Health Care Flat as Amazon Move Seen Shaking Up Pharmacy Business -- Health Care Roundup

July 02 2018 - 5:02PM

Dow Jones News

Shares of health-care companies were more or less flat amid

predictions that another corner of the U.S. health system would

soon undergo a transformation. Amazon.com could rapidly grow the

recently acquired PillPack business of online drug distribution and

eventually capture between 20% and 80% of the "maintenance"

pharmaceutical distribution business in the U.S., a roughly $270

billion market, according to analysts at brokerage Morgan Stanley.

In a note to clients, Morgan Stanley said Amazon would likely

"leverage" its physical Whole Foods locations as it builds its

online pharmacy. While CVS Holdings' Aetna acquisition will likely

help it carve out a role in the new pharmaceutical-distribution

world, other incumbents, such as Walgreen, may have to change

strategy, according to the brokerage. Shares of the pharmacy

chains, which fell precipitously when the PillPack deal was

reported last week, rose slightly Monday.

-Rob Curran, rob.curran@dowjones.com

(END) Dow Jones Newswires

July 02, 2018 16:47 ET (20:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

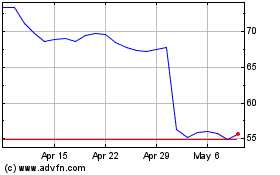

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

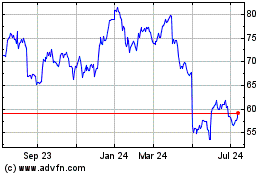

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024