fees associated with banking activities and

losses from realization of marketable securities.

Results of Operations

The table below provides

our results of operations for the three and six months ended June 30, 2018 as compared to the three and six months ended June 30,

2017.

|

|

|

Three months ended June 30,

|

|

|

Six months ended June 30,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2018

|

|

|

2017

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

|

|

(In thousands, except per share data)

|

|

|

|

|

|

|

|

Revenue

|

|

|

270

|

|

|

|

270

|

|

|

|

538

|

|

|

|

538

|

|

|

Research and development expenses

|

|

|

1,940

|

|

|

|

2,347

|

|

|

|

3,884

|

|

|

|

5,090

|

|

|

General and administrative expenses

|

|

|

1,105

|

|

|

|

624

|

|

|

|

1,988

|

|

|

|

1,413

|

|

|

Total operating expenses

|

|

|

2,775

|

|

|

|

2,701

|

|

|

|

5,334

|

|

|

|

5,965

|

|

|

Financial expenses (income), net

|

|

|

(90

|

)

|

|

|

(9

|

)

|

|

|

(143

|

)

|

|

|

(111

|

)

|

|

Taxes on income

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Net loss

|

|

|

2,685

|

|

|

|

2,692

|

|

|

|

5,191

|

|

|

|

5,854

|

|

|

Other comprehensive income:

|

|

|

(7

|

)

|

|

|

(41

|

)

|

|

|

22

|

|

|

|

(65

|

)

|

|

Comprehensive loss

|

|

|

2,678

|

|

|

|

2,651

|

|

|

|

5,213

|

|

|

|

5,789

|

|

|

Basic and diluted net loss per share

|

|

$

|

0.17

|

|

|

$

|

0.22

|

|

|

$

|

0.34

|

|

|

$

|

0.48

|

|

Revenue

Licensing revenue was

approximately $0.3 million and approximately $0.5 million for the three and six months ended June 30, 2018 and for the three and

six months ended June 30, 2017. The above mentioned revenue resulted from the amortization of the up-front payments under the Samil

Agreement.

Research and Development

Expenses

Our research and development

expenses amounted to approximately $1.9 million and approximately $3.9 million during the three and six months ended June 30, 2018,

respectively, representing a decrease of approximately $0.4 million, or 17%, and approximately $1.2 million, or 24%, respectively,

compared to approximately $2.3 million and approximately $5.1 million for the comparable period in 2017.

The decrease during

the three and six months ended June 30, 2018 primarily resulted from a decrease of approximately $0.4 and $1.3 million, respectively,

in subcontractor expenses in connection with our clinical studies, as compared to such expenses for the comparable period in 2017.

General and Administrative

Expenses

Our general and administrative

expenses amounted to approximately $1.1 million and approximately $2.0 million during the three and six months ended June 30, 2018,

respectively, representing an increase of approximately $0.5 million, or 83%, and $0.6 million, or 43%, respectively, compared

to approximately $0.6 million and approximately $1.4 million for the comparable period in 2017.

The increase during

the three and six months ended June 30, 2018 primarily resulted from an increase of approximately $0.3 million in both

periods in salaries and benefits due to a provision for year-end compensation as well as an increase of approximately $0.2

million and $0.3 million, respectively, in professional fees and investor relations related expenses, as compared to such

expenses for the comparable period in 2017.

Operating Loss

As a result of the

foregoing, for the three and six months ended June 30, 2018, our operating loss was approximately $2.8 million and approximately

$5.3 million, respectively, representing an increase of $0.1 million, or 4%, and a decrease of $0.7 million, or 12%, respectively,

as compared to approximately $2.7 million and approximately $6.0 million for the comparable period in 2017.

Financial Income,

Net

Our financial income,

net amounted to approximately $0.1 million and approximately $0.15 million during the three and six months ended June 30, 2018,

respectively, compared to $0.01 million and $0.1 million for the comparable period in 2017.

The increase during the

three months ended June 30, 2018 primarily resulted from an increase in interest income from marketable securities, as compared

to such expenses for the comparable period in 2017.

Net Loss

As a result of the

foregoing, for the three months ended June 30, 2018 and 2017, our net loss was approximately $2.7 million and for the six months

ended June 30, 2018, our net loss was approximately $5.2 million representing a decrease of $0.7 million, or 12%, as compared to

approximately $5.9 million for the comparable prior year period.

Liquidity and Capital Resources

To date, we have funded

our operations primarily through proceeds from private placements and public offerings. Under our existing ATM offering,

as of the date hereof, we may sell, from time to time, up to approximately $32.0 million of additional ordinary shares. During

the six months ended June 30, 2018, we sold 149,260 ordinary shares under our existing ATM offering for total net proceeds of approximately

$2.9 million.

We have incurred substantial

losses since our inception. As of June 30, 2018, we had an accumulated deficit of approximately $81.8 million and positive working

capital (current assets less current liabilities) of approximately $90.7 million. We expect that operating losses will continue

for the foreseeable future.

As of June 30, 2018, we

had cash and cash equivalents of approximately $6.2 million and marketable securities of approximately $88.0 million invested in

accordance with our investment policy, totaling approximately $94.1 million, as compared to approximately $13.0 million and approximately

$6.0 million as of December 31, 2017, totaling approximately $19.0 million. The increase is mainly attributable to the approximately

$70.3 million in net proceeds raised in an underwritten public offering that was completed in June 2018, and the $5.9 million in

net proceeds raised in our registered direct offering during April 2018.

We had negative cash flow

from operating activities of approximately $4.9 million for the six months ended June 30, 2018, as compared to negative cash flow

from operating activities of approximately $6.7 million for the six months ended June 30, 2017. The negative cash flow from operating

activities for the six months ended June 30, 2018 is mainly attributable to our net loss of approximately $5.1 million.

We had negative cash flow

from investing activities of approximately $82.0 million for the six months ended June 30, 2018, as compared to positive cash flow

from investing activities of approximately $5.1 million for the six months ended June 30, 2017. The negative cash flow from investing

activities for the six months ended June 30, 2018 was primarily due to the net investment of marketable securities.

We had positive cash flow

from financing activities of approximately $80.0 million for the six months ended June 30, 2018, as compared to positive cash flow

from financing activities of approximately $0.2 million for the six months ended June 30, 2017. The positive cash flow from financing

activities for the six months ended June 30, 2018 is mainly attributable to the net proceeds from our underwritten public offering

and registered direct offering.

Although there can be no assurance, we believe that our existing cash resources will be sufficient to

fund our projected cash requirements for more than 12 months from the date of issuance of this Form 6-K. Nevertheless, we will

require significant additional financing in the future to fund our operations if and when we progress into Phase III trials of

Aramchol and clinical trials for other indications and other research and development activities. Our management may choose to

raise such additional capital, which would be authorized by our board of directors, at their discretion.

Trend Information

We are a development stage

company, and it is not possible for us to predict with any degree of accuracy the outcome of our research, development or commercialization

efforts. As such, it is not possible for us to predict with any degree of accuracy any significant trends, uncertainties, demands,

commitments or events that are reasonably likely to have a material effect on our net sales or revenues, income from continuing

operations, profitability, liquidity or capital resources, or that would cause financial information to not necessarily be indicative

of future operating results or financial condition. However, to the extent possible, certain trends, uncertainties, demands, commitments

and events are in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Controls and Procedures

As a “foreign private

issuer”, we are only required to conduct the evaluations required by Rules 13a-15(b) and 13a-15(d) of the Exchange Act as

of the end of each fiscal year and therefore have elected not to provide disclosure regarding such evaluations at this time.

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release, dated August 2, 2018

|

|

|

|

|

|

101.INS

|

|

XBRL Instance Document

|

|

|

|

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

|

|

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

|

|

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Document

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Galmed Pharmaceuticals Ltd.

|

|

|

|

|

|

Date: August 2, 2018

|

By:

|

/s/ Allen Baharaff

|

|

|

|

Allen Baharaff

|

|

|

|

President and Chief Executive Officer

|

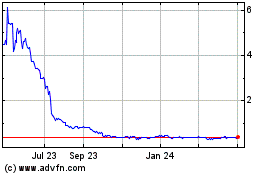

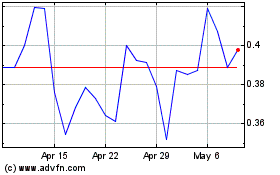

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024